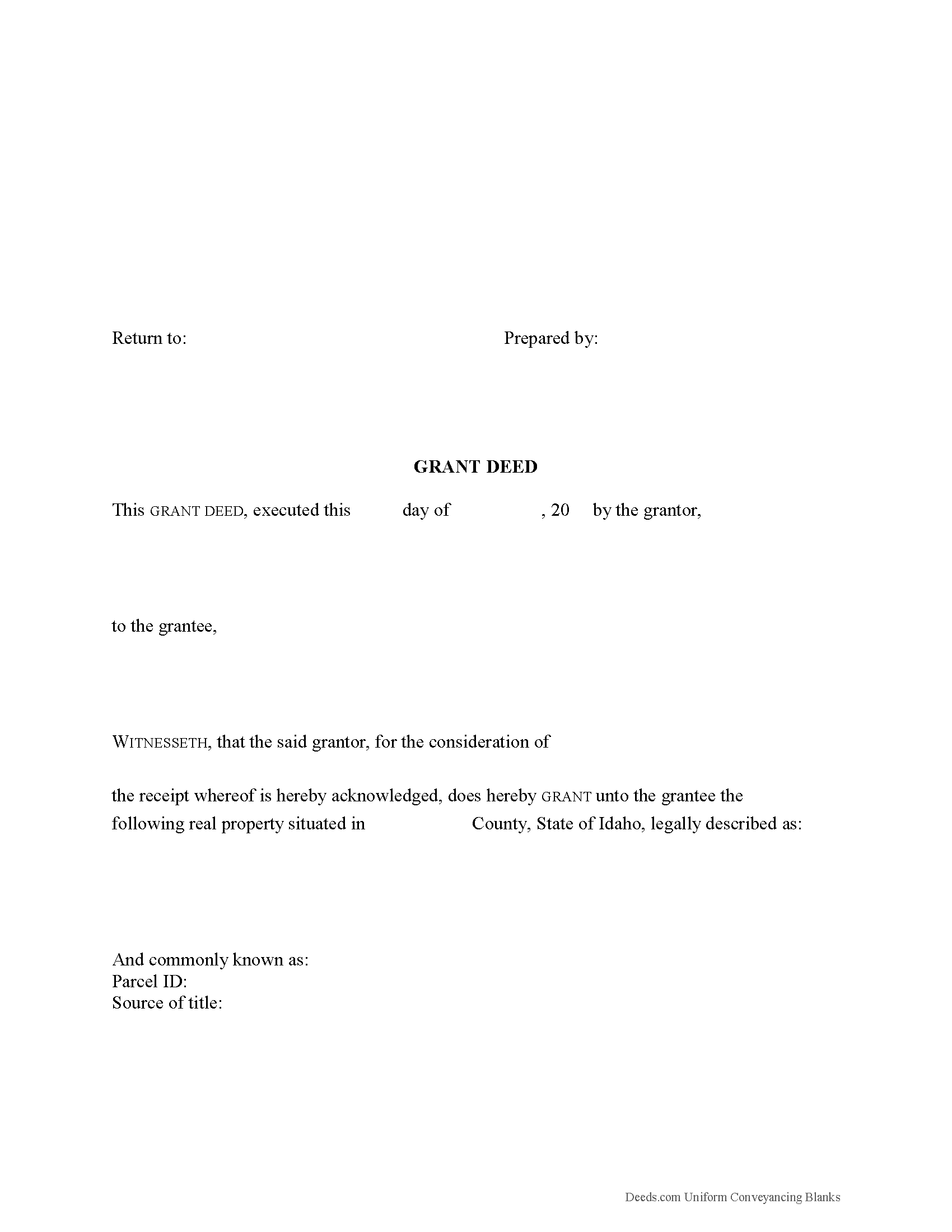

Gooding County Grant Deed Form

Gooding County Grant Deed Form

Fill in the blank form formatted to comply with all recording and content requirements.

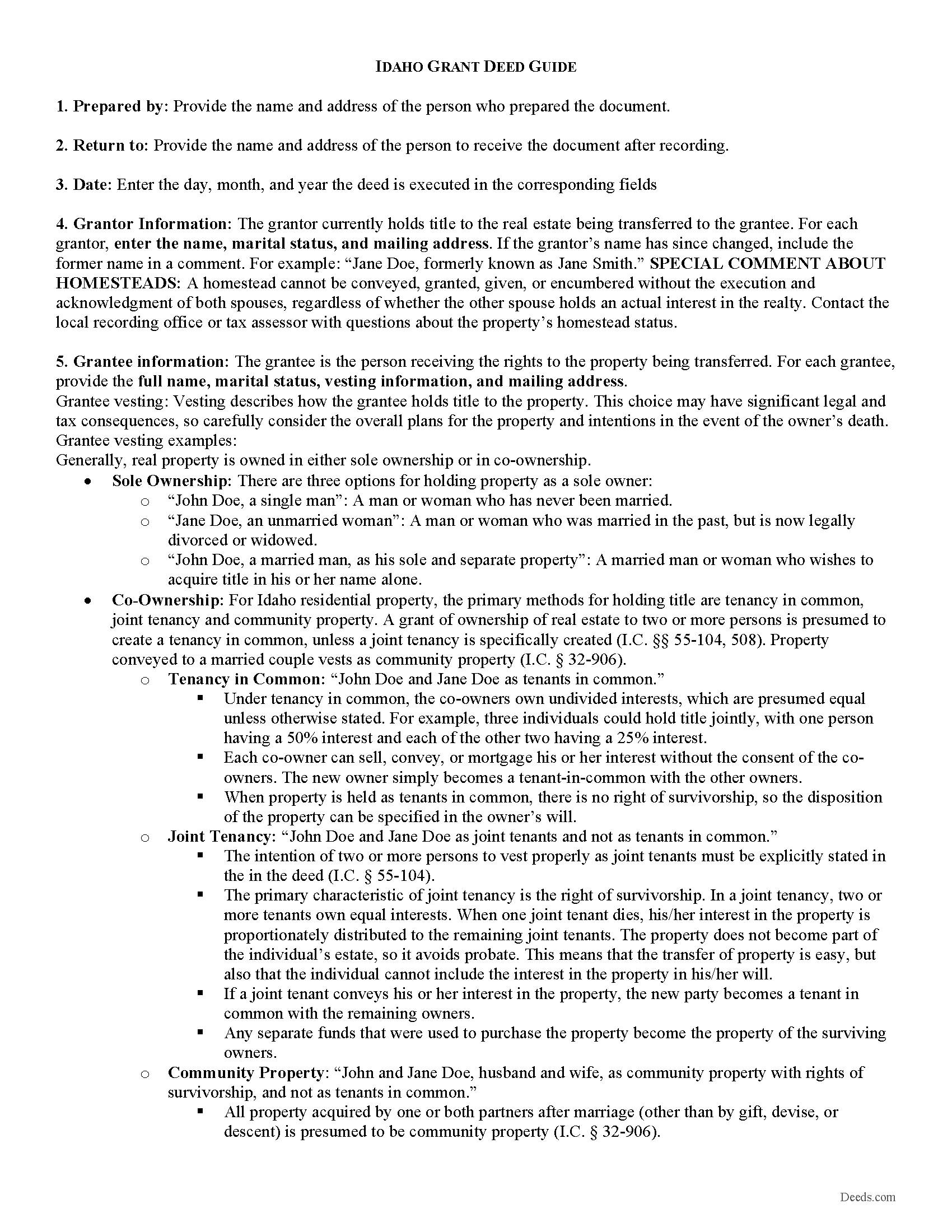

Gooding County Grant Deed Guide

Line by line guide explaining every blank on the form.

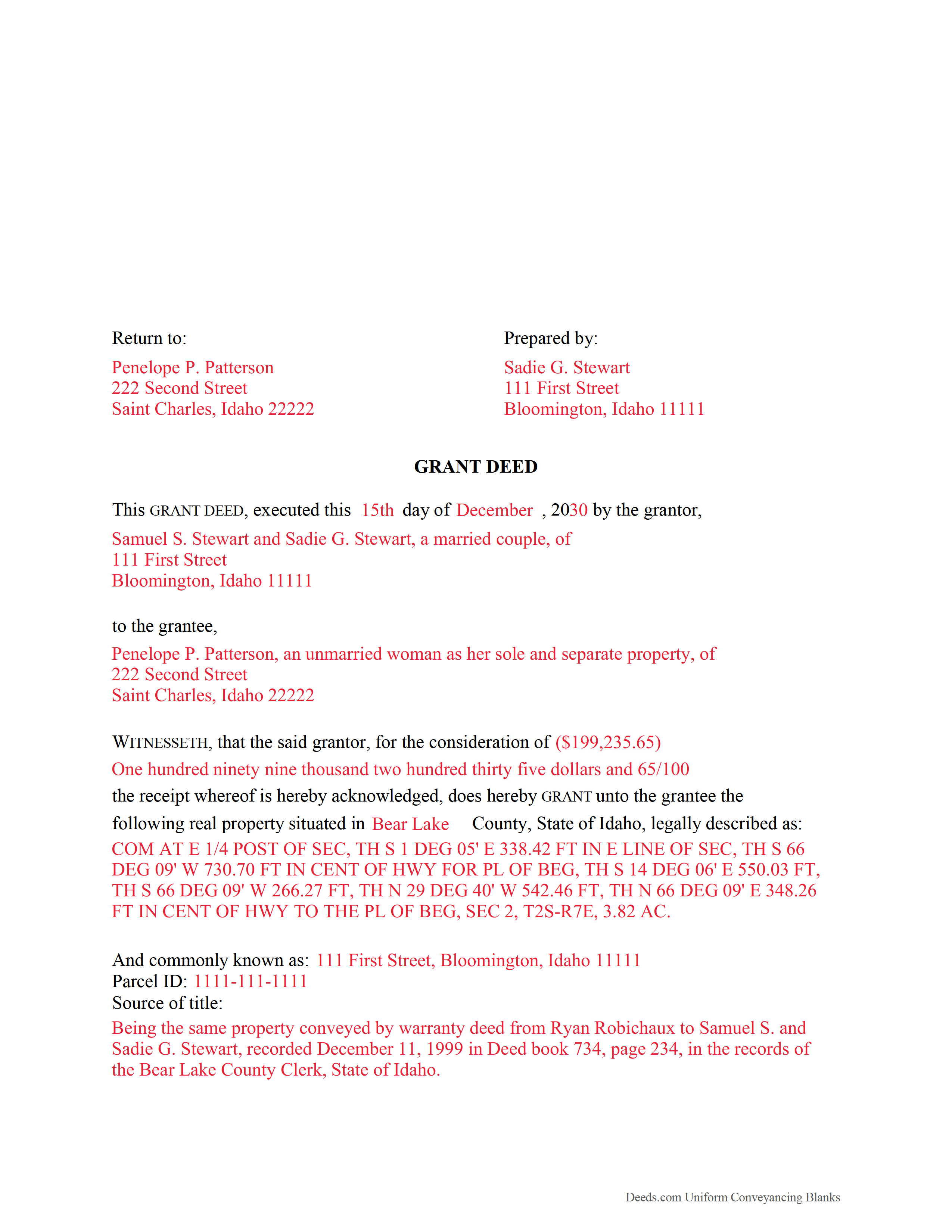

Gooding County Completed Example of the Grant Deed Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Gooding County documents included at no extra charge:

Where to Record Your Documents

Gooding County Clerk-Auditor-Recorder

Gooding, Idaho 83330

Hours: 7:30 to 5:30 Mon-Thu

Phone: (208) 934-4841

Recording Tips for Gooding County:

- Documents must be on 8.5 x 11 inch white paper

- Recording fees may differ from what's posted online - verify current rates

- Ask about their eRecording option for future transactions

- Request a receipt showing your recording numbers

Cities and Jurisdictions in Gooding County

Properties in any of these areas use Gooding County forms:

- Bliss

- Gooding

- Hagerman

- Wendell

Hours, fees, requirements, and more for Gooding County

How do I get my forms?

Forms are available for immediate download after payment. The Gooding County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Gooding County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Gooding County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Gooding County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Gooding County?

Recording fees in Gooding County vary. Contact the recorder's office at (208) 934-4841 for current fees.

Questions answered? Let's get started!

A grant deed, also referred to as a bargain and sale deed, is a legal document used to transfer, or convey, rights in real property from a grantor (seller) to a grantee (buyer). Idaho does not provide a statutory form for a grant deed, but the statutes identify the warranties implied by the word "grant" in a deed. In Idaho, the word "grant" guarantees that previous to the execution of the conveyance, the grantor has not conveyed the same property, or any right, title, or interest therein to any person other than the grantee, and that the estate is free from encumbrances at the time of execution of the deed (I.C. 55-612). Therefore, if the grantee later discovers that the grantor has sold the property to a third party, or if there are encumbrances not mentioned in the deed, the grantee can sue the grantor to recover the value of the property.

In addition to meeting all state and local recording standards, the deed must include the grantor's full name and marital status, as well as the grantee's full name, marital status, mailing address, and vesting. Vesting describes how the grantee holds title to the property. For Idaho residential property, the primary methods for holding title are tenancy in common, joint tenancy and community property. A grant of ownership of real estate to two or more persons is presumed to create a tenancy in common, unless a joint tenancy is specifically created (I.C. 55-104, 508). Property conveyed to a married couple vests as community property (I.C. 32-906).

A lawful grant deed must be signed by the grantor and contain an acknowledgement. Acknowledgements may be made at any place within the state of Idaho, before a justice or clerk of the Supreme Court, or a notary public, of the Secretary of State, or United States commissioner and must meet the requirements as set forth in I.C. 55-707. Once acknowledged or proved and certified as provided, it should be recorded in the recorder's office in the county where such lands are located. If left unrecorded, a grant deed is void as against any subsequent purchaser or mortgagee of the same property whose conveyance is first duly recorded (I.C. 55-812).

This article is provided for informational purposes only and is not a substitute for the advice of an attorney. Contact an attorney with questions about grant deeds or any other issues related to the transfer of real property in Idaho.

Important: Your property must be located in Gooding County to use these forms. Documents should be recorded at the office below.

This Grant Deed meets all recording requirements specific to Gooding County.

Our Promise

The documents you receive here will meet, or exceed, the Gooding County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Gooding County Grant Deed form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Daniel Z.

August 23rd, 2019

I am satisfied with the service. Live in another state and could not go directly to the county office for my deed. Your service solved my problem. Thank you

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Don M.

September 17th, 2022

Easy to set up account. If I am presented with a chance to review the service, I will do that after I have received it.

Thank you!

ANGELA S.

February 13th, 2020

My E-deed was not excepted by the county, so I had to snail mail the documents to the recorders office. Will probably not use this site again, as it did not fulfill my purpose, but would recommend to those who do not have complicated forms.

Thank you for your feedback. We really appreciate it. Have a great day!

Sheri L.

July 9th, 2019

Very helpful even though what I'm looking for hasnt updated yet. I'll use you again.

Thank you!

David A.

April 23rd, 2019

Excellent service. I have been looking for a beneficiary deed for quite a wile with no success. My friend found your site and I was overjoyed. Fast, easy to use, and understand.I recommend this site to anyone.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Shane J.

April 21st, 2020

Easy to use and quickly filed documents!

Thank you!

JIM H.

July 21st, 2022

Excellent service Always find the documents in minutes. Supporting docs is a super plus!

Thank you!

Deneene C.

April 17th, 2020

Was a great help to me. I'm very pleased .

Thank you!

Dale V.

April 21st, 2019

Great site good price everything easy to use and correct.. Thanks

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

SUSAN R.

March 15th, 2021

So easy to download and print. Also the examples are very helpful.

Thank you for your feedback. We really appreciate it. Have a great day!

Billie M.

November 15th, 2023

My overall experience was positive. Little trouble uploading documents but resolved. I had two mineral deeds to file in Arkansas, two different counties, exactly the same form, only difference being property description; one was completed, one was canceled. I emailed to inquire why and the reply was in an automatic email indicating that email address was not monitored and if further action would be taken on Deeds.com part, I would be notified. Other than that, I would recommend their services to avoid using snail mail.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Linda S.

March 8th, 2019

I am quite pleased with this website. I was able to complete my task with relative ease thanks to all the help these forms provided .The example forms really helped me to navigate the process. I would recommend this service highly.

Thank you Linda, we really appreciate your feedback.

Leah P.

March 16th, 2021

Thank you for your complete listing of deeds and forms. The Deed form I needed worked perfectly!

Thank you!

Lawrence C.

October 18th, 2024

Excellent and expeditious service. Will definitely use in the future when the need arises.

Thank you for your positive words! We’re thrilled to hear about your experience.

Martin T.

January 8th, 2021

The deed I needed was available to me easily. I was able to fill it out with the help of the example deed provided. I am very satisfied with the value received for the price paid.

Thank you!