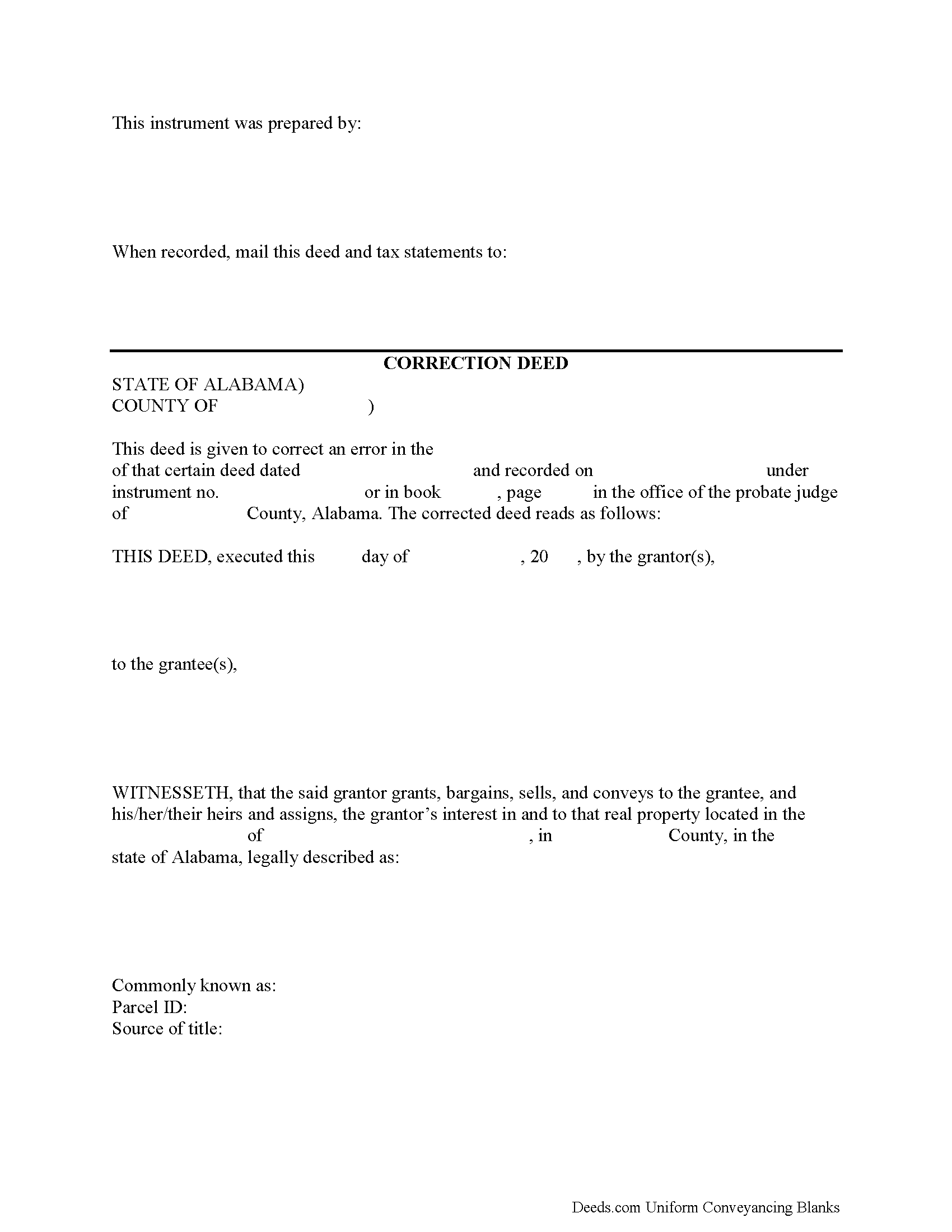

Marion County Correction Deed Form

Marion County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

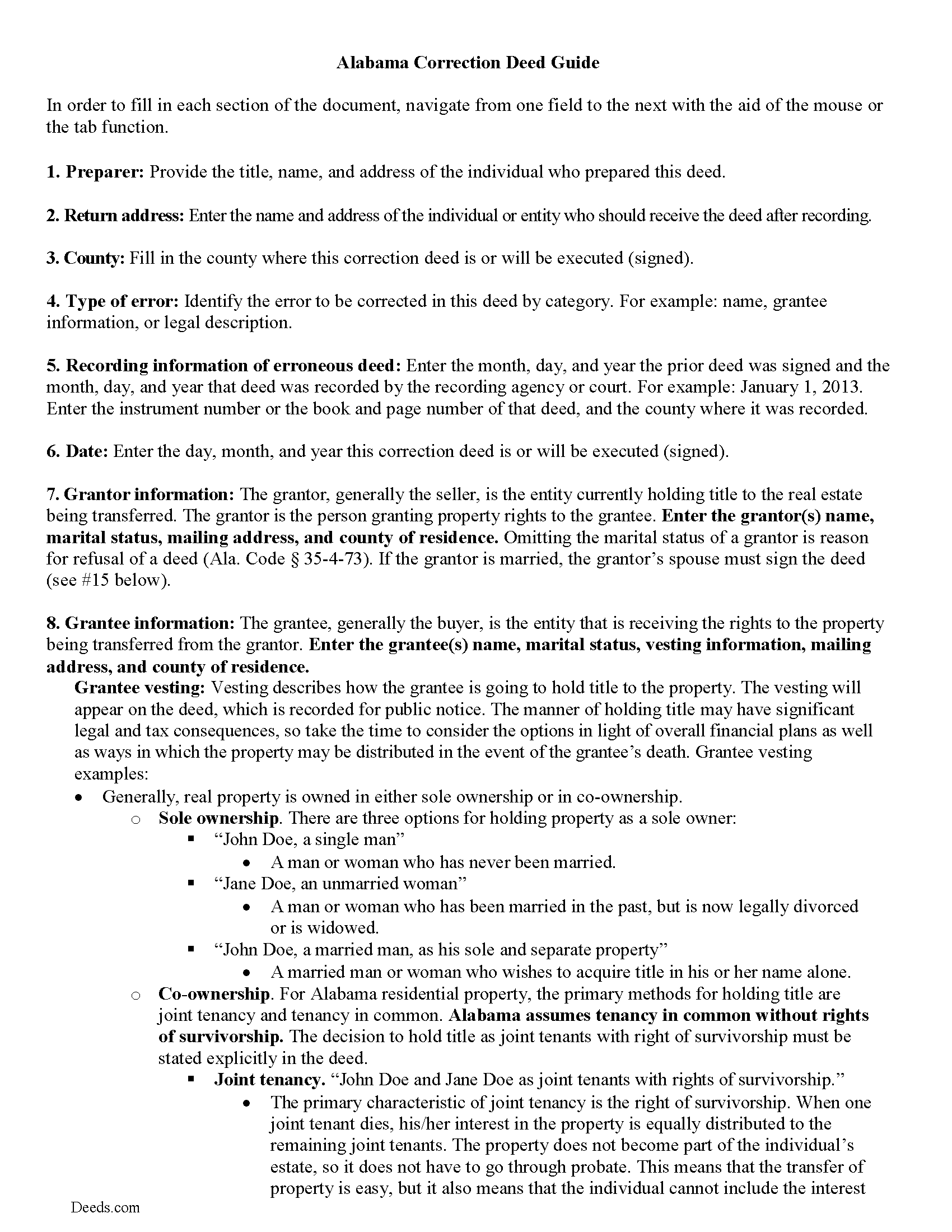

Marion County Correction Deed Guide

Line by line guide explaining every blank on the form.

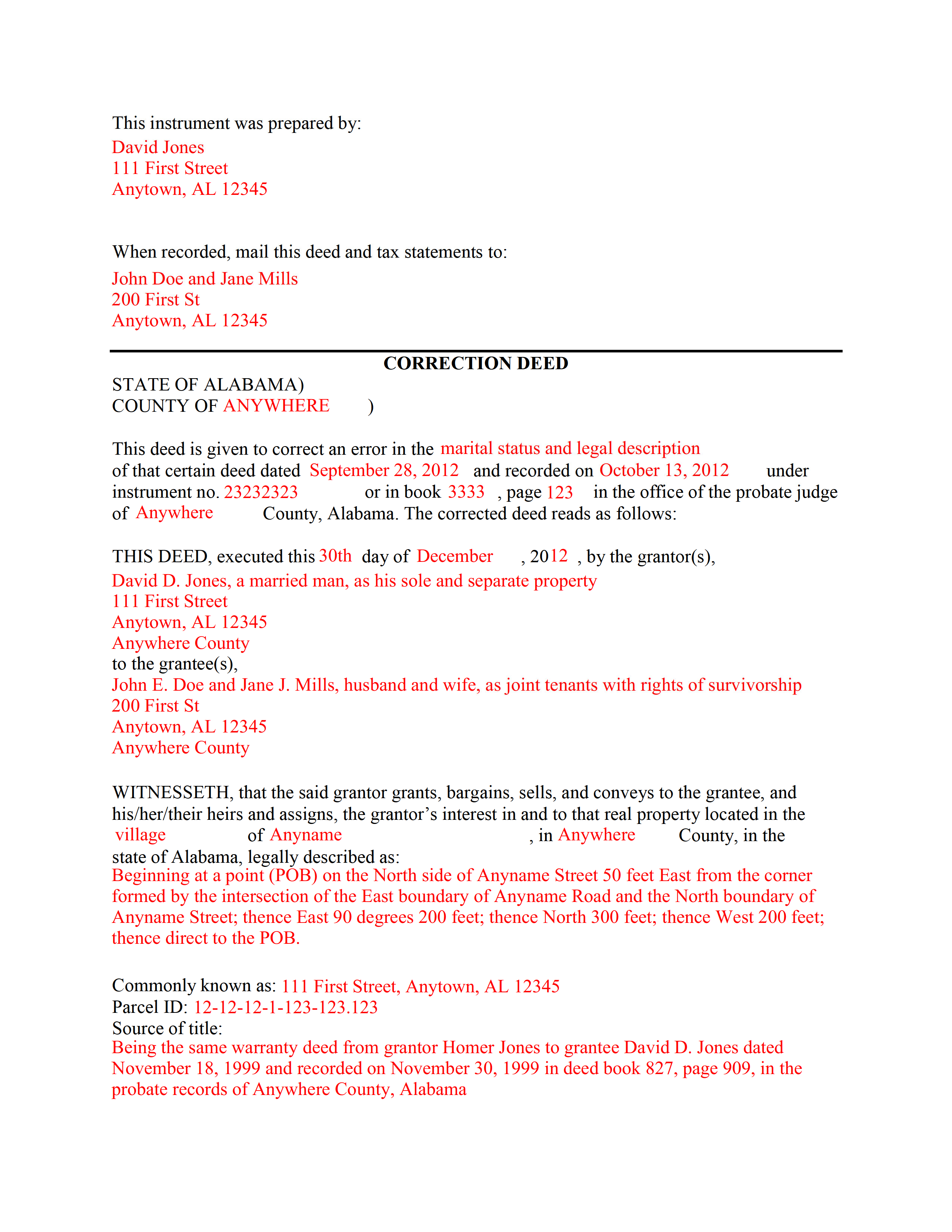

Marion County Completed Example of the Correction Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Marion County documents included at no extra charge:

Where to Record Your Documents

Marion Probate Office

Hamilton, Alabama 35570

Hours: 8:00 to 4:30 M-F

Phone: (205) 921-2471

Recording Tips for Marion County:

- White-out or correction fluid may cause rejection

- Ask about their eRecording option for future transactions

- Leave recording info boxes blank - the office fills these

- Recording early in the week helps ensure same-week processing

Cities and Jurisdictions in Marion County

Properties in any of these areas use Marion County forms:

- Bear Creek

- Brilliant

- Guin

- Hackleburg

- Hamilton

- Winfield

Hours, fees, requirements, and more for Marion County

How do I get my forms?

Forms are available for immediate download after payment. The Marion County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Marion County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Marion County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Marion County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Marion County?

Recording fees in Marion County vary. Contact the recorder's office at (205) 921-2471 for current fees.

Questions answered? Let's get started!

A correction deed is an instrument used to correct an error in a deed that has been recorded at an earlier date. This type of deed is important because it ensures the accuracy of property records, which are essential for clear property titles and smooth real estate transactions.

In order to correct a prior deed on record, use a correction deed, which must be notarized and recorded at the same county agency as the earlier deed. The correction deed makes specific reference, by execution and recording date, as well as instrument ID or book/page number, to the earlier deed and rerecords it in its entirety. It states the type of error made and adds the corrected information in the respective section of the instrument. All parties who signed the prior deed must sign the correction deed in the presence of a notary.

Common reasons to use a Correction Deed.

Correcting Minor Errors: A Correction Deed is often used to rectify minor mistakes in a previously recorded deed, such as typographical errors, misspellings, or errors in personal details of the grantor or grantee (like names or addresses).

Property Description: One of the most common reasons for using a Correction Deed is to correct an inaccurate legal description of the property. Since the legal description defines the exact boundaries and dimensions of the property, accuracy is crucial.

Incorrect Recording Information: Sometimes, a deed might reference incorrect recording data from earlier transactions. A Correction Deed can rectify these references to ensure the chain of title is accurate.

Notary Acknowledgment: If the original deed contained errors in the notary acknowledgment, such as missing information or incorrect dates, a Correction Deed might be used to correct these issues.

(Alabama Correction Deed Package includes form, guidelines, and completed example) For use in Alabama only.

Important: Your property must be located in Marion County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Marion County.

Our Promise

The documents you receive here will meet, or exceed, the Marion County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Marion County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

ROBERT J.

March 26th, 2020

Easy to order!

Thank you!

Hugh B R.

February 24th, 2021

Very user friendly and fast. Pleasure using this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Kenneth-Wayne L.

August 20th, 2020

1) I was very pleased when the staff mentioned your service since the three referenced on the Recorder's website all wanted HUGE Account set-up and maintenance fees AND BIG fees per recording, and yours has no set-up fee AND nominal per-recording fee; 2) My (few) recordings will be NON-LAND Related, summary or entire record(s) of Administrative (Procedures Act) records, Other than the Border width and Cover Sheet, do you anticipate any other special requirements for such recording(s)? NOTE: I just sent one by Snail Mail, and they just informed me that due to the GERMIPHOBIA 'Pandemic' the ONLY open and record Snail Mail ONCE A MONTH On the first of each chmonth!

Thank you!

Vera O.

February 25th, 2022

I love how quick and easy everything was. I'll definitely be using deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Susan T.

January 21st, 2019

This was perfect for my county I will be recommending your forms to all my clients thank you.

Thank you Susan, have a great day!

Teri B.

January 7th, 2019

Glad to have all of the helpful extra information, even though they don't answer all questions for all situations. So, I accessed public records and asked questions at the auditor's office. Also, on my Mac computer, filling out the actual deed form is a challenge because the screen jumps to the last page everytime I try to type a few letters or hit the return key, so I'm rollling back up to the first 2 pages after most keystrokes. A bit annoying. Overall, happy to have these form options are available! There is really no need to wait and pay for an attorney when all the information needed is available via public records. Fill in the blanks!

Thanks so much for the feedback Teri. There are known issues between Adobe and Mac, we try to work around them as much as possible. Have a wonderful day!

Michelle G.

May 28th, 2021

This was a great service! I was having trouble recording something and found this was the best, and quickest, way to get it completed. Excellent service! Will definitely use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

David L.

December 29th, 2020

It was a very easy to use application. I can only give it four stars because I have yet to receive confirmation from the county that my application was acceptable, ie., format, font, etc. I believe it will be fine.

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

August 31st, 2024

The form cost was reasonable - it helped me organize my thoughts and write things down to help minimize the attorney fees.

We are grateful for your engagement and feedback, which help us to serve you better. Thank you for being an integral part of our community.

Deborah P.

September 13th, 2022

Very helpful! Easy and clear guidance. Good examples on sample forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

BRIAN M.

May 1st, 2020

Excellent Service, Fast and efficient. Thank You!

Thank you!

Monte J.

June 28th, 2019

Very helpful.

Thank you!

Dirmarcus S.

January 30th, 2025

I say I really do love Deed.com! Super easy to navigate and easy to get what you need for paperwork without spending a lot of money

Thank you for your positive words! We’re thrilled to hear about your experience.

Colleen N.

March 30th, 2021

The instruction were very clear and the sample was also very helpful.

Thank you!

Dianne J.

August 25th, 2020

Happy to give you a 5 star rating. We have never been a position to get changes on and record our own deed. You made the process very easy. Submitted my forms on a Friday, made one correction that was requested of me, paid our fees and the received notification of deed being recorded the next Tuesday. Wonderful work on your part and super easy for me. Thanks!

Thank you for your feedback. We really appreciate it. Have a great day!