Okaloosa County Quitclaim Deed Forms (Florida)

Express Checkout

Form Package

Quitclaim Deed

State

Florida

Area

Okaloosa County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Okaloosa County specific forms and documents listed below are included in your immediate download package:

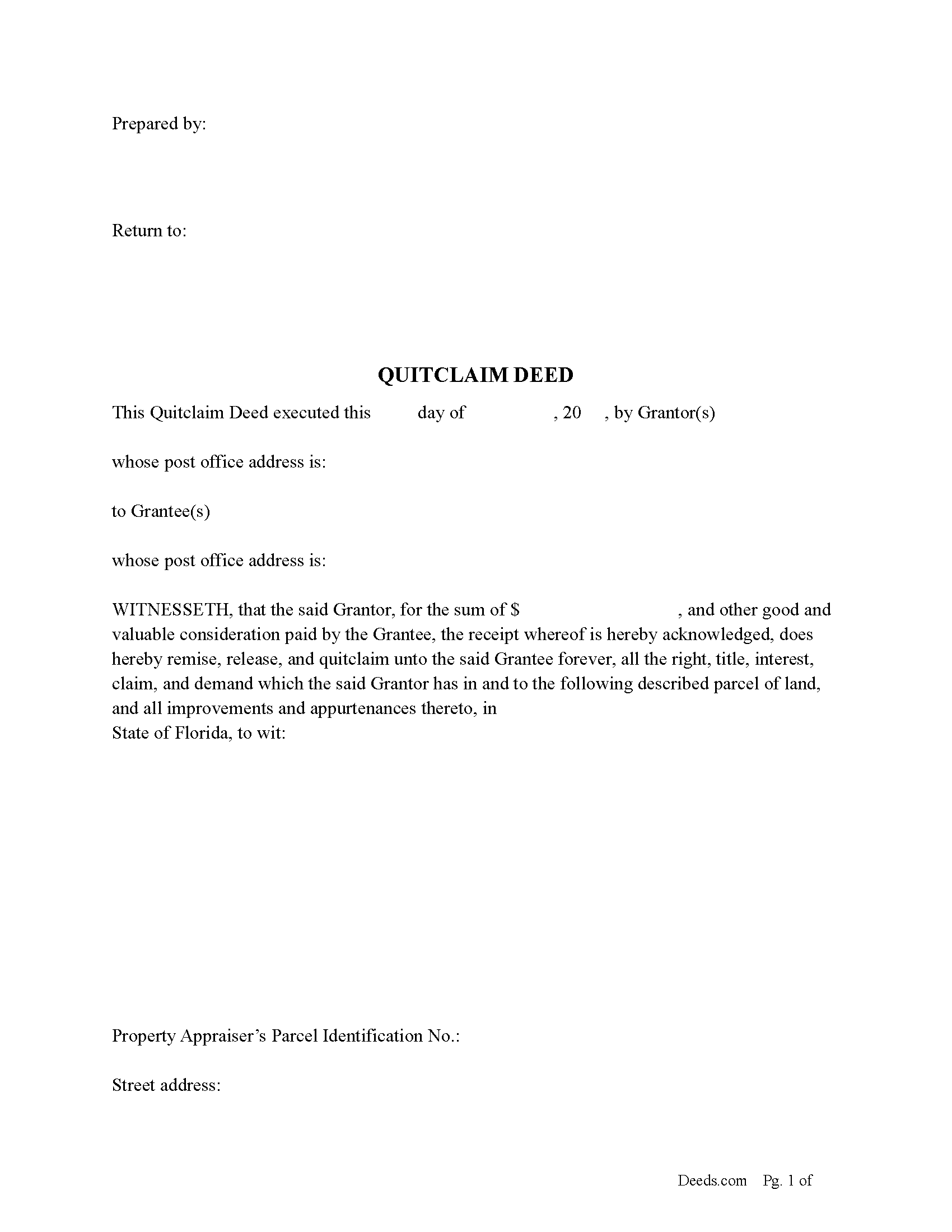

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Florida recording and content requirements.

Included document last reviewed/updated 3/22/2024

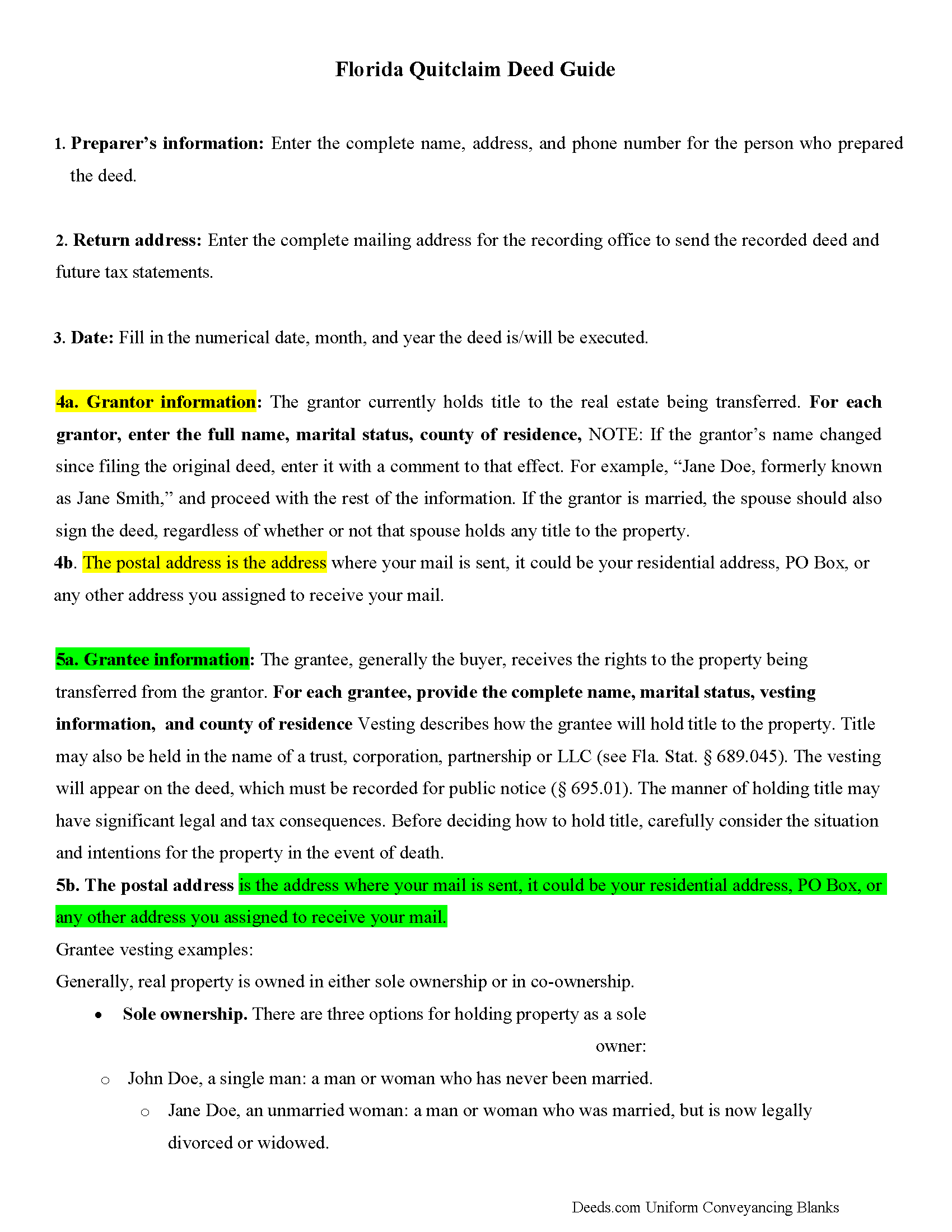

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included document last reviewed/updated 3/14/2024

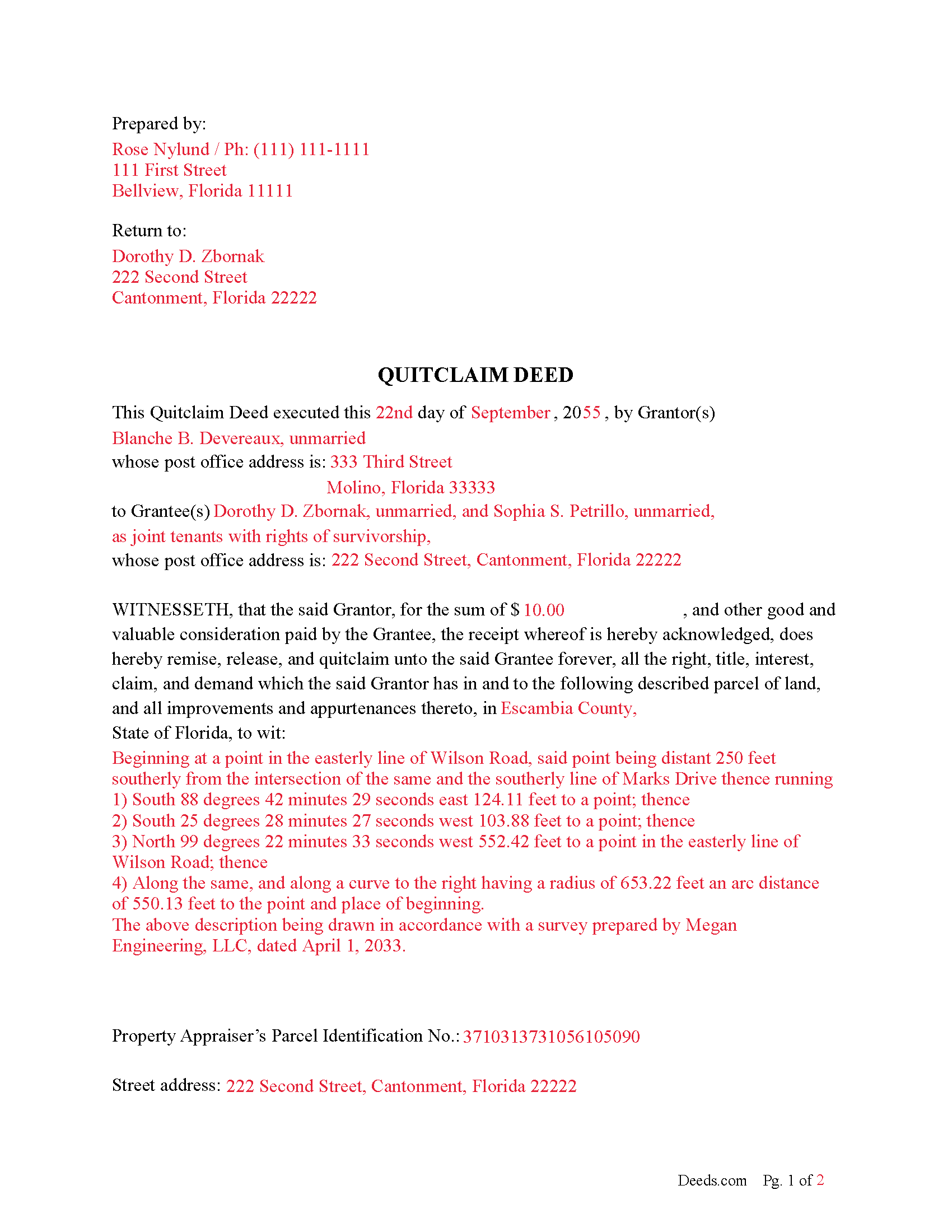

Completed Example of the Quitclaim Deed Document

Example of a properly completed Florida Quitclaim Deed document for reference.

Included document last reviewed/updated 3/5/2024

Included Supplemental Documents

The following Florida and Okaloosa County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Florida or Okaloosa County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Okaloosa County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Okaloosa County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Okaloosa County that you need to transfer you would only need to order our forms once for all of your properties in Okaloosa County.

Are these forms guaranteed to be recordable in Okaloosa County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Okaloosa County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Quitclaim Deed Forms:

- Okaloosa County

Including:

- Baker

- Crestview

- Destin

- Eglin Afb

- Fort Walton Beach

- Holt

- Hurlburt Field

- Laurel Hill

- Mary Esther

- Milligan

- Niceville

- Shalimar

- Valparaiso

What is the Florida Quitclaim Deed

Florida statutory requirements for quit claim deed form content:

F. S. 689.01 presents the basic rules for conveying real property in Florida. Although quitclaim deeds are not specifically defined in the Florida Statutes, the correct language, modifications, and content work together to create an instrument that legally transfer ownership of land.

All quitclaim deeds must be in writing and be signed by the grantor in the presence of two witnesses. In addition to these details, F. S. 689.02 presents the form for a warranty deed. It includes requirements for the date of conveyance; the names, addresses, and counties of both parties (grantor and grantee); the amount of consideration (usually money); and a complete legal description of the property. The statutory form also requests the property appraiser's parcel ID, which should be included if possible, and the grantee's social security number, which may be omitted on documents submitted for recordation and entry into the public record. This basic form also includes warranty covenants, however, which must be deleted and/or changed where appropriate because quit claim deeds do not contain any warranty protection for the grantee.

If the real estate described in the quitclaim deed is a homestead, F. S. 689.111 explains that if the grantor is married, both spouses must sign the conveyance whether both have ownership of the property or not.

Recording:

F. S. 695.26 provides the requirements for recording instruments affecting real property:

* Each signature must have the signor's name typed or printed beneath the signature, and each signor's complete mailing address must be in the body of the quit claim deed. In most cases, the addresses are included with the grantor/grantee information.

* Quit claim deeds must contain the name and mailing address of the individual who prepared the document.

* Each witness's signature must have the signor's name typed or printed beneath the signature.

* The quit claim deed must be acknowledged by a notary public or other official authorized to take acknowledgements and administer oaths.

* Specific format: 3" x 3" space at the top right of the first page, 1" around the sides and bottom, 1" x 3" at the top right of all other pages with 1" around the sides and bottom.

Florida follows a "notice" recording statute. F. S. 695.01 asserts that conveyances of real property, including quit claim deeds, must be formally recorded according to law, thereby providing notice to the public of a change in ownership of the parcel of land. This means that if the grantor conveys the same property to another bona fide purchaser (buyer of the land for value, usually money), and the earlier deed is not recorded, the later grantee will generally retain ownership.

Recording quit claim deeds or other instruments that formalize a change in ownership of property preserves the chain of title (sequence of owners), which simplifies future conveyances. F. S. 695.11 states that instruments submitted for recording to the clerk of circuit court's office are considered to be recorded at the time they are filed. Each document receives a unique, sequential, official register number to identify the order of submission; lower numbers have priority over higher numbers in the same series.

F. S. 695.01 goes on to explain that grantees by quit claim are considered "bona fide purchasers without notice within the meaning of the recording acts." This is because quit claim deeds contain no warranties of title. Regardless, the best way to protect the interests of all parties is to record the deed as soon as possible after its execution.

(Florida Quitclaim Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Okaloosa County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Okaloosa County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4323 Reviews)

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Sandra T.

May 4th, 2023

I hope this will address all I need to make sure my father is not being taken for granted by my siblings and a nephew and his wife.

thank you

Thank you!

pete k.

February 11th, 2021

Excellent service and quick turnaround time.I ordered a copy of my property deed and I received a downloadable digital copy in about 10 to 15 minutes. Very impressed. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

LISA R.

May 4th, 2022

I was very pleased to find your website and the range of services you offer. I was recommended to hire an estate attorney, but the forms you provided will eliminate the need for that. Thank you for the help!

Thank you for your feedback. We really appreciate it. Have a great day!

Jules S.

May 6th, 2020

I can't believe I haven't been using this service since inception. The only thing I would recommend is to allow us to delete an erroneous upload. I accidentally uploaded the same document twice but I saw no way for me to correct my mistake other than to send an email.

Thank you for your feedback. We really appreciate it. Have a great day!

Gregory C.

March 17th, 2022

All of these forms should be downloadable in .zip format - having to do 8-9 downloads is ridiculous, respectfully.

Thank you for your feedback. We really appreciate it. Have a great day!

Michele B.

June 9th, 2022

It was a wonderful experience. Thank you for your help.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value.

In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Edward S.

November 9th, 2021

Easy to use and comprehensive in content. Would recommend to anyone that is looking for a cheaper alternative to a lawyer. (They hate services that cut into their business)

Thank you!

Lanette H.

September 9th, 2020

I liked getting the forms but I was charged twice for some reason. I'm not sure what happened with that. Can you reimburse me? Thank you. Lanette

Thank you for your feedback Lanette. In review, it looks like your first payment was declined, second one was approved and processed. What you are seeing is one payment and a hold placed by your financial institution for the declined attempt. We are not sure why they do this but the hold usually falls off after a few day depending on their policy. If you have further questions about this you can contact your financial institution and they will explain. Have a great day.

Karen K.

October 16th, 2020

Deeds was very easy to use. I thought it might take weeks to complete, but the whole process was completed in just a few hours. I am very satisfied with my experience and would use them again

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

David Y.

March 10th, 2020

Really great forms. Did the quitclaim, everything was perfect, recorded with no problems at all. Thanks!

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.