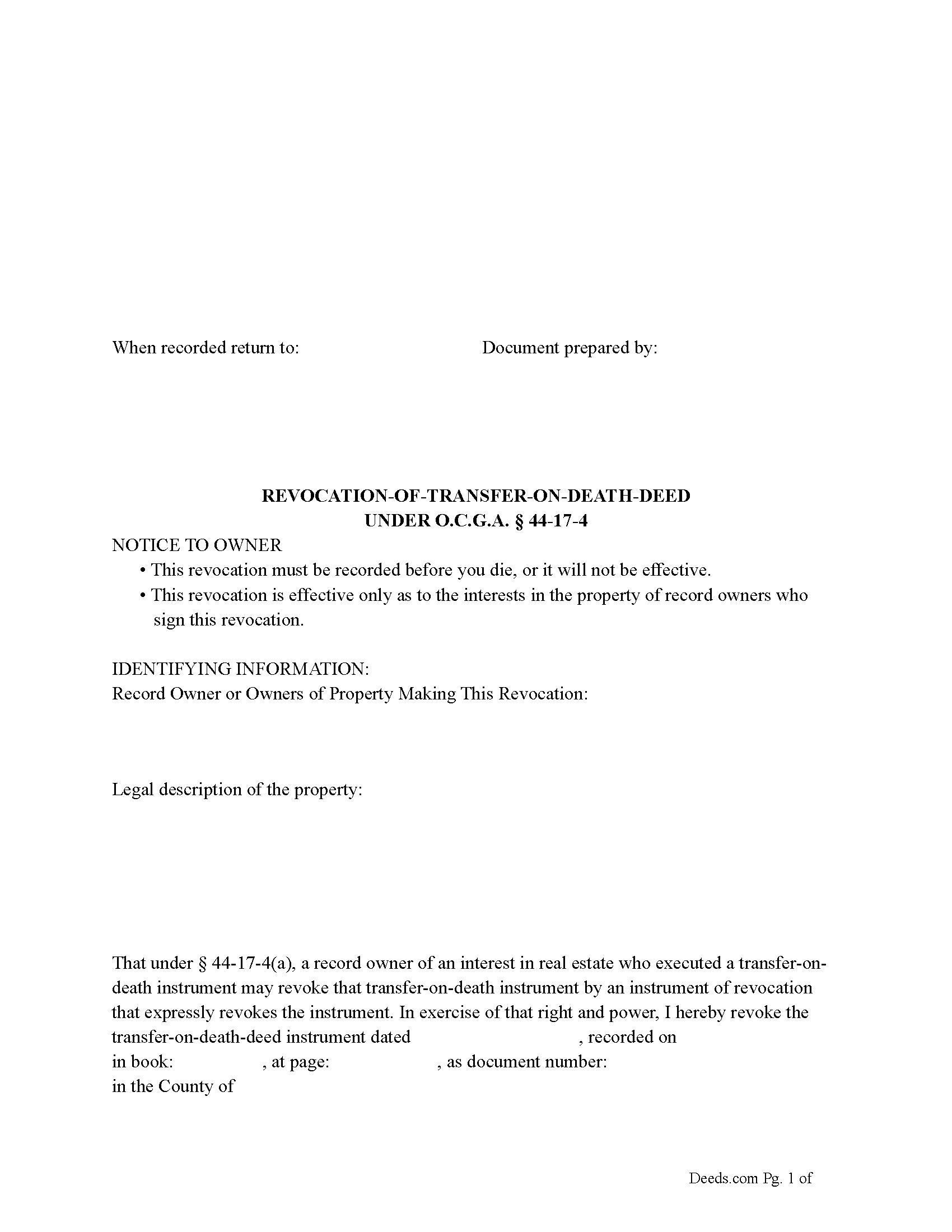

Early County Revocation of Transfer on Death Deed Form

Early County Revocation of Transfer on Death Deed Form

Fill in the blank Revocation of Transfer on Death Deed form formatted to comply with all Georgia recording and content requirements.

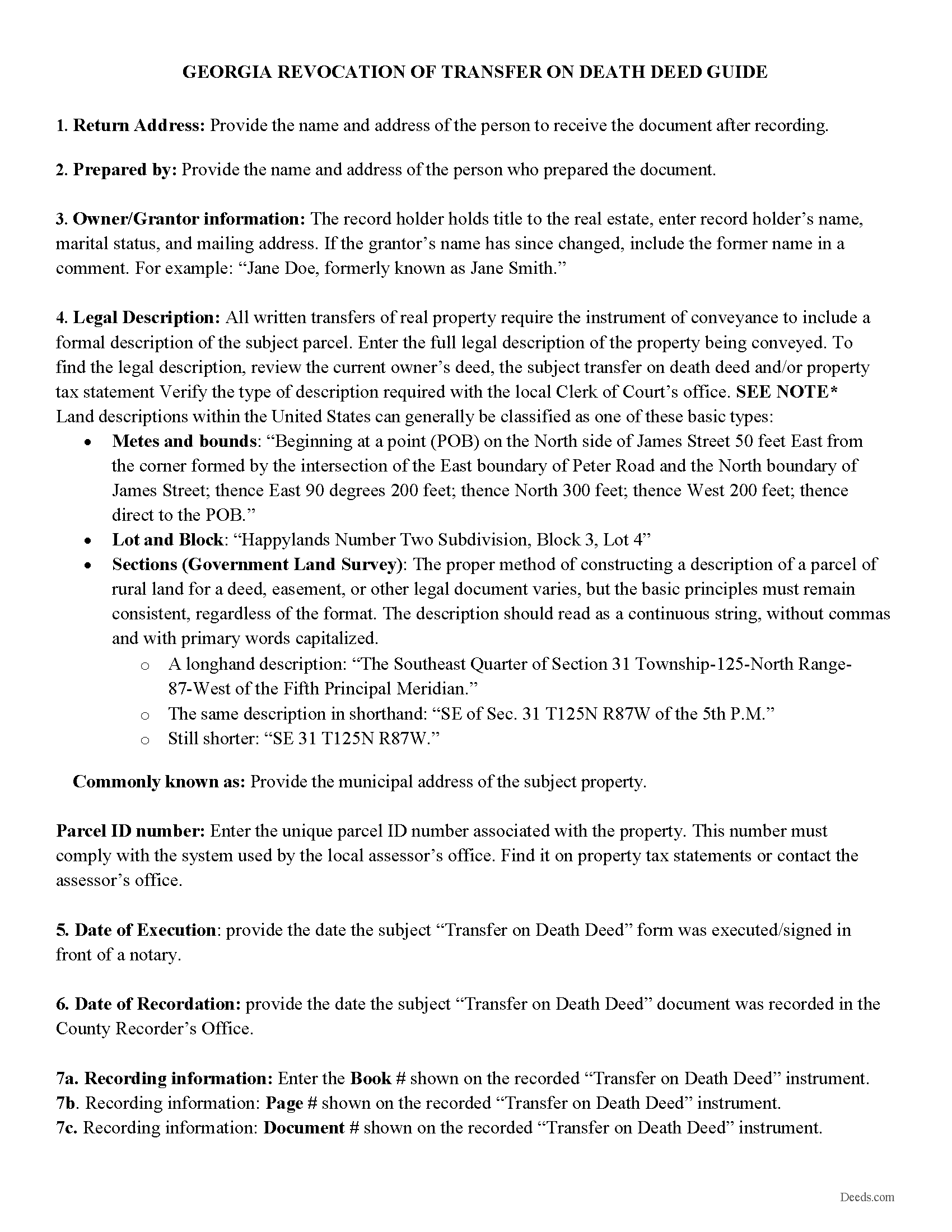

Early County Revocation of Transfer on Death Deed Guide

Line by line guide explaining every blank on the Revocation of Transfer on Death Deed form.

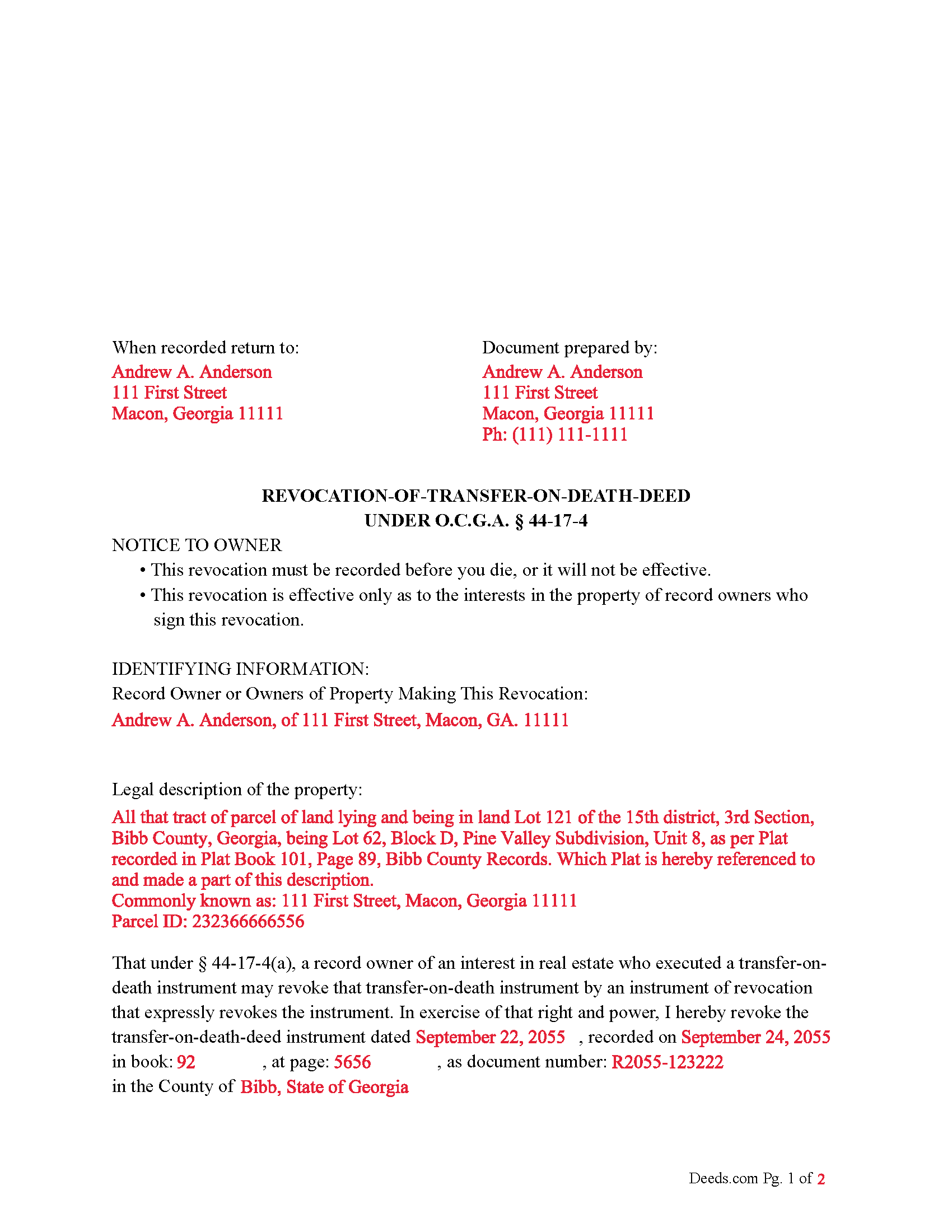

Early County Completed Example of the Revocation of Transfer on Death Deed Document

Example of a properly completed Georgia Revocation of Transfer on Death Deed document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Georgia and Early County documents included at no extra charge:

Where to Record Your Documents

Clerk of Superior Court

Blakely, Georgia 39823

Hours: 8:00am - 5:00pm Monday - Friday

Phone: (229) 723-3033

Recording Tips for Early County:

- Double-check legal descriptions match your existing deed

- Documents must be on 8.5 x 11 inch white paper

- Avoid the last business day of the month when possible

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Early County

Properties in any of these areas use Early County forms:

- Blakely

- Cedar Springs

- Damascus

- Jakin

Hours, fees, requirements, and more for Early County

How do I get my forms?

Forms are available for immediate download after payment. The Early County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Early County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Early County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Early County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Early County?

Recording fees in Early County vary. Contact the recorder's office at (229) 723-3033 for current fees.

Questions answered? Let's get started!

Under Georgia law, specifically Section 44-17-4, the process for revoking a transfer-on-death (TOD) deed involves several steps:

Revoking a TOD Deed:

Execution and Acknowledgment: The record owner (the person who created the TOD deed) must execute an instrument of revocation. This means the owner must sign a document stating the revocation. The signature must be acknowledged before an officer as provided in Code Section 44-2-15, typically a notary public. Two additional witnesses must also attest to the signature.

Content of the Revocation Instrument: The instrument must refer to the original TOD deed.

The instrument must be signed by the record owner or their duly authorized attorney-in-fact.

Recording the Revocation: The instrument of revocation must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

No Consent Required: The revocation does not require the consent, agreement, or notice to the designated grantee beneficiary or beneficiaries.

Changing the Beneficiary Designation: Executing a New TOD Deed: The record owner can change the beneficiary designation by executing a new TOD deed.

This new TOD deed must also be acknowledged and recorded in the same manner as the original.

Recording the New TOD Deed: The new TOD deed must be recorded in the office of the clerk of the superior court in the county where the real estate is located.

Effect of the New TOD Deed: The new TOD deed automatically revokes all prior beneficiary designations for that interest in real estate. Again, no consent, agreement, or notice to the previously designated grantee beneficiary or beneficiaries is required.

Additional Note: A TOD deed cannot be revoked by the provisions of a will. This means that the revocation must occur through the specified process during the owner's lifetime and cannot be undone through a will after the owner's death.

By understanding and following these steps, you can confidently manage and update your real estate beneficiary designations, ensuring they reflect your latest intentions.

Important: Your property must be located in Early County to use these forms. Documents should be recorded at the office below.

This Revocation of Transfer on Death Deed meets all recording requirements specific to Early County.

Our Promise

The documents you receive here will meet, or exceed, the Early County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Early County Revocation of Transfer on Death Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Joseph R.

July 23rd, 2022

Deeds.com has saved me quite a bit in attorney fees by making legal forms available on line. Easy to use, just fill in the blanks.

Thank you for your feedback. We really appreciate it. Have a great day!

Pat A.

July 18th, 2019

I was impressed that the forms were easy to read and the directions were helpful. Thank you for providing this.

Thank you!

Dan B.

June 6th, 2022

Excellent service even faster then I expected. Very pleased and a reasonable priced document. I encourage people too use Deeds.Com

Thank you for your feedback. We really appreciate it. Have a great day!

Alexander M.

June 13th, 2025

Great recording service ! Very professional and easy to navigate !!!!

It was a pleasure serving you. Thank you for the positive feedback!

Debby P.

October 5th, 2023

Great company! I have been using Deeds.com for many years. I just opened a new account when I retired from my Escrow job. My recording was flawless!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Matt G.

May 10th, 2019

The process went smoothly and gave me what I needed. As an improvement, I would recommend that deeds.com sends an email when there is a new message in the portal. I didn't get any updates and had to log in to track progress each time.

Thank you for your feedback. We really appreciate it. Have a great day!

Donna J.

June 29th, 2019

Doesn't have samples pertaining to me. Still searching for correct wording forGRANTORS (plural) so its legally written.

Thank you for your feedback. We really appreciate it. Have a great day!

Ann M.

February 11th, 2022

I was extremely pleased with how easy this process was, and how quickly my document was recorded. I will definitely use this again!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anthony L.

February 15th, 2020

I recently needed an affidavit of death. The form and help tools made it easy to fill out and file. the Recorder accepted this form . Which made the experience painless and easy . All things considered..

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle N.

April 1st, 2019

Great experience

Thank you Michelle.

Troy D.

October 9th, 2020

Excellent Service. Great time savings over having to send someone to the recording office. Am planning on utilizing this service for our recording needs.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Glenn H.

January 15th, 2022

Searched online 3 hours until I found Deeds.com, afterwards smooth sailing definitely 5 stars

Thank you for your feedback. We really appreciate it. Have a great day!

Mack H.

July 16th, 2020

I got what I was looking for! Turned out well and like I thought it would.

Thank you!

Susan K.

February 16th, 2019

Very helpful; information included on the form explanations about Colorado laws in regards to beneficiary deeds helped us understand the issues involved.

Thank you for your feedback. We really appreciate it. Have a great day!

charles b.

July 21st, 2024

The product I needed was available, easy to download, access and complete. The instructions were very helpful. I had previously purchased another product which was terrible. I highly recommend Deeds.com

We appreciate your business and value your feedback. Thank you. Have a wonderful day!