Mitchell County Quitclaim Deed Forms (Kansas)

Express Checkout

Form Package

Quitclaim Deed

State

Kansas

Area

Mitchell County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Mitchell County specific forms and documents listed below are included in your immediate download package:

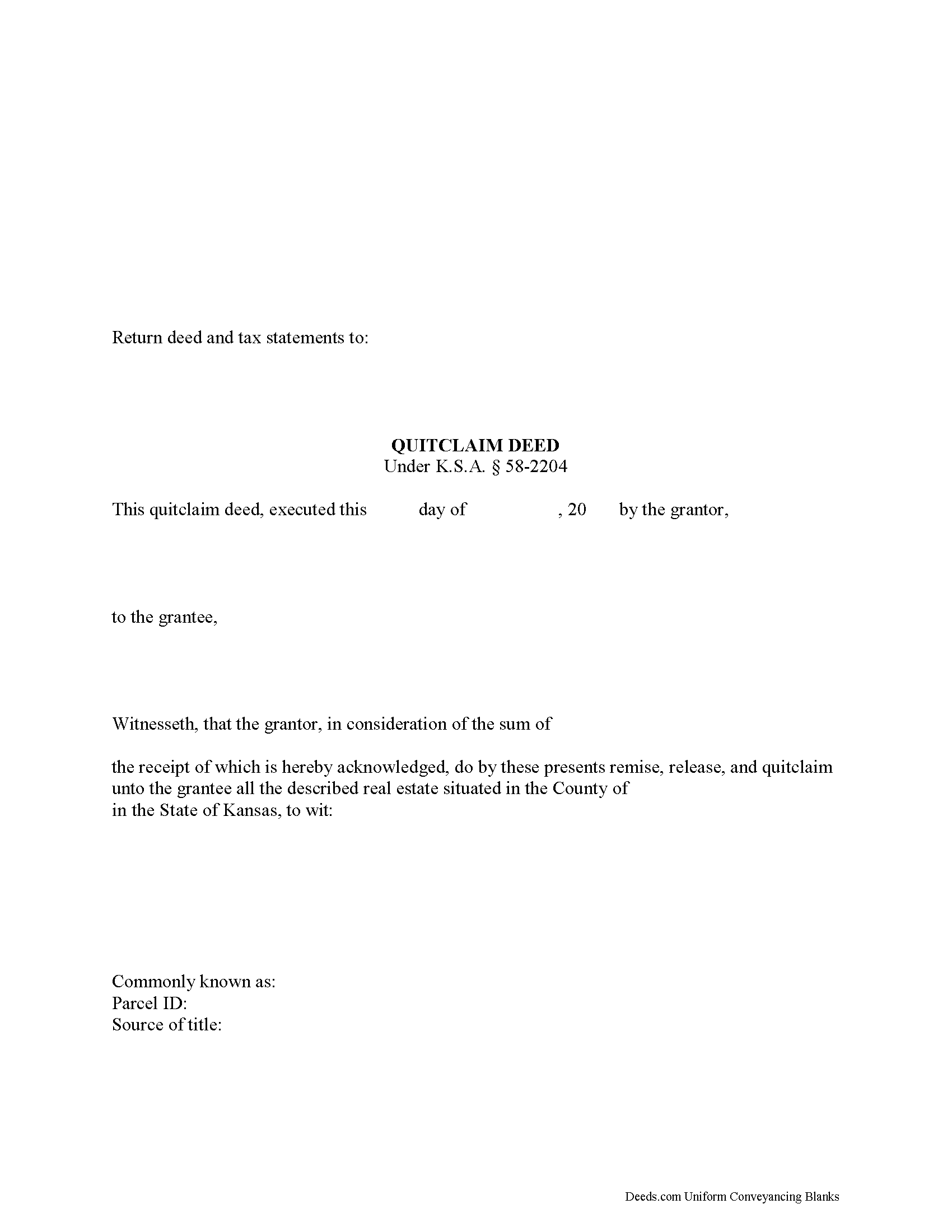

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Kansas recording and content requirements.

Included document last reviewed/updated 2/29/2024

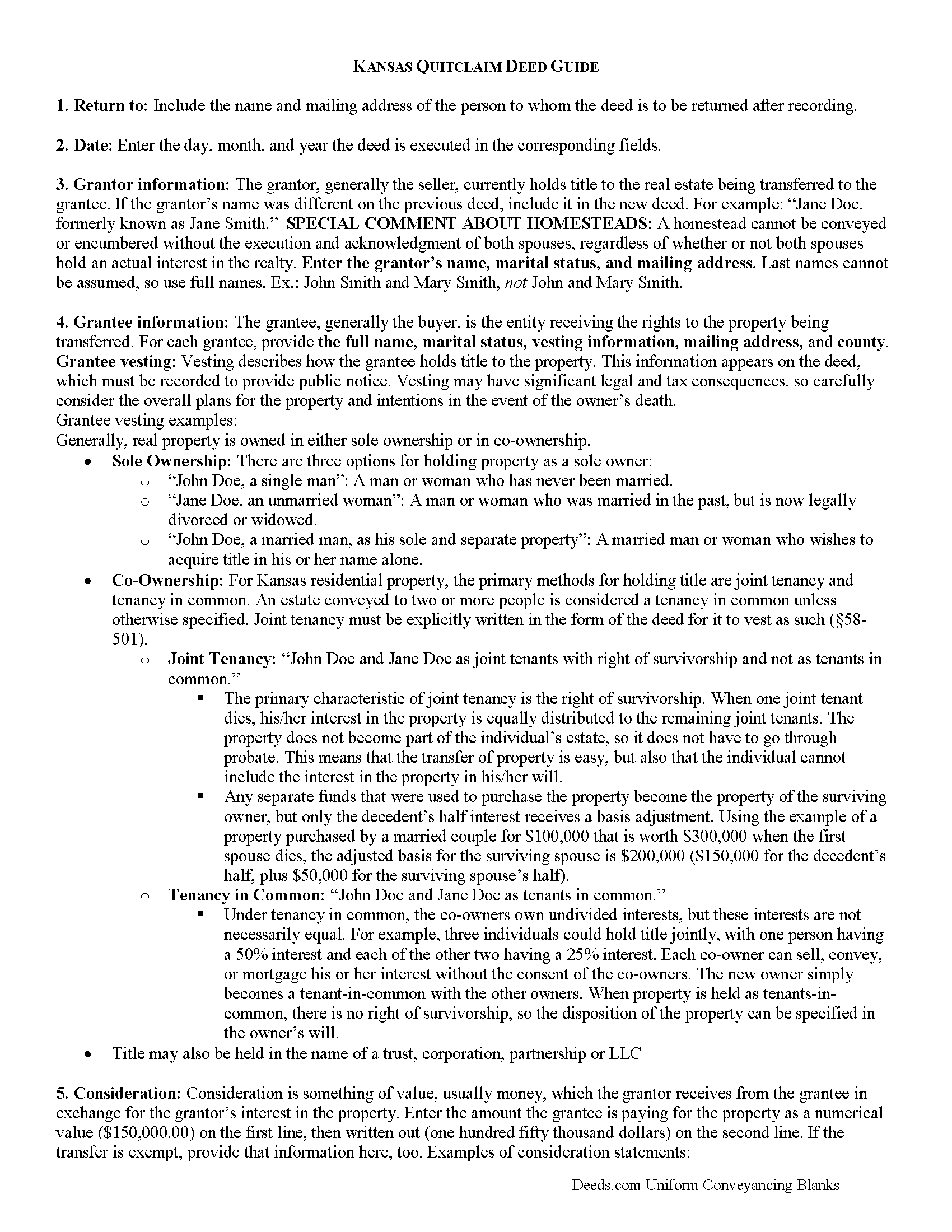

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included document last reviewed/updated 1/25/2024

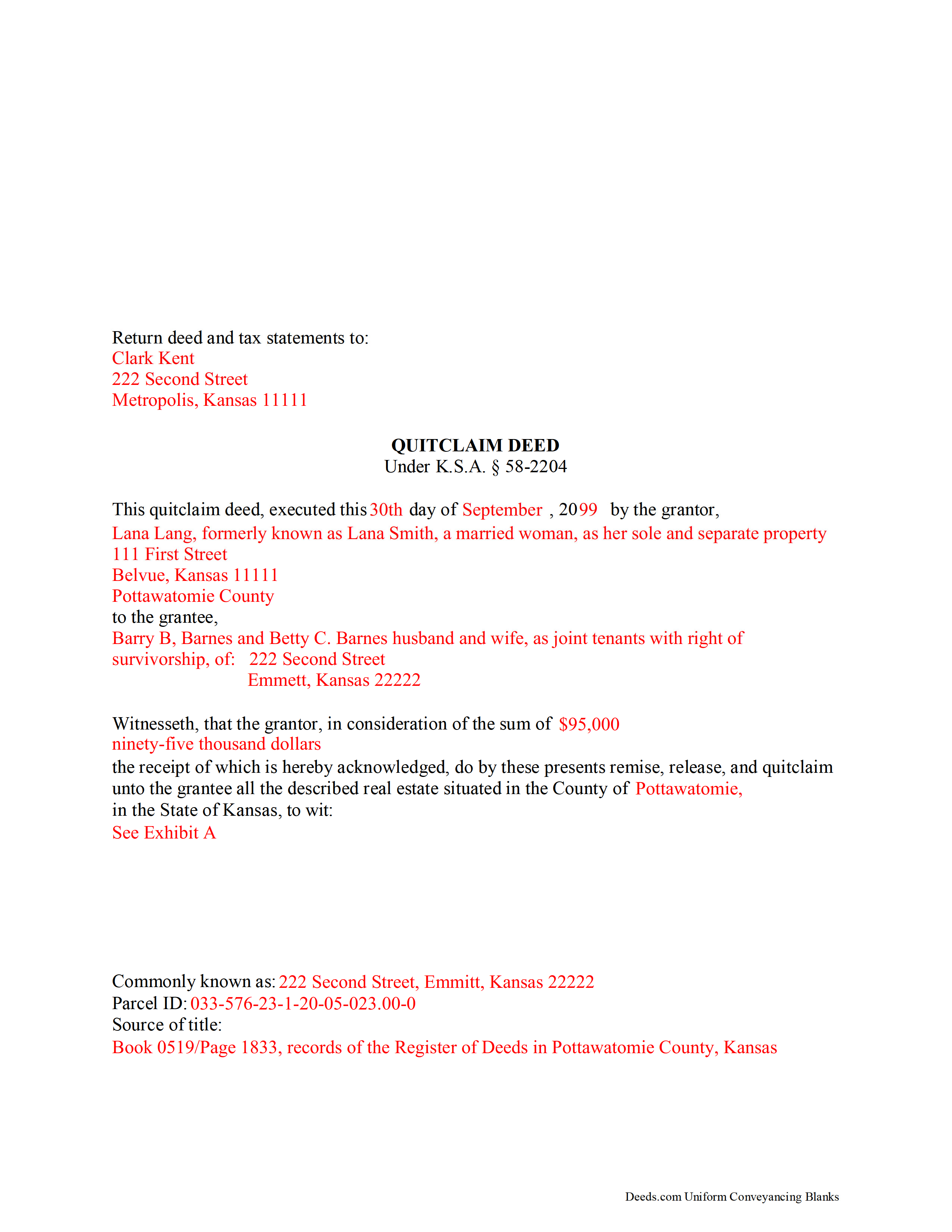

Completed Example of the Quitclaim Deed Document

Example of a properly completed Kansas Quitclaim Deed document for reference.

Included document last reviewed/updated 12/14/2023

Included Supplemental Documents

The following Kansas and Mitchell County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Kansas or Mitchell County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Mitchell County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Mitchell County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Mitchell County that you need to transfer you would only need to order our forms once for all of your properties in Mitchell County.

Are these forms guaranteed to be recordable in Mitchell County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mitchell County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Quitclaim Deed Forms:

- Mitchell County

Including:

- Beloit

- Cawker City

- Glen Elder

- Hunter

- Simpson

- Tipton

What is the Kansas Quitclaim Deed

Kansas Quitclaim Deed Content:

K.S.A. 58-2202 explains that "every conveyance of real estate shall pass all the estate of the grantor therein." K.S.A. 58-2202 states that transfers in ownership of land are valid when a deed is executed by someone with an ownership interest in the property. K.S.A. 58-2204 provides the statutory form for quitclaim deeds, including the minimum requirements and correct language. The necessary information includes the names and addresses of all grantors and grantees, a complete legal description of the property, the consideration (usually money), and the notarized signature of the grantor or an authorized representative. K.S.A. 58-2209 reinforces the requirement of the grantor's notarized signature. K.S.A. 58-2211 expands the discussion about who may acknowledge the instrument to include those authorized by uniform law to perform notarial acts. K.S.A. 28-115 states that all signatures must have the signor's name typed or printed immediately below them. Finally, K.S.A. 58-2221 adds the obligation to include details about the transaction in which the grantor gained ownership of the property. In addition, be certain that the document contains an appropriately descriptive heading (in this case, "Quit Claim Deed).

Recording:

K.S.A. 58-2221 explains that every written instrument conveying ownership interests in real estate should be presented for recording to the office of the register of deeds of the county where the land is located. K.S.A. 28-115 contains formatting requirements:

* Legal-sized paper (8" x 14") is the maximum size for recording without a non-standard document fee.

* The document must be printed in minimum 8-point type.

Kansas follows a "race-notice" recording statute, as described in K.S.A. 58-2222, 2223. Every written instrument, such as a quit claim deed, submitted for recording as directed, imparts constructive notice to all subsequent bona fide purchasers (buyers for value). Unrecorded deeds only provide actual notice to the parties involved with the conveyance, but because they are not entered into the public record, future buyers might not be aware of the change in ownership. For example, let's say that the grantor quit claims his/her rights to the real estate to grantee A, who fails to record the otherwise properly executed deed. Then the grantor quit claims the same property to grantee B, who records the instrument according to the statute. By presenting the deed for recordation, grantee B enters the transaction into the public record and, as a result, will generally prevail in a dispute about the real owner of the parcel of land. In short, recording the quit claim deed as soon as possible after it is executed is one of the simplest ways to preserve the rights and interests of both the buyer and the seller.

(Kansas Quitclaim Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Mitchell County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mitchell County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4320 Reviews)

Lorie S.

April 24th, 2024

It was available to download immediately

Thank you!

TIFFANY B.

April 24th, 2024

THIS SERVICE IS AMAZING! IT SAVES ME SO MUCH TIME!

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Nancy A.

April 24th, 2024

This is an excellent resource. I was surprised because the price is so low I thought the products might be inferior. Not only were were the requested documents high quality, additional unrequested documents were added to my order that I didn\'t realize I would need until I read them. I especially appreciate that all the documents were specific to my county. I highly recommend using deeds.com.

Your satisfaction with our services is of utmost importance to us. Thank you for letting us know how we did!

Gerald B.

April 5th, 2021

Thank you so much for the helpful service and quick action! If needed, I will definitely choose Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Erik H.

July 16th, 2020

tl;dr - Bookmarked and anticipating using this site for years to come.

My justification for rating 5/5

1. Provide intuitive method for requesting property records.

2. Cost for records *seems reasonable.

3. They clearly state that interested parties could gather these records at more affordable costs through the county (which was more confusing for an inexperienced person such as myself). I mean, I appreciate and respect this level of honesty.

*I didn't shop around too much because it was difficult for me to find other services that could deliver CA property records.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kenneth J.

May 5th, 2022

I thought the forms were good but expensive, Spending almost 30 dollars for a 3 page form was a stiff price to pay. I won't be getting any more

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara S.

February 28th, 2019

I had an issue due to the fact that I had many beneficiaries. I was and still am not sure how to handle this. We do have Adobe Pro and can modify the form, if needed. But I would like to talk to your organization for more information.

While we are unable to assist you specifically with completing the document we can note that this is addressed in the guide. Information that does not fit in the available space should be included in an exhibit page.

Joe F.

January 11th, 2021

TOOK ME SEVERAL DAYS TO FIND A SITE THAT DIDNT CHARGE $100 JUST TO USE ONE FORM. THANKS

Thank you for your feedback. We really appreciate it. Have a great day!

ROBERT M.

May 27th, 2019

Lots of Info.

Forms seem straightforward.

Easy to Fill out.

Thank you for your feedback. We really appreciate it. Have a great day!

John A.

December 21st, 2021

Very easy to use. Would recommend to anyone

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Samuel T.

June 26th, 2021

So far, so good. explanations provided for the forms and instructions on how I should proceed were clear as a bell, and it was nice to get immediate delivery of the forms. I'll be looking for other ways to take advantage of this site, for sure.

Thank you!

Ted C.

May 7th, 2021

Everything was straight forward. I think I was able to accomplish my objective.

Thank you!

Mark M.

October 1st, 2020

So nice to find the forms I was looking for. Great site!! Thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Carol S.

November 18th, 2020

Excellent ...easy, timely!

Thank you for your feedback. We really appreciate it. Have a great day!

John W.

January 9th, 2019

The forms were easy to acquire and easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.