Herkimer County Mortgage and Promissory Note Forms (New York)

All Herkimer County specific forms and documents listed below are included in your immediate download package:

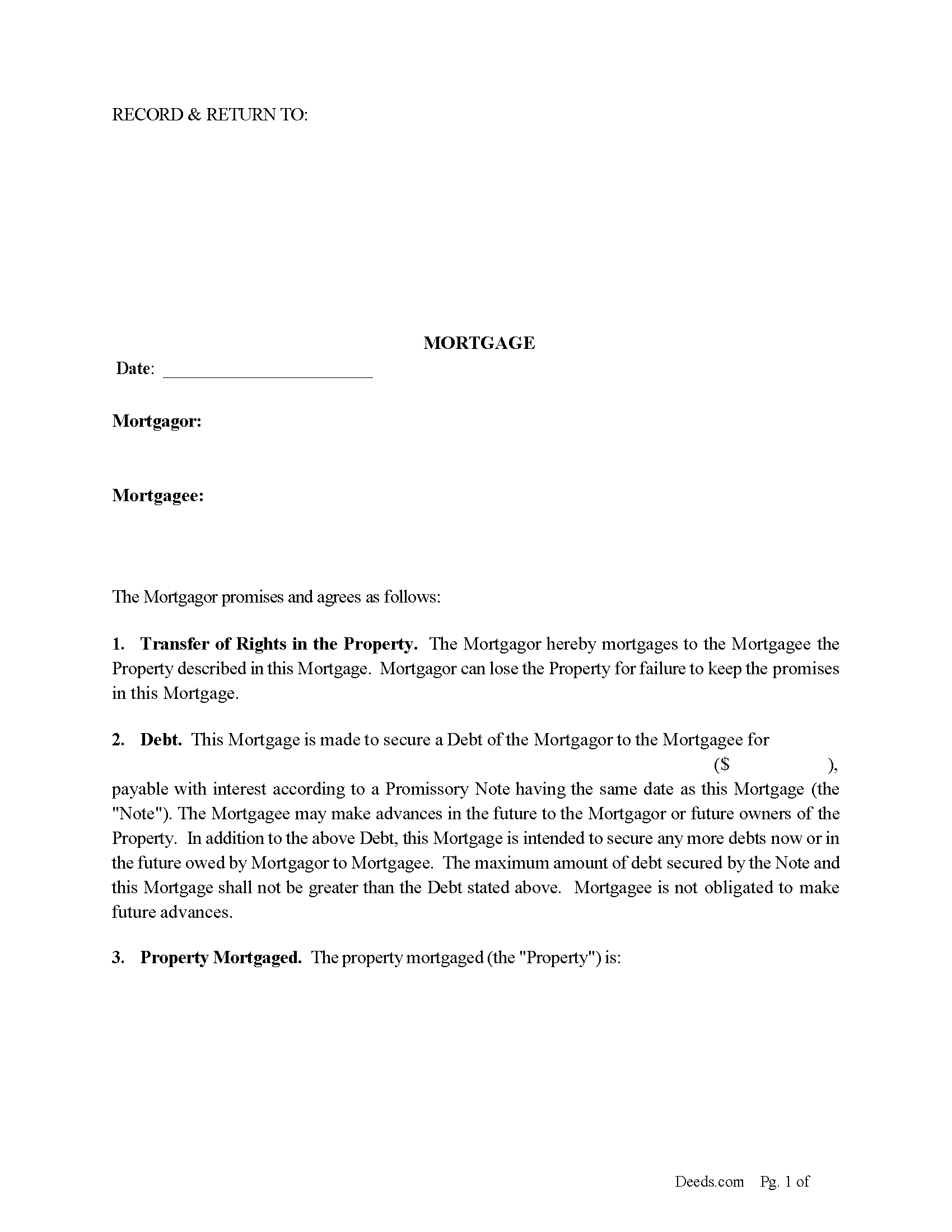

Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/19/2024

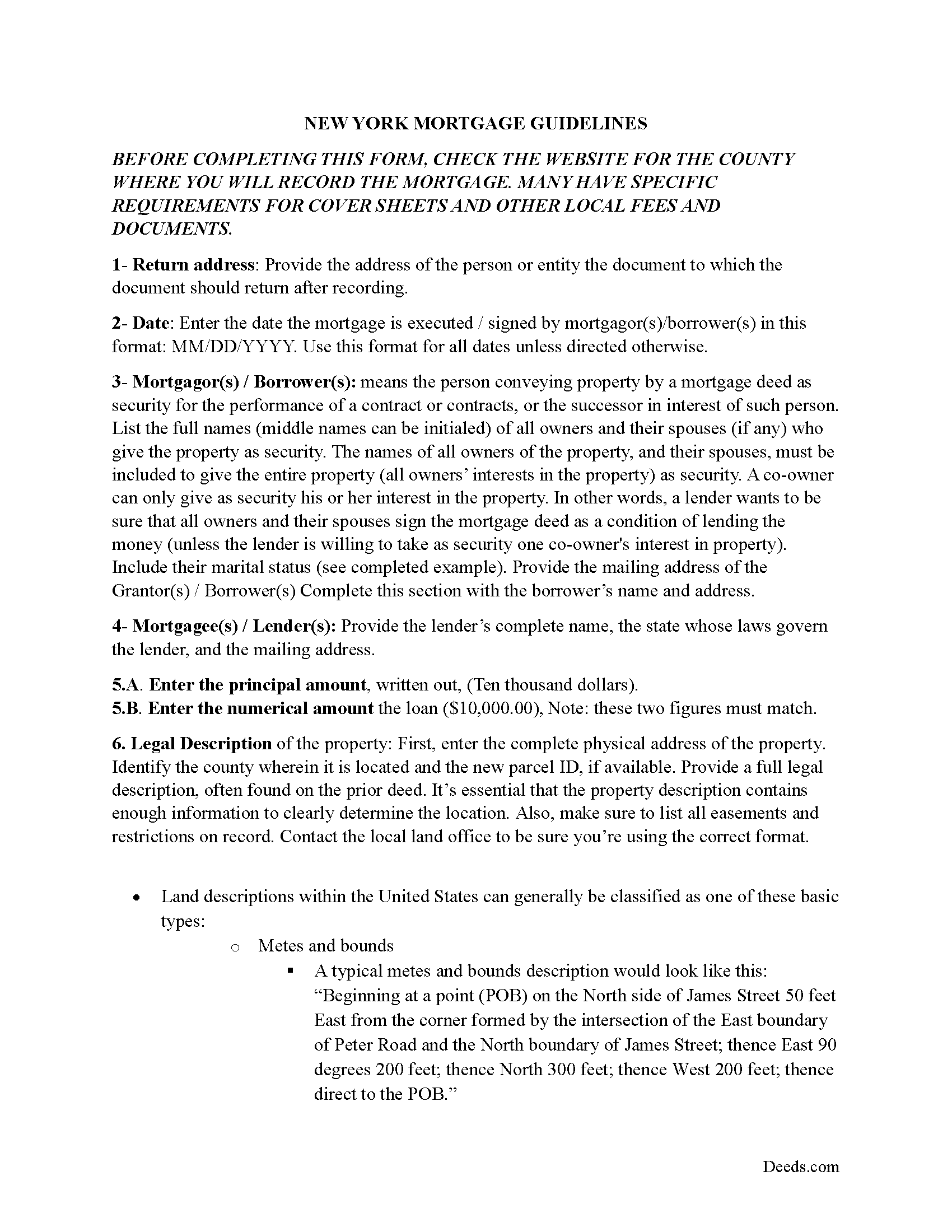

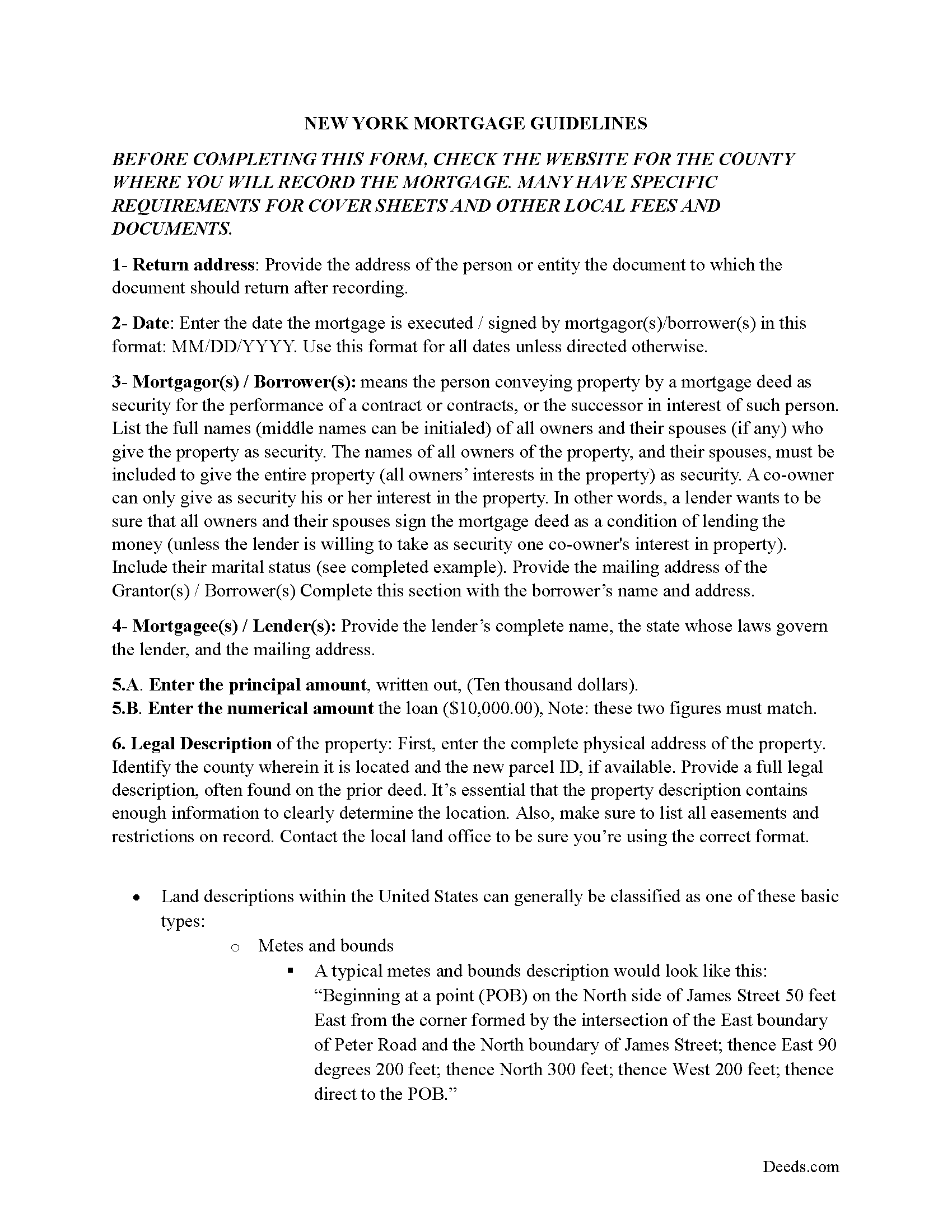

Mortgage Guidelines

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/4/2024

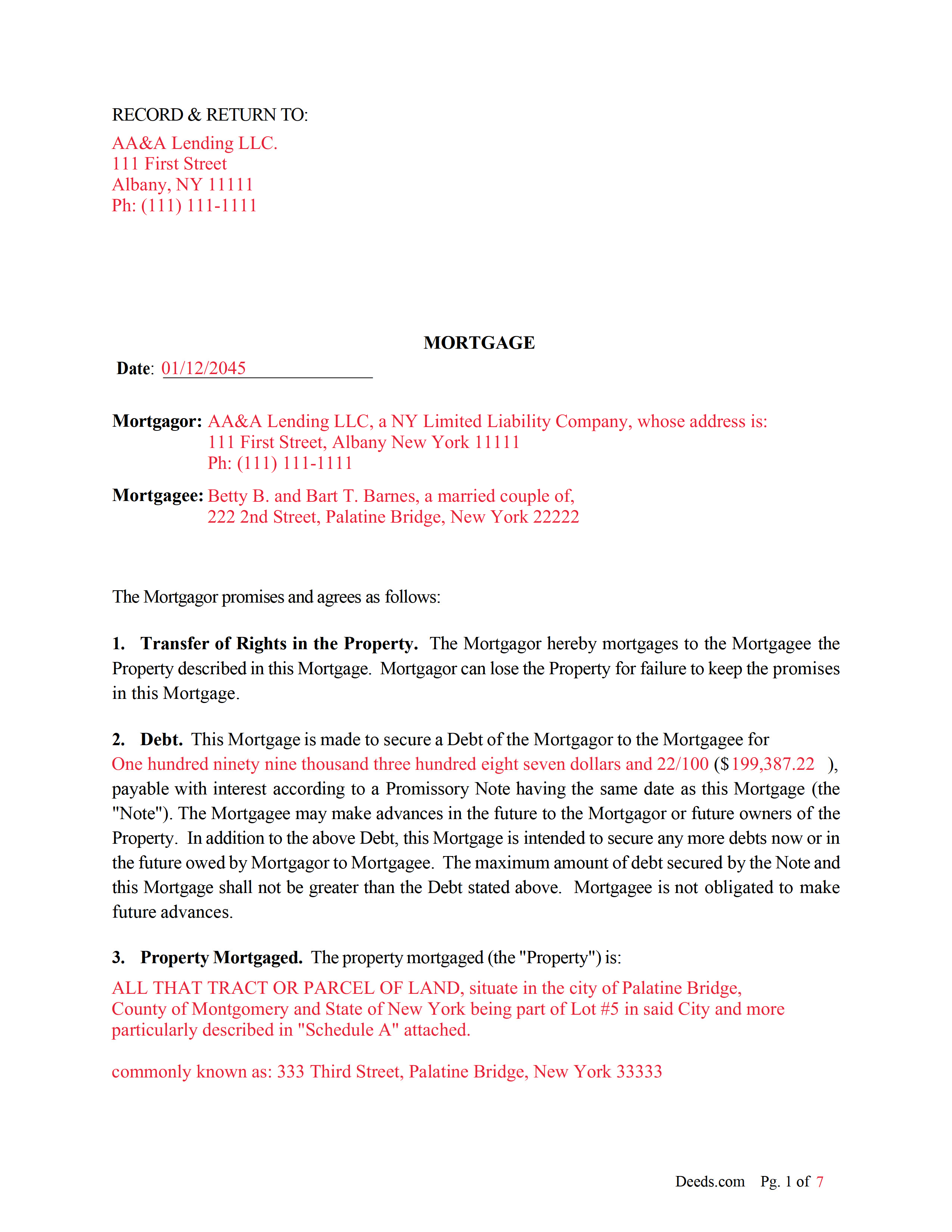

Completed Example of the Mortgage Document

Example of a properly completed form for reference.

Included document last reviewed/updated 2/19/2024

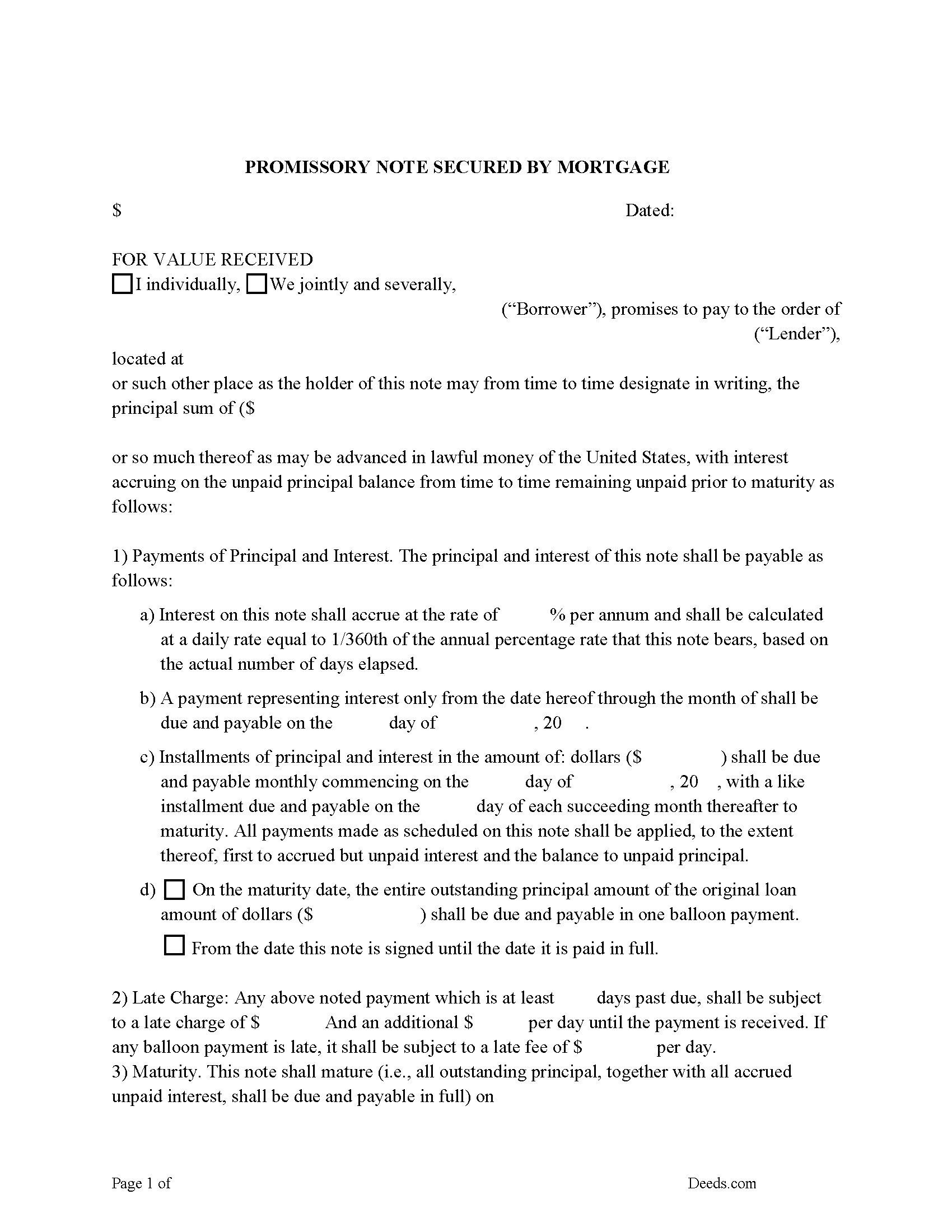

Promissory Note Form

Fill in the blank Mortgage and Promissory Note form formatted to comply with all New York recording and content requirements.

Included document last reviewed/updated 4/2/2024

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 1/11/2024

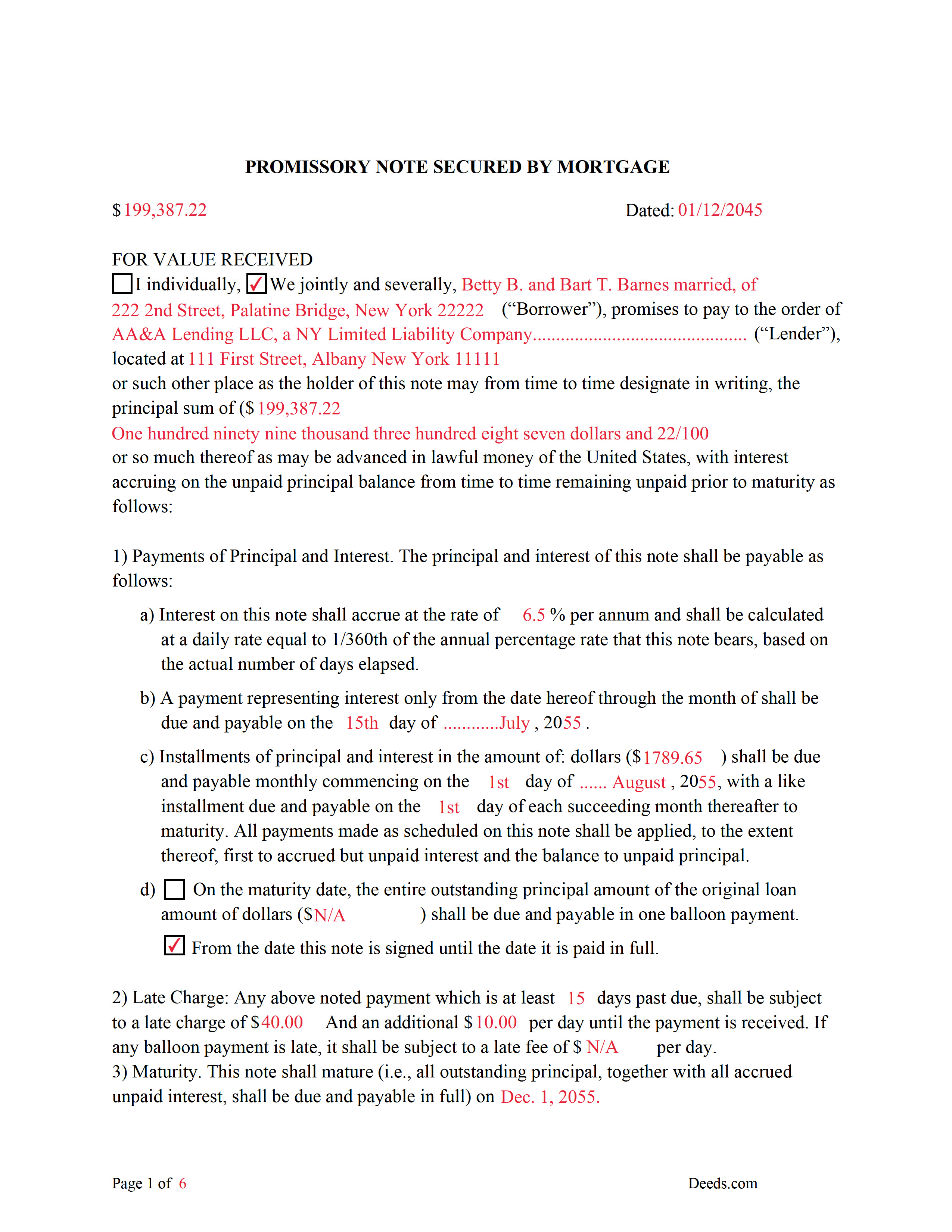

Completed Example of the Promissory Note Document

Example of a properly completed New York Mortgage and Promissory Note document for reference.

Included document last reviewed/updated 5/3/2024

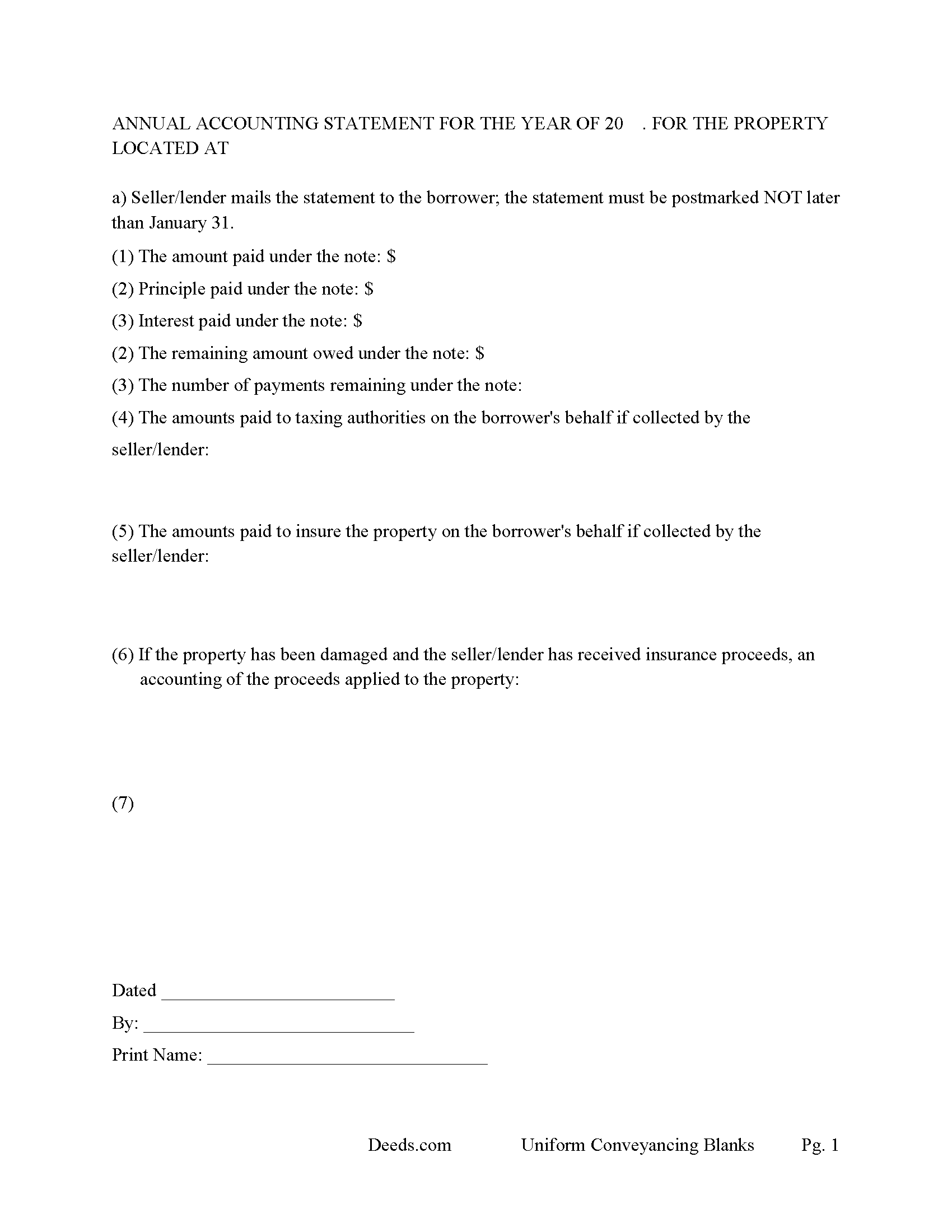

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included document last reviewed/updated 1/30/2024

The following New York and Herkimer County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Herkimer County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Herkimer County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Herkimer County Mortgage and Promissory Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Mortgage and Promissory Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Herkimer County that you need to transfer you would only need to order our forms once for all of your properties in Herkimer County.

Are these forms guaranteed to be recordable in Herkimer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Herkimer County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Herkimer County

Including:

- Cold Brook

- Dolgeville

- Eagle Bay

- Frankfort

- Herkimer

- Ilion

- Jordanville

- Little Falls

- Middleville

- Mohawk

- Newport

- Old Forge

- Poland

- Salisbury Center

- Thendara

- Van Hornesville

- West Winfield

A mortgage is a conveyance of title to property that is given as security for a loan until the grantor (borrower) repays the lender according to terms defined in an attached promissory note. It contains a lien against the security property that ends when the debt is repaid.

Use this form for financing real property- residential, rental units, condominiums, vacant land, small commercial and planned unit developments.

Mortgage covenants

Transfer of Rights in the Property. The Mortgagor hereby mortgages to the Mortgagee the Property described in this Mortgage. Mortgagor can lose the Property for failure to keep the promises in this Mortgage.

Applicable Law. Mortgagee shall have all the rights set forth in Section 254 of the New York Real Property Law in addition to Mortgagee's rights set forth in this Mortgage, even if the rights are different from each other.

Non-Judicial Foreclosure. Mortgagee shall have the power of sale under Article 14 of the Real Property Actions and Proceedings Law, as it may be amended from time to time, and under any successor statute or statute of similar impo1t and effect which may subsequently be enacted providing for non-judicial sale of the Property, subject to the requirements and restrictions applicable to such statutory process.

Promissory Note

A promissory note is a negotiable instrument that contains an unconditional written promise, signed by the borrower, to repay the lender or its designated agent. The promissory note also defines the amount and specific terms of the loan between borrower (maker) and lender (payee/holder).

The promissory note is not recorded on its own. Instead, it is presented for recording along with its related deed of trust or mortgage.

A mortgage that includes a power of sale clause and a promissory note that includes stringent default terms can be beneficial to the lender

(New York Mortgage Package includes forms, guidelines, and completed examples) For use in New York only.

Our Promise

The documents you receive here will meet, or exceed, the Herkimer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Herkimer County Mortgage and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4326 Reviews )

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca W.

January 24th, 2023

Very easy to find and download.

Thank you!

Jeffrey G.

December 31st, 2020

Nice an easy. Just wondered if I can come back and still have my order (forms) available to get again, if I have an issue with saving them.

Thank you for your feedback. We really appreciate it. Have a great day!

Helen L.

February 1st, 2023

The website was easy to navigate but only needed one form. The guide was helpful also. Cost want high but contains many documents that I didn't need but may someday. Could not save form after completed but printed copies that needed to be court filed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph M.

January 4th, 2021

Very easy to use the service and responses came very quickly.

Thank you!

Janis H.

February 13th, 2020

Amazing! Great forms - created the quitclaim fairly easy, recorded with no issues. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Jeff H.

July 1st, 2021

Very simple and fast service, and the fees are appropriate. It would be good to get email notifications when there are new messages and/or status updates.

Thank you for your feedback. We really appreciate it. Have a great day!

mark L.

April 18th, 2020

i really liked that the information i received from Deed .com concerning deed and title transfer for representative made it so i was able to find the correct forms that i needed. It was a bonus that Deed.com had the forms and instructions that i required

Thank you for your feedback. We really appreciate it. Have a great day!

Cindy H.

October 21st, 2020

Loved it! Quick and easy, done in 24 hours.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert I.

May 9th, 2023

This site was easy to use with full instructions on how to fill out and file forms very good

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna W.

October 6th, 2022

Answered all of my questions and was very easy to use. I will use Deeds.com to do all of my real estate forms from now on. Thanks.

Thank you!

SHARON R.

September 12th, 2019

Excellent Service! Please note that form Realty Transfer Tax Statement of Value does not print completely. Part of the pages are cut off. Otherwise, excellent service.

Thank you for your feedback. We really appreciate it. Have a great day!

Keith L.

March 15th, 2019

Great to have a downloadable form, rather than a cloud solution that gives no guarantee of privacy. Appreciated the sample.......but all of that still left me with open issues about how to tweak the form to serve my particular needs......for example: how to ensure that survivor rights were properly characterized; how far back I should go with the "Source" section + how I should layer my own additions to the chain of ownership, etc. Nonetheless, an overall happy experience. Thank you for your help

Thank you for your feedback. We really appreciate it. Have a great day!