Palo Pinto County Release of Lien - by Deed of Trust and Note Forms (Texas)

All Palo Pinto County specific forms and documents listed below are included in your immediate download package:

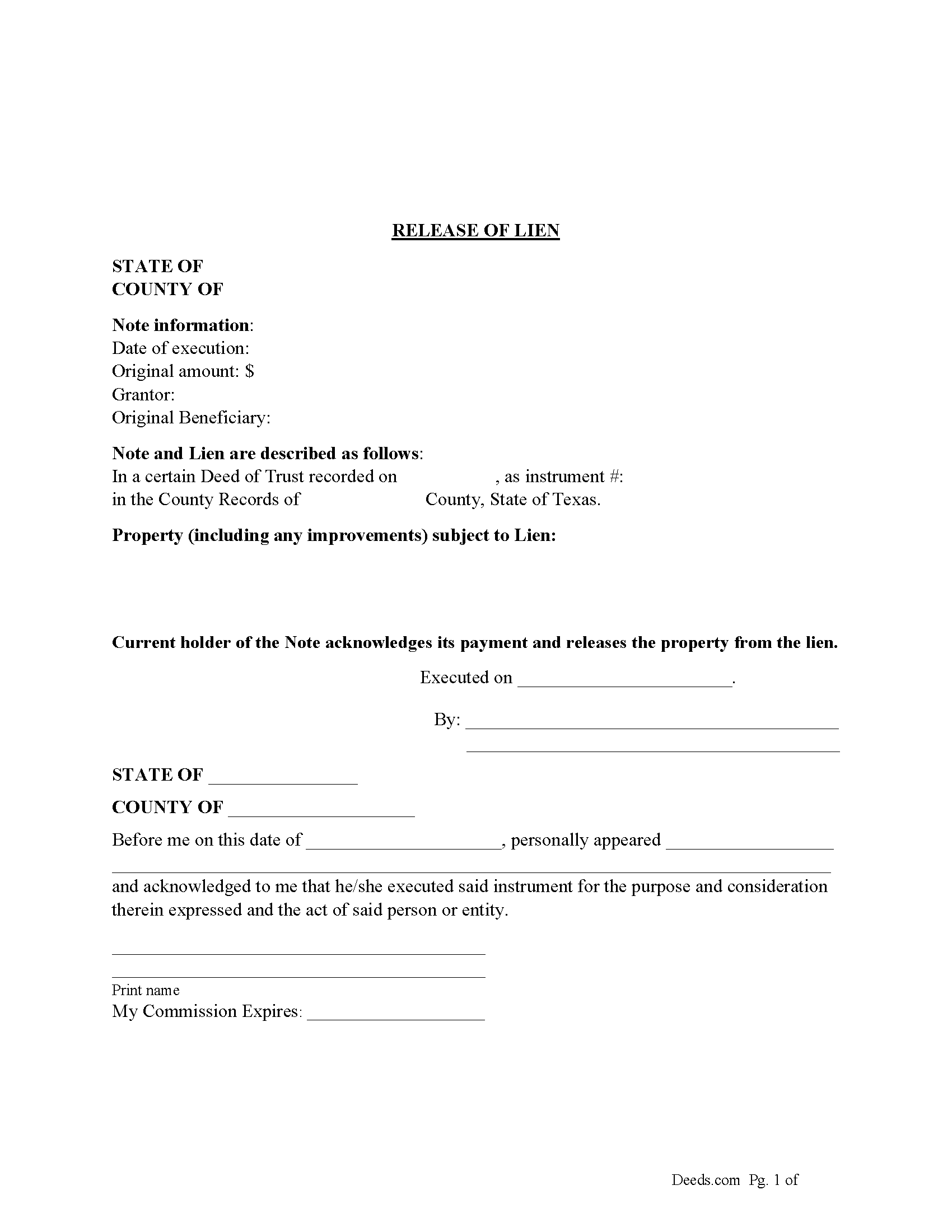

Release of Lien Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/16/2024

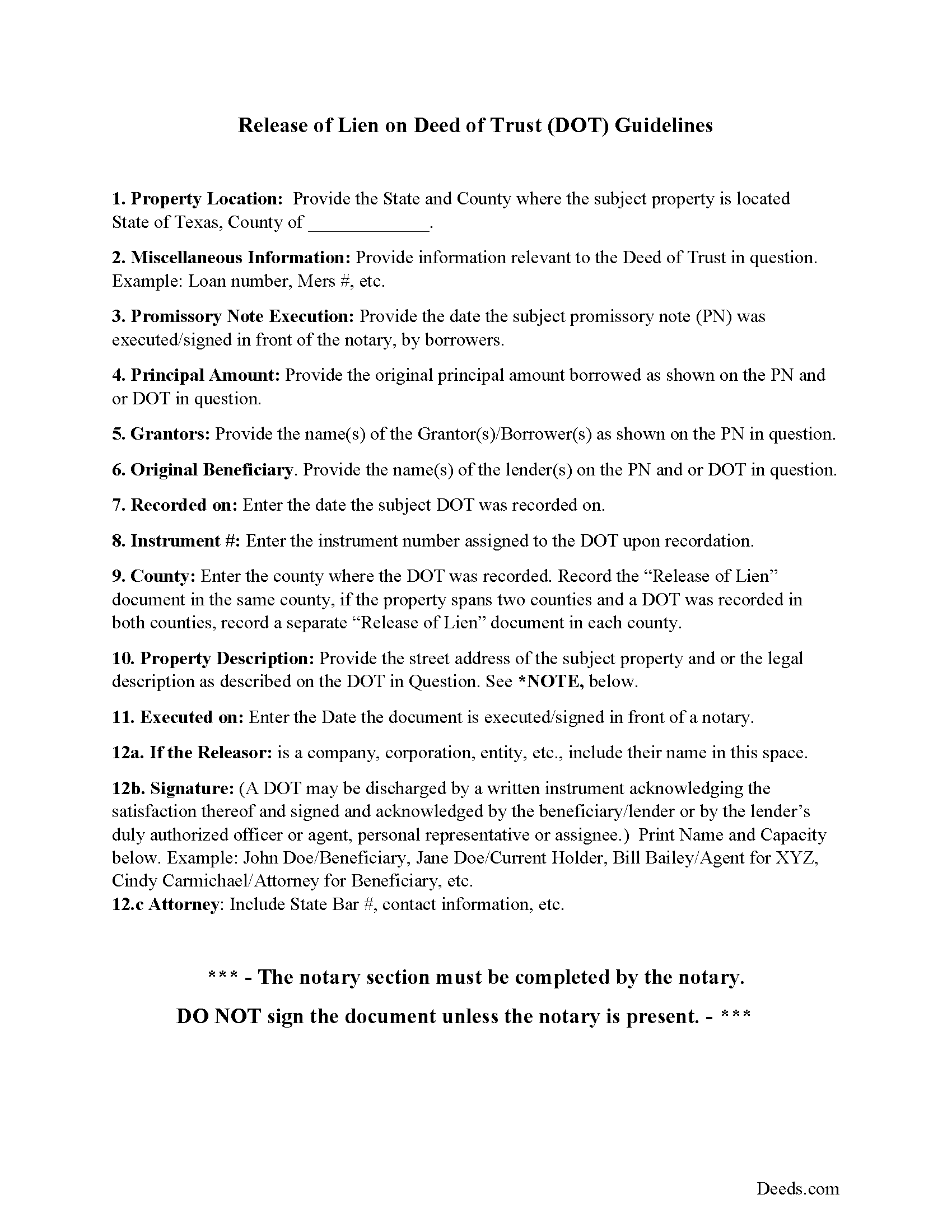

Guidelines for Release of Lien

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 1/5/2024

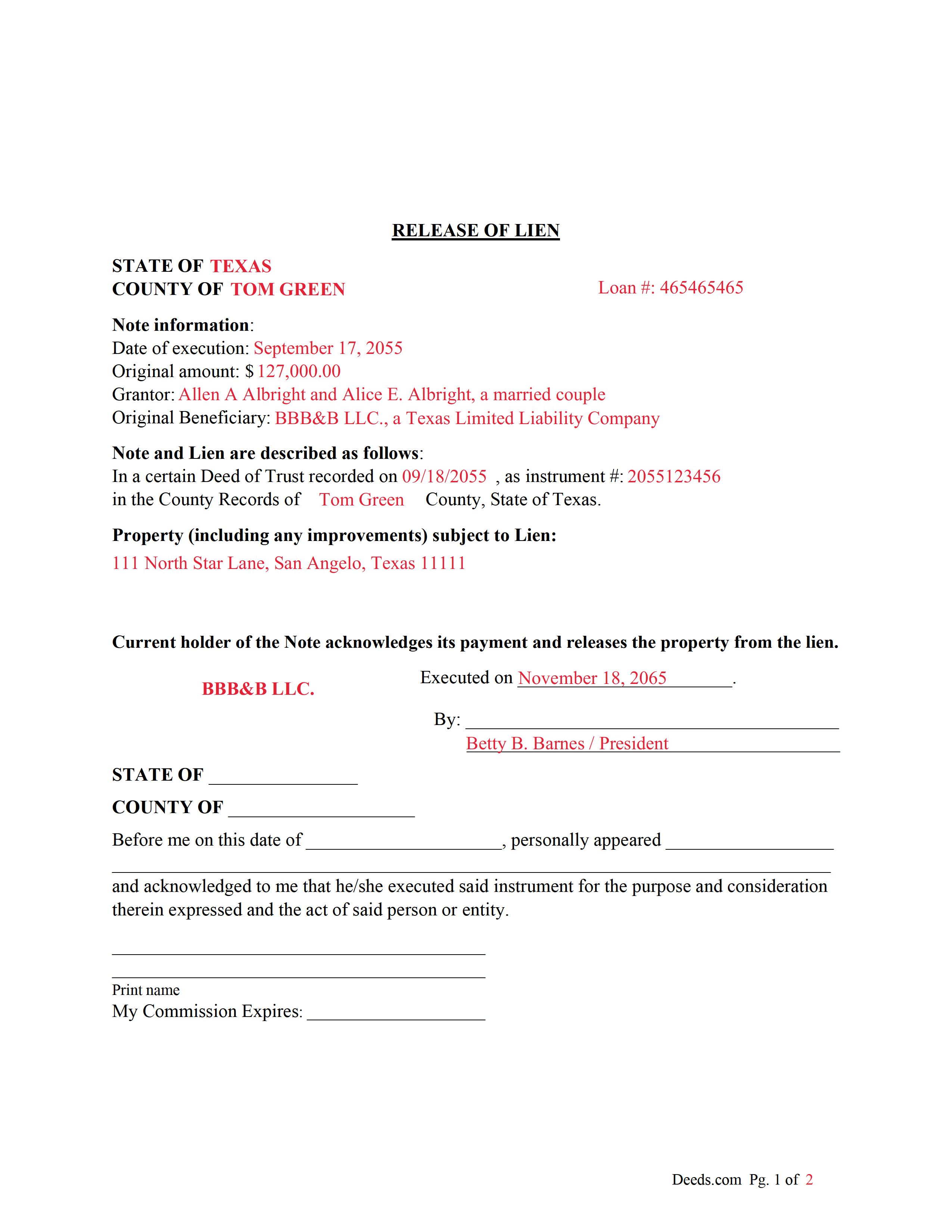

Completed Example of the Release of Lien Document

Example of a properly completed form for reference.

Included document last reviewed/updated 3/27/2024

The following Texas and Palo Pinto County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Texas or Palo Pinto County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Palo Pinto County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Palo Pinto County Release of Lien - by Deed of Trust and Note forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Release of Lien - by Deed of Trust and Note forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Palo Pinto County that you need to transfer you would only need to order our forms once for all of your properties in Palo Pinto County.

Are these forms guaranteed to be recordable in Palo Pinto County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Palo Pinto County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Palo Pinto County

Including:

- Gordon

- Graford

- Mineral Wells

- Mingus

- Palo Pinto

- Santo

- Strawn

This form used to release a lien placed on real property by a previously recorded Deed of Trust. The current holder/lender or representative signs the Release of Lien document, acknowledging payment and release of the lien.

(Texas Release of Lien Package includes form, guidelines, and completed example) For use in Texas only.

Our Promise

The documents you receive here will meet, or exceed, the Palo Pinto County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Palo Pinto County Release of Lien - by Deed of Trust and Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4326 Reviews )

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Roger M.

January 22nd, 2021

EASY. WORKED WITH PROBLEMS.

Thank you!

Linda L.

July 7th, 2021

The service was excellent. The fee to use Deeds was more than I expected however, but the service was excellent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

April C.

May 18th, 2021

Spot on forms and process. YMMV but way more efficient and cost effective than contacting an ambulance... attorney.

Thank you!

David W.

February 9th, 2021

Excellent assistance provided by your forms, guide and example.

Thank you!

Jon B.

April 27th, 2021

The information and documents received are great. But the communication with customer service is not good at all. I've been waiting three days for them to respond to a question. I don't think they are going too.

Thank you for your feedback. We really appreciate it. Have a great day!

James G.

November 18th, 2019

Deed.com had some hard to find mineral interest deeds for Oklahoma.I'm an attorney in Texas with no Ok experience. The examples on Deed.com were very useful and saved me lots of time.

James G.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Margaret A.

April 30th, 2021

Thank for the help. Needed that disclaimer to avoid filing a full ITR tax return to get an L-9

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

jerry k.

May 27th, 2021

very easy to download, works great

Thank you for your feedback. We really appreciate it. Have a great day!

Samuel Shera Singh B.

November 6th, 2022

I found the documents I needed and so many more that I will utilize for business, personal and family needs. Also I made a purchase of an additional document I did not need that serves the same purpose as one I purchased and Deeds.com had no issue refunding the unnecessary document in an unbelievably quick response and refund. I would recommend this document provider to everyone including legal office management.

Thank you for your feedback. We really appreciate it. Have a great day!

Laura H.

January 12th, 2023

Process was easy. The instructions for TOD and a sample completed form was very helpful. E-recording of deed saved a trip to the county building and well worth the very reasonable charge.

Thank you for your feedback. We really appreciate it. Have a great day!

Evelia G.

January 4th, 2019

I love this guide. Thank you for having this available.

Thanks so much for your feedback Evelia, have a fantastic day!

Betty S.

May 2nd, 2022

Thank you for the excellent and complete layout of all forms needed to complete the Affidavit of Death and Heirship, including the notarial officer and an example of how these forms should be completed. This method definitely saves time and money and an answer to my family's Prayers.

Thank you for your feedback. We really appreciate it. Have a great day!