Most home buyers get a mortgage loan to finance the purchase. And for most people, the mortgage servicing company holds some of the owner’s payment in escrow, and pays property taxes out of that account on behalf of the borrower as long as the mortgage exists.

But what if the mortgage servicer lets a tax payment slip through the cracks?

Fumbles Do Happen…

Mistakes are especially possible when a loan is sold from one company to the next. And that’s a frequent occurrence in the mortgage lending world, as most homeowners know.

But how would a homeowner know about a payment lapse?

In a case of unpaid taxes, the homeowner should receive a past-due bill from the local tax collector. Sometimes, a homeowner is just checking up on the account, and it looks like a tax payment wasn’t made.

So, check in on your escrow account from time to time, and particularly after one company sells your mortgage to the next. It never hurts to make sure your homeowner’s insurance and property tax payments are on track.

Now, to Fix the Problem…

Taxes can’t be ignored. A borrower with an overdue tax bill should take action without delay.

Too much delay in a case of late property tax payments can lead to:

- A delinquency penalty from the local government.

- A lien on the home’s title.

- Ultimately, foreclosure.

So, be sure the issue is resolved promptly. Here’s how:

- Contact your mortgage company. Ask it to cover the past-due bill immediately.

- If the issue isn’t promptly resolved, send a copy of the tax collector’s notice and a notice of error to your mortgage company for “[f]ailure to pay taxes, insurance premiums, or other charges, including charges that the borrower and servicer have voluntarily agreed that the servicer should collect and pay, in a timely manner…” This letter should also include the borrower’s name and loan number.

- Under federal law, the servicer must acknowledge receipt of the notice of error within five business days. If there is a concern about imminent foreclosure, the borrower may decide to call the tax office and resolve the past-due bill.

- Request a refund from the mortgage servicing company. The borrower is entitled to a refund for penalties resulting from a mortgage servicing company’s lapse in tax or insurance payments.

The company might also agree to reduce a future bill in light of the borrower’s inconvenience. It doesn’t hurt to ask. In any case, the company has 30 days to resolve an error it has made. This can be extended to a 45-day period, but the company must explain the extension to the borrower within these first 30 days.

Foreclosure Sales: When Cities Keep the Change

Foreclosures over unpaid tax bills are distressing enough as they are. And yes, foreclosure can happen on account of a simple mistake by a mortgage servicing company which puts a homeowner into tax delinquency status.

Now, we’d at least expect local governments that foreclose on homes to return any profits above and beyond the unpaid debt to the people whose homes they’ve seized. And yet some states have allowed local governments to keep all the proceeds from these home sales. You read that right. Multiple states allow governments to keep profits from foreclosure sales, at least in some circumstances.

This practice takes away the life savings of homeowners. The local authorities’ “surplus retention” of equity can mean the agencies are getting many multiples of the debts owed.

Building equity as a homeowner is a time-honored tradition. Yet foreclosing on homes and “keeping the change” happens in more places, and more often, than most people would guess.

There’s a fitting nickname for the nasty practice of surplus retention: home equity theft.

The Supremes Weigh In—Forcing Change

People shouldn’t have to give up their life savings on account of tax bills they’ve struggled to pay — or didn’t even know they missed. The nation’s highest court agrees.

Recently, the U.S. Supreme Court called the practice unconstitutional. The Justices cited the U.S. Constitution’s Takings Clause. The Clause keeps governments from nabbing people’s property without fair compensation.

We covered the Supreme Court ruling here. The ruling came out in May 2023.

And now, it’s vital that states adjust their laws according to the Supreme Court’s decision. State laws should let tax authorities and companies collect only the amount owed. Never more.

How State Lawmakers Are Responding

Nebraska now has Legislative Bill 727 (PDF). This law, which the governor approved in June 2023, prohibits the retention of surplus home equity. Within 30 days after recording of the tax deed, Nebraska’s law now states, “the grantee shall pay the surplus to the previous owner of the property described in the deed.”

The State Senate of New York is hard at work on a similar requirement. New York State Assembly Bill 2021-A10681 (bill summary webpage) directs “the return of surplus proceeds from tax lien foreclosures to a former owner” in addition to mandating a “14-day posted notice prior to the public auction of a property.”

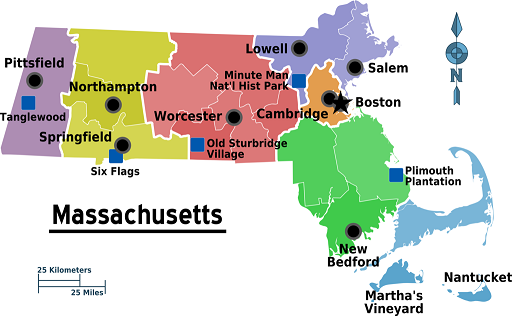

And then there’s Massachusetts. ln light of the U.S. Supreme Court’s decision this year, Massachusetts is overhauling its surplus-retention laws and weeding out unjust tax lien provisions.

Massachusetts had been treating homeowners in tax lien foreclosures harshly. Its law allowed cities to receive “full title of the property” they have foreclosed. That is now changing.

It was the surplus retention law in Minnesota that U.S. Supreme Court struck down as unconstitutional. The decision is forcing change in foreclosure proceedings — not just in Minnesota, but also in Massachusetts, in Nebraska, in New York, and across the country.

Our Takeaway? “Trust, But Verify” That Your Mortgage Company Is on the Ball

If you have a mortgage, you probably pay extra funds into your mortgage escrow account each month. And from that escrow account, the mortgage company pays your property taxes and your homeowners’ insurance by their due dates. The mortgage company wants to take care of everything — and under the federal law, as long as your monthly payment isn’t 30+ days past due, it must make those payments.

Just be aware that slip-ups (although rare) do happen. Now and then, an escrow disbursement doesn’t get done.

A lapse in an insurance policy violates mortgage requirements and must be resolved immediately. The lender will place its own insurance policy on the home when homeowners cancel their policies.

As for unpaid property taxes, these result in liens. Watch out! A property tax lien has priority even over the mortgage itself. Concerned homeowners may decide to pay a past-due bill themselves to resolve the matter quickly, and then pursue their rights with the mortgage company. If you find yourself in this jam, and your mortgage company can’t or won’t resolve it in a timely manner (see the “Fix the Problem” section above for the timeline), you can report it to the federal Consumer Financial Protection Bureau, and talk to a local lawyer with foreclosure experience for case-specific advice.

To avert distress, keep tabs on your mortgage company from month to month — and especially after a new mortgage servicing company takes over your account.

Supporting References

12 C.F.R. § 1024.17.

12 C.F.R. § 1024.35.

Tyler v. Hennepin County, 598 U.S. 631 (2023). See also SCOTUS Blog: Tyler v. Hennepin County, Minnesota.

Colin Allen (American Property Owners Alliance) and Jim Manley (Pacific Legal Foundation), in Herald Talk, from the Boston Herald (MediaNews Group): Opinion – Massachusetts Property Owners Need Better Protections (Jul. 14, 2023).

Kimberly Rau for MassLandlords, Inc. (via MassLandlords.net): SCOTUS Rules Home Equity Theft Is Unconstitutional (Ju. 6, 2023).

Consumer Financial Protection Bureau, via ConsumerFinance.gov: Ask CFPB – What Should I Do if I Get a Tax Bill From the City or County Saying the Mortgage Servicer Did Not Pay My Taxes? (last reviewed Aug. 25, 2017).

Deeds.com: Surplus-Retention Seizures: Legalized Home Equity Theft? (Dec. 30, 2022).

And as linked.

More on topics: Massachusetts, Surviving foreclosure

Photo credits: Property tax by Nick Youngson CC BY-SA 3.0 (via Pix4free); also Wikimedia Commons: public domain and Yellow3467 (CC BY-SA 4.0).