Maui County Transfer on Death Deed Forms (Hawaii)

Express Checkout

Form Package

Transfer on Death Deed

State

Hawaii

Area

Maui County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Maui County specific forms and documents listed below are included in your immediate download package:

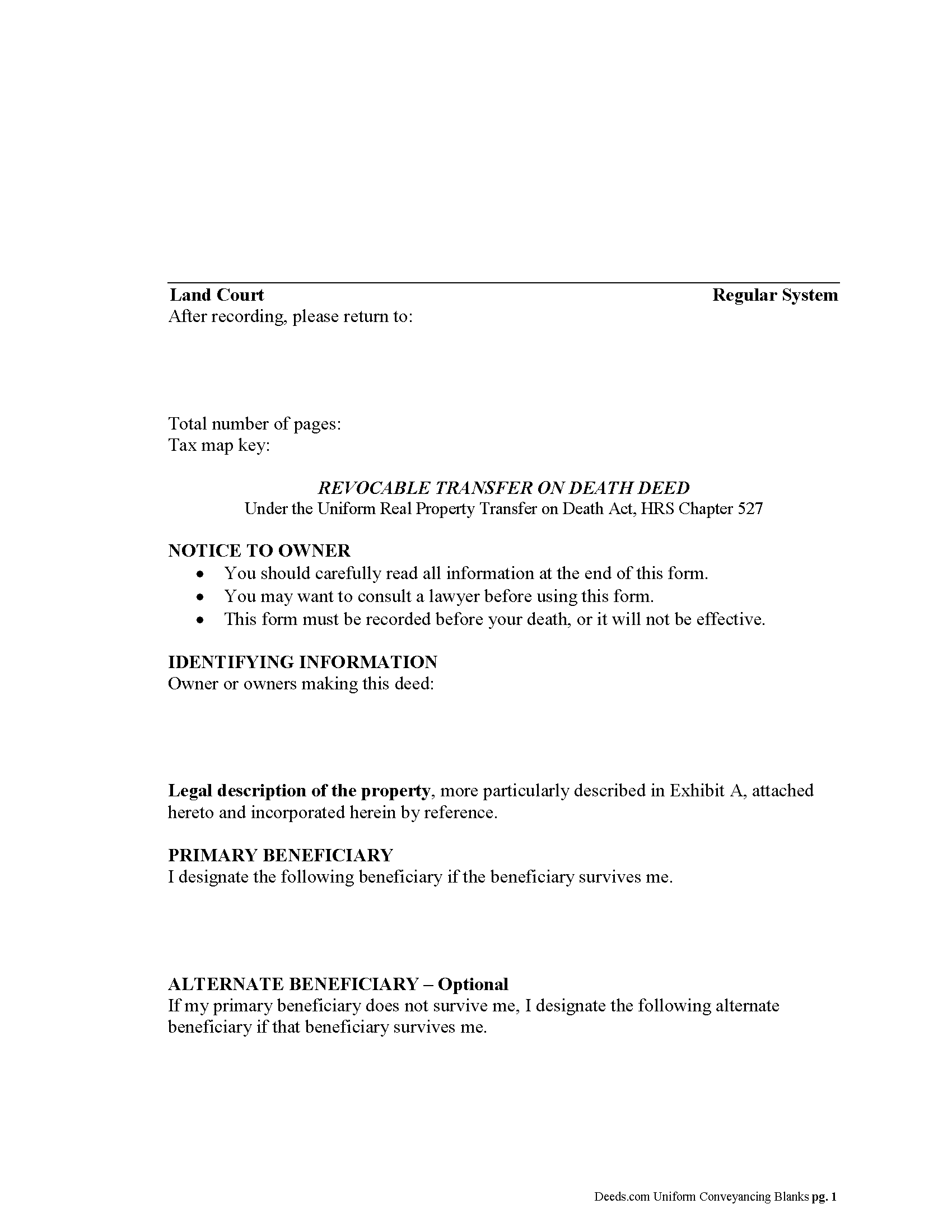

Transfer on Death Deed

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/22/2024

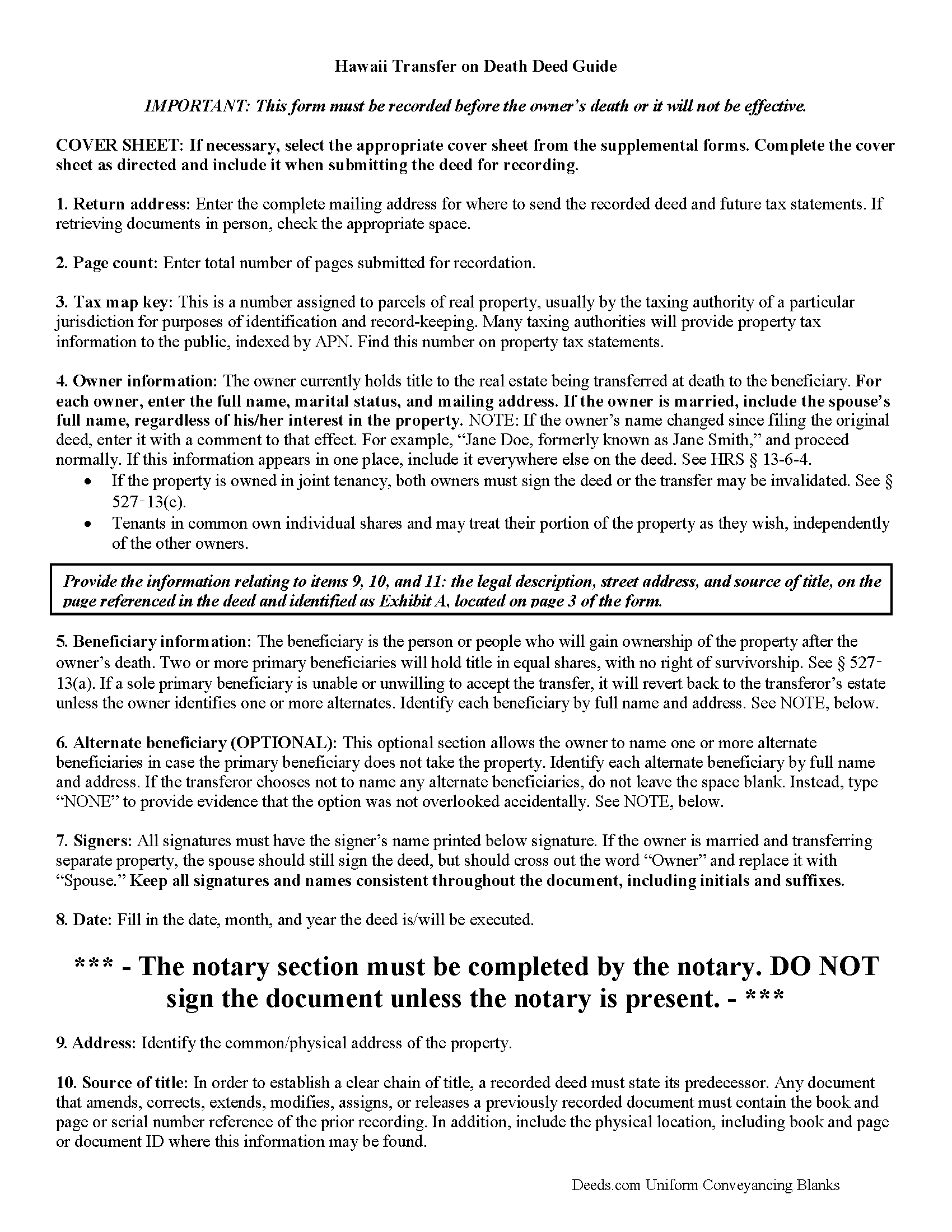

Transfer on Death Deed Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/2/2024

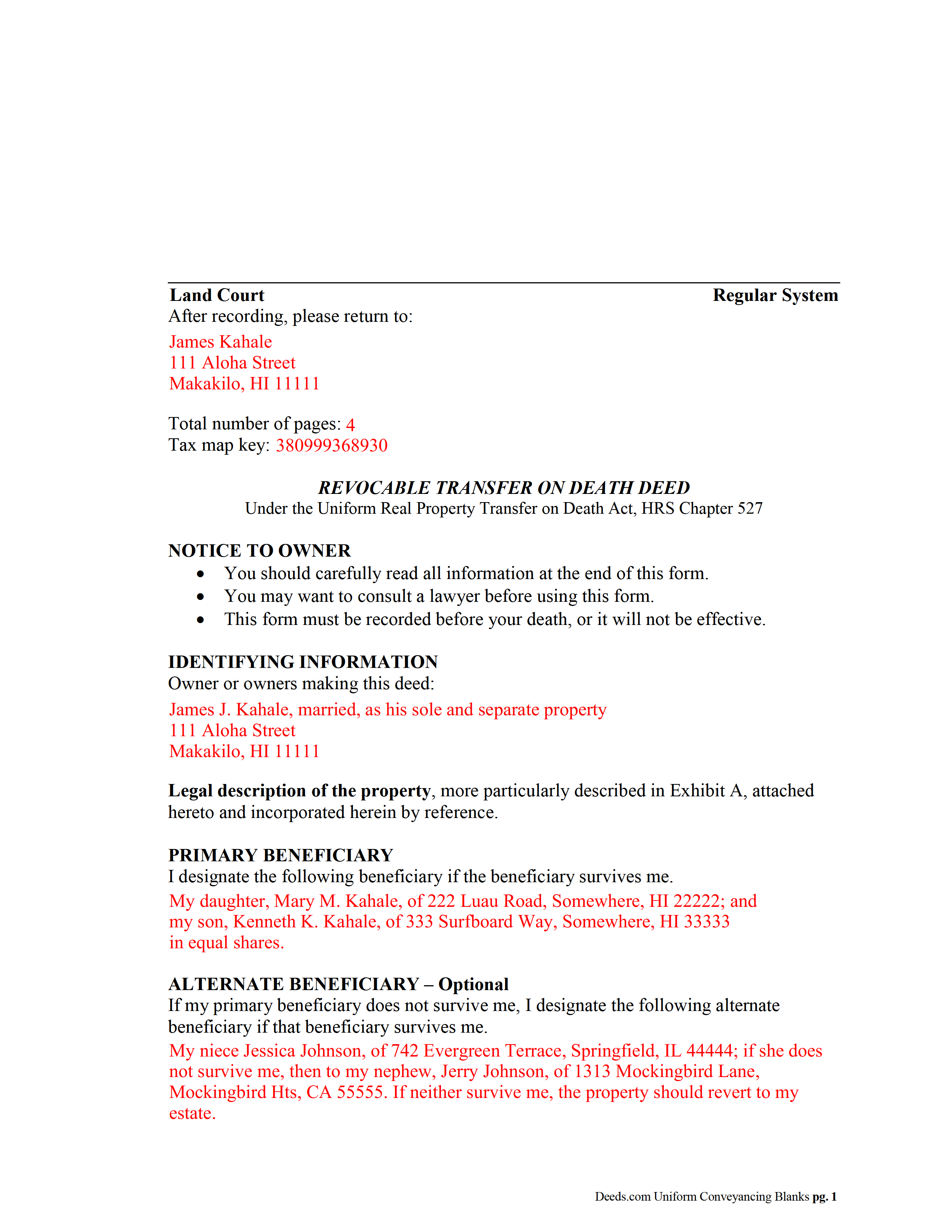

Completed Example of the Transfer on Death Deed Document

Example of a properly completed form for reference.

Included document last reviewed/updated 6/16/2023

Included Supplemental Documents

The following Hawaii and Maui County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Hawaii or Maui County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Maui County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Maui County Transfer on Death Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Transfer on Death Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Maui County that you need to transfer you would only need to order our forms once for all of your properties in Maui County.

Are these forms guaranteed to be recordable in Maui County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Maui County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Transfer on Death Deed Forms:

- Maui County

Including:

- Haiku

- Hana

- Hoolehua

- Kahului

- Kalaupapa

- Kaunakakai

- Kihei

- Kualapuu

- Kula

- Lahaina

- Lanai City

- Makawao

- Maunaloa

- Paia

- Pukalani

- Puunene

- Wailuku

What is the Hawaii Transfer on Death Deed

Transfer on Death Deeds in Hawaii

In 2011, Hawaii enacted its version of the Uniform Real Property Transfer on Death Act (URPTODA), found at Chapter 527 of the Hawaii Revised Statutes.

Along with Hawaii, a growing number of states are choosing to adopt the provisions of the URPTODA. The new law allows landowners to direct the distribution of what is often their most significant asset, their real estate, with a correctly executed and recorded transfer on death deed.

Transfer on death deeds are nontestamentary, which means ownership of the property passes to the beneficiary without instructions in a will or the need for probate (5277). Unnecessary conflicts are likely to add confusion and expense, however, so property owners should take care to ensure that their wills and TODDs contain the same instructions.

Hawaii's version of the URPTODA sets out the specific requirements for lawful transfer on death deeds:

The capacity required to make or revoke a transfer on death deed is the same as the capacity required to make a will (5278, 560:2-501).

It must contain the essential elements and formalities of a properly recordable inter vivos deed, such as warranty or quitclaim deed (5279(1))

It must state that the transfer to the designated beneficiary is to occur at the transferor's death (5279 (2))

Most importantly, it must be recorded before the transferor's death in the office of the clerk of the county commission in the county where the property is located (5279 (3)).

The named beneficiary gains no present rights to the property, only a potential future interest. Instead, the transferors retain absolute control during their lives. This includes the freedom to sell or transfer it to someone else, and to modify or revoke the intended transfer on death (52712). These details, along with the fact that TODDs only convey the property rights remaining, if any, at the owner's death, explain why they do not require notice or consideration (52710).

According to 52713(a), the beneficiary gains equitable interest in the property ONLY when the owner dies. Note, however, that the beneficiary must be alive at the time of the transferor's death or the interest returns to the estate. To prevent this from happening, the owner may identify one or more contingent beneficiaries. All beneficiaries take title subject to any obligations (contracts, easements, etc.) associated with the property when the transferor dies (52713(b)).

With the new transfer on death deeds, real property owners in Hawaii have access to a convenient, flexible tool for managing one aspect of a comprehensive estate plan. Even so, a TODD may not be appropriate for everyone. Since each situation is unique, contact an attorney with specific questions or for complex circumstances.

Our Promise

The documents you receive here will meet, or exceed, the Maui County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Maui County Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Charles W.

July 7th, 2019

I was vey pleased with this service. It offered all of the necessary step by step information guides for completing the forms. Again, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Angela W.

February 16th, 2022

All went well.

Thank you for your feedback. We really appreciate it. Have a great day!

Victoria S.

March 13th, 2021

Deed.com is AMAZING! I only had about 2 weeks to get my quit claim deed recorded by my county office before my refinace due date approached. When I uploaded my quit claim to Deed.com I got it electronically recored by county register's office in "24 hours"!!! Deed.com is quick and efficient and I will dedinitely be using Deed.com again if I ever need a document recorded again.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas B.

May 29th, 2020

My deeds were filed with Pinellas County Florida with a simple process and with no problems. 5 star for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Martha R.

March 16th, 2023

Provided all the info that I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Chelsie F.

April 3rd, 2020

Super customer service and communication! Fast service and more informative than expected! Can't say thanks enough.

Thank you!

Marc Z.

March 24th, 2019

Thank you for having an easy to navigate website with updated documents! Had everything I needed, took care of business and on to the next transaction.- Aloha

Thank you Marc. Have a fantastic day!

Terri E.

October 6th, 2023

Quick Accurate experience will recommend this service to my friends

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shana D.

June 9th, 2022

I ordered the wrong forms because I didn't do enough research to understand what I needed. Their customer service was more understanding than I deserved.

Thank you!

Karen D.

July 17th, 2020

Awesome,thorough, and fast.

Thank you!

Dubelsa T.

July 13th, 2020

Loved it!!!!! Beats going downtown!!!! Super easy and fast!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dean B.

September 17th, 2020

I needed to cut and paste my phone number with the dashes in order to use this website with my iPhone

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.