Wexford County Certificate of Trust MCL 700.7913 Forms (Michigan)

All Wexford County specific forms and documents listed below are included in your immediate download package:

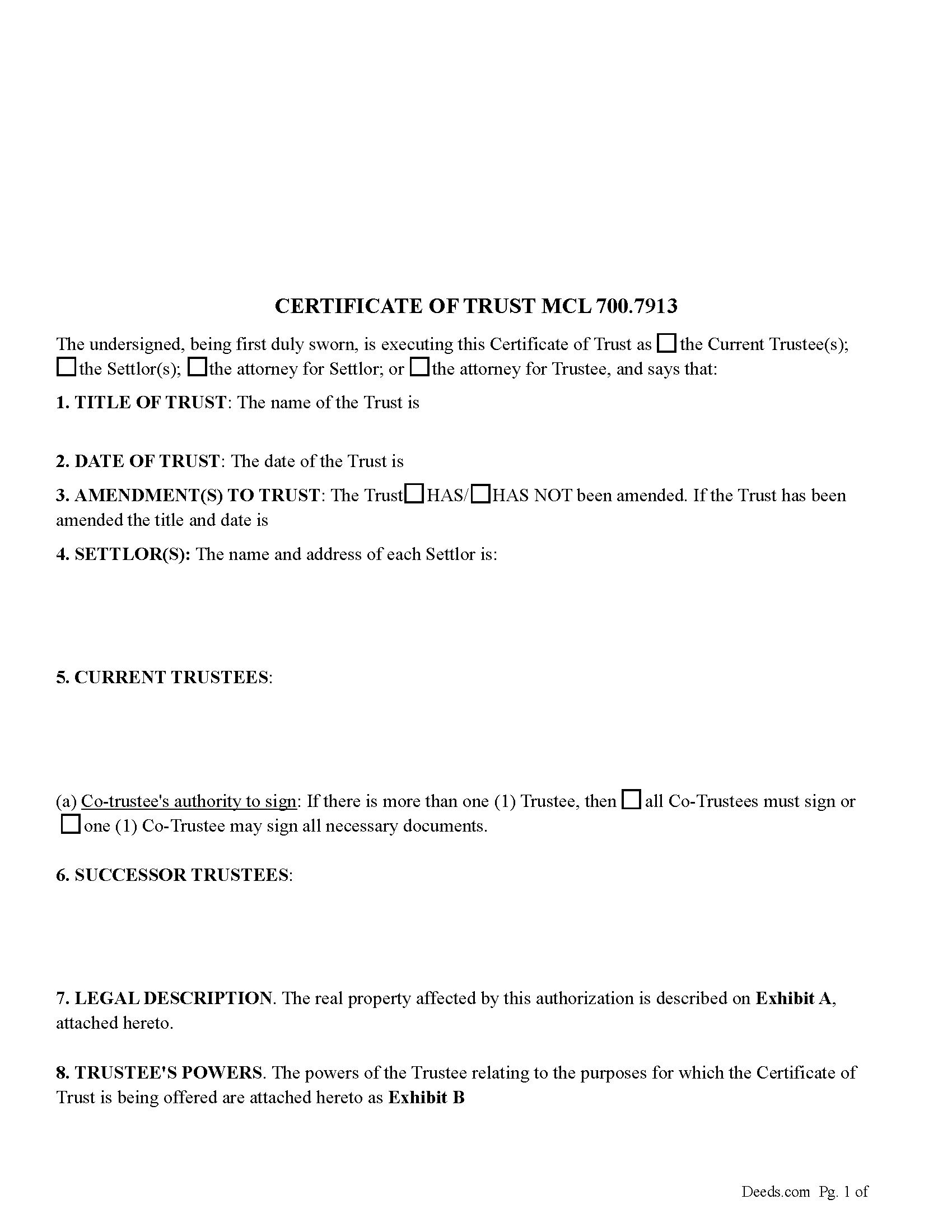

Michigan Certificate of Trust MCL 700.7913 Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 1/8/2024

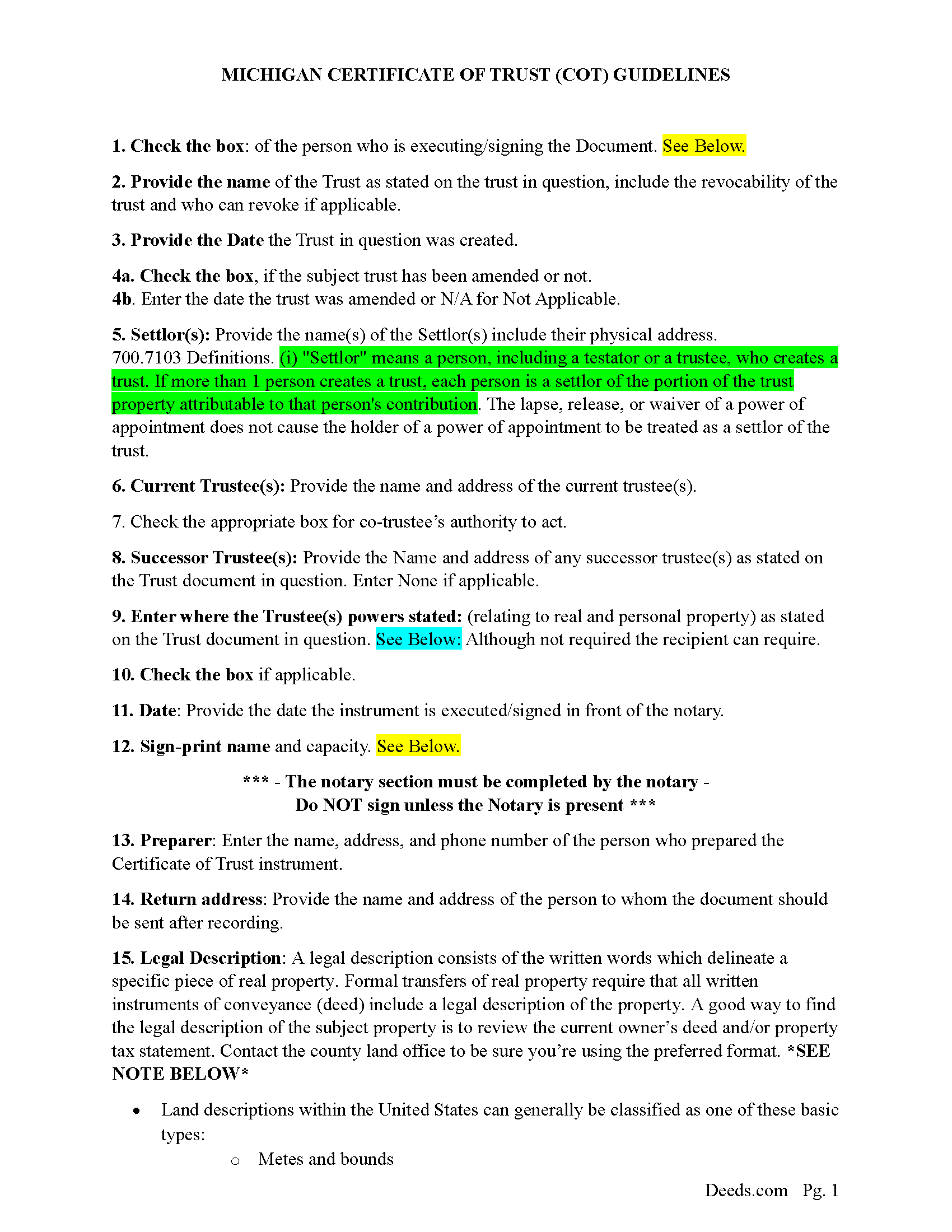

Certificate of Trust Guidelines

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/8/2024

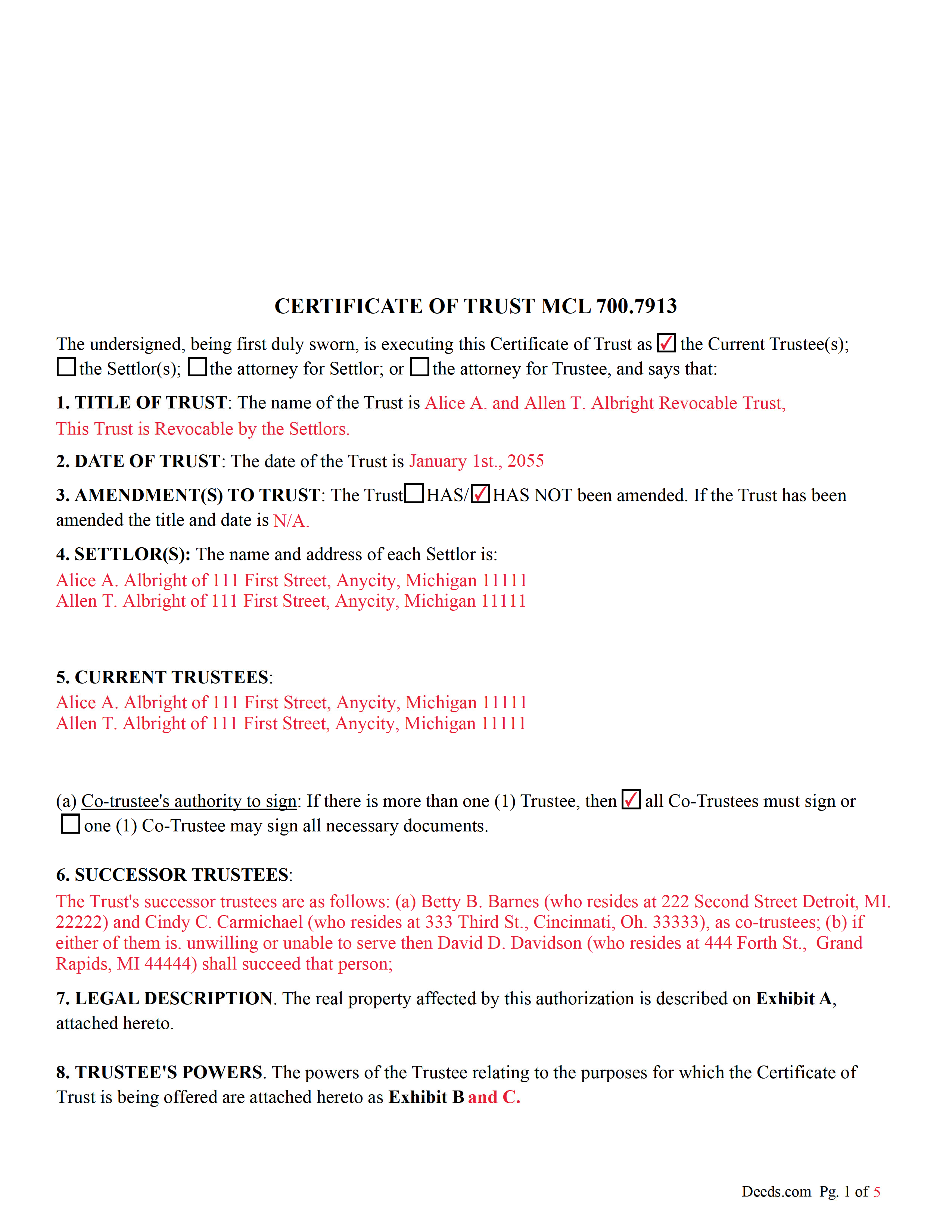

Completed Example of the Certificate of Trust Document

Example of a properly completed form for reference.

Included document last reviewed/updated 2/16/2024

The following Michigan and Wexford County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Michigan or Wexford County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Wexford County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Wexford County Certificate of Trust MCL 700.7913 forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Certificate of Trust MCL 700.7913 forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Wexford County that you need to transfer you would only need to order our forms once for all of your properties in Wexford County.

Are these forms guaranteed to be recordable in Wexford County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Wexford County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Wexford County

Including:

- Boon

- Buckley

- Cadillac

- Harrietta

- Manton

- Mesick

New legislation was signed into law in 2018 that, in essence, consolidated the two types of certificates of trust into one, a (Certificate of Trust) and a (Certificate of Trust Existence and Authority). This Certificate of Trust allows those with an interest in real property the necessary information regarding the Trust to help either fund the Trust or allow real property to be transferred with a clear title. A COT provides pertinent/relevant information needed to satisfy title companies and/or banks. When a Trustee wants to sell real property that is part of a trust, a COT will be required at or before the closing.

Pursuant to the current law, a certificate of trust must include:

The name of the trust, the date of the trust, and the date of each operative trust instrument.

The name and address of each current trustee.

The powers of the trustee relating to the purposes for which the certificate of trust is offered.

The revocability or irrevocability of the trust and the identity of any person holding the power to revoke the trust.

The authority of co-trustees to sign on behalf of the trust or otherwise authenticate on behalf of the trust and whether all or less than all co-trustees are required to exercise the trustee powers.

A statement that the trust has not been revoked, modified or amended in any manner that would cause the representations included in the certificate of trust to be incorrect.

The certificate of trust may be signed or otherwise authenticated by the settlor, any trustee (including a successor trustee), or an attorney for the settlor or the trustee.

700.7913 Certificate of trust.

Sec. 7913.

(1) Instead of furnishing a copy of the trust instrument to a person other than a trust beneficiary, the trustee may furnish to the person a certificate of trust that must include all of the following information:

(a) The name of the trust, the date of the trust, and the date of each operative trust instrument.

(b) The name and address of each current trustee.

(c) The powers of the trustee relating to the purposes for which the certificate of trust is being offered.

(d) The revocability or irrevocability of the trust and the identity of any person holding a power to revoke the trust.

(e) The authority of cotrustees to sign on behalf of the trust or otherwise authenticate on behalf of the trust and whether all or less than all of the cotrustees are required to exercise powers of the trustee.

(2) A certificate of trust may be signed or otherwise authenticated by the settlor, any trustee, or an attorney for the settlor or trustee. The certificate must be in the form of an affidavit.

(3) A certificate of trust must state that the trust has not been revoked, modified, or amended in any manner that would cause the representations included in the certificate of trust to be incorrect.

(4) A certificate of trust need not include the dispositive terms of the trust instrument.

(5) A recipient of a certificate of trust may require the trustee to furnish copies of those excerpts from each trust instrument that designate the trustee and confer on the trustee the power to act in the pending transaction.

(6) A person that acts in reliance on a certificate of trust without knowledge that the representations included in the certificate of trust are incorrect is not liable to any person for so acting and may assume without inquiry the existence of the trust and other facts included in the certificate of trust.

(7) A person that in good faith enters into a transaction in reliance on a certificate of trust may enforce the transaction against the trust property as if the representations included in the certificate of trust were correct.

(8) A person that makes a demand for the trust instrument in addition to a certificate of trust or excerpts of the trust instrument is liable for damages, costs, expenses, and legal fees if the court determines that the person that made the demand did not act pursuant to a legal requirement to demand the trust instrument.

(9) This section does not limit the right of a person to obtain a copy of the trust instrument in a judicial proceeding that concerns the trust.

(Michigan COT Package includes form, guidelines, and completed example) For use in Michigan only.

Our Promise

The documents you receive here will meet, or exceed, the Wexford County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Wexford County Certificate of Trust MCL 700.7913 form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4326 Reviews )

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph S.

November 27th, 2023

THIS IS MY FIRST EXPERIENCE WITH DEEDS.COM. I DLED THE ESTATE DEED FORM THAT I HOPE WILL GO THROUGH OK WITH THE COUNTY. IT WILL BE SOMETIME UNTIL I HAVE IT FILLED IN AND ALL THE NAMES IN, NORARIZED AND FILED. CAN I RECONTACT YOU FOLKS IF THERE IS A PROBLEM? THANK YOU, JOE SEUBERT

We are motivated by your feedback to continue delivering excellence. Thank you!

Debra B.

April 14th, 2020

I was very glad to have this option for filing a form as it would have taken 4 days due to offices being closed to the public during the COVID 19 epidemic. I found the process to be fairly simple and I was able to file the document within 24 hours.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

MATTHEW R.

March 12th, 2021

Absolutely amazing throughout the whole process

Thank you!

Trent D.

April 17th, 2022

You Guys are Fantastic and the service you all provide. Is PRICELESS!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lorraine J.

April 6th, 2023

Thank-you.

Thank you!

Cynthia (Cindy) R.

August 24th, 2020

This has been the most seamless process I have ever experienced. Thank you for addressing my needs so quickly and professionally.

Thank you!

Elizabeth F.

February 14th, 2022

This was great other than exemption codes did not populate and I couldn't refer to it.

Thank you for your feedback. We really appreciate it. Have a great day!

Lori W.

July 28th, 2023

Timely, efficient and easy to use.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Amy S.

March 7th, 2022

So convenient! I love this service. I highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Dale K.

August 11th, 2020

A very user friendly website!

Thank you!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Evelynne H.

December 3rd, 2020

The service was quick and easy to use. Which is something I really appreciate.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!