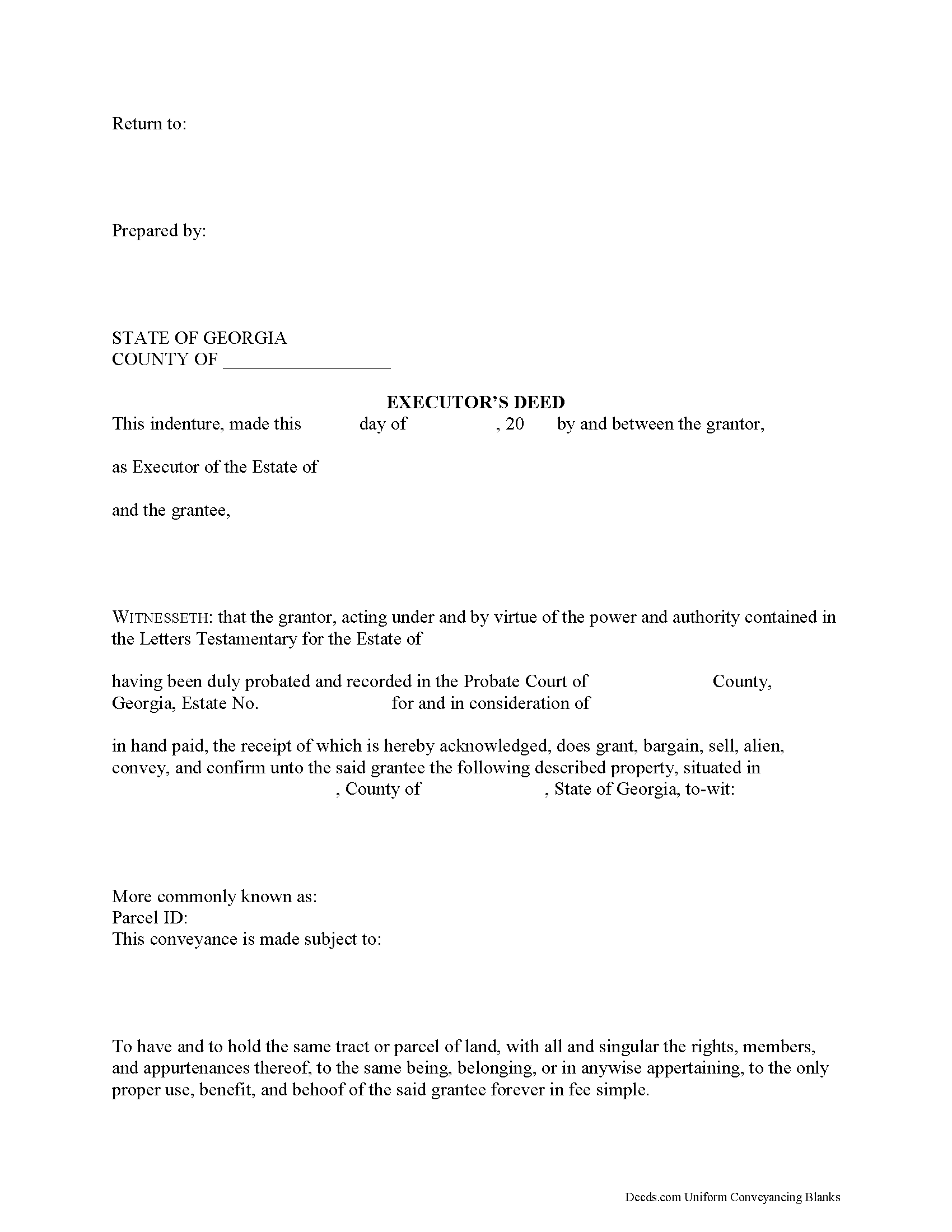

Hall County Executor Deed Form

Hall County Executor Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

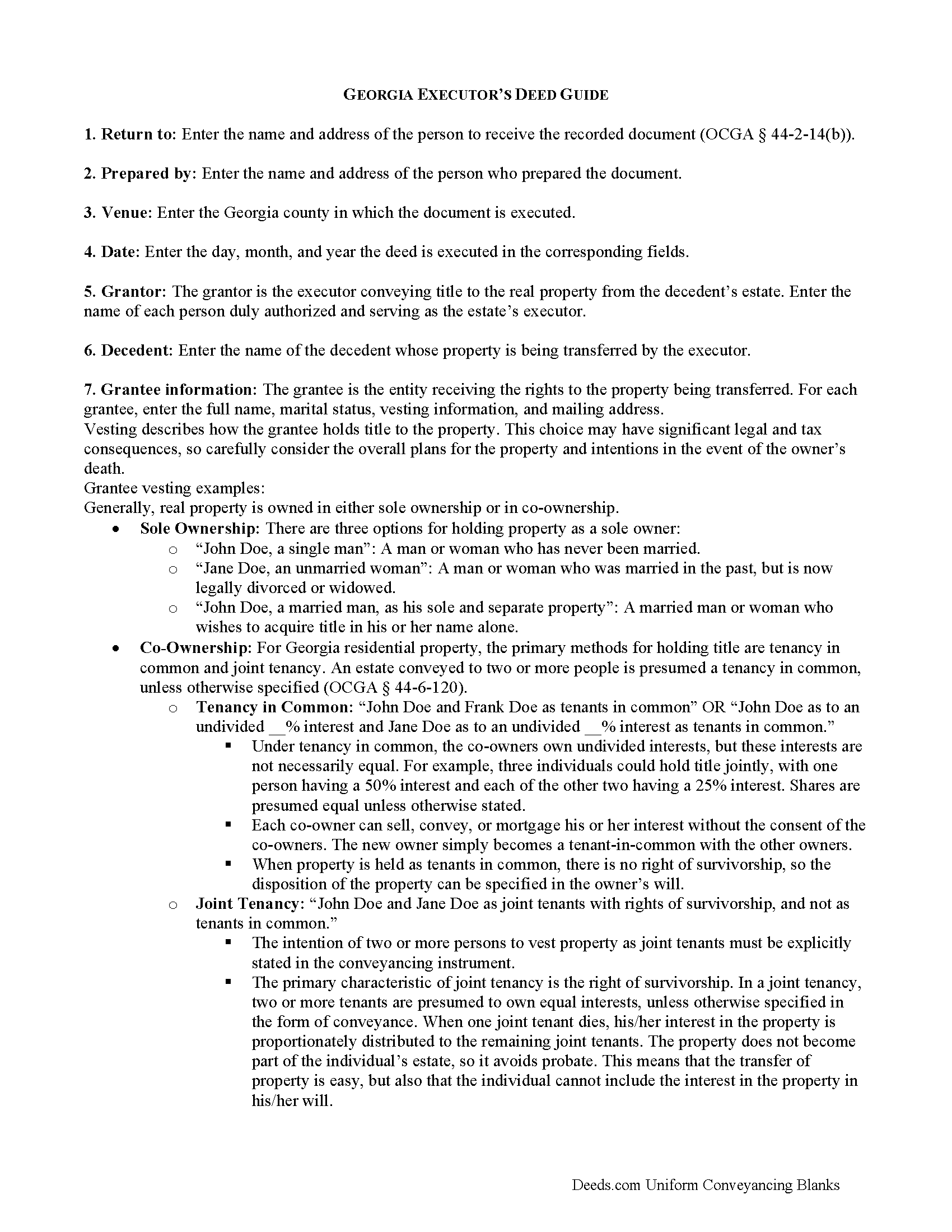

Hall County Executor Deed Guide

Line by line guide explaining every blank on the form.

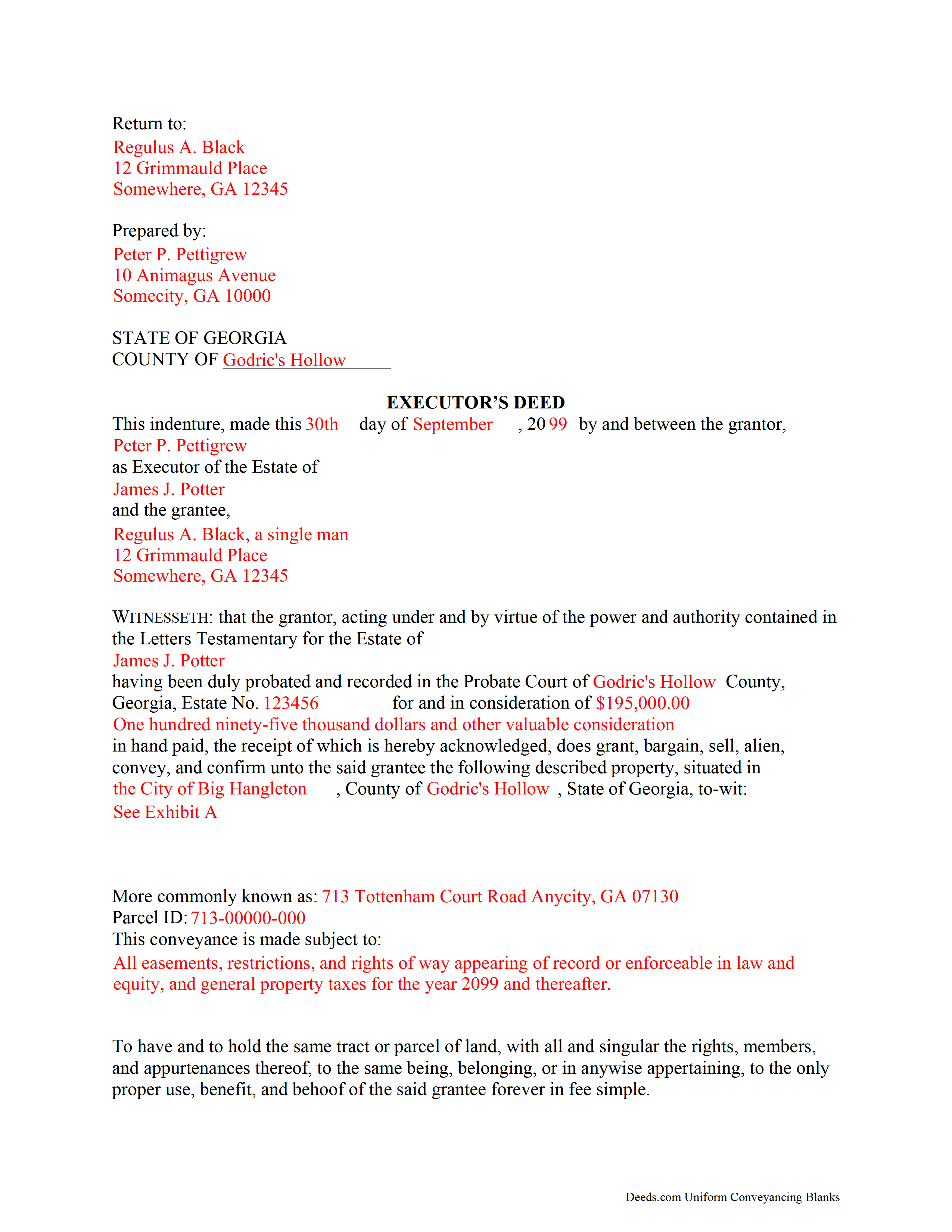

Hall County Completed Example of the Executor Deed Document

Example of a properly completed form for reference

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Hall County documents included at no extra charge:

Where to Record Your Documents

Clerk of Court - Real Estate Division

Gainsville, Georgia 30501

Hours: 8:30 to 4:00 M-F

Phone: (770) 531-7058

Recording Tips for Hall County:

- Check that your notary's commission hasn't expired

- Avoid the last business day of the month when possible

- Recorded documents become public record - avoid including SSNs

Cities and Jurisdictions in Hall County

Properties in any of these areas use Hall County forms:

- Chestnut Mountain

- Clermont

- Flowery Branch

- Gainesville

- Gillsville

- Lula

- Murrayville

- Oakwood

Hours, fees, requirements, and more for Hall County

How do I get my forms?

Forms are available for immediate download after payment. The Hall County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Hall County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Hall County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Hall County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Hall County?

Recording fees in Hall County vary. Contact the recorder's office at (770) 531-7058 for current fees.

Questions answered? Let's get started!

When people create their wills, they generally name one or more individuals to supervise the distribution of their assets. Georgia customarily uses the term "personal representative" to refer to both executors and administrators, but get more specific when it comes to conveying title to real estate. An executor is a personal representative designated in a will to manage a testate decedent's estate; an administrator is appointed by the probate court, and can be involved in either testate or intestate (without a will) processes.

During probate, the court may direct an executor to sell real property pursuant to the terms of the decedent's will, to pay the estate's debts, or to consolidate the decedent's estate for devise among multiple beneficiaries. The named personal representative uses an executor's deed to transfer real property from a testate estate. The executor's deed contains all the information required for a standard conveyance, such as a quitclaim or warranty deed, but also includes relevant details about the decedent and the probate case.

To transfer title to a buyer, record the completed executor's deed, along with any necessary supporting documents, with the real property records of the appropriate county.

Consult an attorney with questions about the executor's deed, or with any other issues related to probate in Georgia.

(Georgia Executor Deed Package includes form, guidelines, and completed example)

Important: Your property must be located in Hall County to use these forms. Documents should be recorded at the office below.

This Executor Deed meets all recording requirements specific to Hall County.

Our Promise

The documents you receive here will meet, or exceed, the Hall County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Hall County Executor Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4574 Reviews )

ralph f.

January 31st, 2019

I VERY MUCH APPRECIATE THE PROMPT RESPONSE & HELPFULNESS. I WILL DEFINITELY USE THIS SERVICE IN THE FUTURE. THANK YOU!

Thank you Ralph, we appreciate your feedback.

Nancy A.

June 23rd, 2021

First time user and I was pleasantly surprised how quick and easy it was to get my Deed recorded. And the fee was not outrageous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lance G.

January 12th, 2021

Fast and dependable service, which is so critical in the real estate business. Excellent experience.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori F.

January 20th, 2021

That was easy!

Thank you for your feedback. We really appreciate it. Have a great day!

Nina L.

April 13th, 2023

I needed a specific form. I found it, printed it and saved myself $170 because I didn't need a lawyer. Thank you

Thank you for your feedback. We really appreciate it. Have a great day!

Robert B.

April 5th, 2019

Everything worked Fine. I wish there was an John Doe type of an example for the Tax form.

Thank you!

Linda S.

August 9th, 2019

I had no problem signing up to Deeds.com. It was easy and effective. I was able to retrieve my records.

Thank you!

Jennifer M P.

December 14th, 2022

Locating the deed I needed was not too hard. I love that you can download and complete it on your time frame.

Thank you!

Lynne B.

October 17th, 2020

It was very easy to navigate and very fast response time.

Thank you!

Rebecca M.

February 22nd, 2023

Haven't used yet but I will check it out tomorrow

Thank you!

Dana R.

February 20th, 2021

This site is Awesome! So easy to use and they really work fast. I will use this for all my Maricopa County Recorder items or deeds, etc. Love this site.

Thank you for your feedback. We really appreciate it. Have a great day!

Katherine S.

July 11th, 2022

This was easy!!

Thank you!

WILLIAM H.

April 17th, 2021

i also need a "NOTE" and this trust deed is not exactly what i wanted. it may work but not to well.

Thank you for your feedback. We really appreciate it. Have a great day!

Jennifer H.

October 12th, 2020

Deeds.com is amazing. It made finding out how to file legal documents worry free and easily understood. Thank You

Thank you for your feedback. We really appreciate it. Have a great day!

Barbara B.

April 23rd, 2020

A great help! Thank you.

Thank you!

Legal Forms Disclaimer

Use of Deeds.com Legal Forms:On our Site, we provide self-help "Do It Yourself Legal Forms." By using a form from our Site, you explicitly agree to our Terms of Use. You acknowledge and agree that your purchase and/or use of a form document does not constitute legal advice nor the practice of law. Furthermore, each form, including any related instructions or guidance, is not tailored to your specific requirements and is not guaranteed or warranted to be up-to-date, accurate, or applicable to your individual circumstances.

NO WARRANTY:The Do It Yourself Legal Forms provided on our Website are not guaranteed to be usable, accurate, up-to-date, or suitable for any legal purpose. Any use of a Do It Yourself Legal Form from our website is undertaken AT YOUR OWN RISK.

Limitation of Liability:If you use a Do It Yourself Legal Form available on Deeds.com, you acknowledge and agree that, TO THE EXTENT PERMITTED BY APPLICABLE LAW, WE SHALL NOT BE LIABLE FOR DAMAGES OF ANY KIND (INCLUDING, WITHOUT LIMITATION, LOST PROFITS OR ANY SPECIAL, INCIDENTAL, OR CONSEQUENTIAL DAMAGES) ARISING OUT OF OR IN CONNECTION WITH THE LEGAL FORMS OR FOR ANY INFORMATION OR SERVICES PROVIDED TO YOU THROUGH THE DEEDS.COM WEBSITE.

Damage Cap:In circumstances where the above limitation of liability is prohibited, OUR SOLE OBLIGATION TO YOU FOR DAMAGES SHALL BE CAPPED AT $100.00.