Stone County Deed of Trust and Promissory Note Form

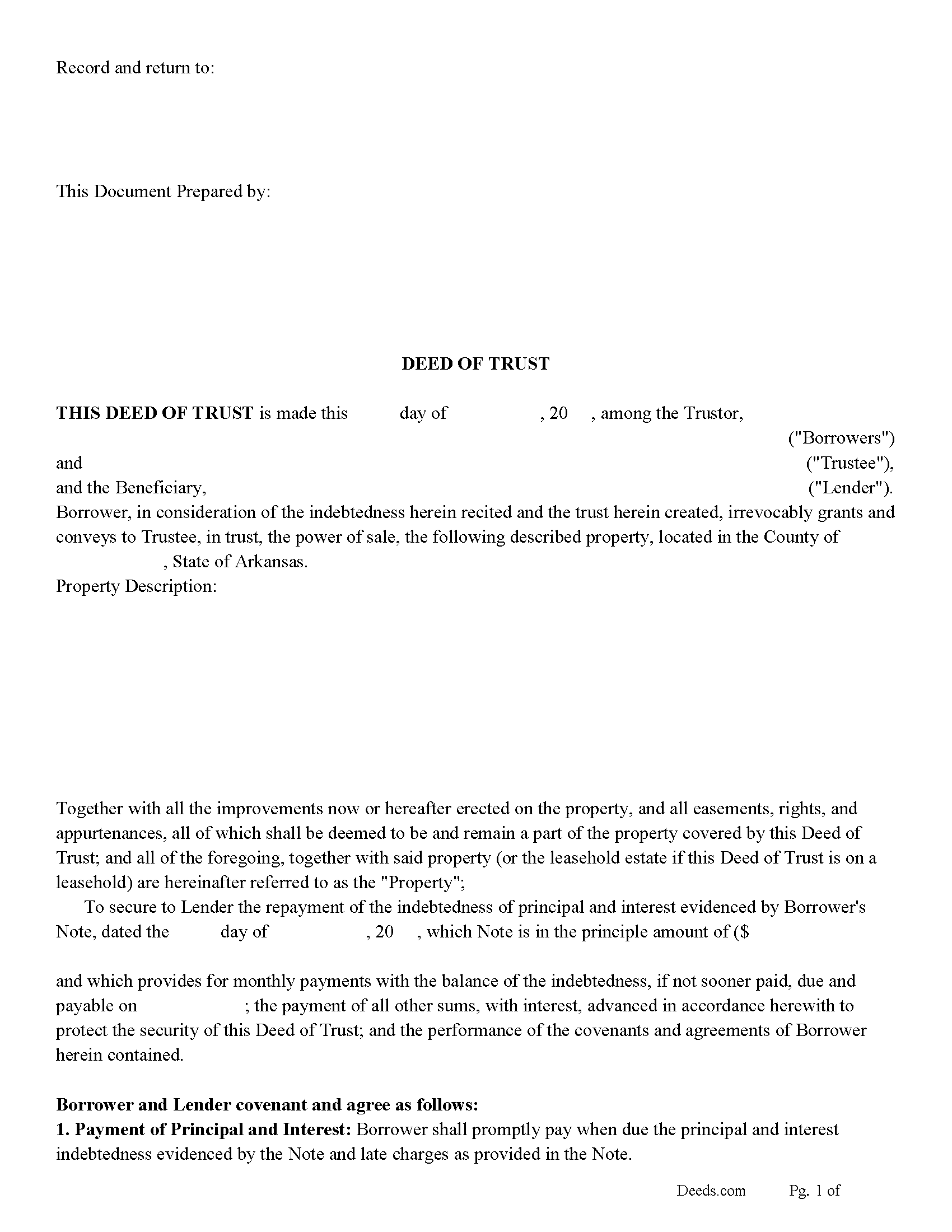

Stone County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

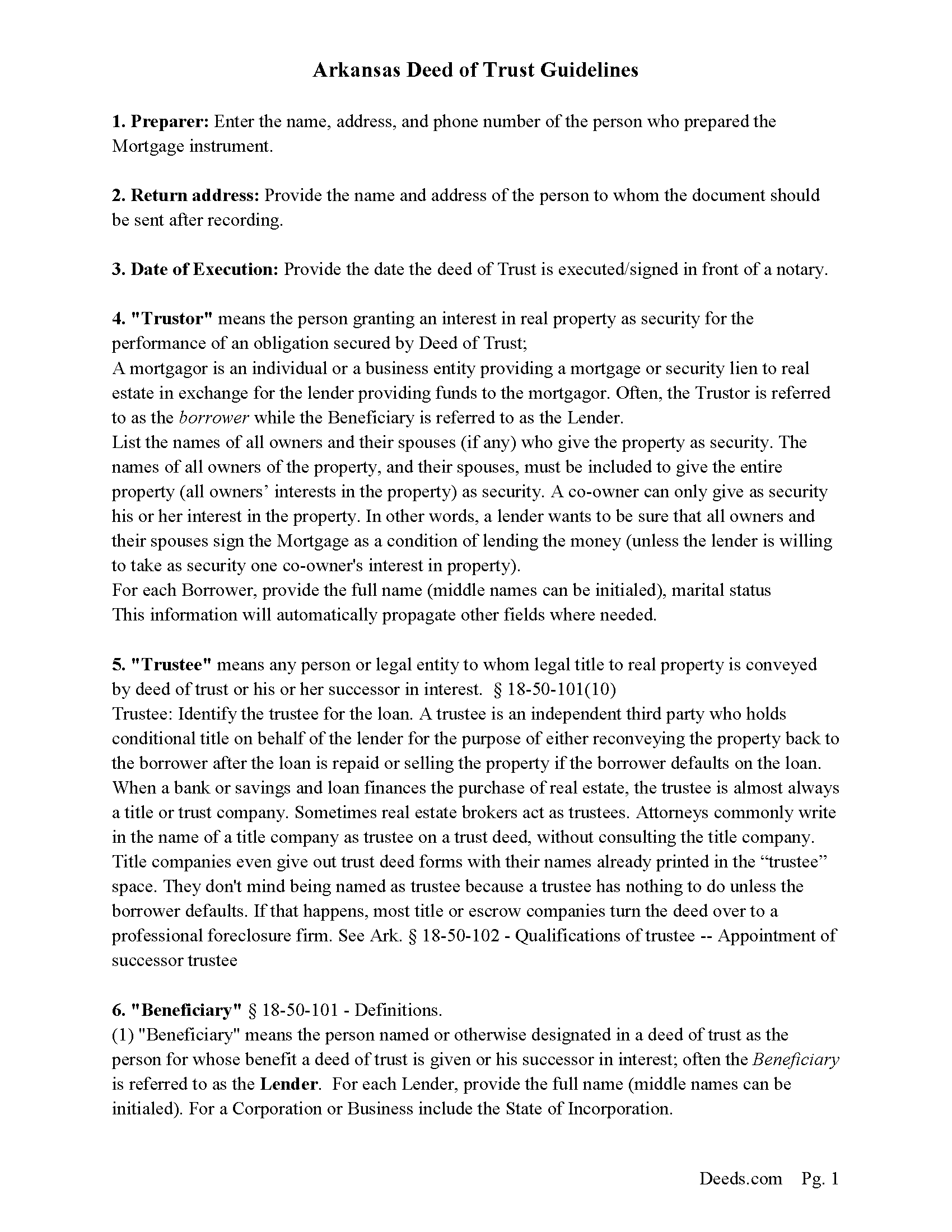

Stone County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

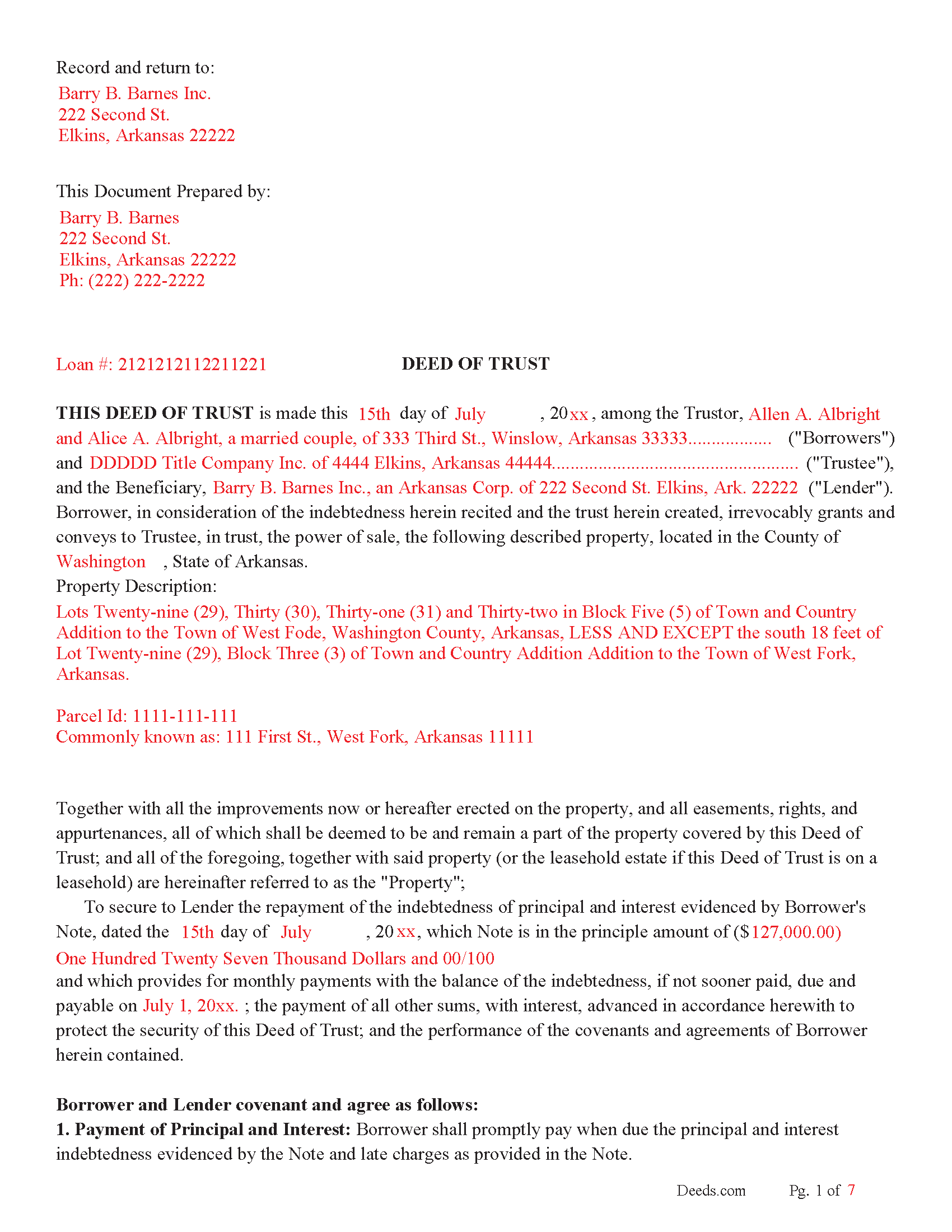

Stone County Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

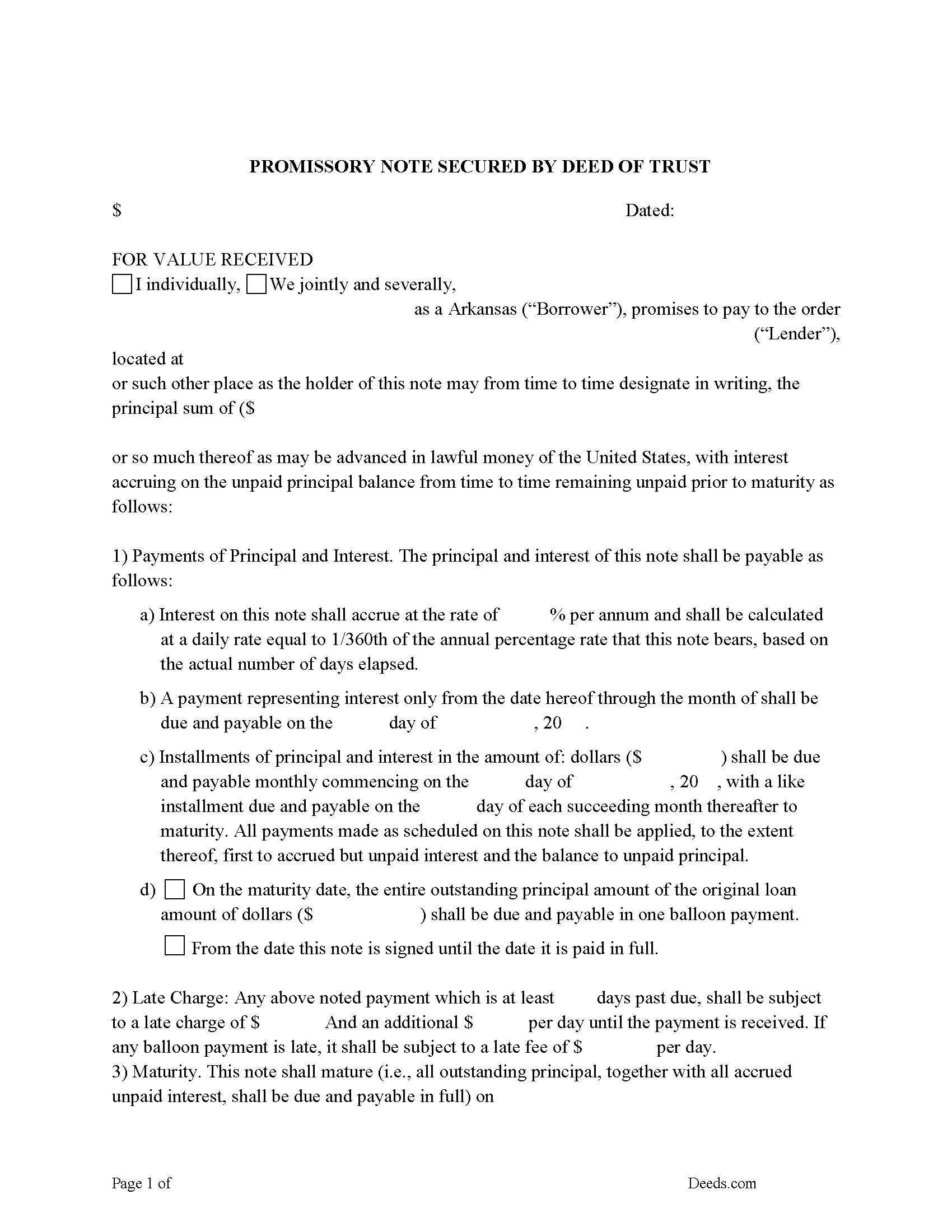

Stone County Promissory Note Form

Promissory Note-secured.

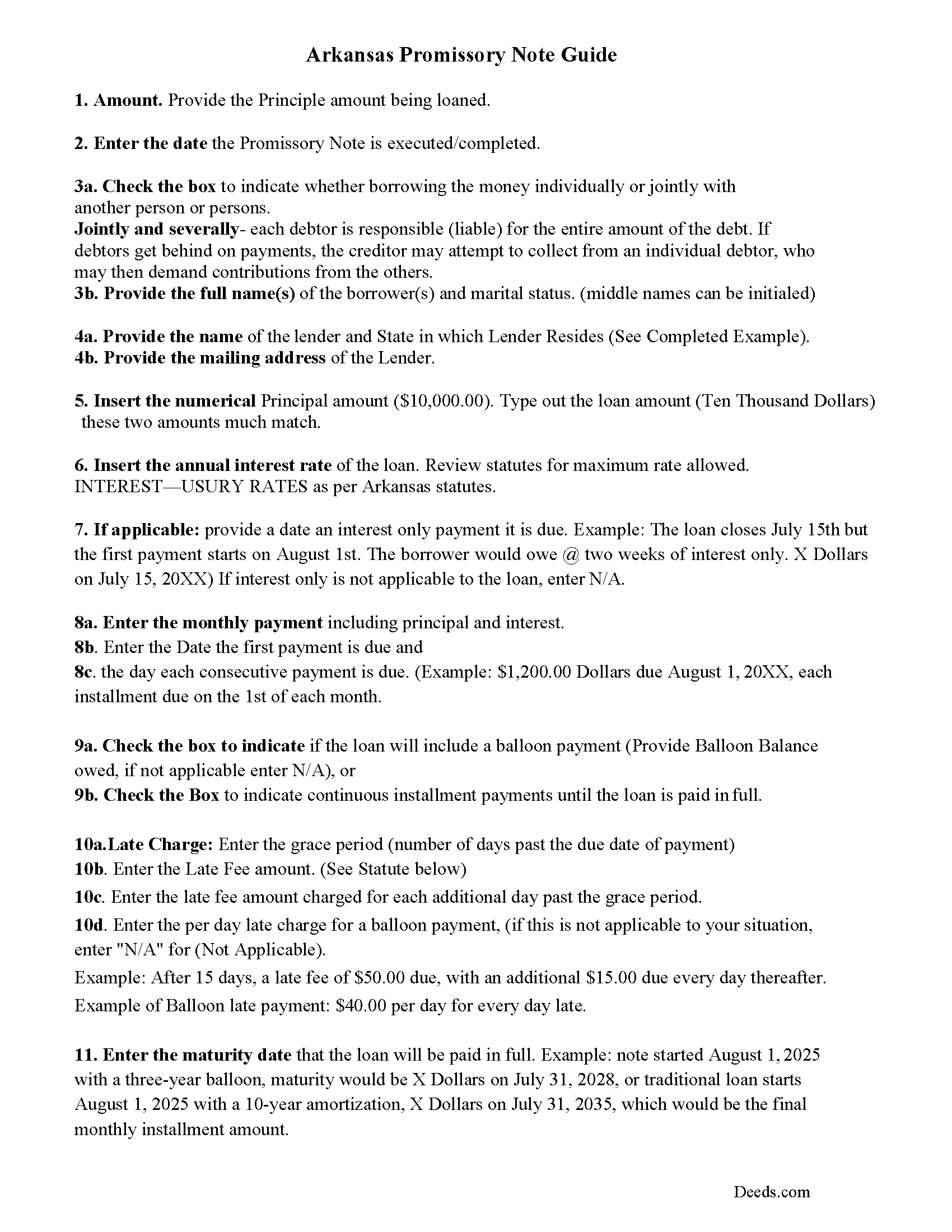

Stone County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

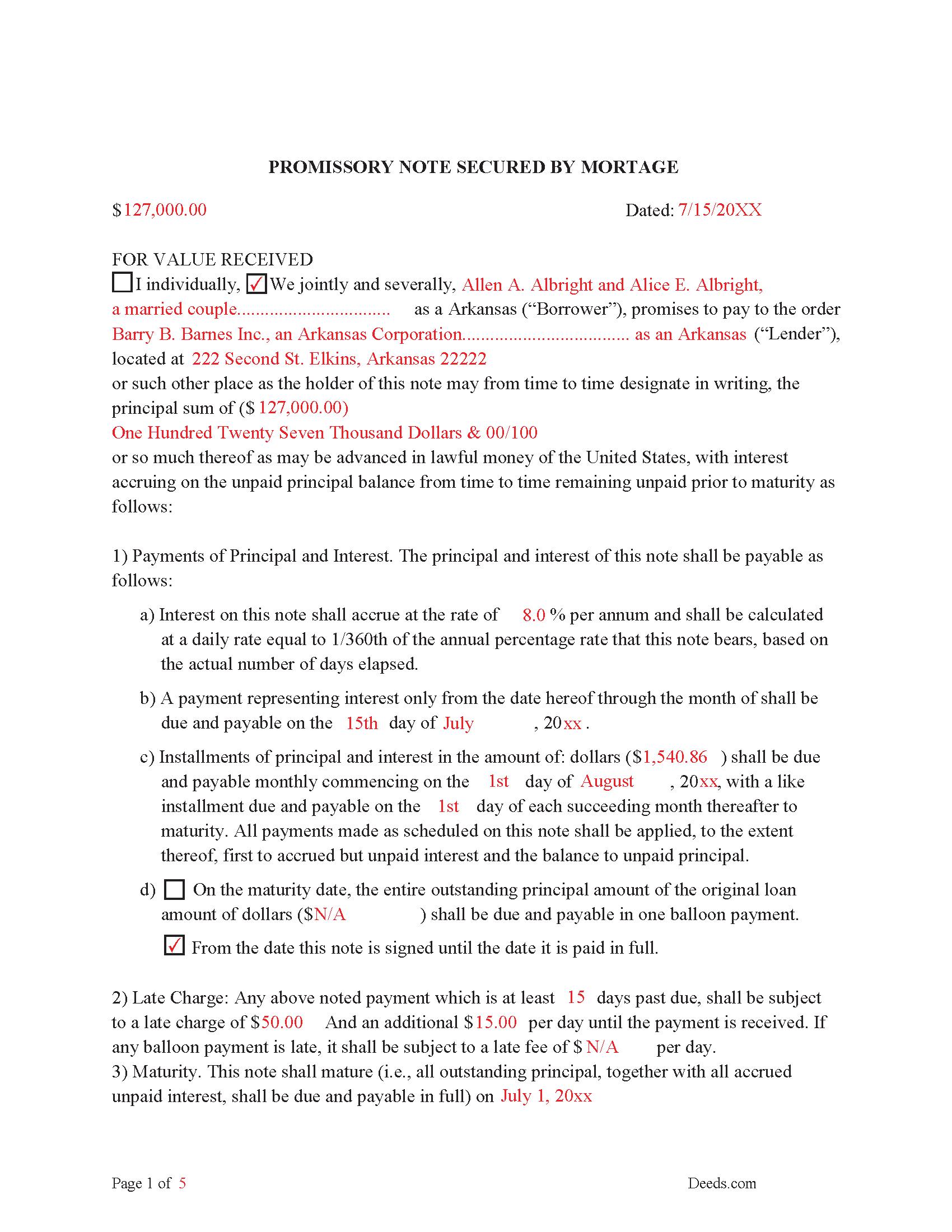

Stone County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

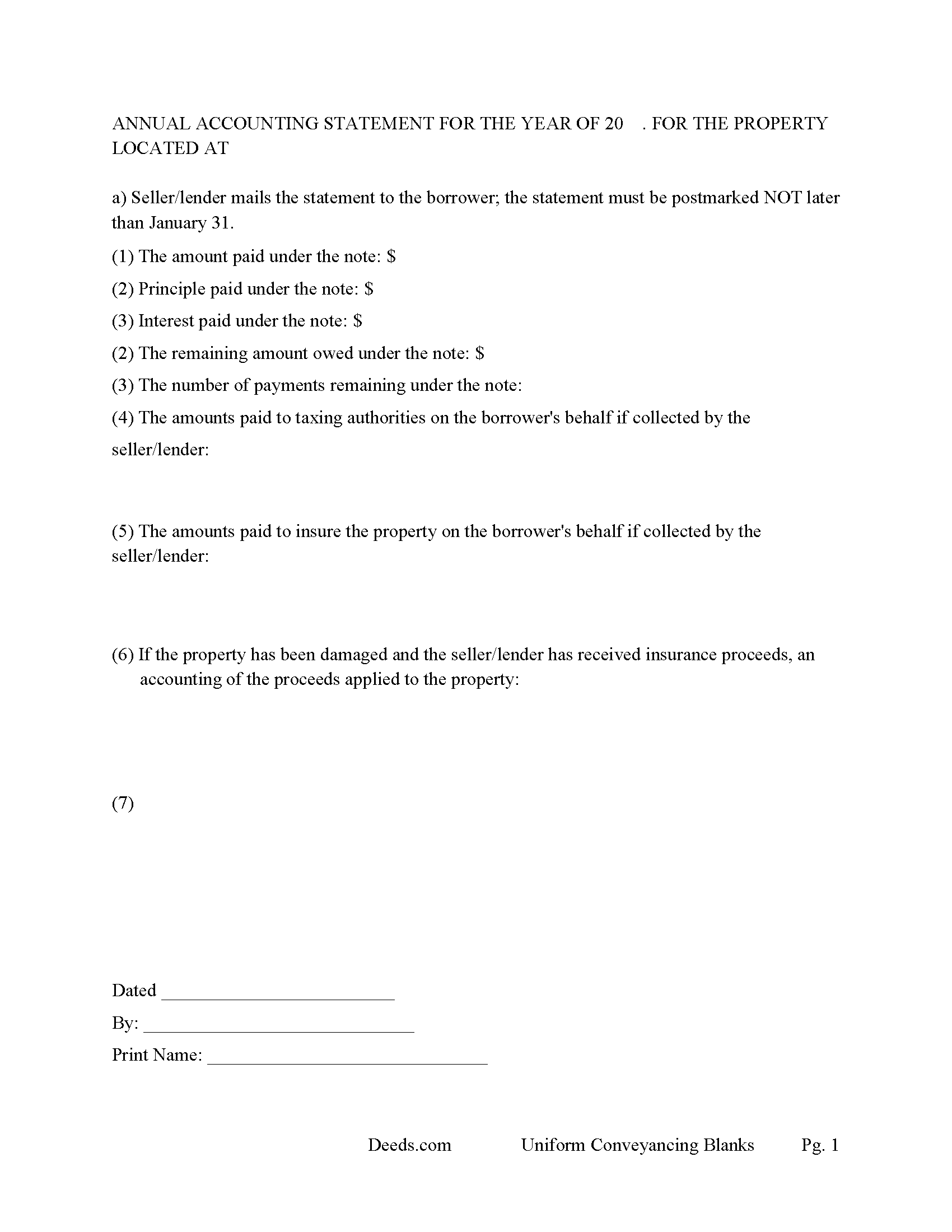

Stone County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

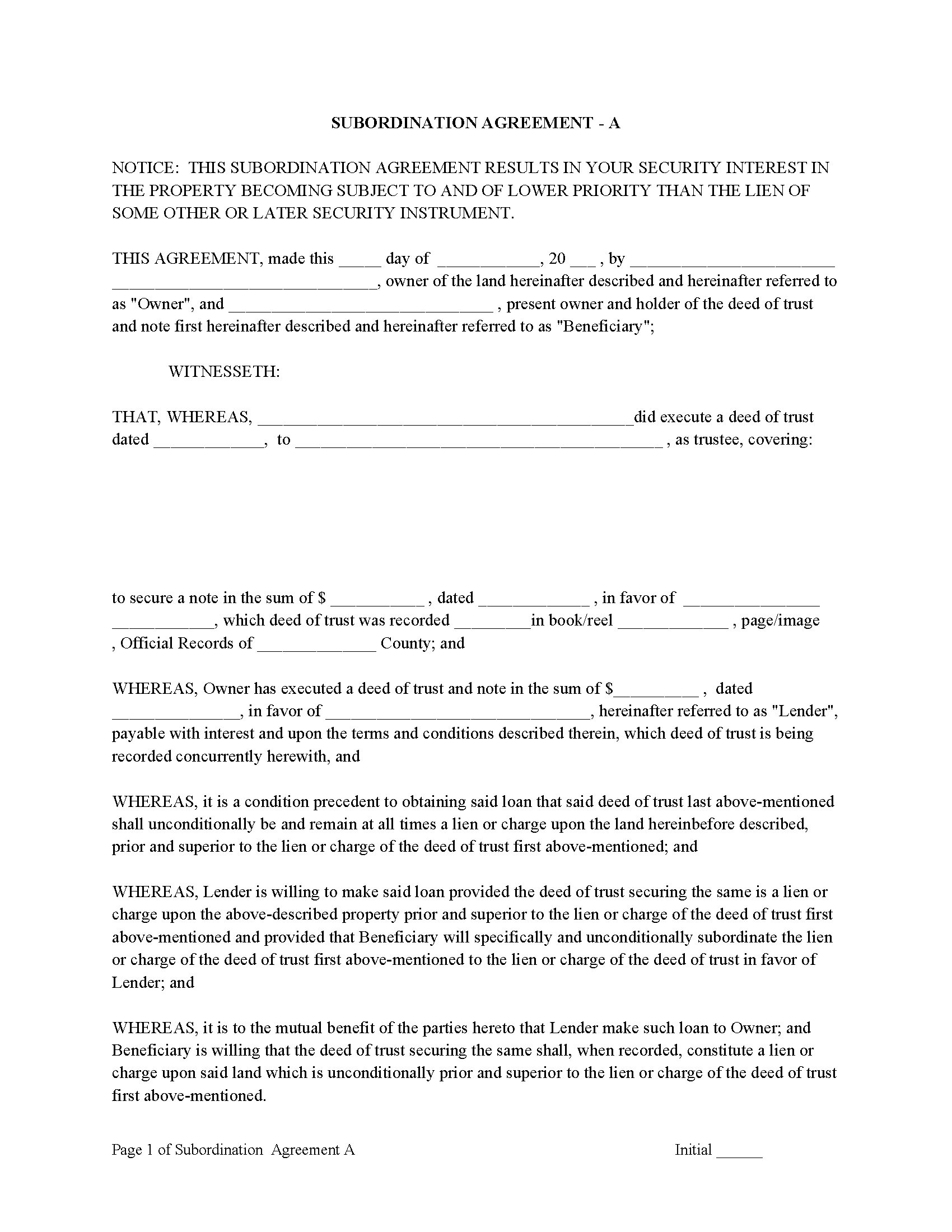

Stone County Subordination Argeements

Used to place priority on claim of debt. Included are 4 separate agreements for unique situations. If needed, add to Deed of Trust as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Stone County documents included at no extra charge:

Where to Record Your Documents

Stone County Circuit Clerk

Mountain View, Arkansas 72560

Hours: 8:30 to 4:30 M-F

Phone: (870) 269-3271

Recording Tips for Stone County:

- Bring extra funds - fees can vary by document type and page count

- Request a receipt showing your recording numbers

- Ask about their eRecording option for future transactions

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Stone County

Properties in any of these areas use Stone County forms:

- Fifty Six

- Fox

- Marcella

- Mountain View

- Onia

- Pleasant Grove

- Timbo

Hours, fees, requirements, and more for Stone County

How do I get my forms?

Forms are available for immediate download after payment. The Stone County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stone County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stone County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stone County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stone County?

Recording fees in Stone County vary. Contact the recorder's office at (870) 269-3271 for current fees.

Questions answered? Let's get started!

("Deed of trust" means a deed conveying real property in trust to secure the performance of an obligation of the grantor or any other person named in the deed to a beneficiary and conferring upon the trustee a power of sale for breach of an obligation of the grantor contained in the deed of trust;) (Ark. Statute 18-50-101(2)) A power of sale allows for a non-judicial foreclosure in the case of default, saving time and expense. If Lender invokes the power of sale, Lender shall execute or cause Trustee to execute the written notice of the occurrence of any event of default and Lender's election to cause the Property to be sold and shall cause such notice to be recorded in each county in which the Property or some portion thereof is located. Lender or Trustee shall mail copies of such notice in the manner prescribed by applicable law. 18-50-103.

(A trustee may not sell the trust property unless: The deed of trust or mortgage is filed for record with the recorder of the county in which the trust property is situated;) (Ark. Statute 18-50-103(1))

A deed of trust contains three (3) parties: Grantor/Trustor, Trustee, and Beneficiary/Lender

"Grantor" means the person conveying an interest in real property by a mortgage or deed of trust as security for the performance of an obligation; (Ark. Statute 18-50-101 (3))

"Beneficiary" means the person named or otherwise designated in a deed of trust as the person for whose benefit a deed of trust is given or his successor in interest; (Ark. Statute 18-50-101 (1))

("Trustee" means any person or legal entity to whom legal title to real property is conveyed by deed of trust or his or her successor in interest.) Examples of how a Trustee can be chosen are given. (Ark. Statute 18-50-101 (10)).

14-15-402. Instruments to be recorded. (a) It shall be the duty of each recorder to record in the books provided for his or her office all deeds, mortgages, conveyances, deeds of trust, bonds, covenants, defeasances, affidavits, powers of attorney, assignments, contracts, agreements, leases, or other instruments of writing of, or writing concerning, any lands and tenements or goods and chattels, which shall be proved or acknowledged according to law, that are authorized to be recorded in his or her office.

A deed of trust secured by a promissory note with stringent default terms can be advantageous to the lender in the case of a default. Use this form for financing residential, condominiums, rental units (up to 4), planned unit developments, and small commercial.

(Arkansas Deed of Trust Package includes forms, guidelines, and completed examples) For use in Arkansas only.

Important: Your property must be located in Stone County to use these forms. Documents should be recorded at the office below.

This Deed of Trust and Promissory Note meets all recording requirements specific to Stone County.

Our Promise

The documents you receive here will meet, or exceed, the Stone County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stone County Deed of Trust and Promissory Note form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Elizabeth M.

August 18th, 2021

So fare easy and straight forward

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas D.

April 30th, 2020

The documents themselves are fine and the information provided with them is helpful. I find the actual processing of the documents, however, to be difficult particularly once the document has been saved. First, I note that the box for the date only allows entry of the last 2 digits of the year. Unfortunately, my download only allows me to enter one of the 2 digits required. When I delete it repeatedly, it eventually allows both digits to be entered but puts them in extremely small text and in superscrypt. I have not found a solution to this problem and am not sure the deed can even be recorded with this problem. Another problem is that if you try to revise the document after you have saved it the curser goes to the end of the line after each key entry. This means that there basically is no way to efficiently save the document for reworking later since you will have to delete everything you have entered in the text box unless you only need to make a single keystroke change or are willing to replace the curser after each entry. Try that with a long property description! Please note that I am using a Mac to prepare my documents and perhaps this is part of an "incompatibility problem". However, I didn't see a disclaimer regarding Mac use and so would expect the documents to perform correctly. Overall, I give the program a "2 star" rating because I am experiencing significant difficulties in entering dates in the documents even before saving them and because saving your work for later revision appears to be basically unworkable.

Thank you for your feedback Thomas, we appreciate you being specific about the issues you encountered. Adobe and Mac have a fairly long history of issues working together.

Gary A.

March 15th, 2019

I believe this is the way to go without the need of a lawyer. Fast downloads, very informative, Now the work starts

Thank you Gary.

Margaret S.

February 19th, 2025

Your service is second to none. Your website is user-friendly, easy to navigate and within minutes I had the forms I needed. Keep up the good work!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kimberly M.

November 12th, 2019

Love Deeds.com. So easy to work with and quick as well.

Thank you again for your kind words! Have a fantastic day!

Joseph D.

July 1st, 2022

Exellent and easy! Thqanks!

Thank you for your feedback. We really appreciate it. Have a great day!

Gerlinde H.

June 18th, 2019

This was fantastic. I downloaded the document, filled it out, printed it, had it notarized and drove to the recorders office and had it recorded within less than 15 minutes. Instructions are precise and easy to understand. You saved me hundreds of dollars a lawyer would have charged for the same work.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Larry L.

September 18th, 2023

Easy, quick and responsive for recording purposes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joey S.

March 5th, 2022

This is the easiest process ever!

Thank you!

Gerald C.

May 25th, 2019

Pros, quick purchase and document availability including instructions and examples. Cons, For the cert. of trust, the form would not accept the length of our trust name with no way to get around. The pdf file printing did not meet the requirements for 2.5" top margin and .5" other margins as well as the 10pt font size as the form information was shrunk down even when normal printing.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary J.

September 15th, 2020

Whomever "KCH" is, that person was of great help. It took me several tries due my inexperience with ADOBE SCAN, but that certainly is no fault of yours!! KVH was very patient with me, and in fact resolved the things I was doing wrong for me, without my even requesting the assistance.

Thank you!

Dennis S.

October 24th, 2020

I am still working on the forms. I am having problems doing the forms as you can only save as pdf and it is difficult to change or modify the pdf. You have to purchase a pdf convertor program. but all seems to be there to do the deed submittals.

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara E.

March 2nd, 2021

I'm not sure if KVH is the identity to the person who helped me. I hope it is so you know just how much she helped She was great and very patient with me and with Wayne County Register of Deeds. I'm am really glad I had her on my team in this long endeavor.

Thank you for the kinds words Barbara. We appreciate you.

jonathan f.

June 12th, 2020

I had a one time event. The website instructions were straightforward; the job was completed quickly; the cost was modest. I am completely satisfied and will not hesitate to use again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Nancy D.

July 30th, 2019

Program works well. Saves a lot of time trying to find out what you need to do.

Thank you!