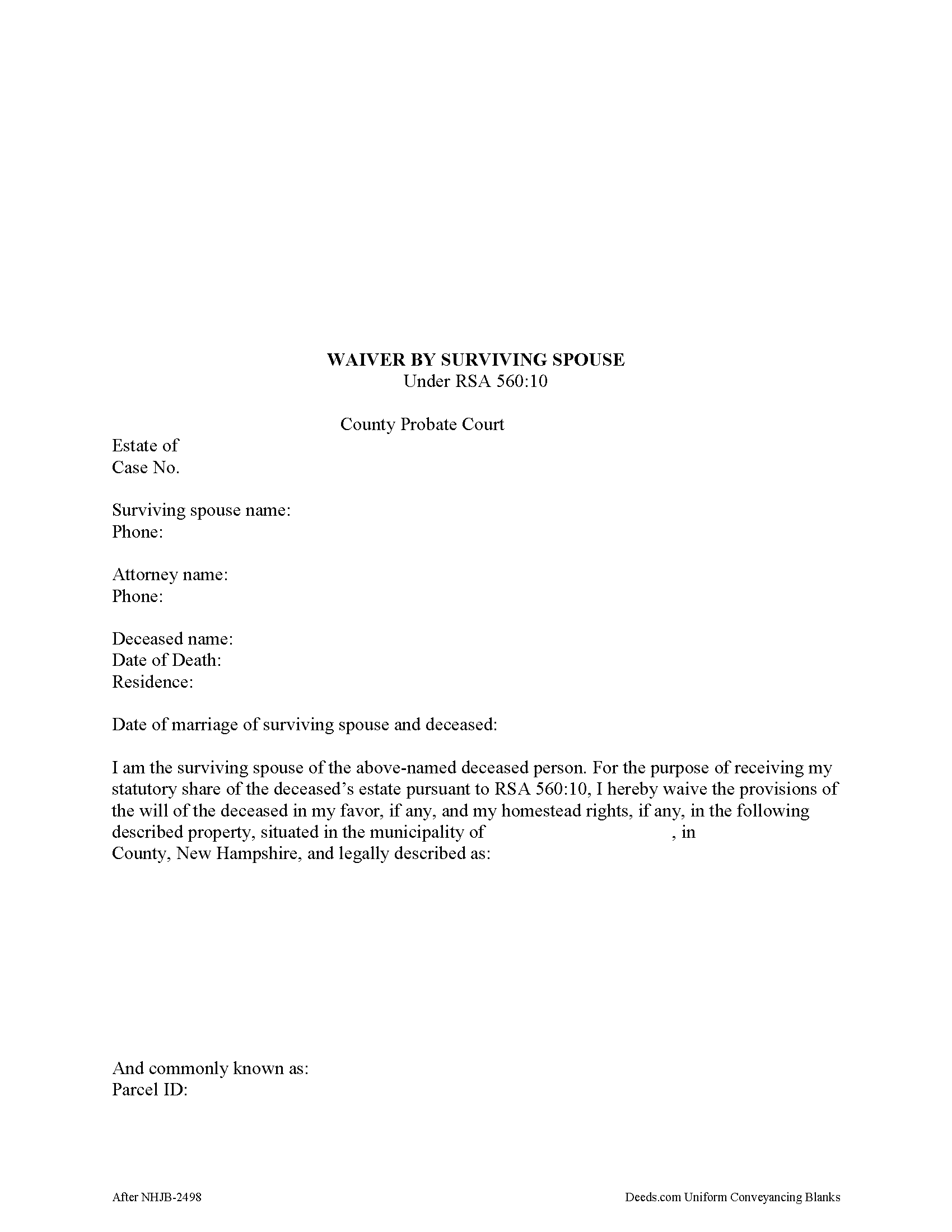

New Hampshire Waiver by Surviving Spouse

Use this document to waive a surviving spouse's testate distribution and homestead rights, if any, in order to take a statutory share of the deceased spouse's estate. Widows or widowers may opt to execute a waiver of surviving spouse when the statutory share for a surviving spouse under RSA 560:10 is greater than the testate distribution.

Pursuant to RSA 560:14, file the waiver with the probate court within six months of the administrator's appointment, and, when real property is involved, record in the registry of deeds of the county where the property to which it pertains is located.

The document must state the surviving spouse's name, the decedent's name and date of death, and the date of marriage of the surviving spouse and decedent. Because the document relates to real property, it also requires a legal description of the relevant realty. The surviving spouse waiving testamentary distribution and homestead rights must sign in the presence of a notary public.

Consult an attorney licensed in the State of New Hampshire with questions regarding rights of surviving spouses.

(New Hampshire WBSS Package includes form, guidelines, and completed example)