Stone County Deed of Trust with Installment of Taxes and Insurance Form

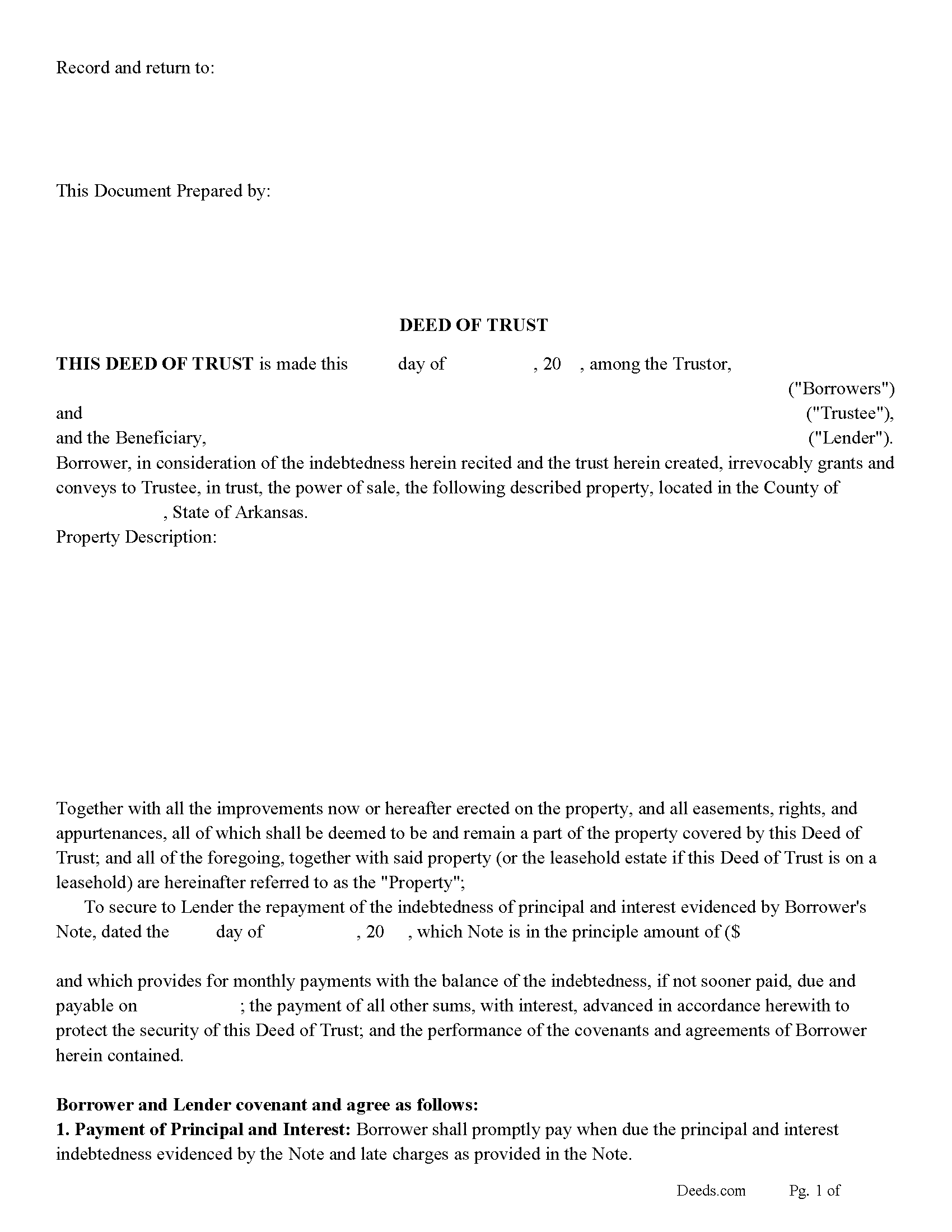

Stone County Deed of Trust with Installment of Taxes and Insurance Form

Fill in the blank form formatted to comply with all recording and content requirements.

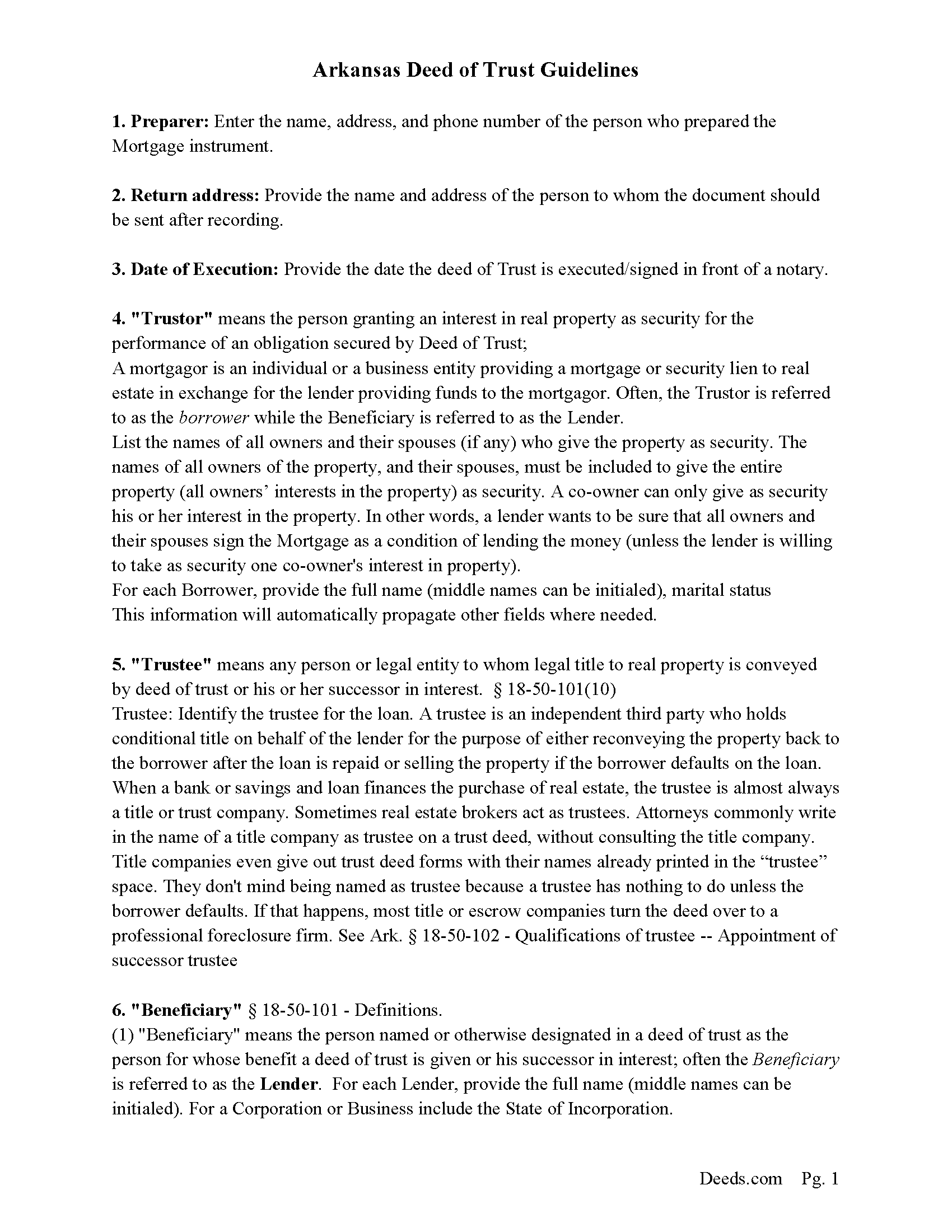

Stone County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

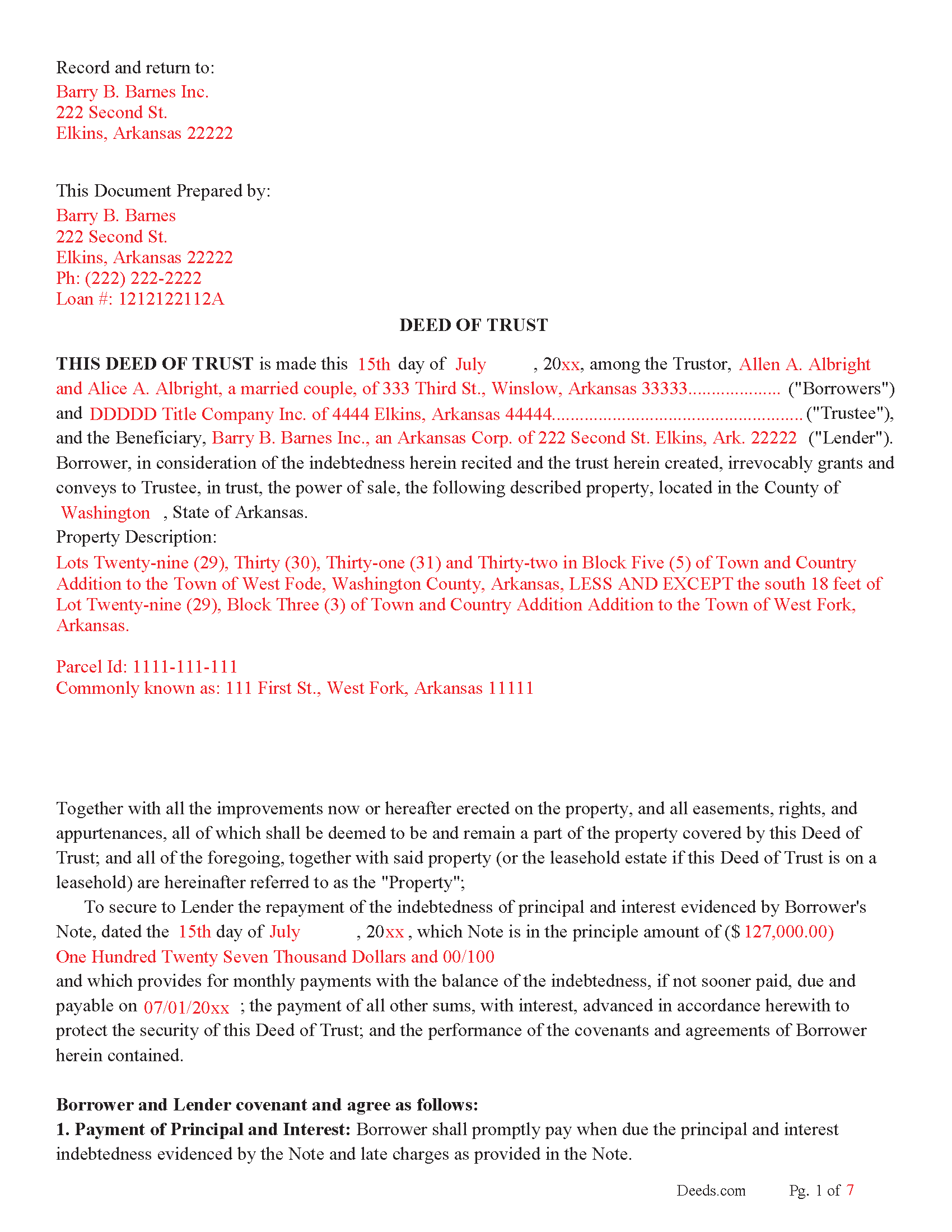

Stone County Completed Example of the Trust Deed Document

Example of a properly completed form for reference.

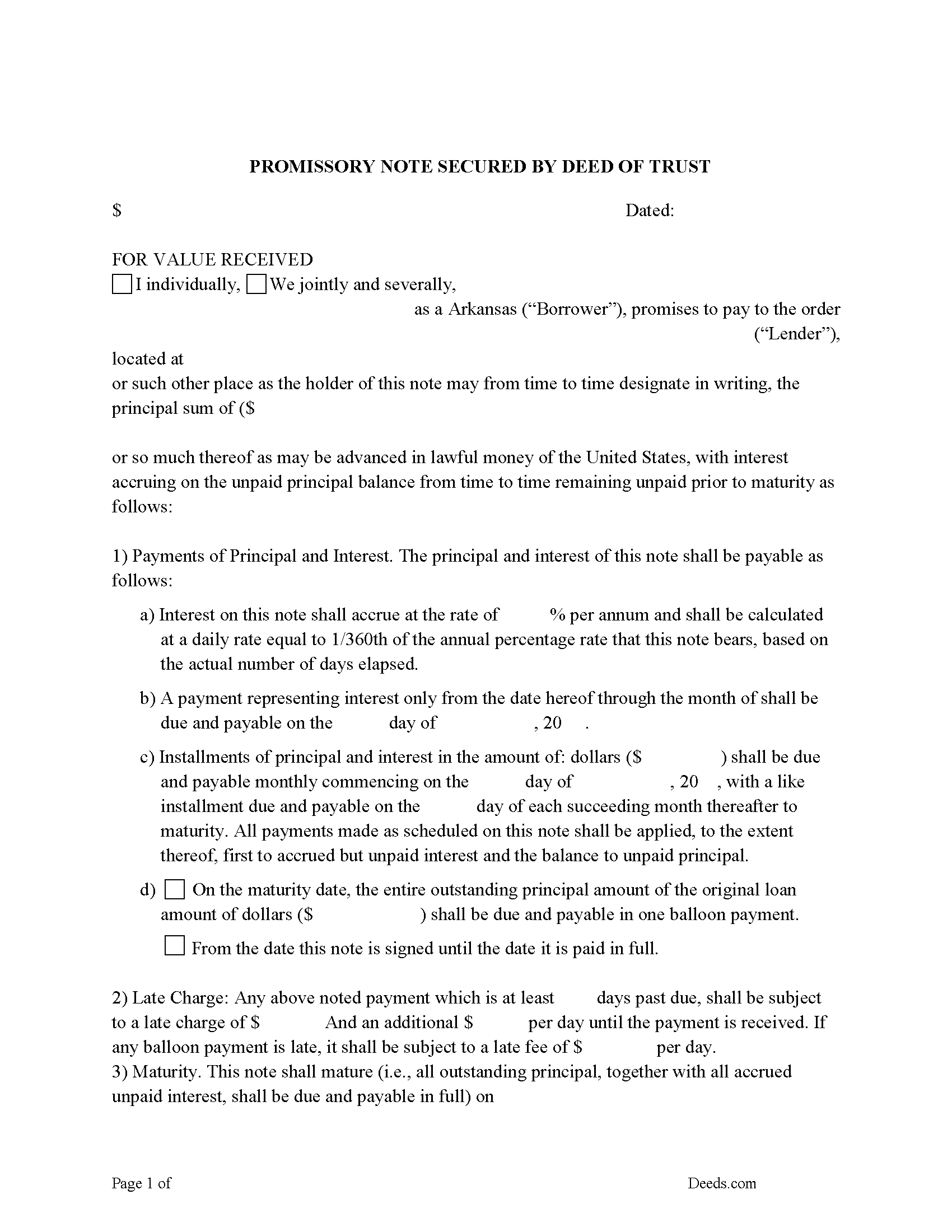

Stone County Promissory Note Form

Arkansas Promissory Note.

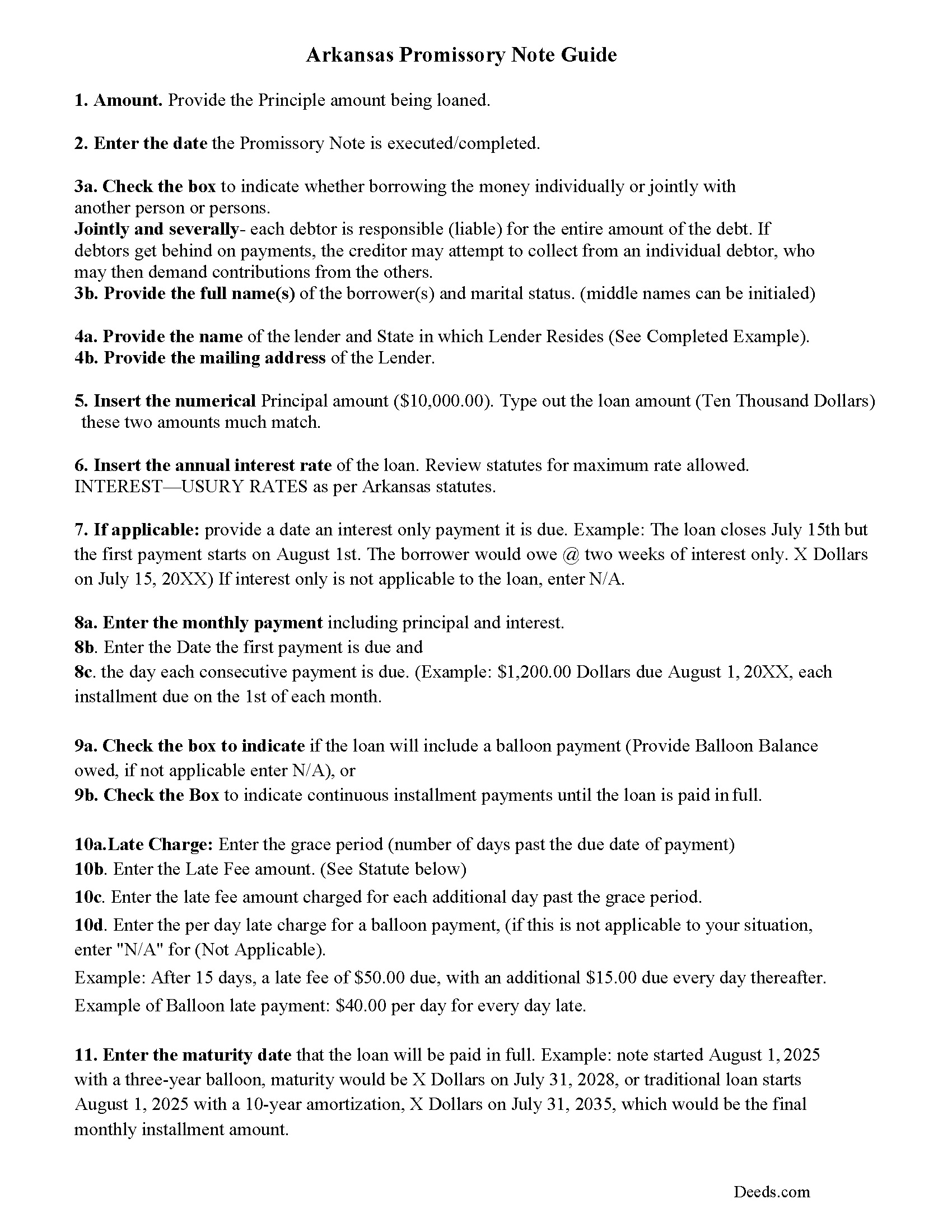

Stone County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

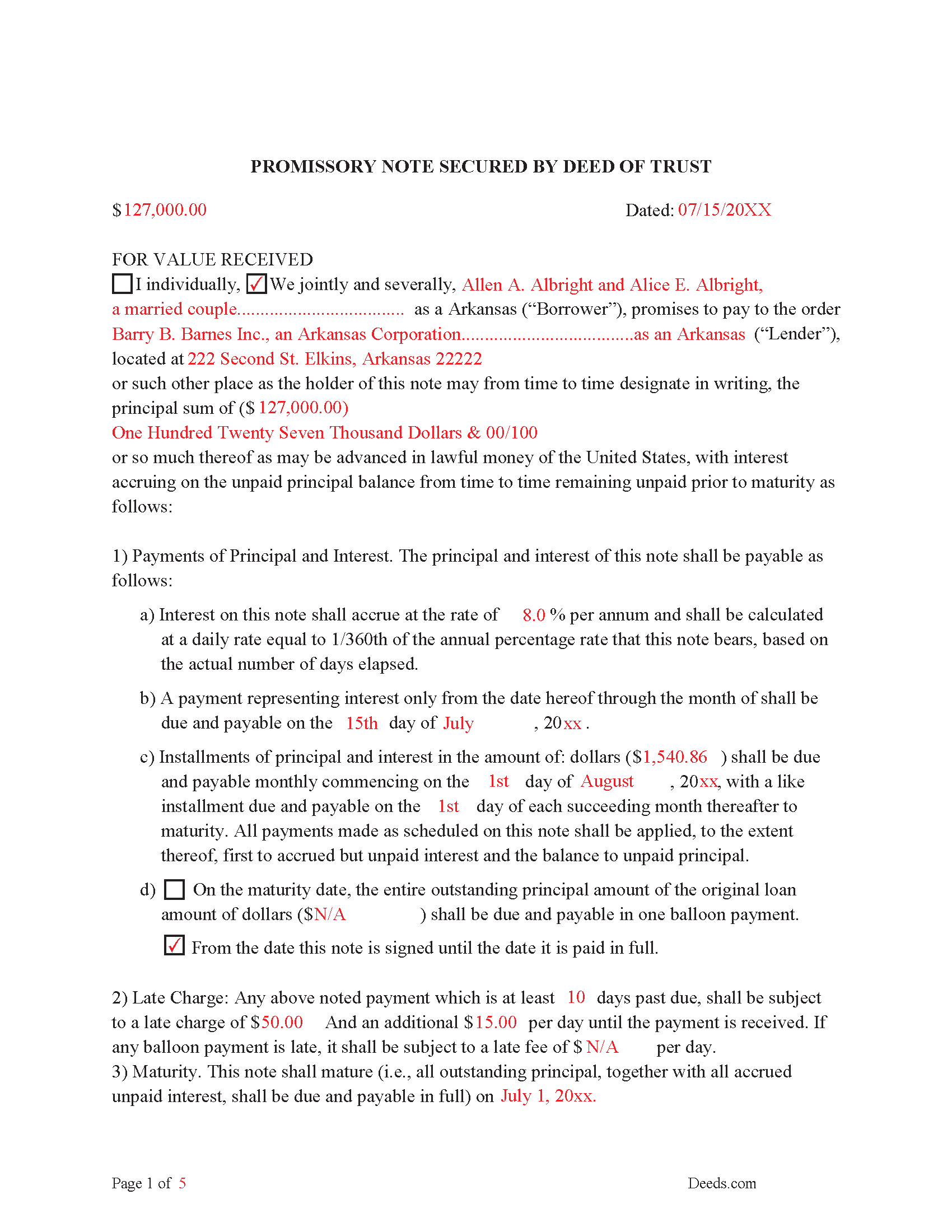

Stone County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

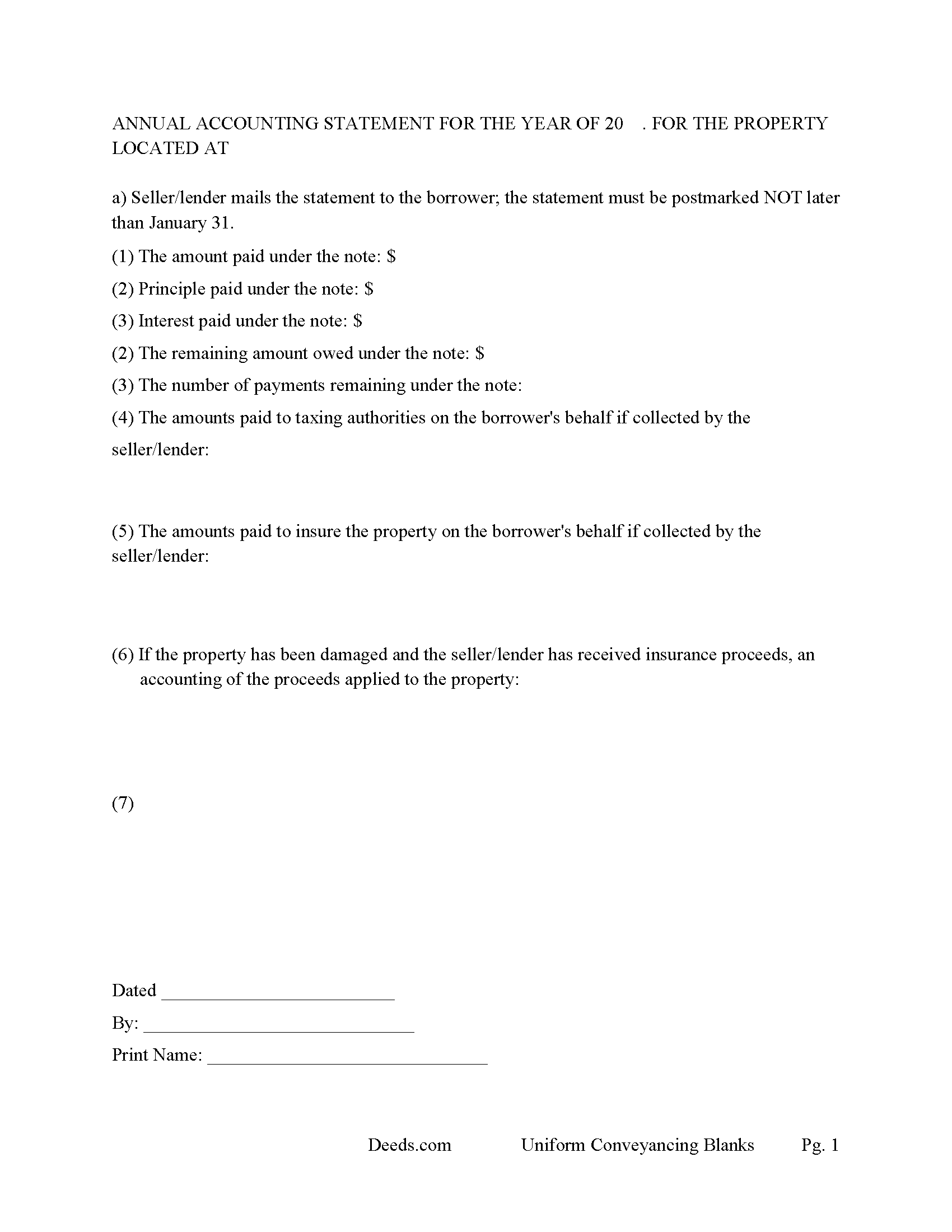

Stone County Annual Accounting Statement Form

Mail to borrower for fiscal year reporting.

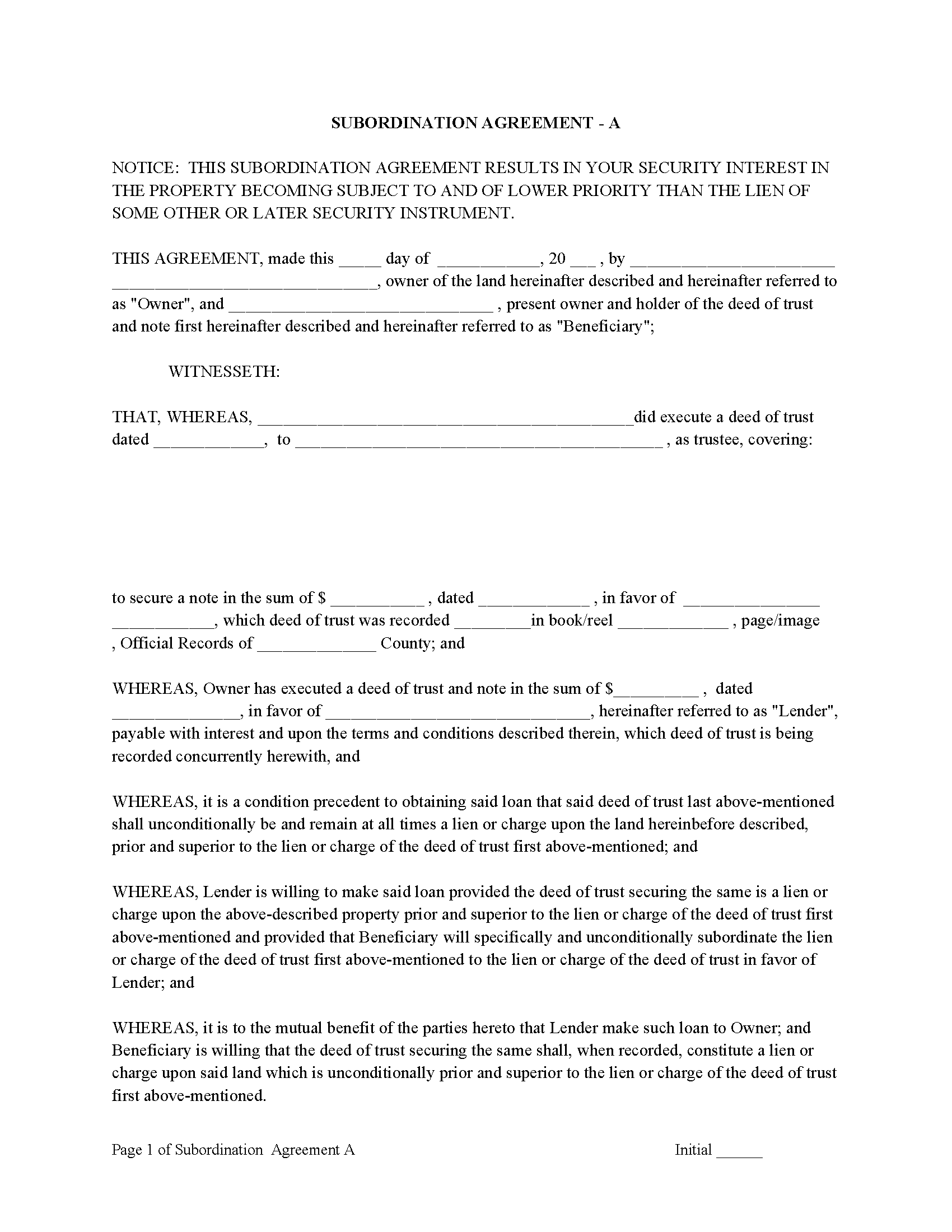

Stone County Subordination Argeements

Used to place priority on claim of debt. Included are 4 separate agreements for unique situations. If needed, add to Deed of Trust as an addendum or rider.

All 8 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Stone County documents included at no extra charge:

Where to Record Your Documents

Stone County Circuit Clerk

Mountain View, Arkansas 72560

Hours: 8:30 to 4:30 M-F

Phone: (870) 269-3271

Recording Tips for Stone County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Request a receipt showing your recording numbers

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Stone County

Properties in any of these areas use Stone County forms:

- Fifty Six

- Fox

- Marcella

- Mountain View

- Onia

- Pleasant Grove

- Timbo

Hours, fees, requirements, and more for Stone County

How do I get my forms?

Forms are available for immediate download after payment. The Stone County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stone County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stone County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stone County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stone County?

Recording fees in Stone County vary. Contact the recorder's office at (870) 269-3271 for current fees.

Questions answered? Let's get started!

("Deed of trust" means a deed conveying real property in trust to secure the performance of an obligation of the grantor or any other person named in the deed to a beneficiary and conferring upon the trustee a power of sale for breach of an obligation of the grantor contained in the deed of trust;) (Ark. Statute 18-50-101(2)) A power of sale allows for a non-judicial foreclosure in the case of default, saving time and expense. If Lender invokes the power of sale, Lender shall execute or cause Trustee to execute the written notice of the occurrence of any event of default and Lender's election to cause the Property to be sold and shall cause such notice to be recorded in each county in which the Property or some portion thereof is located. Lender or Trustee shall mail copies of such notice in the manner prescribed by applicable law. 18-50-103.

(A trustee may not sell the trust property unless: The deed of trust or mortgage is filed for record with the recorder of the county in which the trust property is situated;) (Ark. Statute 18-50-103(1))

A deed of trust contains three (3) parties: Grantor/Trustor, Trustee, and Beneficiary/Lender

"Grantor" means the person conveying an interest in real property by a mortgage or deed of trust as security for the performance of an obligation; (Ark. Statute 18-50-101 (3))

"Beneficiary" means the person named or otherwise designated in a deed of trust as the person for whose benefit a deed of trust is given or his successor in interest; (Ark. Statute 18-50-101 (1))

("Trustee" means any person or legal entity to whom legal title to real property is conveyed by deed of trust or his or her successor in interest.) Examples of how a Trustee can be chosen are given. (Ark. Statute 18-50-101 (10)).

14-15-402. Instruments to be recorded. (a) It shall be the duty of each recorder to record in the books provided for his or her office all deeds, mortgages, conveyances, deeds of trust, bonds, covenants, defeasances, affidavits, powers of attorney, assignments, contracts, agreements, leases, or other instruments of writing of, or writing concerning, any lands and tenements or goods and chattels, which shall be proved or acknowledged according to law, that are authorized to be recorded in his or her office.

THIS DEED OF TRUST DIFFERS IN THAT IT ALLOWS THE LENDER TO COLLECT TAXES AND INSURANCE PAYMENTS MONTHLY. THIS GIVES THE LENDER MORE CONTROL, FOR EXAMPLE: A LENDER MIGHT NOT REALIZE TAXES AND/OR INSURANCE PAYMENTS ARE IN ARREARS UNTIL SIX (6) MONTHS AFTER DELINQUENCY. THIS FORM IS CONSISTENT WITH INVESTOR OR OWNER FINANCING.

Funds for Taxes and Insurance: Subject to applicable law or a written waiver by Lender, Borrower shall pay to lender on the day monthly payments of principal and interest are payable under the Note, until the Note is paid in full, a sum ("Funds") equal to one twelfth (1/12) of the yearly taxes and assessments which may attain priority over this Deed of Trust, and ground rents on the Property, if any, plus one twelfth (1/12) of yearly premium installments of hazard insurance, plus one twelfth (1/12) of yearly premium installments for mortgage insurance, if any, all as reasonably estimated initially and from time to time by Lender on the basis of assessments and bills and reasonable estimates thereof.

For use in Arkansas only.

Important: Your property must be located in Stone County to use these forms. Documents should be recorded at the office below.

This Deed of Trust with Installment of Taxes and Insurance meets all recording requirements specific to Stone County.

Our Promise

The documents you receive here will meet, or exceed, the Stone County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stone County Deed of Trust with Installment of Taxes and Insurance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

ALI T.

January 31st, 2024

It is very easy to use Deeds.Com to perform eRecording. The case staff are very professional and punctual. My eRecording package was completed within a day where it usually takes months. Thank You

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin M.

May 13th, 2020

Maricopa County Recorders office directed to use Deeds.com for all forms, etc. Easily found the Warranty Deed form, instructions & sample form I was looking for.

Thank you!

Elaine E. W.

February 13th, 2021

Your product package was thorough and I am the one who does not know how to use or begin to be interactive with a computer. I wish I had learned long ago....ok your directions appear to be clear but when you are not familiar to the words.....it can and is difficult.....I downloaded the forms and completed them by hand/pen.....I just hope it will be acceptable to the recorder....Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

June 10th, 2022

Thank you! You are so awesome. Its amazing to be able to get everything together in a download packet. You make it so easy for the user.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Janette P.

April 30th, 2021

It was easy to find what I needed but I thought the price was too high.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan C.

January 20th, 2024

The Transfer on Death Deed paperwork was easy to complete, as it included a detailed guide and a completed example. We encountered no issues recording the document with our County. Thanks to Deeds.com, we were also able to save time and money by utilizing a DIY approach for our situation.

We are delighted to have been of service. Thank you for the positive review!

Leonard N.

January 21st, 2021

Nice and clear. Can't wait to process the completed documents at the Recorder's Office

Thank you!

Carl T.

February 23rd, 2021

Great site with good information and pricing. Let me know when you are able to record documents in California.

Thank you for your feedback. We really appreciate it. Have a great day!

Brenda M. K.

August 2nd, 2020

Great service Easy to do Efficient

Thank you for your feedback. We really appreciate it. Have a great day!

Ricardo C.

October 16th, 2020

I was pleased with the process. Easy and secure. Great customer service. I will use again for sure

Thank you!

Julius D.

July 10th, 2020

Worked great....WV accepted this document and made the whole process easy...thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Darlo M.

November 19th, 2022

The process for getting the forms I needed was easy through Deeds.com I would use them again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Douglas T.

August 9th, 2021

Deeds.com supplied me with forms I needed immediately.

Thank you!

Gail M.

October 27th, 2022

Great website. Once submit payment documents are immediately emailed, easy to print and clear format. Will definitely use again!

Thank you for your feedback. We really appreciate it. Have a great day!

ANGELIA E.

December 23rd, 2020

Thanks for your expedite process

We appreciate your business and value your feedback. Thank you. Have a wonderful day!