Newport County Warranty Deed Forms (Rhode Island)

Express Checkout

Form Package

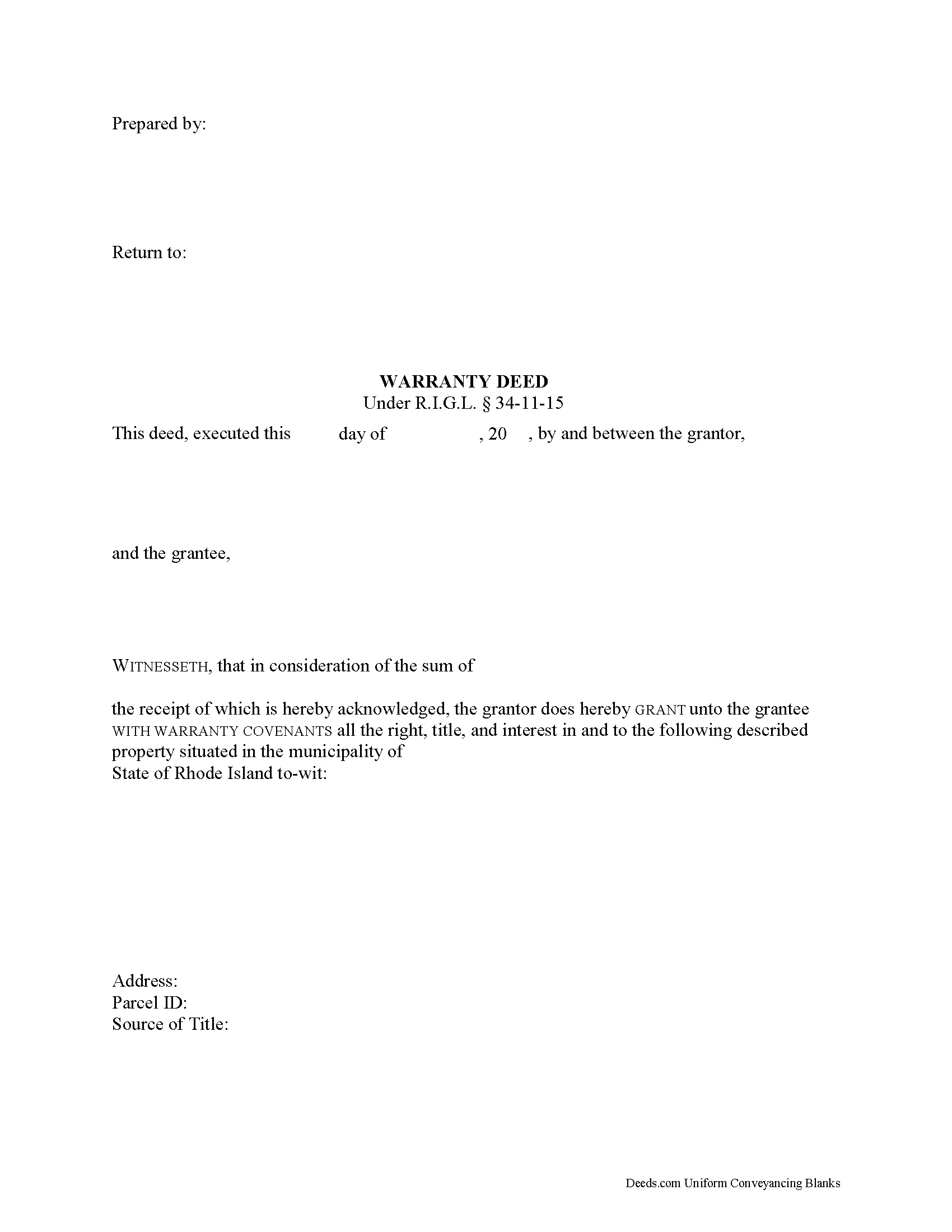

Warranty Deed

State

Rhode Island

Area

Newport County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Newport County specific forms and documents listed below are included in your immediate download package:

Warranty Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 1/2/2024

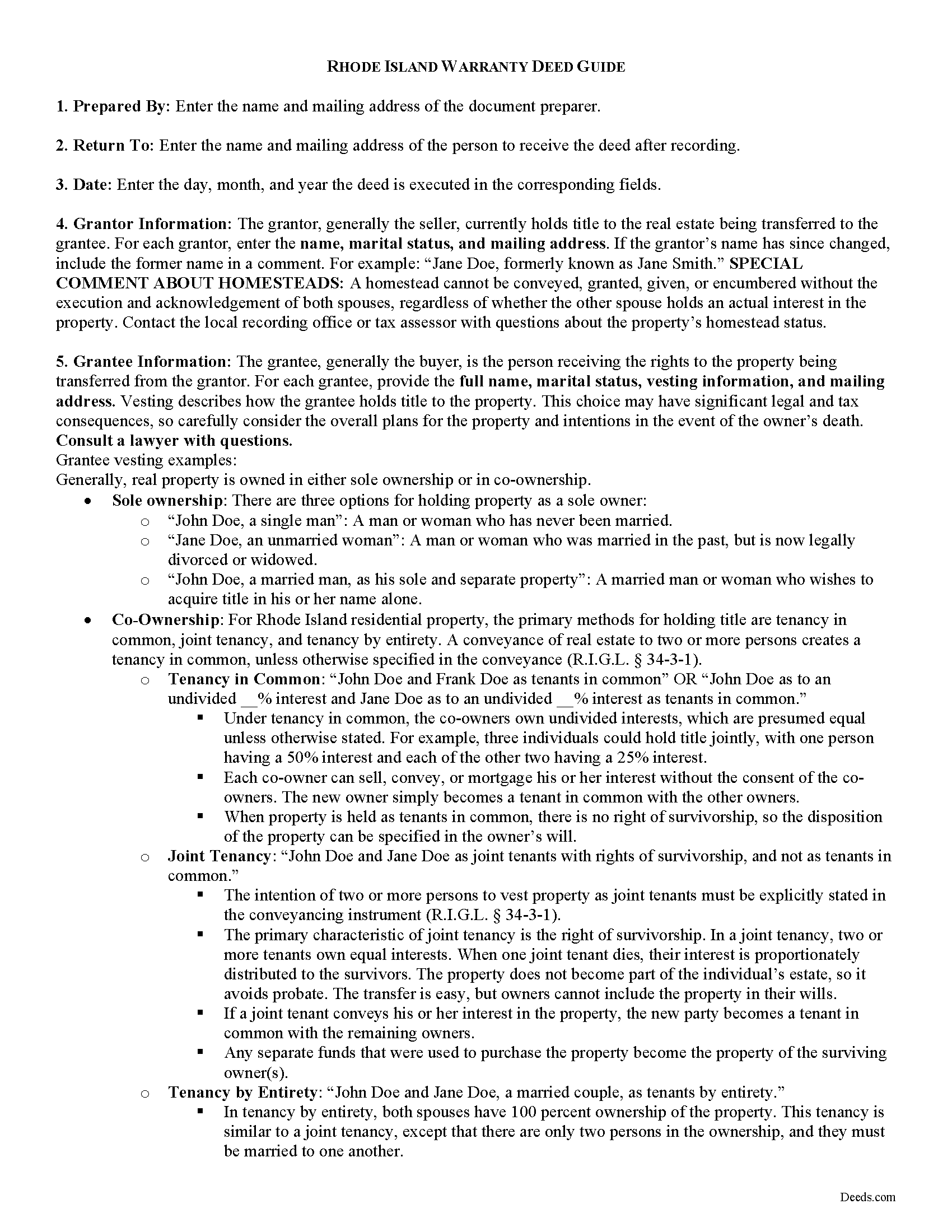

Warranty Deed Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/3/2024

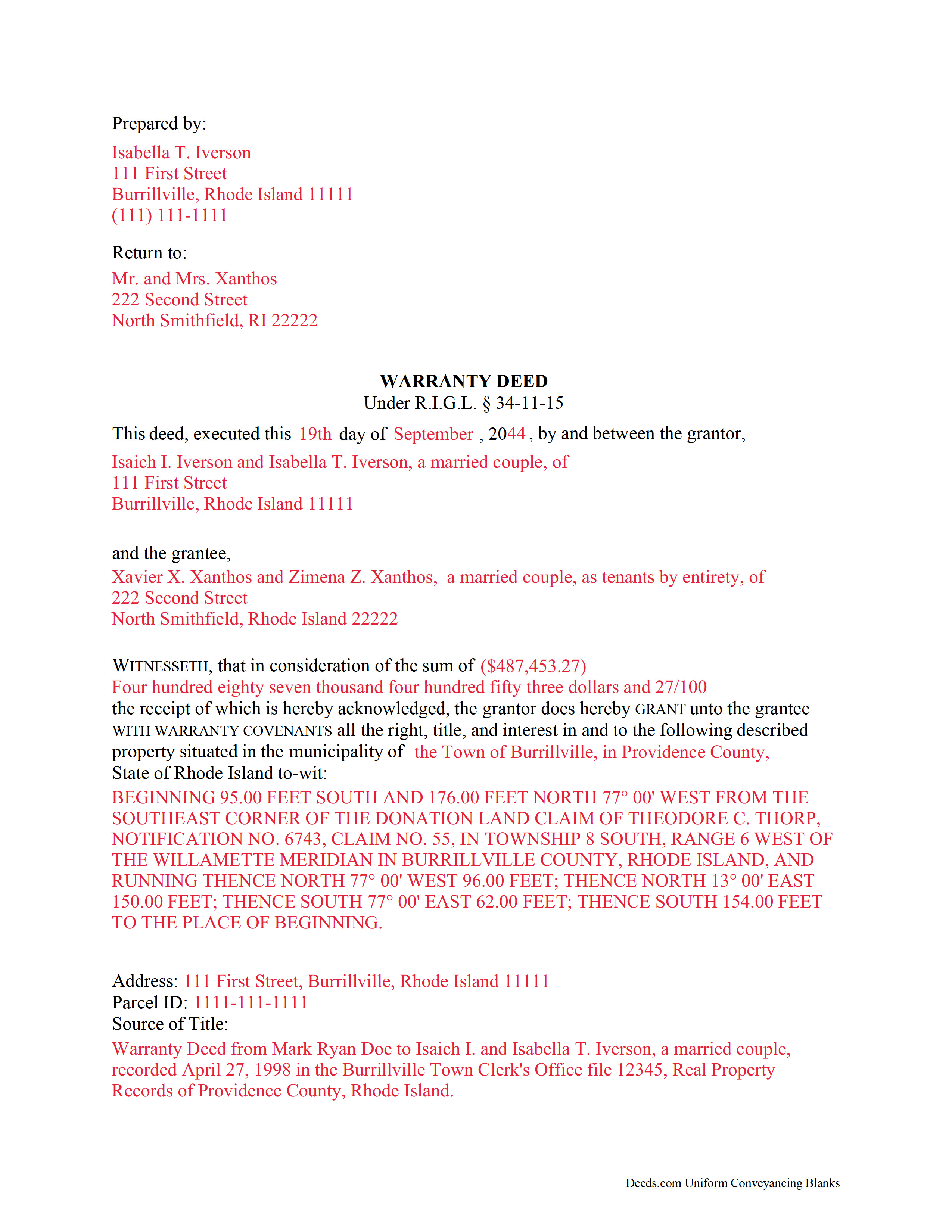

Completed Example of the Warranty Deed Document

Example of a properly completed form for reference.

Included document last reviewed/updated 3/20/2024

Included Supplemental Documents

The following Rhode Island and Newport County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Rhode Island or Newport County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Newport County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Newport County Warranty Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Warranty Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Newport County that you need to transfer you would only need to order our forms once for all of your properties in Newport County.

Are these forms guaranteed to be recordable in Newport County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Newport County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Warranty Deed Forms:

- Newport County

Including:

- Adamsville

- Jamestown

- Little Compton

- Middletown

- Newport

- Portsmouth

- Tiverton

What is the Rhode Island Warranty Deed

In Rhode Island, title to real property can be transferred from one party to another by recording a warranty deed. A warranty deed conveys an interest in real property to the named grantee with full warranties of title.

Warranty deeds are statutory in Rhode Island under R.I.G.L. 34-11-15, and they convey real property in fee simple with the most assurance of title. When the words "with warranty covenants" are included in the conveyancing clause, the following covenants are implied: the grantor guarantees that he or she holds title to the property and has good right to convey it; that the property is free from encumbrances (with the exception of any noted in the deed); and that the grantor will defend the title against all claims (R.I.G.L. 34-11-16). This warranty of title is greater than that of a limited or special warranty deed, which guarantees the title only against claims that arose during the time the grantor held title to the property, or a quitclaim deed, which offers no warranties of title.

A lawful warranty deed includes the grantor's full name, mailing address, and marital status; the consideration given for the transfer; and the grantee's full name, mailing address, marital status, and vesting. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Rhode Island residential property, the primary methods for holding title are tenancy in common, joint tenancy, and tenancy by entirety. A conveyance of real estate to two or more persons creates a tenancy in common, unless otherwise specified in the conveyance (R.I.G.L. 34-3-1).

As with any conveyance of realty, a warranty deed requires a complete legal description of the parcel. Recite the prior deed reference to maintain a clear chain of title, and detail any restrictions associated with the property. Finally, the form must meet all state and local standards for recorded documents. The completed deed must be signed by the grantor (and his or her spouse, if applicable) in the presence of a notary.

The grantor must indicate his or her residency status on the face of the deed. A residency affidavit, completed by the grantor, is required for sales of realty by nonresidents. Transfers by nonresidents are subject to withholding of a percentage of the total payment by the grantee/buyer. Buyers may only depend on the seller's residency status by receipt of an affidavit of residency. For more on withholding of Rhode Island tax, see R.I.G.L. 44-30-71.3, and consult a lawyer with questions.

Rhode Island levies a Real Estate Conveyance Tax based on the consideration paid (R.I.G.L. 44-25-1(a)). This tax is due upon recording. If there is no consideration paid, the deed must include a statement to the effect that "the consideration is such that no documentary stamps are required" (R.I.G.L. 44-25-1(b)). If the transfer is exempt from the Real Estate Conveyance Tax, state the reason on the face of the deed. See R.I.G.L. 44-25-2 for a list of exemptions. A completed Form CVYT-1 (Real Estate Conveyance Tax return) is required for all transfers of real property, and should be submitted to the Rhode Island Division of Taxation.

Record the original completed deed, along with any additional materials, at the city or town clerk's office in the municipality where the property is located. (Rhode Island records at the municipal level.) Contact the same office to verify accepted forms of payment.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact a lawyer with questions about statutory warranty deeds, or for any other issue related to the transfer of real property Rhode Island.

(Rhode Island WD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Newport County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Newport County Warranty Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Cedric W.

January 2nd, 2021

This process was very easy to go through, from beginning to end. It was fast, precise and got the job done without me having to leave my computer. If opportunities arise, I will definitely use deeds.com again.

Thank you for your feedback. We really appreciate it. Have a great day!

Jesse S.

January 2nd, 2020

I am excited for your service. I'm counting on this working-and calling to see if I can e-file with the County of dealing with, and if so, your service will have saved me more years of stress, worrying about how to correct a deed that was titled incorrectly.

Thank you!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem.

Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description!

Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

WILLIAM M.

February 11th, 2021

After a long search this site is the best all inclusive service. Contacting Customer Service received an timely reply. Highly recommened.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Leticia A.

January 20th, 2020

Down to the point,covers every angle with great tips:Don't forget Probate.

Thank you!

Lois S.

June 8th, 2020

This website made it easy to quickly research what was recorded/released on the title of my home.

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah B.

January 6th, 2019

Easy download, and super easy to fill out. Had them recorded Friday with zero issues. Recommended.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Christine L.

April 18th, 2019

I would like the ability to edit the document.

Thank you for your feedback Christine.

Terrence L.

April 29th, 2020

Awesome service! 4 services wouldn't handle a 1-time filing, but Deeds.com got the job done in less than 21 hours, for only $15 (plus filing fees). This saved me days of difficulty and aggravation, esp. during COVID-19 lockdown!

Thank you for your feedback. We really appreciate it. Have a great day!

Michael M.

April 30th, 2019

Easy to follow directions and instructions to properly and legally fill-in the Deed that I requested. It was also very easy and convenient. If I was going to employ an Attorney or Legal Documents Preparer, they would easily charge me between $150 to $225 a Deed! For the cost of $19.97, anyone would pursue this price! Thank you, Deeds.com for a wonderful and terrific experience! I'm going to need you again to change Titles for my other Investment Properties.

Thank you for your feedback. We really appreciate it. Have a great day!

Maureen M.

January 3rd, 2021

Easy to use and download. Will use in the future, if ever needed.

Thank you for your feedback. We really appreciate it. Have a great day!

Glenda C.

February 21st, 2021

It was easy to find what I was looking for.

The instructions were easy to follow.

The example given was most beneficial in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.