Rockland County Quitclaim Deed Forms (New York)

All Rockland County specific forms and documents listed below are included in your immediate download package:

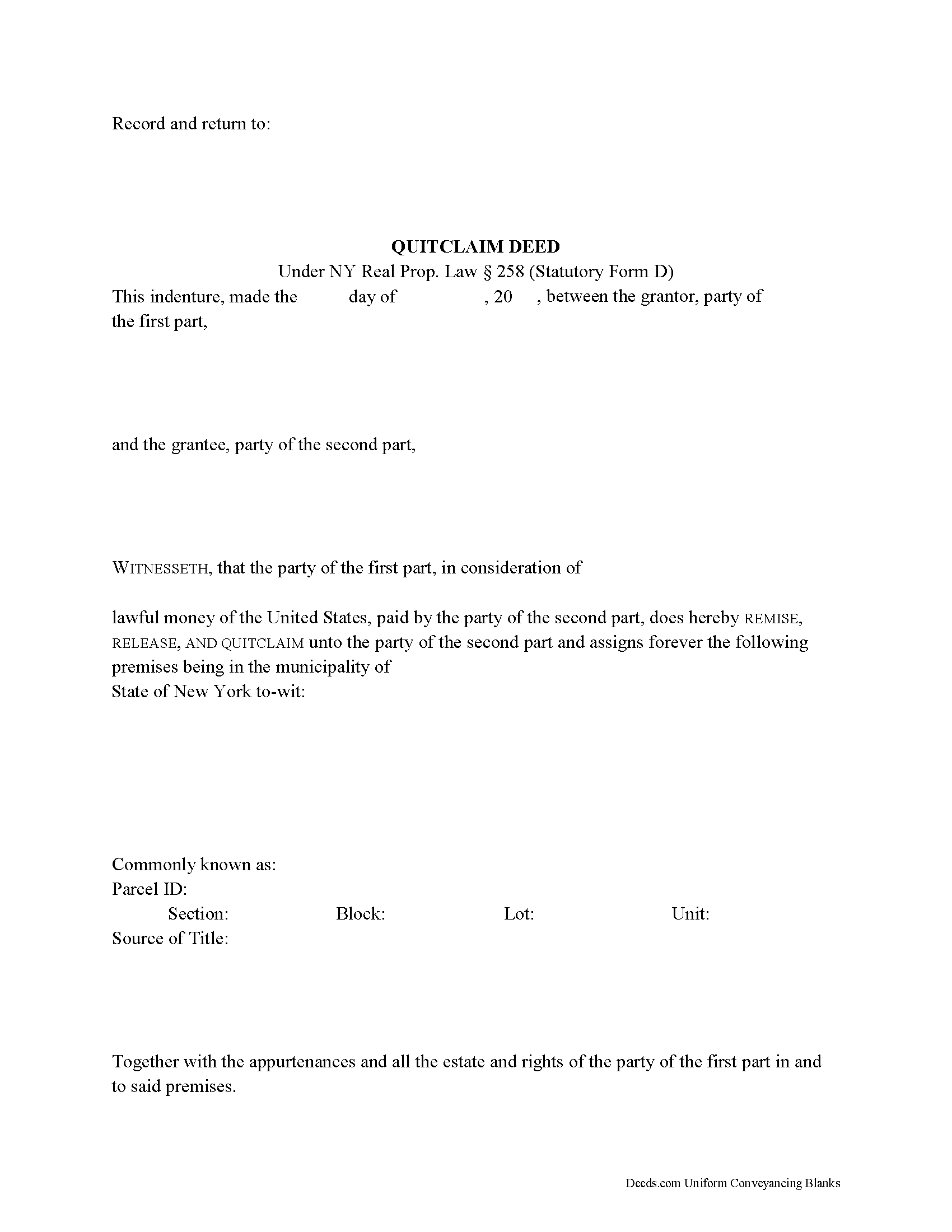

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all New York recording and content requirements.

Included document last reviewed/updated 4/24/2024

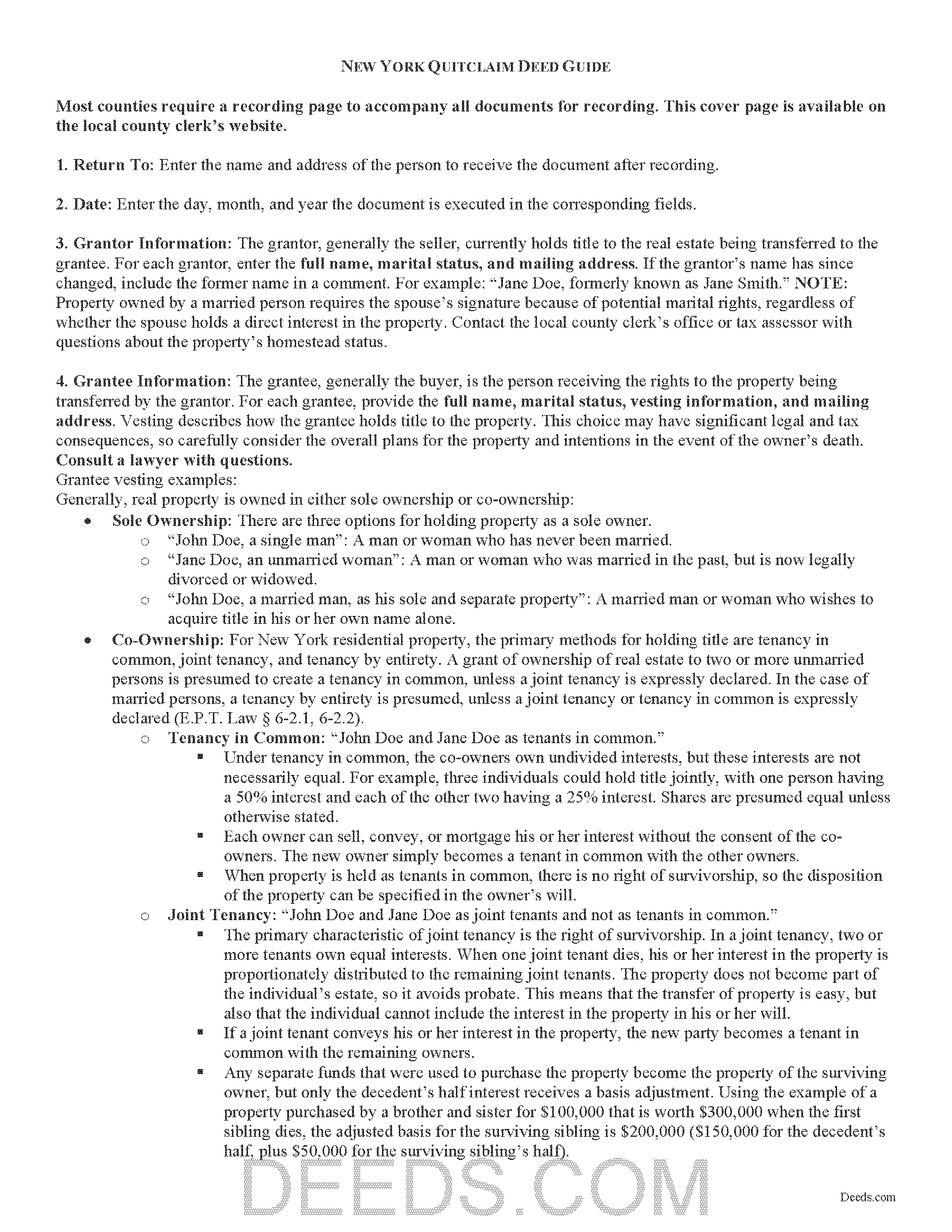

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included document last reviewed/updated 2/1/2024

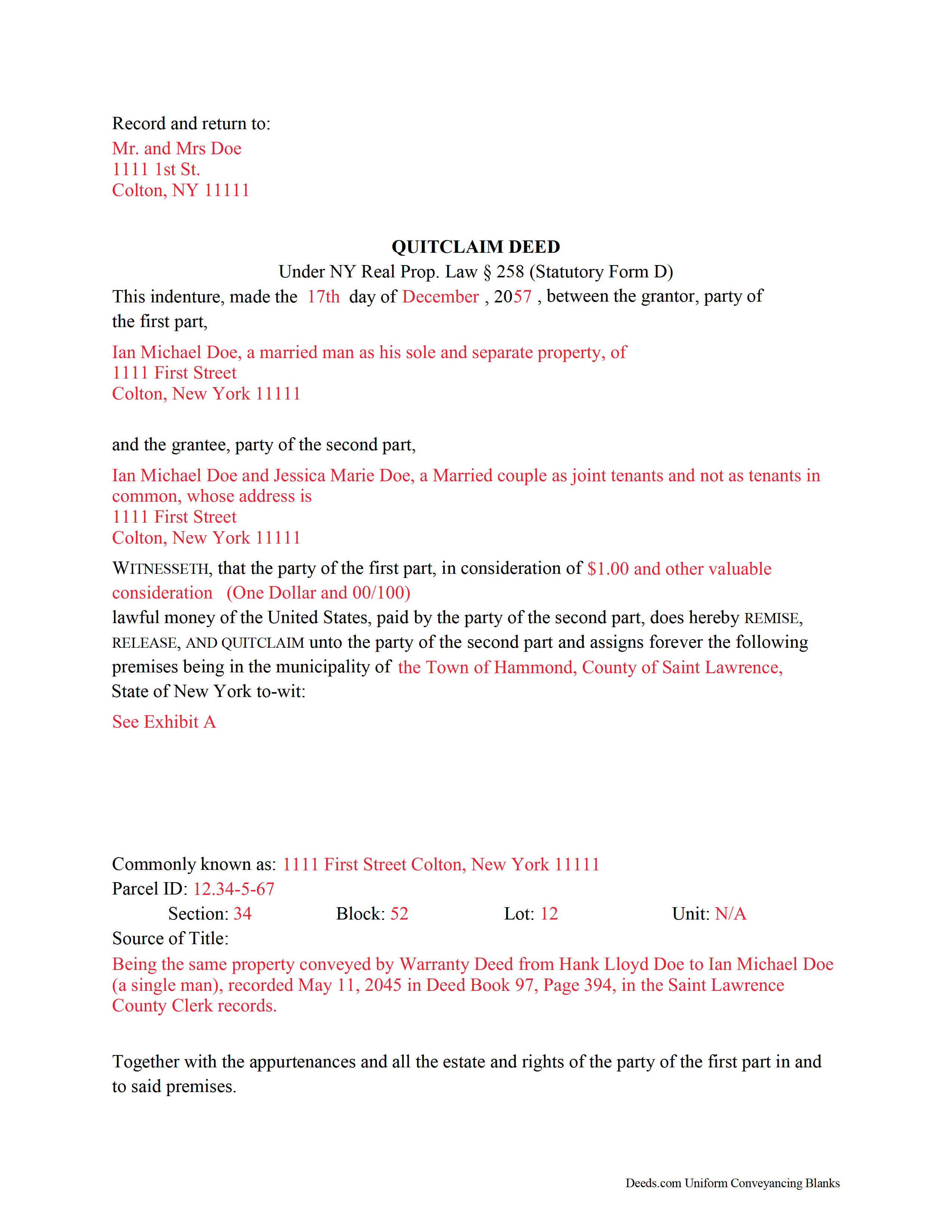

Completed Example of the Quitclaim Deed Document

Example of a properly completed New York Quitclaim Deed document for reference.

Included document last reviewed/updated 4/8/2024

The following New York and Rockland County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by New York or Rockland County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Rockland County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Rockland County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Rockland County that you need to transfer you would only need to order our forms once for all of your properties in Rockland County.

Are these forms guaranteed to be recordable in Rockland County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Rockland County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Rockland County

Including:

- Bear Mountain

- Blauvelt

- Congers

- Garnerville

- Haverstraw

- Hillburn

- Monsey

- Nanuet

- New City

- Nyack

- Orangeburg

- Palisades

- Pearl River

- Piermont

- Pomona

- Sloatsburg

- Sparkill

- Spring Valley

- Stony Point

- Suffern

- Tallman

- Tappan

- Thiells

- Tomkins Cove

- Valley Cottage

- West Haverstraw

- West Nyack

In New York, interest to real property can be transferred from one party to another by executing a quitclaim deed. Quitclaim deeds are statutory under NY Real Prop. Law Section 258 Statutory Form D.

Quitclaim deeds offer no warranties of title and provide the least amount of protection to the grantee. They do not guarantee that the grantor has good title or ownership of the property and only transfer whatever interest the grantor may have in the property at the time of execution. They are generally reserved for divorces and other transfers of property between family members.

Quitclaim deeds offer less assurance than bargain and sale deeds, which convey whatever interest the grantor holds at the time of execution, sometimes with the promise that the grantor "has not done or suffered anything whereby the said premises have been incumbered in any way whatever" (NY Real Prop. Law Section 258 (Statutory Form C)). Bargain and sale deeds without covenant against grantor do not guarantee that the property conveyed is without encumbrances made by the grantor, but they do imply that the grantor held or holds an interest in the property being conveyed.

A lawful quitclaim deed must meet all state and local standards for recorded documents, including the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership.

For New York residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A grant of ownership of real estate to two or more unmarried persons is presumed to create a tenancy in common, unless a joint tenancy is expressly declared. In the case of married persons, a tenancy by entirety is presumed, unless a joint tenancy or tenancy in common is expressly declared (E.P.T. Law Sections 6-2.1, 6-2.2).

As with any conveyance of realty, a quitclaim deed requires a complete legal description of the parcel, including the section, block, lot, and unit numbers. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property.

Sign the deed in the presence of a notary public or other authorized official. Record the deed at the county clerk's office in the county where the property is located for a valid transfer. Contact the same office to confirm accepted forms of payment.

Most counties in New York require a recording page to accompany all documents for recording. This cover page is available on the local county clerk's website, and it factors into the total page count when calculating recording fees. Contact the county clerk's office to verify requirements.

In New York, the real estate transfer tax is due at the time of recording. File Form TP-584 (Combined Real Estate Transfer Tax Return) with the appropriate county clerk (TAX Law 31-D-1449-EE(2)(d)). Non-residents of New York State must also file an IT-266 Tax Form (Non-Resident Real Property Estimated Income Tax Payment Form) (TAX Law 22-663).

Pursuant to R.P.P. Law 9-333.3, a Real Property Transfer Report is required to accompany all conveyances, excluding deeds of oil and gas or mineral rights. Use Form RP-5217-NYC for real property transfers within the five boroughs of New York City, and use Form RP-5217 for real property transfers in all other counties. Contact the local county clerk's office to confirm the specific local requirements.

This article is provided for informational purposes only and is not a substitute for legal advice. Speak to an attorney with questions about quitclaim deeds or for any other issues related to transfers of real property in New York.

(New York QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Rockland County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Rockland County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4325 Reviews )

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!rn

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Eileen S.

November 6th, 2019

It seems fast.

Thank you!

Patrick K.

September 1st, 2020

Fast and easy to use. Great update communications

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah M.

June 24th, 2021

Absolutely great. The staff is responsive and knowledgeable. The online interface is excellent. The total cost for finalizing the sale on our property (minus state filing fees) was $39. A wonderful experience.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas C.

July 31st, 2021

This platform made electronic filing of a lien easy and quick. I was able to accomplish everything from my laptop and phone, and the fees were reasonable. I would recommend deeds.com for efiling property related documents.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

VICKI R.

July 15th, 2020

Thank you for your helpful information.

Thank you!

John M.

September 16th, 2022

Easy to use site with a good selection of documents

Thank you!

Melody S.

February 11th, 2021

Although I was given quite a bit of information, I wanted my property title. I was not informed of what I would receive before I paid for this service.

Thank you!

Kelli B.

January 31st, 2019

Amazingly simple and fast. A great service.

Thank you!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

THOMAS K.

August 17th, 2020

Very pleased with all info and forms

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Missie R.

June 17th, 2020

Very fast and professionally handled.

Thank you!

Dennis B.

June 19th, 2019

It was easy to download the necessary "Death of Joint Tenant" forms. These easy to use interactive forms are made to comply with the laws specific to your state.

Thank you!