Custer County Statement of Mechanics Lien Form (Colorado)

All Custer County specific forms and documents listed below are included in your immediate download package:

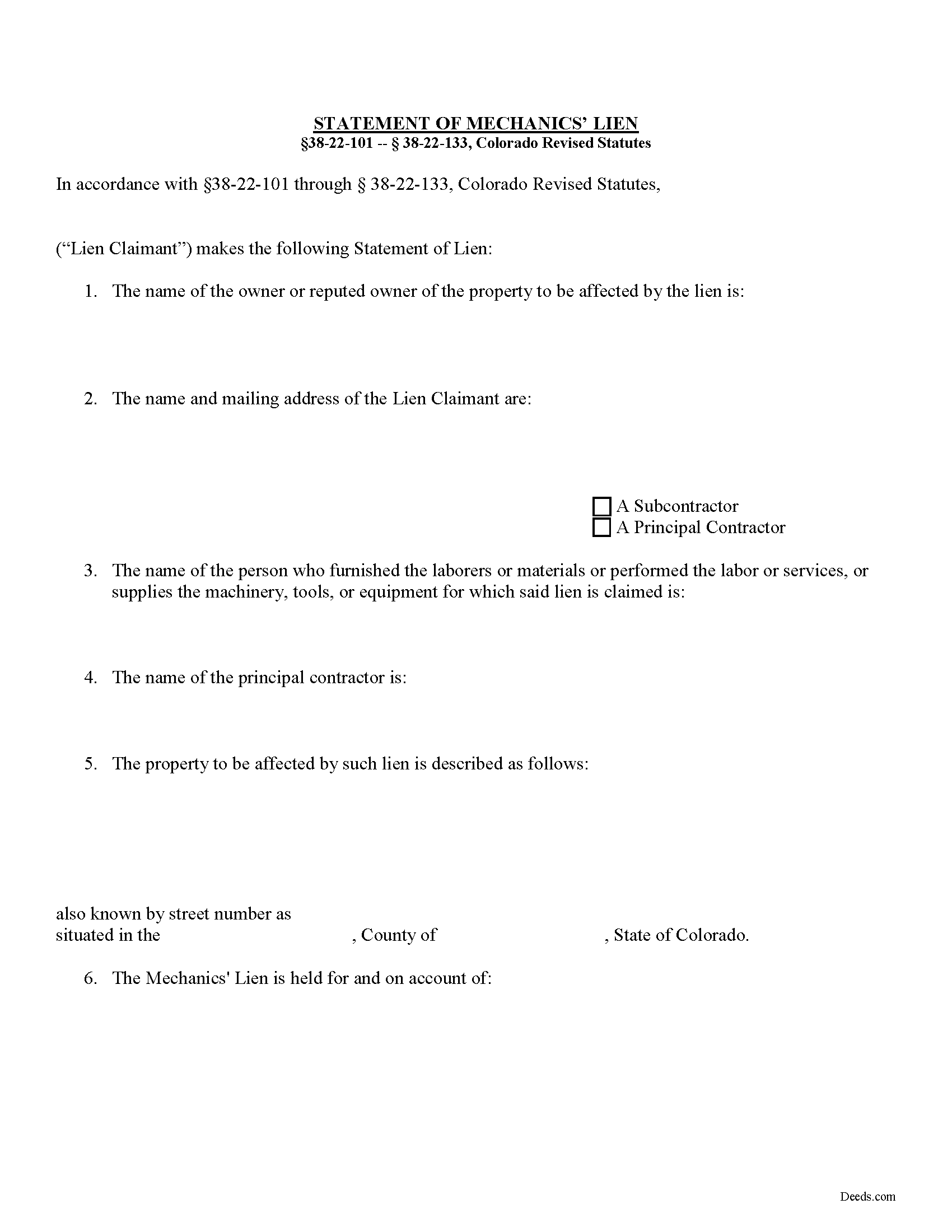

Statement of Mechanics Lien Form

Fill in the blank Statement of Mechanics Lien form formatted to comply with all Colorado recording and content requirements.

Included Custer County compliant document last validated/updated 4/4/2025

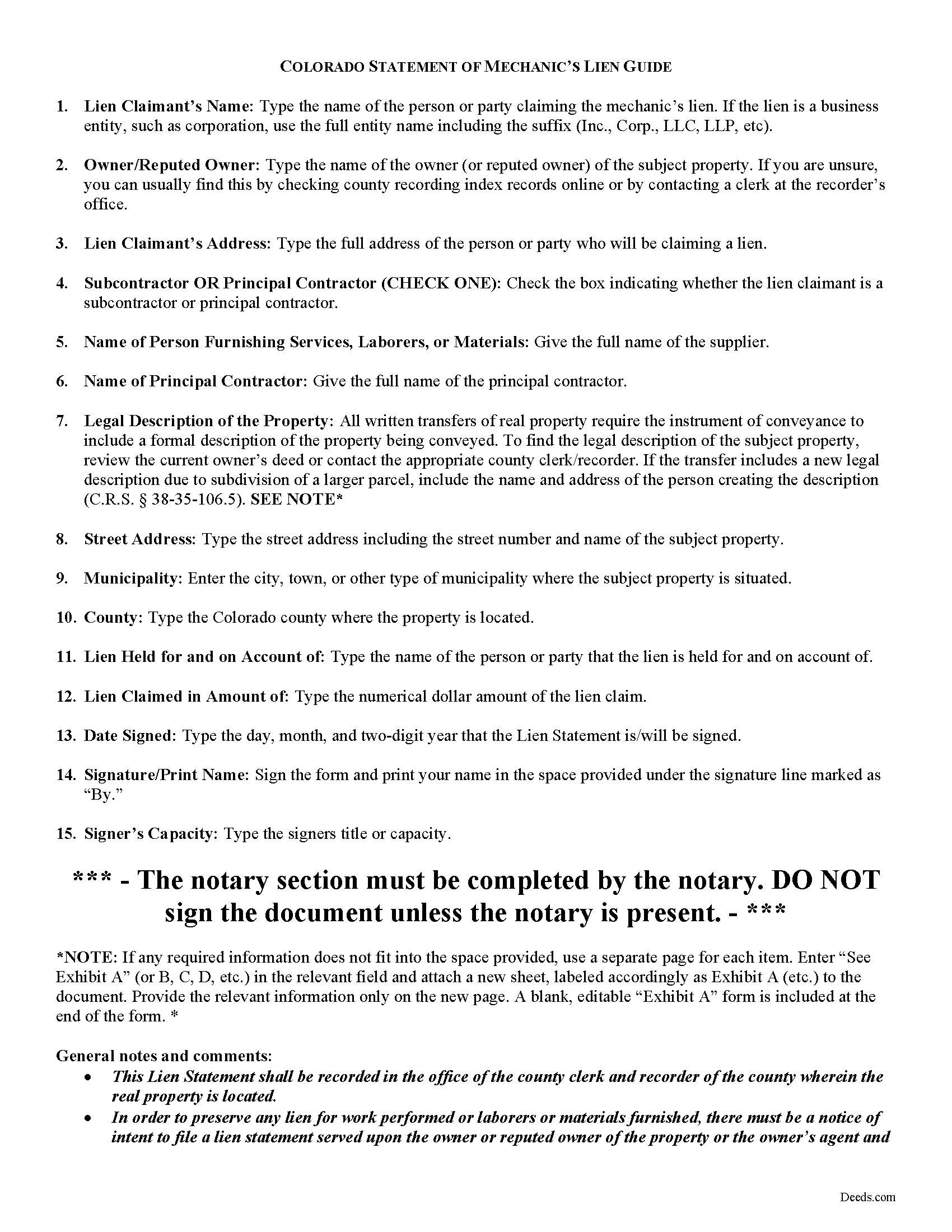

Statement of Lien Guide

Line by line guide explaining every blank on the form.

Included Custer County compliant document last validated/updated 12/20/2024

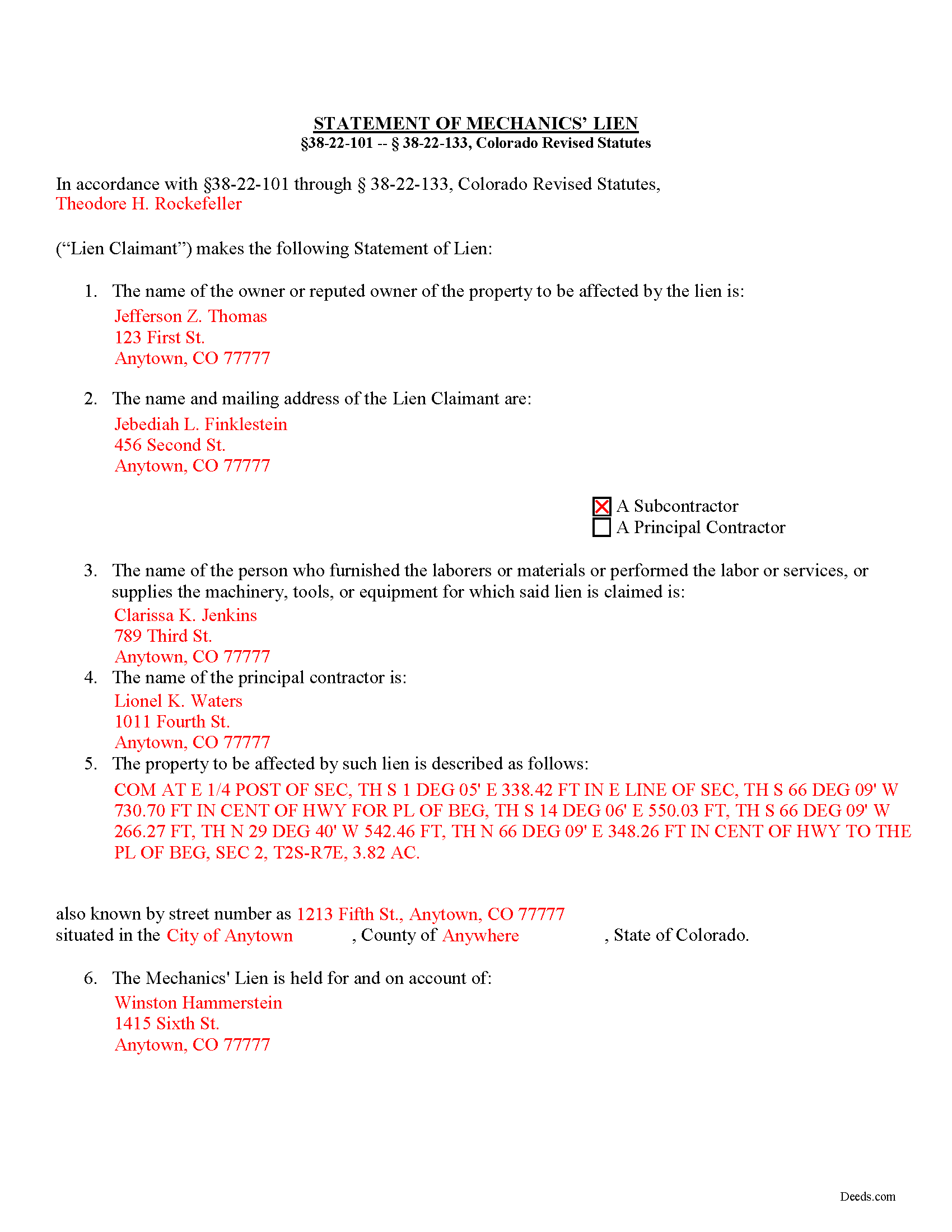

Completed Example of the Verified Statement of Lien Document

Example of a properly completed form for reference.

Included Custer County compliant document last validated/updated 5/19/2025

The following Colorado and Custer County supplemental forms are included as a courtesy with your order:

When using these Statement of Mechanics Lien forms, the subject real estate must be physically located in Custer County. The executed documents should then be recorded in the following office:

Custer County Clerk and Recorder

Courthouse - 205 S 6th St / PO Box 150, Westcliffe, Colorado 81252

Hours: 8:00 to 4:00 M-F

Phone: (719) 783-2441 or 783-0441

Local jurisdictions located in Custer County include:

- Westcliffe

- Wetmore

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Custer County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Custer County using our eRecording service.

Are these forms guaranteed to be recordable in Custer County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Custer County including margin requirements, content requirements, font and font size requirements.

Can the Statement of Mechanics Lien forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Custer County that you need to transfer you would only need to order our forms once for all of your properties in Custer County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Colorado or Custer County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Custer County Statement of Mechanics Lien forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Statement of Lien in Colorado

Contractors and subcontractors have a unique remedy available to them when a property owner or some other party involved in the "chain" refuses to pay up. This special remedy is called a mechanic's lien, also sometimes known as a contractors, materialman, or construction lien. The lien works like a mortgage by giving a type of property interest to the lien holder. With a lien in place, it becomes more difficult for the owner to sell or refinance a property. Other contractors will also see there is already a lien before they begin any additional work. In Colorado, mechanic's liens are governed under 38-22-101 -- 38-22-133 of the Colorado Revised Statutes (C.R.S.). In Colorado, claimants must file a Statement of Lien document to claim a mechanic's lien.

The Statement of Lien must contain the following: (1) The name of the owner or reputed owner of such property, or in case such name is not known to him, a statement to that effect; (2) the name of the person claiming the lien; (3) the name of the person who furnished the laborers or materials or performed the labor for which the lien is claimed; (4) the name of the contractor when the lien is claimed by a subcontractor or by the assignee of a subcontractor, or, in case the name of such contractor is not known to a lien claimant, a statement to that effect; (5) a description of the property to be charged with the lien, sufficient to identify it; and (6) a statement of the amount due or owing such claimant. C.R.S. 38-22-109(1).

The Lien Statement must be signed and sworn to by the party, or by one of the parties who is claiming the lien, or by some other person on their behalf, to the best knowledge, information, and belief of the affiant; and the signature of any such affiant to any such verification shall be a sufficient signing of the statement. C.R.S. 38-22-109(2).

Before the Lien Statement can be filed, you must have fulfilled the preliminary notice requirement. In order to preserve any lien for work performed or laborers or materials furnished, there must be a notice of intent to file a lien statement served upon the owner or reputed owner of the property (or the owner's agent and the principal or prime contractor or his or her agent) at least ten (10) days before the time of filing the lien statement with the county clerk and recorder. C.R.S. 38-22-109(3). The notice of intent must be served by personal service or by registered or certified mail, return receipt requested, addressed to the last known address of such persons, and an affidavit of such service or mailing at least ten (10) days before filing of the lien statement. Id.

The timeline for filing the lien depends on who is the party claiming the lien. Mechanic's liens claimed for labor and work by the day or piece, (but without furnishing laborers or materials), must be filed for record after the last items of labor has been performed and at any time before the expiration of two months after the labor or work is completed. C.R.S. 38-22-109(4). All other lien claimants must file their claims at any time before the expiration of four months after the day on which the last labor is performed or the last act of furnishing laborers or materials. C.R.S. 38-22-109(5).

If there is an error in a filed lien statement, a new or amended statement may be filed within the periods provided for claiming a lien to correct or cure any mistake (or for the purpose of more fully complying with the provisions of the lien law). C.R.S. 38-22-109(6).

Once the lien is in place, remember it won't last forever. A mechanic's lien will not remain effective longer than one year from the filing of the lien, unless within thirty days after each annual anniversary of the filing of the lien statement, the lien claimant files an affidavit in the office of the county clerk and recorder of the county wherein the property is located, stating that the improvements on said property have not been completed. C.R.S. 38-22-109(8).

This article is provided for informational purposes only and should not be relied upon a substitute for the advice of an attorney. If you have any questions about claiming a mechanic's lien, please contact a Colorado-licensed attorney.

Our Promise

The documents you receive here will meet, or exceed, the Custer County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Custer County Statement of Mechanics Lien form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4562 Reviews )

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Robert F.

June 30th, 2025

Breeze.... It feels silly to hire an attorney to do this for just one beneficiary. Thanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pauline C.

June 29th, 2025

Everything that was stated to be included in my order was complete. Very satisfied

Thank you for your positive words! We’re thrilled to hear about your experience.

HAMIDREZA M.

March 22nd, 2021

excellent service

Thank you!

Marc T.

August 31st, 2021

Walked the document through our county offices today. the directions to fill out the document were awesome and we had no issues, We now have a TOD property. Beats paying an attorney $200.00

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah A.

July 26th, 2022

Excellent,

Thank you!

Larry T.

July 28th, 2020

Ordered a 'Gift Deed' form

The 'Example' form was most helpful.

The actual form was very detailed, and seemed to 'cover all the bases'

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clarence F.

January 25th, 2022

very easy to use !!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Stephen D.

March 1st, 2019

The service was very helpful and fast saving me time. I am sure I will use it again.

Thank you

Thanks Stephen! Have a fantastic day.

Linda P.

October 26th, 2020

Very informative. It was very helpful.

Thank you!

Donna C.

April 1st, 2022

Easy to use.

Thank you!

Dana R.

February 20th, 2021

This site is Awesome! So easy to use and they really work fast. I will use this for all my Maricopa County Recorder items or deeds, etc. Love this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Robert S.

January 10th, 2019

Documents available immediately as advertised. Was easy to understand the guide and complete the deed form for notarization and filing for recording.

Thank you!

Jules S.

May 6th, 2020

I can't believe I haven't been using this service since inception. The only thing I would recommend is to allow us to delete an erroneous upload. I accidentally uploaded the same document twice but I saw no way for me to correct my mistake other than to send an email.

Thank you for your feedback. We really appreciate it. Have a great day!

laura w.

March 7th, 2021

I found Deeds to be okay except I was hoping it would give me a title or deed to my house if I would have known I would have just got a warranty deed I probably would not have pay the money but it's still worth it

Thank you for your feedback. We really appreciate it. Have a great day!