The Complete Guide to Quitclaim Deeds

How do you transfer a home from one owner to another? You’ll need to select a type of deed — a legal document that conveys a real estate title.

The quitclaim deed is the simplest. Just as the name suggests, with a quitclaim deed, one owner (or set of co-owners) quits their claim to the next title holder(s).

Unlike in a standard, financed home purchase, there is no required title search for a quitclaim. This means no one is examining the chain of title to be sure the current owner (called the “grantor”) really has the right to convey the property. If liens or other claims exist on the property, the quitclaim doesn’t expose those possible claims. Nor does it require the grantor to resolve those issues. The recipient (the “grantee”) gets only the interest the grantor actually had — if any.

Quitclaim, defined: A legal instrument that transfers an interest in real estate from one person or entity (grantor) to another (grantee). As a non-warranty deed, the quitclaim conveys only the interest the grantor has. It does not guarantee the grantor legally owns the property.

Available Forms

What Are the Best Reasons to Use a Quitclaim Deed?

Many people ask: When is a quitclaim the right deed to use for transferring a home? The usual quitclaim situations involve transfers between people who are related to each other. Parents, siblings, and other relatives might transfer homes this way. For a few other common examples:

- A property inheritance could be quitclaimed to a deceased homeowner’s living beneficiaries.

- A divorcing couple transferring a title from co-ownership to sole ownership might use a quitclaim deed. Important: Quitclaiming to a divorcing spouse does not remove your obligation to repay a mortgage loan.

- A homeowner who marries might decide to add a spouse’s name to the house title by transferring a quitclaim deed from the former sole owner’s name to both names.

- People with legal name changes might use the quitclaim to convey the title to the new name.

- Business owners might quitclaim homes into their business names.

- A homeowner might quitclaim a house into a living trust.

Quitclaims are also used to clarify ownership. If questions come up about someone possibly having an interest in the title, that person could agree to sign a quitclaim to make sure the new owner holds the title, free and clear of the doubt. Title companies sometimes have people execute quitclaims to clear up questions before they will insure a title. Lenders may ask non-borrowing spouses to quitclaim their interest in a home that’s collateral for a loan.

There are also scenarios where getting a warranty deed is virtually impossible. A property with a title defect might have no way to move from one owner to the next without a quitclaim. Of course, that just pushes the reckoning further into the future, so approaching a court with a quiet title case could be the key to resolution. Consult a local real estate attorney for guidance if you are in this situation.

Important Considerations Before You Quit Your Claim

Quitclaiming to a family member to avoid probate is certainly possible, but it’s usually not the best way to handle estate planning. Sometimes the simplest way is not the best!

If you have decided a quitclaim is right for your particular situation, make some indispensable phone calls first. Check with your title insurance provider and your mortgage servicer before quitclaiming a home. Find out how it will impact your policy coverage or mortgage. You probably don’t want to lose your insurance coverage, or trigger an early loan payoff date.

As for the nuts and bolts, remember that each state has its own requirements for quitclaim deed text and format. Each state has specific signature, witness, and notarization rules. In addition, many local recording authorities add requirements for margins, paper size, property identification, and other details. For a valid transfer, be sure to follow the rules.

Quitclaims, like all property transfers, affect your rights. Consult with an experienced lawyer in your state to protect your interests.

Can You Quitclaim a House Yourself?

Homeowners have the right to transfer their ownership. A homeowner can create a valid quitclaim deed from scratch. But these days, it’s easy to find a quitclaim deed form for your state online and download it. Alternatively, you can visit the recording office in the home’s county, and request a form.

A quitclaim deed requires the signature of every owner before the property changes hands. In community property states, like Texas and California, both spouses must sign deeds involving real estate transfers. The grantor or grantors sign the property over, and the grantee(s) might also need to sign, depending on state laws. Some states require witnesses. Typically, the grantor's signature must be notarized. Note: The notarization affirms that the identity of the person signing the document has been verified — not that the quitclaim deed is valid.

Once the completed document has been signed, delivered, and accepted by the grantee, it is considered legally executed. (The grantee has the prerogative to refuse the deed.)

The grantee takes the final step, by recording the executed deed with the county clerk or county recorder of deeds. To convey the title so that it’s in the public record and binding for third parties, a quitclaim deed must be signed, notarized, and recorded in the property’s county. Filers should expect to pay recording fees.

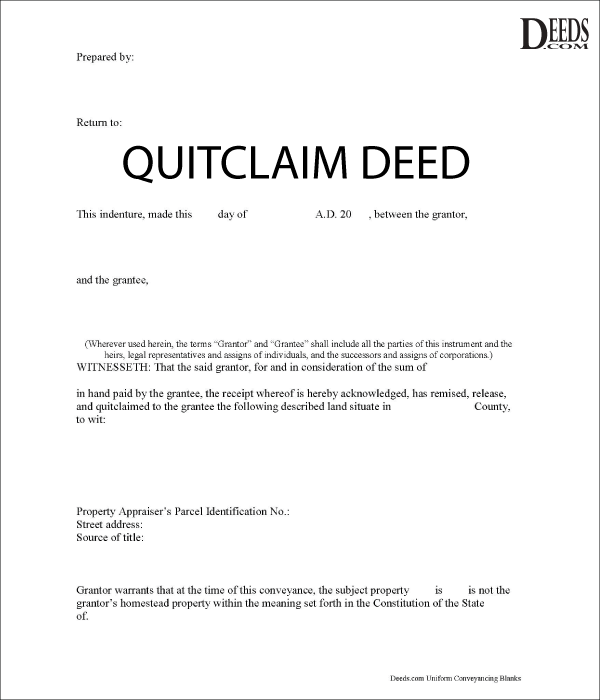

Contents of a Quitclaim Deed

A quitclaim must, of course, be in writing. It must include a legal description of the property, the address and county, the transfer date, and the names of the parties. While each county has specific formatting requirements, key elements are common to all quitclaim deeds:

- Title: State what the document is. Examples: Quitclaim Deed or California Quitclaim Deed.

- Executed date: State the date on which the completed quitclaim is signed and notarized.

- Names of grantor and grantee: A grantor is the person or persons transferring real estate to another person or persons, who are called grantees. “Person” can mean any entity that may hold a title. Examples: a human being; an LLC, partnership, or corporation; or a trust or trustee.

- Habendum (granting) clause: This is the legal transfer terminology, such as "does hereby remise, release and quitclaim unto the said Grantee forever, all the right, title, interest and claim which the said Grantor has in and to the following described parcel of land, and improvements and appurtenances thereto..."

- Consideration: State the amount of consideration for the property — that is, what the grantee is paying for it. When the property is being transferred but not sold, parties often use $1 as the amount of consideration rather than zero. Still, the grantor should speak to an accountant about declaring the gift.

- Legal description: Here is the description of the property being transferred. Ensure you use the proper format by copying the legal description text precisely from the prior deed.

- Signatures: See the previous section for details.

- Prepared by: This section lets the world know who prepared the deed. Examples: The grantor or the grantor’s attorney.

Preventing Fraud and Abuse

As you see, the quitclaim deed carries no warranty. So, except in the case of quitclaim fraud, the grantee cannot sue if the grantor did not own the interest that the quitclaim purported to transfer. Even if you can sue because of the presence of fraud, it is extremely difficult to recover a title that was wrongly transferred.

Because a recipient enjoys greater protection with a warranty deed than with a quitclaim, a quitclaim deed is usually used among parties who know each other, and have some familiarity with the property’s history.

If you are considering buying real estate, especially from someone you do not know, and they offer to transfer the property to you using a quitclaim, seek the advice of an attorney or title professional.

If you own real estate and are asked to sign a quitclaim to a business that says it can save your home or help you refinance, know that you are giving your real estate to someone else. You will not be likely to get it back.

Should the Recipient of a Quitclaim Order a Title Search?

A warranty deed says its grantor owns the property free and clear, and has the right to transfer it to another party. But quitclaims are non-warranty deeds. Quitclaims can have unknown title defects.

The recipient of a quitclaim can uncover title defects by having a title search done. The search can uncover a range of claims against the property, such as:

- An unpaid mortgage lien (and sometimes multiple home loans) remaining on the property.

- A tax lien imposed by a government to recover unpaid taxes.

- A mechanic’s lien (construction lien) representing an unpaid bill.

- Liens imposed by a court for an obligation of a prior owner.

- A broken chain of title due to an improper transfer in the past.

- A bankruptcy or a new judgment against the current owner, which might cloud the title even if it has been clear up to this point.

- The possibility of unknown heirs.

- Restrictive zoning laws impacting the use and value of the home

- Unpermitted construction or renovations.

- An easement or a claim on part of the property by another landowner, utility company, etc.

Can You Do a Title Search Yourself?

Yes, and checking the county records is a good practice for homeowners and anyone who might be asked to accept a deed. The local recorder’s office is conveniently located in the home’s county. Plus, many title records now appear online.

For a more thorough process, have a title insurance company or abstractor perform a title search. Because these professionals have access to multiple data sources, their searches may find issues that the lay person can easily miss.