Hot Spring County Deed of Trust with Installment of Taxes and Insurance Form (Arkansas)

All Hot Spring County specific forms and documents listed below are included in your immediate download package:

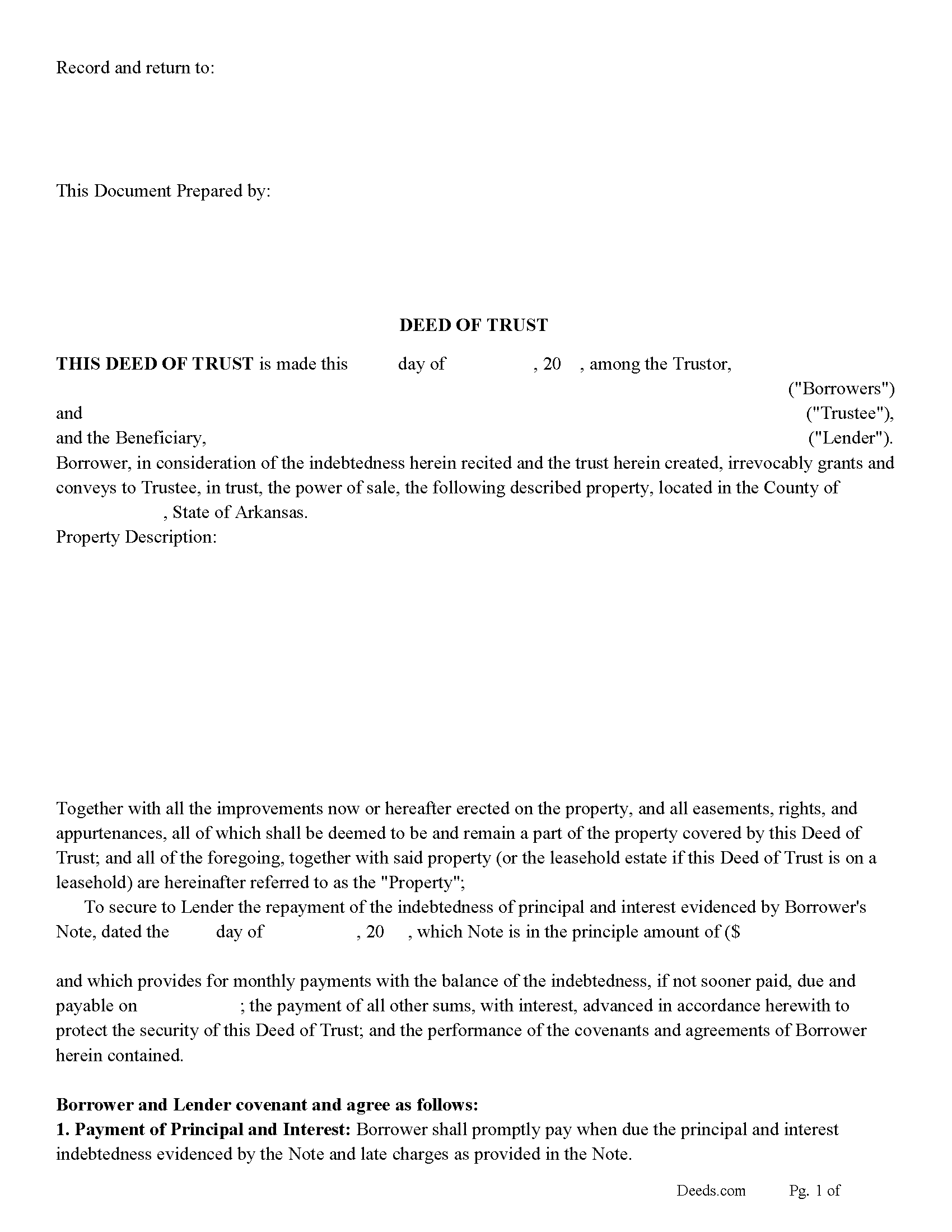

Deed of Trust with Installment of Taxes and Insurance Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Hot Spring County compliant document last validated/updated 6/30/2025

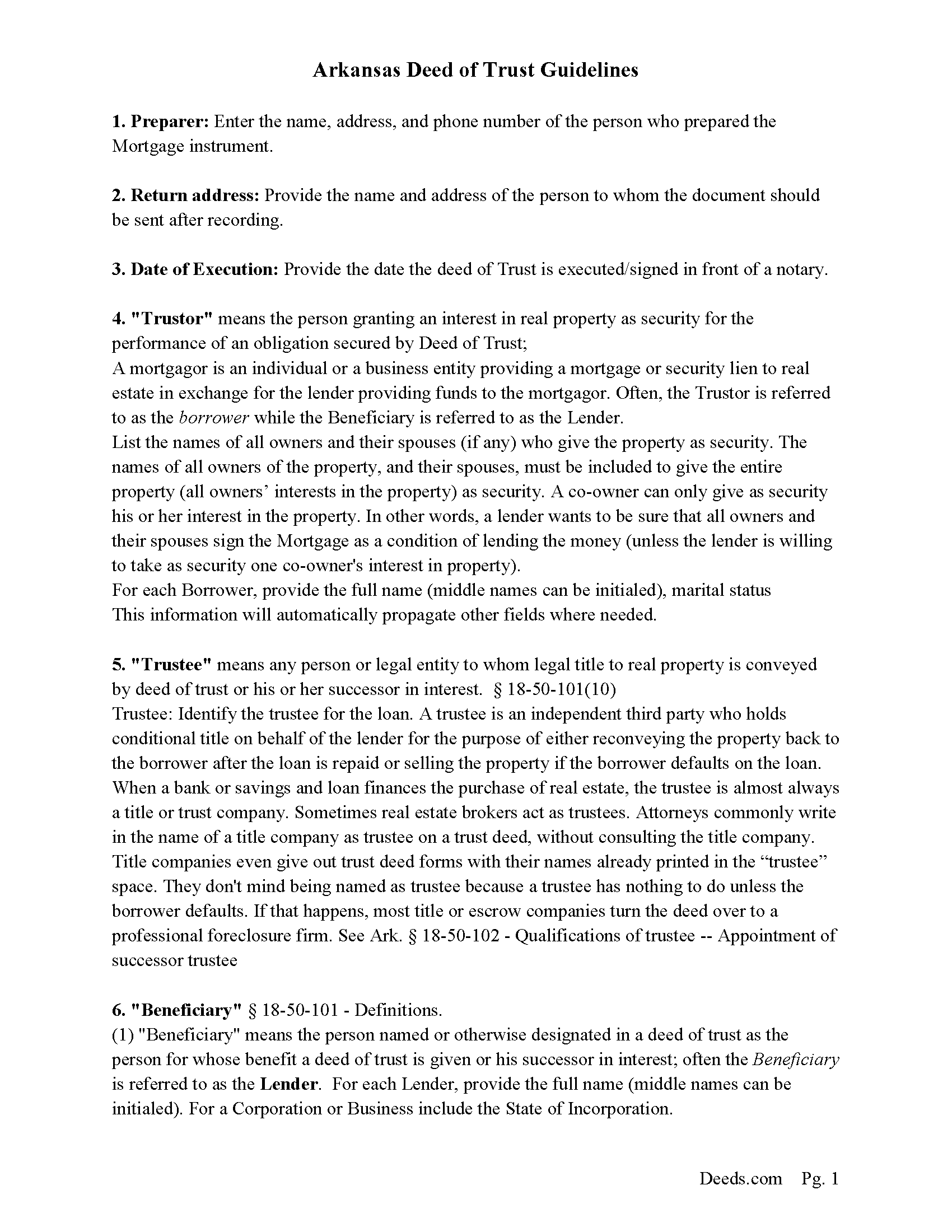

Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

Included Hot Spring County compliant document last validated/updated 7/2/2025

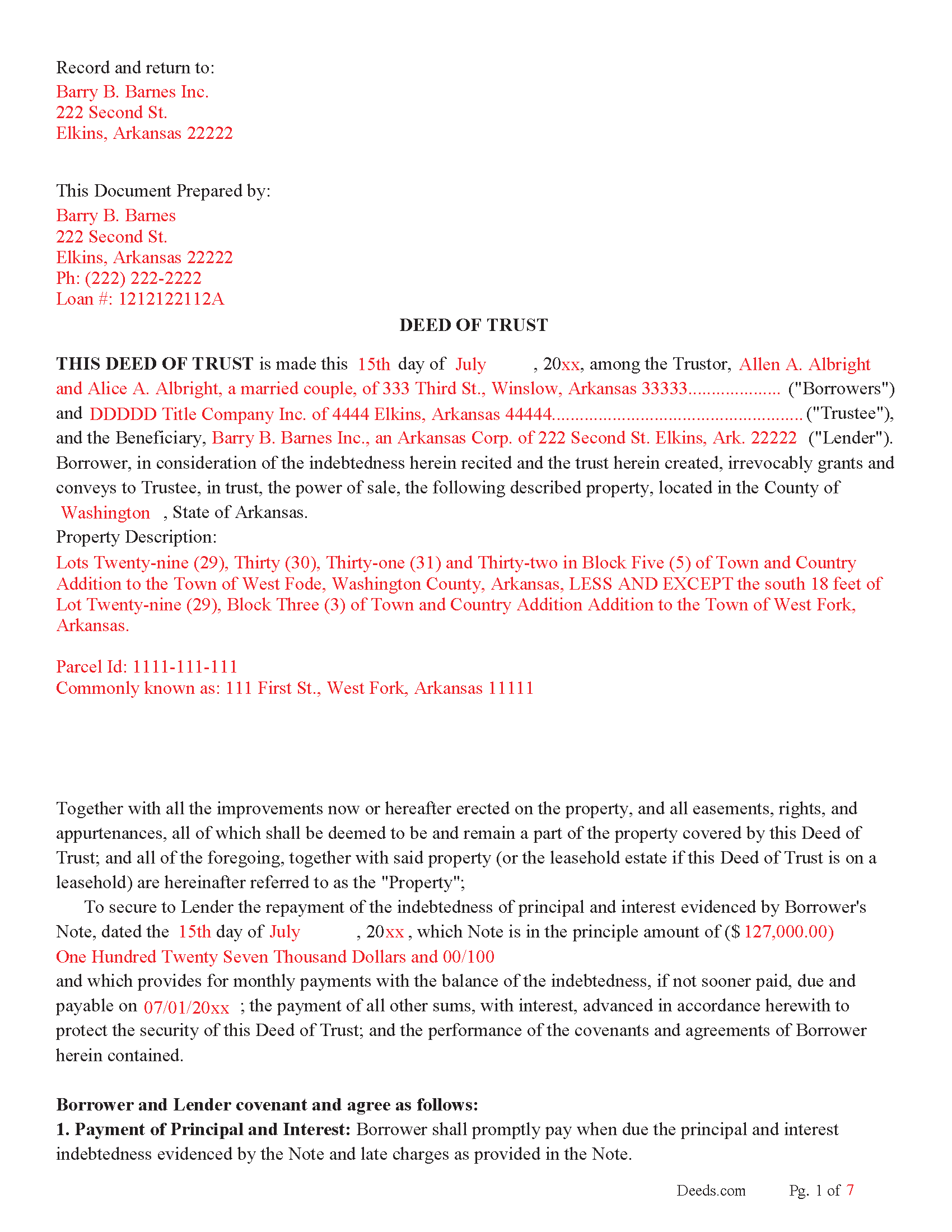

Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

Included Hot Spring County compliant document last validated/updated 2/21/2025

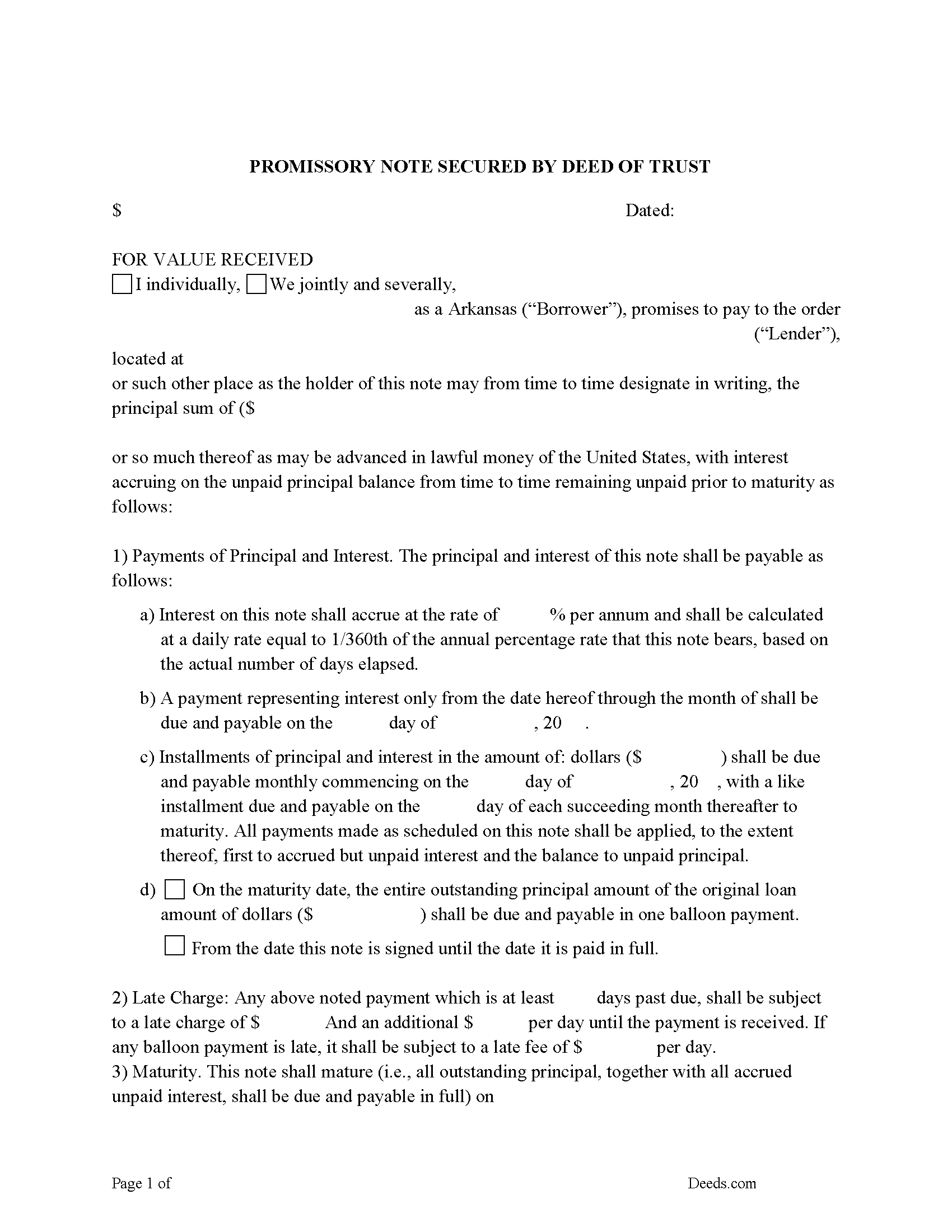

Promissory Note Form

Arkansas Promissory Note.

Included Hot Spring County compliant document last validated/updated 7/2/2025

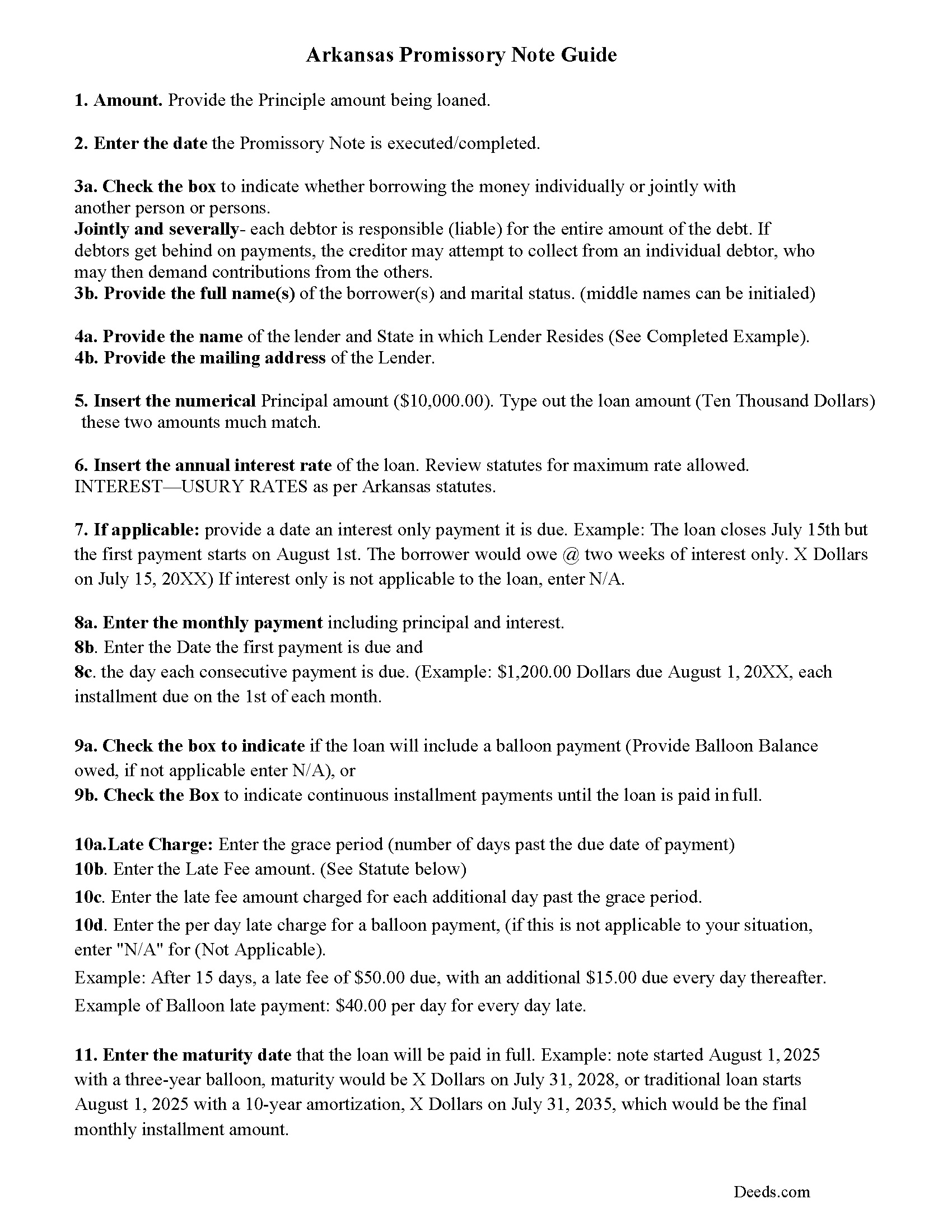

Promissory Note Guidelines

Line by line guide explaining every blank on the form.

Included Hot Spring County compliant document last validated/updated 3/7/2025

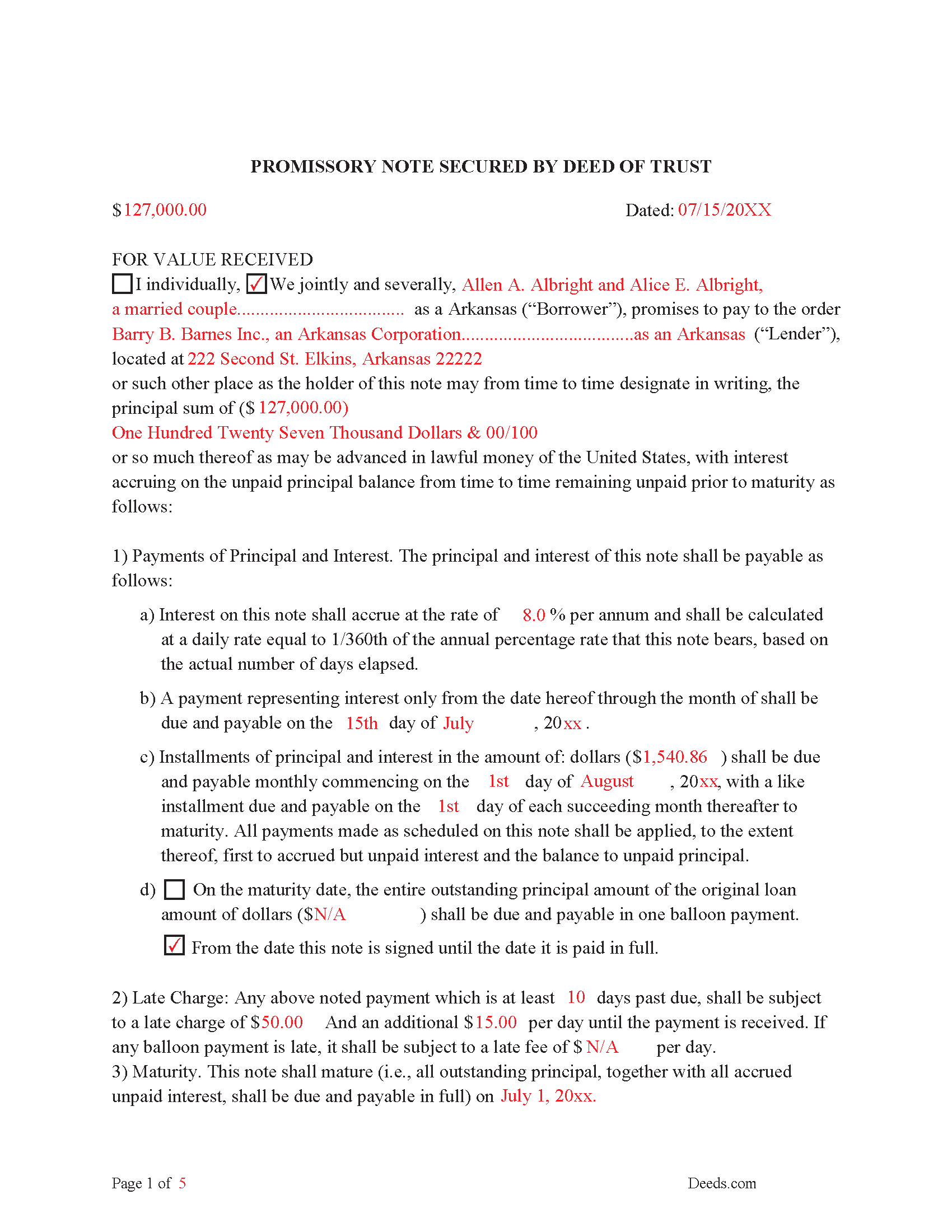

Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

Included Hot Spring County compliant document last validated/updated 5/13/2025

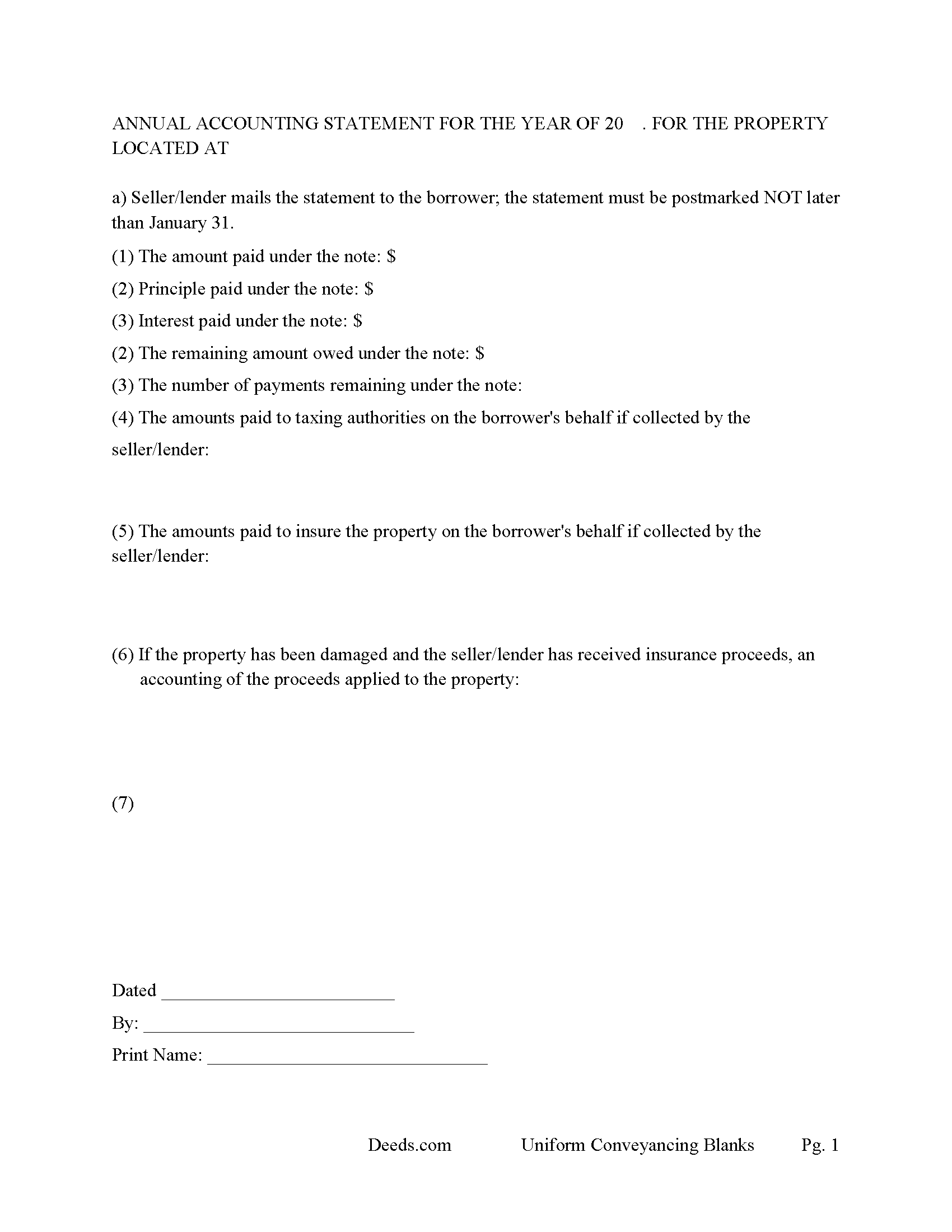

Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

Included Hot Spring County compliant document last validated/updated 4/22/2025

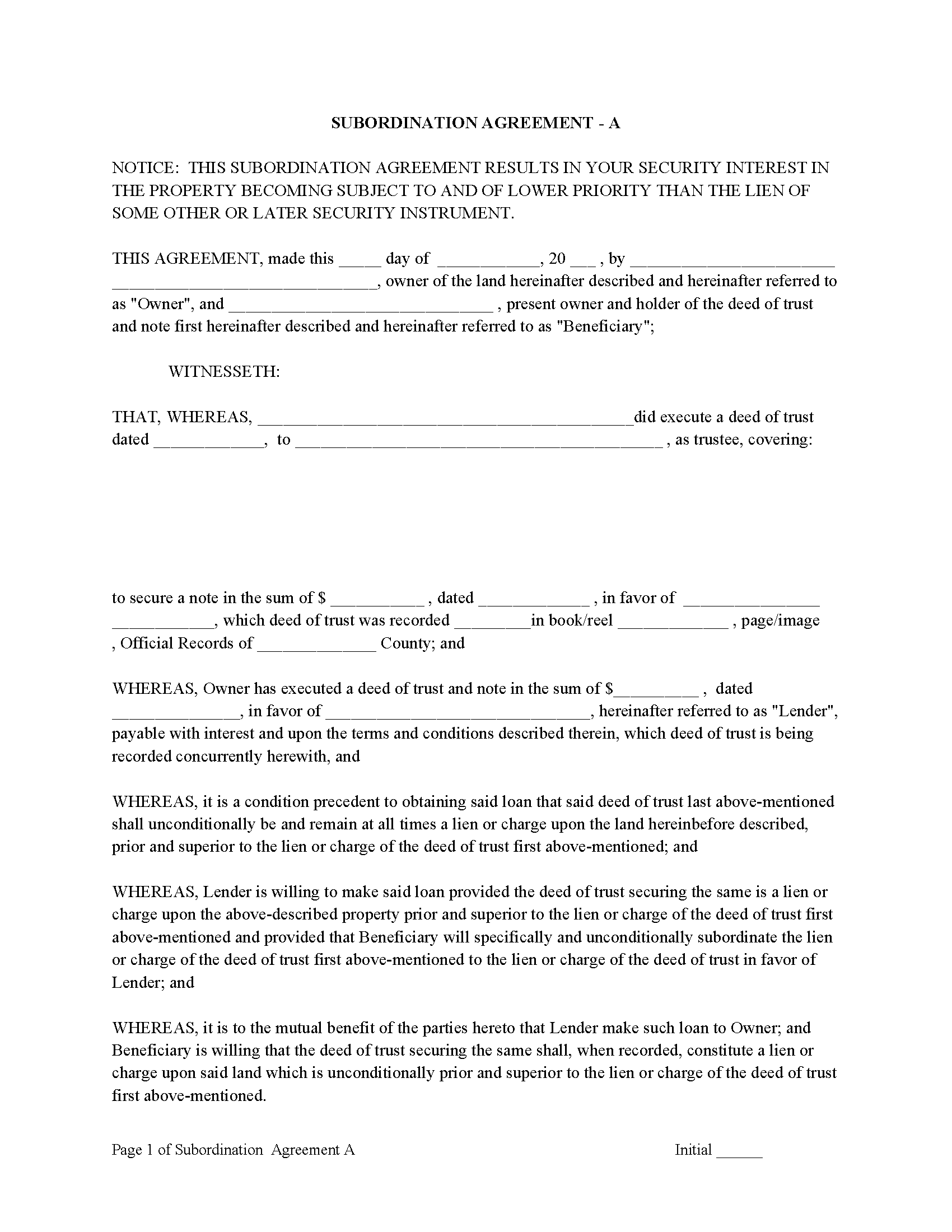

Subordination Argeements

Used to place priority on claim of debt. Included are 4 separate agreements for unique situations. If needed, add to Deed of Trust as an addendum or rider.

Included Hot Spring County compliant document last validated/updated 7/3/2025

The following Arkansas and Hot Spring County supplemental forms are included as a courtesy with your order:

When using these Deed of Trust with Installment of Taxes and Insurance forms, the subject real estate must be physically located in Hot Spring County. The executed documents should then be recorded in the following office:

Hot Spring County Circuit Clerk

210 Locust St, Malvern, Arkansas 72104

Hours: 8:30 to 4:00 M-F

Phone: (501) 332-2281

Local jurisdictions located in Hot Spring County include:

- Bismarck

- Bonnerdale

- Donaldson

- Friendship

- Jones Mill

- Malvern

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Hot Spring County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Hot Spring County using our eRecording service.

Are these forms guaranteed to be recordable in Hot Spring County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hot Spring County including margin requirements, content requirements, font and font size requirements.

Can the Deed of Trust with Installment of Taxes and Insurance forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Hot Spring County that you need to transfer you would only need to order our forms once for all of your properties in Hot Spring County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Hot Spring County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Hot Spring County Deed of Trust with Installment of Taxes and Insurance forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

("Deed of trust" means a deed conveying real property in trust to secure the performance of an obligation of the grantor or any other person named in the deed to a beneficiary and conferring upon the trustee a power of sale for breach of an obligation of the grantor contained in the deed of trust;) (Ark. Statute 18-50-101(2)) A power of sale allows for a non-judicial foreclosure in the case of default, saving time and expense. If Lender invokes the power of sale, Lender shall execute or cause Trustee to execute the written notice of the occurrence of any event of default and Lender's election to cause the Property to be sold and shall cause such notice to be recorded in each county in which the Property or some portion thereof is located. Lender or Trustee shall mail copies of such notice in the manner prescribed by applicable law. 18-50-103.

(A trustee may not sell the trust property unless: The deed of trust or mortgage is filed for record with the recorder of the county in which the trust property is situated;) (Ark. Statute 18-50-103(1))

A deed of trust contains three (3) parties: Grantor/Trustor, Trustee, and Beneficiary/Lender

"Grantor" means the person conveying an interest in real property by a mortgage or deed of trust as security for the performance of an obligation; (Ark. Statute 18-50-101 (3))

"Beneficiary" means the person named or otherwise designated in a deed of trust as the person for whose benefit a deed of trust is given or his successor in interest; (Ark. Statute 18-50-101 (1))

("Trustee" means any person or legal entity to whom legal title to real property is conveyed by deed of trust or his or her successor in interest.) Examples of how a Trustee can be chosen are given. (Ark. Statute 18-50-101 (10)).

14-15-402. Instruments to be recorded. (a) It shall be the duty of each recorder to record in the books provided for his or her office all deeds, mortgages, conveyances, deeds of trust, bonds, covenants, defeasances, affidavits, powers of attorney, assignments, contracts, agreements, leases, or other instruments of writing of, or writing concerning, any lands and tenements or goods and chattels, which shall be proved or acknowledged according to law, that are authorized to be recorded in his or her office.

THIS DEED OF TRUST DIFFERS IN THAT IT ALLOWS THE LENDER TO COLLECT TAXES AND INSURANCE PAYMENTS MONTHLY. THIS GIVES THE LENDER MORE CONTROL, FOR EXAMPLE: A LENDER MIGHT NOT REALIZE TAXES AND/OR INSURANCE PAYMENTS ARE IN ARREARS UNTIL SIX (6) MONTHS AFTER DELINQUENCY. THIS FORM IS CONSISTENT WITH INVESTOR OR OWNER FINANCING.

Funds for Taxes and Insurance: Subject to applicable law or a written waiver by Lender, Borrower shall pay to lender on the day monthly payments of principal and interest are payable under the Note, until the Note is paid in full, a sum ("Funds") equal to one twelfth (1/12) of the yearly taxes and assessments which may attain priority over this Deed of Trust, and ground rents on the Property, if any, plus one twelfth (1/12) of yearly premium installments of hazard insurance, plus one twelfth (1/12) of yearly premium installments for mortgage insurance, if any, all as reasonably estimated initially and from time to time by Lender on the basis of assessments and bills and reasonable estimates thereof.

For use in Arkansas only.

Our Promise

The documents you receive here will meet, or exceed, the Hot Spring County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hot Spring County Deed of Trust with Installment of Taxes and Insurance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

Roy M.

November 4th, 2021

Excellent service. Easy to use

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Annette H.

April 7th, 2022

Clear directions. Giving a sample filled-in set of forms was great! Economical cost. Will refer others & use Deeds.com again.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Diane G.

August 5th, 2022

easy to use

Thank you!

DELORES D.

July 20th, 2022

SO EASY. love that there is an example to follow and instructions.

Thank you!

Mark S.

June 28th, 2022

The forms were easy to fill in and file. I've never filed anything like this before and the forms made it extremely easy.

Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Gail D.

October 22nd, 2024

Very concise and thorough website. Easily navigated and easily affordable.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Moving Forward V.

October 13th, 2023

Great Service!

Thank you!

Karen M.

June 16th, 2020

Nicely Done - Blank Deeds, Guidelines, examples, etc. Thank you as a former paralegal, I am impressed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carolyn G.

September 1st, 2021

I was extremely pleased with this experience, which literally took a minimum amount of time. One recommendation: make certain that when documents are uploaded that they have been received in the appropriate file. The lack of clarity caused me to upload twice or three times. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

William M.

May 30th, 2025

I found your service for deeds easy to use and I was able to quickly get the information (forms, example of forms filled out, and guide for filling out the form) down downloaded. I wish all government services and information was as easy to use as your's was. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David H.

March 16th, 2021

Thank You the form is easy to use.

Thank you!

Dale V.

April 21st, 2019

Great site good price everything easy to use and correct.. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!