Marion County Collateral Assignment of Note and Liens (Security Agreement) Forms (Texas)

All Marion County specific forms and documents listed below are included in your immediate download package:

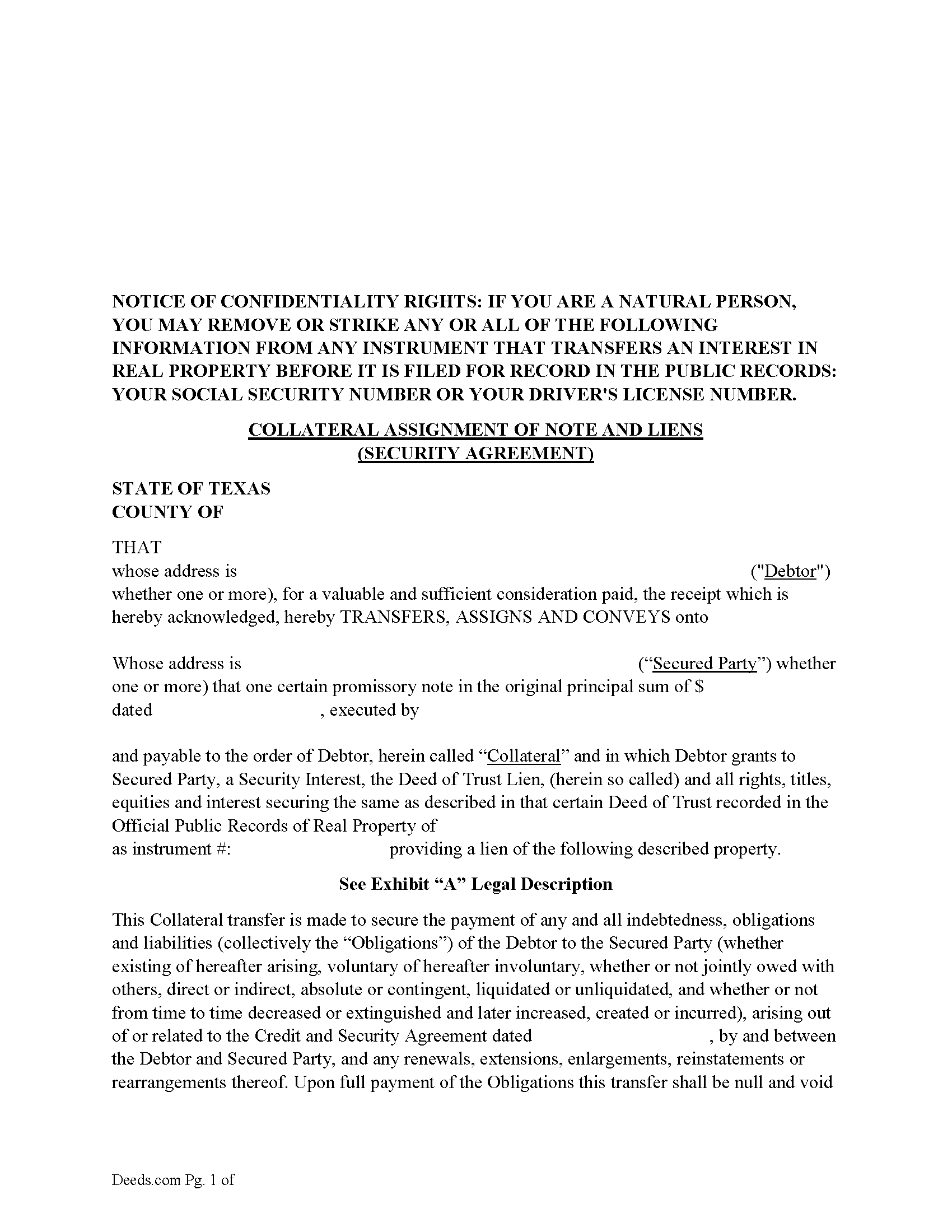

Collateral Assignment of Note and Liens Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 3/28/2024

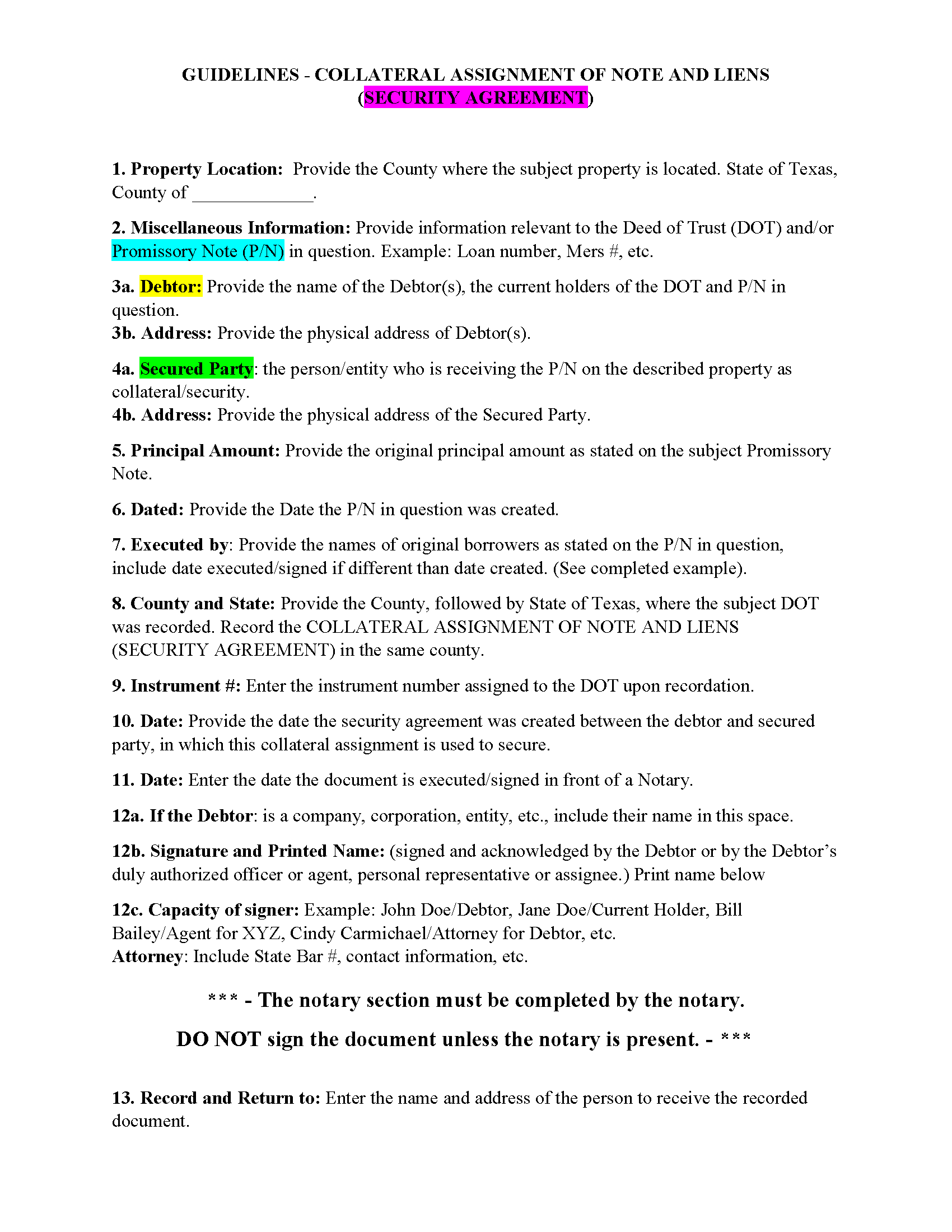

Guidelines - Collateral Assignment of Note and Liens

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/9/2024

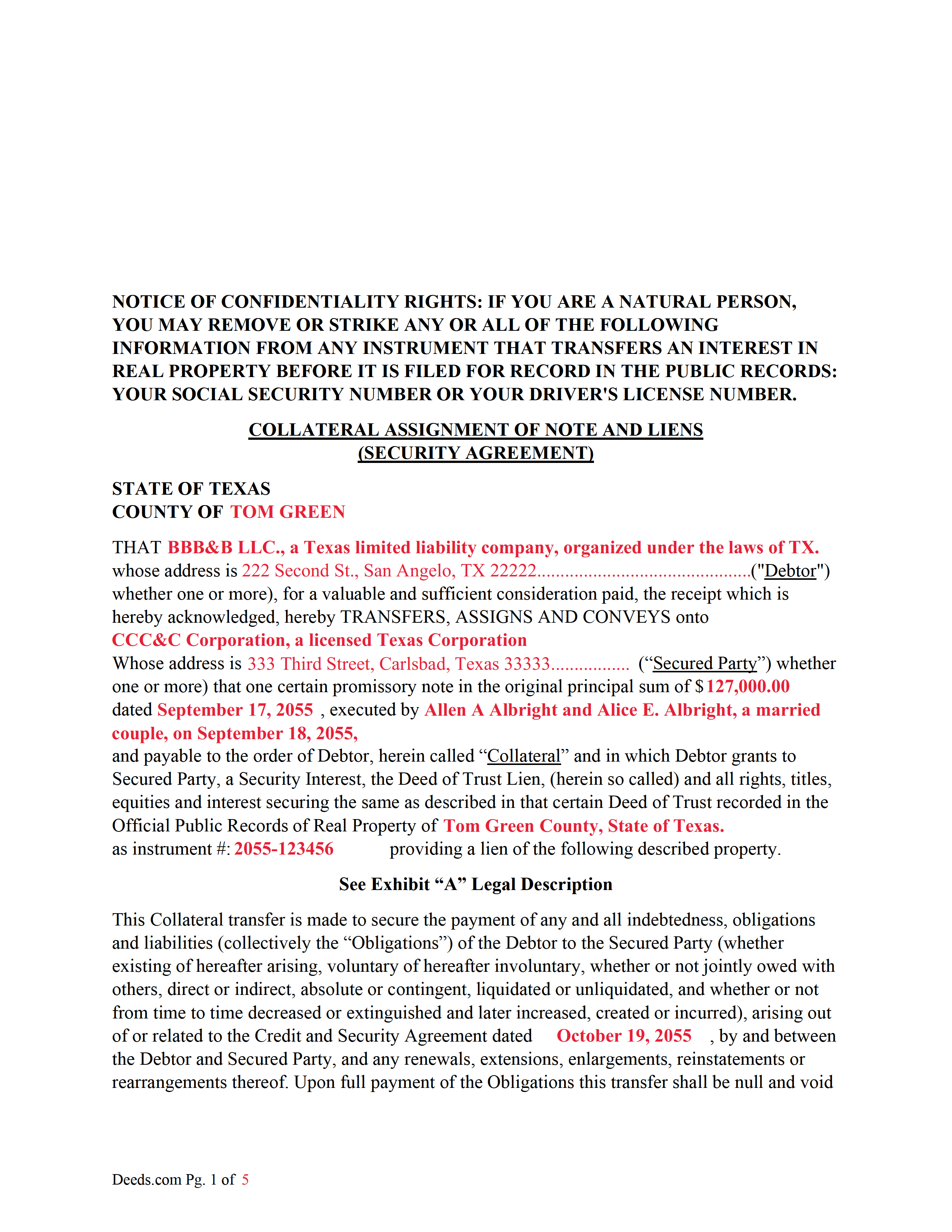

Completed Example of the Collateral Assignment of Note and Liens Document

Example of a properly completed form for reference.

Included document last reviewed/updated 1/3/2024

The following Texas and Marion County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Marion County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Marion County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Marion County Collateral Assignment of Note and Liens (Security Agreement) forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Collateral Assignment of Note and Liens (Security Agreement) forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Marion County that you need to transfer you would only need to order our forms once for all of your properties in Marion County.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Marion County

Including:

- Jefferson

- Lodi

1. Borrower/Obligor 2. Debtor/Original Lender 3. Secured Party(SP)/3rd Party/New Lender

This form assigns the current Debtors/lenders security interest in a promissory note backed by a previously recorded Deed of Trust Lien, with all rights, titles, equities and interest securing the same as described in that certain Deed of Trust. This collateral is assigned to a Secured Party to protect a Security Agreement made between the Debtor and Secured Party. A collateral assignment is a pledge that the Debtor will pay the Secured Party as agreed. Debtor authorizes Secured Party, at Secured Party's option, to collect any and all sums becoming due upon the Collateral, such sums to be held by Secured Party without liability for interest thereon and applied toward the payment of the Obligations as and when the same becomes payable, and Secured Party shall have the full control of the Collateral and the Deed of Trust Lien securing the same until the Obligations are fully paid and shall have the further right to release the Deed of Trust Lien securing the Collateral upon the full and final payment to Secured Party.

Typically used by Private Lenders/Debtors to borrow money on a property that they financed by a Deed of Trust Lien and Promissory Note.

Sec. 9.102. DEFINITIONS AND INDEX OF DEFINITIONS. (a) In this chapter:

(12) "Collateral" means the property subject to a security interest or agricultural lien. The term includes:

(A) proceeds to which a security interest attaches;

(B) accounts, chattel paper, payment intangibles, and promissory notes that have been sold; and

(C) goods that are the subject of a consignment.

(28) "Debtor" means:

(A) a person having an interest, other than a security interest or other lien, in the collateral, whether or not the person is an obligor;

(B) a seller of accounts, chattel paper, payment intangibles, or promissory notes; or

(C) a consignee.

(66) "Promissory note" means an instrument that evidences a promise to pay a monetary obligation, does not evidence an order to pay, and does not contain an acknowledgement by a bank that the bank has received for deposit a sum of money or funds.

(73) "Secured party" means:

(A) a person in whose favor a security interest is created or provided for under a security agreement, whether or not any obligation to be secured is outstanding;

(B) a person that holds an agricultural lien;

(C) a consignor;

(D) a person to which accounts, chattel paper, payment intangibles, or promissory notes have been sold;

(E) a trustee, indenture trustee, agent, collateral agent, or other representative in whose favor a security interest or agricultural lien is created or provided for; or

(F) a person that holds a security interest arising under Section 2.401, 2.505, 2.711(c), 2A.508(e), 4.210, or 5.118.

(74) "Security agreement" means an agreement that creates or provides for a security interest.

For use in Texas only.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Collateral Assignment of Note and Liens (Security Agreement) form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4325 Reviews )

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!rn

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

mary c.

May 24th, 2022

Really good product, included guide to filling out forms.

Totally pleased with that part.

Customer service however was terrible. Did not hear back after I sent two emails. The site signed me up but after I was accepted they would not allow me to download a form, with the notation my account was closed. Had to use another email. Had problems with that. Finally got off of site and went to a login site that allowed me to download the forms. If you can get past setting up your account, it is fantastic site. Nice price compared to alternatives. Also I recieved two validation codes. Have no idea why they were sent.

Thank you!

Beth O.

January 15th, 2023

Easy peasy! Thank y'all so much.

Thank you!

Joe D.

June 15th, 2019

Complete coverage of deeds, laws, etc.

Thank you!

Rahul P.

July 19th, 2023

Excellent Site for recording documents to respective county Recorder Office.rnExcellent customer service, very well informed and experienced staff who responds promptly and guide customers throughout recording process.rnMy recording was suspended But KVH (Staff) gave me proper timely advise and guided me for the procedure till recording was done by county office.rnI would like to give 6 stars or more to the site as per my experience with this site. Highly recommended site

Thank you for your feedback. We really appreciate it. Have a great day!

Martine S.

July 29th, 2020

Very easy process and was recorded in a prompt manner. We will be using your services again in the future for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly J H.

August 1st, 2023

The Washington State Transfer on Death Deed I purchased worked perfectly.

Thank you for your feedback. We really appreciate it. Have a great day!

Jacqueline C.

August 15th, 2019

Was relieved to see your site actually delivered what I paid for.

Thank you!

Angelique A.

December 27th, 2018

Very helpful and quick customer service. Highly recommended

Thank you for your feedback Angelique, we appreciate you. Have a great day!

ruth l.

January 6th, 2021

I found this sight very helpful. All the information that one needs to file a quit claim deed. thank you so much.

Thank you!

Eppie G.

October 19th, 2021

Perfect

Thank you!

Dianne W.

July 14th, 2020

Thank you for responding so quickly to my question. I was able to locate the form and get everything downloaded. Once I saw the icon, it was easy peasy!!

Thank you!

Gwen R.

January 23rd, 2019

Happy with the forms no complaints at all.

Thank you Gwen!