Phillips County Satisfaction of Deed of Trust Form (Arkansas)

All Phillips County specific forms and documents listed below are included in your immediate download package:

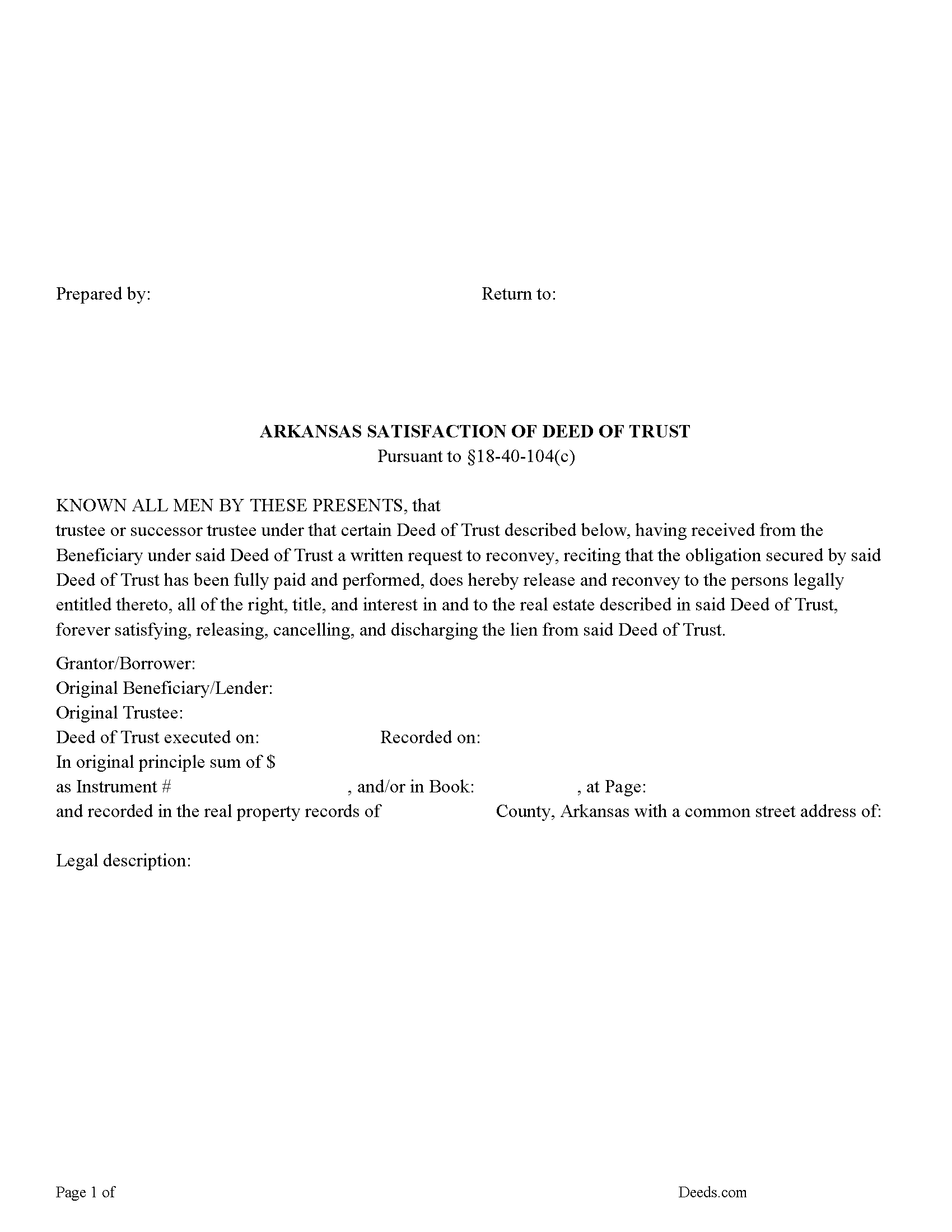

Satisfaction of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Phillips County compliant document last validated/updated 1/20/2025

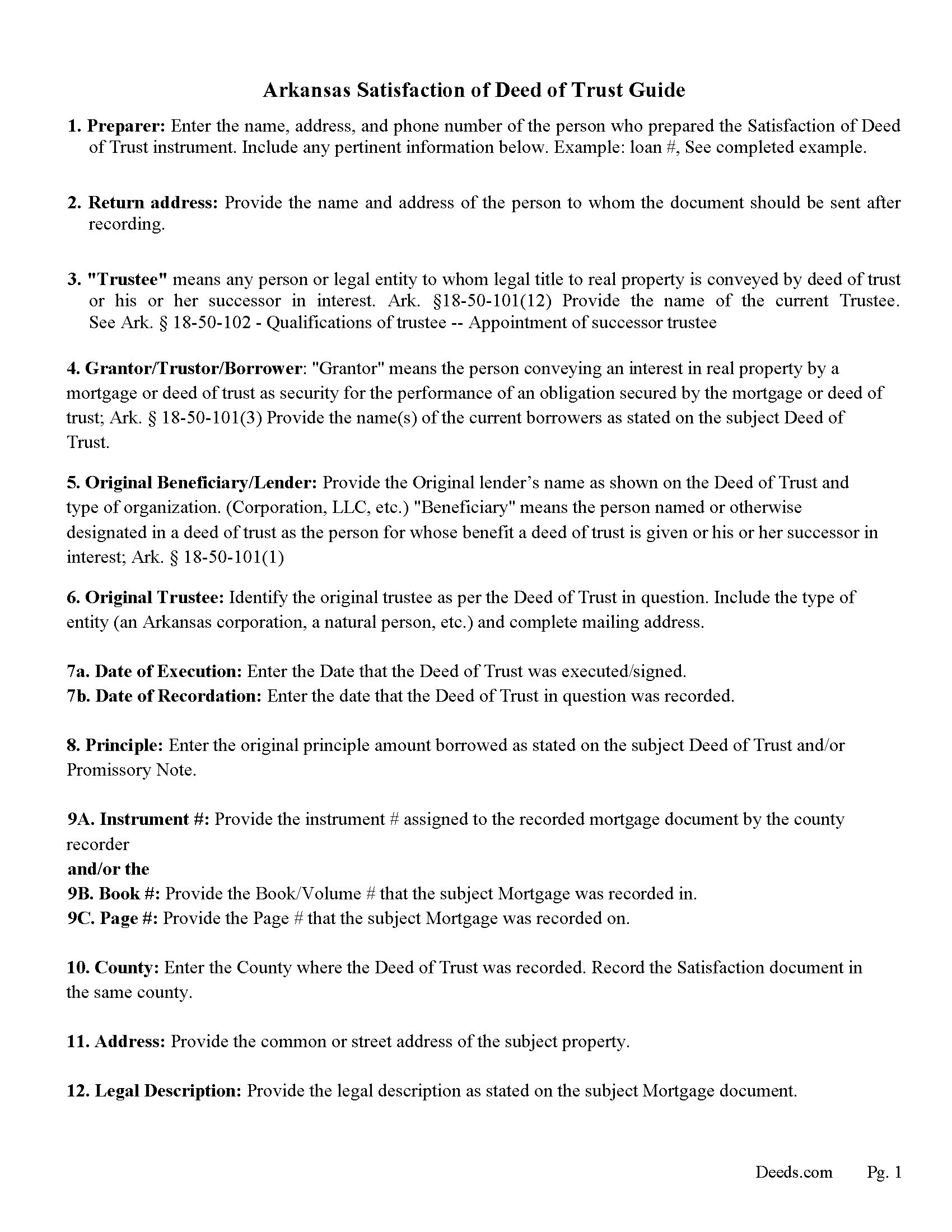

Satisfaction of Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

Included Phillips County compliant document last validated/updated 7/3/2025

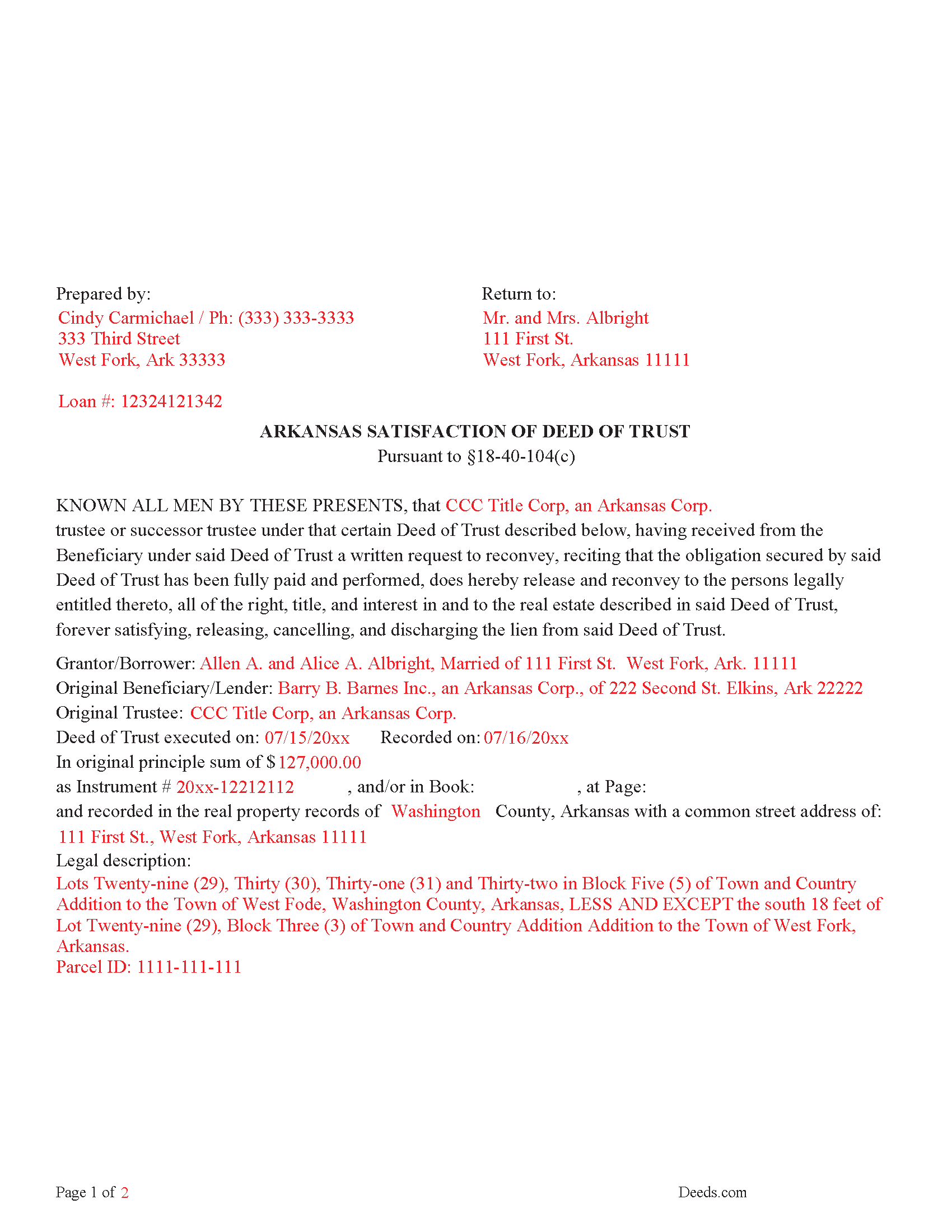

Completed Example of the Satisfaction of Deed of Trust Document

Example of a properly completed form for reference.

Included Phillips County compliant document last validated/updated 1/17/2025

The following Arkansas and Phillips County supplemental forms are included as a courtesy with your order:

When using these Satisfaction of Deed of Trust forms, the subject real estate must be physically located in Phillips County. The executed documents should then be recorded in the following office:

Phillips County Circuit Clerk

620 Cherry St, Suite 206, Helena, Arkansas 72342

Hours: 8:00am to 4:15pm M-F

Phone: (870) 338-5515

Local jurisdictions located in Phillips County include:

- Barton

- Crumrod

- Elaine

- Helena

- Lambrook

- Lexa

- Marvell

- Mellwood

- Oneida

- Poplar Grove

- Turner

- Wabash

- West Helena

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Phillips County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Phillips County using our eRecording service.

Are these forms guaranteed to be recordable in Phillips County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Phillips County including margin requirements, content requirements, font and font size requirements.

Can the Satisfaction of Deed of Trust forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Phillips County that you need to transfer you would only need to order our forms once for all of your properties in Phillips County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Arkansas or Phillips County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Phillips County Satisfaction of Deed of Trust forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

(The trustee of a deed of trust or a person employed by the trustee shall reconvey all or any part of the property encumbered by a deed of trust to the person entitled to the property on written request of the beneficiary of the deed of trust for a reasonable fee plus costs.)(Chapter 40 - Mortgages 18-40-104(c). Acknowledgment of satisfaction on record)

A trustee of a deed of trust shall be any:

(1) Attorney who is an active licensed member of the Bar of the Supreme Court of the State of Arkansas or law firm among whose members includes such an attorney;

(2) Bank or savings and loan association authorized to do business under the laws of Arkansas or those of the United States;

(3) Corporation which is an affiliate of a bank or savings and loan association authorized to do business under the laws of Arkansas or those of the United States, which is either an Arkansas bank or a registered out-of-state bank, as the terms are defined under 23-45-102, which maintains a branch in the State of Arkansas; or

(4) Agency or authority of the State of Arkansas where not otherwise prohibited by law.

(b) (1) The beneficiary may appoint a successor trustee at any time by filing a substitution of trustee for record with the recorder of the county in which the trust property is situated.

(2) The new trustee shall succeed to all the power, duties, authority, and title of the original trustee and any previous successor trustee. 18-50-102(a). Qualifications of trustee -- Appointment of successor trustee.

This form can be used by the Trustee or Successor Trustee, for full satisfaction/reconveyance. the beneficiary generally has sixty (60) days to record a Satisfaction of Deed of Trust once requested.

(If a person receiving satisfaction does not, within sixty (60) days after being requested, acknowledge satisfaction as stated in subsection (a) of this section or request the trustee to reconvey the property as stated in subsection (c) of this section, he or she shall forfeit to the party aggrieved any sum not exceeding the amount of the mortgage money, to be recovered by a civil action in any court of competent jurisdiction.) (Chapter 40 - Mortgages Ark. Statute 18-40-104(d). Acknowledgment of satisfaction on record)

(Arkansas Satisfaction Package includes form, guidelines, and completed example) For use in Arkansas only.

Our Promise

The documents you receive here will meet, or exceed, the Phillips County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Phillips County Satisfaction of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4563 Reviews )

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Dan V.

December 24th, 2021

Very happy, thanks.

Thank you!

Jermaine H.

December 25th, 2021

Great informative site.... helped me find exactly what I was looking for. DETAILED information on my property!

Thank you for your feedback. We really appreciate it. Have a great day!

John T.

January 11th, 2022

I bought a quitclaim deed package, and it was very easy to use. Prints nicely. Two thumbs up!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LISA R.

May 4th, 2022

I was very pleased to find your website and the range of services you offer. I was recommended to hire an estate attorney, but the forms you provided will eliminate the need for that. Thank you for the help!

Thank you for your feedback. We really appreciate it. Have a great day!

Jay W.

February 7th, 2019

your service is more than I expected easy to navigate, great info, easy to understand. other other sites every time you go to next page there is something to buy to get the info you want.

Jay

Thank you!

Nicolette C.

March 3rd, 2025

Deeds.com was a wealth of information and easy to navigate through the myriad of forms to choose from. During a time of family tragedy, this site was a valuable resource to complete necessary paperwork and ensure assets were in proper names and titles.

We are sincerely grateful for your feedback and are committed to providing the highest quality service. Thank you for your trust in us.

Rebecca M.

December 28th, 2021

This was pretty easy to fill out. The directions on all of the forms was very good. This should make life much easier at the County Recorder.

Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Joseph L.

August 11th, 2021

I am an invalid and needed just one quitclaim form. I was able to quickly enter and complete the form. Unfortunately, it will probably be a last hurrah for me..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wanda W.

January 23rd, 2025

Terrific!!!

Thank you!

Noal S.

May 18th, 2025

The download package is very thorough and complete for the Corrective Deed I needed to file. The material is state/county specific and includes a completed example. The price is reasonable compared to an attorney fee from $400 to $600

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lisa A.

January 3rd, 2024

I am so thankful for the time saved by using Deeds.com. Not having to run downtown and stand in line is awesome!

We are delighted to have been of service. Thank you for the positive review!

Diana M.

June 25th, 2020

First time user - process went very smooth and fast. It took me a little to find my messages. At first I didn't know you process documents other than deeds so maybe you should consider putting on your home page that it's not only for deeds - it's for any document that needs recording. :)

Thank you for your feedback. We really appreciate it. Have a great day!