Walton County Request for a Sworn Statement of Account Form

Walton County Request for a Sworn Statement of Account Form

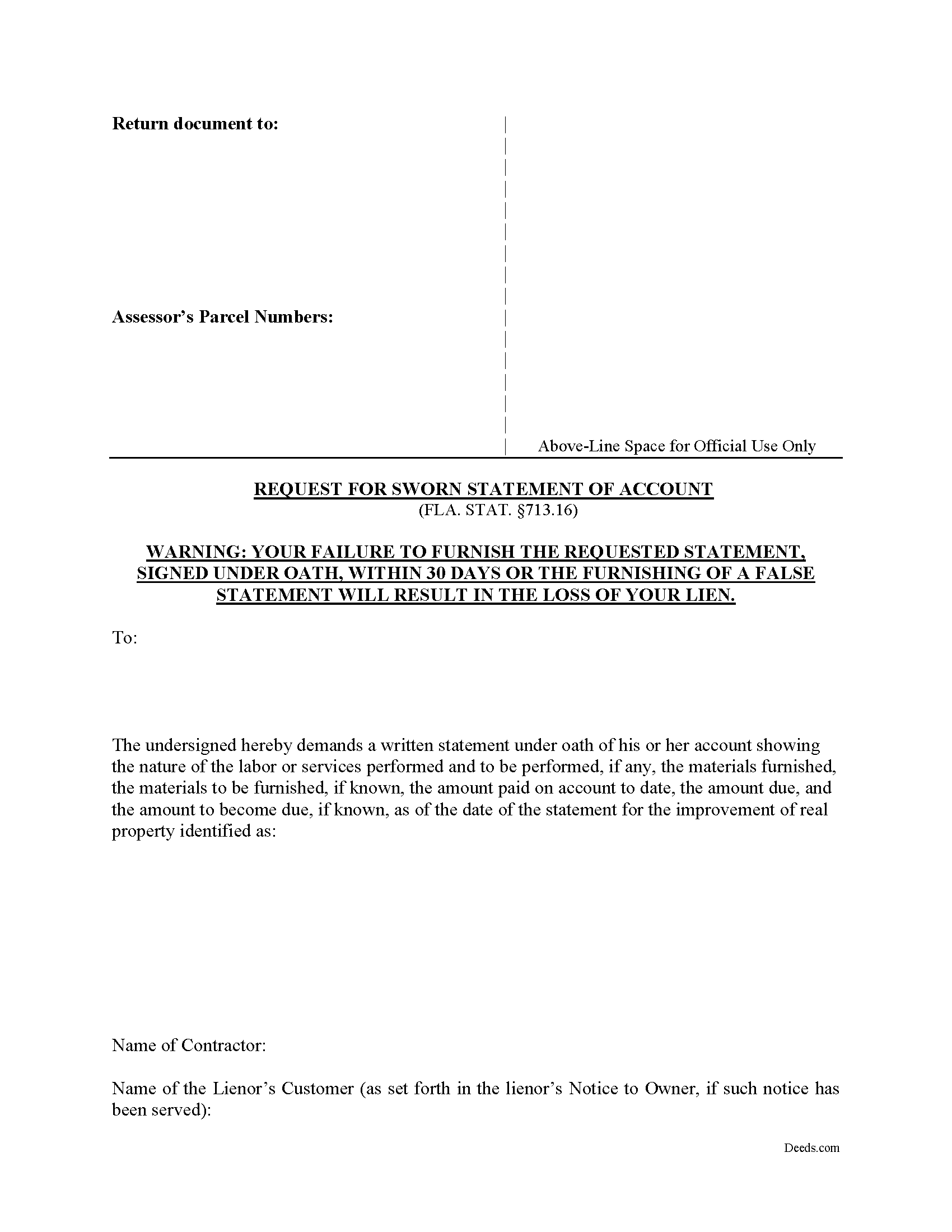

Fill in the blank form formatted to comply with all recording and content requirements.

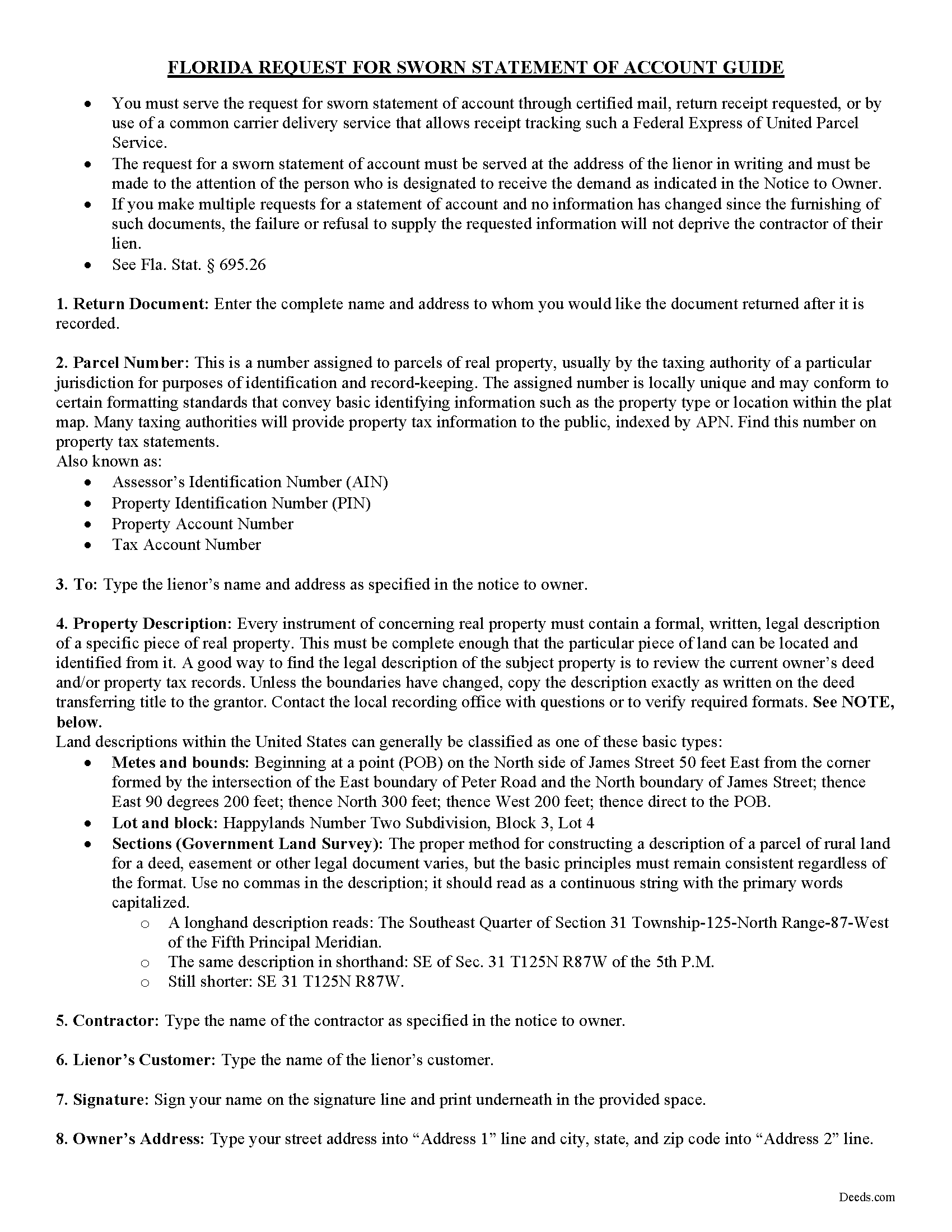

Walton County Request for a Sworn Statement of Account Guide

Line by line guide explaining every blank on the form.

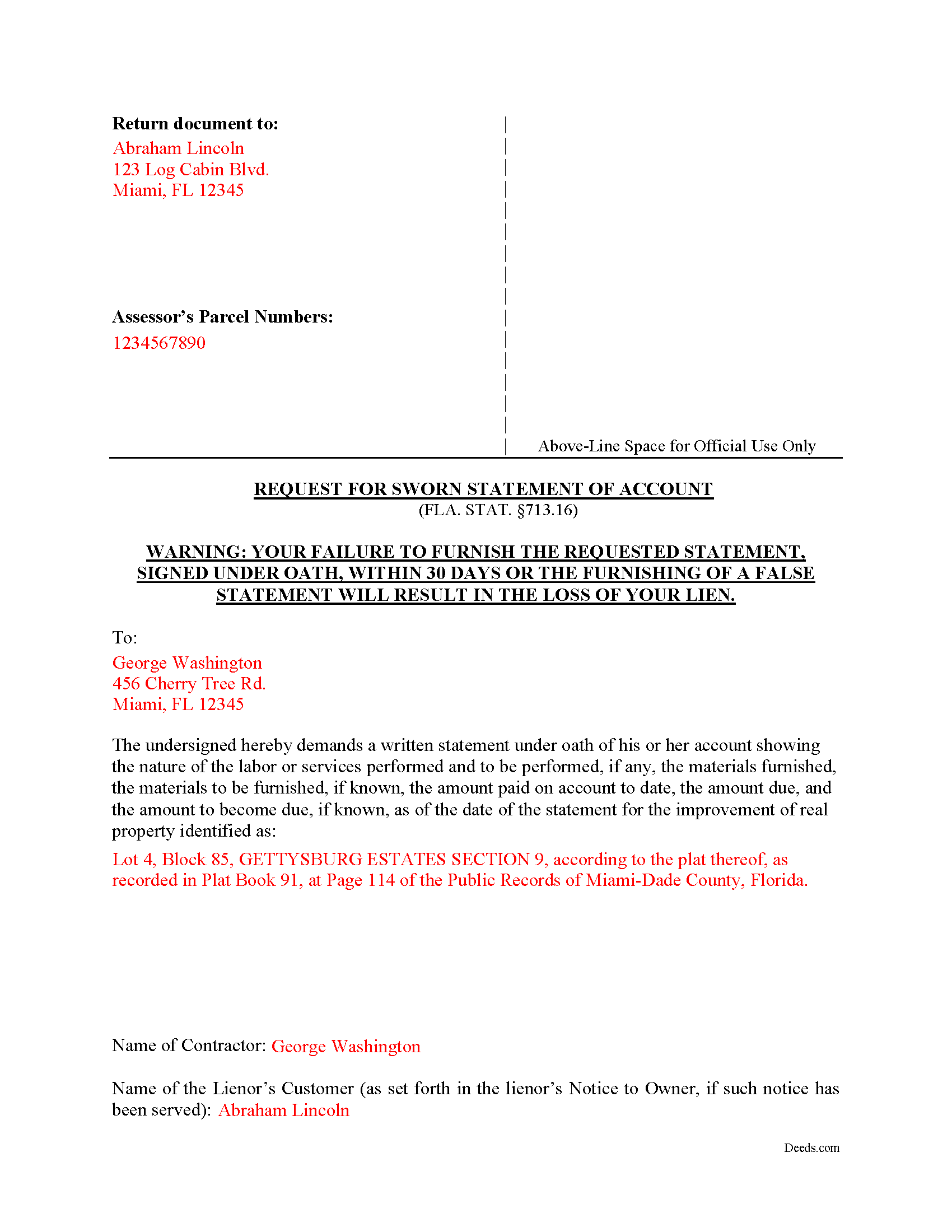

Walton County Completed Example of the Request for a Sworn Statement of Account Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Walton County documents included at no extra charge:

Where to Record Your Documents

Walton Clerk & Comptroller

DeFuniak Springs, Florida 32433 / 32435

Hours: 8:00am to 4:30pm M-F

Phone: (850) 892-8115 - press 2 for Records

South Walton Office

Santa Rosa Beach, Florida 32459

Hours: 8:00am to 4:30pm M-F

Phone: (850) 267-3066

Recording Tips for Walton County:

- Ensure all signatures are in blue or black ink

- Check margin requirements - usually 1-2 inches at top

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Walton County

Properties in any of these areas use Walton County forms:

- Argyle

- Defuniak Springs

- Freeport

- Miramar Beach

- Mossy Head

- Paxton

- Ponce De Leon

- Rosemary Beach

- Santa Rosa Beach

Hours, fees, requirements, and more for Walton County

How do I get my forms?

Forms are available for immediate download after payment. The Walton County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Walton County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Walton County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Walton County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Walton County?

Recording fees in Walton County vary. Contact the recorder's office at (850) 892-8115 - press 2 for Records for current fees.

Questions answered? Let's get started!

What is a request for a sworn statement of account?

Under section 713.16 Fla. Stat. (2016), a statutory Request for a Sworn Statement of Account is used by property owners in response to a notice of intent to place a lien on the owner's property.

The request is addressed to the lienor and contains a description of the owner's property, the name of the contractor, and the name of the lienor's customer (if different from the owner). The form is then signed and dated by the owner. The demand to the lienor must be served on the lienor at the address (and to the attention) of any person designated to receive the demand as stated in the notice to owner. Failure or refusal to provide the statement as directed will not deprive the lienor of his or her lien. (713.16(2)).

A response to the form from the contractor must include a written statement, given under oath, of his or her account showing the nature of the labor or services performed and to be performed, if any, the materials furnished, the materials to be furnished, if known, the amount paid on account to date, the amount due, and the amount to become due, if known, as of the date of the statement for the improvement of the identified real property. (713.16(2)).

The lienor must furnish the requested statement within 30 days of receipt. If the lienor furnishes a false or misleading statement, the lienor will lose the right to recover attorney's fees in any action to enforce the claim of lien. See 713.16(5)(b).

Each case is unique, so contact an attorney with questions about the sworn statement of account, for complex situations, or any other issues relating to Florida's Construction Lien Law.

Important: Your property must be located in Walton County to use these forms. Documents should be recorded at the office below.

This Request for a Sworn Statement of Account meets all recording requirements specific to Walton County.

Our Promise

The documents you receive here will meet, or exceed, the Walton County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Walton County Request for a Sworn Statement of Account form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Josephine H.

October 28th, 2019

Wonderful site. Pretty complete and super easy to use. Thank you.

Thank you for your feedback. We really appreciate it. Have a great day!

Christina H.

April 15th, 2021

The process was straightforward, quick and reasonably priced. The agents provided updates every step of the way.

Thank you!

Kathy Z.

November 11th, 2022

Great site !! Very easy to navigate and explanations are clear and simple to understand. Thank You!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

STANLEY F.

March 25th, 2019

Forms were spot on and able to save over $100 by not going to an attorney to complete the same documents. There were templates on how forms are supposed to be completed. You just need a notary to sign.

Thank you Stanley, we really appreciate your feedback.

Catherine P.

January 2nd, 2019

I got what I needed and you provided great templates.

Thank you!

Carol M.

January 13th, 2020

Great service

Thank you!

David S.

April 6th, 2024

This site was recommended by my County's Clerks office website. Let me tell you when I received my specific State and County's Quit Claim Deed forms from Deeds.com, every conceivable form that could be needed in addition to the full instructions, and a sample filled out form, I was impressed (five stars) and made things so easy for me to feel confident in my legal activity on a land transaction.

Thank you for your positive words! We’re thrilled to hear about your experience.

Sylvia Y.

September 2nd, 2020

Fantastic forms! So nice to have them formatted correctly for our county, the recorder here can be very picky with the margins. No issues at all.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin V.

January 5th, 2022

Quick and trouble free experience!

Thank you for your feedback. We really appreciate it. Have a great day!

Kathy C.

March 7th, 2022

It's worth the cost to download the fill in the blank forms. So quick and easy. The lady I spoke to on the phone was super nice and very helpful. She deserves a medal for being so patient with me.

Thank you!

Sarah K.

October 22nd, 2019

I was annoyed when I realized I couldn't put the document into Word or WordPerfect. I had to retype the entire document. What a waste of time and money.

Sorry to hear of your annoyance. We have canceled your order and payment. We do hope that you find something more suitable to your needs elsewhere. Have a wonderful day.

Emili C.

October 14th, 2020

Thank you! I received my forms promptly and they are easy to follow along for filling out. The examples gave me confidence that they were done correctly.

Thank you for your feedback. We really appreciate it. Have a great day!

Gary S.

January 9th, 2022

Easy to use. Very helpful

Thank you!

Bayyinah M.

March 30th, 2022

EasyPeasy!

Thank you!

Joyce S.

August 5th, 2019

Download very easy. Forms are just what I need. Thanks

Thank you for your feedback. We really appreciate it. Have a great day!