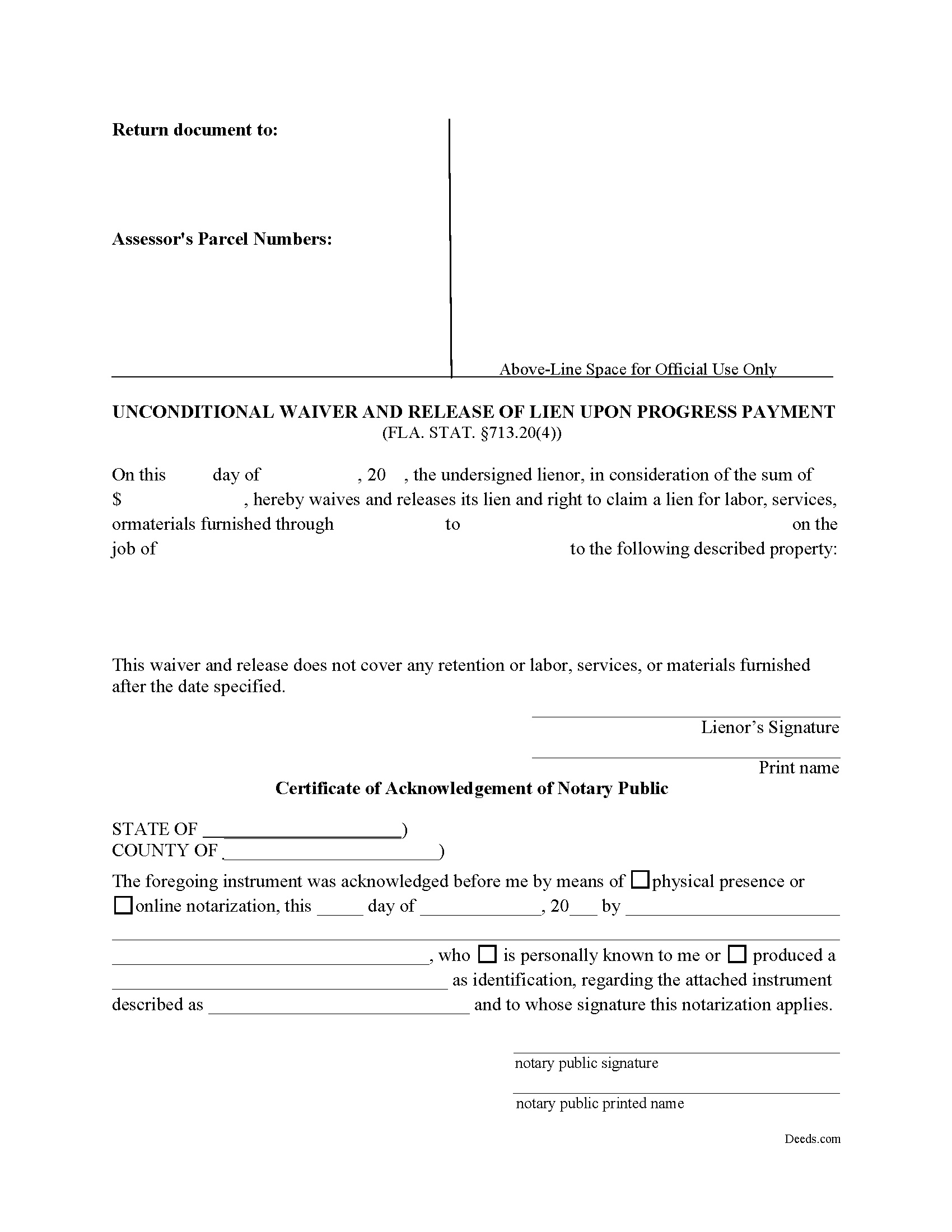

Flagler County Unconditional Waiver and Release of Lien upon Progress Payment Form

Flagler County Unconditional Waiver and Release of Lien upon Progress Payment Form

Fill in the blank form formatted to comply with all recording and content requirements.

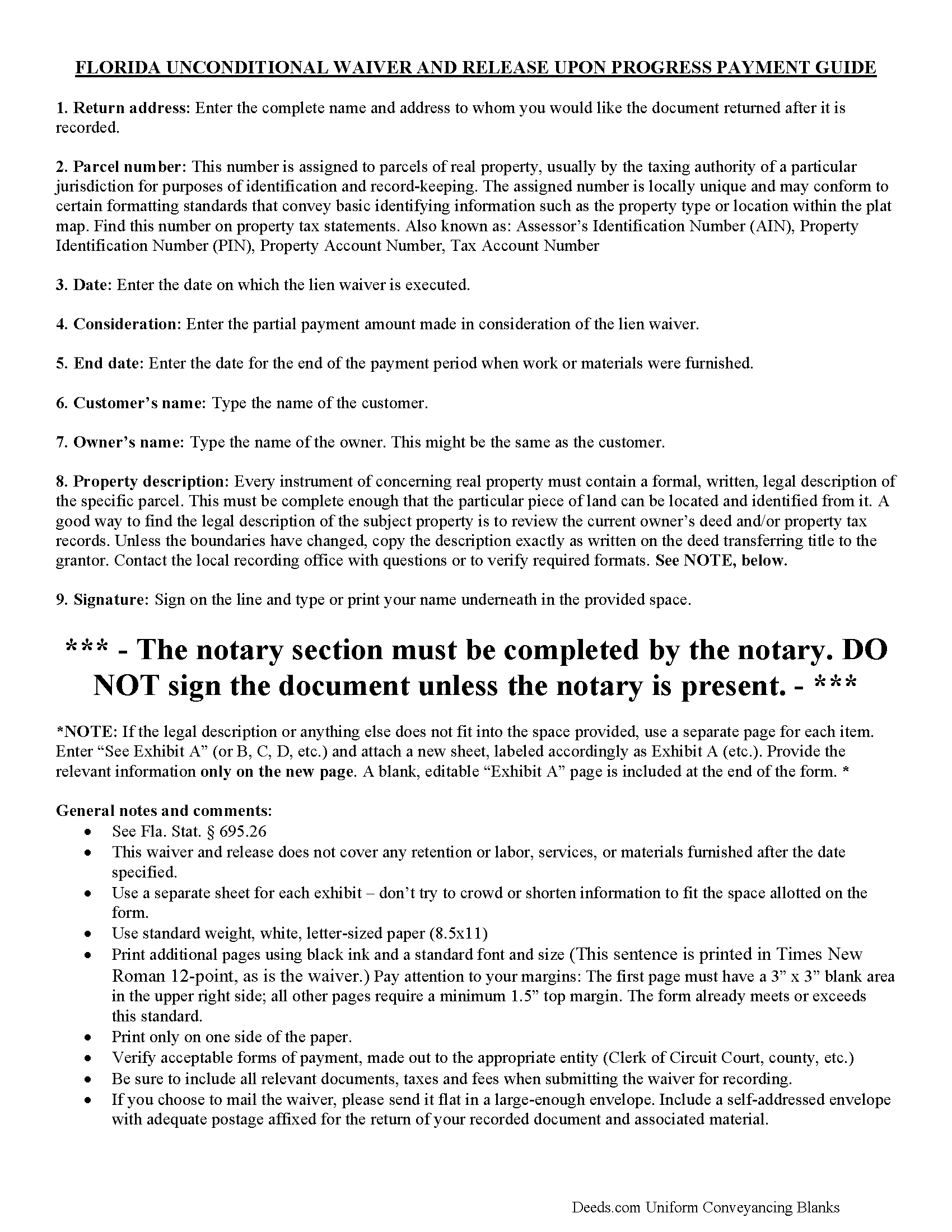

Flagler County Unconditional Waiver and Release of Lien upon Progress Payment Guide

Line by line guide explaining every blank on the form.

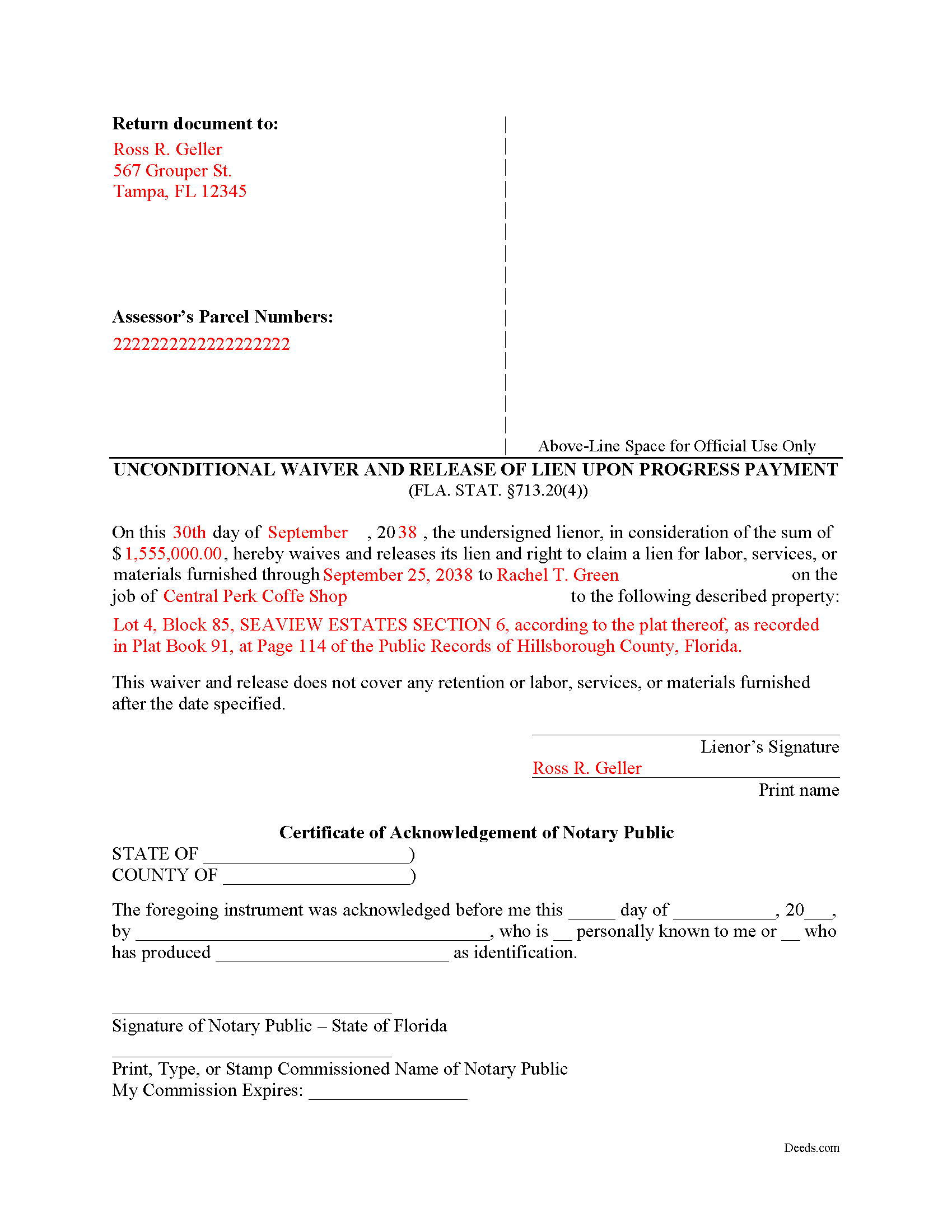

Flagler County Completed Example of the Unconditional Waiver and Release of Lien upon Progress Payment Form

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Florida and Flagler County documents included at no extra charge:

Where to Record Your Documents

Clerk of the Circuit Court - Recording Division

Bunnell, Florida 32110

Hours: 8:30am - 4:30pm M-F Closed For Lunch 12:00 pm - 1:00 pm

Phone: (386) 313-4360

Recording Tips for Flagler County:

- Check that your notary's commission hasn't expired

- Both spouses typically need to sign if property is jointly owned

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Flagler County

Properties in any of these areas use Flagler County forms:

- Bunnell

- Flagler Beach

- Palm Coast

Hours, fees, requirements, and more for Flagler County

How do I get my forms?

Forms are available for immediate download after payment. The Flagler County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Flagler County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Flagler County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Flagler County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Flagler County?

Recording fees in Flagler County vary. Contact the recorder's office at (386) 313-4360 for current fees.

Questions answered? Let's get started!

Florida's Construction Lien Law codifies statutory waivers at section 713.20.

A lien waiver operates by waiving (disclaiming) the lienor's right to all or part of an established lien. Lien waivers can be conditional, or only effective when the payment is actually received, or unconditional, meaning the lien is waived upon execution of the form, regardless of any remaining balance due. s. 713.20(7) Fla. Stat. (2016). They can also release a lien based on partial or full payment.

This form unconditionally releases a portion of the lien based on an agreed-upon progress payment. It requires a return address, the parcel identifier and legal description for the property being improved, the lienor's name, the customer's name, the owner's name, the amount paid, and an ending date for the period of time covered by the payment. 713.20(4).

Exercise caution when using unconditional waivers. If the lienor suspects for any reason that the payment is or will be invalid, he or she should consider a conditional waiver instead.

Each case is unique. Contact an attorney for complex situations or with questions about using an unconditional waiver and release of lien upon progress payment, or any other issues relating to Florida's Construction Lien Law.

Important: Your property must be located in Flagler County to use these forms. Documents should be recorded at the office below.

This Unconditional Waiver and Release of Lien upon Progress Payment meets all recording requirements specific to Flagler County.

Our Promise

The documents you receive here will meet, or exceed, the Flagler County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Flagler County Unconditional Waiver and Release of Lien upon Progress Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

Tracey M.

August 9th, 2022

Using Deeds.com was unbelievably quick and easy to file a deed restriction with our local county office. From uploading the initial file to deeds.com, to having a fully recorded document was right on one hour - and all from the comfort of my home. I found your service was easy to use and your staff were very quick in responding to my filing. I will definitely use and recommend deeds.com in the future.

Thank you for your feedback. We really appreciate it. Have a great day!

Alan C.

January 20th, 2024

The Transfer on Death Deed paperwork was easy to complete, as it included a detailed guide and a completed example. We encountered no issues recording the document with our County. Thanks to Deeds.com, we were also able to save time and money by utilizing a DIY approach for our situation.

We are delighted to have been of service. Thank you for the positive review!

Blaine G.

February 4th, 2022

Pretty good promissory note...but unable to delete some of the not needed stuff. Fill in blanks are fine but not all the template language is appropriate in my situation

Thank you for your feedback. We really appreciate it. Have a great day!

Clarence F.

January 25th, 2022

very easy to use !!!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

David C.

January 17th, 2020

Very fast service

Thank you!

REBECCA E.

March 24th, 2022

Very easy process from you so far, thanks! i don't hav a computer, only an apple iphone, so on a day very soon i'll need to go to my Fayetteville library to download and complete the forms. thanks for any suggestions/advice you may have...

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

ed c.

May 24th, 2022

real easy and fast

Thank you!

Christine L.

May 13th, 2025

User friendly!

Thank you!

CHRISTIN P.

September 27th, 2019

Did not use site; too expensive.

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence R.

February 4th, 2020

Forms do not allow enough space for fields and cutoff. Need to expand the fields to allow for more writing. I ended up re-typing to be able to include full property description. Would be nice if available in Word format rather than only PDF format.

Thank you for your feedback. We really appreciate it. Have a great day!

virginia a.

May 15th, 2022

Thank you for the prompt instructions on the download and installation. The only problem I had was trying to input data into the form once I renamed the form.and saved it. I was unable to change the size of the font and was very frustrated. In the end I finally had to redo the entire form through Word using your format.

Thank you!

James A.

March 9th, 2021

Thanks for you help to get me out of a quick problem. Downloads were great. I recommend this service for the arcane situations of legal angst.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Cathy S.

October 15th, 2022

Great forms! Repeat customer here, wouldn't go anywhere else.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tiffany J.

December 26th, 2020

Easy steps to create an account, will recommend to anyone.

Thank you for your feedback. We really appreciate it. Have a great day!

William H.

August 4th, 2025

Was easy to find forms I needed and download was quick.

Thank you for your positive words! We’re thrilled to hear about your experience.