Stone County Gift Deed Form

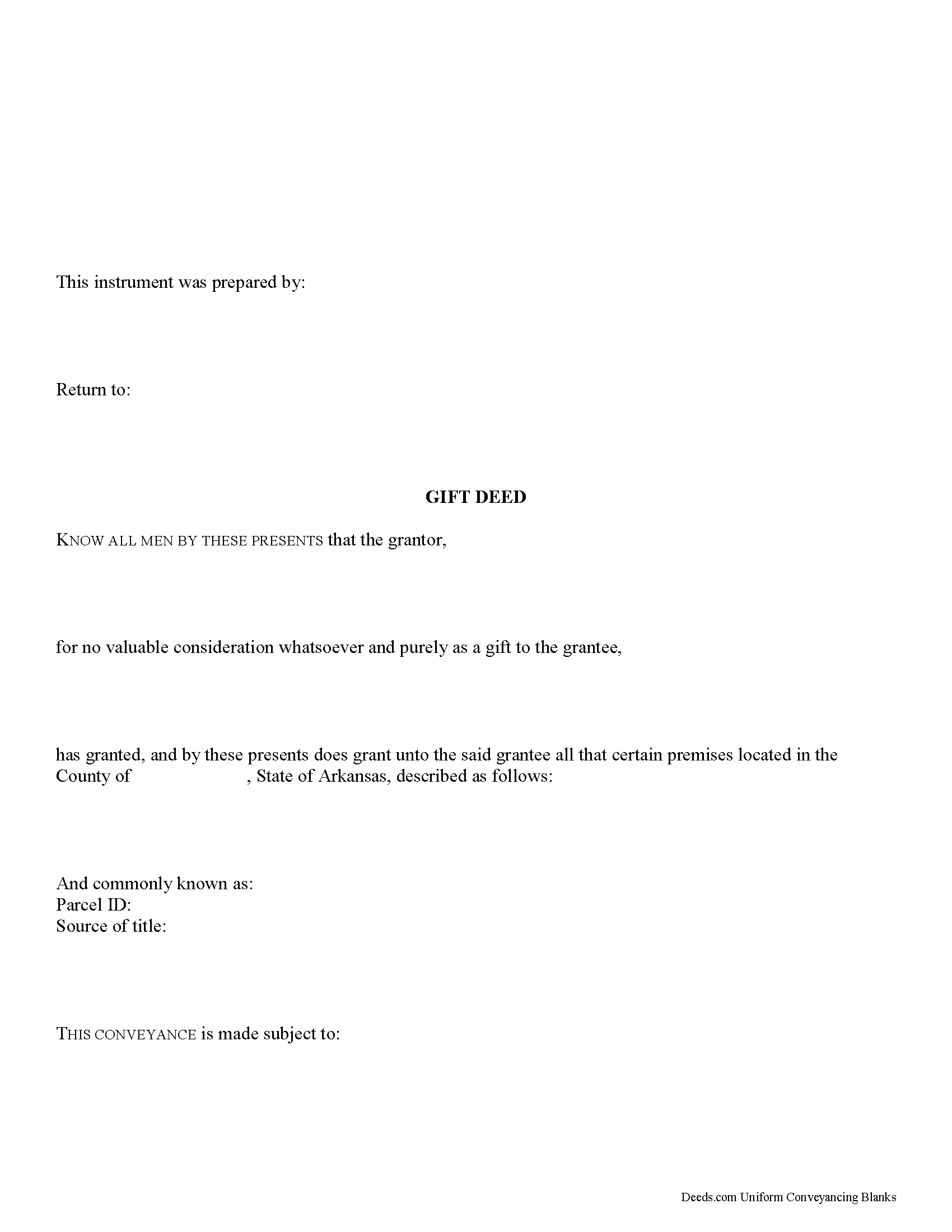

Stone County Gift Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

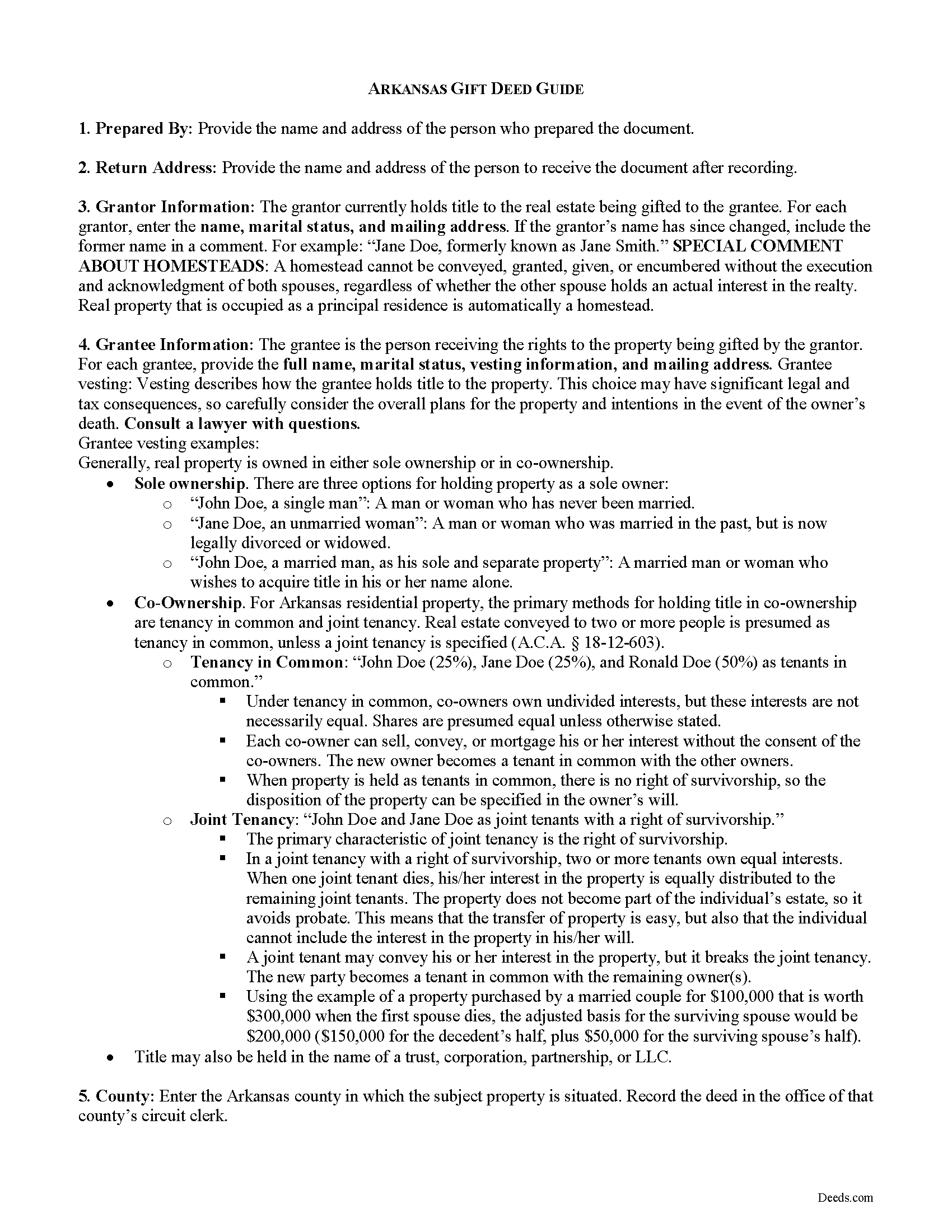

Stone County Gift Deed Guide

Line by line guide explaining every blank on the form.

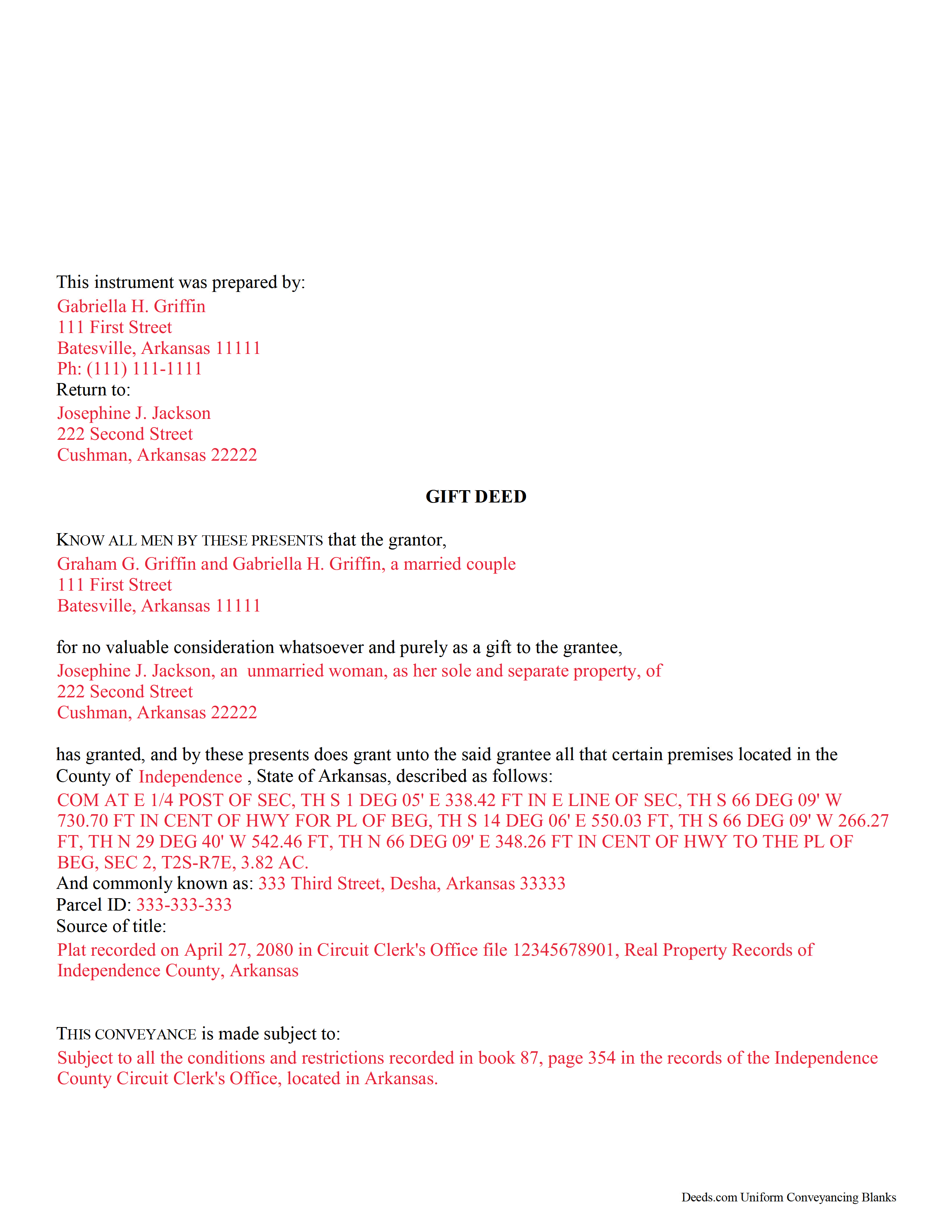

Stone County Completed Example of the Gift Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Arkansas and Stone County documents included at no extra charge:

Where to Record Your Documents

Stone County Circuit Clerk

Mountain View, Arkansas 72560

Hours: 8:30 to 4:30 M-F

Phone: (870) 269-3271

Recording Tips for Stone County:

- Check that your notary's commission hasn't expired

- Double-check legal descriptions match your existing deed

- Recorded documents become public record - avoid including SSNs

- Ask about their eRecording option for future transactions

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Stone County

Properties in any of these areas use Stone County forms:

- Fifty Six

- Fox

- Marcella

- Mountain View

- Onia

- Pleasant Grove

- Timbo

Hours, fees, requirements, and more for Stone County

How do I get my forms?

Forms are available for immediate download after payment. The Stone County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Stone County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Stone County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Stone County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Stone County?

Recording fees in Stone County vary. Contact the recorder's office at (870) 269-3271 for current fees.

Questions answered? Let's get started!

Gifts of Real Property in Arkansas

Gift deeds convey title to real property from one party to another with no exchange of consideration, monetary or otherwise. Often used to transfer property between family members or to gift property as a charitable act or donation, these conveyances occur during the grantor's lifetime. Gift deeds must contain language that explicitly states that no consideration is expected or required. Ambiguous language, or references to any type of consideration, can make the gift deed contestable in court.

A lawful gift deed includes the grantor's full name and marital status, as well as the grantee's full name, marital status, vesting, and mailing address. Vesting describes how the grantee holds title to the property. Generally, real property is owned in either sole ownership or in co-ownership. For Arkansas residential property, the primary methods for holding title in co-ownership are tenancy in common and joint tenancy. Arkansas does not recognize community property. Real estate conveyed to two or more people is presumed as tenancy in common, unless a joint tenancy is specified (A.C.A. 18-12-603).

As with any conveyance of realty, a gift deed requires a complete legal description of the parcel. Recite the source of title to establish a clear chain of title, and detail any restrictions associated with the property. Each grantor must sign the deed in the presence of a notary public for a valid transfer. Transfers in Arkansas require two witness signatures (A.C.A. 18-12-104). All signatures must be original. Record the completed deed, along with any additional materials, in the circuit clerk's office of the county where the property is located. Contact the same office to verify accepted forms of payment.

In Arkansas, every legal transfer of real property requires a Real Property Transfer Tax Affidavit form. This form should be completed by the grantee and filed with the instrument (A.C.A. 26-60-107). When real property is conveyed as a gift, no transfer tax is due. The grantee should indicate such on the affidavit.

With gifts of real property, the recipient of the gift (grantee or donee) is not required to declare the amount of the gift as income, but if the property accrues income after the transaction, the grantee is responsible for paying the requisite state and federal income tax.

In Arkansas, there is no state gift tax. For questions regarding state taxation laws, consult a tax specialist. Gifts of real property in Arkansas are, however, subject to the federal gift tax. The person or entity making the gift (grantor or donor) is responsible for paying the federal gift tax; however, if the donor does not pay the gift tax, the donee will be held liable.

In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that if a gift is valued below $15,000, a federal gift tax return (Form 709) does not need to be filed. However, if the gift is something that could possibly be disputed by the IRS -- such as real property -- a donor may benefit from filing a Form 709.

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an Arkansas lawyer with any questions about gift deeds or other issues related to the transfer of real property.

(Arkansas Gift Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Stone County to use these forms. Documents should be recorded at the office below.

This Gift Deed meets all recording requirements specific to Stone County.

Our Promise

The documents you receive here will meet, or exceed, the Stone County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Stone County Gift Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Lynda D S.

November 2nd, 2022

Sorry, I did not see that I was in the wrong review and just sent a review of a "product" I ordered online. As for Deeds.com I was very happy with the process and speed of getting the forms. I have used this site before. Highly recommend.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Viola J.

August 2nd, 2021

You made this so easy to process the Executor Deed. THANK YOU a thousand times. Appreciate that all forms are in one place and I did not have to search all over the internet to get what I needed.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rebecca H.

December 14th, 2020

Very pleased with the ease of this deed form. Completing the deed form to make sure everything was in my name took ten minutes. Thanks.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa D.

December 7th, 2022

Had the correct forms I needed with guides and examples to follow on filling them out. Very easy to use. Thanks!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rut P M.

November 15th, 2020

I was very pleased with the document I downloaded. I was able to edit it easily and save a copy both as a permanent copy or one that could still be edited. I also liked being able to cut and paste longer paragraphs. It cost a little more than I expected; however, it was worth it be cause I didn't have to fill it out by hand. Great job!

Thank you for your feedback. We really appreciate it. Have a great day!

Samuel T.

June 26th, 2021

So far, so good. explanations provided for the forms and instructions on how I should proceed were clear as a bell, and it was nice to get immediate delivery of the forms. I'll be looking for other ways to take advantage of this site, for sure.

Thank you!

Brenda M.

December 26th, 2018

It was quick and easy to obtain the document I needed

Thanks so much for your feedback Brenda, we really appreciate it. Have a great day!

Rosie R.

November 22nd, 2021

LOVE THIS!! I am a REALTORand from time to time I have had to take documents for filing. I'm so glad I invested some time online researching eFiling services. The first few search results that populated required an expensive annual or monthly subscription. Luckily I continued to scroll and found Deeds.com. No annual or monthly subscription required. Just pay per use. I uploaded a ROL late one night and Deed.com had it eFiled the very next morning!!! They keep you updated throughout the process via email notifications which you click on the link provided in the email that directs you to your online portal to view the status and once your documents have been filed you can immediately download the filed of record documents including the receipt from the county in which the documents were filed. SO SIMPLE, CONVENIENT, & QUICK-THANK YOU DEEDS.com!!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

BARRY D.

March 24th, 2024

Could not have been easier. Instructions were clear. Guidelines and example were clearly written. Erecording worked fast and let me skip a dreaded trip downtown to be ignored by government employees who hate their jobs.

Thank you for your positive words! We’re thrilled to hear about your experience.

RUTH A.

October 25th, 2024

I am so very thankful for the service that you provide for the public, thank you very much.

We deeply appreciate the trust you have placed in our services. Thank you for your valuable feedback and for choosing us.

Jane C.

February 25th, 2023

I wasn't sure what I was looking for initially so I printed out the wrong thing. Had to pay again to get the right one but much less expensive than getting it from a lawyer. Our military lawyers will make the forms official but they don't have the forms. Hope this makes things easier for our children when we pass. Thank you for offering this service.

Thank you for taking the time to leave your feedback. We have canceled and refunded the payment for your first order. We don't want you to pay for something you're not going to use. Have an amazing day.

Darrell W.

November 10th, 2021

Fast and easy to use. Nice to have available online.

Thank you for your feedback. We really appreciate it. Have a great day!

Patsy H.

January 10th, 2022

I had trouble at first printing out the forms but once I figured out what to do, all went well. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kirsten Z.

March 31st, 2021

Thank you! Including the Guide and completed example was especially helpful.

Thank you for your feedback. We really appreciate it. Have a great day!