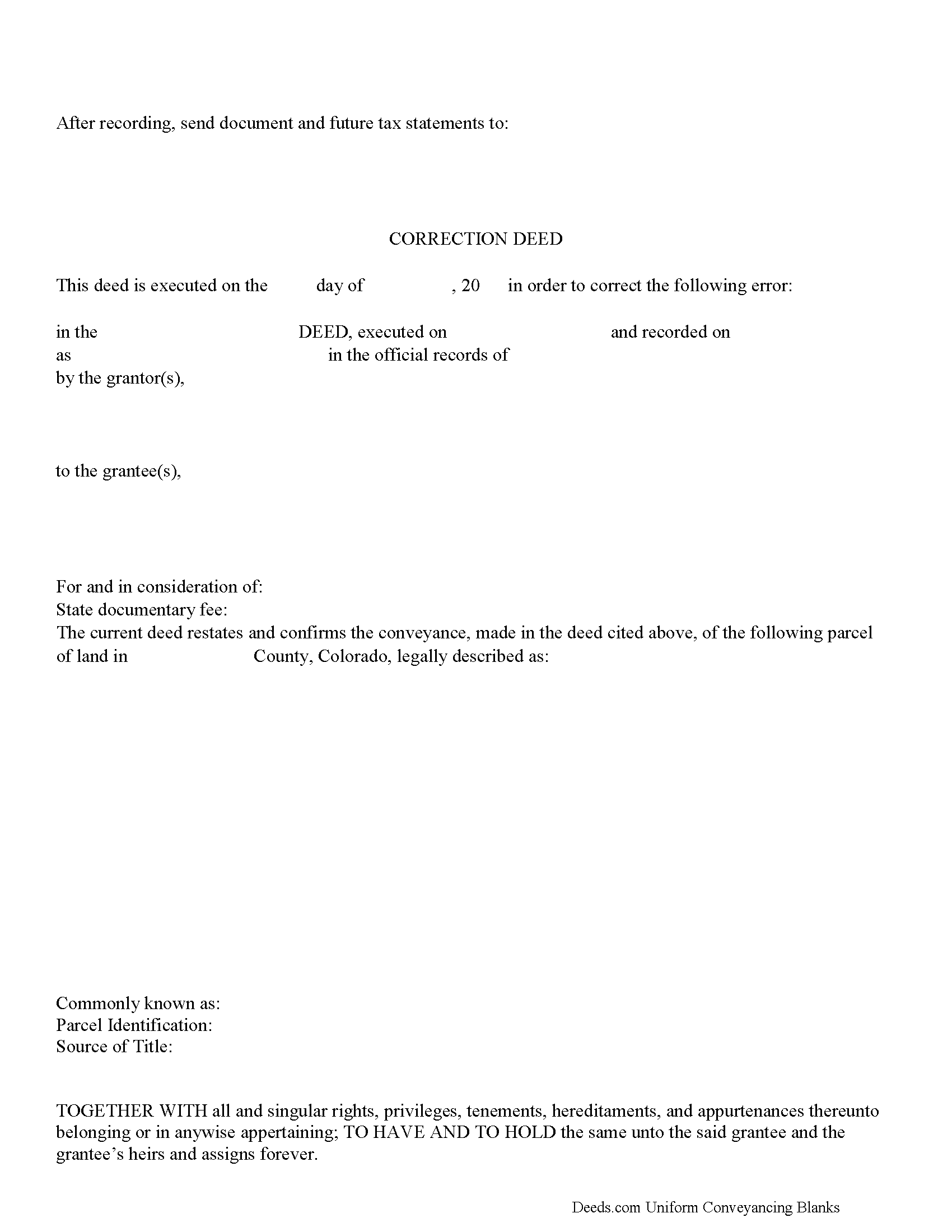

Lake County Correction Deed Form

Lake County Correction Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

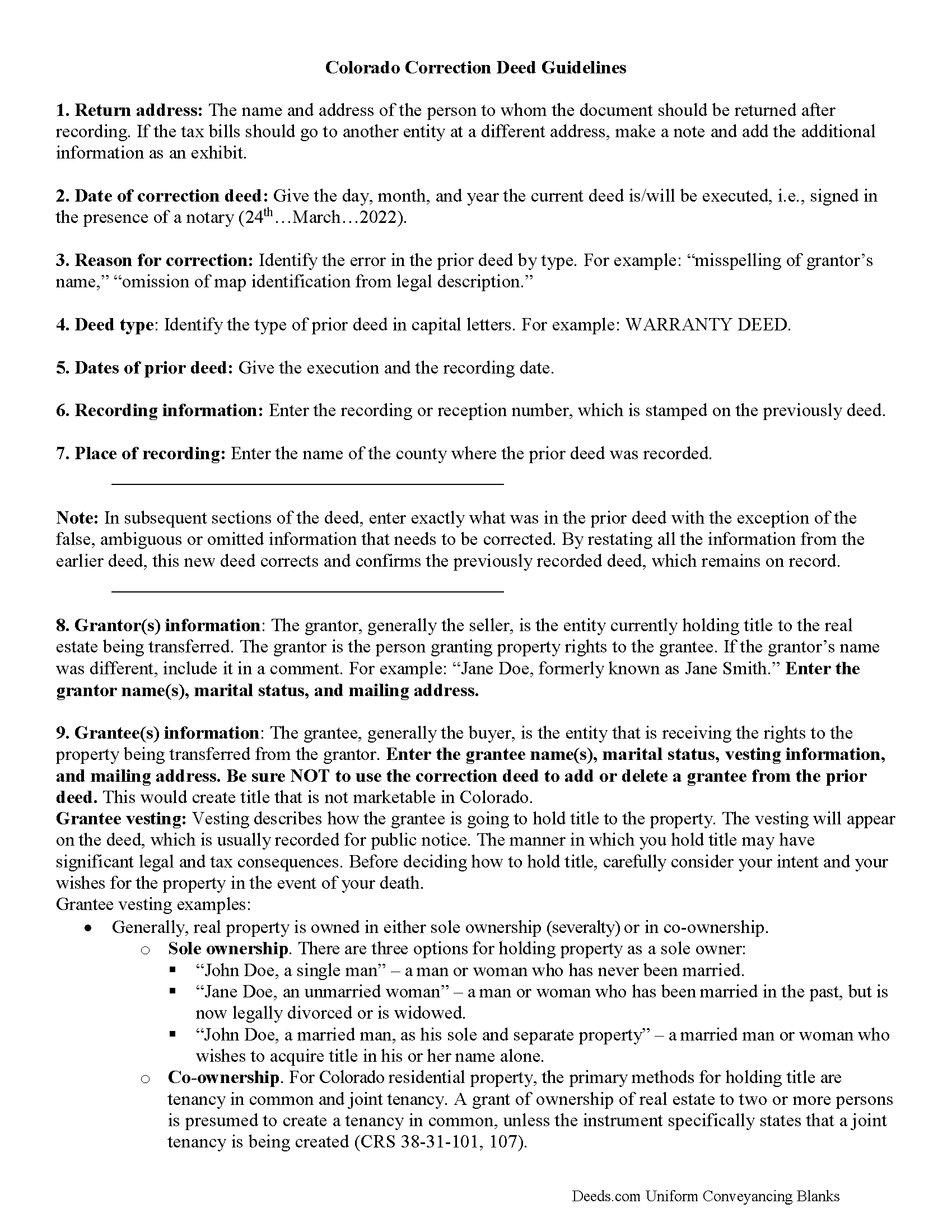

Lake County Correction Deed Guide

Line by line guide explaining every blank on the form.

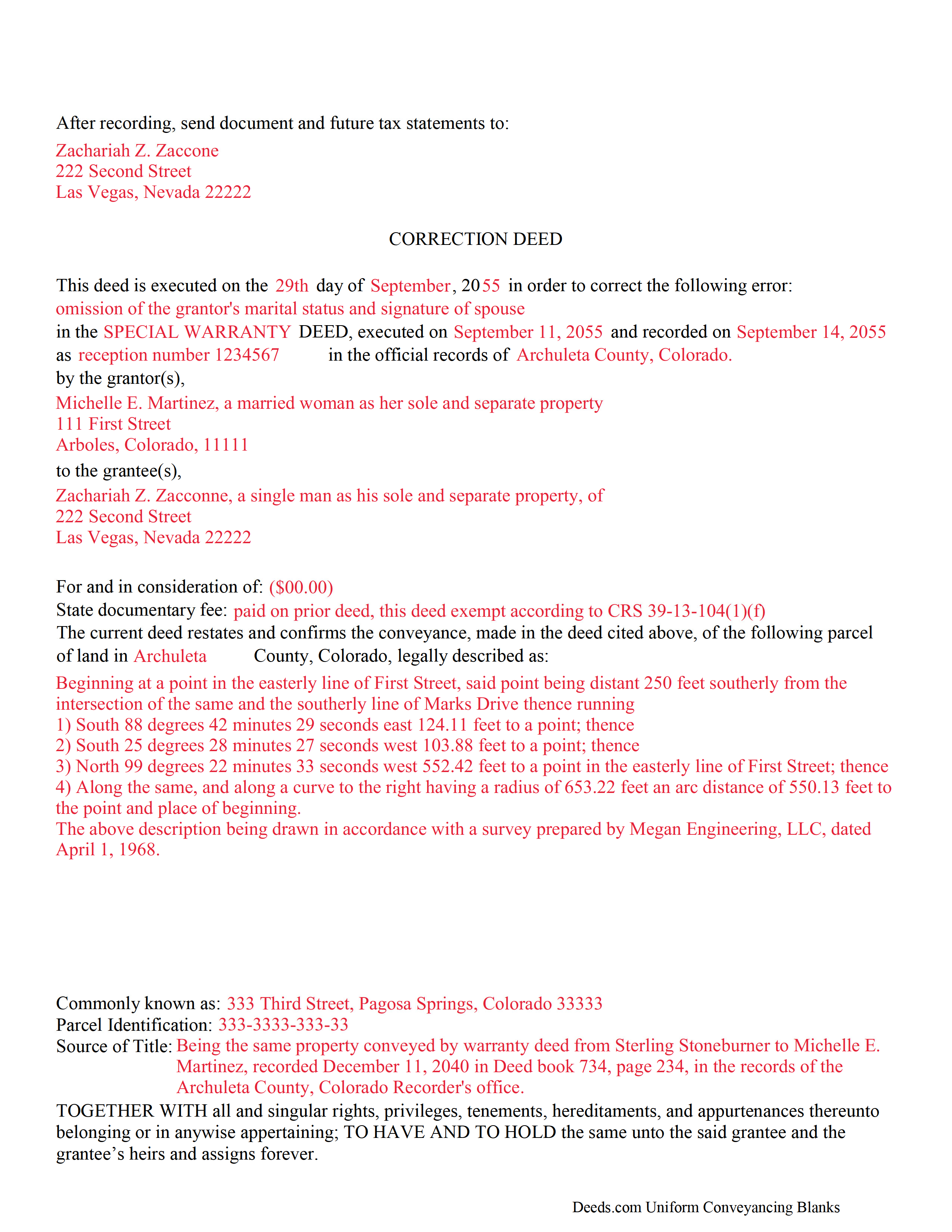

Lake County Completed Example of the Correction

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Colorado and Lake County documents included at no extra charge:

Where to Record Your Documents

Lake County Clerk and Recorder

Leadville, Colorado 80461

Hours: Monday through Friday 8:30 to 5:00

Phone: (719) 486-4131

Recording Tips for Lake County:

- Bring your driver's license or state-issued photo ID

- Check that your notary's commission hasn't expired

- Leave recording info boxes blank - the office fills these

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Lake County

Properties in any of these areas use Lake County forms:

- Climax

- Leadville

- Twin Lakes

Hours, fees, requirements, and more for Lake County

How do I get my forms?

Forms are available for immediate download after payment. The Lake County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Lake County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Lake County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Lake County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Lake County?

Recording fees in Lake County vary. Contact the recorder's office at (719) 486-4131 for current fees.

Questions answered? Let's get started!

Use this deed form to make minor corrections in a previously recorded warranty, special warranty or quitclaim deed.

In Colorado, a previously recorded deed can be corrected by recording a second deed, called a correction or corrective deed. The sole purpose of such a document is to prevent potential title flaws, which may create problems when the current owner attempts to sell the property. The correction deed does not convey title but confirms the prior conveyance. For the most part it reiterates the prior deed verbatim, except for the corrected item and the consideration.

The errors usually adjusted by a corrective deed are minor omissions or typographical mistakes, sometimes called scrivener's errors. Among those are misspelled names, omitted or wrong middle initial, a minor error in the property description, or an omitted execution date, or a faulty acknowledgment. However, certain types of changes cannot be achieved by using a correction deed. For example: the addition or omission of a grantee; changing the manner in which title is held to/from "joint tenants with rights of survivorship"; making material changes to the legal description; or deleting a portion of the originally transferred property. As far as changes to the legal description are concerned, use a correction deed only if a portion of the property was left out of the original conveyance.

The correction deed must be executed from the original grantor to the original grantee and state that its purpose is to correct a specific error, identified by type. It references the prior deed by date(s) and recording/reception number, as well as county of recording. A correction deed generally is exempt from state documentary fee (CRS 39-13-104(1)(f), which is calculated based on the consideration stated in the deed. Thus, many counties advise to enter $0 as consideration and to state the exemption on the correction deed (CRS 39-13-104(2)).

(Colorado Correction Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Lake County to use these forms. Documents should be recorded at the office below.

This Correction Deed meets all recording requirements specific to Lake County.

Our Promise

The documents you receive here will meet, or exceed, the Lake County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Lake County Correction Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4578 Reviews )

James K.

May 15th, 2024

Looks like a very professional site. I just don’t know what it would cost using this site.

Thanks for the kind words about the website James, sorry to hear that you could not find pricing information, we will try harder.

Sally P.

June 22nd, 2023

I cannot thank the staff at Deeds.com enough for all of their assistance and their quick and their most pleasant responses. They were extremely quick and efficient to help me to file my documents. Thanks for everything and I will definitely be referring folks to your site.

Our team is deeply committed to providing efficient, reliable assistance and it's always rewarding to know we've made a difference for our customers. Your kind words about our quick and pleasant responses are much appreciated and will certainly serve as an extra boost of motivation for our team.

We also sincerely appreciate your intention to refer others to our site. Your trust and confidence in our service means a lot to us, and we're grateful to have you as part of the Deeds.com community.

Michael M.

June 19th, 2019

Deeds.com had what I needed at the time that I needed it. Thank you very much.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Pamela G.

November 18th, 2020

I have an apple phone. I could not fill in the form to pay because apple phones do not have a dash that can be used when the field requires a phone number with a dash. I had to borrow an android phone in which the telephone keypad had a dash that could be used. It was easy to pay using an android phone but impossible to pay using an apple phone. Remove the requirement for dashes to allow apple phones to use this service.

Thank you!

Christopher B.

November 26th, 2019

Record retrieval by staff is very prompt!!! Great customer service for sure!

Thank you for your feedback. We really appreciate it. Have a great day!

Mario G.

November 3rd, 2021

Very courteous staff, and helpful didn't take any time for someone to assist me on my needs Thank you so much.

Thank you for your feedback. We really appreciate it. Have a great day!

Dawna M.

June 15th, 2021

Easy to use website and immediate documents appropriate for my area. My only complaint is that the forms had an alignment problem where the fields that were filled in by me did not line up with the template text. I tried to correct it to no avail so I ended up having to retype the entire document. I purchased two templates and both had the same issue.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenda C.

February 21st, 2021

It was easy to find what I was looking for. The instructions were easy to follow. The example given was most beneficial in completing form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Hamed T.

January 12th, 2022

Easy Process! Realy recommend them for E-Recording!

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine M.

April 30th, 2021

Great service, very efficient and super fast.

Thank you!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

Carolyn A.

October 18th, 2019

Easy to use!!

Thank you!

Cheryl B.

November 20th, 2021

Seems easy enough, may have downloaded forms I don't need, however I'm hoping that these are the only I'll need. Did a lot of research and Deeds.com looks to be the best for anything you need. I am very happy at finally being able to find the forms I was looking for so easily. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Judi W.

May 24th, 2022

Great website! Well organized, easy to navigate and put to practical use. Would use again.

Thank you!

Jami B.

November 6th, 2019

I was blown away by all the information I received for just $19.00!! I am still reading through it. Great job of explaining everything.

Thank you!