Lake County Affidavit of Deceased Grantor Form

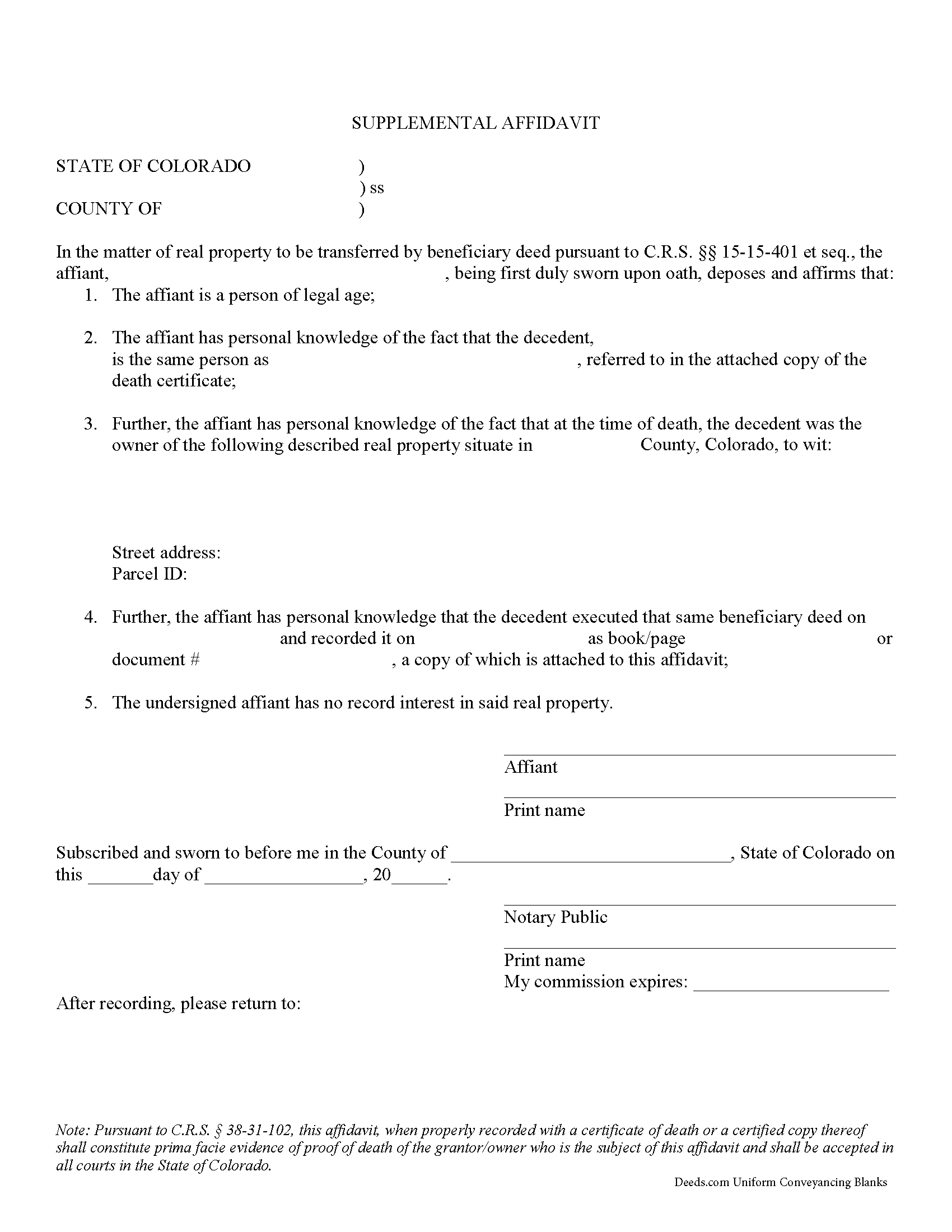

Lake County Affidavit of Deceased Grantor Form

Fill in the blank form formatted to comply with all recording and content requirements.

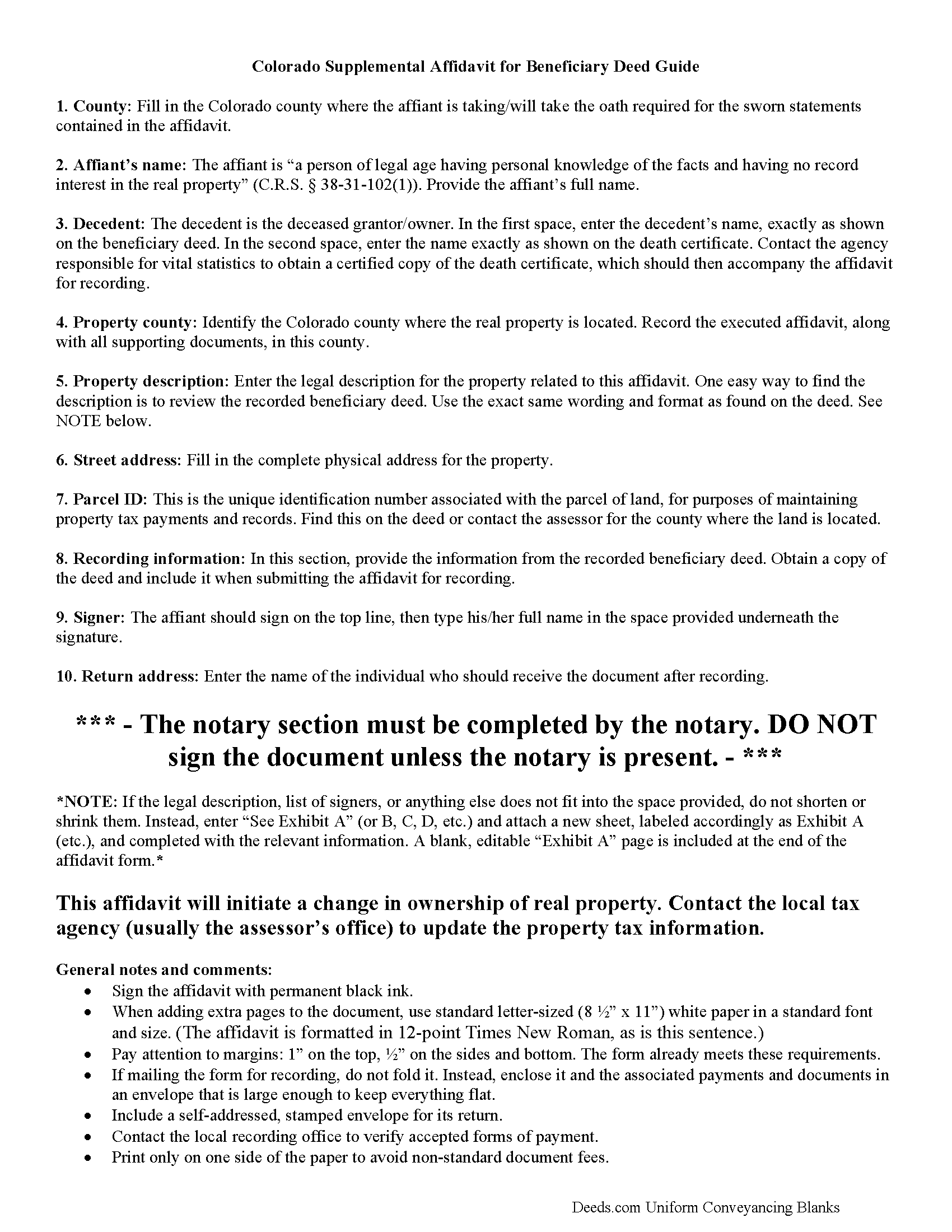

Lake County Affidavit of Deceased Grantor Guide

Line by line guide explaining every blank on the form.

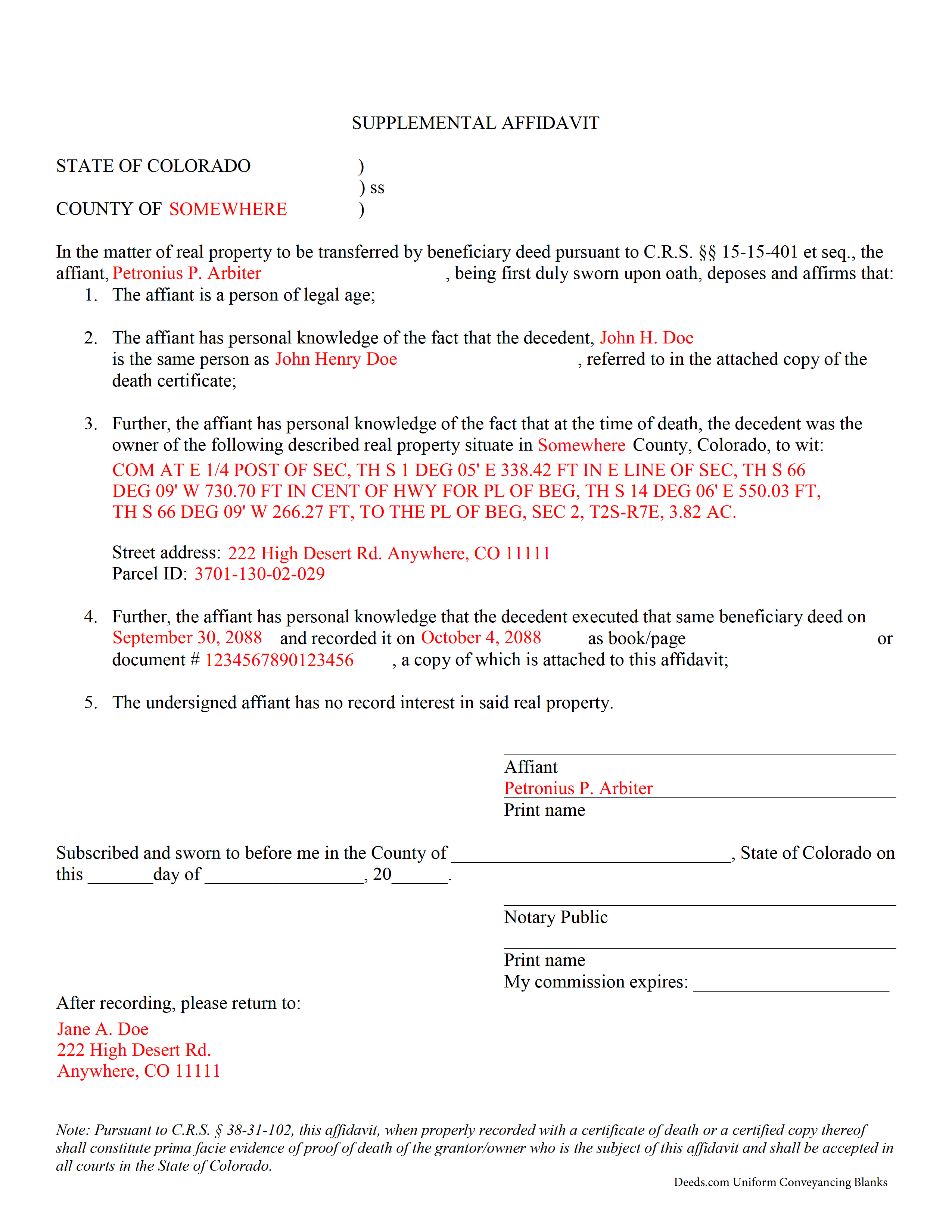

Lake County Completed Example of the Affidavit of Deceased Grantor Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Lake County documents included at no extra charge:

Where to Record Your Documents

Lake County Clerk and Recorder

Leadville, Colorado 80461

Hours: Monday through Friday 8:30 to 5:00

Phone: (719) 486-4131

Recording Tips for Lake County:

- Ensure all signatures are in blue or black ink

- Check that your notary's commission hasn't expired

- Check margin requirements - usually 1-2 inches at top

- Recording fees may differ from what's posted online - verify current rates

- Multi-page documents may require additional fees per page

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Climax

- Leadville

- Twin Lakes

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at (719) 486-4131 for current fees.

Questions answered? Let's get started!

Use a Colorado supplemental affidavit of deceased grantor owner to complete the transfer of real property initiated by recording a Colorado beneficiary deed.

Completing the Transfer from a Colorado Beneficiary Deed

Beneficiary deeds provide a relatively straightforward, effective way for Colorado land owners to convey real estate, after death, to one or more named beneficiaries without the need for probate. See C.R.S. 15-15-401 et seq.

State law provides that title "to the interest in real property transferred by a beneficiary deed shall vest in the designated grantee-beneficiary only on the death of the owner" (15-15-407(1)). The beneficiary should offer proof "of the death of the owner or a grantee-beneficiary... in the same manner as for proving the death of a joint tenant" (15-15-413). That process is specified in 38-31-102, and it involves completing and filing a supplemental affidavit, along with a copy of the decedent's death certificate, with the recorder or register of deeds for the county where the land is located. While not specifically required, it is also a good idea to include a copy of the recorded beneficiary deed.

By recording the supplemental affidavit, the beneficiary provides public notice of the change in ownership. This is important because it preserves the chain of title (ownership history), which should simplify future sales of the land.

(Colorado Affidavit of Deceased Grantor Package includes form, guidelines, and completed example)

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Affidavit of Deceased Grantor meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Affidavit of Deceased Grantor form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

janice b.

April 29th, 2021

This is a very helpful site when you don't know exactly what to do. Very clear in explaining the wording on deeds. Thank you it made a big difference knowing the right way to do things.

Thank you for your feedback. We really appreciate it. Have a great day!

CINDY P.

July 30th, 2019

Such any easy process! Thank you!

Thank you Cindy, we appreciate your feedback.

Greg M.

March 16th, 2020

This is a great site! Very easy to use and has all the documents I required. Thank you!

Thank you!

CLAUDE G.

September 18th, 2019

just what I needed Thank You

Thank you!

constance t.

December 30th, 2019

Excellent service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ELIZABETH A P.

January 11th, 2019

THE FORMS WERE GOOD, EASY TO UNDERSTAND. NICE TO BE ABLE TO DOWNLOAD THEM INSTANTLY. LIKED THAT I DID NOT HAVE TO JOIN ANYTHING WITH ONGOING FEES.

Thank you Elizabeth, have a great day!

FE P.

March 4th, 2023

Looked into a good number of DIY deeds on the internet. Very glad that I chose Deeds.com. They made it easy to make your own deed based on your state and the process based on the sample included was easy to follow. Also the cost was very reasonable. Great company.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Barbara A.

January 27th, 2023

Much easier than going to the courthouse!

Thank you for your feedback. We really appreciate it. Have a great day!

Mary K.

September 28th, 2019

Awesome site. Looking for a way to save hiring an attorney. Family doesn't have the money for that so this site is much appreciated.

Thank you for your feedback. We really appreciate it. Have a great day!

Cathleen H.

January 25th, 2019

The pdf form is good; however, the input boxes merge into the line above so the text is hard to read when complete. I added a return before entering my data and this solved the problem.

Thank you for your feedback Cathleen. We will have staff take a look at the document for issues with the text fields. Have a great day!

Earnestine C.

September 4th, 2019

Informative and instruction clear and concise, which made it easy for a person without real estate knowledge to acquire needed information. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Victoria L.

February 25th, 2019

This is a fantastic website and financial savings to many. Being able to download and complete the document I needed vs having my attorney complete saved me $800. I would highly recommend this website.

Thank you for the kind words Victoria. Have a great day!

Lynette D.

July 29th, 2020

I planned to use an attorney for this process but deeds.com made it so easy I was able to do it myself and I saved $330 in the process. I really appreciated the instructions and example provided on the site.

Thank you for your feedback. We really appreciate it. Have a great day!

Betty J W.

May 31st, 2022

Was Totally Amazed, it was so easy to follow the example and I am 75 years old. I took my paper work in and it passed with flying colors. Thank-You So much saved me $665.00. BJW

Thank you!

Gary S.

January 9th, 2022

Easy to use. Very helpful

Thank you!