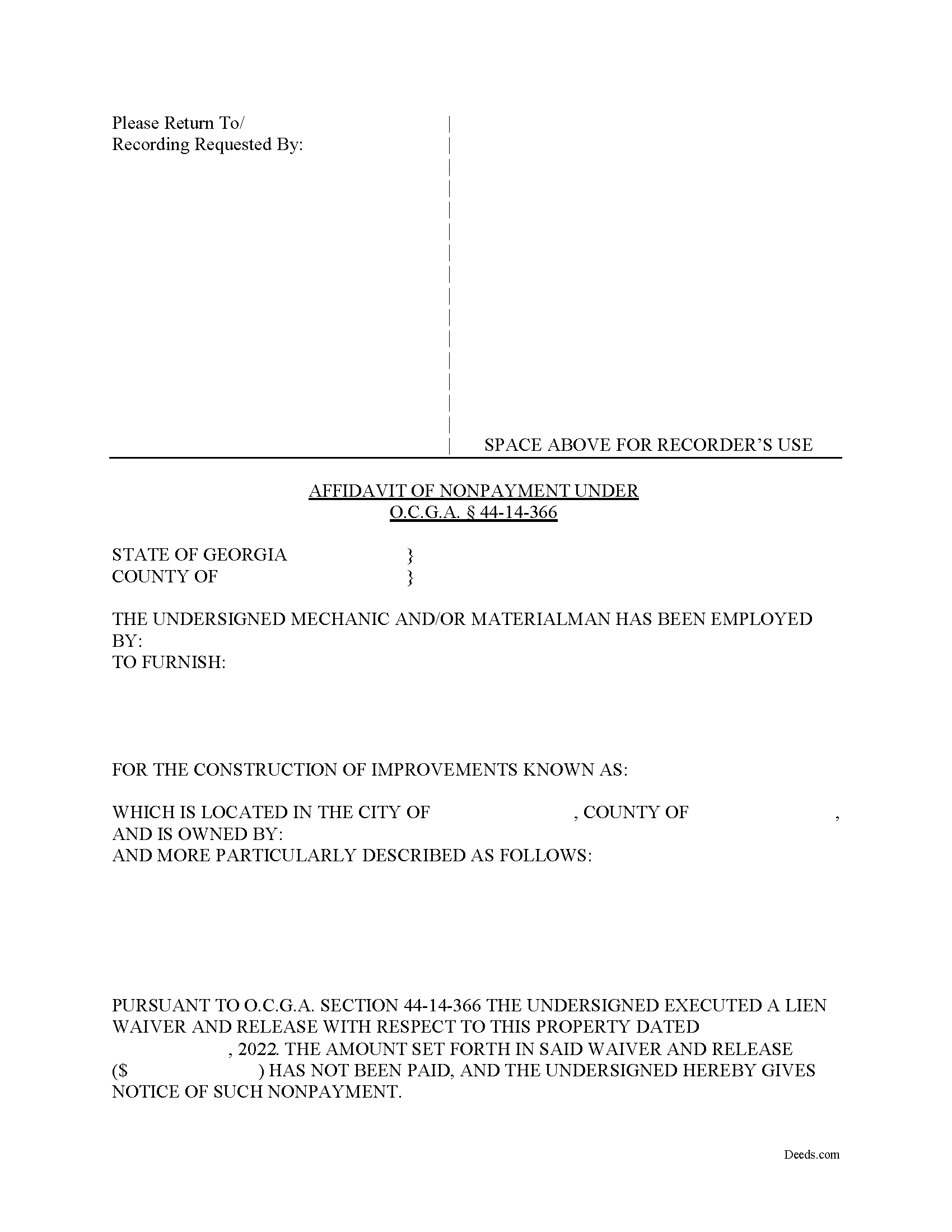

Camden County Affidavit of Non Payment Form

Camden County Affidavit of Non Payment Form

Fill in the blank Affidavit of Non Payment form formatted to comply with all Georgia recording and content requirements.

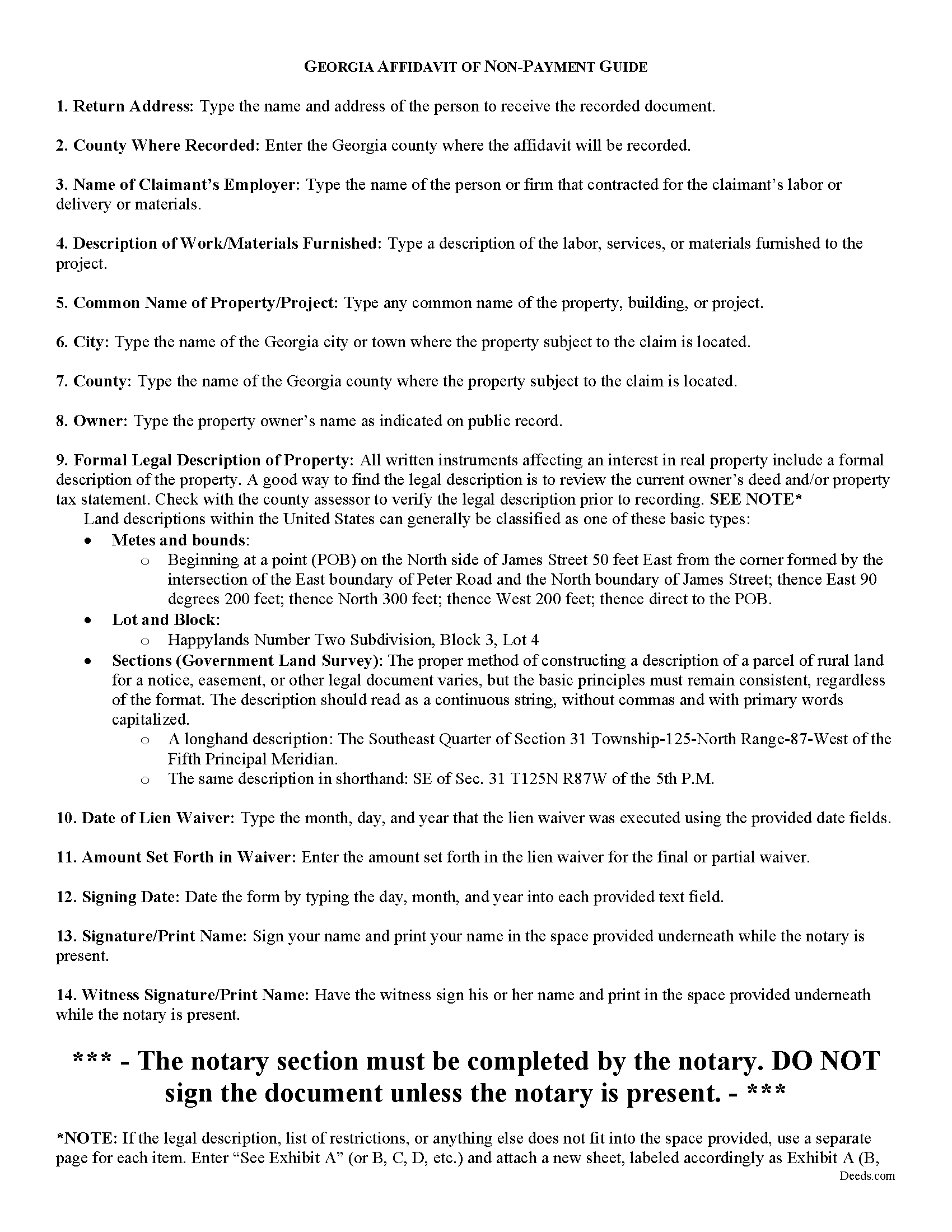

Camden County Affidavit of Non Payment Guide

Line by line guide explaining every blank on the form.

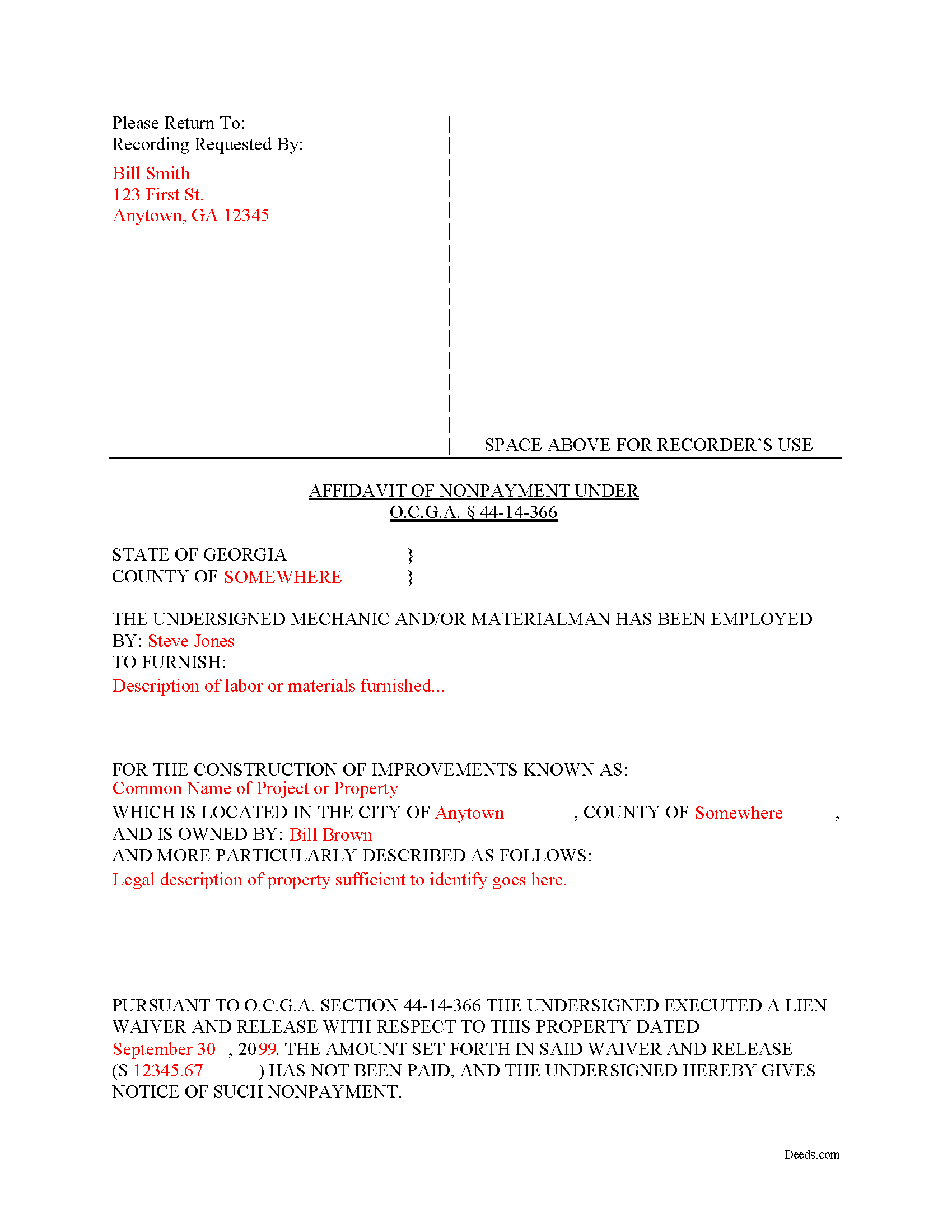

Camden County Completed Example of the Affidavit of Non Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Camden County documents included at no extra charge:

Where to Record Your Documents

Camden Clerk of Superior Court

Woodbine, Georgia 31569

Hours: 8:00 to 5:00 M-F

Phone: (912) 576-5631

Recording Tips for Camden County:

- Ask if they accept credit cards - many offices are cash/check only

- Request a receipt showing your recording numbers

- Ask about accepted payment methods when you call ahead

Cities and Jurisdictions in Camden County

Properties in any of these areas use Camden County forms:

- Kings Bay

- Kingsland

- Saint Marys

- Waverly

- White Oak

- Woodbine

Hours, fees, requirements, and more for Camden County

How do I get my forms?

Forms are available for immediate download after payment. The Camden County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Camden County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Camden County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Camden County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Camden County?

Recording fees in Camden County vary. Contact the recorder's office at (912) 576-5631 for current fees.

Questions answered? Let's get started!

What happens if a contractor records a lien waiver, but the owner never pays the bill?

Best practices dictate that lien claimants should only grant waivers when payment can be verified. Even so, some claimants still choose to execute a waiver before that time. Unlike many other states, Georgia law provides an avenue for recourse: the Affidavit of Non-Payment. An affidavit of non-payment is a sworn statement filed with the county recorder after a lien waiver has already been filed but no payment was ever received.

When executed, a waiver and release of lien is considered binding against the claimant for all purposes, subject only to payment in full of the amount set forth in the waiver and release. 44-14-366(f)(1). This means if payment is never received, the waiver is considered ineffective. Note that, in order to declare the waiver void, the claimant must file an affidavit of non-payment.

An affidavit of non-payment identifies the parties, the nature of work and materials provided, the location of the improvements, the amount unpaid, and the recording information for the waiver. The affiant/claimant signs the document in front of two witnesses, one of whom must be a notary, then submits the completed affidavit to the same office that recorded the original lien and waiver.

The affidavit must be filed sixty days after the date of the execution of the waiver and release. 44-14-366(f)(2)(C). There's an exception to this requirement if the claimant files their lien claim prior to the expiration of the 60-day period. Id.

This article is offered for informational purposes only and should not be relied upon as the substitute for the advice of an attorney. Please contact an attorney with questions about Affidavits of Non-payment or any other issues related to mechanic's liens in Georgia.

Important: Your property must be located in Camden County to use these forms. Documents should be recorded at the office below.

This Affidavit of Non Payment meets all recording requirements specific to Camden County.

Our Promise

The documents you receive here will meet, or exceed, the Camden County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Camden County Affidavit of Non Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

Shawn S.

August 30th, 2019

Seems to be exactly whst j needed. Great job!

Thank you!

Kathryn C.

January 2nd, 2020

I truly appreciate you and you service for all you do to help me ThankYou kathrynchertock

Thank you for your feedback. We really appreciate it. Have a great day!

Susan H.

November 10th, 2024

I used the quitclaim deed form, it was easy to fill out, had notarized and was accepted by the county's recorders office. Having a example form made it so much easier to fill out.

Thank you for your positive words! We’re thrilled to hear about your experience.

Quinn R.

April 3rd, 2023

DEEDS.COM IS THE BEST WAY TO E-RECORD DEEDS. THEY ARE FAST, POLITE AND A FANTASTIC DEAL FOR THE SERVICE THAT THEY OFFER!!!

Thank you!

Elizabeth C.

September 23rd, 2020

Very happy, thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael S.

August 7th, 2024

So convenient.

Knowing our customers are happy is our top priority. Thank you for the wonderful feedback!

Mary S.

January 25th, 2019

I am so excited to find this site. Thank you

Thank you Mary. We appreciate your enthusiasm, have a great day!

Donna G.

April 26th, 2023

Very happy with this service, comprehensive detailed instructions as well as correct forms for my location

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Kevin B.

May 28th, 2023

Easy to use and very helpful

Thank you for taking the time to give us your feedback Kevin. Hope you have an amazing day.

Shelly S.

November 12th, 2021

was fairly easy to work through the forms but needed better information on what goes on a few of the lines

Thank you for your feedback. We really appreciate it. Have a great day!

Deborah D.

June 1st, 2023

What I thought was gonna be a long drawn out tedious process was literally 10min tops... The help was quick and a load off. Thanks y'all.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Elizabeth N.

April 3rd, 2019

I love how easy it is to understand and complete.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Victor W.

March 9th, 2022

Once I was able to get the code Number, it all went well. I was able to easily download and print off what I needed for my lawyer. thank you.

Thank you!

James J.

October 2nd, 2021

Thank you for service. The deed process was easy to complete. My new deed was accepted by the county clerk and the tax assessors office.

Thank you for your feedback. We really appreciate it. Have a great day!

donald h.

January 26th, 2019

very informative and thank everyone involved,my deed needed to be changed and will adjusted.

Thank you!