Morgan County Personal Representative Deed for Distribution Forms (Indiana)

Express Checkout

Form Package

Personal Representative Deed for Distribution

State

Indiana

Area

Morgan County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Morgan County specific forms and documents listed below are included in your immediate download package:

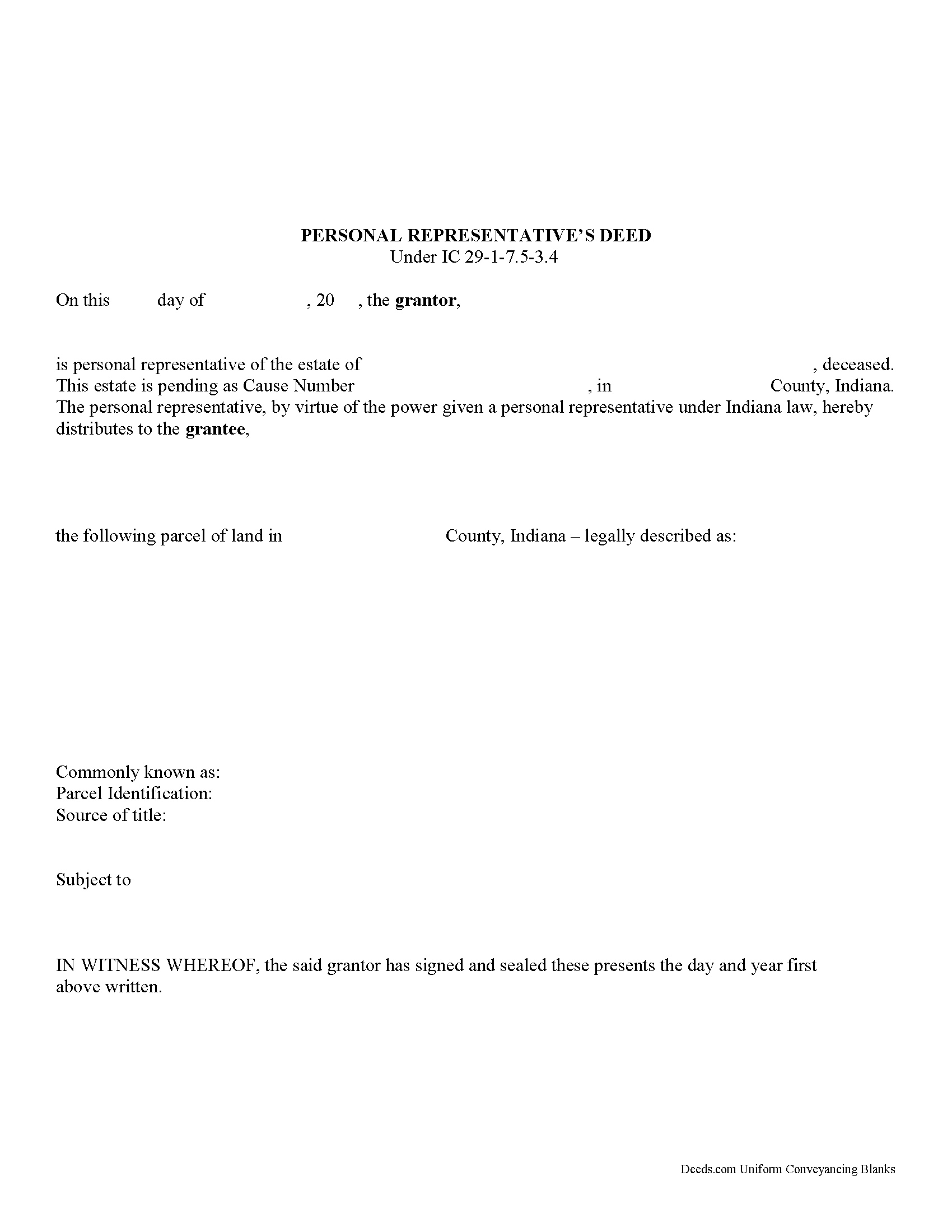

Personal Representative Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 1/23/2024

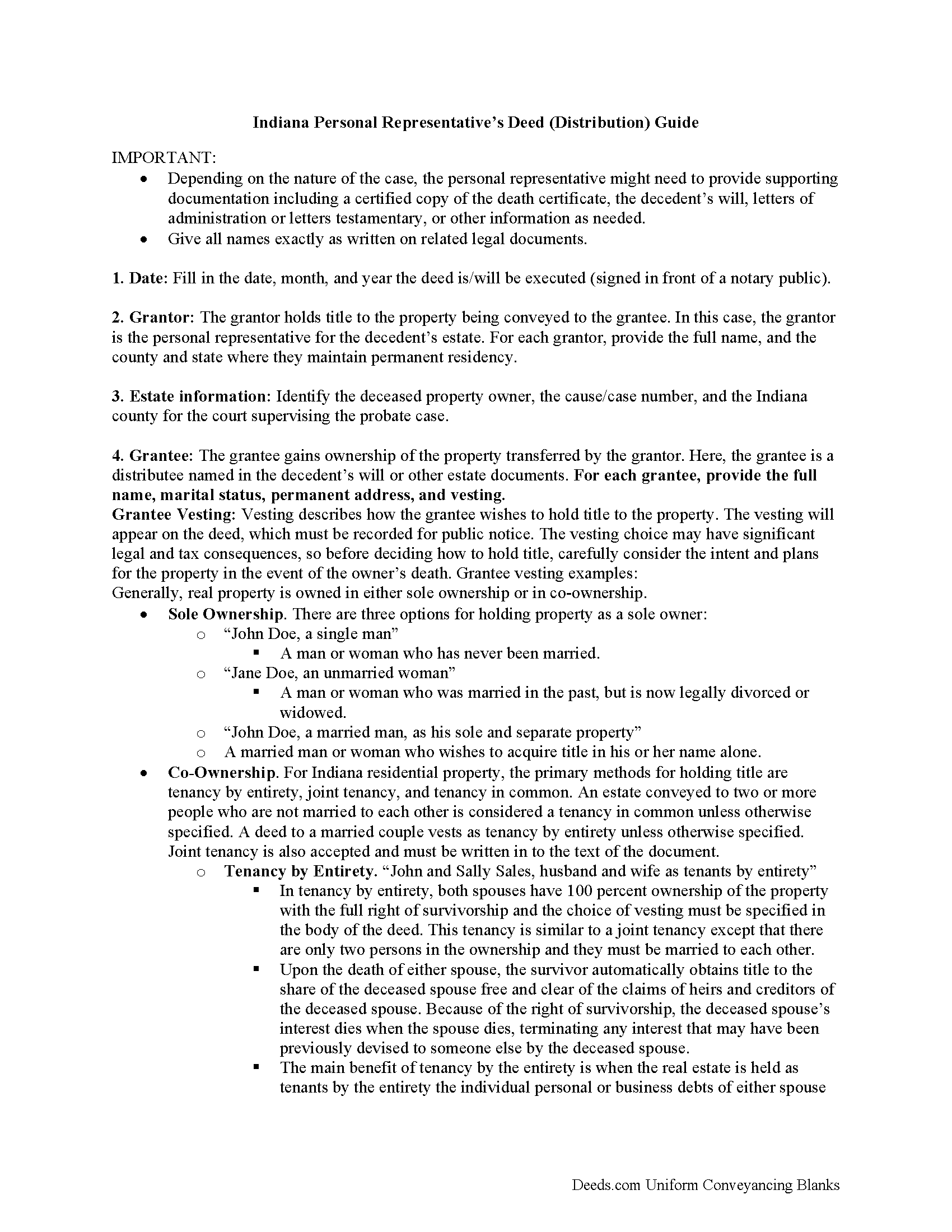

Personal Representative Deed Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/10/2024

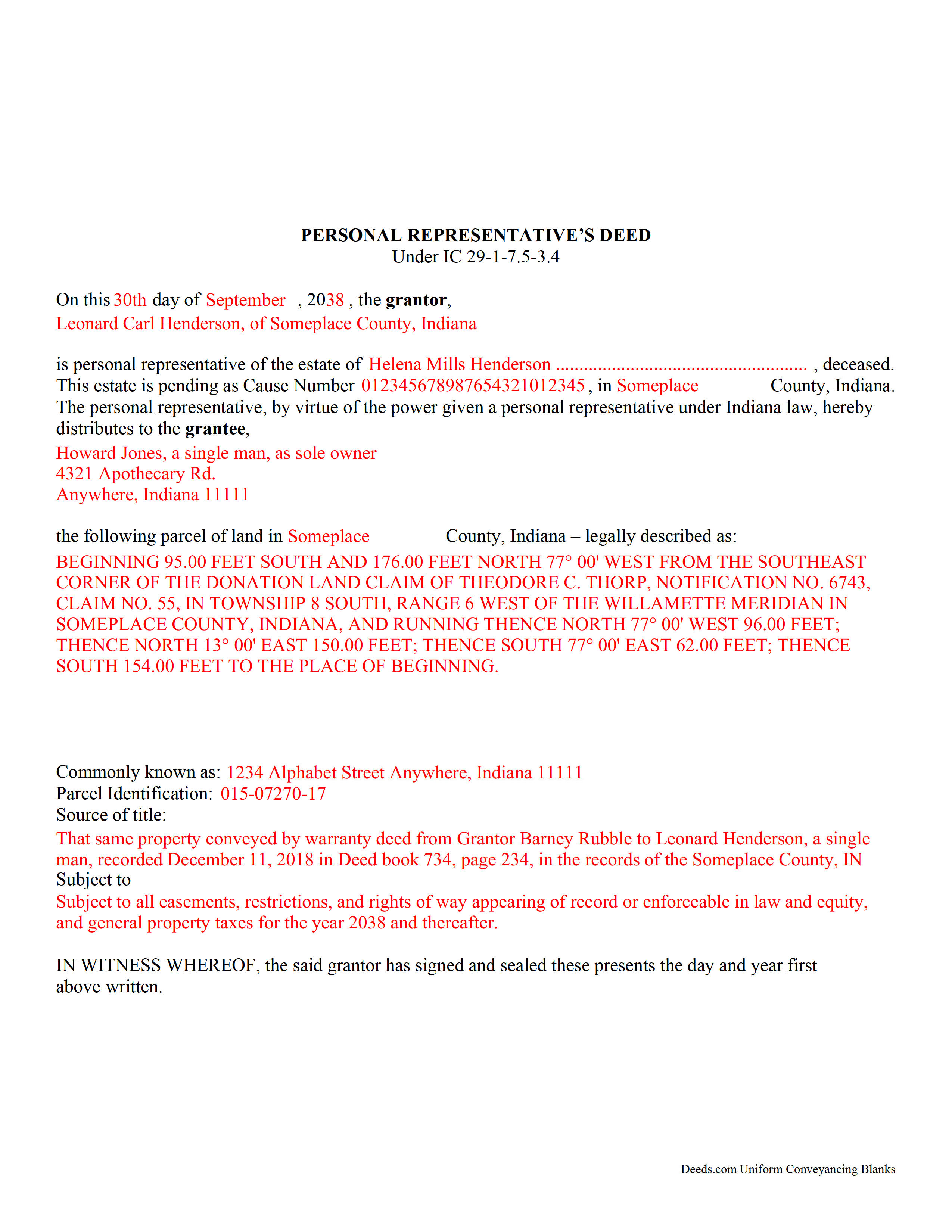

Completed Example of the Personal Representative Deed Document

Example of a properly completed form for reference.

Included document last reviewed/updated 1/17/2024

Included Supplemental Documents

The following Indiana and Morgan County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Indiana or Morgan County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Morgan County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Morgan County Personal Representative Deed for Distribution forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Personal Representative Deed for Distribution forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Morgan County that you need to transfer you would only need to order our forms once for all of your properties in Morgan County.

Are these forms guaranteed to be recordable in Morgan County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Morgan County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Personal Representative Deed for Distribution Forms:

- Morgan County

Including:

- Brooklyn

- Camby

- Eminence

- Martinsville

- Monrovia

- Mooresville

- Morgantown

- Paragon

What is the Indiana Personal Representative Deed for Distribution

Use this form for authorized personal representatives to transfer a decedent's real estate to a devisee or heir as directed by the deceased property owner's will, or according to Indiana's laws of descent and distribution.

When we die, another person becomes responsible for managing the assets we leave behind. If we die testate (with a will), this person is called an executor. If we die intestate (without a will), or other specific situations occur, the court supervising the probate estate appoints an administrator. Once the executor or administrator is in place, Indiana laws identify this individual as a "personal representative." See IC 29-1-1-3(23) for the list of titles included under this role.

The judge supervising the case confirms the personal representative (PR) by issuing letters testamentary or letters of administration, as appropriate. Note that the PR must apply for the letters within five months of the decedent's death (IC 29-1-7-15.1(b)). Once the letters are in place, the PR gains access to the probate estate, defined as "property transferred at the death of a decedent under the decedent's will or under IC 29-1-2, in the case of a decedent dying intestate" IC 29-1-1-3(24).

One common task handled by the PR is transferring ownership of the decedent's real property. Indiana's statutes contain a form related to property distributed to a devisee or heir (IC 29-1-7.5-3.4). In addition to the statutory requirement to provide relevant facts of the probate case, personal representative's deeds must meet all state and local standards for format and content.

Note that personal representative's deeds to not include warranties of title, so it makes sense for distributees or potential purchasers to consider a title search for the property. This can reveal defects in the chain of title (ownership history), and may prevent potential issues in future transactions.

Depending on the circumstances, the PR might need to provide additional supporting documentation including a certified copy of the authorizing letter, death certificate, will, etc. Also, the transfer might require approval from the court or others with an interest in the estate or the property.

Navigating the complexities of a probate case can be overwhelming, but taking the time to ensure a valid transfer during active probate is much easier than untangling problems later on. Please contact an attorney or probate court officer with specific questions or for complex situations.

(Indiana Personal Representative Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Morgan County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Morgan County Personal Representative Deed for Distribution form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Janet C.

April 11th, 2022

Easy to use website and extremely helpful. great service!

Thank you!

LAWRENCE S.

January 9th, 2022

I am mostly satisfied with my Deeds.Com experience. Not sure if you can do anything about this, but since it is fairly common, I thought the Quit Claim Form would have a section specifically for adding spouse to a deed.

Thank you for your feedback. We really appreciate it. Have a great day!

RUSSELL E.

August 5th, 2020

The process sure was easy and fast. Not sure why a rep would question why I am requesting an exhibit page on the Deed when that's a common practice here in AZ. They recorded it the way I sent it so all good.

Thank you!

arturo b d.

September 30th, 2021

just what I needed...thanks

Thank you!

Cynthia H.

February 20th, 2023

The entire process was simple and easy, from purchasing, downloading and saving the documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BROOKE W.

February 16th, 2021

Great fillable form! And the separate instruction sheet was detailed and very clear. I particularly appreciate you including a sample of a completed form. I've filled in real estate forms before but never this one, and there were some things I didn't know.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Vickie M.

April 24th, 2022

The website was easy to use even for me with little computer knowledge.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnny A.

December 15th, 2018

My complete name is

Johnny Alicea Rodriguez

And the DEED is on my half brother and mine name.

Jimmy Dominguez and myself

Thanks

Joey D.

July 29th, 2019

Great product delivered immediately at very reasonable price. Highly recommend !

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Johnnie G.

July 6th, 2020

We had hoped, as this was direct through our State recorder's office, State-specific data would be pre-filled in. Also there is no help when transferring the home title from a Revocable Trust to the living Trustee and new spouse (no example given, no help for which code to use). And the example doesn't match the prior deed revision format submitted by our attorney. So, not the best experience. We may have to get an attorney involved...what we were hoping to avoid

Thank you for your feedback. We really appreciate it. Have a great day!

kathy d.

March 20th, 2019

very easy make sense instructions. Thank you.

Thank you for your feedback Kathy. Have an amazing day!

Melody P.

March 26th, 2021

Great service continues! Thanks again!

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.