Download California Disclaimer of Interest Legal Forms

California Disclaimer of Interest Overview

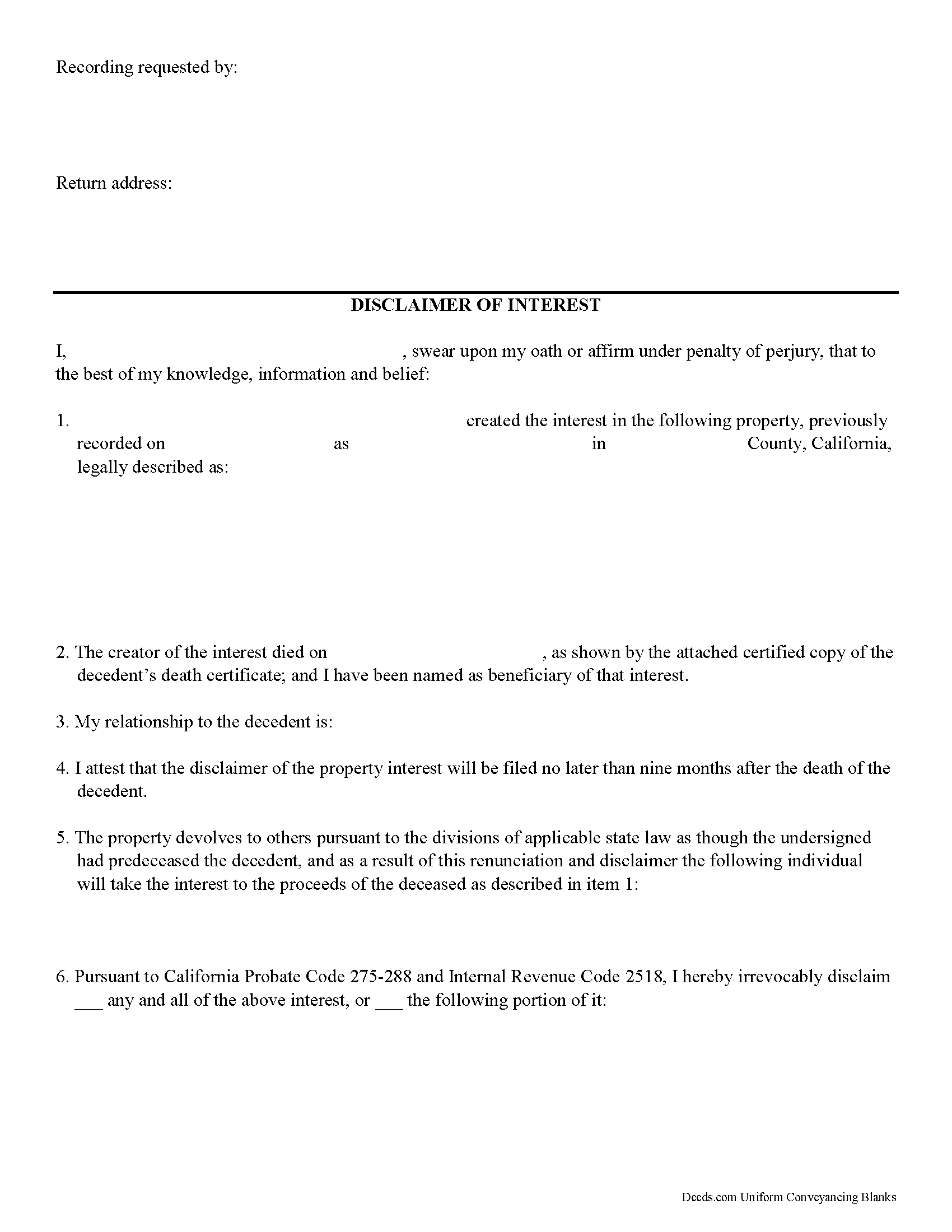

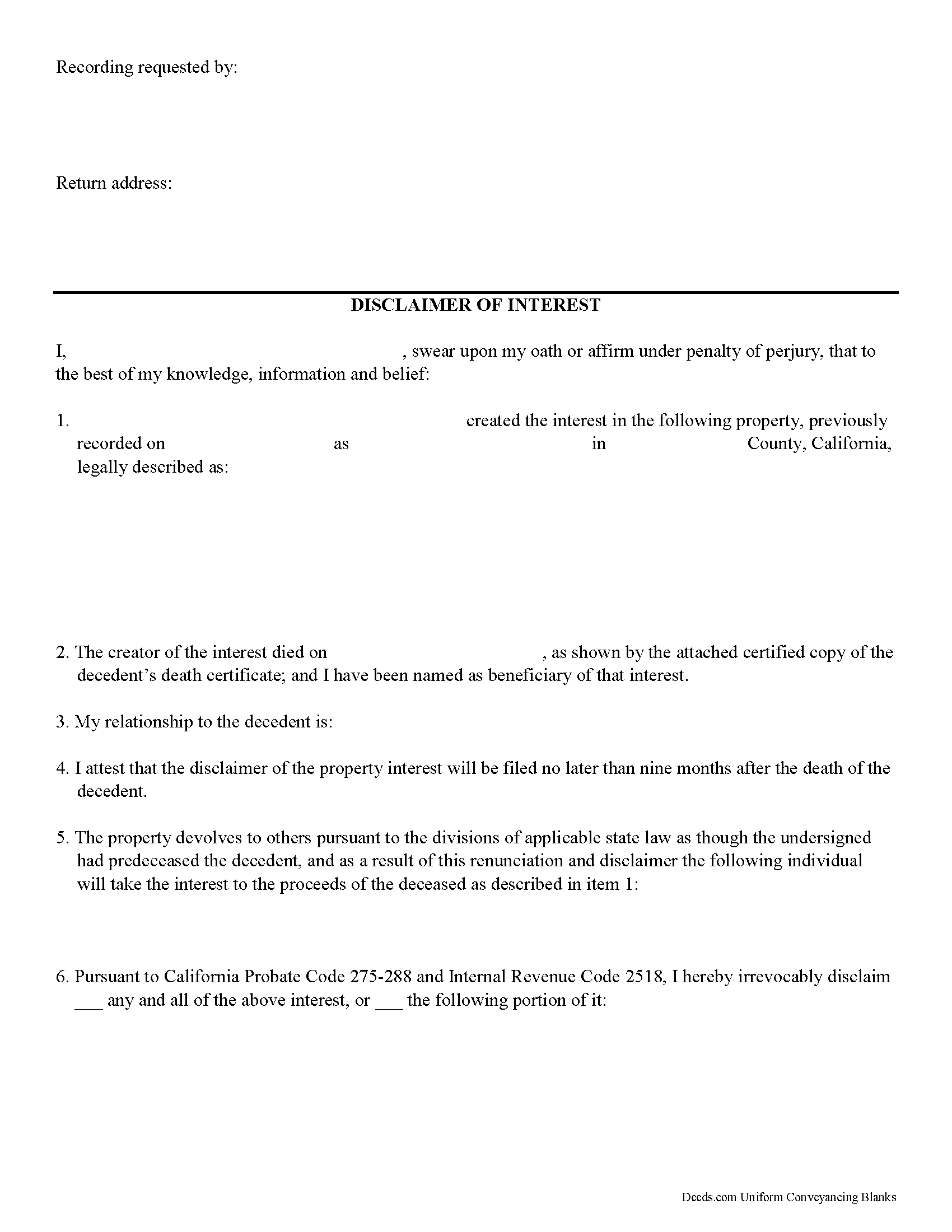

Use the disclaimer to renounce an interest in real property in California.

A beneficiary in California can disclaim a bequeathed asset or power. For a complete list, see Probate Code 267. A disclaimer, which must be in writing and signed by the beneficiary, allows that beneficiary to renounce his or her interest in the property. California statutes allow for the partial rejection of the interest, which must be clearly identified on the disclaimer.

Besides the beneficiary, state the name of the creator of the interest, as well as the next beneficiary to whom the interest will pass, e.g., the next person in line to inherit. In the case of real property, give the entire legal description of the land and provide recording information for the prior deed in order to avoid any problems in the chain of title.

A disclaimer is irrevocable and binding for anyone who makes a claim against the beneficiary, for example, potential creditors. It must be received within nine months after the decedent's death, the transfer, or the 21st birthday of the beneficiary (Probate Code 279) and is only valid if no actions have indicated acceptance of the property.

It must be filed with any of the following entities according to Probate Code 280(a): the superior court in the county where the estate is administered; the representative of the deceased or executor of the estate; the creator of the interest; or "any other person having custody or possession of or legal title to the interest." When in doubt as to the drawbacks and benefits of renouncing the property, consult with an attorney.

(California Disclaimer of Interest Package includes form, guidelines, and completed example)