Pope County Mortgage Secured by Promissory Note Forms (Arkansas)

Express Checkout

Form Package

Mortgage Secured by Promissory Note

State

Arkansas

Area

Pope County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Pope County specific forms and documents listed below are included in your immediate download package:

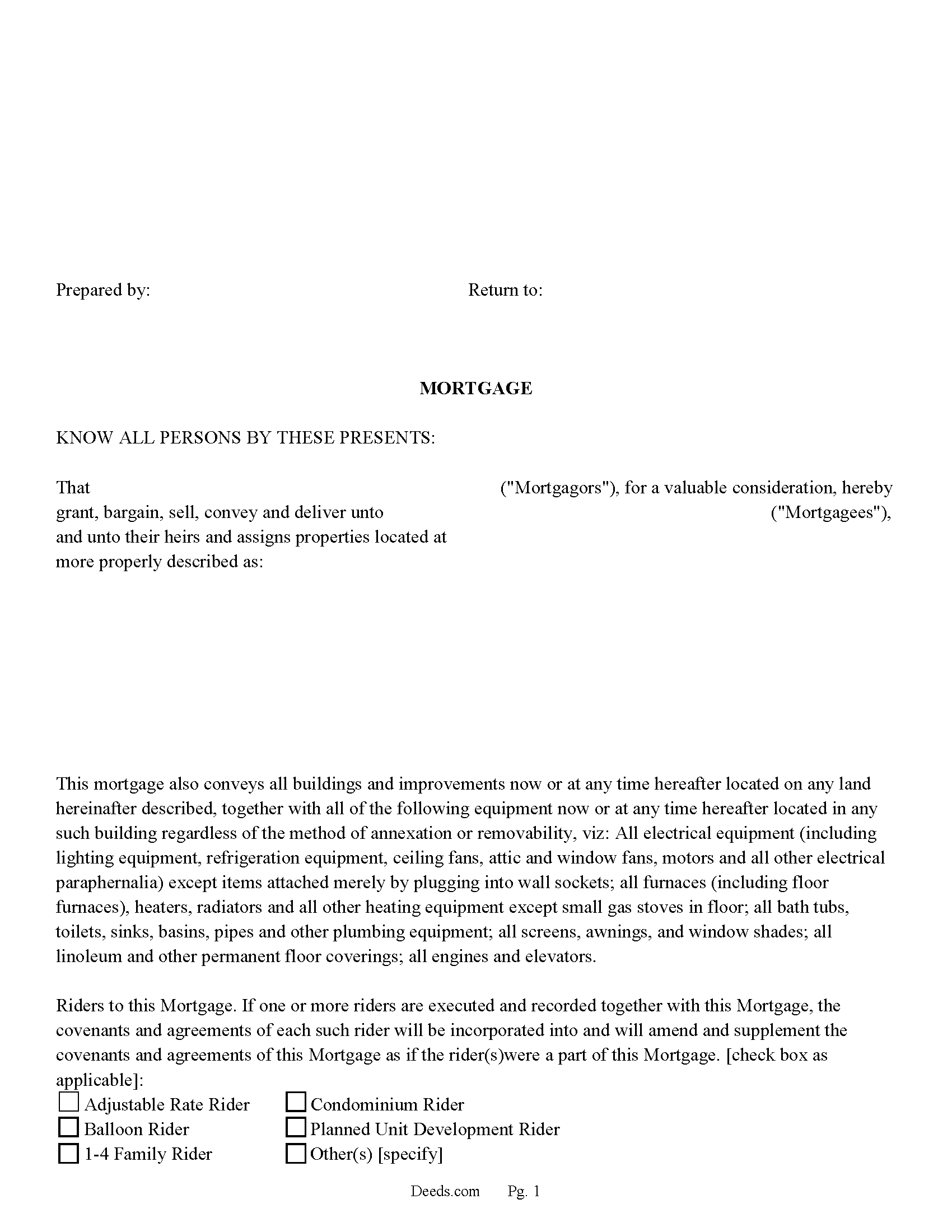

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/4/2024

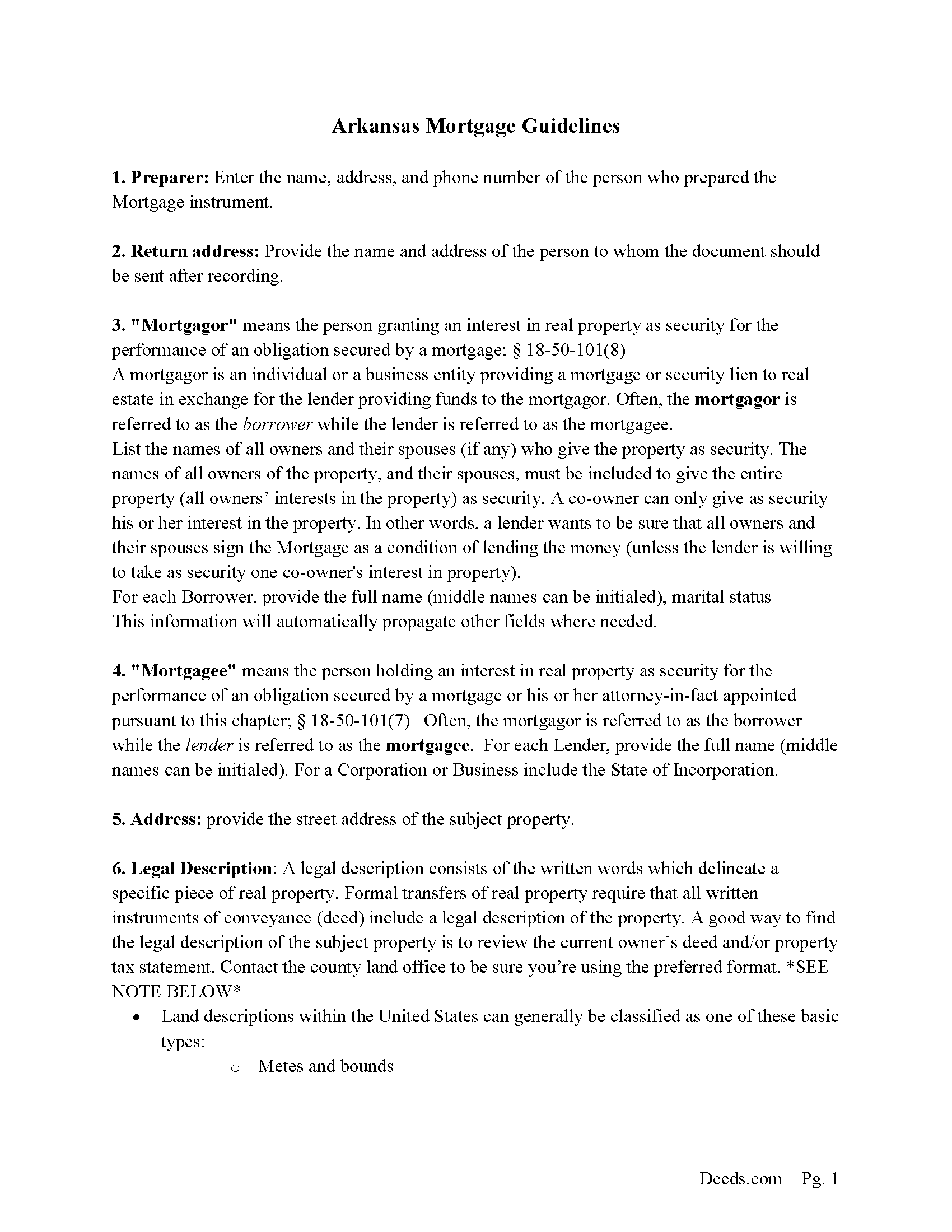

Mortgage Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 2/29/2024

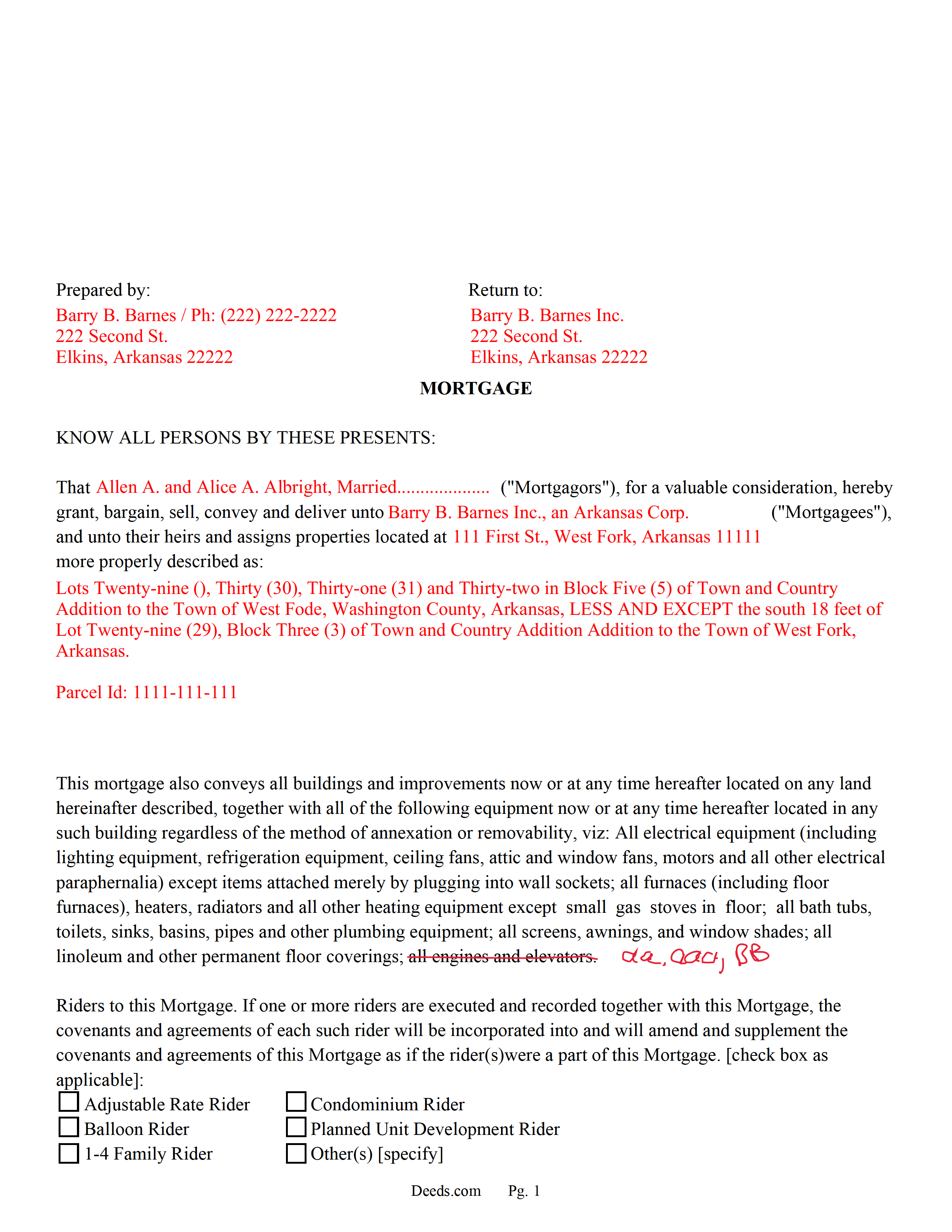

Completed Example of the Mortgage Document

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/19/2024

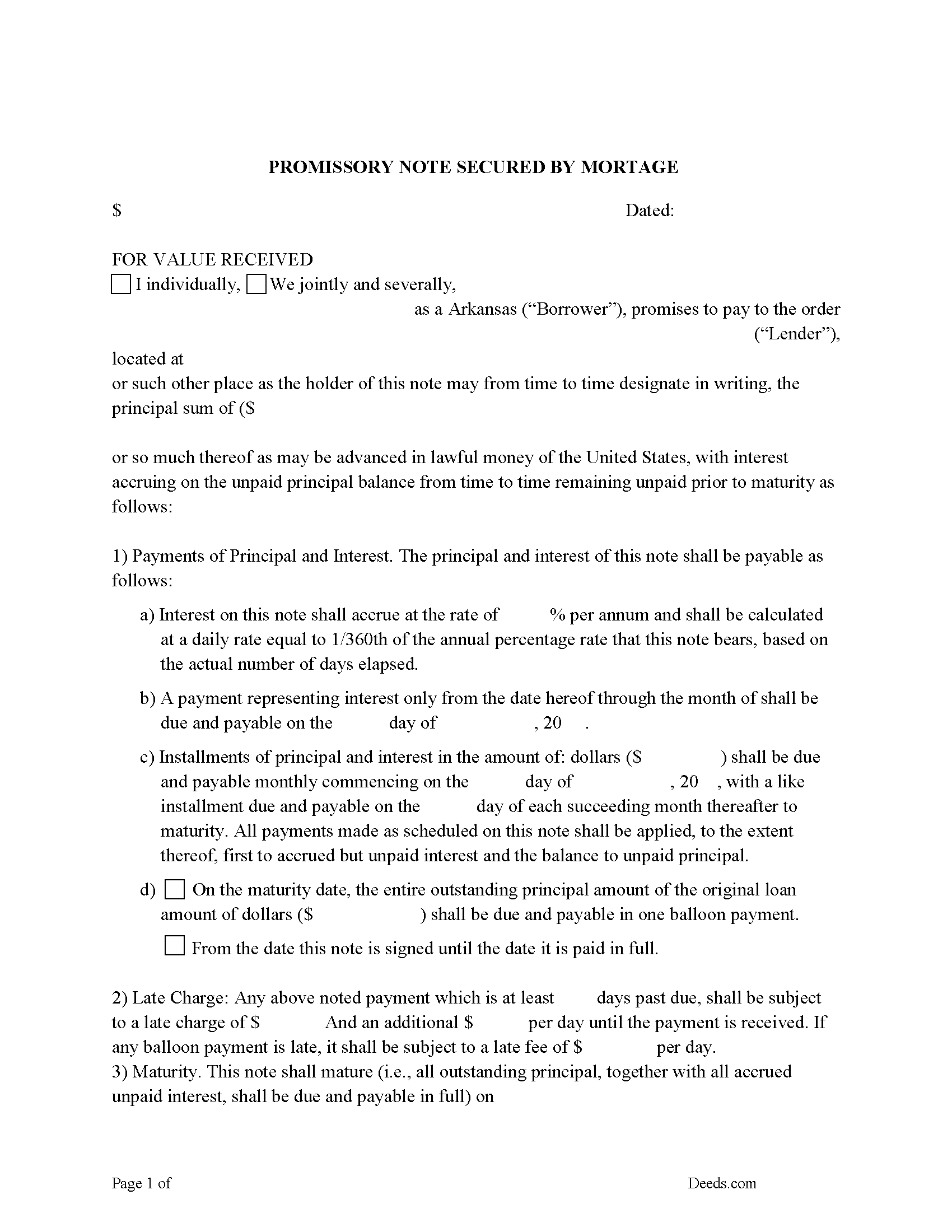

Promissory Note Form

Fill in the Blank Form.

Included document last reviewed/updated 4/8/2024

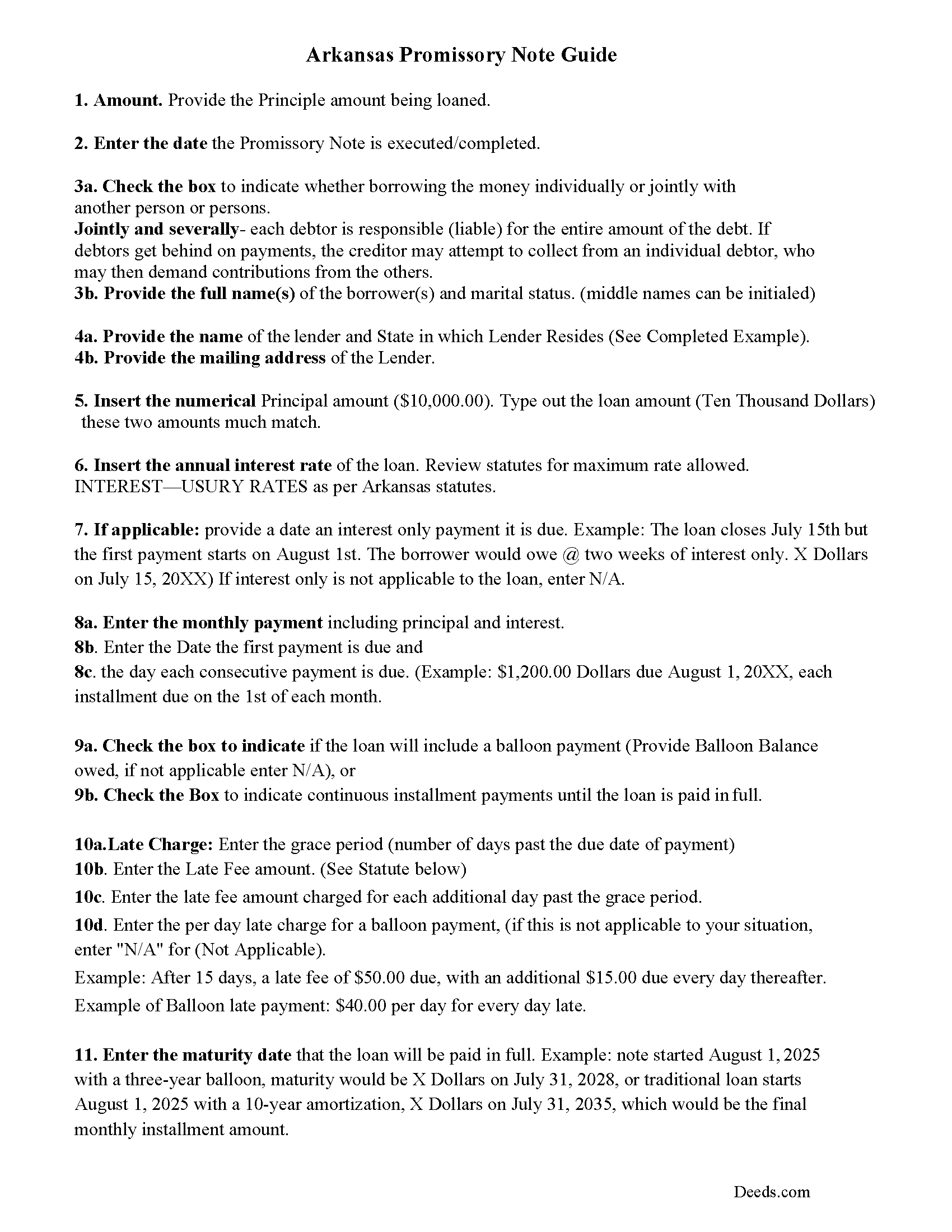

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 2/9/2024

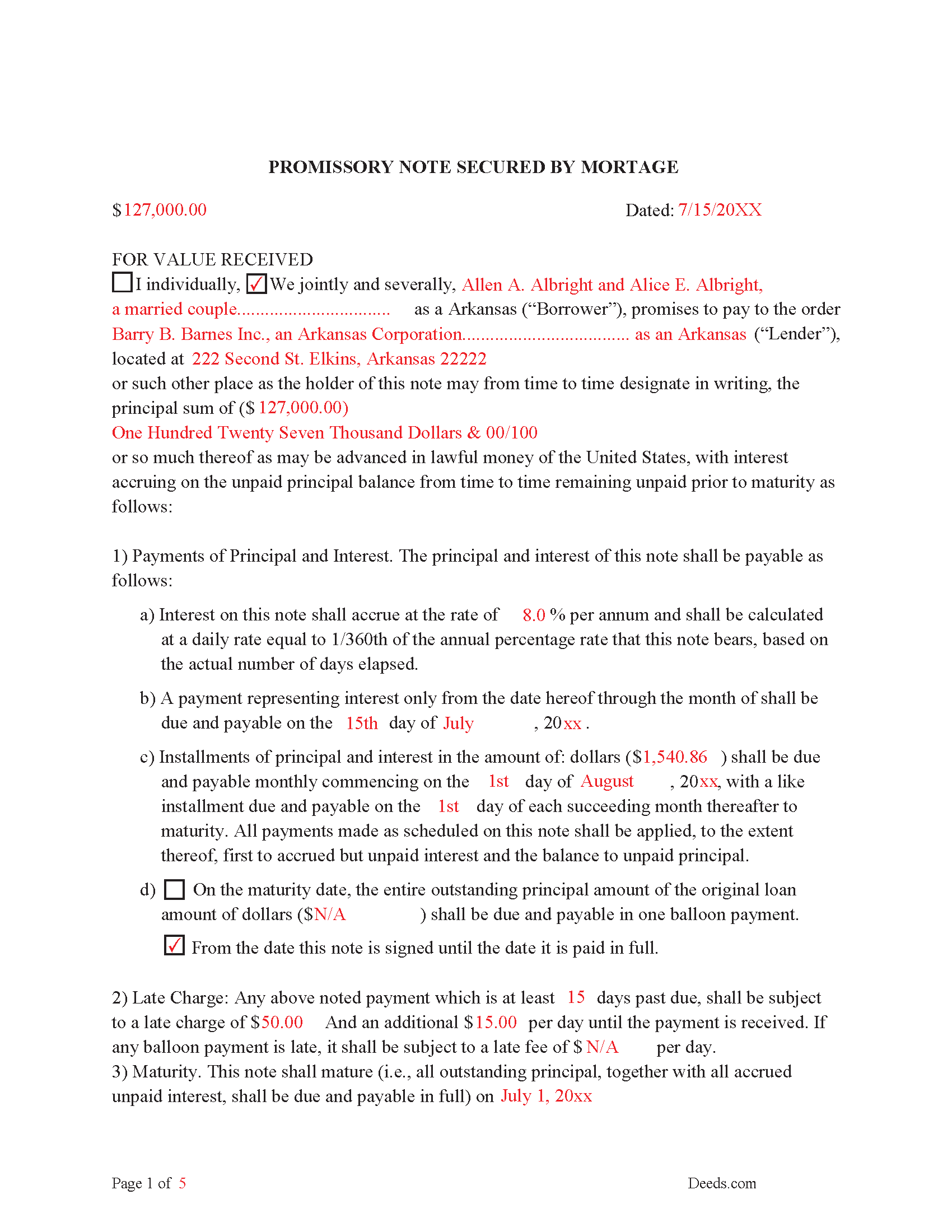

Completed Example of the Promissory Note Document

This Promissory Note is filled in and highlighted, showing how the guideline information, can be interpreted into the document.

Included document last reviewed/updated 3/4/2024

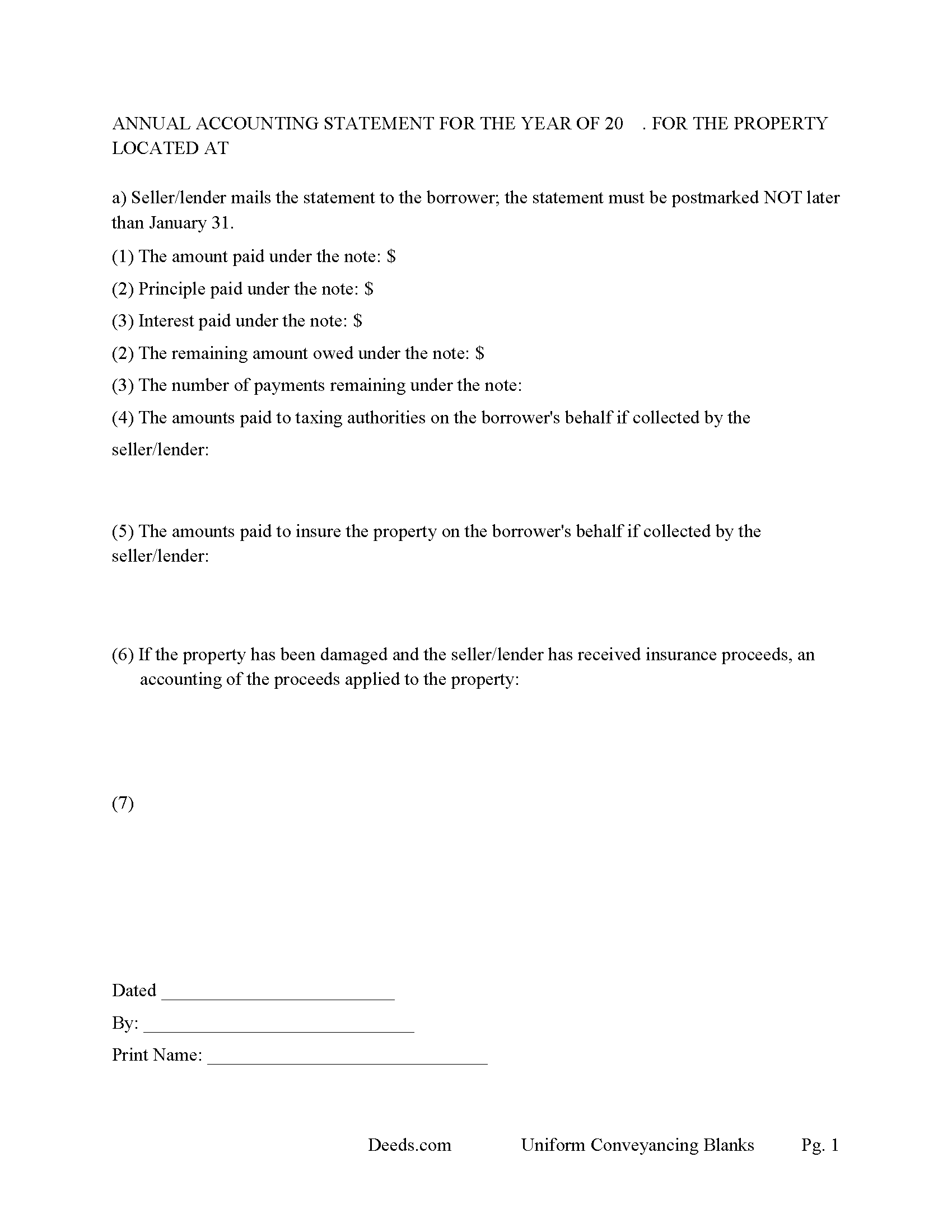

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included document last reviewed/updated 4/2/2024

Included Supplemental Documents

The following Arkansas and Pope County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Pope County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Pope County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Pope County Mortgage Secured by Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Mortgage Secured by Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Pope County that you need to transfer you would only need to order our forms once for all of your properties in Pope County.

Are these forms guaranteed to be recordable in Pope County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Pope County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Mortgage Secured by Promissory Note Forms:

- Pope County

Including:

- Atkins

- Dover

- Hector

- London

- Pottsville

- Russellville

- Tilly

What is the Arkansas Mortgage Secured by Promissory Note

("Mortgage" means the grant of an interest in real property to be held as security for the performance of an obligation by the mortgagor or other person.) (18-50-101 (4))

Once (filed in the recorder's office) the mortgage becomes a (lien on the mortgaged property). (The filing shall be notice to all persons of the existence of the mortgage.) (18-40-102)

The (Mortgagor)/ Borrower grants (an interest in real property as security for the performance of an obligation secured by a mortgage.) (18-50-101 (8))

The (Mortgagee)/Lender holds (an interest in real property as security for the performance of an obligation secured by a mortgage.) (18-50-101 (7))

The borrower must also complete a promissory note. A promissory note is a negotiable instrument that contains an unconditional written promise, signed by the borrower, to repay the lender or its designated agent. It defines the amount and specific terms of the loan between the borrower and the lender (interest rates, default rate, late payment fee, etc.), and must be completed at the same time as the security instrument. Many lenders retain the promissory note for the duration of the mortgage and return it to the borrower after the debt is repaid.

Use these forms for real property, land, single family, condominiums, small commercial and rental units (up to 4). The promissory note can be used for traditional installment and balloon payments. In Arkansas, the Mortgagor/Borrower has the right to redeem the property if it is sold through decree of the circuit court/foreclosure. (This may be done at any time within one (1) year from the date of sale). [The mortgagor may waive the right of redemption in the mortgage so executed and foreclosed.] In this form the Mortgagor/Borrower releases their right of redemption. They also relinquish their rights of homestead (if any). These terms can be beneficial to the Mortgagee/Lender if default occurs. (18-49-106 (2)) [18-49-106 (b)]

(Arkansas Mortgage Package includes forms, guidelines, and completed examples) For use in Arkansas Only.

Our Promise

The documents you receive here will meet, or exceed, the Pope County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Pope County Mortgage Secured by Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Raecita H.

March 19th, 2022

This was the first time I had ever had to fill out a Warranty Deed, so if it was not for your example form on how to fill one out, I would be still be here completely lost. I had originally gone to another site for a Warranty Deed & they wanted double the amount of your price & their website had no examples forms. I am so happy with your site & service. Thank you for giving us the opportunity to be able to download the forms as much as we need to because as many mistakes I made,I had to print quite a few to be able to get it done right.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia S.

April 6th, 2021

Great service got everything I needed with a click of a tab.

Thank You...

Thank you for your feedback. We really appreciate it. Have a great day!

Lance T. W.

August 23rd, 2019

All in all an easy, cost-effective approach to simple legal work.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S B.

May 22nd, 2019

I would not have ordered this form had I realised how limited the fields are for details. There is no room for elaboration of terms. The language only allows one grantor and one grantee, and the gender and quantity default construction is a poor choice. Be basic, but leave room for more.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa B.

April 13th, 2019

Awesome service. User friendly, simple, easy and quick to fill out with instructions and sample copy and print.

Thank you Lisa, we appreciate your feedback.

Robert I.

May 9th, 2023

This site was easy to use with full instructions on how to fill out and file forms very good

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cheryl S.

April 30th, 2021

quick response

Thank you!

Jeanne V.

December 20th, 2021

The service your provide is awesome. I rarely need to file a deed through e-recording, but when an emergency arose and I needed to get the deed recorded fast, your program came through. Well worth the $19.00 cost! It was very convienent and easy to use. I will definitely use this service again!!

Thank you for your feedback. We really appreciate it. Have a great day!

Anthony F.

April 7th, 2020

quick, easy and simple. Also thank you for having the e-submission area particularly with the Covid-19 /Shelter in place things happening.

Thank you for your feedback. We really appreciate it. Have a great day!

Lisa G.

January 4th, 2019

Rec'd downloads for quitclaim deed process in Florida. Recorded with the clerk of courts today and the form was done perfectly--she had no changes to make. Well worth the money--thanks

Glad to hear Lisa, we appreciate you taking the time to leave your feedback.

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

Ondina S.

December 28th, 2021

Am very happy with the wealth of forms that were available with my purchase! This site is an awesome resource which I plan to use in the future.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.