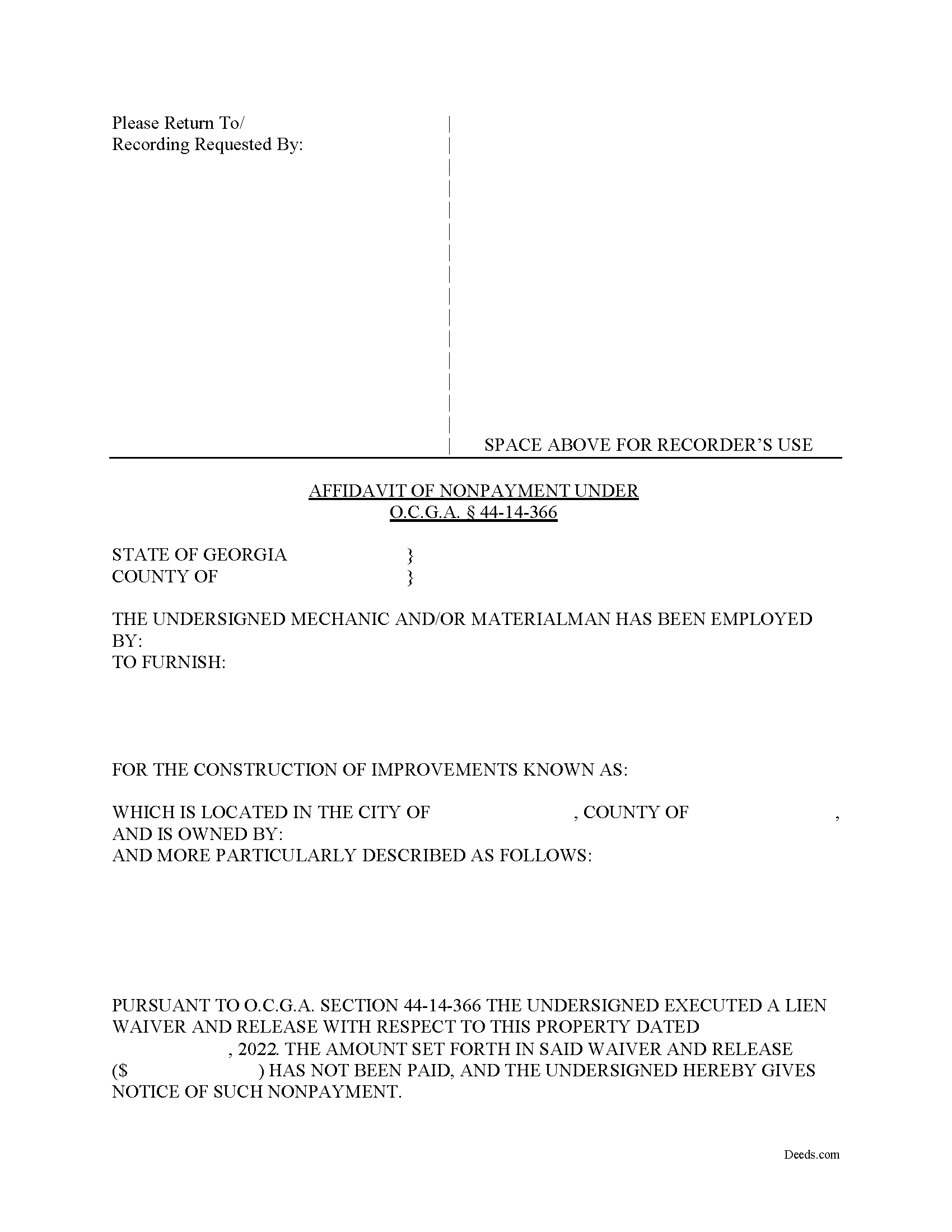

Jackson County Affidavit of Non Payment Form

Jackson County Affidavit of Non Payment Form

Fill in the blank Affidavit of Non Payment form formatted to comply with all Georgia recording and content requirements.

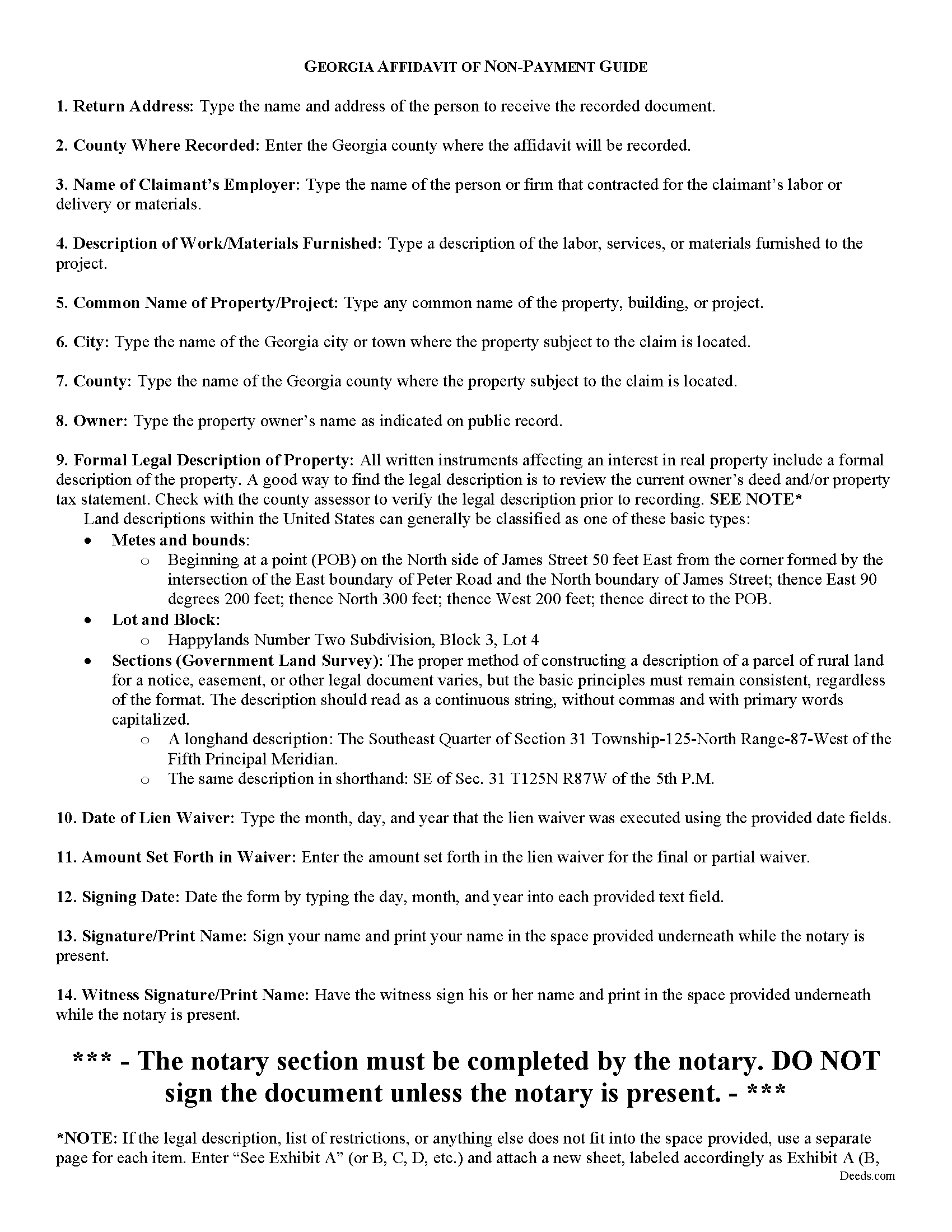

Jackson County Affidavit of Non Payment Guide

Line by line guide explaining every blank on the form.

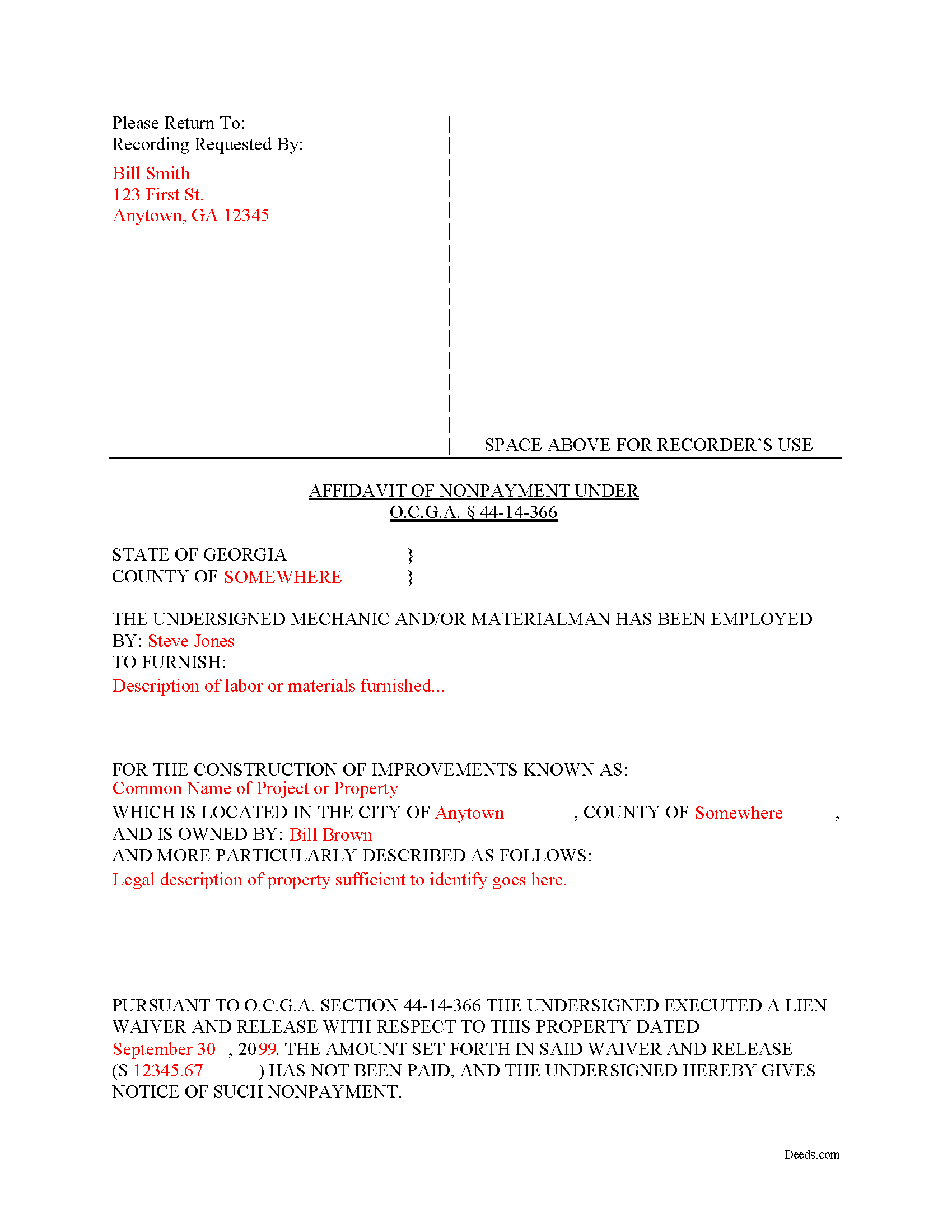

Jackson County Completed Example of the Affidavit of Non Payment Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Jackson County documents included at no extra charge:

Where to Record Your Documents

Jackson County Clerk of Superior Court

Jefferson, Georgia 30549

Hours: 8:00am-5:00pm M-F

Phone: (706) 387-6251

Recording Tips for Jackson County:

- Double-check legal descriptions match your existing deed

- Make copies of your documents before recording - keep originals safe

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Jackson County

Properties in any of these areas use Jackson County forms:

- Braselton

- Commerce

- Hoschton

- Jefferson

- Nicholson

- Pendergrass

- Talmo

Hours, fees, requirements, and more for Jackson County

How do I get my forms?

Forms are available for immediate download after payment. The Jackson County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Jackson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Jackson County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Jackson County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Jackson County?

Recording fees in Jackson County vary. Contact the recorder's office at (706) 387-6251 for current fees.

Questions answered? Let's get started!

What happens if a contractor records a lien waiver, but the owner never pays the bill?

Best practices dictate that lien claimants should only grant waivers when payment can be verified. Even so, some claimants still choose to execute a waiver before that time. Unlike many other states, Georgia law provides an avenue for recourse: the Affidavit of Non-Payment. An affidavit of non-payment is a sworn statement filed with the county recorder after a lien waiver has already been filed but no payment was ever received.

When executed, a waiver and release of lien is considered binding against the claimant for all purposes, subject only to payment in full of the amount set forth in the waiver and release. 44-14-366(f)(1). This means if payment is never received, the waiver is considered ineffective. Note that, in order to declare the waiver void, the claimant must file an affidavit of non-payment.

An affidavit of non-payment identifies the parties, the nature of work and materials provided, the location of the improvements, the amount unpaid, and the recording information for the waiver. The affiant/claimant signs the document in front of two witnesses, one of whom must be a notary, then submits the completed affidavit to the same office that recorded the original lien and waiver.

The affidavit must be filed sixty days after the date of the execution of the waiver and release. 44-14-366(f)(2)(C). There's an exception to this requirement if the claimant files their lien claim prior to the expiration of the 60-day period. Id.

This article is offered for informational purposes only and should not be relied upon as the substitute for the advice of an attorney. Please contact an attorney with questions about Affidavits of Non-payment or any other issues related to mechanic's liens in Georgia.

Important: Your property must be located in Jackson County to use these forms. Documents should be recorded at the office below.

This Affidavit of Non Payment meets all recording requirements specific to Jackson County.

Our Promise

The documents you receive here will meet, or exceed, the Jackson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Jackson County Affidavit of Non Payment form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4582 Reviews )

John C.

February 26th, 2024

Ease and speed of recording are remarkable. This is especially true of deeds with problems: I often get feedback within minutes and can correct problems immediately and still complete the filing in the same day. I wish more counties accepted electronic filing! It would be helpful to list counties that do/do not accept electronic filing so I would not have to upload documents to find out my effort was fruitless.

We are grateful for your feedback and looking forward to serving you again. Thank you!

John U.

April 24th, 2020

It's too early for me to tell because I just uploaded the document today and it hasn't been recorded yet. However, I will say that the website is very user friendly so assuming that everything goes as planned, this is a great service.

Thank you!

Toshimi M.

May 24th, 2021

Sofar very good. Especially an example helps.

Thank you for your feedback. We really appreciate it. Have a great day!

JOHN P.

January 20th, 2019

I thought your service would comply with my request quicker.

Looks like it took 4 minutes to complete your order, sorry it took so long.

Jon I.

May 27th, 2020

I liked the information I download. Just what I was looking for.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Sue D.

November 28th, 2019

Great program

Thank you!

Joanne H.

February 14th, 2022

easy to download and use. this document. thank you

Thank you!

GAYNELL G.

August 9th, 2022

THANKS

Thank you!

David M.

May 21st, 2020

Extremely easy to use. The sample completed document was very helpful. I really appreciated not having to spend a few hundred dollars for a lawyer to generate a document that I can produce myself for a small fraction of the cost.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michael R.

August 25th, 2025

A suggestion: Include instructions on how to add your spouse to the deed, rather than transferring completely to a third party

Thank you for your thoughtful feedback. Adding a spouse to a deed is a common need, and suggestions like yours help us identify where additional guidance would be useful. We’ll take this into consideration as we continue improving our resources.

oscar r.

December 17th, 2021

VERY MUCH HELPFUL SAVED ME 600 on not having to hire attorney

Thank you!

Michael L.

June 15th, 2022

Very helpful and efficient

Thank you!

Stephen K.

July 5th, 2019

The forms were correct and the instructions and Completed sample were very helpful. I filled it out and filed it at the county office, they didn't question anything. Thank you.

Thank you!

Kathryn C.

February 14th, 2022

The transfer deed documents are laid out the way county offices need, but I don't like the requirements so I'm going to leave a bad review.

Well, thanks we guess.

Tom B.

December 18th, 2020

I ended up loading the same file twice and was unable to delete one of them. I did send e request in to have one deleted and I did get a response back that only one file was processed. This was done in a timely manner but required more additional time. It would have been nice to be able to delete the file myself and finish the process at the same time. Other than this every thing did go very well. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!