Newaygo County Lady Bird Quitclaim Deed Forms (Michigan)

All Newaygo County specific forms and documents listed below are included in your immediate download package:

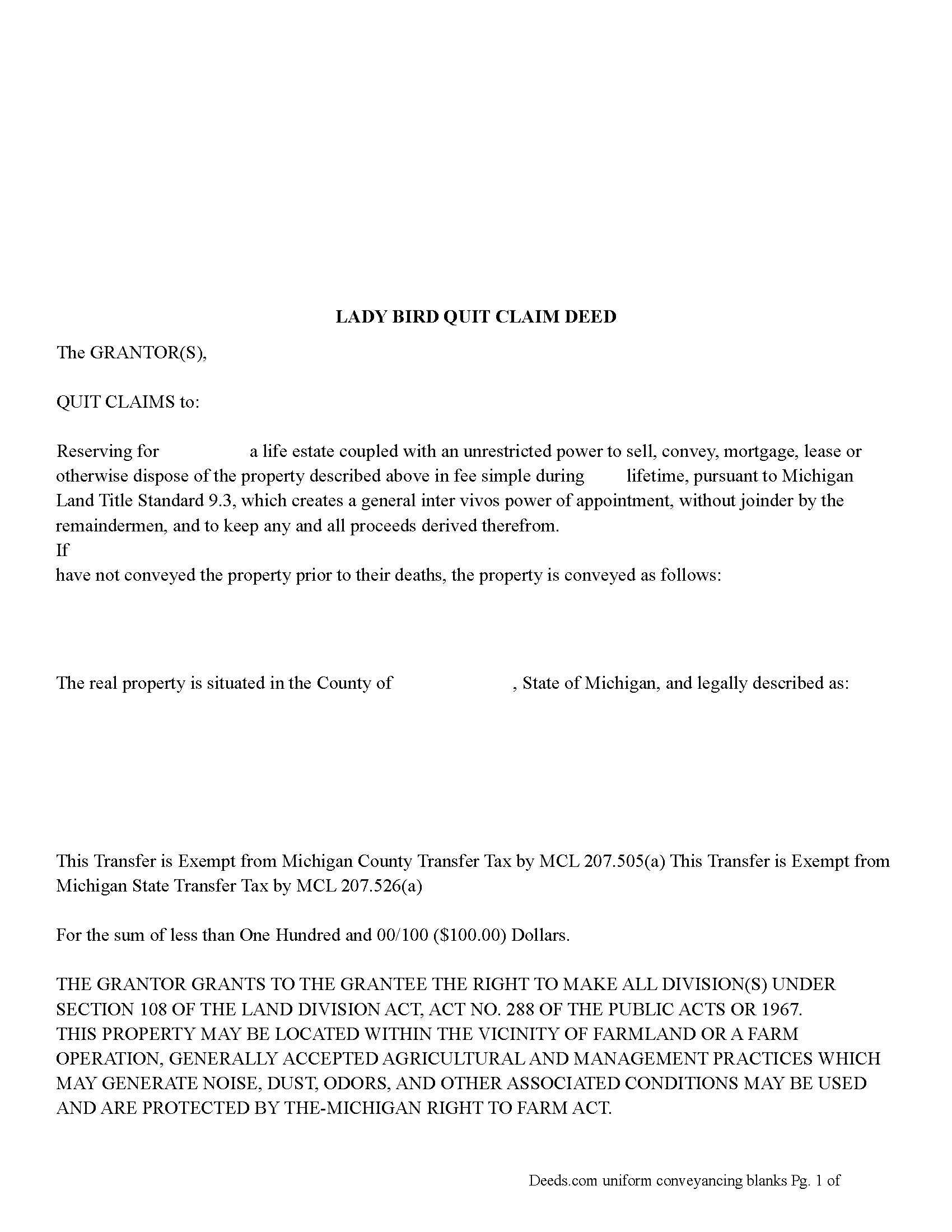

Lady Bird Quitclaim Deed Form

Fill in the blank Lady Bird Quitclaim Deed form formatted to comply with all Michigan recording and content requirements.

Included document last reviewed/updated 4/22/2024

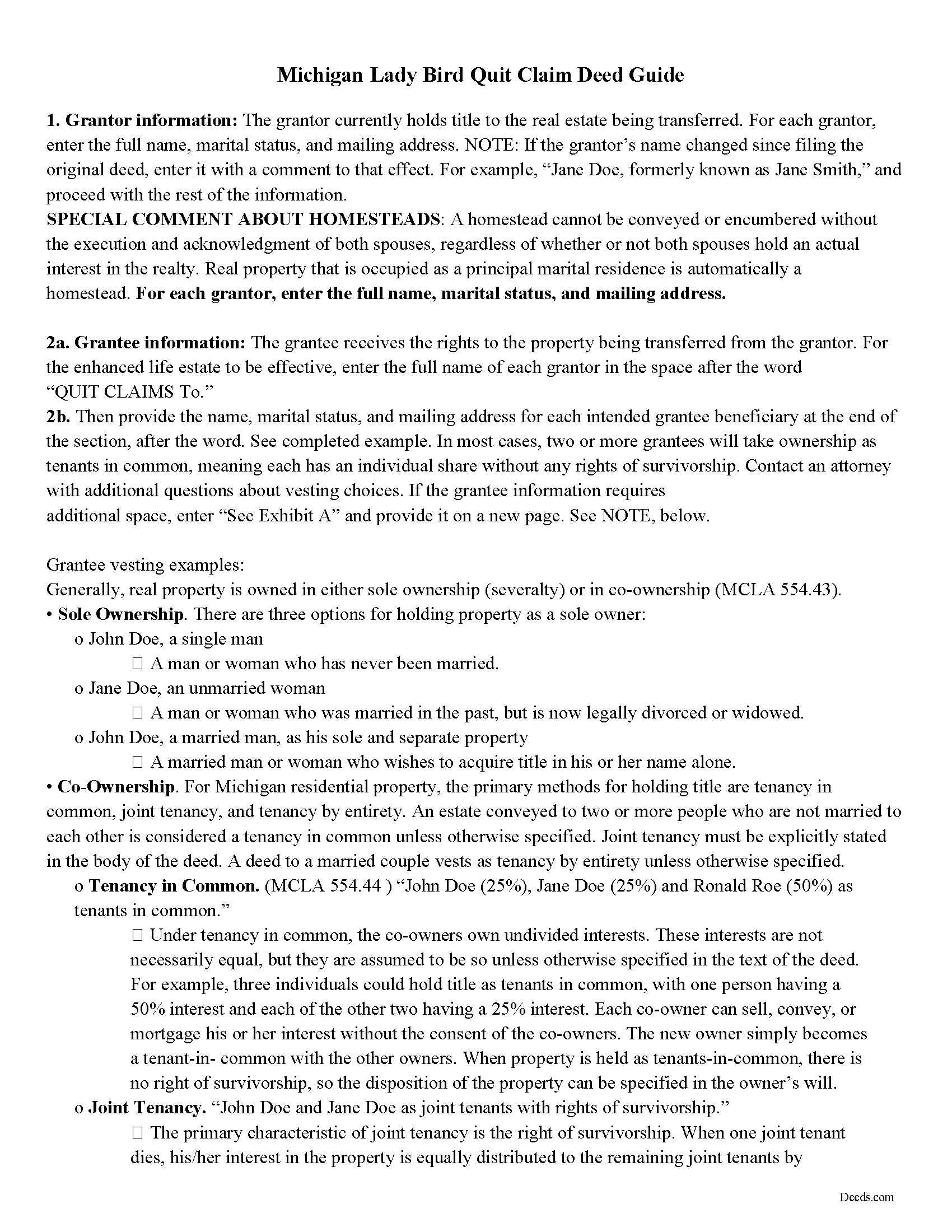

Lady Bird Quitclaim Deed Guide

Line by line guide explaining every blank on the Lady Bird Quitclaim Deed form.

Included document last reviewed/updated 5/3/2024

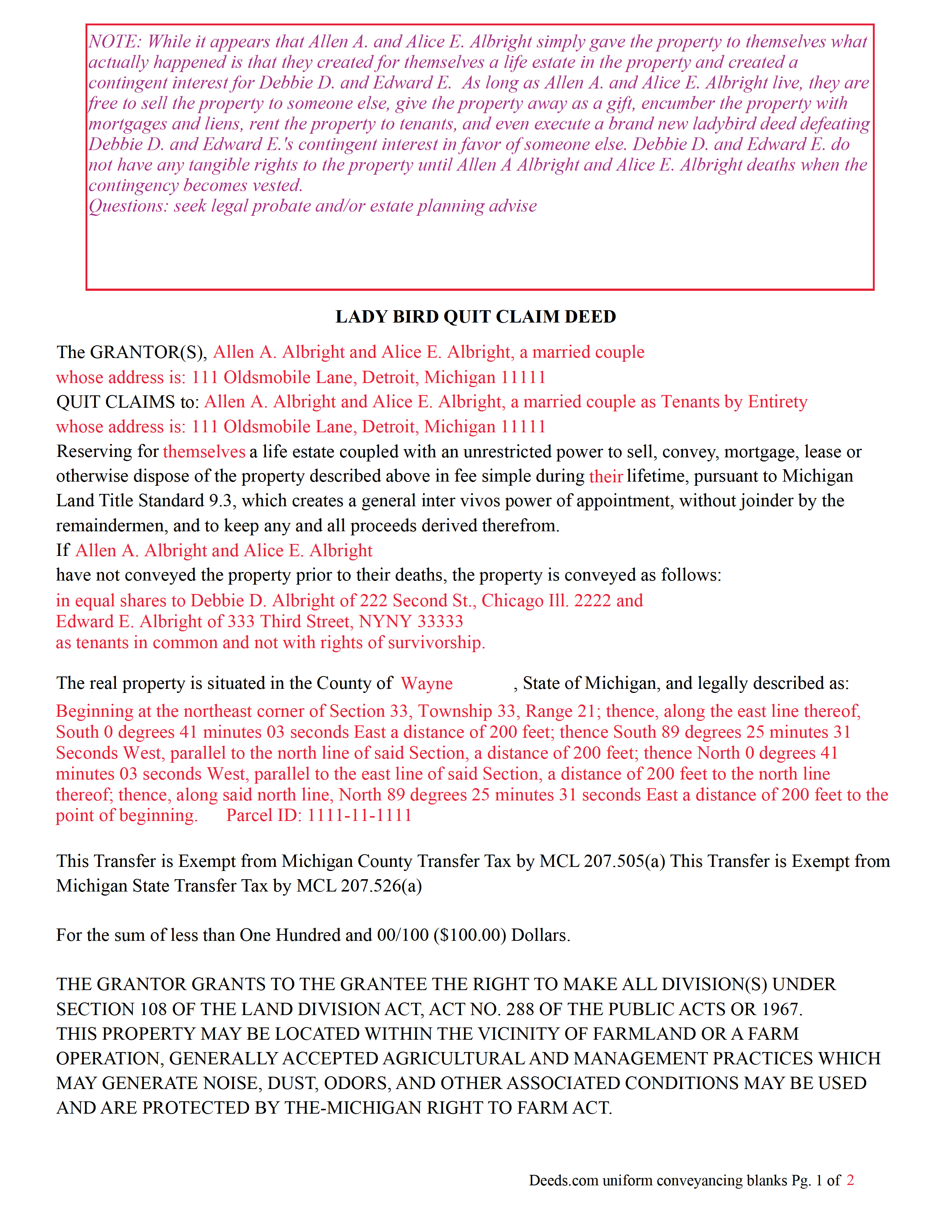

Completed Example Version 1 of the Lady Bird Quitclaim Deed Document

Example of a properly completed Michigan Lady Bird Quitclaim Deed document for reference.

Included document last reviewed/updated 12/14/2023

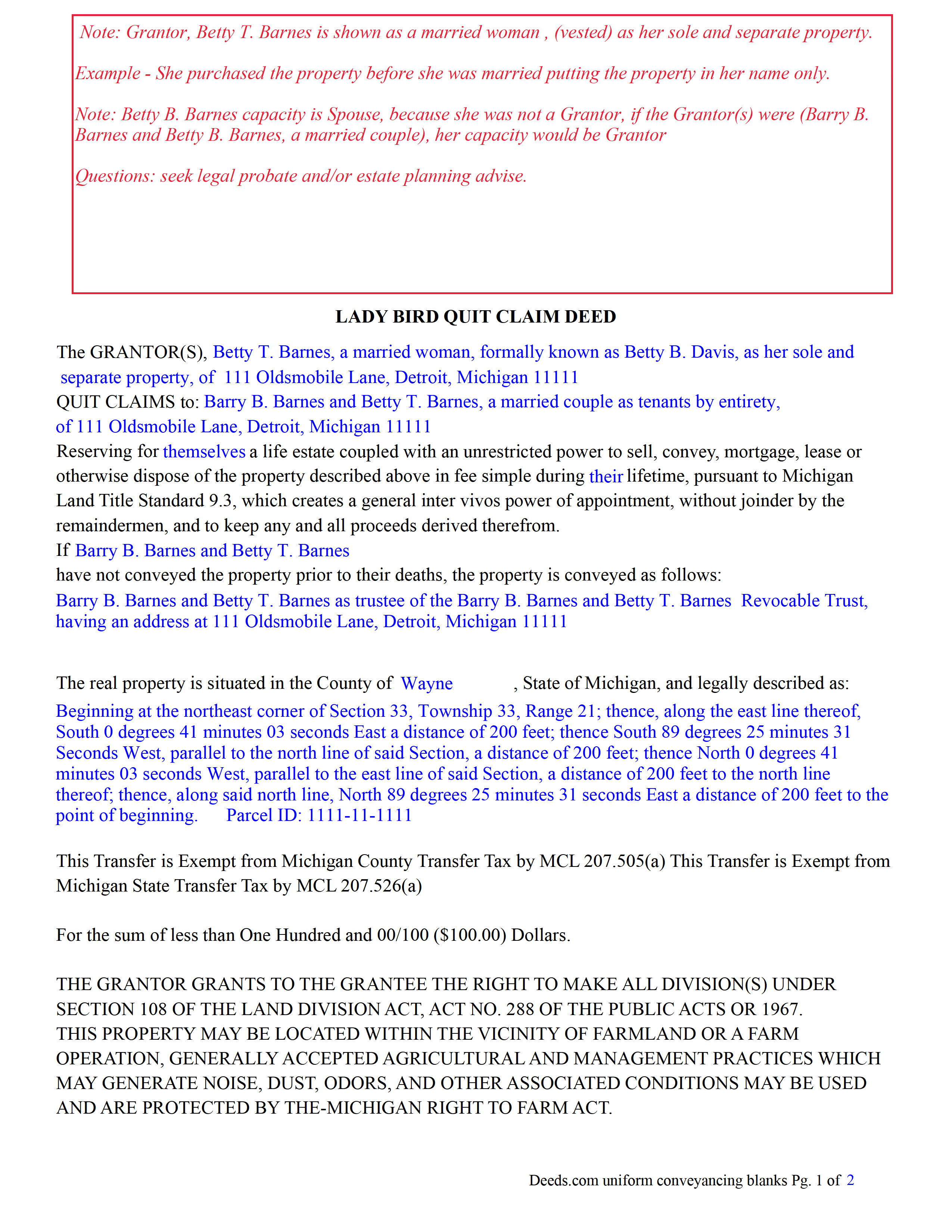

Completed Example Version 2 of the Lady Bird Quitclaim Deed Document

Example of a properly completed Michigan Lady Bird Quitclaim Deed document for reference.

Included document last reviewed/updated 2/27/2024

The following Michigan and Newaygo County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Newaygo County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Newaygo County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Newaygo County Lady Bird Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Lady Bird Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Newaygo County that you need to transfer you would only need to order our forms once for all of your properties in Newaygo County.

Are these forms guaranteed to be recordable in Newaygo County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Newaygo County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Newaygo County

Including:

- Bitely

- Brohman

- Fremont

- Grant

- Newaygo

- White Cloud

A Michigan lady bird quitclaim deed is based on the statutes regarding power of appointment. According to Michigan Land Standards 6th Edition, Standard 9.3

Michigan Land Title Standards Act 9.3 reads: The holder of a life estate, coupled with an absolute power to dispose of the fee estate by inter vivos conveyance, can convey a fee simple estate during the lifetime of the holder. If the power is not exercised, the gift becomes effective.

In Michigan, a Lady Bird Deed Quitclaim Deed is a type of Quitclaim Deed that allows the Grantor, to transfer their property upon their death to a named beneficiary. This is a great tool for estate planning and helps to avoid probate court. These courts deal with someone's assets and belongings after they pass away. Going through this court is typically expensive and time-consuming.

As long as the Grantor lives, he/she/they are free to sell the property to someone else, give the property away as a gift, encumber the property with mortgages and liens, rent the property to tenants, and even execute a brand-new ladybird deed defeating Grantee's contingent interest in favor of someone else. Grantee(s) does/do not have any tangible rights to the property until Grantor's death when the contingency becomes vested.

Consult an estate planning attorney with questions including ladybird deeds.

(Michigan Lady Bird QCD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Newaygo County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Newaygo County Lady Bird Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4325 Reviews )

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!rn

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Z. L.

October 20th, 2021

I appreciate a service that can reach any county in Texas to file deed distribution deeds. It is convenient, time and money saving for our clients and takes the headache out of estate administration. Thanks.

Thank you!

Diane W.

January 3rd, 2020

The forms were immediately available for download, which was nice. However, I was not impressed by the lack of several features: 1) there was no way to edit set text in the form, such as where it says you should consult an attorney. That is not necessary for recording the deed and I wanted to deleted it, but could not. 2) Also, under the "Notes" section, there is a limited area to write; I tried adding a fuller explanation of something, but the form would not accept or include it when I printed the final document. The form may do the job, but it's not very sophisticated or elegant.

Thank you for your feedback. We really appreciate it. Have a great day!

sara g.

June 10th, 2019

THIS WAS A USER FRIENDLY FORM, WAS ABLE TO COMPLETE WITHIN A SHORT TIME. THANK YOU

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Connie L.

January 20th, 2024

Ordered a Quitclaim deed and worked perfectly at Register of Deed office. Liked the instructions and copy of one example filled out made it so much easier to understand. One price is great as most of other companies wanted a membership to join. Will use Deeds.com again if I ever need different forms. Thanks!!!

We are grateful for your feedback and looking forward to serving you again. Thank you!

Toni C.

September 2nd, 2020

Super impressed!! For me to get back my recorded document in one day was awesome. I needed it for a foreclosure and knew if I mailed it in to the Clerk's office I more than likely would not get it back in time. Also the fact that you had no problem with me having a one-time document to record is a plus. I will be using you in the future for my recording needs. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

patricia l.

February 16th, 2019

found this site very easy to use

Thank you for your feedback. We really appreciate it. Have a great day!

patricia l b.

August 1st, 2021

Wonderful service, very user friendly!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem.

Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description!

Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Carol H.

December 22nd, 2021

Great help

Quite useful

Thank you!

Jayne B.

July 1st, 2020

This makes it so easy and I'm so glad I found you.

I visited two other sites before I found this one. They were cumbersome to use to the point where I abandoned them and kept on looking. Then I found yours, and it was a breeze. Thank you so much!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

AKILAH S.

March 14th, 2024

It was a little challenging and I had to call to speak to someone a few time but I got it done and and over with so I'm happy.

It was a pleasure serving you. Thank you for the positive feedback!

David W.

July 13th, 2021

Outstanding. I will definitely recommend your company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!