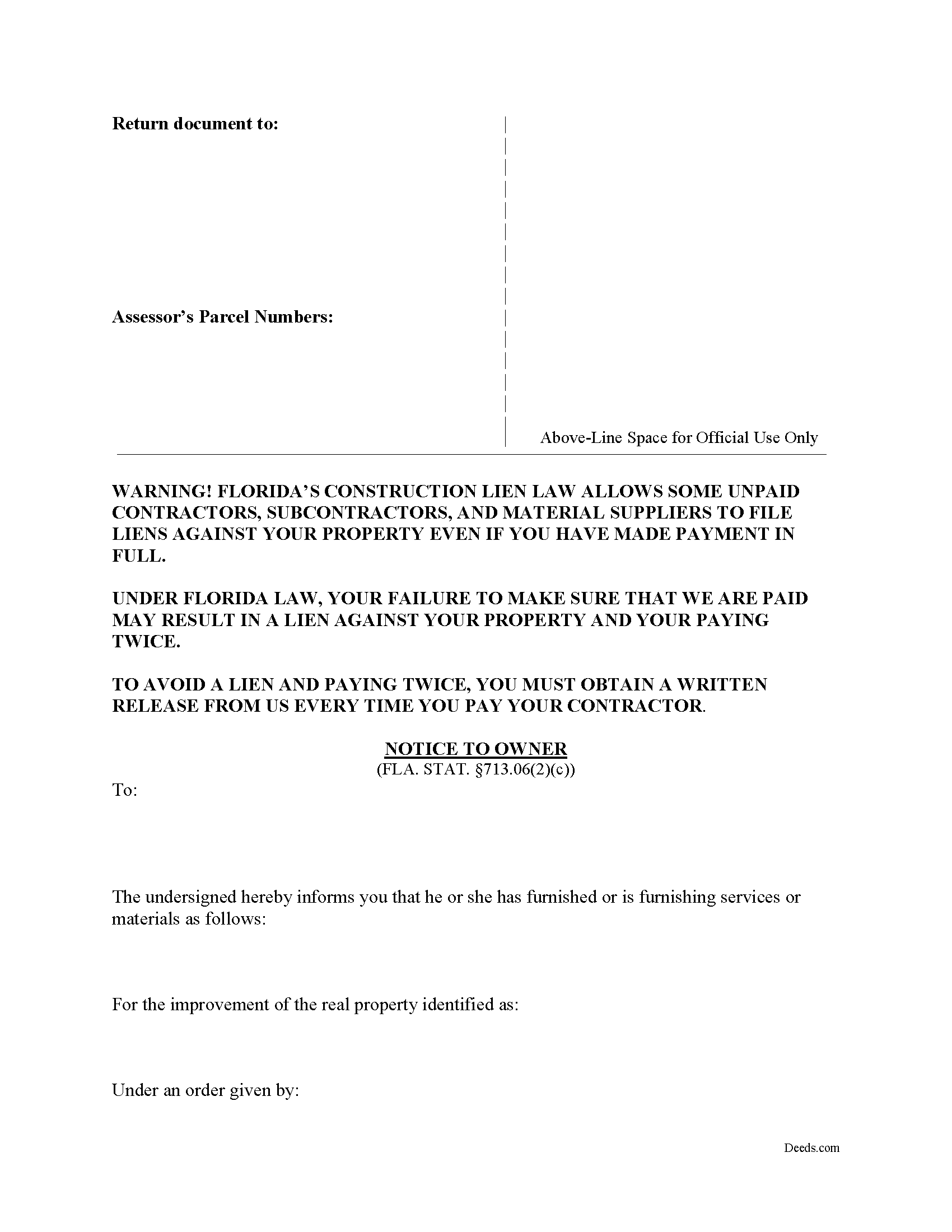

Walton County Notice to Owner Form

Walton County Notice to Owner Form

Fill in the blank form formatted to comply with all recording and content requirements.

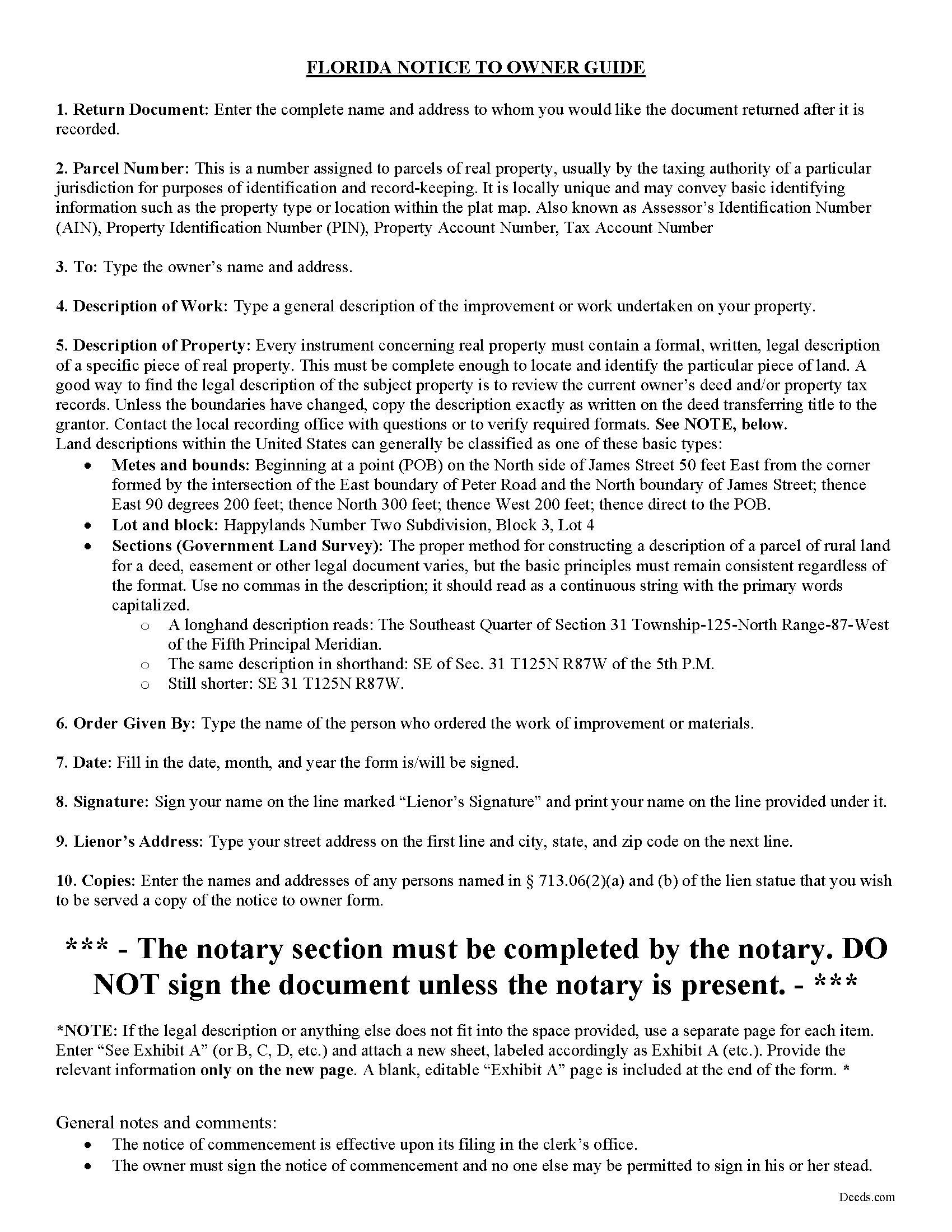

Walton County Notice to Owner Guide

Line by line guide explaining every blank on the form.

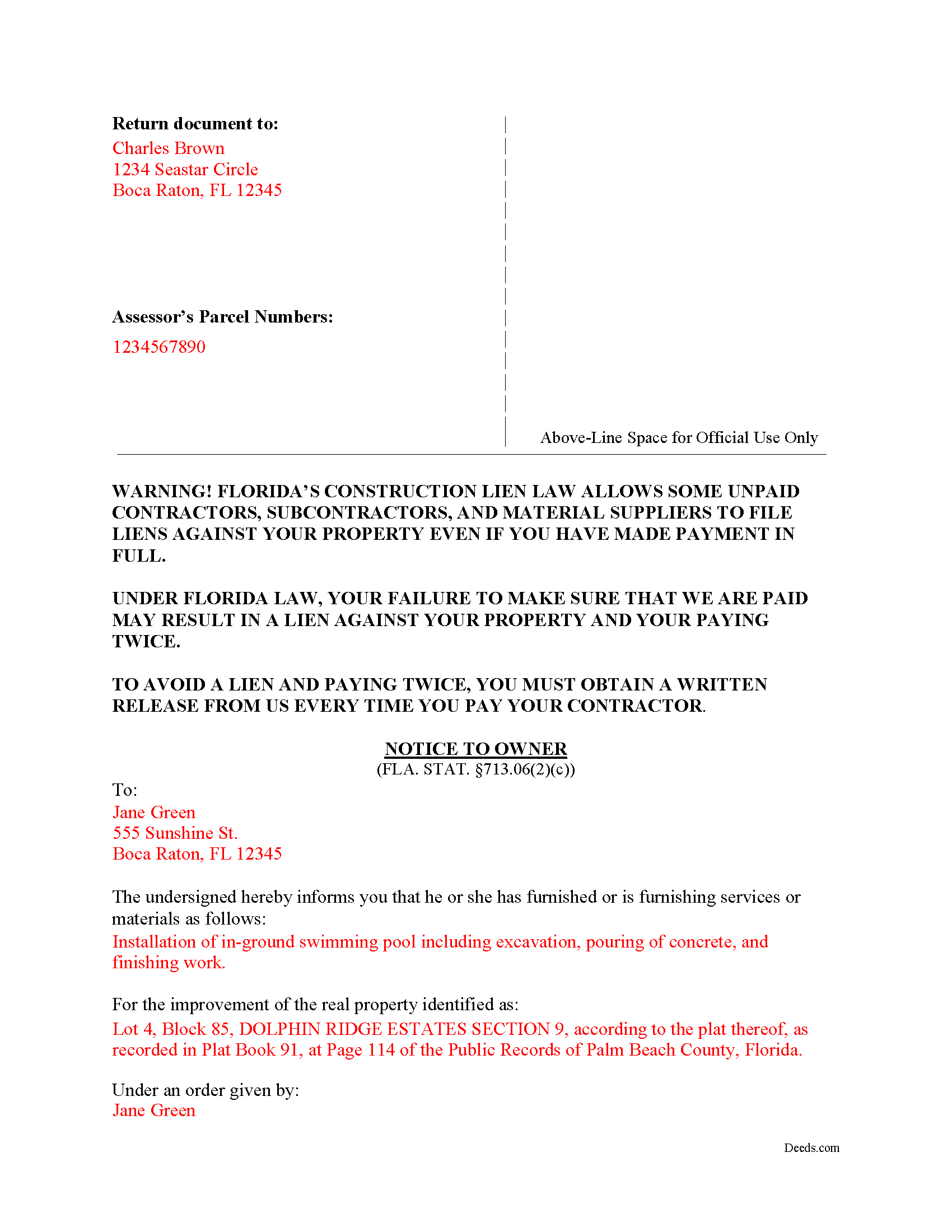

Walton County Completed Example of the Notice to Owner Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Walton County documents included at no extra charge:

Where to Record Your Documents

Walton Clerk & Comptroller

DeFuniak Springs, Florida 32433 / 32435

Hours: 8:00am to 4:30pm M-F

Phone: (850) 892-8115 - press 2 for Records

South Walton Office

Santa Rosa Beach, Florida 32459

Hours: 8:00am to 4:30pm M-F

Phone: (850) 267-3066

Recording Tips for Walton County:

- Check that your notary's commission hasn't expired

- Request a receipt showing your recording numbers

- Both spouses typically need to sign if property is jointly owned

Cities and Jurisdictions in Walton County

Properties in any of these areas use Walton County forms:

- Argyle

- Defuniak Springs

- Freeport

- Miramar Beach

- Mossy Head

- Paxton

- Ponce De Leon

- Rosemary Beach

- Santa Rosa Beach

Hours, fees, requirements, and more for Walton County

How do I get my forms?

Forms are available for immediate download after payment. The Walton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Walton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Walton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Walton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Walton County?

Recording fees in Walton County vary. Contact the recorder's office at (850) 892-8115 - press 2 for Records for current fees.

Questions answered? Let's get started!

A statutory Notice to Owner (NTO) form, under section 713.06 of the Florida Revised Statutes, is a fairly simple document. Sent to an owner by any lienor (subcontractor, sub-subcontractor or material supplier without a direct contract between the two parties), this document informs the owner that the lienor has or will commence the supply of labor, services, or materials for the purpose of improving their real property. The NTO is a first step in securing a mechanics lien on the property.

Florida's lien statute requires lienors as defined at 713.01(18-20) to serve the owner with a NTO form, even if the claimant is not a direct party to a contract with the owner. The lien law sets forth the required contents of the NTO, which must include the lien claimant's name and address, a description of the property, and a description of the services or materials furnished. The claimant must serve the owner either before commencement of the work or furnishing of materials, or within 45 days of such furnishing. Failure to serve the NTO in accordance with the lien statute renders associated liens invalid.

The NTO should be served on the owner in accordance with service methods prescribed under Florida law. The easiest (and least expensive) method is to use certified mail. Other acceptable methods include personal service and posting the notice at the jobsite as a final alternative.

Each case is unique, so contact an attorney with specific questions or for complex situations involving a Notice to Owner or other issue related to Florida's Construction Lien Law.

Important: Your property must be located in Walton County to use these forms. Documents should be recorded at the office below.

This Notice to Owner meets all recording requirements specific to Walton County.

Our Promise

The documents you receive here will meet, or exceed, the Walton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Walton County Notice to Owner form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4588 Reviews )

Michelle M.

July 3rd, 2020

The website was easy to navigate and great communication on every step of the process.

Thank you for your feedback. We really appreciate it. Have a great day!

Cherene K.

February 19th, 2019

The process was easy and reasonable. My only problem was that, when I filled out my form on the computer, the writing I did overlapped with the pre-written words on the form, so that I had to end up doing it by hand. I've used DEEDS before and have not had that problem.

Thank you for your feedback Cherene. We've emailed you for some followup regarding the issue you reported.

Michael P.

February 4th, 2024

WOW!! Thank you for making the availability and access to these forms an unpainful experience at a competitive price. Well done!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cruz C.

December 8th, 2020

L-o-v-e your site. Great over-all usable docs. thanks

Thank you for your feedback. We really appreciate it. Have a great day!

Fay J.

July 30th, 2020

instead of the rep giving me instructions on how to summit the documents,with 3 pages, he or she told me i had all night to figure it out!!! wow...because of that i rate the service very poorly...fast to get it done but very poor customer service...so...i give them a 2.5 rating.

Thank you for your feedback, have a wonderful day Fay.

Richard M.

January 9th, 2020

Needed some help at the beginning but once I was into the program it was smooth sailing.

Thank you!

Jerry G.

September 21st, 2023

I found the document confusing and I don't think I can use it.

Thank you for your feedback. We recognize that do-it-yourself legal documents may not be suitable for everyone. We always advise all our customers to seek assistance from a legal professional familiar with their specific situation for any form they do not completely understand. For your convenience, we have canceled your order and processed a refund.

Steven M.

February 13th, 2025

Happy with your service. Everything as advertised.

Your feedback is greatly appreciated. Thank you for taking the time to share your experience!

Carmen H.

February 2nd, 2021

your site was a godsend for us, really appreciate the sample and instructions you provide, was very useful. And that we can save and use later, you guys are great. I have used your service twice, and will be using you in the future too. Thank you again.

Thank you for your feedback. We really appreciate it. Have a great day!

Roy P.

October 12th, 2021

The forms were just what I needed, very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Brooksye G.

January 15th, 2019

Very helpful. I live in Arkansas and needed information and documents for a Missouri transaction. I got everything I needed without any hassle.

Thank you Brooksye, we really appreciate your feedback.

Ron M.

December 2nd, 2020

The download of forms, etc. was easy and the guides that were provided were good, but more information would have been nice as to where to find tax map #, parcel #, and district mentioned in Exemptions from Property Transfer Fees (and Declaration of Consideration or Value. In general, I was quite pleased with your product.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

joni e.

October 25th, 2019

It was everything that I needed. The county clerk's office kept telling me to get a lawyer for this form, but I didn't need one. Saved myself hundreds of dollars. I've used them many times.

Thank you for your feedback. We really appreciate it. Have a great day!

Martha B.

January 11th, 2019

Not too hard to do, I did get it checked out by an attorney after I completed it just to be safe. He said it was fine, made no changes.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donna L.

October 17th, 2021

So far so good. Looks nice but a more condensed version, when the recorder charges by the page, should be offered.

Thank you for your feedback. We really appreciate it. Have a great day!