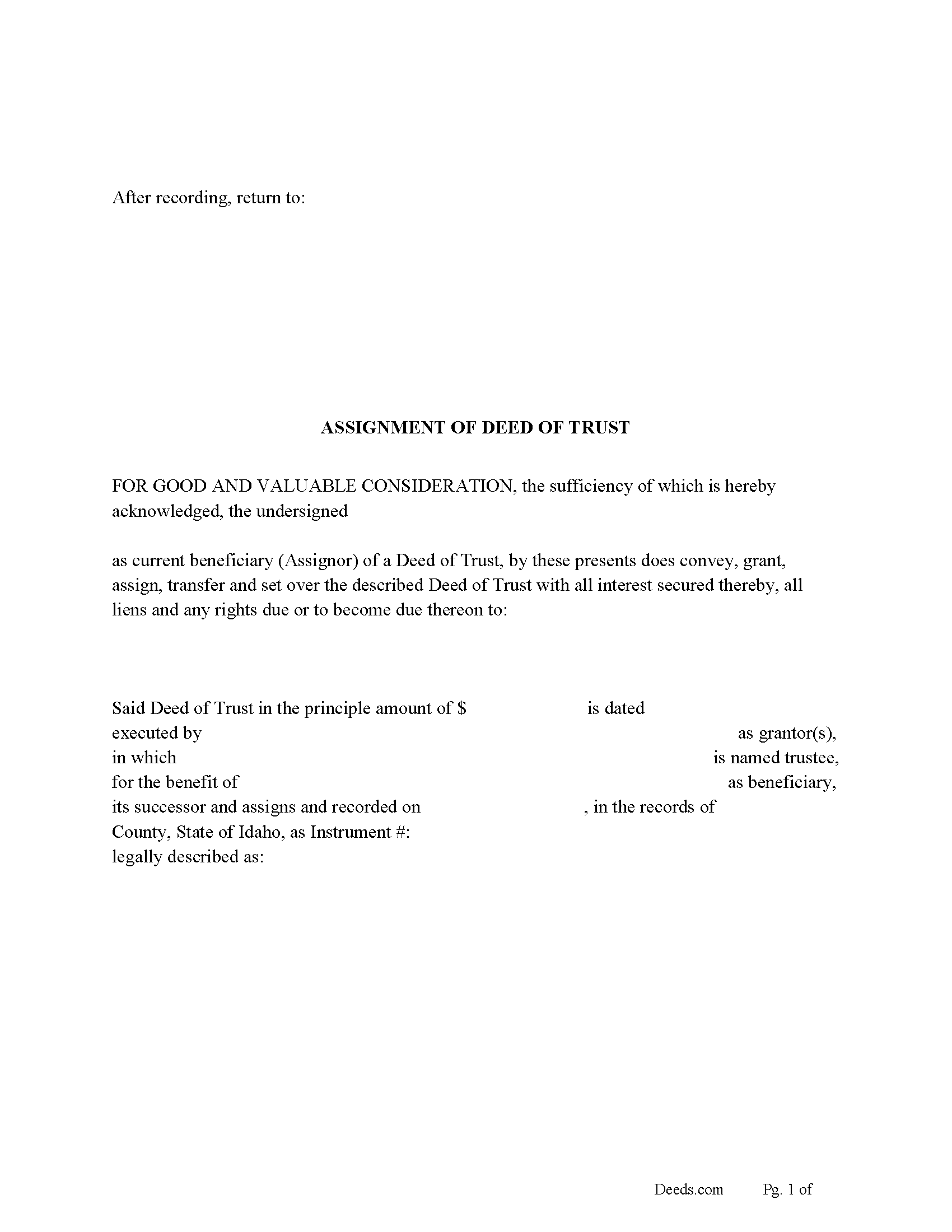

Franklin County Assignment of Deed of Trust Form

Franklin County Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

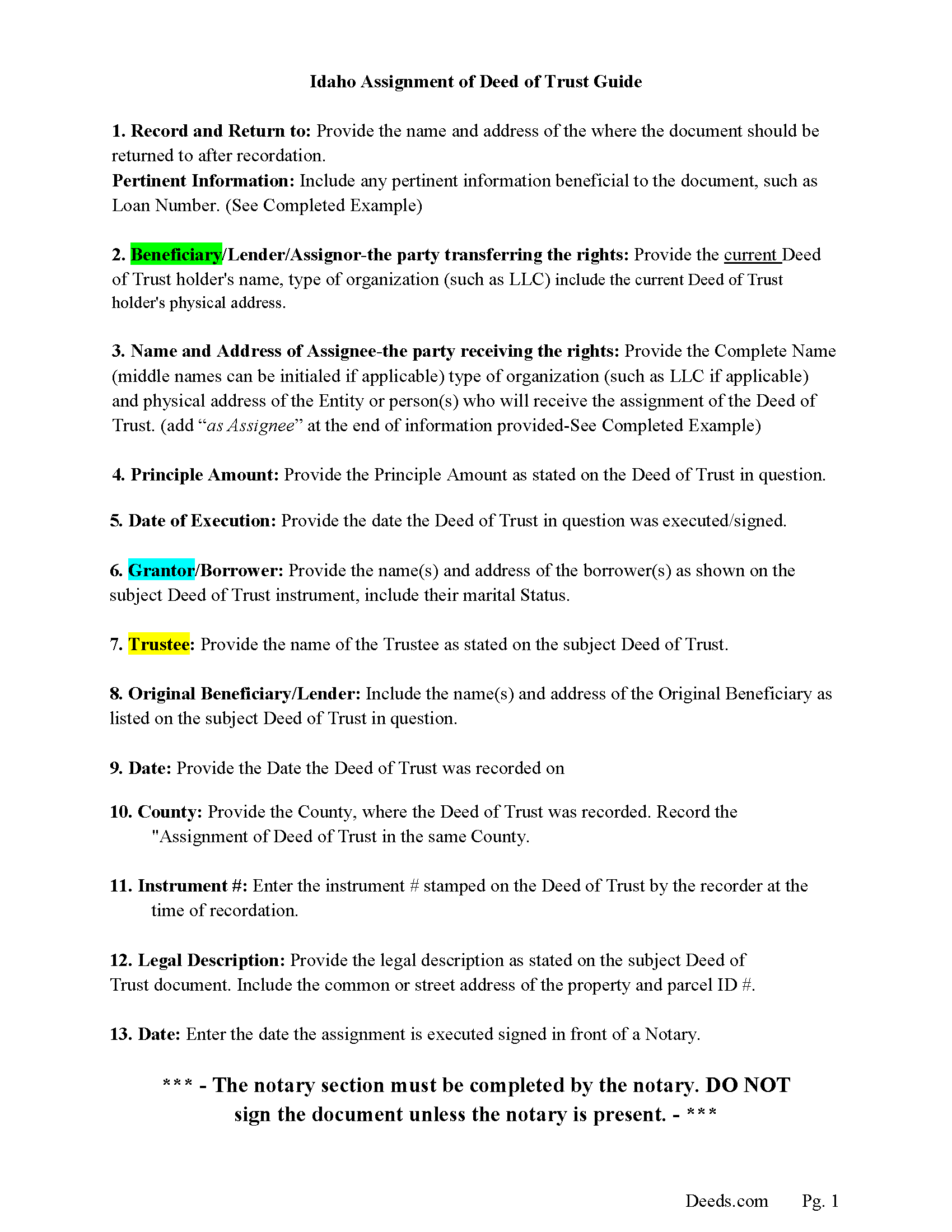

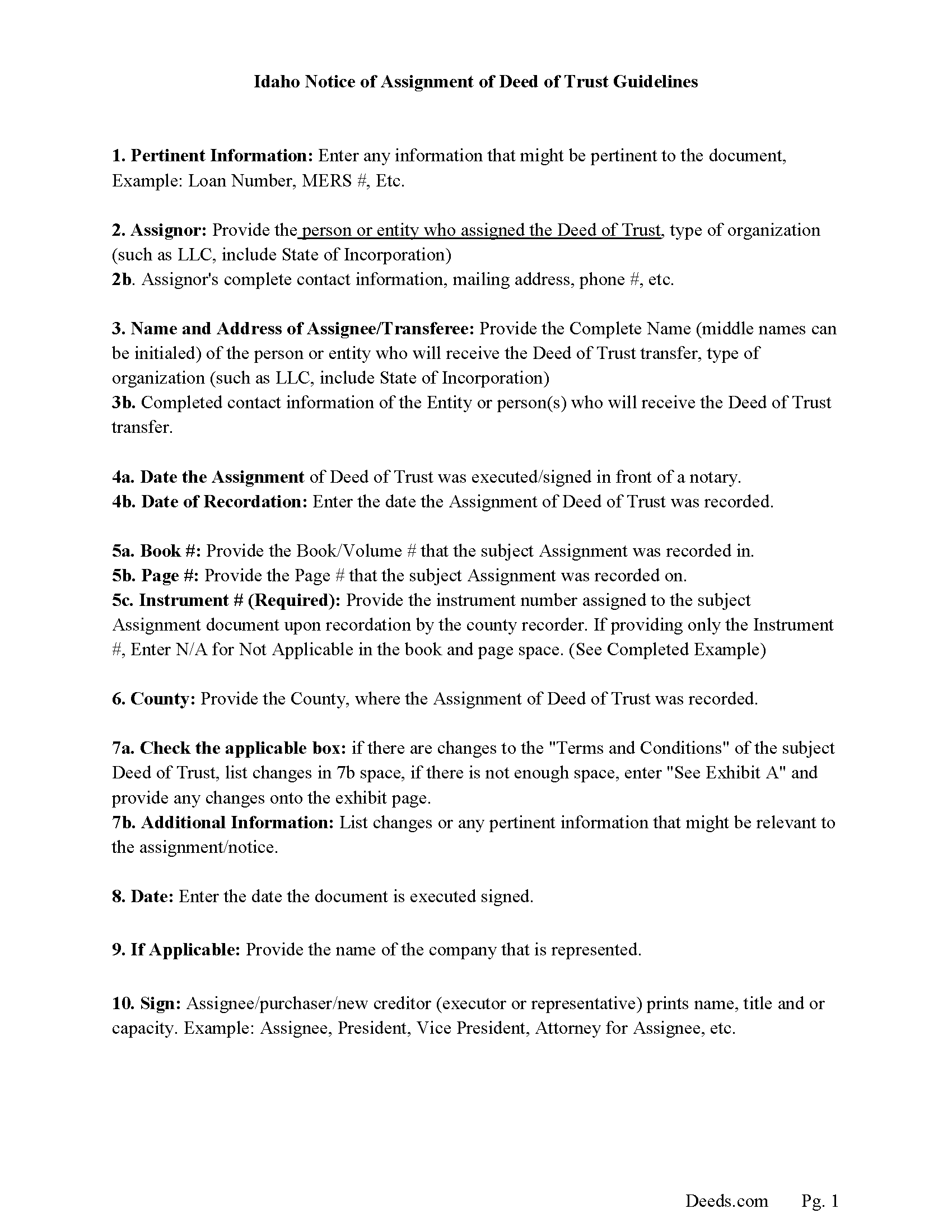

Franklin County Assignment of Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

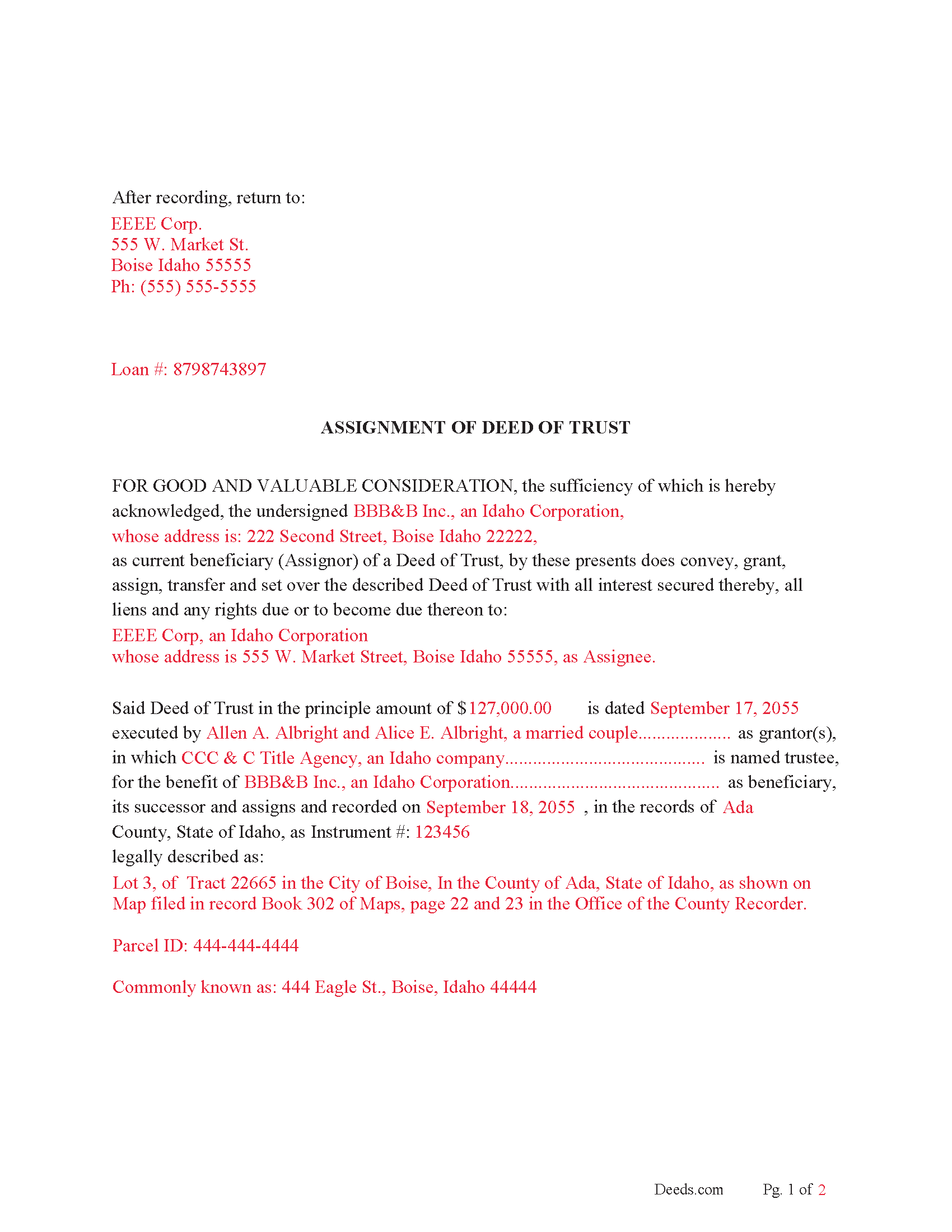

Franklin County Completed Example of the Assignment of Deed of Trust Document

Example of a properly completed form for reference.

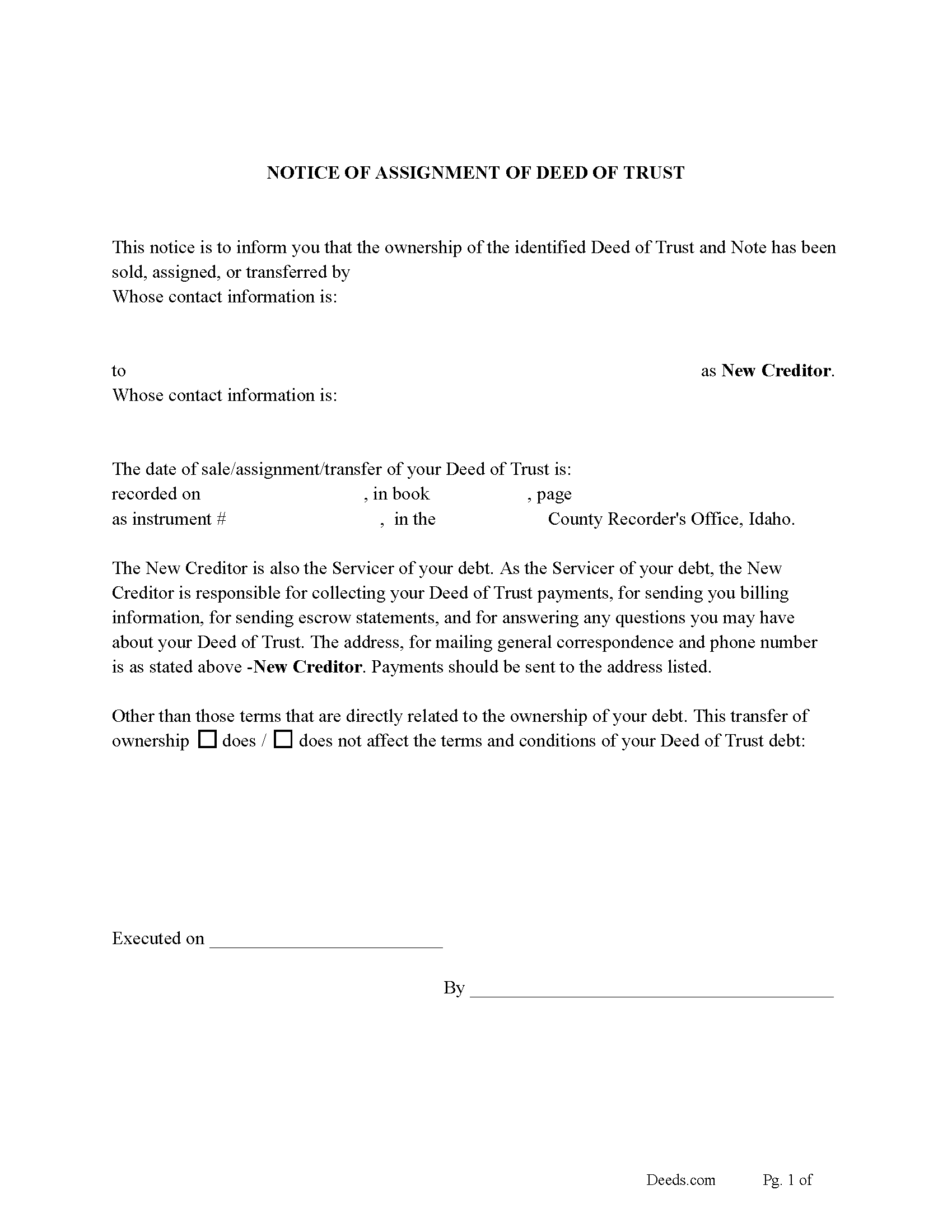

Franklin County Notice of Assignment of Deed of Trust Form

Fill in the blank form formatted to comply with all content requirements

Franklin County Guidelines Notice of Assignment of Deed of Trust

Line by line guide explaining every blank on the form.

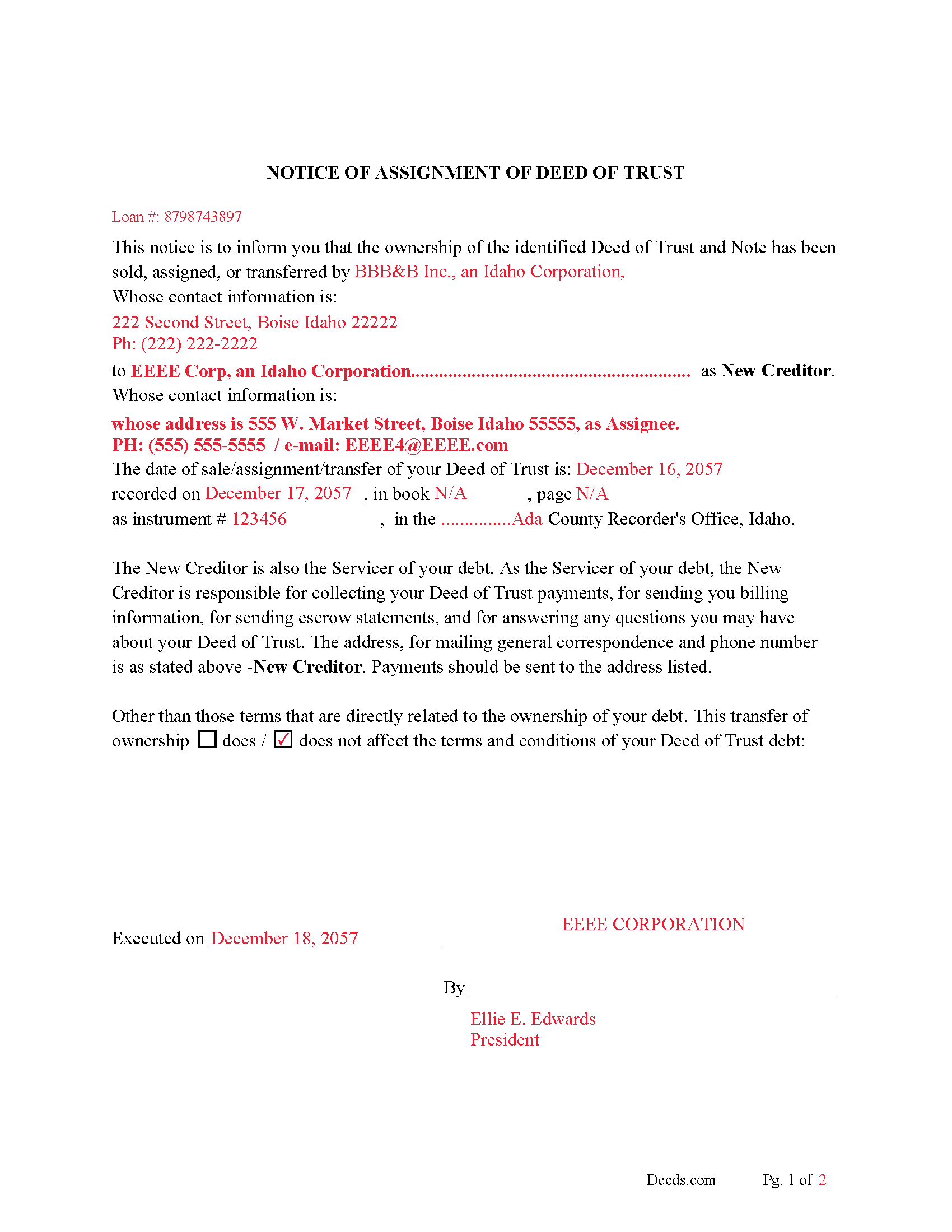

Franklin County Completed Example of the Notice of Assignment of Deed of Trust Document

Example of a properly completed form for reference.

All 6 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Clerk

Preston, Idaho 83263

Hours: 9:00am to 5:00pm M-F

Phone: (208) 852-1090

Recording Tips for Franklin County:

- Ask about their eRecording option for future transactions

- Recorded documents become public record - avoid including SSNs

- Request a receipt showing your recording numbers

- Recording early in the week helps ensure same-week processing

- Some documents require witnesses in addition to notarization

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Clifton

- Dayton

- Franklin

- Preston

- Thatcher

- Weston

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (208) 852-1090 for current fees.

Questions answered? Let's get started!

A recorded instrument in which the current Lender/beneficiary/assignor assigns an existing Deed of Trust to an assignee. This is typically performed when a Deed of Trust has been sold.

Notice of Assignment of Deed of Trust Form Included.

To avoid penalty the truth and lending act requires that borrowers be notified when their Deed of Trust debt has been sold, transferred, or assigned to a new creditor.

For use in Idaho only.

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Assignment of Deed of Trust meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Assignment of Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Joseph T.

February 6th, 2019

I downloaded the wrong form, how do I change this, or can I?

Sorry to hear that. As a one time courtesy we have canceled your order and payment for the documents you ordered in error. Have a great day.

Donna O.

March 6th, 2020

Quick and easy to use. I was able to download the Transfer on Death Deed form to my computer so that I can read through and fill them out at a later time. That made it convenient and "no pressure". The complimentary guide and completed example that came with the form was also very helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Rafael R.

May 9th, 2019

This was my first time using Deed.com. It was easier than I expected. The service is more convenient than filing documents in person or by mail. The response from Deeds.com upon the submission of my order was almost instantaneous.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John V. B.

April 11th, 2019

I have not yet used the site however, I feel that this site could be a big asset to the genealogical community. It is well laid out thus easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Debby R.

July 6th, 2021

Very easy to use

Thank you!

Clifford J.

July 4th, 2022

a lil pricey but i was able to knock out what needed to be done within 2 hours and not all day.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Clarice O.

June 15th, 2020

It was very easy plus exactly what I neded.

Thank you!

Karla L.

September 4th, 2019

Perfect! Recorded my completed deed today with no problems.

Thank you!

Robin G.

August 28th, 2020

Easy to navigate! Will use your services again!

Thank you!

Amanda P.

April 14th, 2021

Quick kind and useful feedback provided related to issues.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Lori C.

November 15th, 2019

It just a little disconcerting that I was not able to preview any of the forms prior to purchasing them. Thank goodness they were the correct forms I needed. I would suggest being able to at least make the picture of the forms a little larger or give the capability to zoom in.

Thank you!

Raj J.

December 2nd, 2020

Perfect, thanks

Thank you!

Liza B.

June 22nd, 2021

Fantastic forms and service, could not be happier, wish you girls did more than deed forms.

Thank you!

Tommie G.

March 11th, 2021

I saved 225.00 with this purchase.Make sure you have an updated property description from your county tax collectors' office.In Bay county,Florida the tax office will email you an updated property description.I attached the email to the the deed.I had to change the date and they accepted a white out and ink correction on your form.

Thank you for your feedback. We really appreciate it. Have a great day!

Craig H.

February 26th, 2022

Worked exactly like it was supposed to. No glitches

Thank you for your feedback. We really appreciate it. Have a great day!