Clark County Substitution of Trustee - for Deed of Trust Forms (Idaho)

Express Checkout

Form Package

Substitution of Trustee - for Deed of Trust

State

Idaho

Area

Clark County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Clark County specific forms and documents listed below are included in your immediate download package:

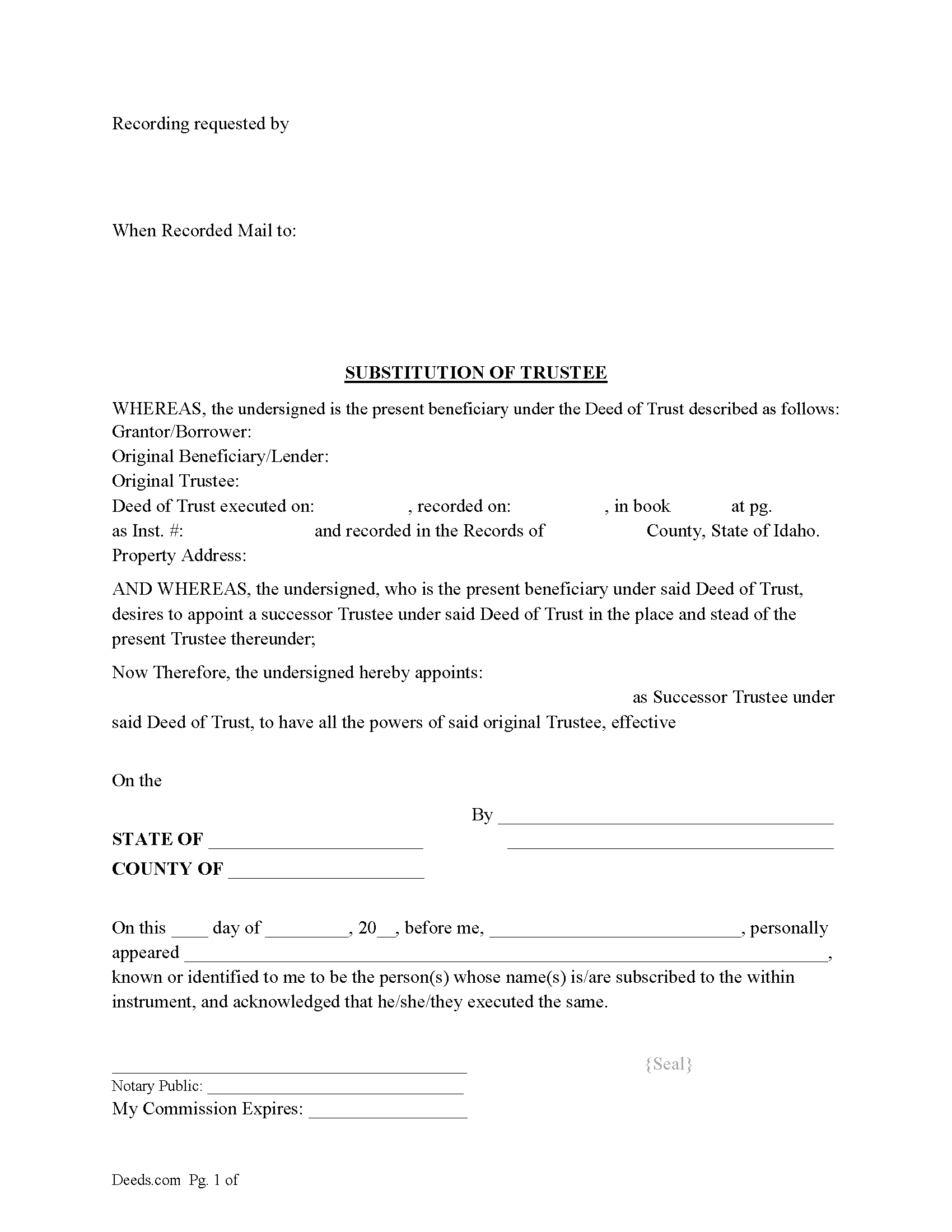

Substitution of Trustee Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 7/6/2023

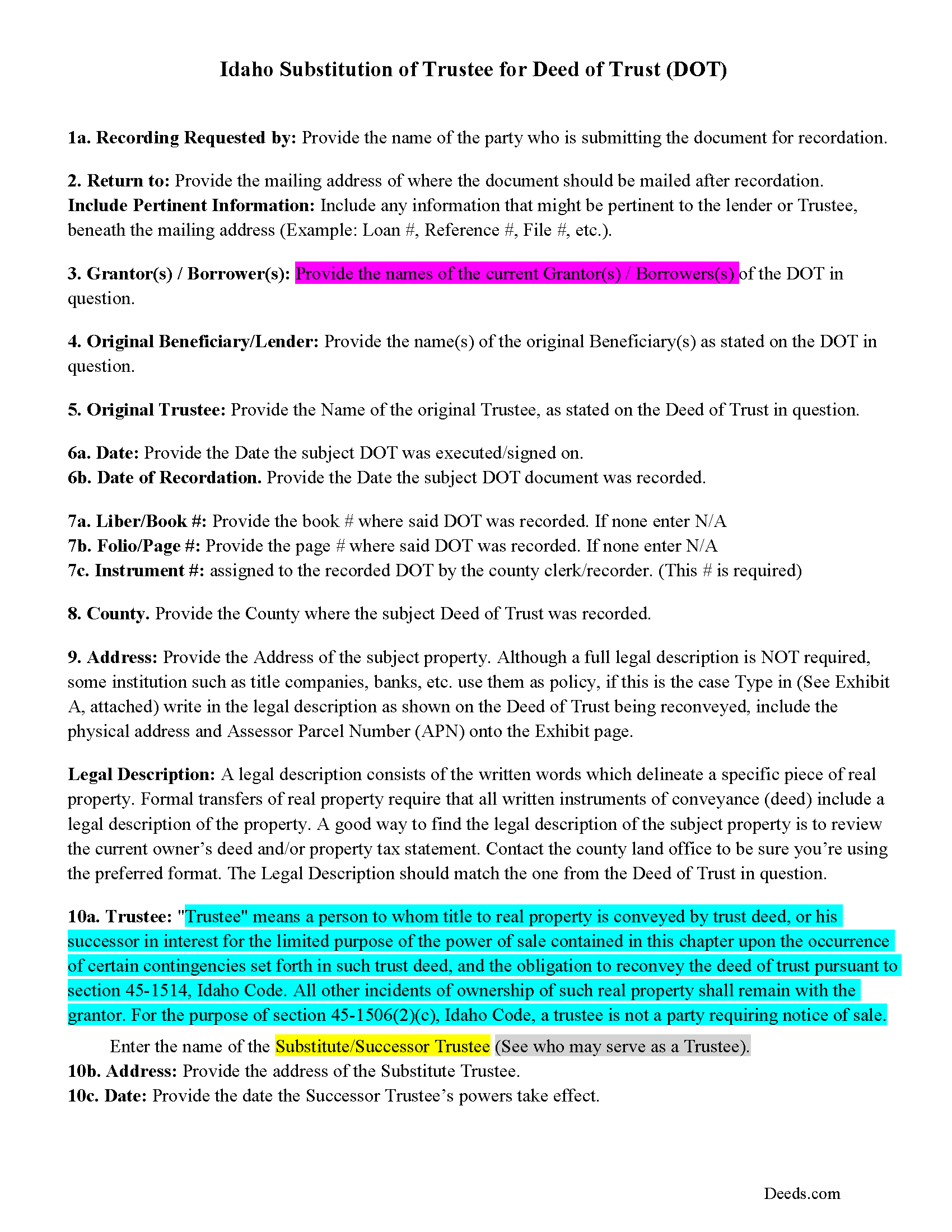

Guidelines for Substitution of Trustee Form

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 3/19/2024

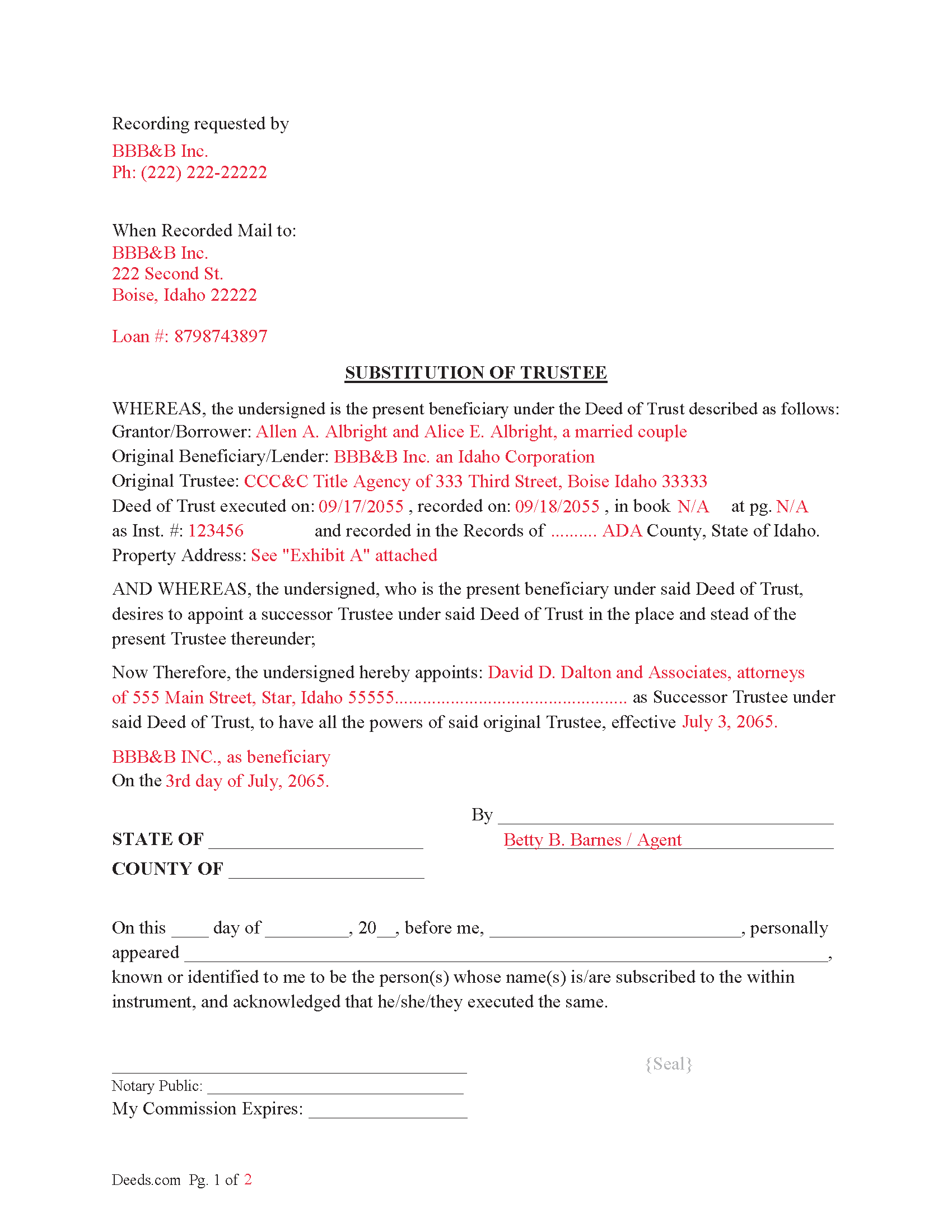

Completed Example of the Substitution of Trustee Document

Example of a properly completed form for reference.

Included document last reviewed/updated 3/29/2024

Included Supplemental Documents

The following Idaho and Clark County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Idaho or Clark County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Clark County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Clark County Substitution of Trustee - for Deed of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Substitution of Trustee - for Deed of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Clark County that you need to transfer you would only need to order our forms once for all of your properties in Clark County.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Substitution of Trustee - for Deed of Trust Forms:

- Clark County

Including:

- Dubois

- Spencer

What is the Idaho Substitution of Trustee - for Deed of Trust

This form is issued by the current beneficiary/lender to replace an existing trustee with a successor trustee in a Deed of Trust. This is commonly performed when the current trustee resigns, can't or won't act on a foreclosure, reconveyance, etc.

45-1504. TRUSTEE OF TRUST DEED --- WHO MAY SERVE --- SUCCESSORS.

(1) The trustee of a trust deed under this act shall be:

(a) Any member of the Idaho state bar;

(b) Any bank or savings and loan association authorized to do business under the laws of Idaho or the United States;

(c) An authorized trust institution having a charter under chapter 32, title 26, Idaho Code, or any corporation authorized to conduct a trust business under the laws of the United States; or

(d) A licensed title insurance agent or title insurance company authorized to transact business under the laws of the state of Idaho.

(2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee. (2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee.

For use in Idaho only.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Substitution of Trustee - for Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

timothy h.

November 12th, 2020

Too complicated and too expensive

Sorry to hear that Timothy, we do hope that you found something more suitable to your needs elsewhere. Have a wonderful day.

Joel N.

September 7th, 2019

Was helpful

Thank you for your feedback. We really appreciate it. Have a great day!

Vicki A.

October 29th, 2023

Very fast and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wesley B.

July 23rd, 2022

Exactly what I needed

Thank you!

Heleena C.

January 4th, 2021

The free additional forms that came with the form I ordered were invaluable as well. Worth every penny!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STEPHEN C.

January 22nd, 2020

Excellent service. Easy to use. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Maurice C.

September 14th, 2023

This is a great service! Very much needed.

Thank you!

Jacinto A.

April 22nd, 2019

The forms are exactly what was needed. But wish I was able to click on the preview form to make sure it was the correct forms

Thank you for your feedback Jacinto.

Anna P.

April 15th, 2021

Deeds.com was a life saver! I was able to have a document recorded the very same day of my request. Thank you for taking care of this! Top notch service.

Thank you!

Robert E B.

May 7th, 2021

Easy to use!

Thank you!

marion v.

March 26th, 2023

Phenomenal website !

Thank you!

Roy C.

January 25th, 2021

Great Product no problems filing

Thank you for your feedback. We really appreciate it. Have a great day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.