Clark County Beneficiary Deed Revocation Form

Clark County Beneficiary Deed Revocation Form

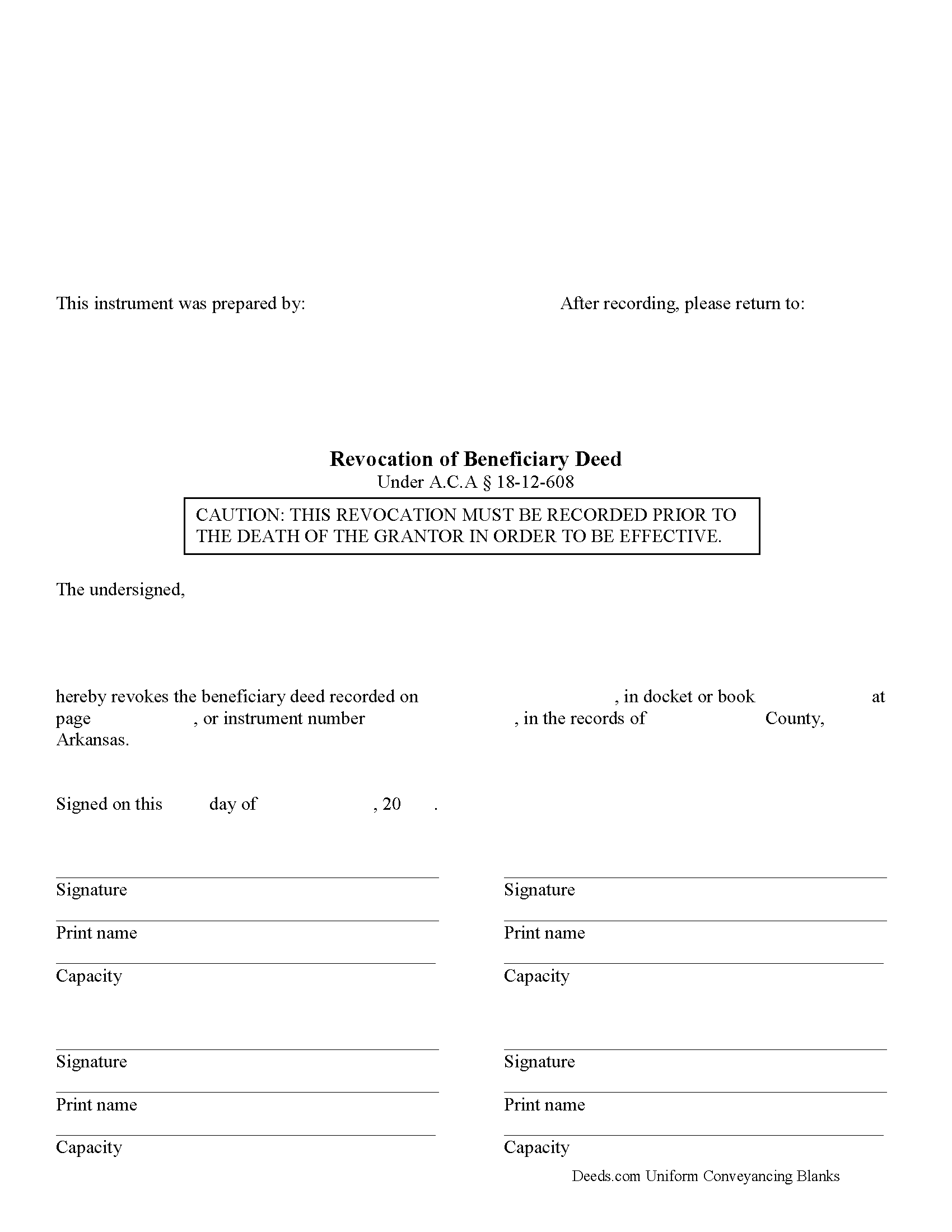

Fill in the blank form formatted to comply with all recording and content requirements.

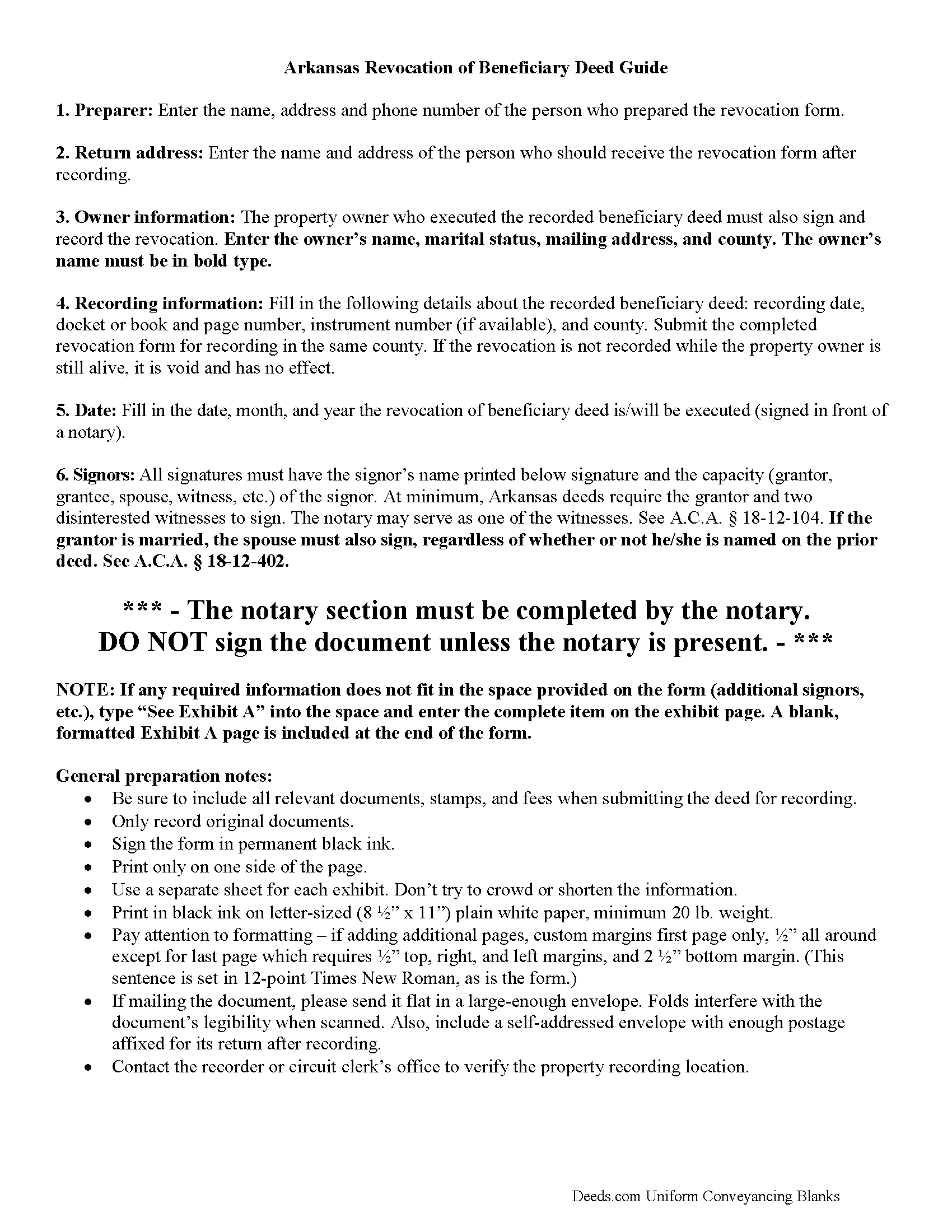

Clark County Beneficiary Deed Revocation Guide

Line by line guide explaining every blank on the form.

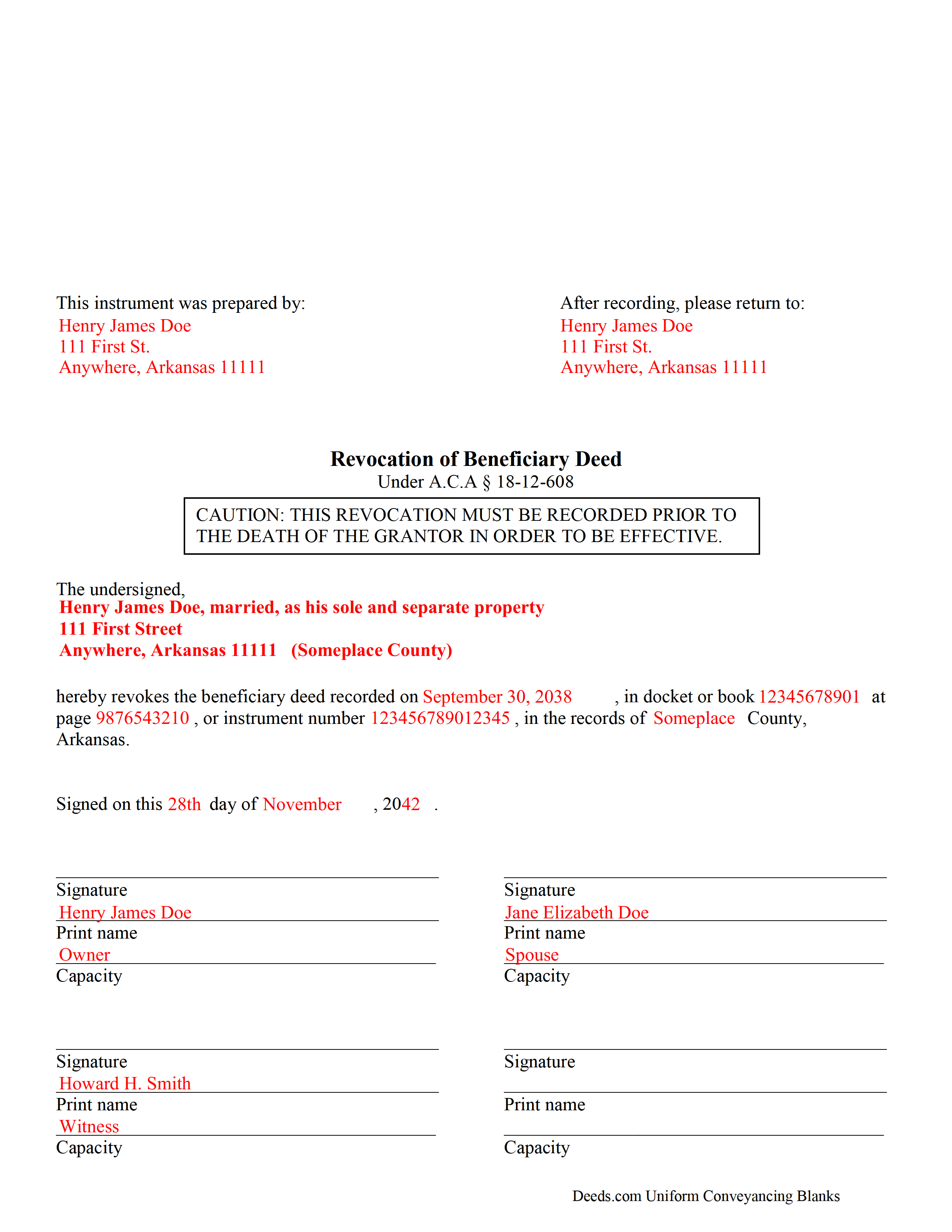

Clark County Completed Example of the Beneficiary Deed Revocation Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Clark County documents included at no extra charge:

Where to Record Your Documents

Clark County Circuit Clerk

Arkadelphia, Arkansas 71923

Hours: 8:30 to 4:30 M-F

Phone: (870) 246-4281

Recording Tips for Clark County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Bring extra funds - fees can vary by document type and page count

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Clark County

Properties in any of these areas use Clark County forms:

- Alpine

- Amity

- Arkadelphia

- Beirne

- Curtis

- Gurdon

- Okolona

- Whelen Springs

Hours, fees, requirements, and more for Clark County

How do I get my forms?

Forms are available for immediate download after payment. The Clark County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Clark County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Clark County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Clark County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Clark County?

Recording fees in Clark County vary. Contact the recorder's office at (870) 246-4281 for current fees.

Questions answered? Let's get started!

Revoking a Beneficiary Deed in Arkansas

Beneficiary deeds in Arkansas are governed by A.S.A. 18-12-608. This statute also includes information about revoking an executed and recorded beneficiary deed.

Section 18-12-608 (d)(1) states that a beneficiary deed "may be revoked at any time by the owner or, if there is more than one (1) owner, by any of the owners who executed the beneficiary deed." Why is this flexibility important? Well, life is uncertain and circumstances change. The original beneficiary may no longer be an appropriate recipient of the real property. Perhaps the beneficiary knows about the transfer, but is unable or unwilling to accept it. Instead of disclaiming the gift when the owner dies, thus forcing the property back into the estate for probate, the owner has the option to revoke the beneficiary deed and designate someone else to receive it.

Regardless of the reason, to revoke a beneficiary deed, the owner must execute a document setting forth the revocation and then record it, DURING HIS/HER LIFE, in the county where the property is situated. This should be the same county where the beneficiary deed was recorded earlier.

The owner may also simply sell the property outright, thereby extinguishing any remaining interest in it and leaving nothing to transfer at death. Or, he/she may execute and record another beneficiary deed, naming someone else to receive the real estate. This method is effective because "the recorded beneficiary deed that is last signed before the owner's death is the effective beneficiary deed, regardless of the sequence of recording." ( 18-12-608(e))

Even though there are several options available to revoke or change a recorded beneficiary deed, recording a revocation is the most efficient way to ensure the owner's wishes are carried out. A revocation discontinues the potential future interest described in the beneficiary deed, which then frees the real estate for whatever the owner wishes to do with it next. This is also important because it helps maintain a clear chain of title, which will make later sales or mortgages of the property less complicated.

Note: as with beneficiary deeds, any changes or revocations must be executed and recorded while the owner is alive.

(Arkansas Beneficiary Revocation Package includes form, guidelines, and completed example)

Important: Your property must be located in Clark County to use these forms. Documents should be recorded at the office below.

This Beneficiary Deed Revocation meets all recording requirements specific to Clark County.

Our Promise

The documents you receive here will meet, or exceed, the Clark County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Clark County Beneficiary Deed Revocation form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Jany F.

November 8th, 2021

Great and quick service.

Thank you!

Daniel L.

February 11th, 2022

You could make instructions clearer on the download process and when download is complete. You could also group things together for 1 or 2 "big" downloads.

Thank you for your feedback. We really appreciate it. Have a great day!

jonnie F.

August 25th, 2020

Easiest and most efficient way to process your documents, this company is amazing. They help me meet the deadline on a critical inspection by processing my NOC in less then a day. Thank You.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lara T.

December 1st, 2021

Made recording my document so much easier and faster. First attempt failed due to illegible blue ink, got that fixed and deeds.com resubmitted and doc was recorded within a couple of hours, all from the comfort of my home.

Thank you for your feedback. We really appreciate it. Have a great day!

patricia w.

August 5th, 2022

Fast, easy download of forms needed. Thank you, Deeds.com

Thank you!

Timothy C.

January 19th, 2022

Excellent service. Pay your fee, download the form and fill out according to specific instructions. Then, again according to instructions, take it to the county clerk's office and have it recorded. It could not be easier.

Thank you!

Jaynell B.

June 25th, 2021

This website was most helpful and easy to use. Glad the information I needed was available

Thank you!

Larry C.

July 7th, 2021

Very easy and convenient, thank you so much.

Thank you!

Michelle G.

May 28th, 2021

This was a great service! I was having trouble recording something and found this was the best, and quickest, way to get it completed. Excellent service! Will definitely use them again!

Thank you for your feedback. We really appreciate it. Have a great day!

Linda P.

January 27th, 2022

Once I found this site the rest was easy. I read through the guide but the example really helped the most. Very easy!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Giovanni S.

February 23rd, 2023

Simple and easy going process

Thank you!

Iryna D.

March 31st, 2020

Exelent work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Patrick N.

October 18th, 2020

Everything I expected. Faster and less expensive than my lawyer.

Thank you!

Gwen R.

January 23rd, 2019

Happy with the forms no complaints at all.

Thank you Gwen!

Don R.

January 26th, 2022

From Pennsylvania here. Documents are great and easy to fill out however you are lacking a couple of things. You only provide the option for a Grant Deed when you purchase by your county which is Mercer County for me. Why not give the ability to get a Warranty Deed that better protects the Grantee? Also, being from Pennsylvania and in a county that mined Buituminous Coal we are required to include the Coal Severance Notice and Bituminous Mine Subsidence and Land Conservation Act Notice. You can check the box on your Deed form that they are required and attached but you do not provide the verbiage or form for this. You state that you know what each county requires and include everything required but you do not include these two required Notices. This has been a requirement for years and the wording never changes. I had to look for these Notices and hand type this information and include it on another seperate page after the Notary section on the Deed. The Grantor has to sign the Coal Severance Notice and be witnessed by a Notary so I had to add another place for the Notary and will have to pay twice for witnessed signatures when it could have been included in your document. My Deed from 2003 was done that way and then the Notary statement after that so it was only one notarized witness of signature.

Thank you for your feedback. We really appreciate it. Have a great day!