Le Flore County Quitclaim Deed Forms (Oklahoma)

Express Checkout

Form Package

Quitclaim Deed

State

Oklahoma

Area

Le Flore County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Le Flore County specific forms and documents listed below are included in your immediate download package:

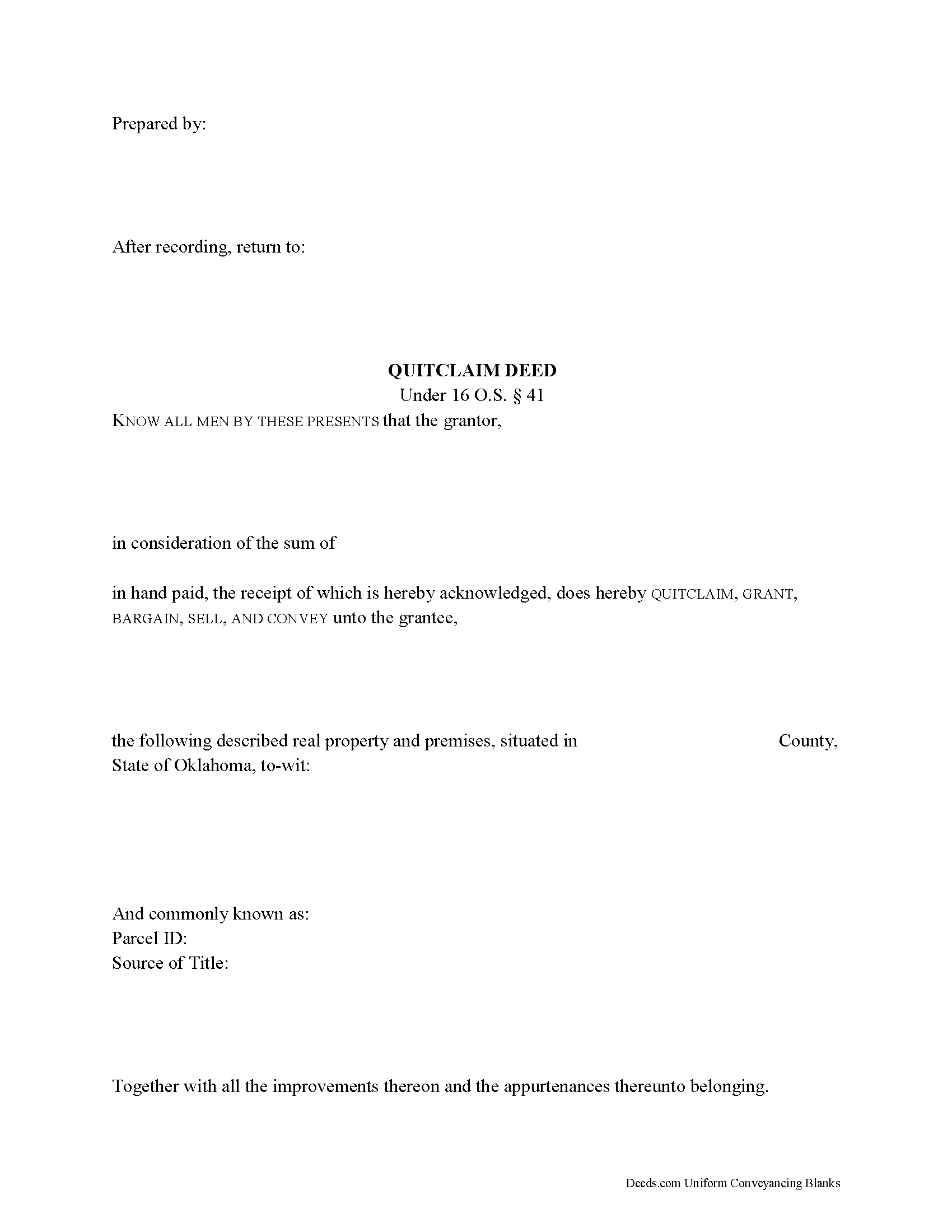

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all Oklahoma recording and content requirements.

Included document last reviewed/updated 4/9/2024

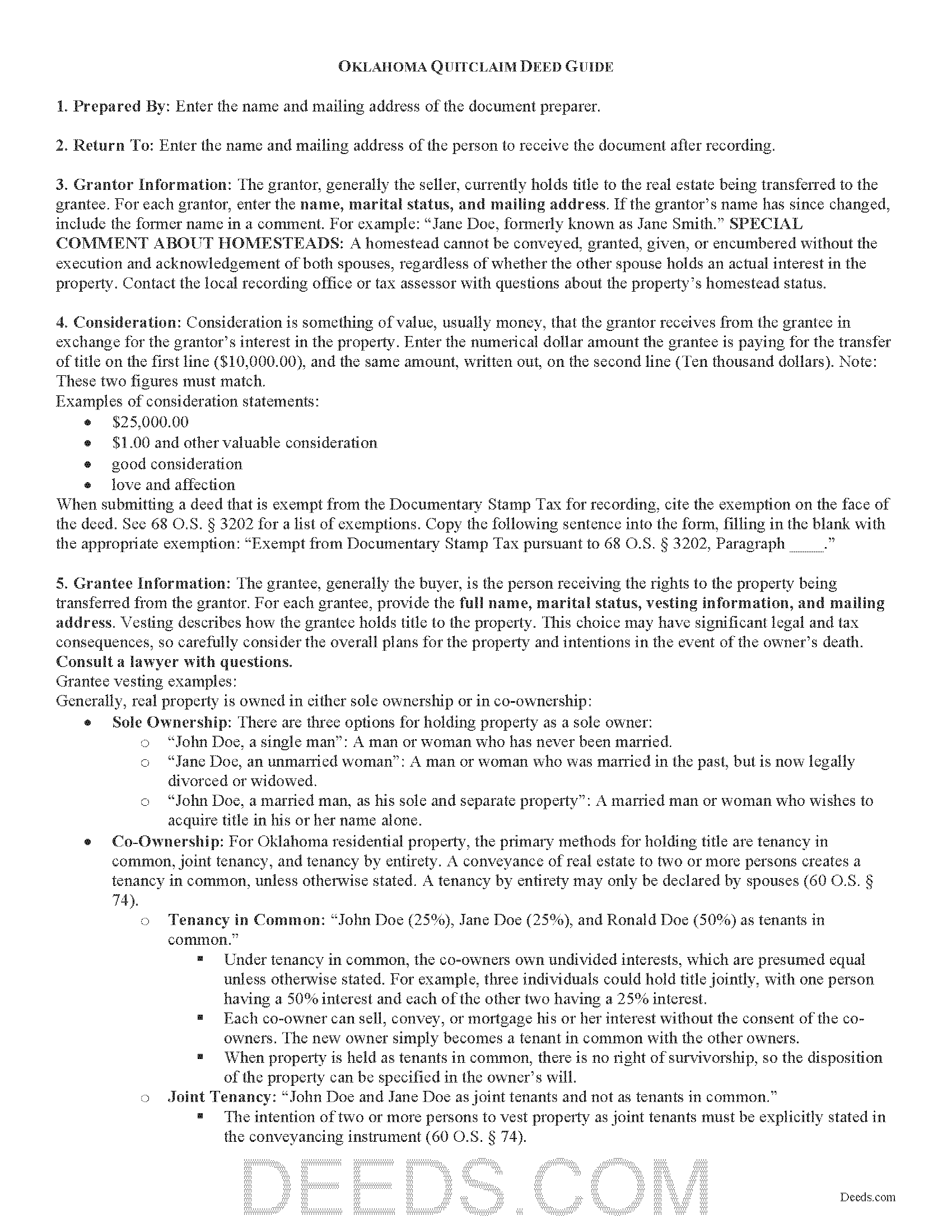

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included document last reviewed/updated 1/23/2024

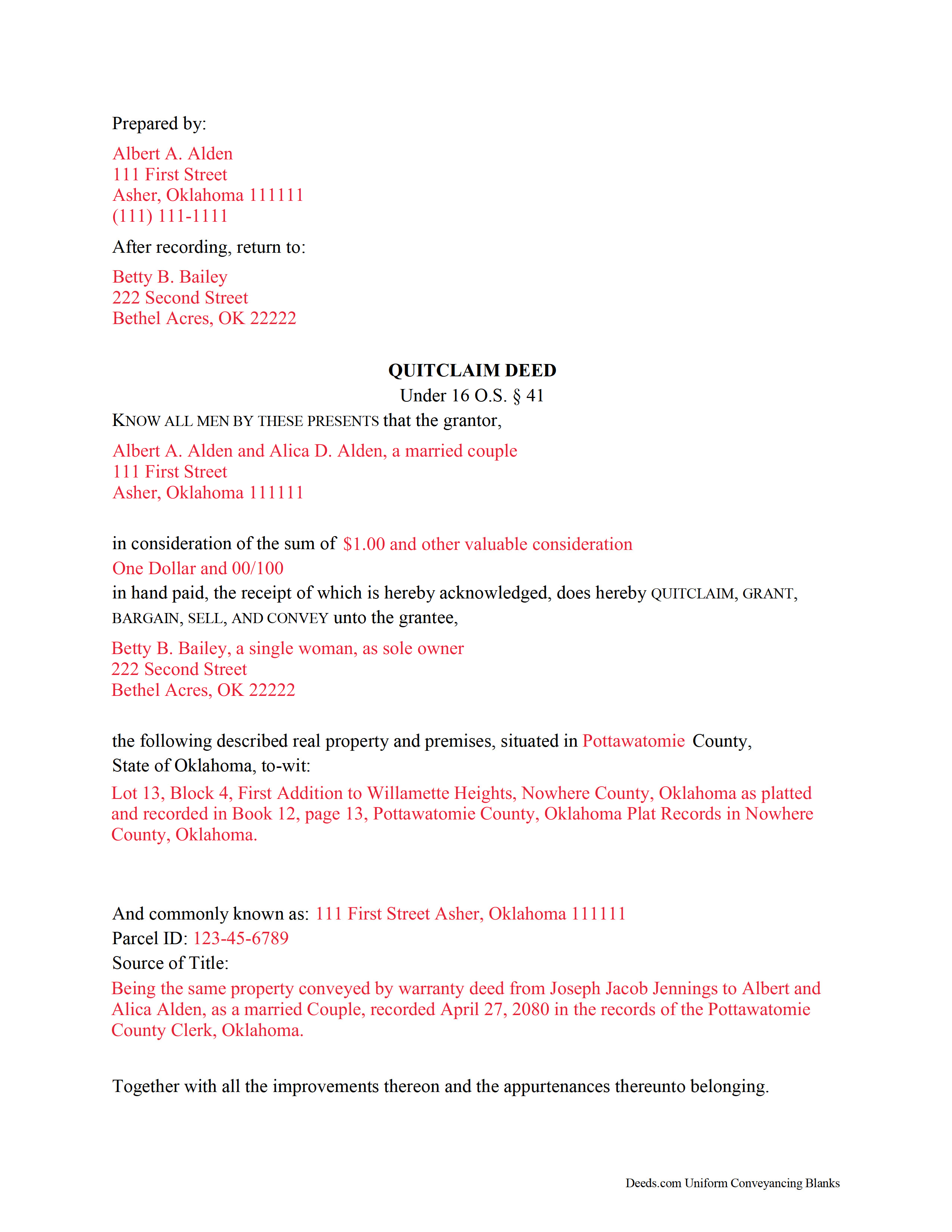

Completed Example of the Quitclaim Deed Document

Example of a properly completed Oklahoma Quitclaim Deed document for reference.

Included document last reviewed/updated 4/16/2024

Included Supplemental Documents

The following Oklahoma and Le Flore County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Oklahoma or Le Flore County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Le Flore County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Le Flore County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Le Flore County that you need to transfer you would only need to order our forms once for all of your properties in Le Flore County.

Are these forms guaranteed to be recordable in Le Flore County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Le Flore County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Quitclaim Deed Forms:

- Le Flore County

Including:

- Arkoma

- Bokoshe

- Cameron

- Fanshawe

- Heavener

- Hodgen

- Howe

- Kiamichi Christian Mission

- Leflore

- Monroe

- Muse

- Panama

- Pocola

- Poteau

- Shady Point

- Spiro

- Whitesboro

- Wister

What is the Oklahoma Quitclaim Deed

In Oklahoma, interest in real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory in Oklahoma under 16 O.S. Section 41, and they convey all the right, title, and interest of the grantor to and in the property (16 O.S. Section 18). This type of deed only conveys the interest the grantor may have at the time the deed is executed, but it does not guarantee that the grantor has good title or right to the property.

Quitclaim deeds offer no warranties of title and provide the least amount of protection to the grantee (buyer). They are generally reserved for divorces and other transfers of property between family members. Quitclaim deeds do not offer the same assurances as general warranty deeds, which convey real property with the most assurance of title, or special warranty deeds, which only guarantee the title against claims that arose during the time the grantor held title to the property.

A lawful quitclaim deed includes the grantor's full name, mailing address, and marital status; the consideration paid for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Oklahoma residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common, unless otherwise specified. Only spouses can declare a tenancy by entirety (60 O.S. Section 74).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel. The legal description must provide the information necessary for indexing as required by Section 287 and 291 of Title 19 O.S. (addition, block & lot, section, township & range, and metes & bounds if necessary for the location). Verify the type of description required with the local county clerk's office. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property.

A quitclaim deed must meet all state and local standards for recorded instruments. Sign the deed in the presence of a notary public and record at the clerk's office in the county where the property is located for a valid transfer. Contact the same office to verify accepted forms of payment. When submitting a deed that is exempt from the Documentary Stamp Tax, cite the exemption claimed on the face of the deed. See 68 O.S. Section 3202 for a list of exemptions. For any questions regarding a transfer of property affecting Indian land, refer to the Bureau of Indian Affairs and contact a lawyer.

This article is provided for informational purposes only and is not a substitute for legal advice. Consult an attorney with questions about quitclaim deeds, or for any other issues related to the transfer of real property in Oklahoma.

(Oklahoma QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Le Flore County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Le Flore County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4323 Reviews)

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Mitchell S.

April 25th, 2024

This service was very helpful, quick, inexpensive and easy to use. Should I ever need it again, I know right where to go.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Mary P.

February 11th, 2019

Excellent easy to follow instructions.

Great to hear Mary, Have a wonderful day!

Rhonda L.

May 27th, 2020

This was one of the most simple but efficient process. Walked me thru every step. Total process was less than 2 weeks.

Thank you!

Dawn M.

October 26th, 2020

So helpful and quick! The response time and kindness was amazing! The steps were easy to follow as well. We will definitely be using Deeds.com in the future!

Thank you for your feedback. We really appreciate it. Have a great day!

Virginia M.

August 26th, 2020

This was the easiest web page ive ever navigated .Found just what i needed fast !

Thank you!

Everette W.

March 5th, 2023

This form was very helpful ... I wish I had run across your before it would have saved me a lot of money.

Thank you!

Frances B.

June 13th, 2019

Excellent product!!!! Accepted at my courthouse without a hitch.

I recommend this company whole heartedly!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane O.

September 1st, 2022

Filling out forms was easy....so far, I am happy !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JESUS G.

June 13th, 2020

Easy And fast to use just scan upload and pay the fee and they take care of the rest.

Thank you!

Rebecca M.

February 22nd, 2023

Haven't used yet but I will check it out tomorrow

Thank you!

Truc T.

October 19th, 2021

great DIY site.

Thank you!

James S.

August 26th, 2020

unbelievable Deeds Rocks

Start to finish 2=Day

Recommended by Coconino County Recorders office

in Arizona

there were incomplete sections. I would correct and resubmit . All done Yeah!!!!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.