Gregory County Quitclaim Deed Forms (South Dakota)

All Gregory County specific forms and documents listed below are included in your immediate download package:

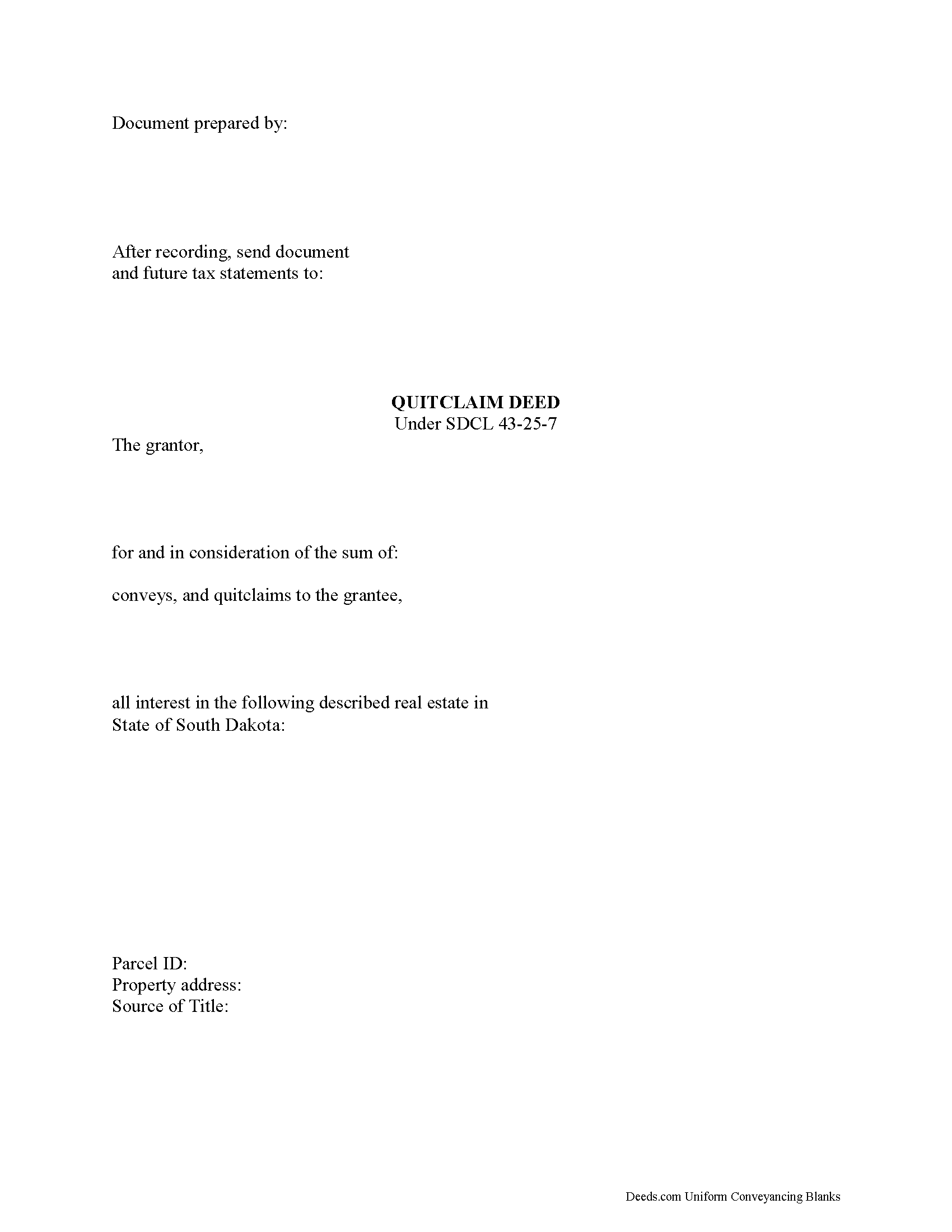

Quitclaim Deed Form

Fill in the blank Quitclaim Deed form formatted to comply with all South Dakota recording and content requirements.

Included document last reviewed/updated 11/21/2023

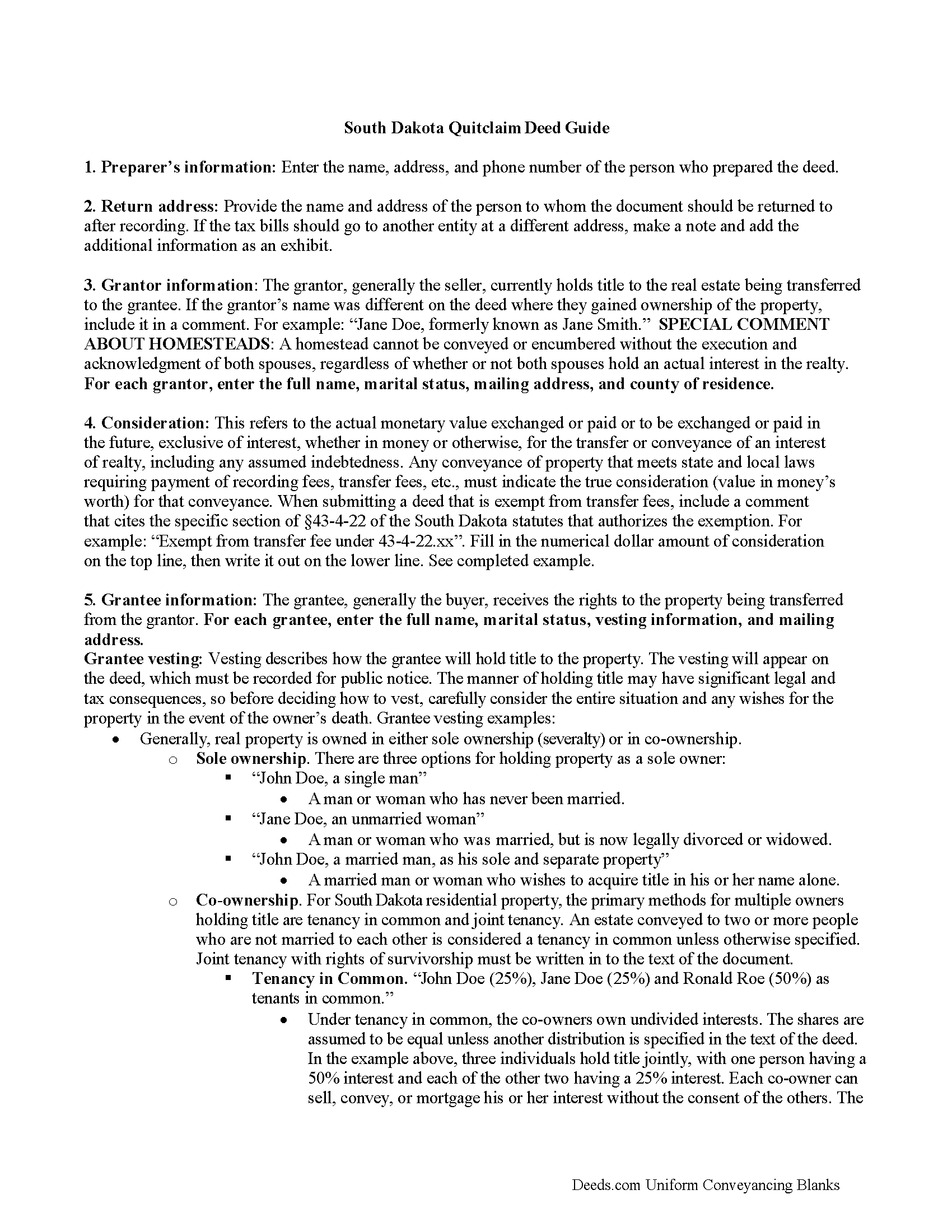

Quitclaim Deed Guide

Line by line guide explaining every blank on the Quitclaim Deed form.

Included document last reviewed/updated 4/30/2024

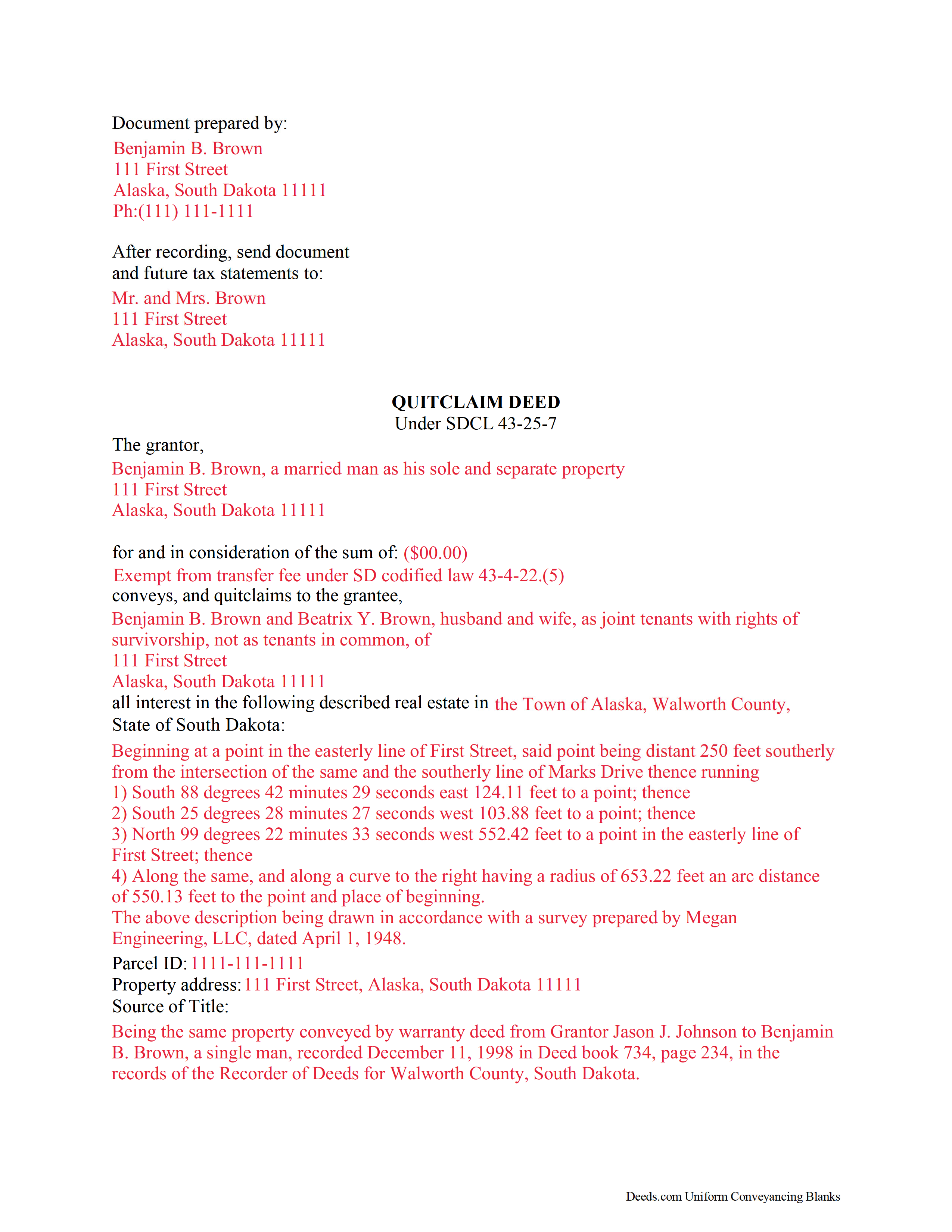

Completed Example of the Quitclaim Deed Document

Example of a properly completed South Dakota Quitclaim Deed document for reference.

Included document last reviewed/updated 4/10/2024

The following South Dakota and Gregory County supplemental forms are included as a courtesy with your order.

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by South Dakota or Gregory County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Gregory County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Gregory County Quitclaim Deed forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Quitclaim Deed forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Gregory County that you need to transfer you would only need to order our forms once for all of your properties in Gregory County.

Are these forms guaranteed to be recordable in Gregory County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gregory County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

- Gregory County

Including:

- Bonesteel

- Burke

- Dallas

- Fairfax

- Gregory

- Herrick

- Saint Charles

The form of a quitclaim deed in South Dakota (South Dakota Codified Laws, 43-25-7) requires, among other items, the grantor's signature and an acknowledgment of that signature. The mailing address of the grantee to the quitclaim deed and a legal description of the property being conveyed are both required at the time of recording (43-28-21). A quitclaim deed presented to a county recorder in South Dakota must be accompanied by a Certificate of Value.

Any person holding real estate under the terms of a quitclaim deed as defined in 43-25-11 will be deemed a purchaser in good faith and for a valuable consideration, unless the person had, at the time of execution and delivery of such conveyance, actual notice or knowledge of a prior unrecorded conveyance affecting title to such real property.

An unrecorded quitclaim deed in South Dakota is valid between the parties named in the instrument and those who have notice of it (43-28-14). In order to provide constructive notice to all purchasers or encumbrancers of the contents within, recording of the quitclaim deed with the county clerk in the appropriate county is necessary (43-28-15). Every conveyance of real property is void against any subsequent purchaser or encumbrancer in good faith and for a valuable consideration whose conveyance is first duly recorded. The Property Title in the South Dakota Codified Laws discusses quitclaim deeds and other real estate documents in further detail.

(South Dakota QD Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Gregory County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gregory County Quitclaim Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

See all reviews ( 4326 Reviews )

David W.

May 4th, 2024

Great examples on how to fill out the quitclaim deed, but no info on how to fill out the cover sheet.

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

Malissa B.

May 1st, 2024

Fast response and quick delivery love it!

It was a pleasure serving you. Thank you for the positive feedback!

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Eleanor W.

November 27th, 2019

Easy to find the form I needed. And the instructions helpful on how to fill out the form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

March 16th, 2021

Thank You the form is easy to use.

Thank you!

Christian M.

June 11th, 2019

Easy to find the necessary documents needed

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kathryn P.

February 9th, 2022

Somewhat easy to traverse.

Thank you!

Carl S.

February 1st, 2019

Complete and easy to order. Helpful other documents were included.

Thank you for your feedback. We really appreciate it. Have a great day!

Laryn A.

March 3rd, 2020

Very happy with the beneficiary deed forms packet. It was helpful to have an example of a properly filled out form. The only suggestion would be is to show where the exemption code should be placed on the form.

Thank you for your feedback. We really appreciate it. Have a great day!

Diane W.

January 3rd, 2020

The forms were immediately available for download, which was nice. However, I was not impressed by the lack of several features: 1) there was no way to edit set text in the form, such as where it says you should consult an attorney. That is not necessary for recording the deed and I wanted to deleted it, but could not. 2) Also, under the "Notes" section, there is a limited area to write; I tried adding a fuller explanation of something, but the form would not accept or include it when I printed the final document. The form may do the job, but it's not very sophisticated or elegant.

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas S.

April 13th, 2019

Very nice.

Thank you!

Josephine R.

November 18th, 2019

Completed, notarized, and recorded with no issues.

Thank you for your feedback. We really appreciate it. Have a great day!

Noah B.

May 14th, 2020

Website is basic, but get's the job done. Communication was prompt and efficient. Would use again. Thank You!

Thank you!

Gabriela C.

August 2nd, 2022

Easy

Thank you!

Scott P.

October 24th, 2020

So far so good

Thank you!