Emmet County Conditional Lien Waiver upon Progress Payment Forms (Iowa)

All Emmet County specific forms and documents listed below are included in your immediate download package:

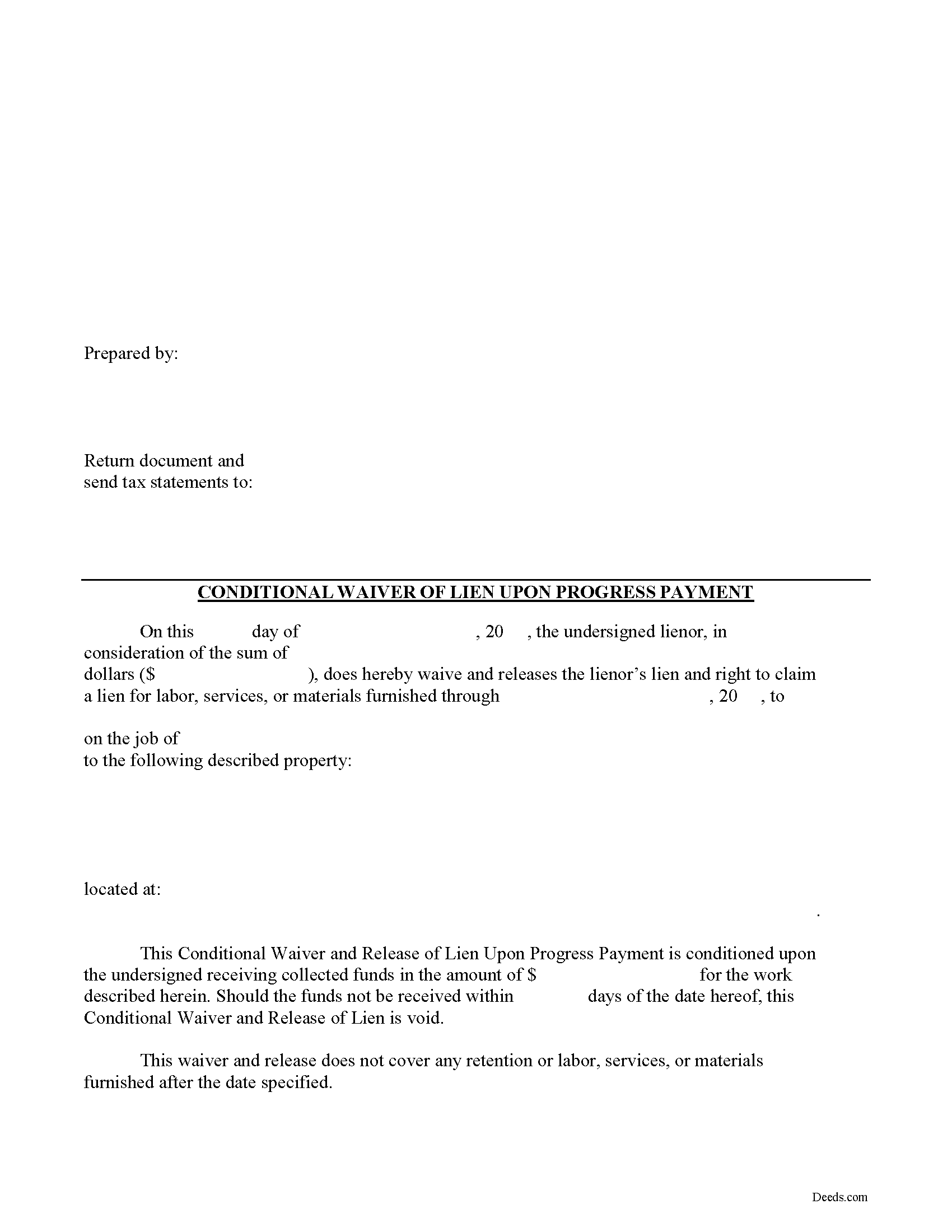

Conditional Lien Waiver upon Progress Payment Form

Fill in the blank Conditional Lien Waiver upon Progress Payment form formatted to comply with all Iowa recording and content requirements.

Included document last reviewed/updated 1/4/2024

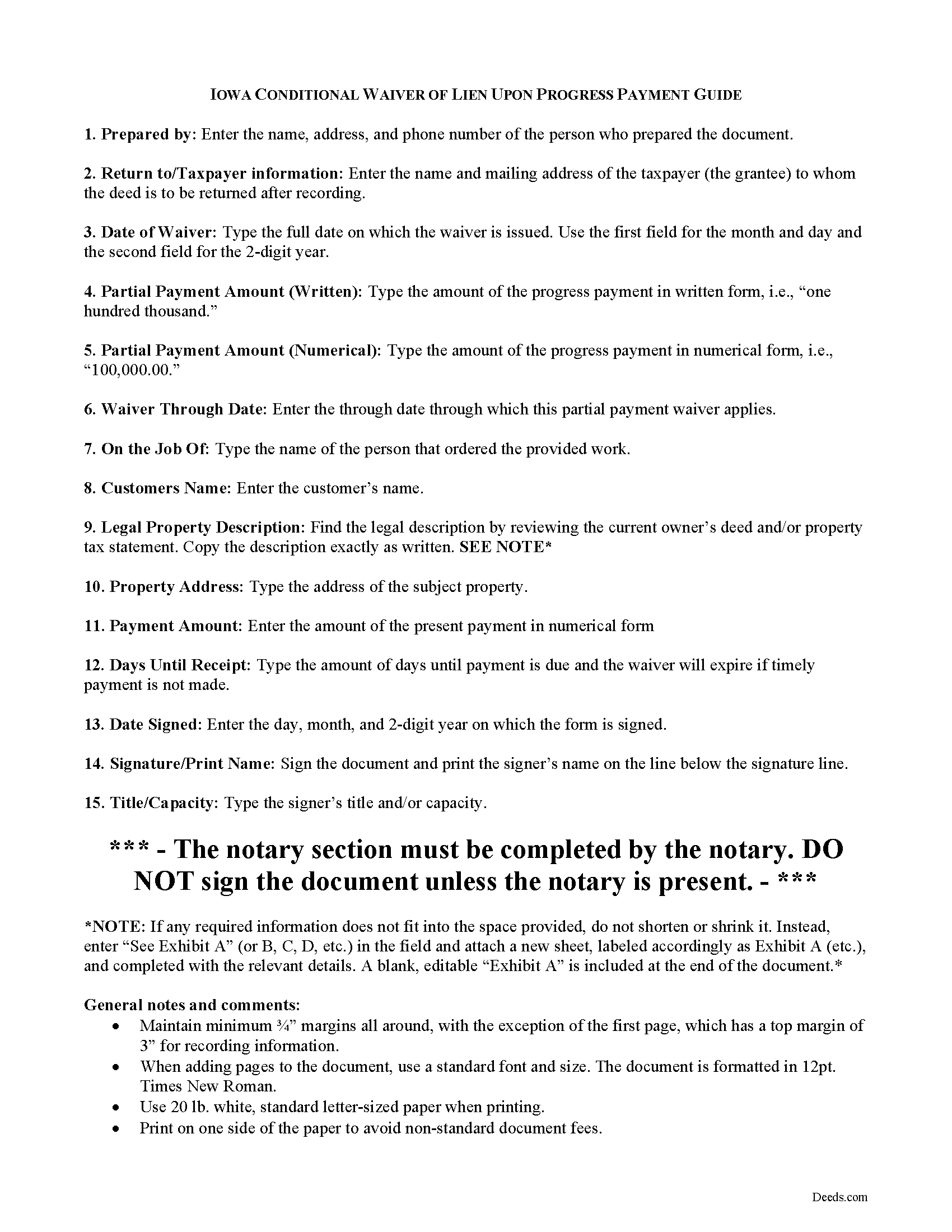

Conditional Lien Waiver upon Progress Payment Guide

Line by line guide explaining every blank on the Conditional Lien Waiver upon Progress Payment form.

Included document last reviewed/updated 4/26/2024

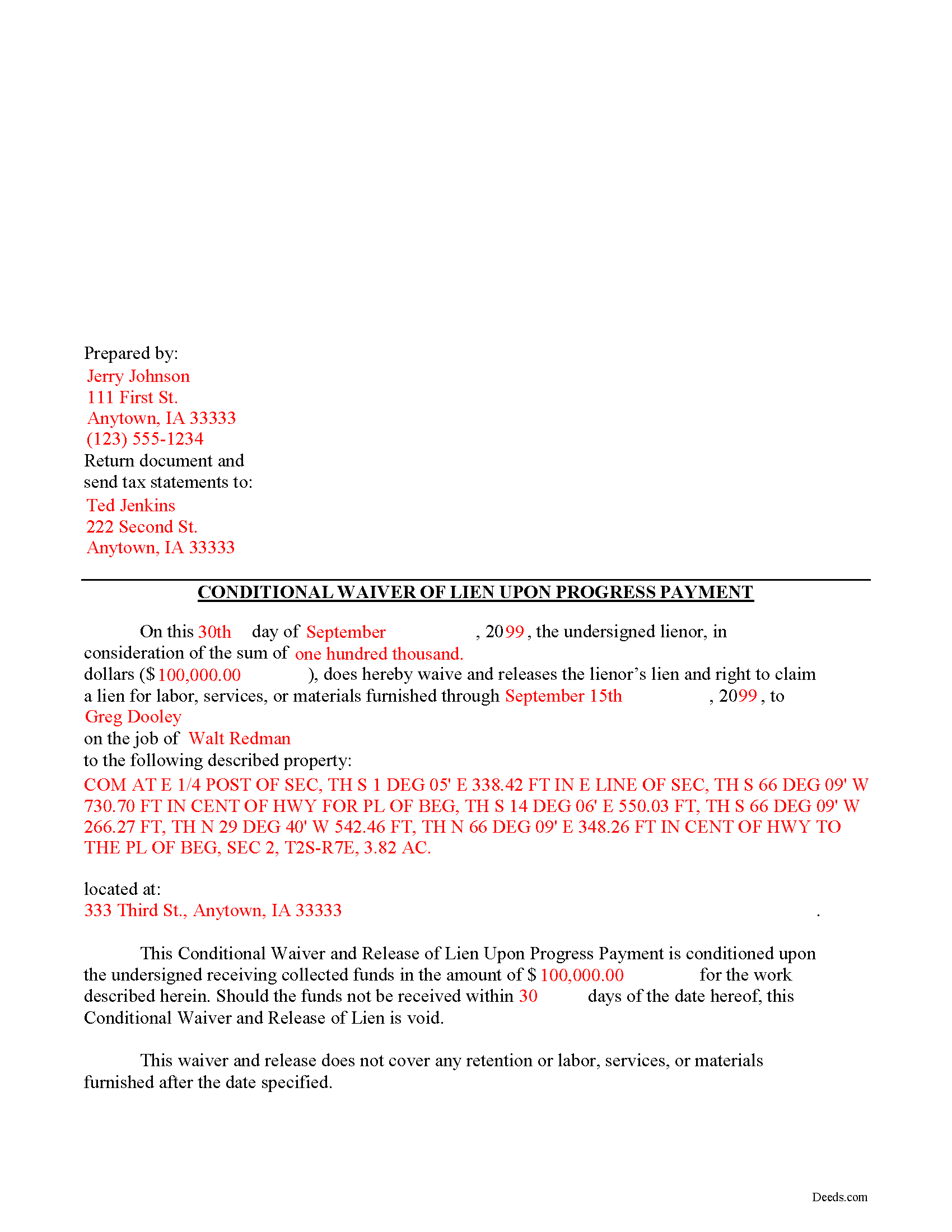

Completed Example of the Conditional Lien Waiver upon Progress Payment Document

Example of a properly completed Iowa Conditional Lien Waiver upon Progress Payment document for reference.

Included document last reviewed/updated 1/4/2024

The following Iowa and Emmet County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Iowa or Emmet County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Emmet County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Emmet County Conditional Lien Waiver upon Progress Payment forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Conditional Lien Waiver upon Progress Payment forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Emmet County that you need to transfer you would only need to order our forms once for all of your properties in Emmet County.

Are these forms guaranteed to be recordable in Emmet County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Emmet County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Emmet County

Including:

- Armstrong

- Dolliver

- Estherville

- Ringsted

- Wallingford

Mechanic's liens are governed under Chapter 572 of Iowa Code. A waiver is a conscious relinquishment of a right. In this case, the person granting the waiver is relinquishing the right to seek a mechanic's lien for all or part of the amount due. This assurance is usually enough to get the other party to pay. In Iowa, there are no statutory forms for waivers although according to the principles of contract law, the parties may agree to such modifications in writing.

Generally, waivers come in four varieties: conditional or unconditional, and based on a partial/progress or final payment. Conditional waivers only become effective after the responsible party's check clears the bank on which it was drawn, and provide more protection for the claimants. Unconditional waivers go into effect immediately, tend to favor the owners' interests, and should only be used after payment is confirmed. Waiving lien rights after a partial payment allows the claimant to retain some lien rights, but to release others based on the amount paid on the overall balance due. Waivers upon final payments remove the claimant's eligibility to place a lien because they state that the account is paid in full.

Regardless of the nature, waivers must identify the parties, the location of the project, relevant dates, and payments.

Partial waivers are used to waive a lien for up to the partial or progress payment amount. A conditional waiver means the waiver is conditioned upon the claimant receiving the amount due. Use the partial conditional waiver when the owner makes less than the full or final payment and the payment method does not guarantee receipt of the money (such as a check that hasn't cleared yet).

This article is provided for informational purposes only and should not be relied upon as a substitute for the advice from a legal professional. Please contact an Iowa attorney with any questions about sending notice to property owners or anything else with regard to mechanic's liens.

Our Promise

The documents you receive here will meet, or exceed, the Emmet County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Emmet County Conditional Lien Waiver upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4325 Reviews )

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!rn

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Kimberly W.

May 11th, 2022

Thank you for making this process so convenient.

Thank you for your feedback. We really appreciate it. Have a great day!

JOANN S.

November 8th, 2020

easy to use and understand forms. saved completed on my computer with no issues, even emailed them to my son for printing. recommend.

Thank you for the kind words Joann, have an amazing day!

Lori F.

July 16th, 2020

These folks are so amazing! They were very kind, patient and the communication was above and beyond. Basically, THEY ROCK!

Thank you!

chris m.

March 10th, 2022

Was warned by attorney that forms from internet have lots of mistakes. But after looking all over, took a chance on here. So far, I am satisfied, and actually happy that I got something that (I believe) meets my state and local requirements. Haven't filed the deed yet, or had to put it into effect, but being able to pick the local area, and have the relevant state law listed on the deed, gives me confidence. Also, got the whole package of possibly relevant forms, and a very good guide how to prep the deed with a sample completed deed - greatly appreciated!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

JAMSHEAD T.

December 13th, 2020

An excellent service. Exactly what one would hope for in the 21st century.

Thank you for your feedback. We really appreciate it. Have a great day!

Anthony F.

April 7th, 2020

quick, easy and simple. Also thank you for having the e-submission area particularly with the Covid-19 /Shelter in place things happening.

Thank you for your feedback. We really appreciate it. Have a great day!

Stephen E.

May 6th, 2020

Thank you for your great response on my needs. In less than 24 hours I had my documents in hand as needed.

Looking forward to working with Deeds.com again.

Steve Esler

Thank you for your feedback Steve, glad we could help.

ralph m.

March 1st, 2019

Overall the experience was pleasant and the services were delivered In a timely fashion

Thank you Ralph. Have a great day!

Susan J.

September 12th, 2019

Simple and easy to use. I was thrilled to find deeds.com during my online search for deed forms and more pleased that I could narrow it down by state and county. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

March 26th, 2021

Great service continues! Thanks again!

Thank you!

Cherene K.

February 19th, 2019

The process was easy and reasonable. My only problem was that, when I filled out my form on the computer, the writing I did overlapped with the pre-written words on the form, so that I had to end up doing it by hand. I've used DEEDS before and have not had that problem.

Thank you for your feedback Cherene. We've emailed you for some followup regarding the issue you reported.

Helen L.

February 1st, 2023

The website was easy to navigate but only needed one form. The guide was helpful also. Cost want high but contains many documents that I didn't need but may someday. Could not save form after completed but printed copies that needed to be court filed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!