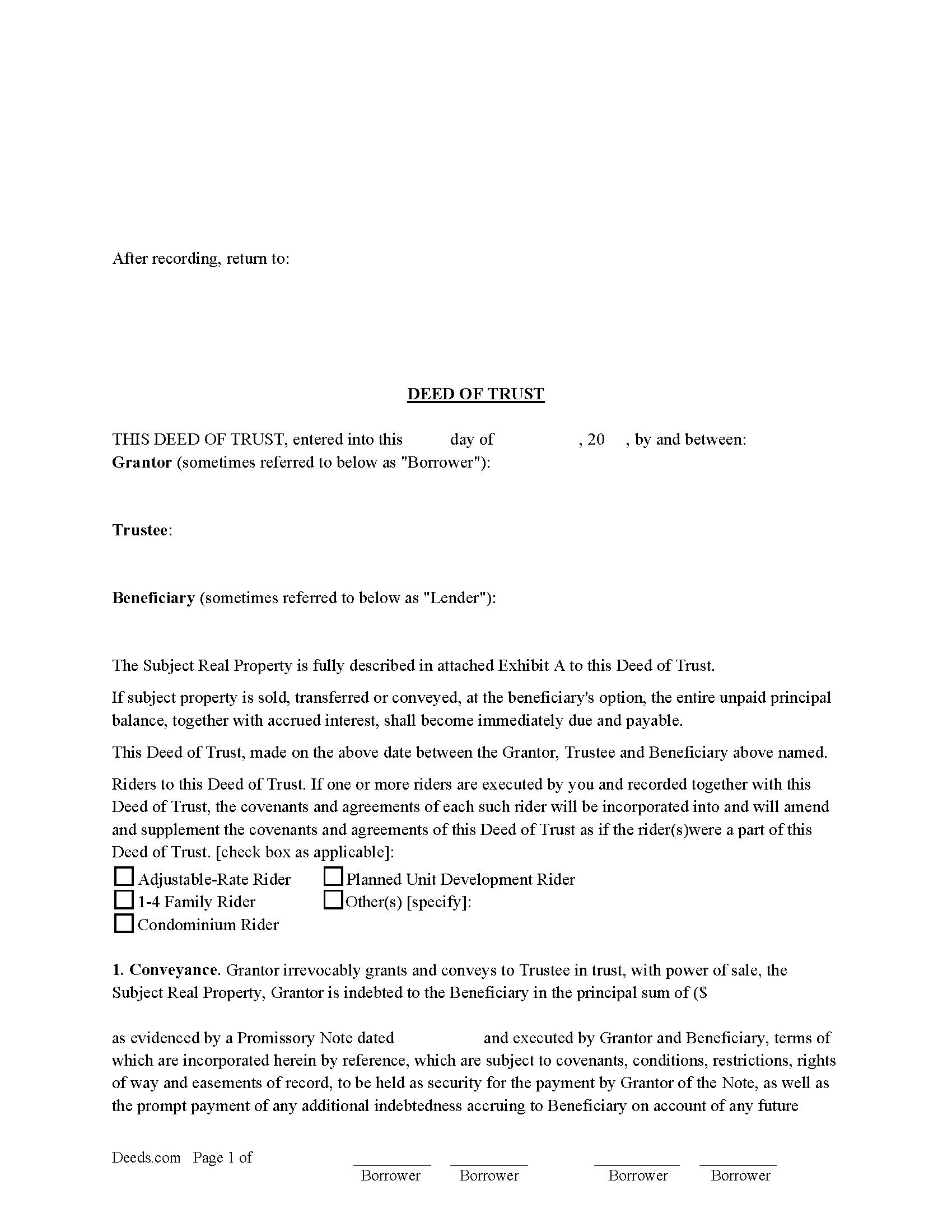

Gooding County Deed of Trust Form

Gooding County Deed of Trust Form

Fill in the blank form formatted to comply with all recording and content requirements.

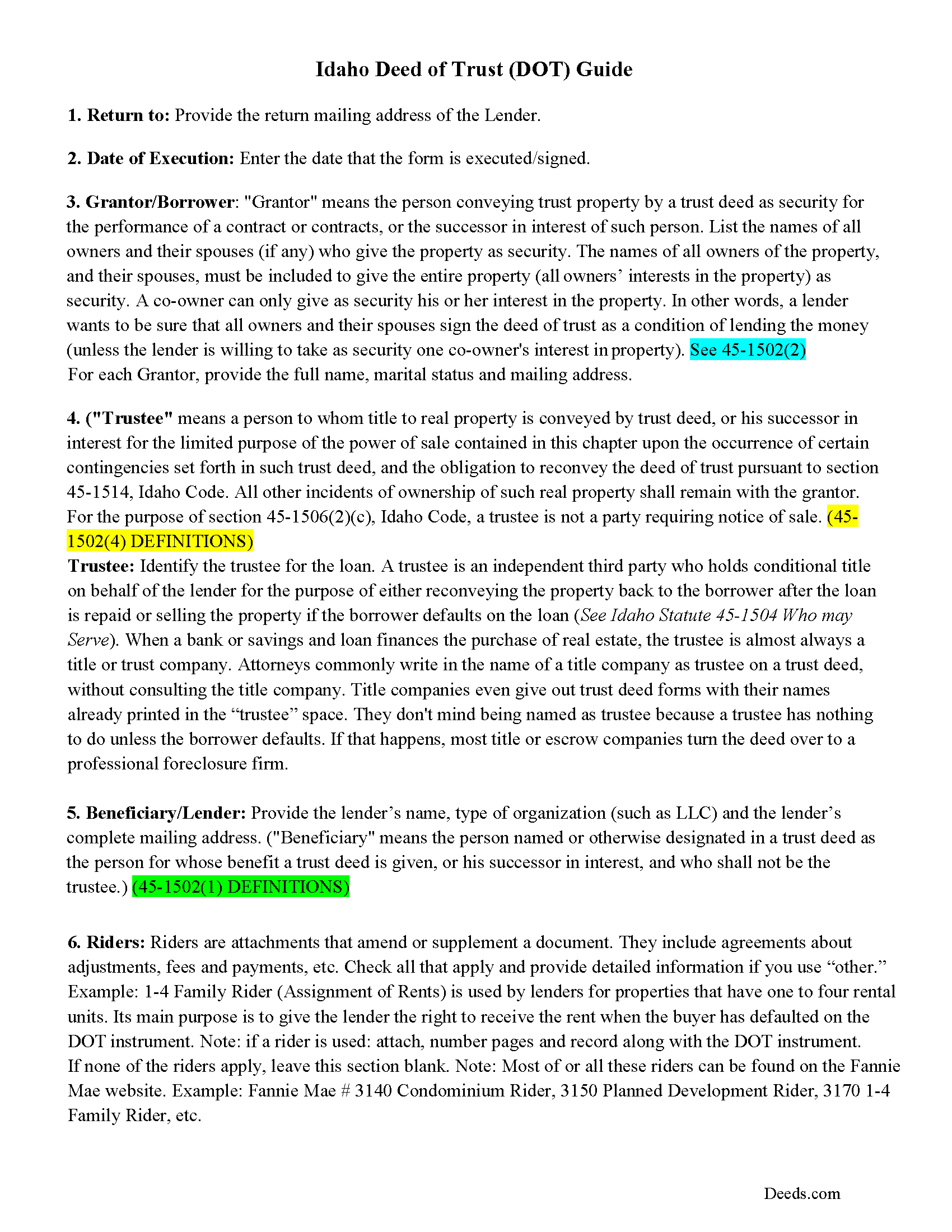

Gooding County Deed of Trust Guidelines

Line by line guide explaining every blank on the form.

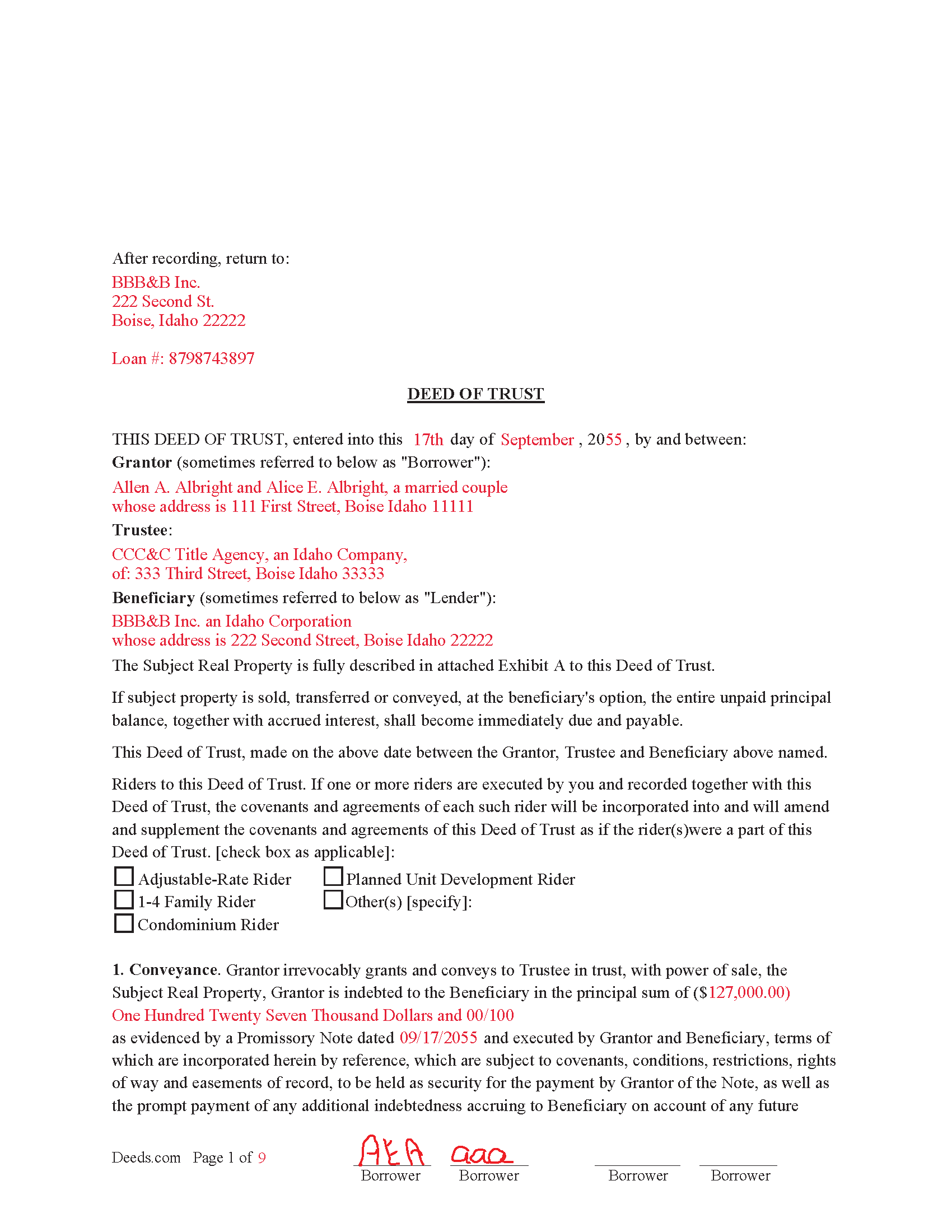

Gooding County Completed Example of the Deed of Trust Form

Example of a properly completed form for reference.

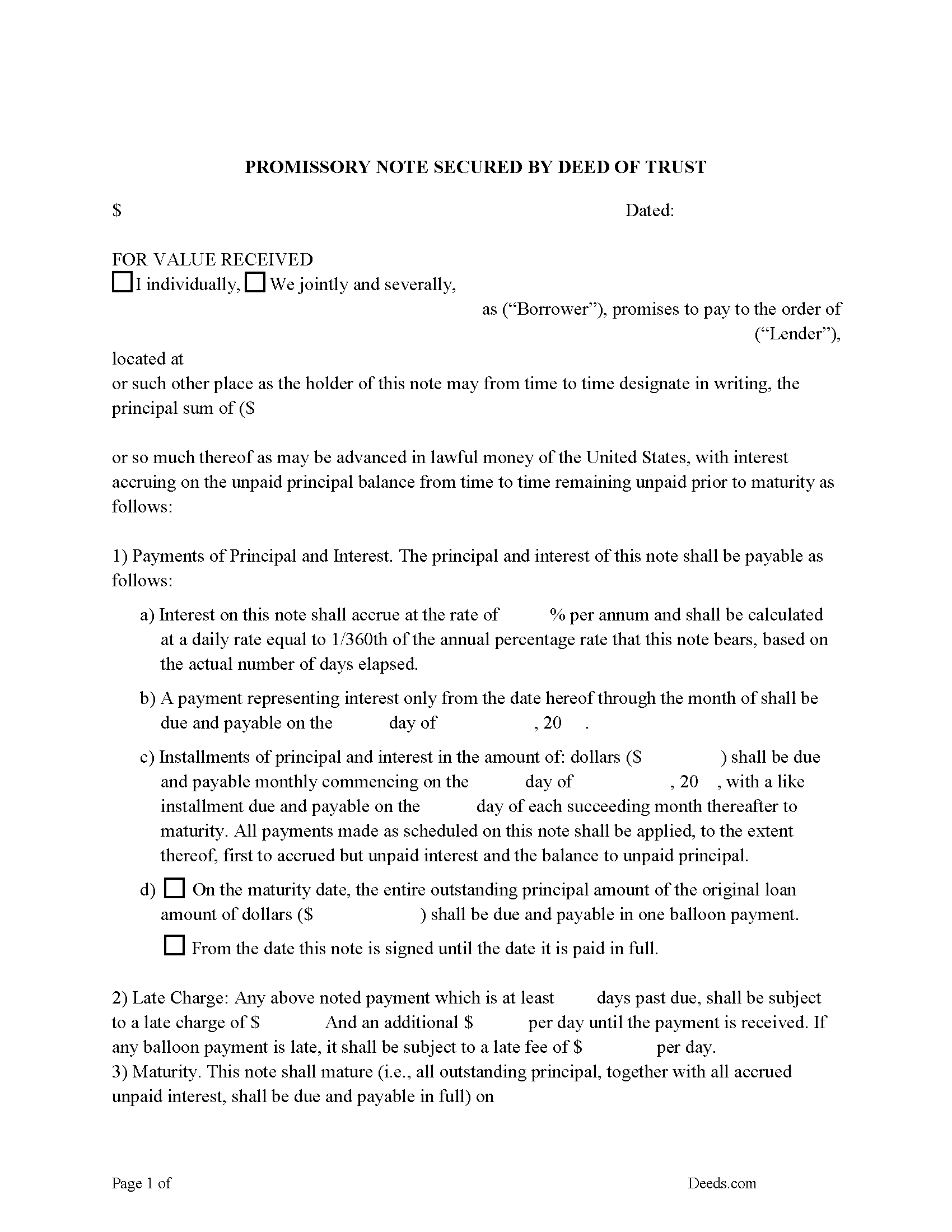

Gooding County Promissory Note Form

Note that is secured by the Deed of Trust document.

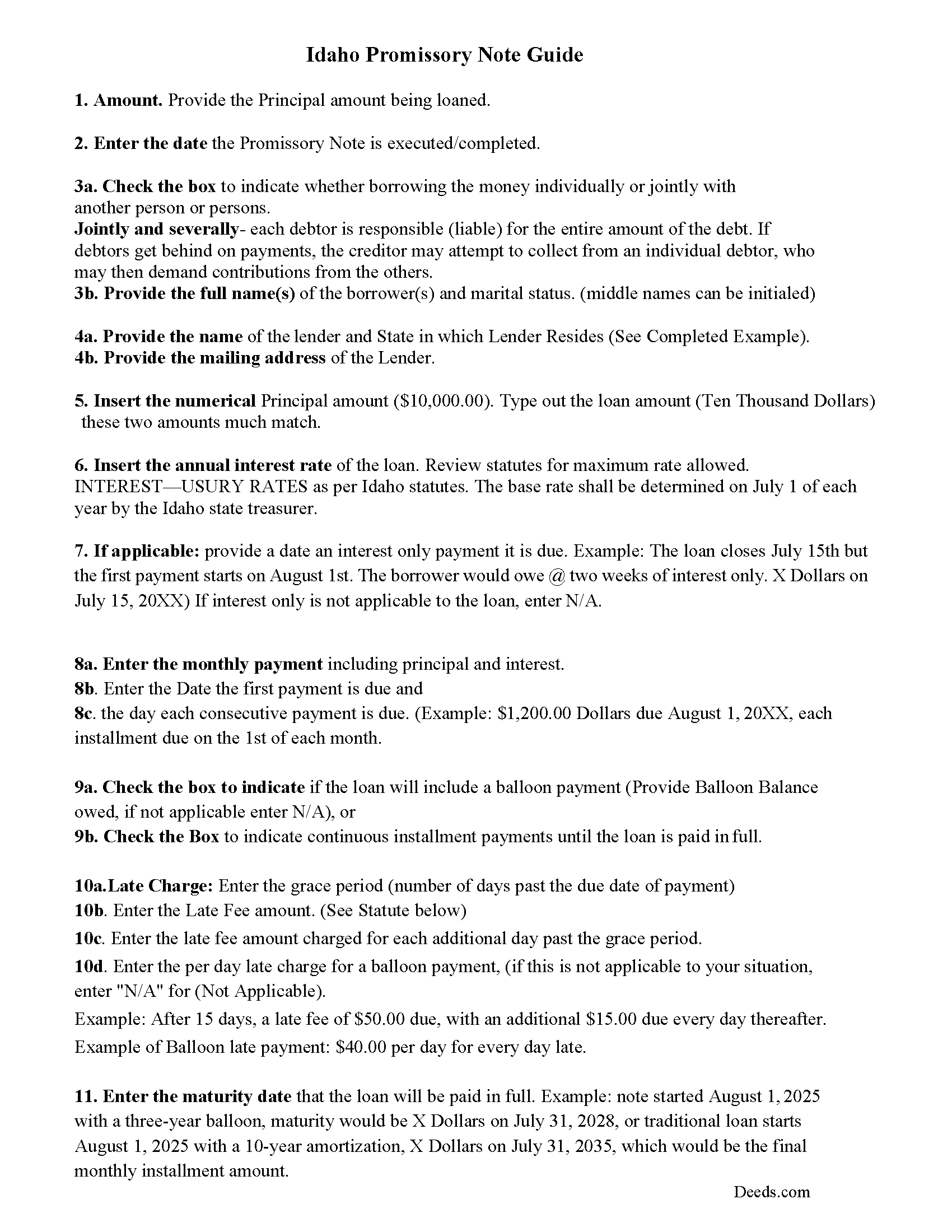

Gooding County Promissory Note Guidelines

Line by line guide explaining every blank on the form.

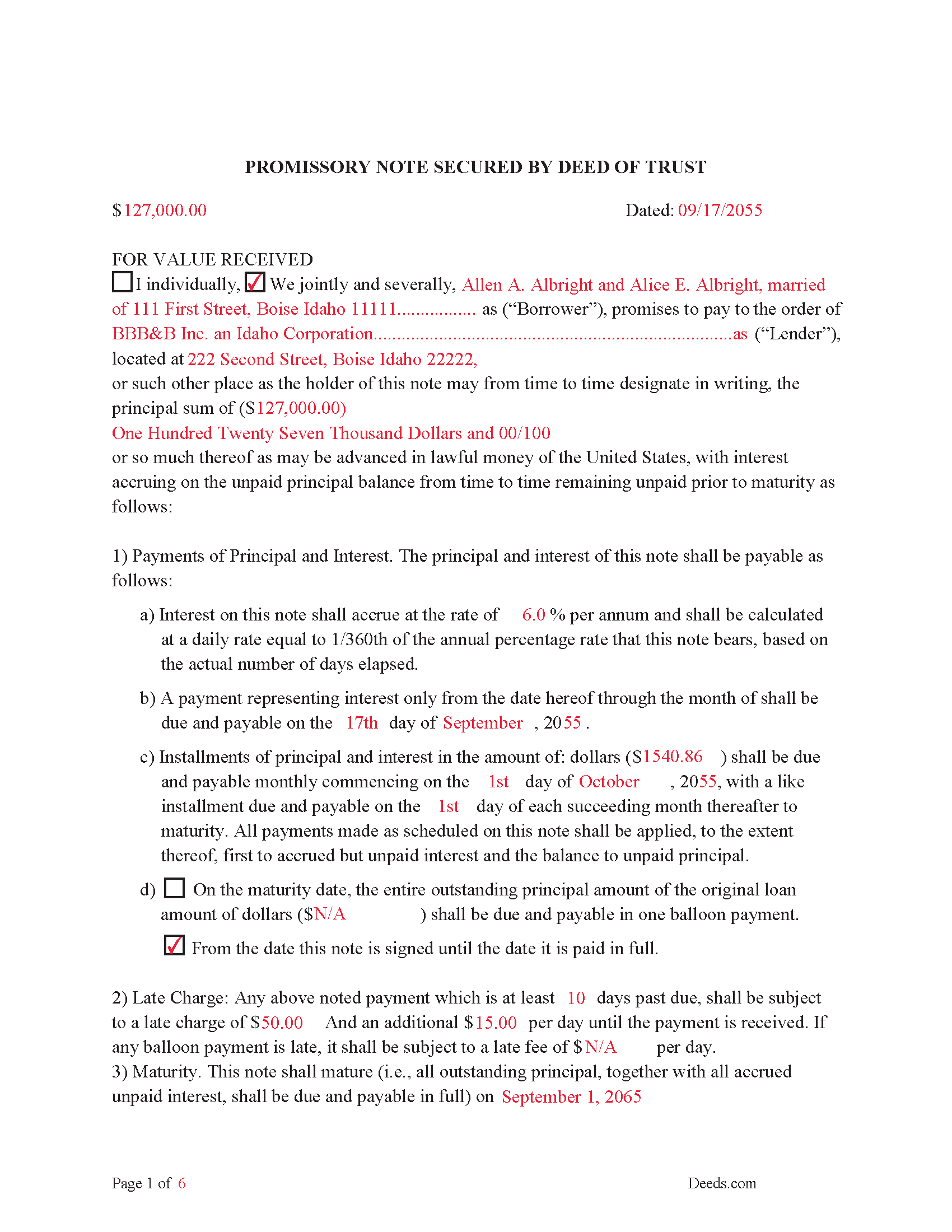

Gooding County Completed Example of the Promissory Note Document

Example of a properly completed form for reference.

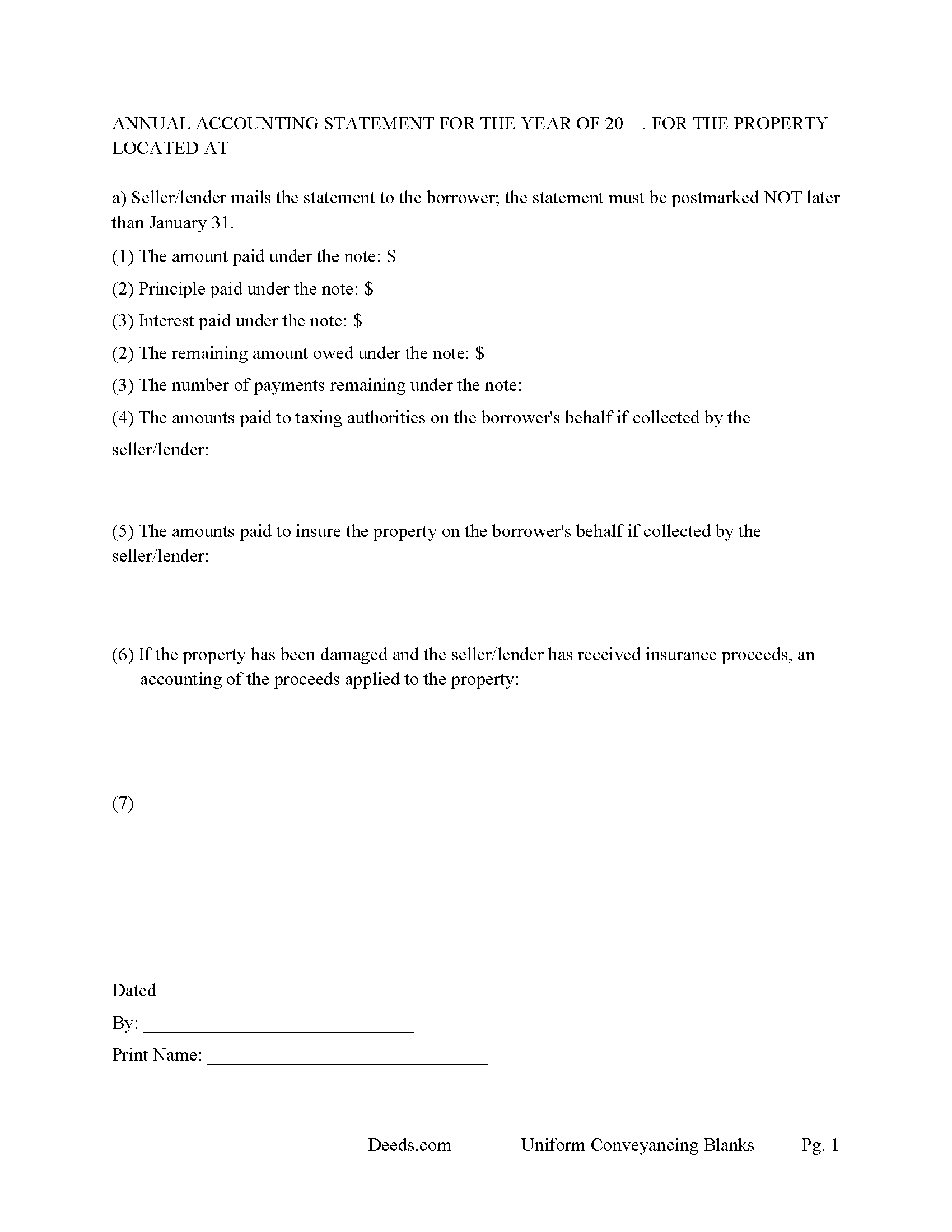

Gooding County Annual Accounting Statement Form

Issue to borrower(s) for fiscal year reporting.

All 7 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Gooding County documents included at no extra charge:

Where to Record Your Documents

Gooding County Clerk-Auditor-Recorder

Gooding, Idaho 83330

Hours: 7:30 to 5:30 Mon-Thu

Phone: (208) 934-4841

Recording Tips for Gooding County:

- Ensure all signatures are in blue or black ink

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- If mailing documents, use certified mail with return receipt

Cities and Jurisdictions in Gooding County

Properties in any of these areas use Gooding County forms:

- Bliss

- Gooding

- Hagerman

- Wendell

Hours, fees, requirements, and more for Gooding County

How do I get my forms?

Forms are available for immediate download after payment. The Gooding County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gooding County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gooding County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gooding County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gooding County?

Recording fees in Gooding County vary. Contact the recorder's office at (208) 934-4841 for current fees.

Questions answered? Let's get started!

A Deed of Trust is the most common instrument used to finance real property in Idaho. A Deed of Trust with a power of sale allows for a non-judicial foreclosure, saving time and expense for the lender. A Deed of Trust/Promissory Note that include stringent default terms can be beneficial to the lender. Use these forms for financing real property: vacant land, residential property, rental units, condominiums, small commercial and planned unit developments.

The promissory note is held by the lender and used for reconveyance once the deed of trust has been satisfied, it is considered to be severable and addresses past due dates, late charges, fees for additional days late, maturity dates, traditional finance and balloon payments, default rates, default terms and conditions, etc.

45-1502. DEFINITIONS --- TRUSTEE'S CHARGE. As used in this act:

(1) "Beneficiary" means the person named or otherwise designated in a trust deed as the person for whose benefit a trust deed is given, or his successor in interest, and who shall not be the trustee.

(2) "Grantor" means the person conveying real property by a trust deed as security for the performance of an obligation.

(3) "Trust deed" means a deed executed in conformity with this act and conveying real property to a trustee in trust to secure the performance of an obligation of the grantor or other person named in the deed to a beneficiary.

(4) "Trustee" means a person to whom title to real property is conveyed by trust deed, or his successor in interest for the limited purpose of the power of sale contained in this chapter upon the occurrence of certain contingencies set forth in such trust deed, and the obligation to reconvey the deed of trust pursuant to section 45-1514, Idaho Code. All other incidents of ownership of such real property shall remain with the grantor. For the purpose of section 45-1506(2)(c), Idaho Code, a trustee is not a party requiring notice of sale.

(5) "Real property" means any right, title, interest and claim in and to real property owned by the grantor at the date of execution of the deed of trust or acquired thereafter by said grantor or his successors in interest. Provided, nevertheless, real property as so defined which may be transferred in trust under this act shall be limited to: (a) any real property located within an incorporated city or village at the time of the transfer; (b) any real property not exceeding eighty (80) acres, regardless of its location, provided that such real property is not principally used for the agricultural production of crops, livestock, dairy or aquatic goods; or (c) any real property not exceeding forty (40) acres regardless of its use or location.

(6) The trustee shall be entitled to a reasonable charge for duties or services performed pursuant to the trust deed and this chapter, including compensation for reconveyance services notwithstanding any provision of a deed of trust prohibiting payment of a reconveyance fee by the grantor or beneficiary, or any provision of a deed of trust which limits or otherwise restricts the amount of a reconveyance fee to be charged and collected by the trustee. A trustee shall be entitled to refuse to reconvey a deed of trust until the trustee's reconveyance fees and recording costs for recording the reconveyance instruments are paid in full. The trustee shall not be entitled to a foreclosure fee in the event of judicial foreclosure or work done prior to the recording of a notice of default. If the default is cured prior to the time of the last newspaper publication of the notice of sale, the trustee shall be paid a reasonable fee.

45-1504. TRUSTEE OF TRUST DEED --- WHO MAY SERVE --- SUCCESSORS.

(1) The trustee of a trust deed under this act shall be:

(a) Any member of the Idaho state bar;

(b) Any bank or savings and loan association authorized to do business under the laws of Idaho or the United States;

(c) An authorized trust institution having a charter under chapter 32, title 26, Idaho Code, or any corporation authorized to conduct a trust business under the laws of the United States; or

(d) A licensed title insurance agent or title insurance company authorized to transact business under the laws of the state of Idaho.

(2) The trustee may resign at its own election or be replaced by the beneficiary. The trustee shall give prompt written notice of its resignation to the beneficiary. The resignation of the trustee shall become effective upon the recording of the notice of resignation in each county in which the deed of trust is recorded. If a trustee is not appointed in the deed of trust, or upon the resignation, incapacity, disability, absence, or death of the trustee, or the election of the beneficiary to replace the trustee, the beneficiary shall appoint a trustee or a successor trustee. Upon recording the appointment of a successor trustee in each county in which the deed of trust is recorded, the successor trustee shall be vested with all powers of an original trustee.

Idaho Code 45-1003 -- Acknowledgment and Recordation Mortgages, and deeds of trust or transfers in trust of real property may be acknowledged or proved, certified and recorded, in like manner and with like effect as grants and conveyances thereof.

For use in Idaho only.

Important: Your property must be located in Gooding County to use these forms. Documents should be recorded at the office below.

This Deed of Trust meets all recording requirements specific to Gooding County.

Our Promise

The documents you receive here will meet, or exceed, the Gooding County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gooding County Deed of Trust form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Christine G.

April 23rd, 2021

. Easy to use.

Thank you for your feedback. We really appreciate it. Have a great day!

Martine S.

July 29th, 2020

Very easy process and was recorded in a prompt manner. We will be using your services again in the future for sure.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Melody P.

April 13th, 2021

Thank you for always providing great service!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Michelle D.

March 4th, 2019

Very professional service, they were timely and proficient with answers and sending in the documents that I requested. Will work with them again in the future

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Donald S.

July 7th, 2020

Good

Thank you!

Emelinda C.

July 29th, 2019

Quick download, hassle-free, no forced membership-just a straight-forward transaction. Thank you!

Thank you for your feedback. We really appreciate it. Have a great day!

Tisha J.

November 10th, 2021

A quick and efficient way to record! Awesome customer service and SUPER FAST turnaround time.!

Thank you!

Elizabeth B.

November 22nd, 2020

Very efficient

Thank you!

Lynnellen S.

May 9th, 2019

My rating is not a 5. Although it had good instructions, it would NOT print the whole document no matter how many times I inputted the names. I ended up writing it in to complete. I also recommend putting it on one page. I had to pay an additional fees per page and if I had to notarize it, why did I have to find 2 witnesses as well. I deserve a discount for the time I spent repeatedly putting the same data. I was trying to save money since Im on social security only. It didnt. Get it to work correctly

Thank you for your feedback Lynnellen. Sorry to hear of your struggle with our document. We've gone ahead and refunded your payment. Hope you have a wonderful day.

Tamica D.

April 22nd, 2020

Exceptional service. Thank you for your assistance.

Thank you!

Clint J.

March 23rd, 2021

Deeds.com is a great way for people that are unfamiliar with legal documents to get things done. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Carnell G.

September 26th, 2020

The basic setup was fine but, I need to review the document in its entirety for accuracy which I have yet to do so. So far so good. The monthly fee is more than I need for right now.

Thank you!

Carrie A.

September 28th, 2020

Great service fast and easy.

Thank you!

marshall w.

September 24th, 2019

was not ready to pay for much needed forms but very important

Thank you for your feedback. We really appreciate it. Have a great day!

Bonnie C.

July 28th, 2021

Easy and convenient. Was nice to have just a one time charge without a so-called anual fee/membership. Will use again if needed. May update review after "all is said and done."

Thank you!