Jackson County Grant Deed Form

Jackson County Grant Deed Form

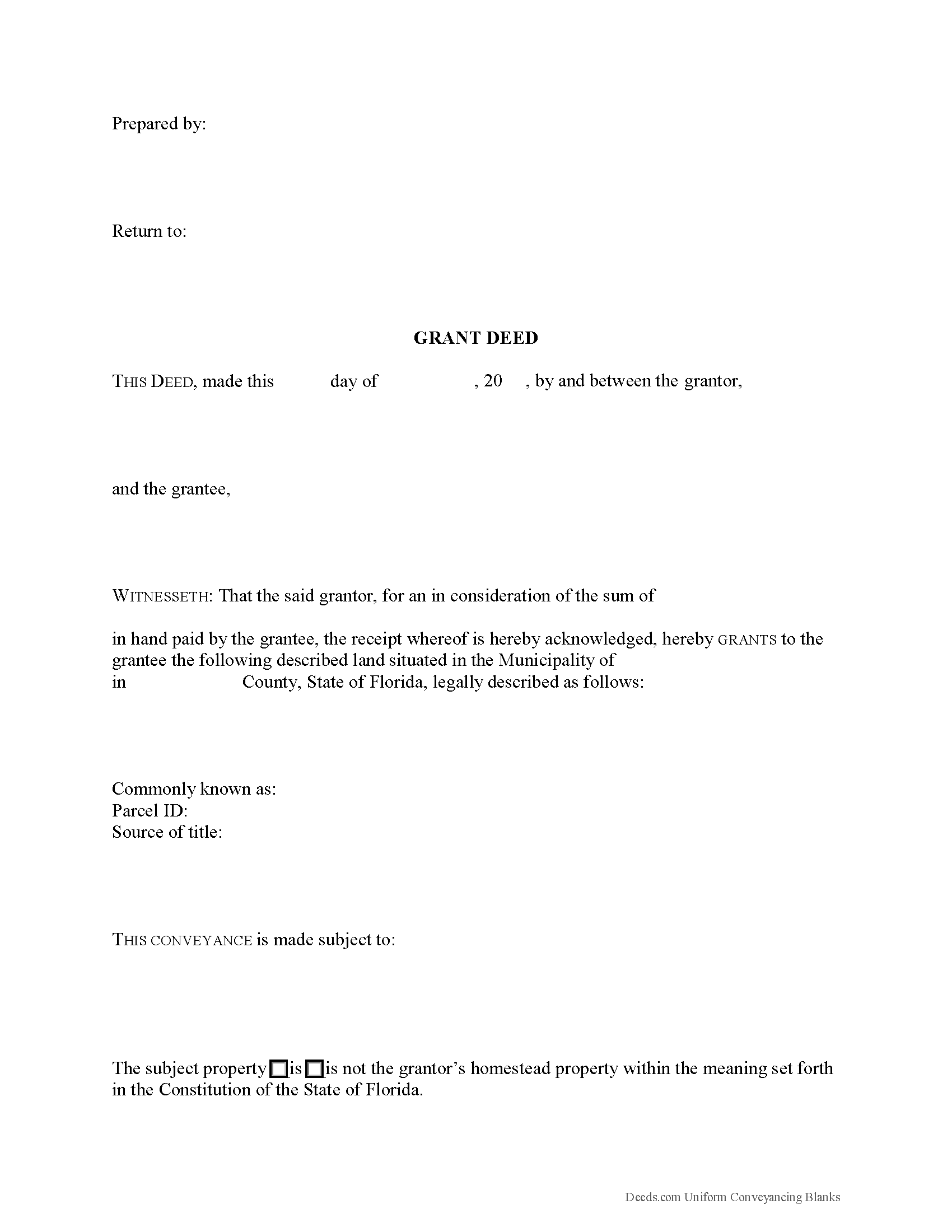

Fill in the blank Grant Deed form formatted to comply with all Florida recording and content requirements.

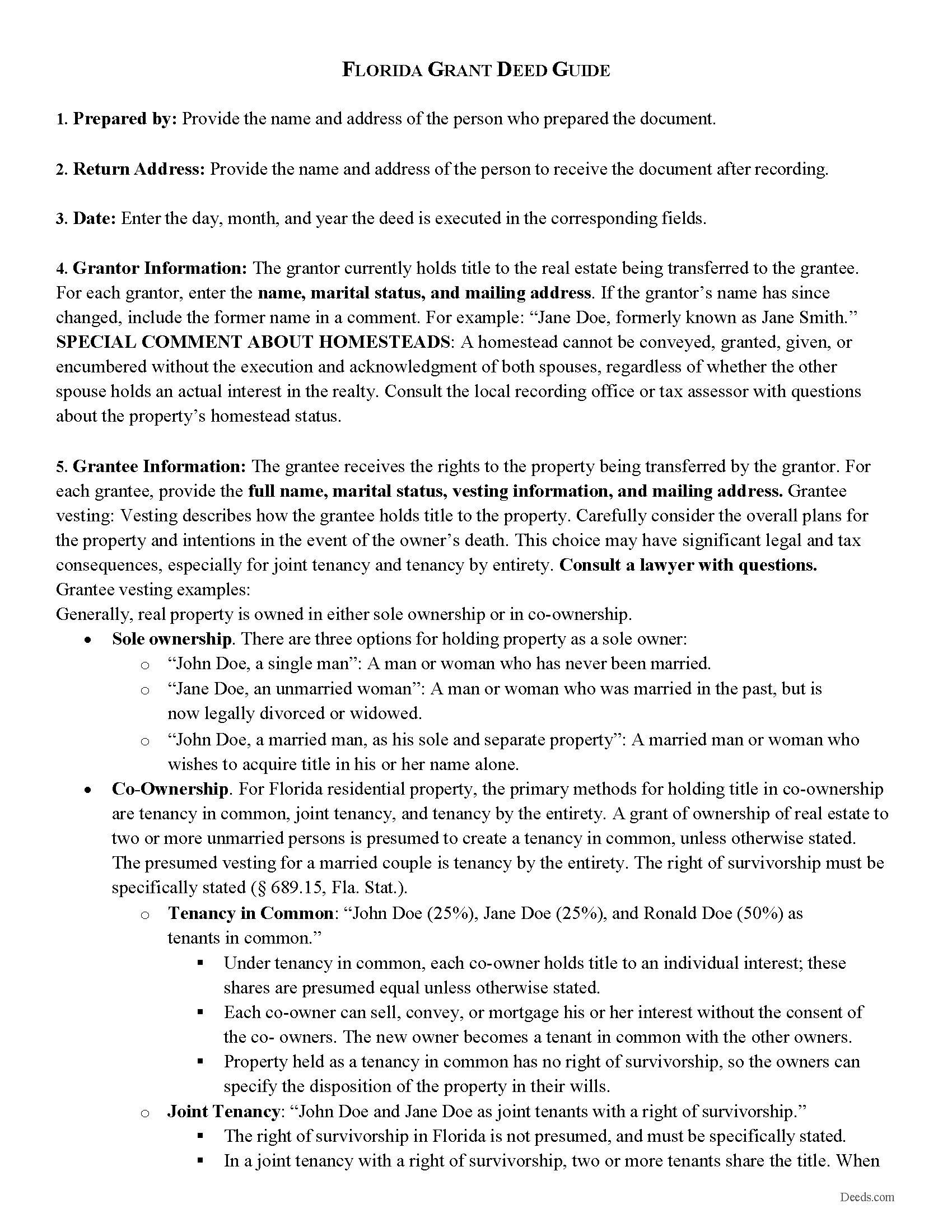

Jackson County Grant Deed Guide

Line by line guide explaining every blank on the Grant Deed form.

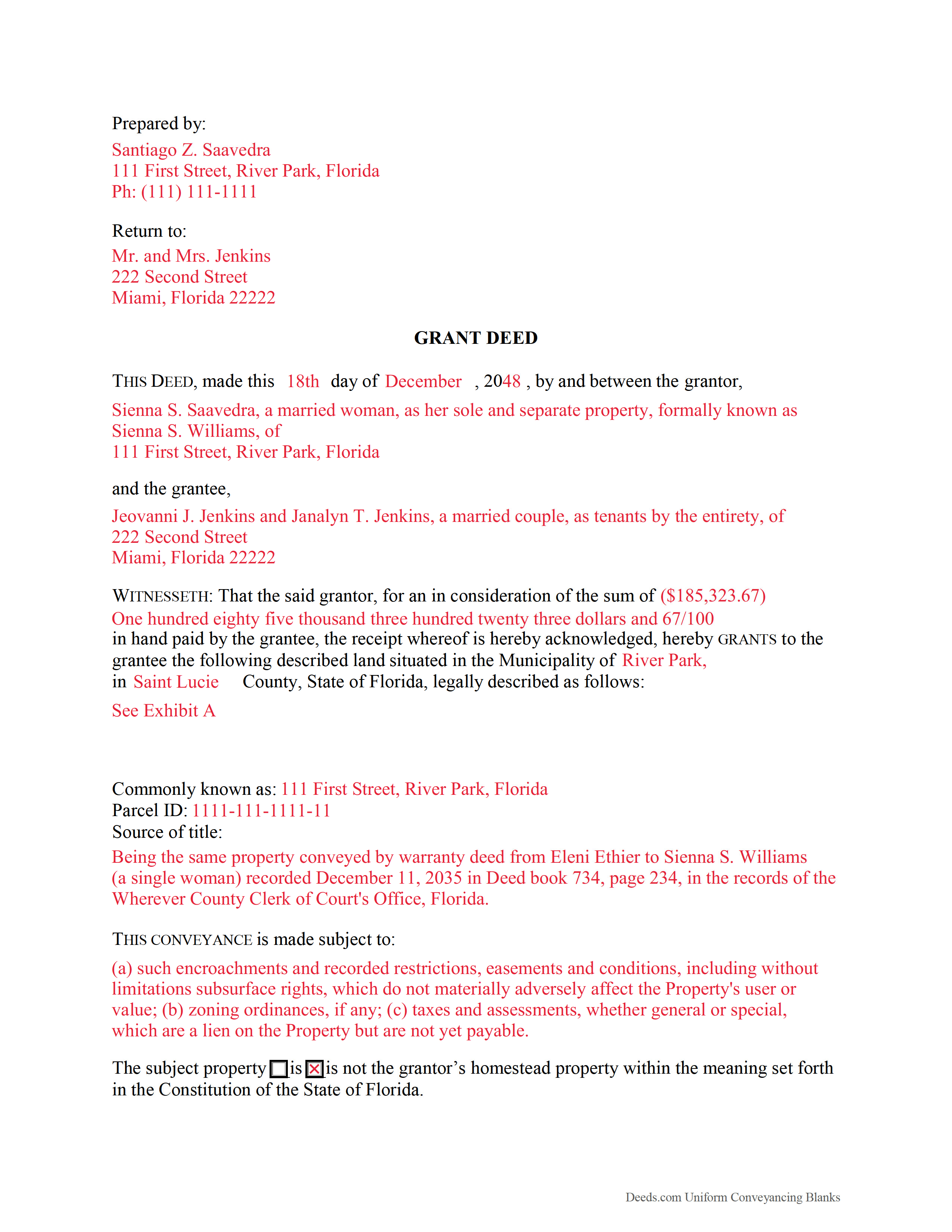

Jackson County Completed Example of the Grant Deed Document

Example of a properly completed Florida Grant Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Jackson County documents included at no extra charge:

Where to Record Your Documents

Clerk of Court - Recording Division

Marianna, Florida 32446 /32447

Hours: 8:00am to 4:30pm M-F

Phone: 850-482-9552

Recording Tips for Jackson County:

- Documents must be on 8.5 x 11 inch white paper

- Check that your notary's commission hasn't expired

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Alford

- Bascom

- Campbellton

- Cottondale

- Cypress

- Graceville

- Grand Ridge

- Greenwood

- Malone

- Marianna

- Sneads

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at 850-482-9552 for current fees.

Questions answered? Let's get started!

A grant deed in Florida can be used to transfer ownership in property from a grantor to a grantee. An estate or interest of freehold, or an estate for a term of more than one year is created, made, granted, transferred, or released by a deed in writing that is signed by the grantor in the presence of two subscribing witnesses (689.01). The grant deed is not mentioned by name in the Florida Revised Statutes, but it can be used in this state to transfer ownership from one living person to another. In a grant deed, the grantor promises that the title has not been previously transferred to anyone other than the grantee and that there are not any encumbrances on the property, other than those that may be stated in the deed. The grant deed does not offer as much protection as a warranty deed.

To entitle a grant deed to be recorded, it must be signed by the grantor, and the execution of the deed must be acknowledged by the party executing it, and proved by two subscribing witnesses or legalized or authenticated by a civil law notary or notary public who affixes his or her official seal, before the officers and in the form or manner dictated by statute. The notary public may serve as a witness, but must sign the document twice if doing so: both as a notary and as a witness. An acknowledgement made in Florida can be made before a judge, clerk, or deputy of any court; a United States commissioner or magistrate; or a notary public or civil law notary of the state. The certificate of acknowledgement or proof must be under the seal of the court or officer (695.03). If acknowledgements are made out of state or in another country, they must conform to the provisions of 695.03(2) and (3).

Unless a grant deed is recorded according to law, it will not be good and effectual in law or in equity against creditors or subsequent purchasers for a valuable consideration and without notice (695.01). Grant deeds should be recorded with the clerk of the circuit court in the county where the property is located. The priority of documents is determined by the order and time of recording.

(Florida Grant Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4580 Reviews )

Phillip S.

February 14th, 2024

I used the Oklahoma Gift Deed transferring property intra-family, and found it easy to complete. I could not find an Oklahoma Affidavit for the new law re citizenship verification, 60 O.S. Sec 121 and found it at another site that was not a fill in online. Oh well. Site was easy to navigate.

We are motivated by your feedback to continue delivering excellence. Thank you!

Donna R.

November 17th, 2021

This was a seamless process. It probably took one minute to fill out my information and upload the document. It was formatted and sent immediately. It was processed the next day at the county recorders office. I have zero complaints. Before finding this company I spent an entire day calling and leaving messages at other e-filing companies like simplfile and others but they all required subscriptions. I just needed to file a single document now and then so that was not a good fit. (And those companies I found out still require the customer to do all the work!). Deeds.com kept me informed throughout the process every step. I'm happy to write this review. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Karen C.

July 28th, 2022

Easily find and print forms necessary for peace of mind.

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

May 28th, 2025

Deeds.com has become a great assistant to our firm! The service is of highest quality and consistently helpful to our law firm in its recording needs. It's summer in Arizona and no one I know wants to drive to downtown Phoenix to record a property deed so think I will add "grateful" to my praise.

Thank you, Mary! We appreciate your kind words and are glad to help make recording easier — especially when it means avoiding a summer trip to downtown Phoenix. We’re grateful for your continued trust.

Michael W.

February 8th, 2025

Wonderful service.

Thank you!

Jennifer M P.

December 14th, 2022

Locating the deed I needed was not too hard. I love that you can download and complete it on your time frame.

Thank you!

F Michael C.

June 15th, 2021

Very easy to use and no hidden costs. You get to download whatever you need and can save it and even reuse it. So it's like having your own library of form that you pay for once. They even give you more related forms than you ask for and it turned out we needed some if those forms as well. The forms meet what our county requires for margins in records and so on. So I will use deeds.com again when I need a different kind of legal form.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Wendy S.

January 11th, 2021

Good template that met my needs. Much better than another draft template that I found on another site. Would have been helpful if the template had been provided in a Word format instead of PDF so that I could remove the sections that are not applicable.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

RONALD L W.

August 11th, 2022

Easy access of downloadable forms for use by Pennsylvania, Allegheny County residents.

Thank you for your feedback. We really appreciate it. Have a great day!

Larry G.

July 20th, 2022

After purchasing the Quit Claim Deed, I felt I had purchased something I could have gotten free somewhere else. But after reviewing all the other information Deed.com provided, I realized you saved me a lot of time that would have been wasted on research. Money well spent.

Thank you for your feedback. We really appreciate it. Have a great day!

Wendy B.

December 20th, 2019

Really appreciate you he quick response and solution to my problem!! Thank you!!

Thank you for your feedback. We really appreciate it. Have a great day!

Chris M.

April 21st, 2025

always helpful always informative always awesome

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Jonny C.

October 21st, 2020

Easy and fast

Thank you!

Kelly M.

August 27th, 2021

Deeds.com made it so easy and convenient to get my homestead document recorded. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cynthia N.

February 25th, 2021

great service, quick and easy!

Thank you!