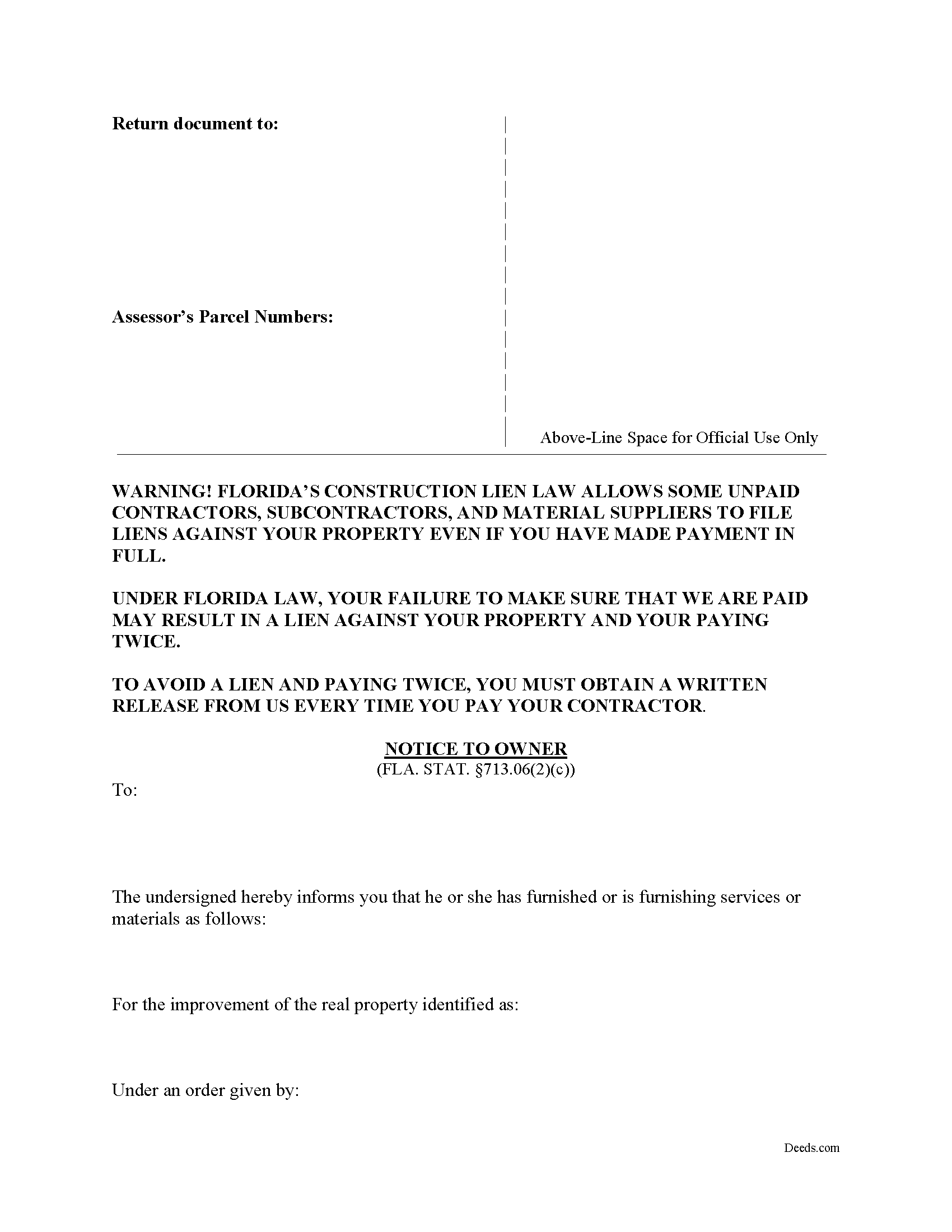

Franklin County Notice to Owner Form

Franklin County Notice to Owner Form

Fill in the blank form formatted to comply with all recording and content requirements.

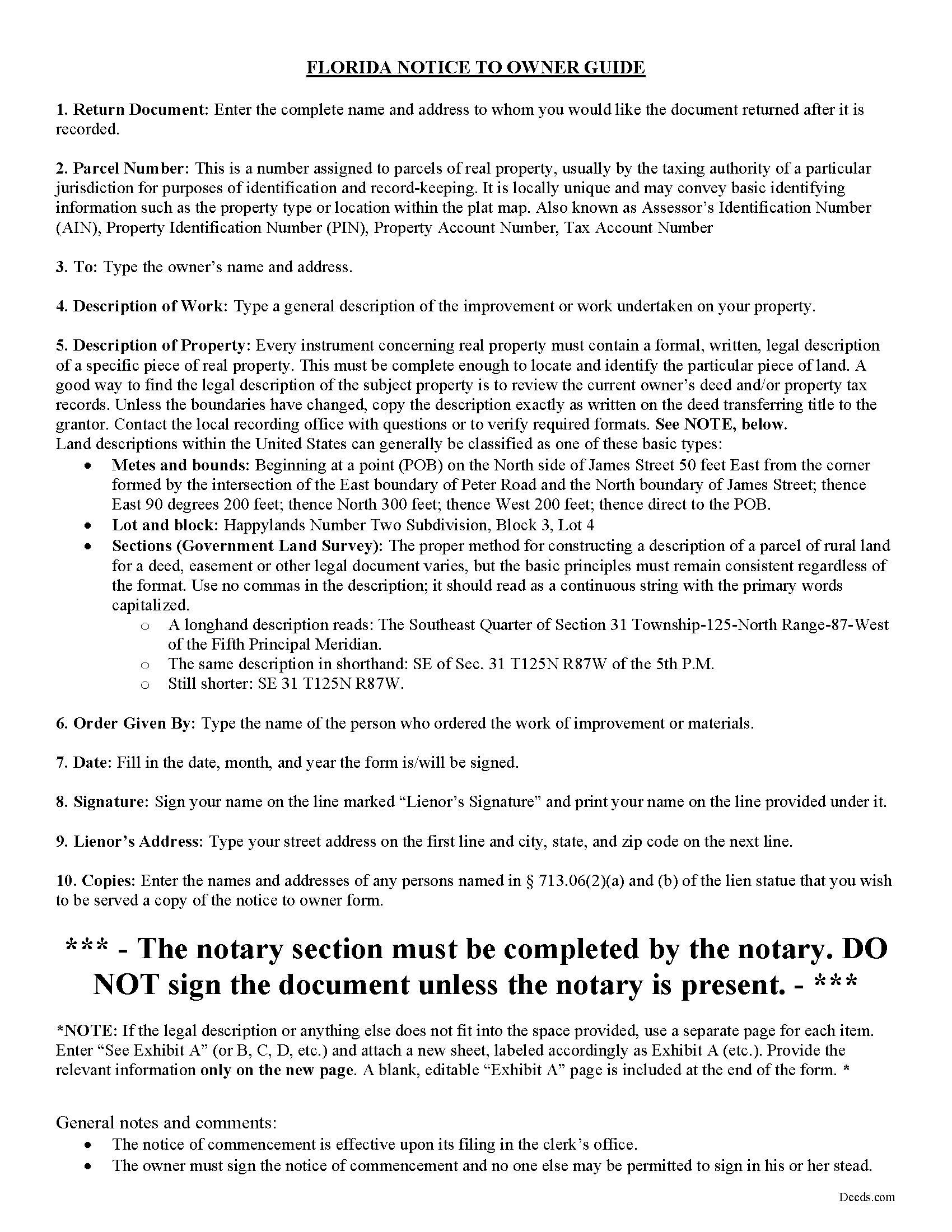

Franklin County Notice to Owner Guide

Line by line guide explaining every blank on the form.

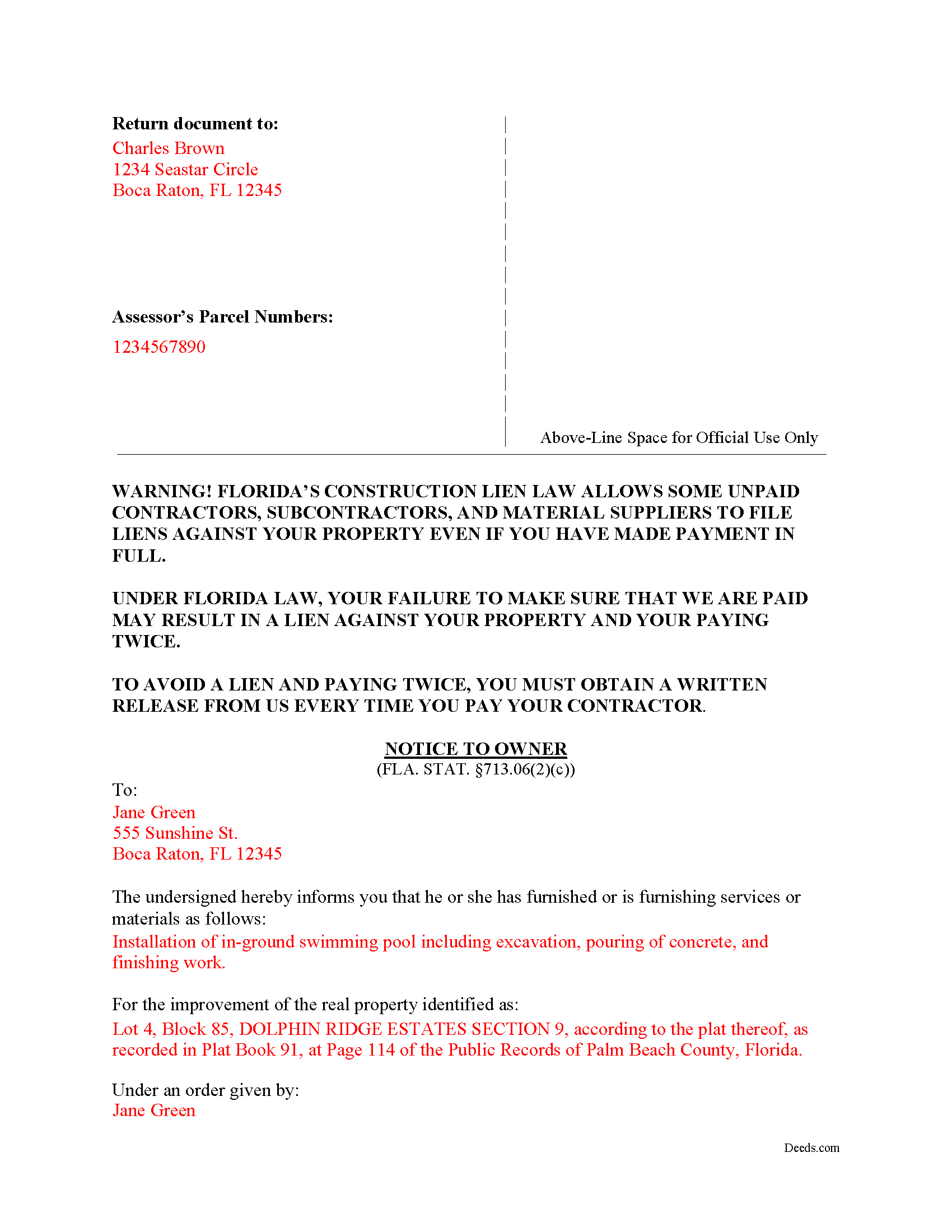

Franklin County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Clerk of Court

Apalachicola, Florida 32320

Hours: 8:00 to 5:00 M-F

Phone: (850) 653-8861 Ext. 102, 109, and 104

Carrabelle Annex

Carrabelle, Florida 32322

Hours: Thursdays only 8:15 to 11:30 & 12:30 to 4:45

Phone: 850-697-3263

Recording Tips for Franklin County:

- Ensure all signatures are in blue or black ink

- Documents must be on 8.5 x 11 inch white paper

- Recorded documents become public record - avoid including SSNs

- Leave recording info boxes blank - the office fills these

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Apalachicola

- Carrabelle

- Eastpoint

- Lanark Village

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (850) 653-8861 Ext. 102, 109, and 104 for current fees.

Questions answered? Let's get started!

A statutory Notice to Owner (NTO) form, under section 713.06 of the Florida Revised Statutes, is a fairly simple document. Sent to an owner by any lienor (subcontractor, sub-subcontractor or material supplier without a direct contract between the two parties), this document informs the owner that the lienor has or will commence the supply of labor, services, or materials for the purpose of improving their real property. The NTO is a first step in securing a mechanics lien on the property.

Florida's lien statute requires lienors as defined at 713.01(18-20) to serve the owner with a NTO form, even if the claimant is not a direct party to a contract with the owner. The lien law sets forth the required contents of the NTO, which must include the lien claimant's name and address, a description of the property, and a description of the services or materials furnished. The claimant must serve the owner either before commencement of the work or furnishing of materials, or within 45 days of such furnishing. Failure to serve the NTO in accordance with the lien statute renders associated liens invalid.

The NTO should be served on the owner in accordance with service methods prescribed under Florida law. The easiest (and least expensive) method is to use certified mail. Other acceptable methods include personal service and posting the notice at the jobsite as a final alternative.

Each case is unique, so contact an attorney with specific questions or for complex situations involving a Notice to Owner or other issue related to Florida's Construction Lien Law.

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4577 Reviews )

Ann D.

December 16th, 2024

I found what my lawyer recommended and was able to download it easily.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Willard V.

May 11th, 2025

While it's nice to get all the forms and info in one package for a reasonable cost, the fixed format of the form does not allow for a lengthy meet and bounds property description for real property. Also, the Cover Sheet has big fillable sections with no instructions about what's supposed to go there. I tried the "Contact Us" link, but all it does is spin saying it's trying verify the security of my connection. Looks like I;m going to have to create my own deed in MS Word instead of just filling in the blacks of the PDF file that I downloaded. Bummer!

Your feedback is a crucial part of our dedication to ongoing improvement. Thank you for your insightful comments.

Melody M.

March 27th, 2023

Thank you Deeds.com for making our Quit Deed process easy and efficient. The instructions and example forms are a must! Excellent value for the price.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael S.

July 11th, 2019

So far, I'm happy with my experience. I'm still reviewing the guide for the docs I downloaded. Including the guide for the docs is indeed a plus.

Thank you Michael, we really appreciate your feedback.

Kay I.

December 11th, 2019

Very easy to use. However, the "sample" filled in red ink did not print for me to refer to. Is that the correct desire, not to print?

Thank you for your feedback. We really appreciate it. Have a great day!

Eric S.

August 11th, 2020

Very easy and efficient to use. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle M.

April 24th, 2023

This was an excellent source. The fee was much lower than the first site I checked. The sample form was very helpful.

Thank you!

Carol O.

April 3rd, 2023

Easy process as I had an example of my other property deeds to work from plus my most current Real Estate Tax forms.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

George W.

February 26th, 2021

Phenomenal service! If only every request and transaction with other companies could be this seamless and efficient!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Willie P.

June 15th, 2022

got the forms needed plus all the information needed to fill them out.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carole M.

June 9th, 2020

So far it seems easy and hopefully be acceptable to Hillsborough Co

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shawn S.

August 30th, 2019

Seems to be exactly whst j needed. Great job!

Thank you!

Randall M.

March 31st, 2022

These forms worked fantastic!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles C.

October 1st, 2020

Easy to use, fast!

Thank you!

Mary M.

May 7th, 2019

So easy to use. I was able to download all the forms I need, it saves a lot of time!

Thank you!