Kaufman County Release of Lien - by Deed of Trust and Note Forms (Texas)

All Kaufman County specific forms and documents listed below are included in your immediate download package:

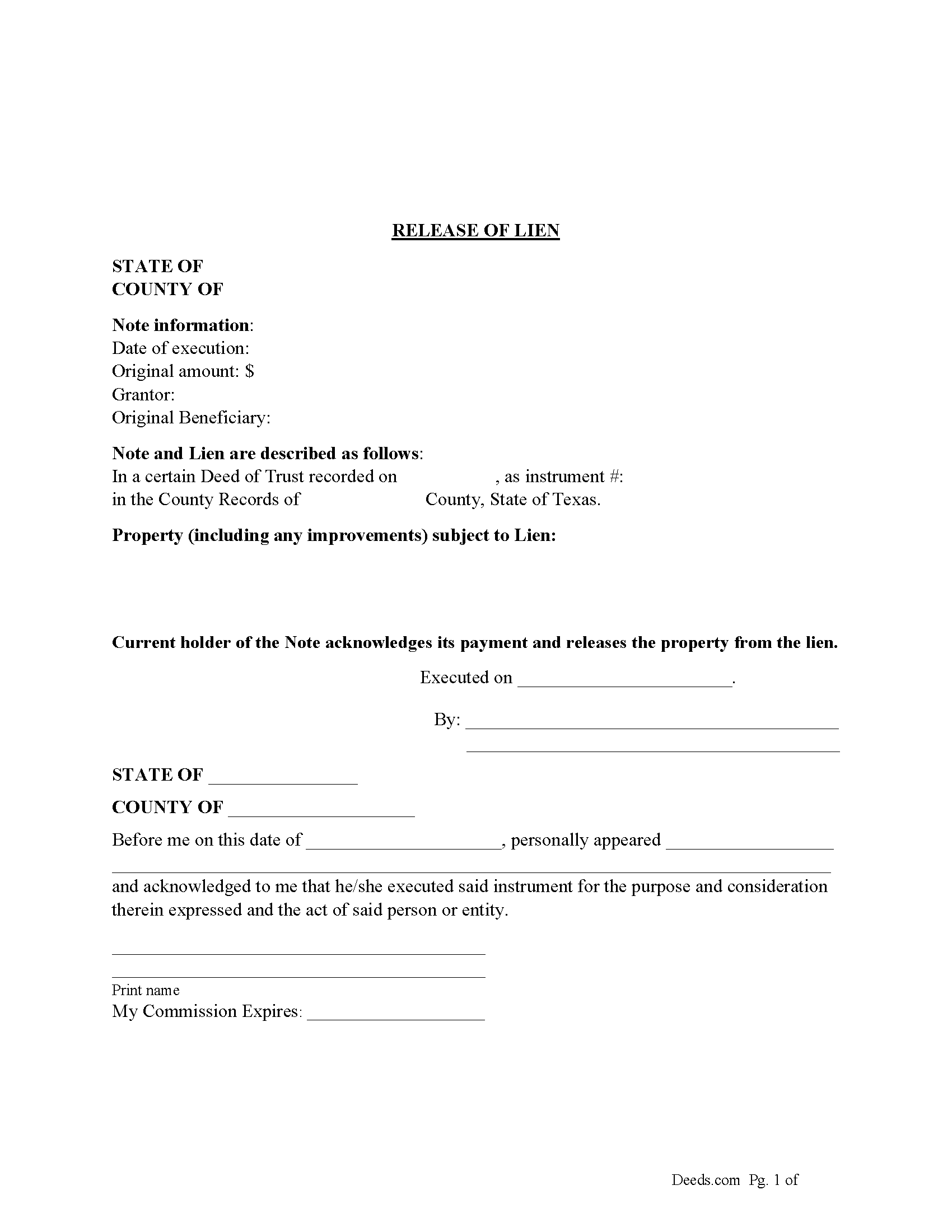

Release of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/16/2024

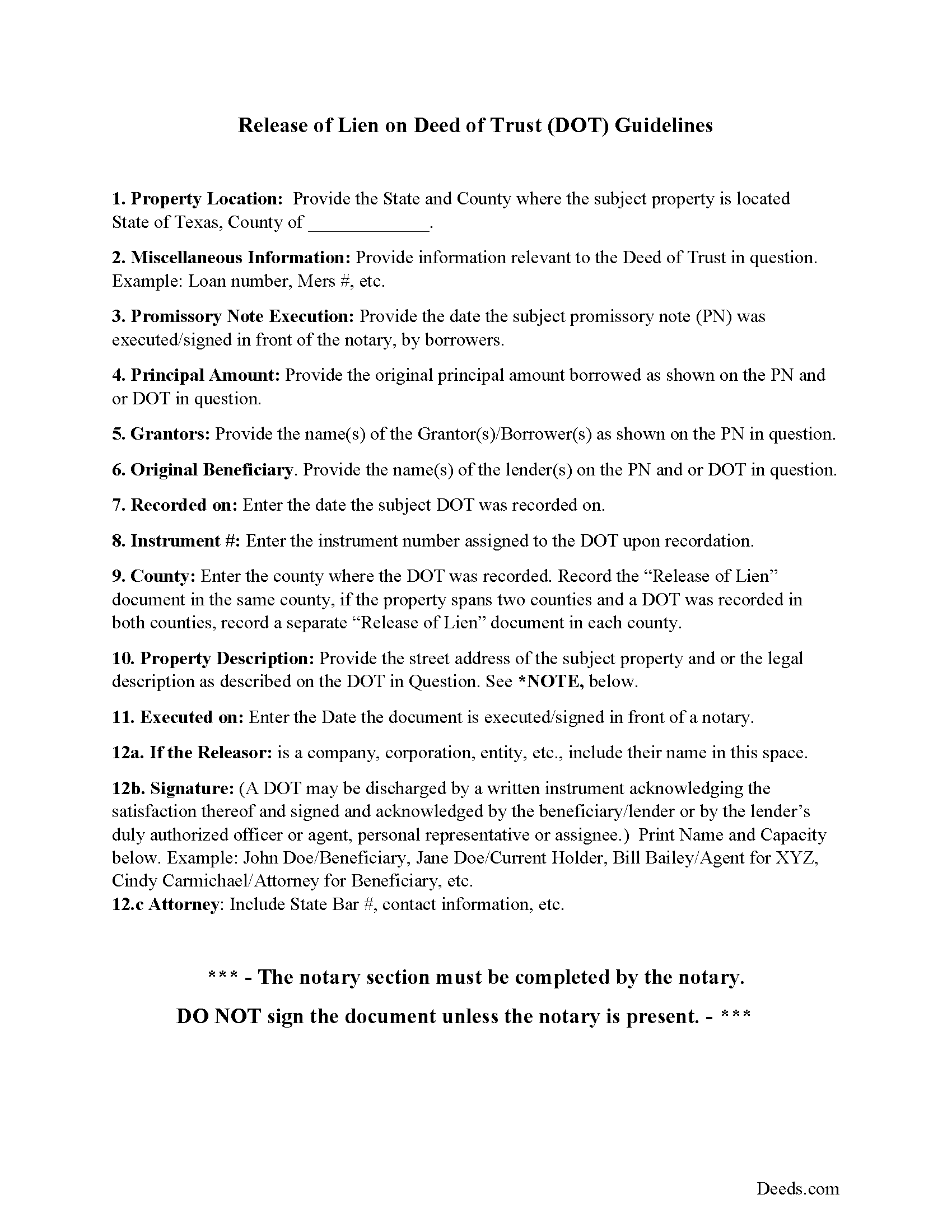

Guidelines for Release of Lien

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 1/5/2024

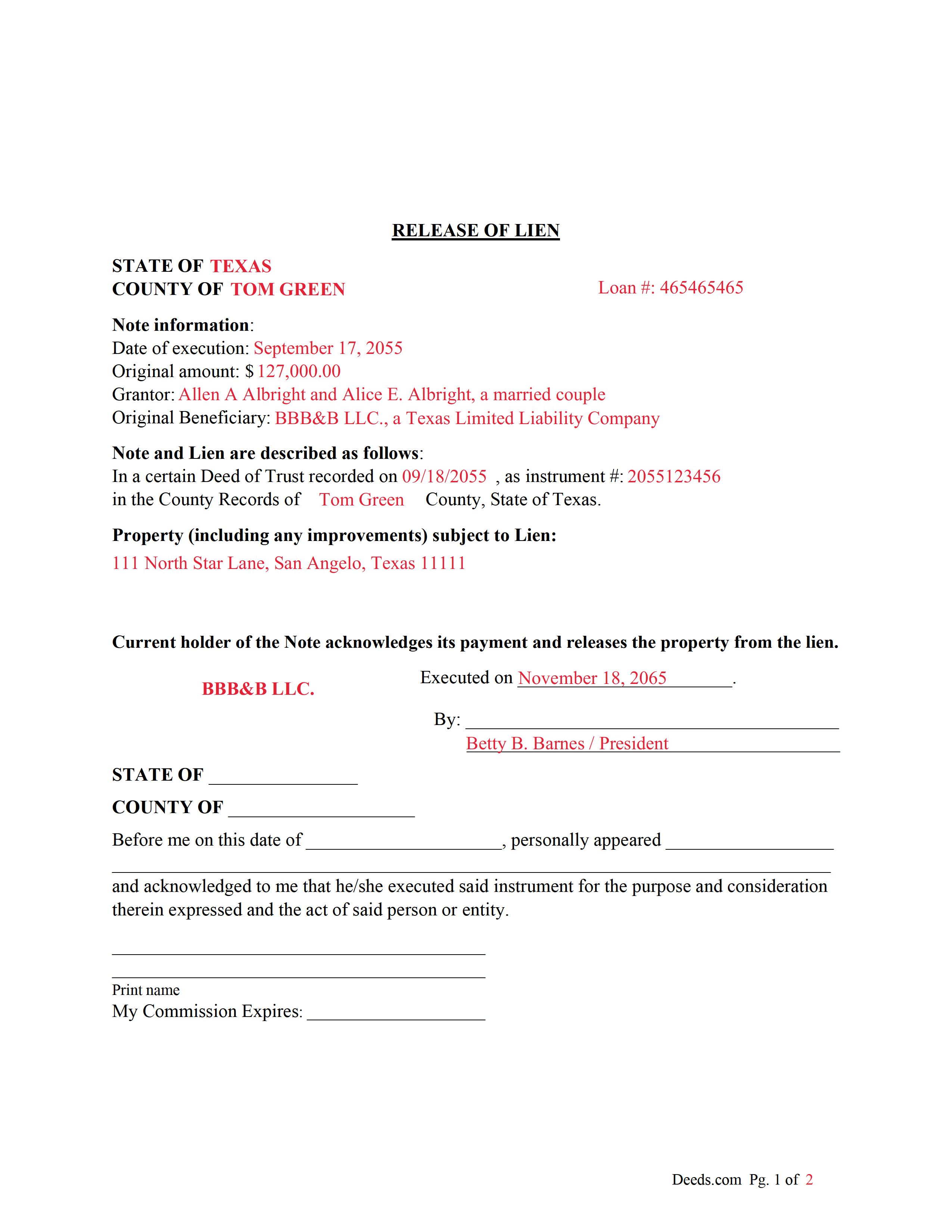

Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

Included document last reviewed/updated 3/27/2024

The following Texas and Kaufman County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Kaufman County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Kaufman County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Kaufman County Release of Lien - by Deed of Trust and Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Release of Lien - by Deed of Trust and Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Kaufman County that you need to transfer you would only need to order our forms once for all of your properties in Kaufman County.

Are these forms guaranteed to be recordable in Kaufman County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Kaufman County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Kaufman County

Including:

- Crandall

- Elmo

- Forney

- Kaufman

- Kemp

- Mabank

- Rosser

- Scurry

- Terrell

This form used to release a lien placed on real property by a previously recorded Deed of Trust. The current holder/lender or representative signs the Release of Lien document, acknowledging payment and release of the lien.

(Texas Release of Lien Package includes form, guidelines, and completed example) For use in Texas only.

Our Promise

The documents you receive here will meet, or exceed, the Kaufman County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Kaufman County Release of Lien - by Deed of Trust and Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4326 Reviews )

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MARILYN T.

January 8th, 2021

Deed.com was so easy to use to file my Quit Claim deed. They instructed me on how to send them my documents and it was a breeze. The cost was minimal and saved me tons of time.

Thank you!

Samuel M.

October 8th, 2020

it was convenient to have a starting place, however, though the property is in Colorado, the probate is in Iowa, so I had to create my own document because you locked my capacity to edit the form I paid for. If I pay for it, I should be able to edit everything including non fill in text. I could not open it in word, as I normally could.

Thank you for your feedback. We really appreciate it. Have a great day!

Craig J.

June 7th, 2021

Package downloaded without any problems. Help sheet was fair. Maybe they could cross reference the help number on the help sheet to the form better - somehow. Overall, I was pleased. I was able to download, fill in the blanks and do what edits I thought it needed with ease. Cost was very reasonable. I'll give it a 5.

Thank you for your feedback. We really appreciate it. Have a great day!

Scott A.

August 3rd, 2019

The information and instructions provided is thorough and great. But, the fill-in-the-blanks form does not work well and is very frustrating. The font size of the information I was adding on each individual line varies and is determined by the number of characters entered on that individual line. So the font size is different on each line. And the number of lines is fixed making it impossible to fill in the full legal name of the trust I needed to fill out the form for. My needs are somewhat unusual, but the form should have been designed to be flexible enough to handle it. A blank paper form would have been more useful.

Thank you for your feedback. We really appreciate it. Have a great day!

Clint J.

March 23rd, 2021

Deeds.com is a great way for people that are unfamiliar with legal documents to get things done. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

rita t.

November 4th, 2019

Thanks for asking, everything was fine. Forms worked as expected, no problems.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lorie C.

April 15th, 2023

Easy and effective...surely saved hundreds by avoiding a lawyer.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Debra D.

January 2nd, 2019

Really good forms, easy to understand and use. The guide was a must have, made the process very simple.

Thank you!

Lori M.

March 6th, 2021

So easy to use. The directions are very clear.

Thank you!

Rosemary W.

February 27th, 2021

considering the current epidemic your fees save me time and parking fees. with help from DC recorder of deeds I was directed to the correct link to process my deed

Thank you for your feedback. We really appreciate it. Have a great day!

William S C.

June 11th, 2021

The Lady Bird Deed appears to be fine with me as are the instructions. However, there apparently are no specific laws in Texas addressing them other than they are OK. The problem is that lenders are surely going to use them as triggers for their due on sale clauses, especially as the current small mortgage rates begin to increase. The solution to that seems to be to sign and have them notarized, but not to record them unless the holder needs to enforce the provisions. It seems to me that you should consider your solution to that problem in your instructions.

Thank you for your feedback. We really appreciate it. Have a great day!

Lucinda E.

October 14th, 2019

I thought this form was great and easy to complete but the instructions were unclear as to whether the grantee- beneficiaries needed to sign and notarize their signatures as well. It did not appear to be the case but it would be helpful if the instructions spelled this out better.

Thank you for your feedback. We really appreciate it. Have a great day!