Alpine County Disclaimer of Interest Forms (California)

Express Checkout

Form Package

Disclaimer of Interest

State

California

Area

Alpine County

Price

$27.97

Delivery

Immediate Download

Payment Information

Included Forms

All Alpine County specific forms and documents listed below are included in your immediate download package:

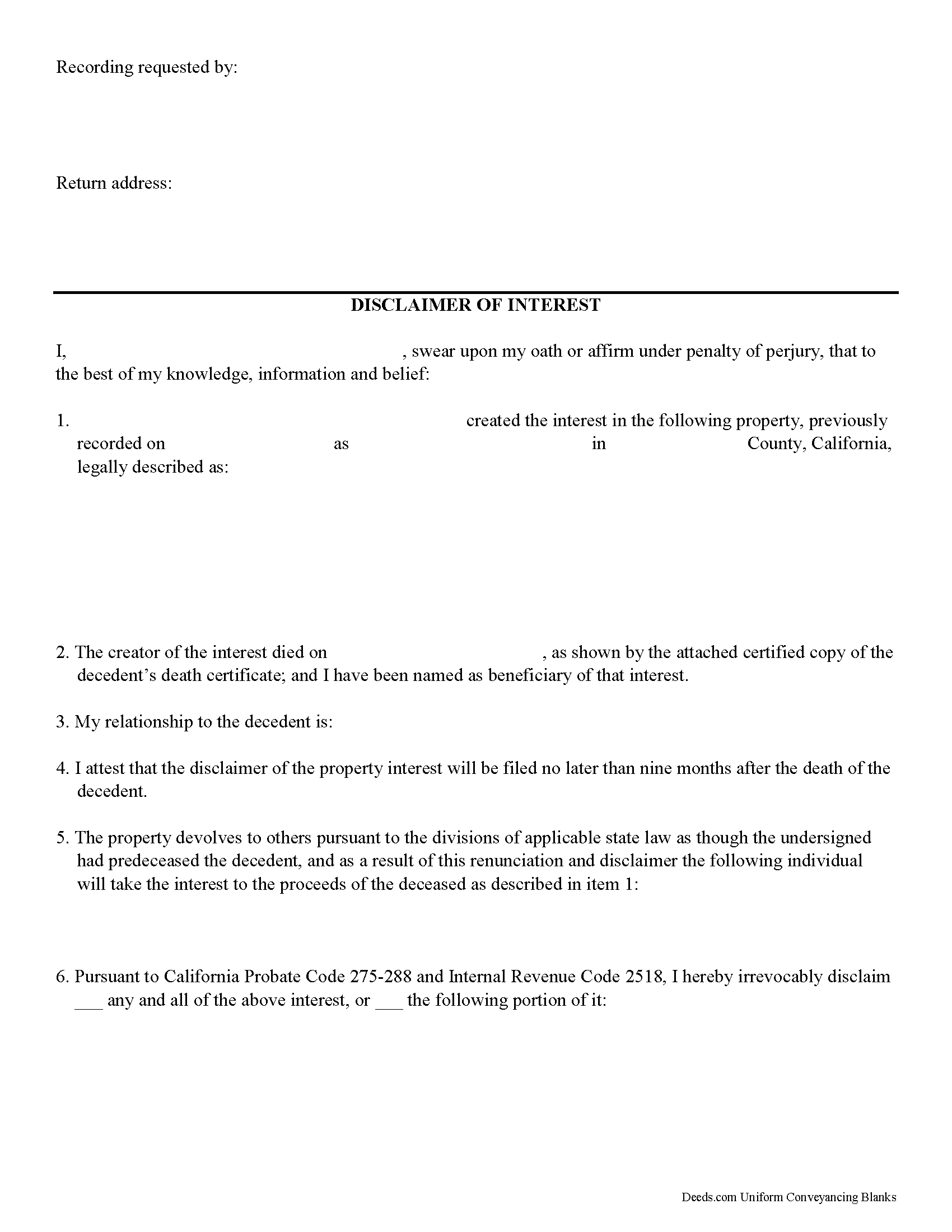

Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included document last reviewed/updated 4/2/2024

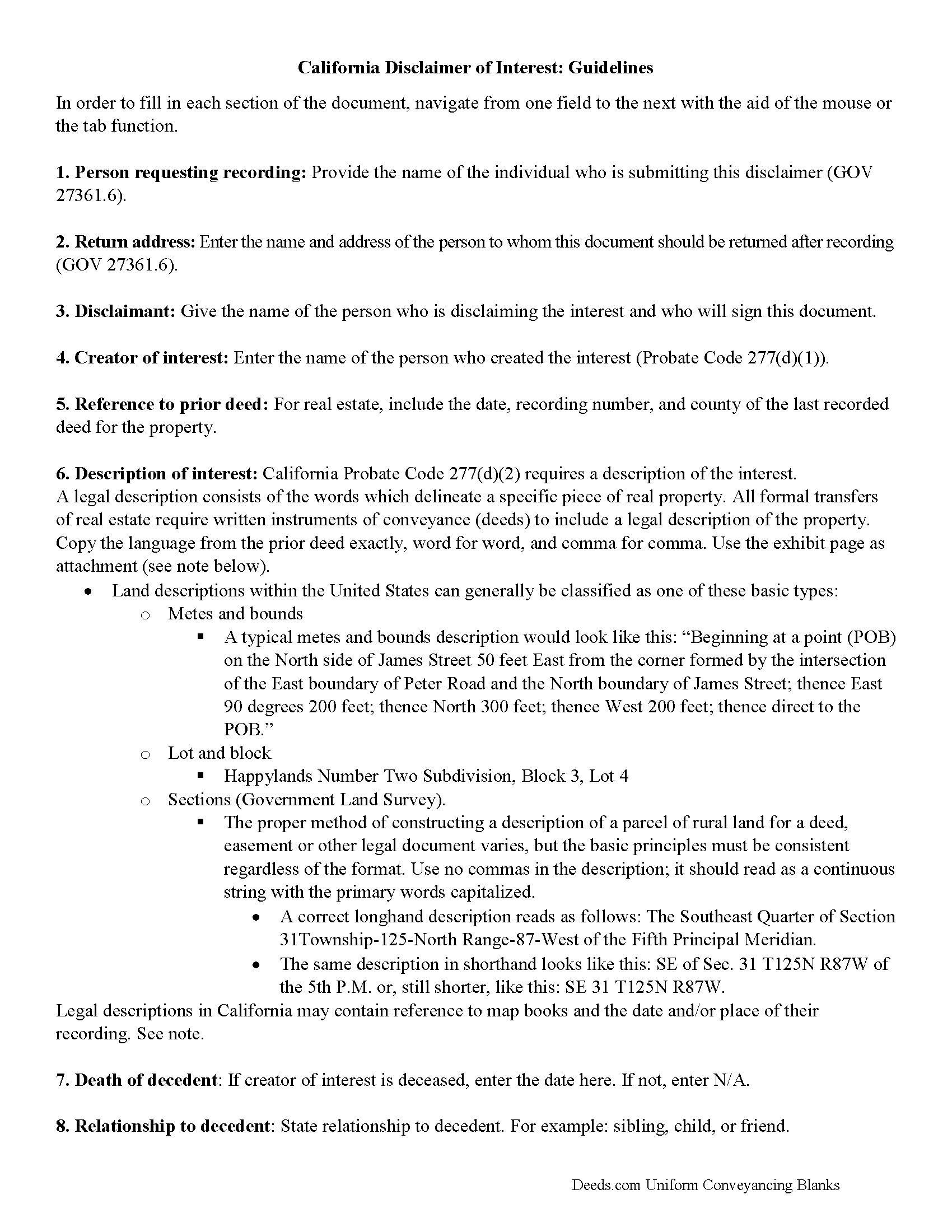

Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

Included document last reviewed/updated 4/9/2024

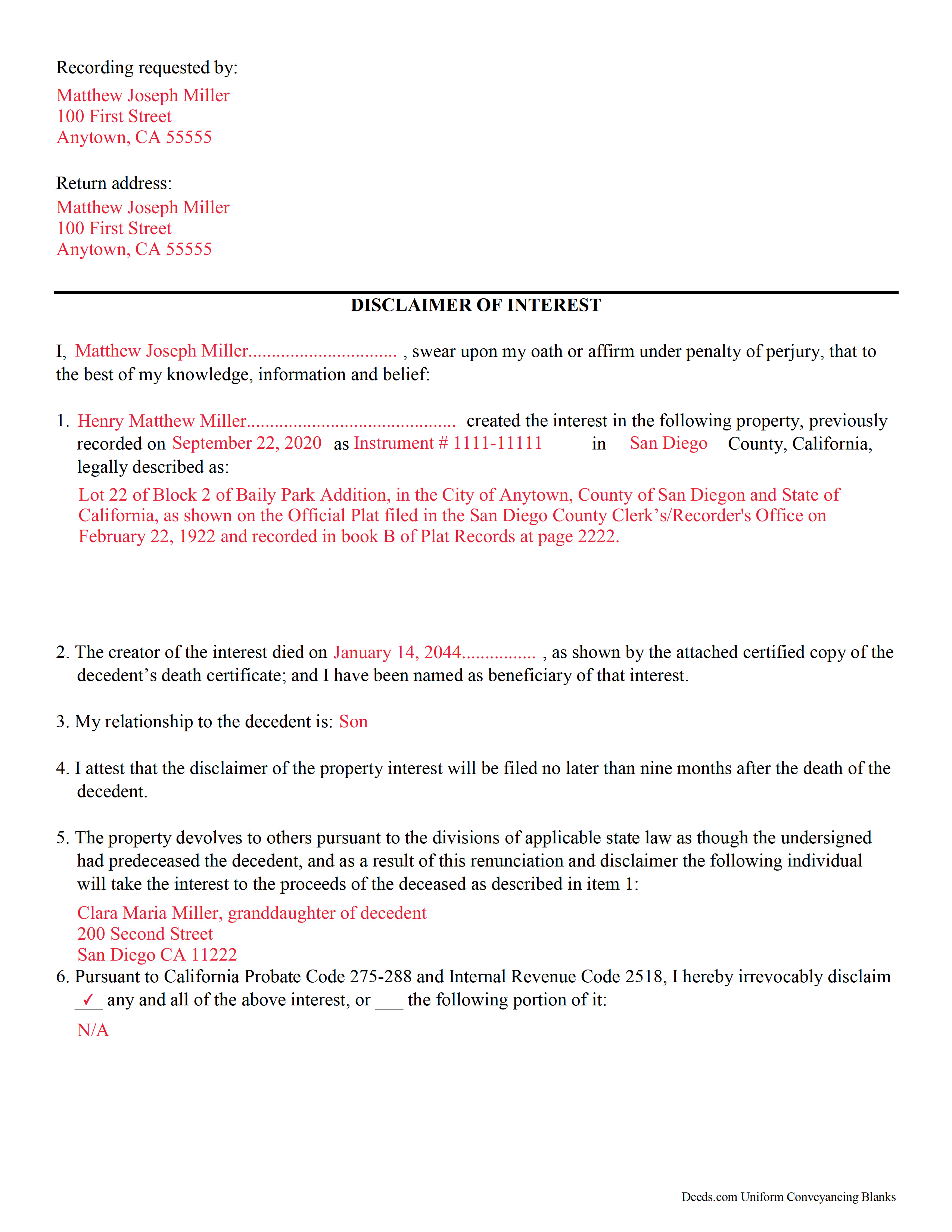

Completed Example of the Disclaimer of Interest Form

Example of a properly completed form for reference.

Included document last reviewed/updated 4/18/2024

Included Supplemental Documents

The following California and Alpine County supplemental forms are included as a courtesy with your order.

Frequently Asked Questions:

How long does it take to get my forms?

Forms are available immediately after submitting payment.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by California or Alpine County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

How do I get my forms, are they emailed?

Forms are NOT emailed to you. Immediately after you submit payment, the Alpine County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be sent to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance.

What type of files are the forms?

All of our Alpine County Disclaimer of Interest forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Can the Disclaimer of Interest forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Alpine County that you need to transfer you would only need to order our forms once for all of your properties in Alpine County.

Are these forms guaranteed to be recordable in Alpine County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Alpine County including margin requirements, content requirements, font and font size requirements.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Areas Covered by These Disclaimer of Interest Forms:

- Alpine County

Including:

- Kirkwood

- Markleeville

What is the California Disclaimer of Interest

Use the disclaimer to renounce an interest in real property in California.

A beneficiary in California can disclaim a bequeathed asset or power. For a complete list, see Probate Code 267. A disclaimer, which must be in writing and signed by the beneficiary, allows that beneficiary to renounce his or her interest in the property. California statutes allow for the partial rejection of the interest, which must be clearly identified on the disclaimer.

Besides the beneficiary, state the name of the creator of the interest, as well as the next beneficiary to whom the interest will pass, e.g., the next person in line to inherit. In the case of real property, give the entire legal description of the land and provide recording information for the prior deed in order to avoid any problems in the chain of title.

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors. It must be received within nine months after the decedent's death, the transfer, or the 21st birthday of the beneficiary (Probate Code 279) and is only valid if no actions have indicated acceptance of the property.

It must be filed with any of the following entities according to Probate Code 280(a): the superior court in the county where the estate is administered; the representative of the deceased or executor of the estate; the creator of the interest; or "any other person having custody or possession of or legal title to the interest." When in doubt as to the drawbacks and benefits of renouncing the property, consult with an attorney.

(California Disclaimer of Interest Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Alpine County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Alpine County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

Reviews

4.8 out of 5 (4324 Reviews)

Michael L.

April 25th, 2024

Professional, simple. Very good.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

April 25th, 2024

Always helpful!\r\n

We are thankful for your continued support and feedback, which inspire us to continuously improve. Thank you..

Mark E.

April 25th, 2024

This was easy to use and only contained one glaring error-where to send the completed form to finish the process. I’ve completed the form, does this mean I get the amended deed sent to me? I think not.

Your insights are invaluable to us and help us strive for better service. Thank you for taking the time to share your thoughts.

Yvette D.

January 15th, 2021

Excellent service and customer support. Thank you for your help and time.

Thank you!

Owen w.

January 5th, 2021

Was very pleased with execution of the forms. Easy to understand and was hassle free.

Thank you!

RICHARD MANUEL F.

January 26th, 2023

I never could even think to solve an important issue involving even overseas individuals without even a lawyer within 24 h. This service works for real and I'll keep using it from now for any future needs, referring to and proposing it as a legitimate, trusted real Optimus service. I'm extremely satisfied and being a Public Official myself I got to say that these guys have really impressed me!

Thank you!

Laurence G.

May 23rd, 2020

Easy to use, inexpensive, very helpful

Thank you!

Daniel A.

April 25th, 2022

First time using Deeds.com. Downloaded the PDF forms for creating an Illinois Mortgage and Promissory Note. Filled them out, saved them, and printed them out. Going to send them to my Title Company for closing on a property. Save a bunch of money on not have to pay lawyer fees for creating the same legal documents that Deeds.com provided.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jay B.

March 17th, 2021

I've never had a problem locating the records I need. I can't imagine what can be done to improve the service.

Thank you!

Kevin C.

August 10th, 2022

Nice site but $30 to download a blank form is a bit much.

Thank you for your feedback. We really appreciate it. Have a great day!

Dana L.

January 29th, 2021

So far, so good! Love you guys!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

stephanie h.

April 2nd, 2020

Very satisfied. In the middle of COVID19 I was able to complete important paperwork even though I wasn't completely sure what I was doing on my own. Quick and easy. Thank you. It means a lot to me.

Thank you for your feedback. We really appreciate it. Have a great day!

CECIL E C.

June 27th, 2019

You made it easy to attain the documents I needed. The cost was very reasonable...thanks

Thank you for your feedback Cecil, we really appreciate it.

Michael D.

August 19th, 2019

Your Guide is very good but does not explain precisely where one can find the Instrument Number for the originally filed Claim of Lien.

Thank you for your feedback. We really appreciate it. Have a great day!

Corinne S.

December 3rd, 2019

Did not need power to "serve" contractor. All work done well, paid for, nothing more. Worth noting when things could go awry!

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.