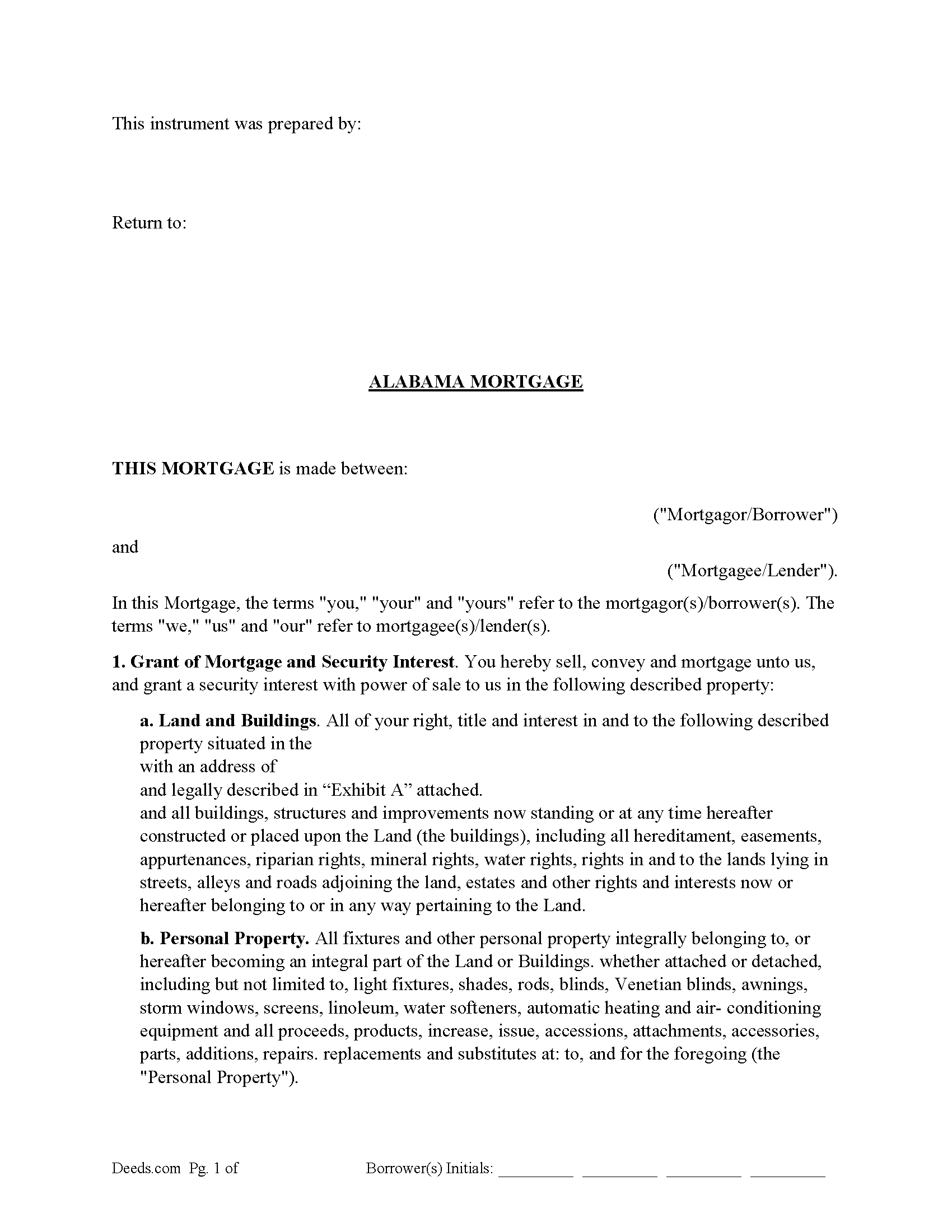

Lawrence County Mortgage Form

Lawrence County Mortgage Form

Fill in the blank form formatted to comply with all recording and content requirements.

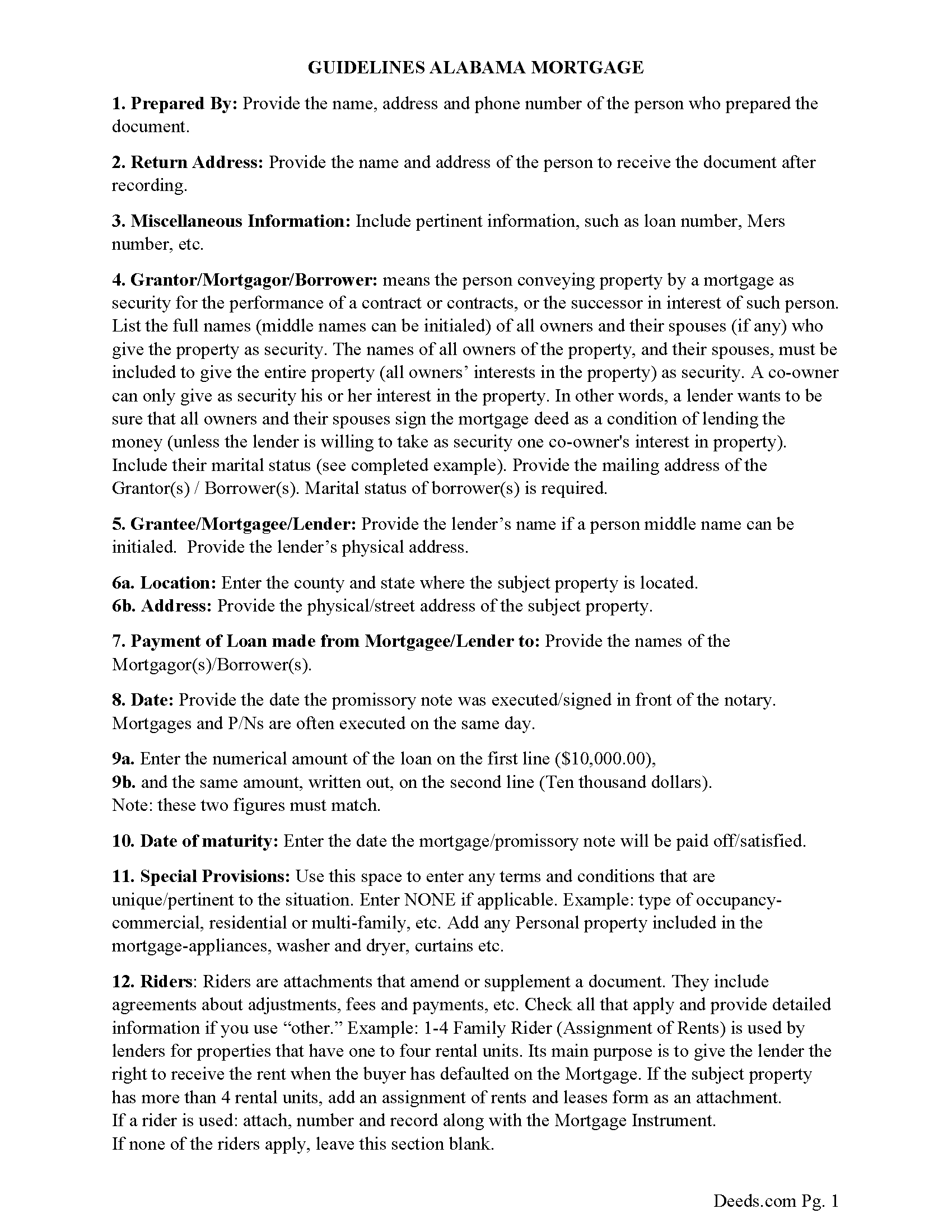

Lawrence County Mortgage Guidelines

Line by line guide explaining every blank on the form.

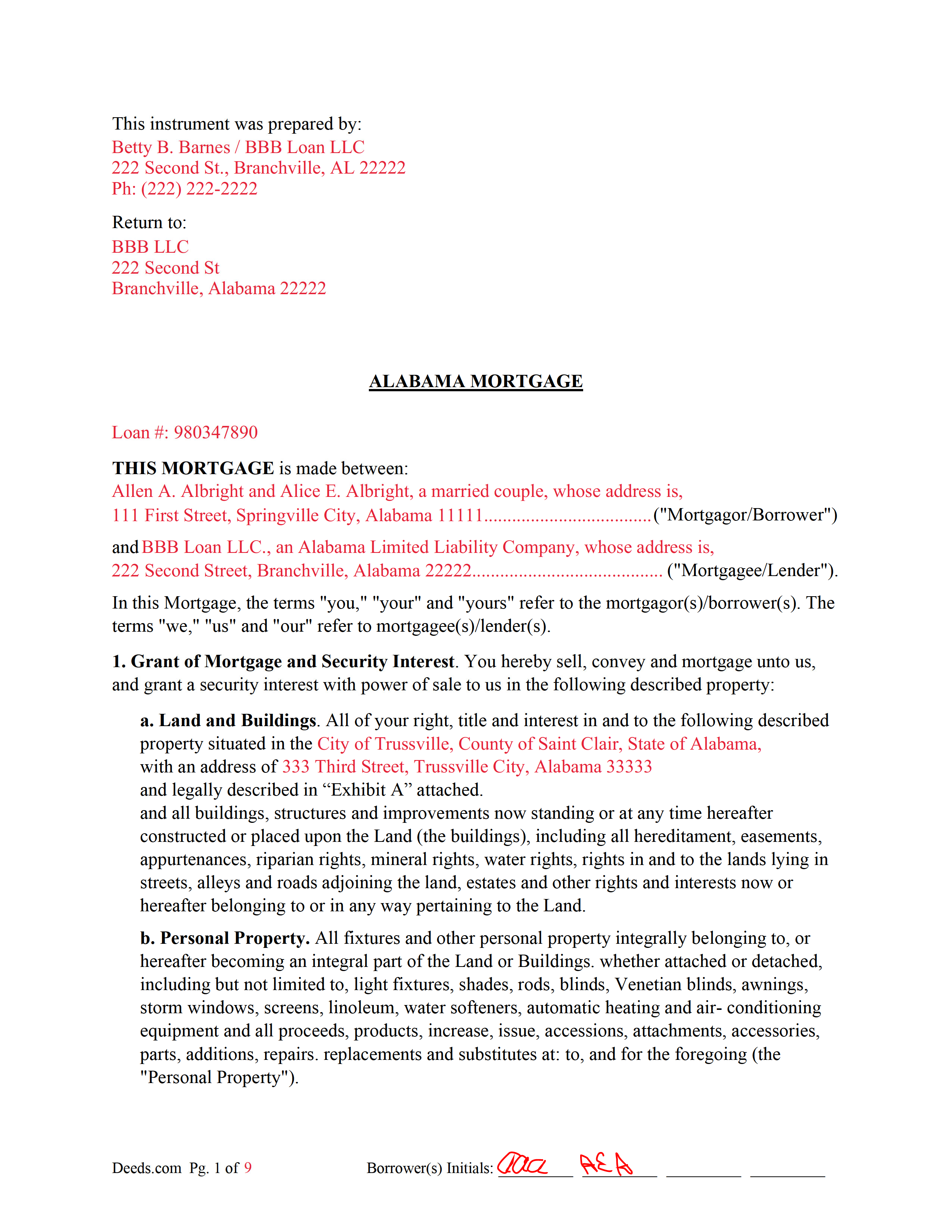

Lawrence County Completed Example of the Mortgage Document

Example of a properly completed form for reference.

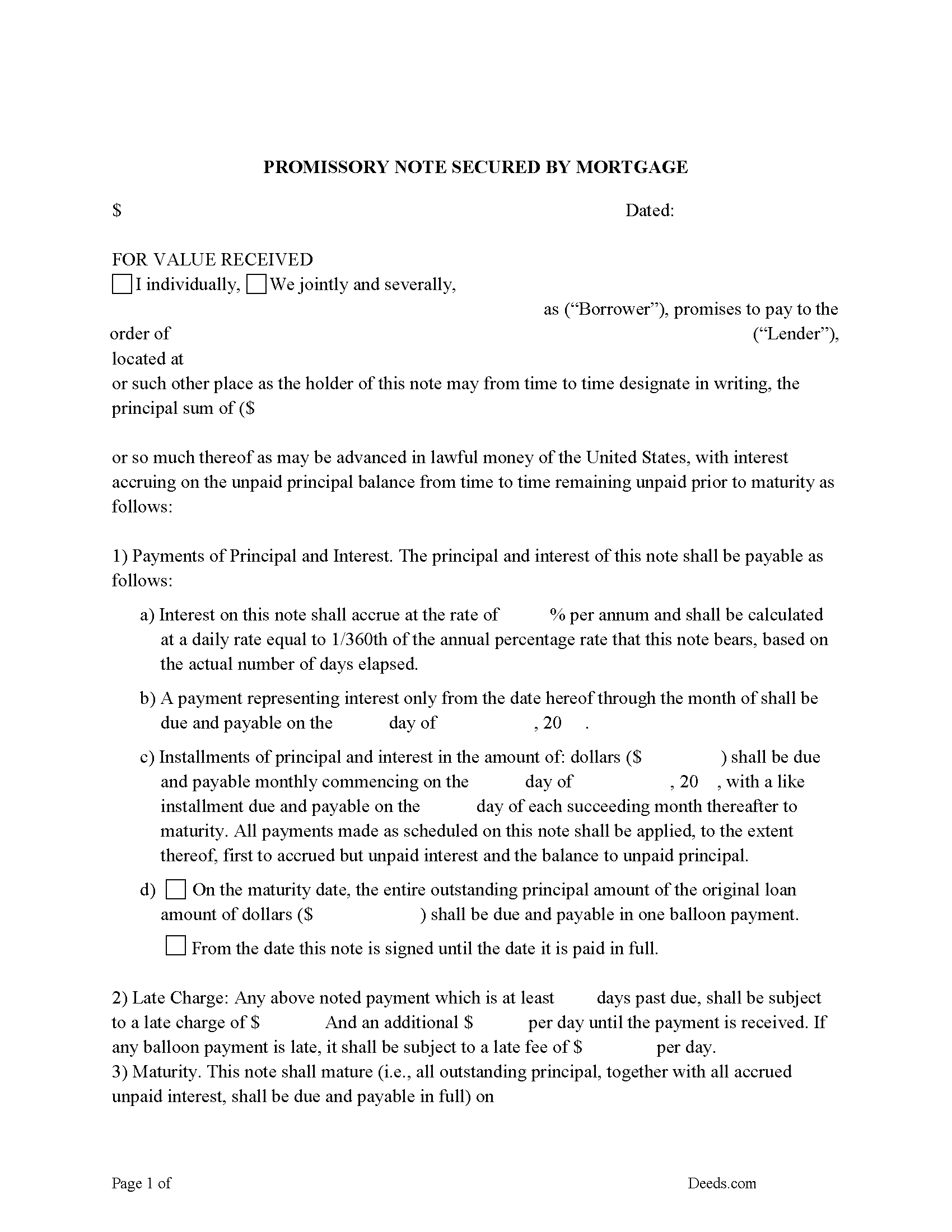

Lawrence County Promissory Note Form

Note that is secured by the Mortgage. Can be used for traditional installments or balloon payment.

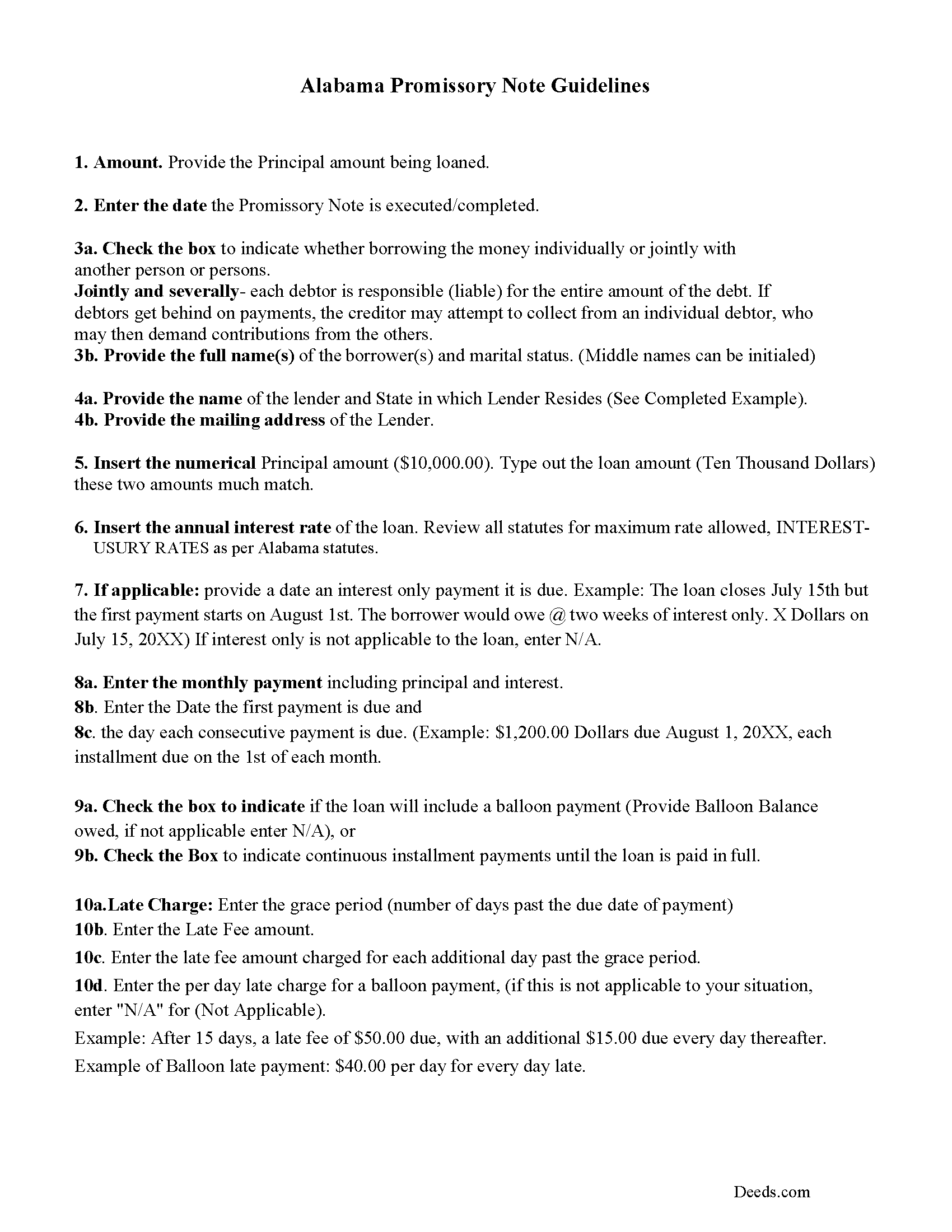

Lawrence County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

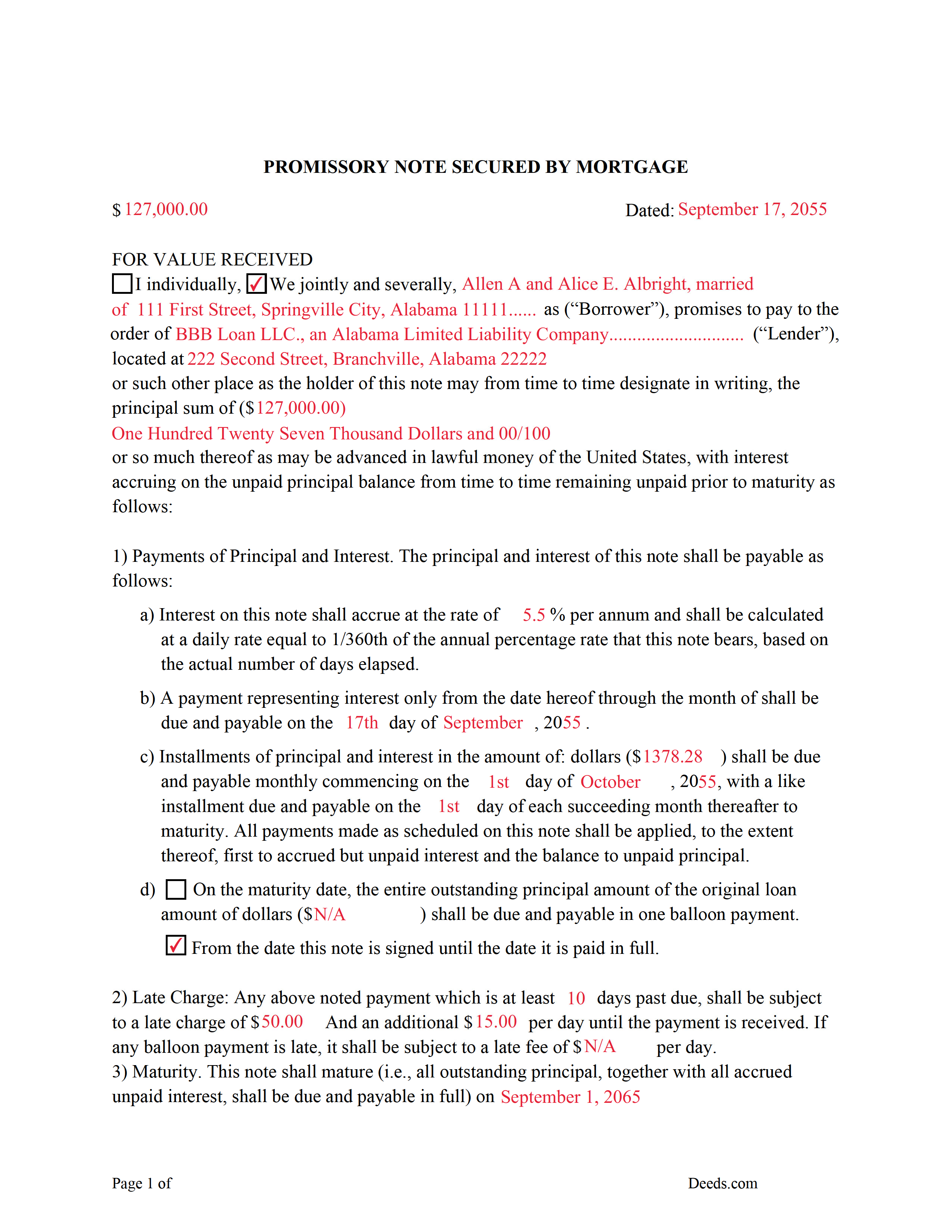

Lawrence County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

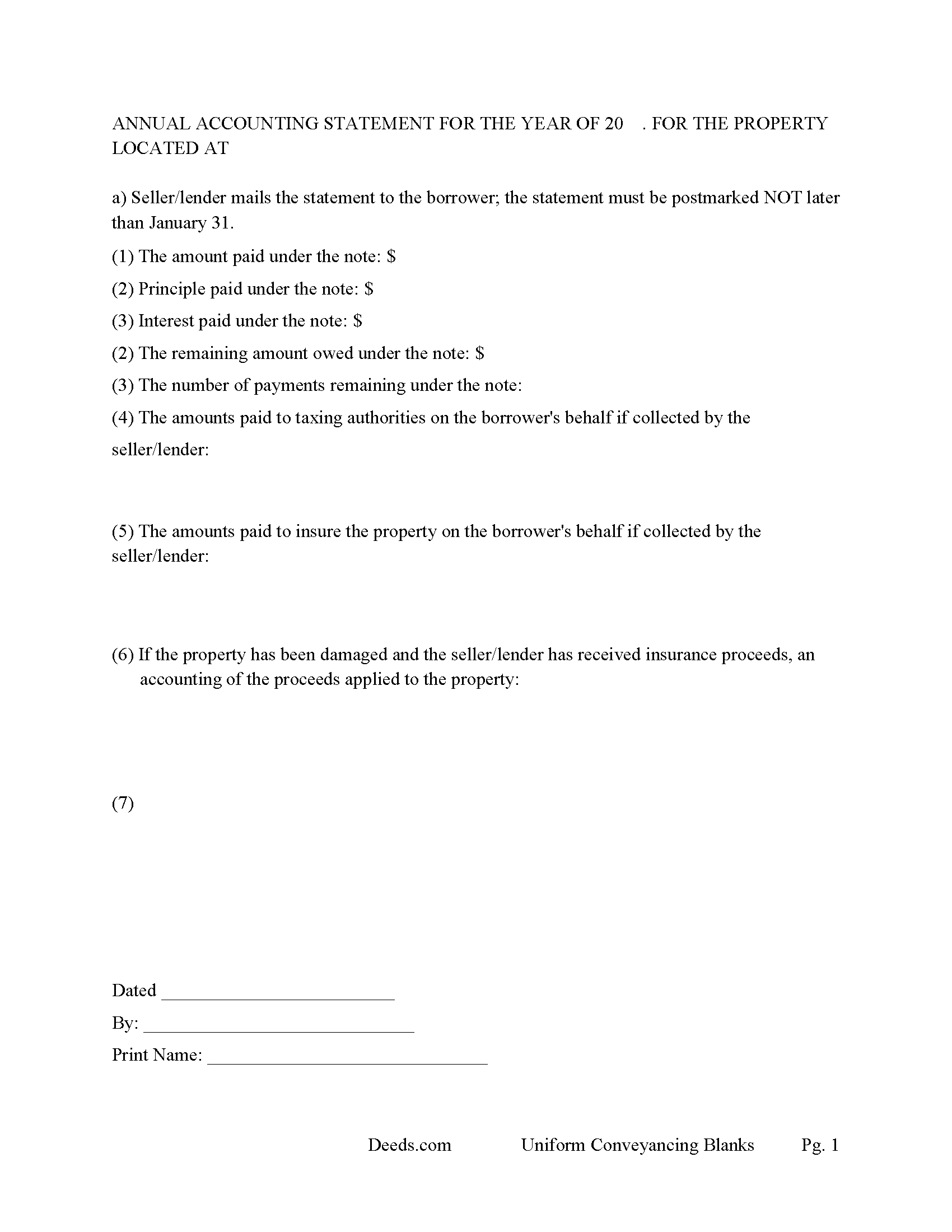

Lawrence County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Alabama and Lawrence County documents included at no extra charge:

Where to Record Your Documents

Lawrence County Probate Office

Moulton, Alabama 35650

Hours: 8:00 to 4:30 Monday through Friday

Phone: (256) 974-2439

Recording Tips for Lawrence County:

- Documents must be on 8.5 x 11 inch white paper

- Ask if they accept credit cards - many offices are cash/check only

- Avoid the last business day of the month when possible

- Recording fees may differ from what's posted online - verify current rates

Cities and Jurisdictions in Lawrence County

Properties in any of these areas use Lawrence County forms:

- Courtland

- Hillsboro

- Moulton

- Mount Hope

- Town Creek

Hours, fees, requirements, and more for Lawrence County

How do I get my forms?

Forms are available for immediate download after payment. The Lawrence County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lawrence County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lawrence County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lawrence County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lawrence County?

Recording fees in Lawrence County vary. Contact the recorder's office at (256) 974-2439 for current fees.

Questions answered? Let's get started!

The short definition of a mortgage is that it's a loan used to purchase real property. In Alabama, the mortgage is comprised of two parts: the security instrument and the promissory note. A security instrument is a specific type of document that provides security for the lender and contains terms (agreements) that apply until the buyer (borrower) repays the lender according to terms defined in an attached promissory note.

While the lender holds legal title to the property during this time, the borrower holds equitable title, which means they may occupy the property as if they hold legal title, but until the loan has been repaid, the lender actually owns it. This is because mortgages involve a lien against the property, held as security, that ends when the debt is repaid, and the owner assumes legal title (after recording a release of mortgage).

The buyer must also complete a promissory note. A promissory note is a negotiable instrument that contains an unconditional written promise, signed by the borrower, to repay the lender or its designated agent. It defines the amount and specific terms of the loan between the borrower and the lender and must be completed at the same time as the security instrument. Many lenders retain the promissory note for the duration of the mortgage and return it to the borrower after the debt is repaid.

The Code of Alabama sets forth the rules for mortgages in that state at Title 35 Section 10 but does not provide a statutory form for security instruments. A typical mortgage includes the names of all borrowers (and their spouses, if applicable), information about the lending institution, the date the borrower signed the promissory note, the property county and address, and a legal description of the property. The borrower must indicate if the security instrument includes any riders, or attachments that amend or supplement a document.

The mortgage must be signed by each borrower and acknowledged by an authorized individual. Alabama requires spouses' signatures for mortgages of single-family owner-occupied dwellings ("homestead mortgages"), even if they are not borrowers (Ala. Code Sec. 6-10-3). A homestead is defined in Alabama as a single-family owner-occupied dwelling.

Security instruments must meet standards of form and content for recording documents relating to real property. Record the completed mortgage at the local probate office.

Secured Promissory Notes in Alabama

At the same time the buyer fills out the mortgage form, they must also complete a promissory note. A promissory note is a negotiable instrument that contains an unconditional written promise, signed by the borrower, to repay the lender or its designated agent. It defines the amount and specific terms of the loan between the borrower and the lender.

Promissory notes can be secured or unsecured. Unsecured notes set forth the terms and conditions associated with repayment, but there is no mention of collateral to protect the lender's interest. These are more common with personal property. Mortgages, which are real property transactions, use secured promissory notes. The borrower offers the property as security (collateral) to guarantee the loan and agrees that a failure to repay the loan could cause the lender to foreclose on it.

The borrower must complete a promissory note, but it is rarely recorded with the mortgage. Many lenders retain the note for the duration of the mortgage and return it to the borrower after the debt is repaid. If the situation demands a recorded promissory note, ensure that it meets all state and local standards for submitting documents.

Use these forms to finance residential property, condominiums, planned unit developments, vacant land, small commercial and rental property up to 4 units (more than 4 units add our "Assignment of Rents and Leases" form). This mortgage contains a power of sale clause, allowing for a non-judicial foreclosure, saving time and expense for the lender. A Promissory Note secured by a Mortgage that include stringent default terms can be beneficial to the lender.

Section 35-10-1 - Power of Sale Constitutes Part of Security; by Whom Executed; Effect of Conveyance; Index of Foreclosure Deeds. Where a power to sell lands is given to the grantee in any mortgage, or other conveyance intended to secure the payment of money, the power is part of the security, and may be executed by any person, or the personal representative of any person who, by assignment or otherwise, becomes entitled to the money thus secured; and a conveyance of the lands sold under such power of sale to the purchaser at the sale, executed by the mortgagee, any assignee or other person entitled to the money thus secured, his agent or attorney, or the auctioneer making the sale, vests the legal title thereto in such purchaser. Probate judges shall index foreclosure deeds by the names of the original grantor and grantee in the mortgage, and also by the names of the grantor and grantee in the foreclosure deeds.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney.

(Alabama Mortgage Package includes forms, guidelines, and completed examples) For use in Alabama only.

Important: Your property must be located in Lawrence County to use these forms. Documents should be recorded at the office below.

This Mortgage meets all recording requirements specific to Lawrence County.

Our Promise

The documents you receive here will meet, or exceed, the Lawrence County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lawrence County Mortgage form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Sun H.

January 16th, 2024

It was great working with deeds.com. I needed to record quickclaim deed and the staff was very responsive and communicative throughout the process where I needed to modify the documents repeated. Thank you for making the recording much easy by setting up the e-recording service!

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Troy B.

July 8th, 2020

Very pleased with website very simple to navigate through

Thank you for your feedback. We really appreciate it. Have a great day!

Robert M.

February 22nd, 2020

Best site of its kind I have ever found. Informative, intuitive, and best of all, everything worked on the first try. I will be HAPPY to recommend it. --- A retired full prof of business administration

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Jeffery W.

August 25th, 2020

Great service!

Thank you!

Jennifer J.

March 21st, 2022

I have to admit this process was a scary one but you have made it very clear and simple to follow along with. I felt their virtual hand holding, that is how user friendly it is. Thank you for being top notch.

Thank you!

Paula S.

September 24th, 2019

I highly recommend this website. It was quick and easy with very helpful guides and examples! I am so very thankful that I stumbled across the Deed website! Definitely worth every penny spent!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Karen H.

April 6th, 2024

Saves a trip to the Recorders Office!

It was a pleasure serving you. Thank you for the positive feedback!

Tracy H.

January 14th, 2021

Deeds.com was an amazing experience. They made it so easy and stress free. The agent I worked with was fantastic and communicated quickly to make it a very positive experience. I will be using them from now on. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem. Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description! Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Norma G.

May 9th, 2019

Thank you! This is very helpful

Thank you!

james e.

August 23rd, 2022

Would be nice if these things downloaded with the type of document rather than a number

Thank you for your feedback. We really appreciate it. Have a great day!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!

Brenda S.

April 9th, 2021

Awesome forms, filled them out on my computer, printed them out complete, notarized, recorded, wonderful process. THANKS

Thank you for the kind words Brenda. Have a great day!

Tyler B.

June 8th, 2022

Great!

Thank you!

Monty H.

November 6th, 2019

Perfection. The filled-out form was especially helpful and I appreciate not having to share personal/financial information over the Internet, as required by so many other legal form service providers.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!