Alexander County Special Warranty Deed Forms (Illinois)

Express Checkout

Form Package

Special Warranty Deed

State

Illinois

Area

Alexander County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Alexander County specific forms and documents listed below are included in your immediate download package:

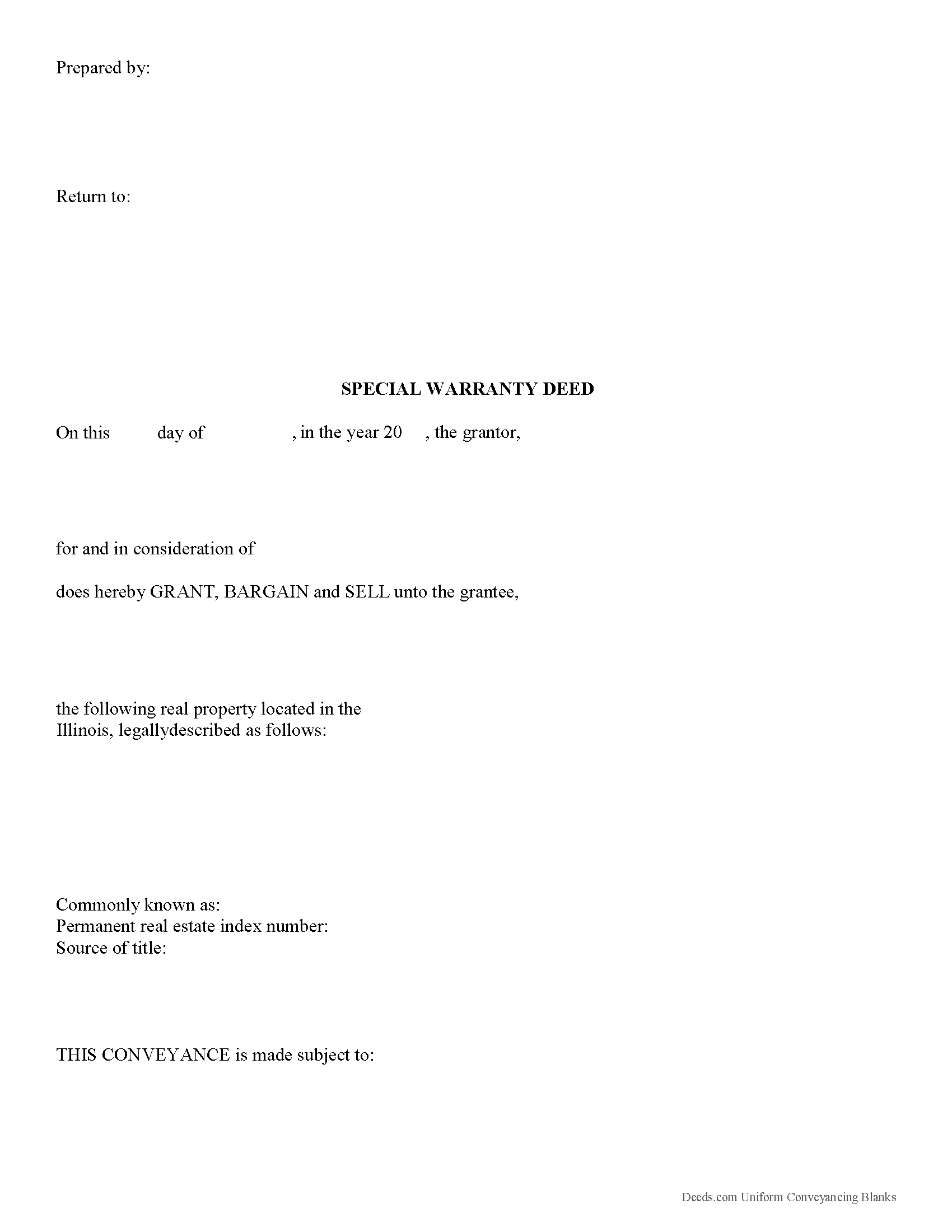

Special Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 2/23/2024

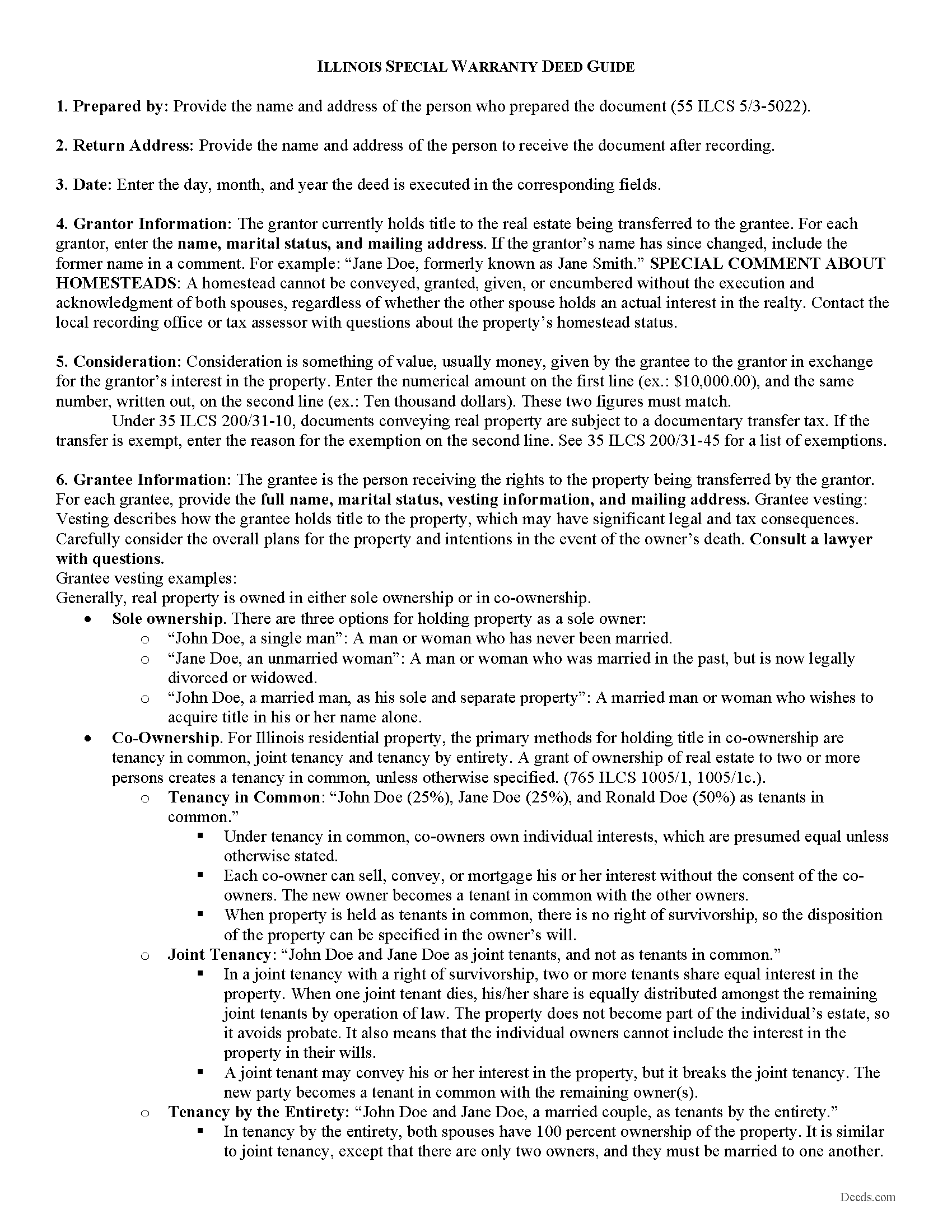

Special Warranty Deed Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 2/8/2024

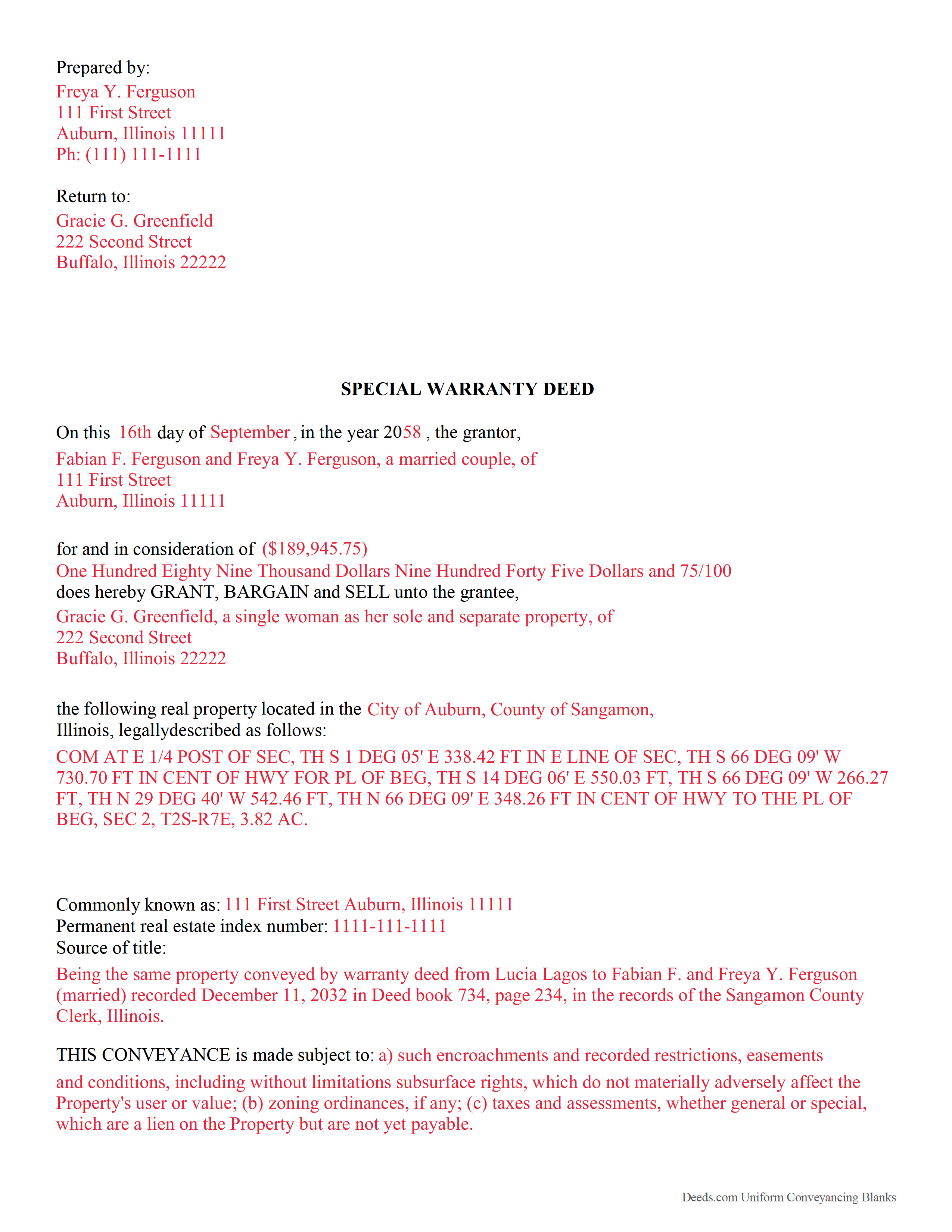

Completed Example of the Special Warranty Deed Document

Example of a properly completed form for reference.

Included document last reviewed/updated 11/23/2023

Included Supplemental Documents

The following Illinois and Alexander County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Alexander County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Alexander County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Alexander County Special Warranty Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Special Warranty Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Alexander County that you need to transfer you would only need to order our forms once for all of your properties in Alexander County.

Are these forms guaranteed to be recordable in Alexander County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Alexander County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Special Warranty Deed Forms:

- Alexander County

Including:

- Cairo

- Mc Clure

- Miller City

- Olive Branch

- Tamms

- Thebes

- Unity

What is the Illinois Special Warranty Deed

A special warranty deed is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). Also referred to as a limited warranty deed, this type of deed provides significant liability protection for the grantor (seller), and less protection for the grantee (buyer). In a special warranty deed, the grantor only warrants against defects in the title during his or her ownership, and that he or she has an actual right to the title, and is authorized to sell it. Unlike a deed with full warranty, however, it does not guarantee that there are no other claims on the title of the property before the grantor owned the property, nor does it bind the grantor to defend against them. Because of the risk of unknown claims on the title, special warranty deeds are less common than traditional warranty deeds for residential real estate transactions.

A special warranty deed, once acknowledged, should be recorded in the recorder's office in the county where such lands are located. If it is acknowledged in Illinois, acknowledgements may be taken before a notary public, United States commissioner, county clerk, or any court, judge, clerk, or deputy clerk of such court. When they are taken before a notary public or United States commissioner, they must be attested by his or her official seal; and if taken before a judge or clerk of a court, the acknowledgements must be attested by the seal of the court (765 ILCS 5/20).

A lawful deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Illinois residential property, the primary methods for holding title in co-ownership are tenancy in common, joint tenancy and tenancy by entirety. A grant of ownership of real estate to two or more persons creates a tenancy in common, unless a joint tenancy or tenancy by the entirety is specified. (765 ILCS 1005/1, 1005/1c.).

As with any conveyance of real estate, special warranty deeds must comply with all state and local recording standards, including a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property.

Include all relevant documents, affidavits, forms, and fees with the along with the deed for recording as well. Pursuant to 35 ILCS 200/31-10, documents conveying real property are subject to a documentary transfer tax. An Illinois Real Estate Transfer Declaration is required (35 ILCS 200/31-25), unless an exemption is claimed. See 35 ILCS 200/31-45 for a list of exemptions.

A Notarial Record Form is also required, unless an exemption is claimed. A list of exempt conveyances can be found on page 1 of the Notarial Record Form (5 ILCS 312/3-102). Some Illinois counties require a Plat Act Affidavit of Metes and Bounds pursuant to 765 ILCS 205/1 with all deeds, assuring that the land has not been divided or identifies specific types of division according to the plat act. Contact the local recorder for additional details about supplemental document requirements.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Consult an attorney with questions about special warranty deeds or for any other issues related to the transfer of real property.

(Illinois Special Warranty Deed Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Alexander County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Alexander County Special Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Anne S.

June 13th, 2019

Responsive and honest. They were unable to obtain records for me, no fault of theirs, and immediately let me know and credited my account. I give Deeds dot com five stars and would come back. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Victor K.

January 27th, 2023

The form I needed was correct and paginated as required. It was accepted w/o penalties. I was not happy about the information which I found way too scant. One sample form does not cover enough possibilities, more would be helpful. The instruction page is a bit better but sometimes it is not clear enough - sometimes it is not clear what the numbered items in the form correspond to. There is no guidance about the process and it would take very little to provide it. Example about "description", say where to find. There is a bunch of "free forms" attached but no guide on which are needed and when. Example: at the counter I was given a paper "conveyance" form and asked to fill it - I did not know it was needed and what it did and so I had not d

Thank you for your feedback. We really appreciate it. Have a great day!

Joanne D.

May 14th, 2020

Loved your easy to follow instructions along with the paperwork forms that I was looking for. Would highly suggest this service to everyone. You should share this platform with other counties!! Extremely helpful

Thank you!

Cynthia M.

July 5th, 2019

I wanted the Lady Bird Deed for my estate, and it was very easy to download, fill out and file. My county records department accepted it with no issue. Thank you Deeds.com! You saved me over $500.00!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephanie G.

February 28th, 2019

Wonderful. Easier to fill out this form than I thought it would be.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer B.

February 8th, 2019

I didn't care for it because I was having to do other things in between filling it out and all of a sudden it would not allow me back in it to make changes. Luckily I had saved it and then had to do FILL/SIGN option which looks ugly but that was the only way I could add what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MIchael T.

March 23rd, 2023

very helpful in a trouble free manner.

Thank you!

Sylvia O.

April 27th, 2023

Very efficient, and the samples and instructions are very easy to follow.

Thank you Deeds.com

Thank you!

Diane S.

May 13th, 2020

Money well spent. I used the example and filled out with no problem.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BILL G.

October 22nd, 2019

Slick

Thank you!

RONALD L W.

August 11th, 2022

Easy access of downloadable forms for use by Pennsylvania, Allegheny County residents.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

August 27th, 2021

This was really easy and very helpful.

Thanks,

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.