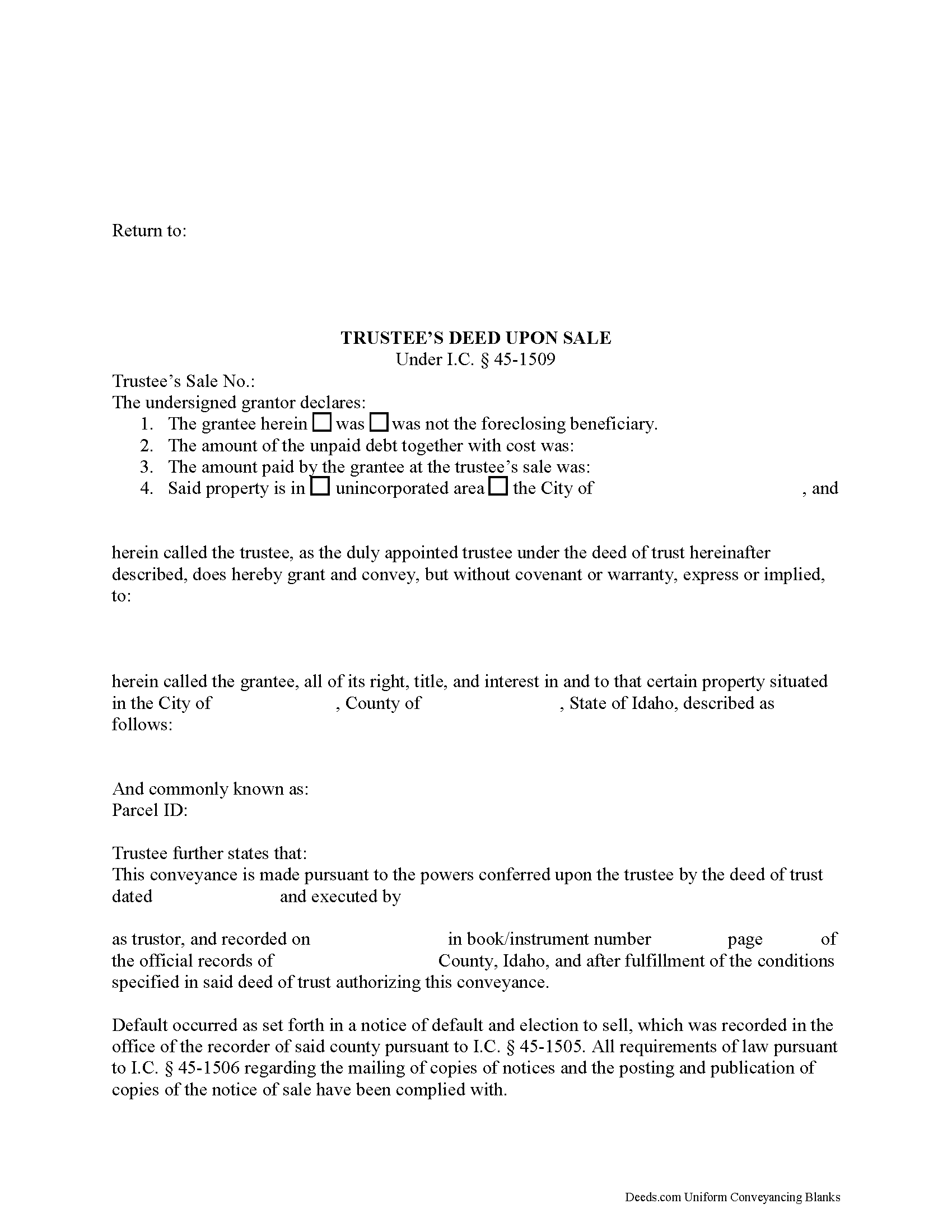

Boise County Trustee Deed Upon Sale Form

Boise County Trustee Deed Upon Sale Form

Fill in the blank form formatted to comply with all recording and content requirements.

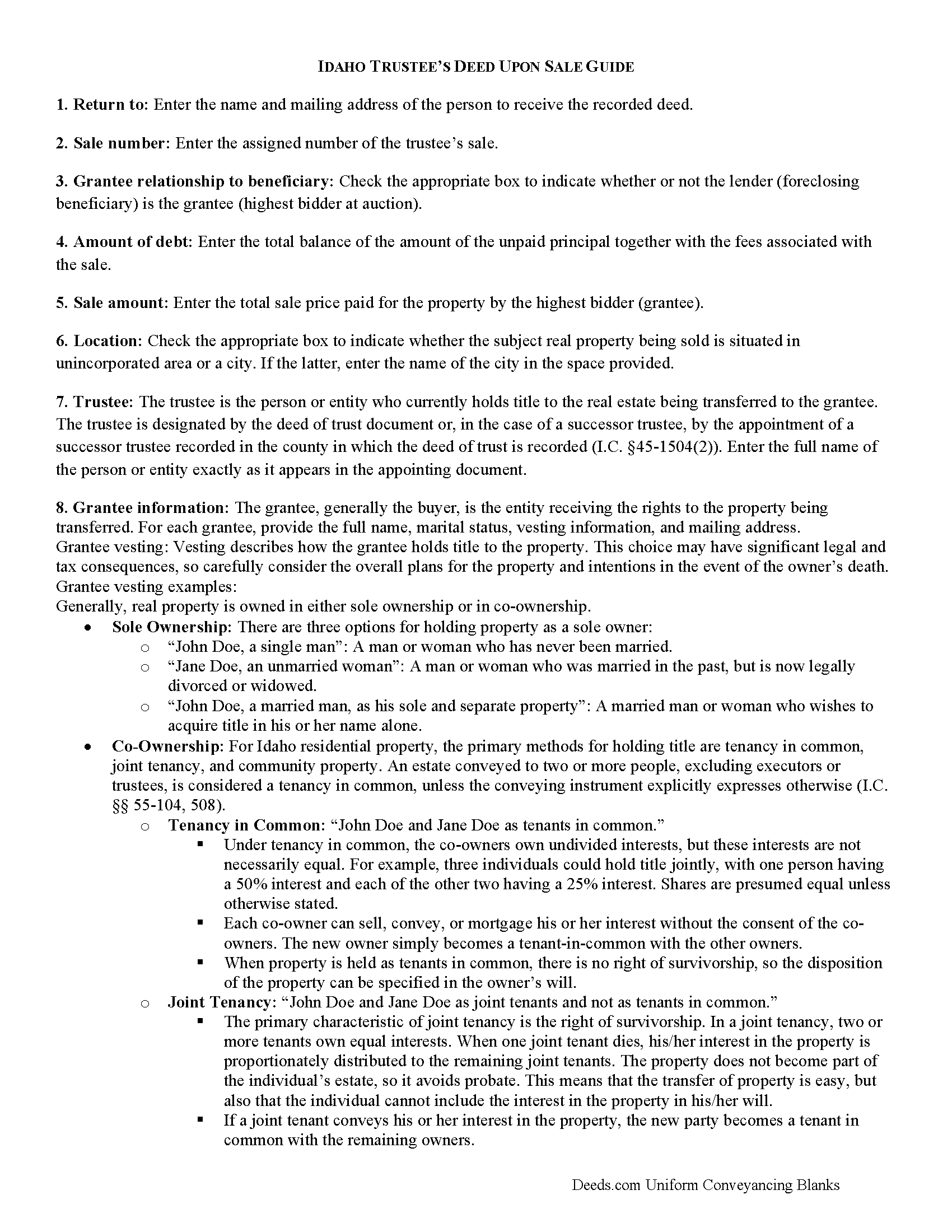

Boise County Trustee Deed Upon Sale Guide

Line by line guide explaining every blank on the form.

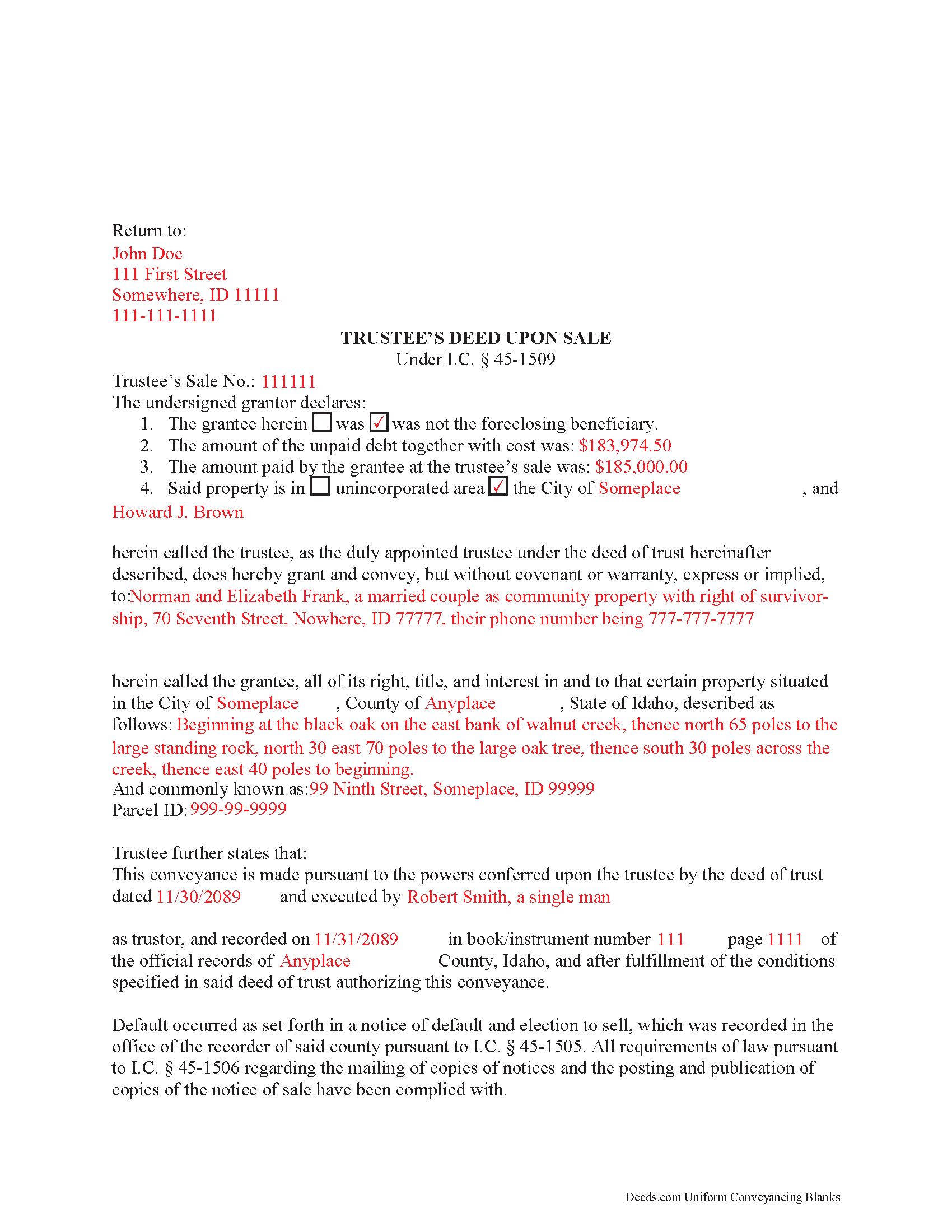

Boise County Completed Example of the Trustee Deed upon Sale Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Idaho and Boise County documents included at no extra charge:

Where to Record Your Documents

Boise County Clerk

Idaho City, Idaho 83631

Hours: 8:00am-5:00pm M-F

Phone: (208) 392-4431

Recording Tips for Boise County:

- Double-check legal descriptions match your existing deed

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Boise County

Properties in any of these areas use Boise County forms:

- Banks

- Garden Valley

- Horseshoe Bend

- Idaho City

- Lowman

- Placerville

Hours, fees, requirements, and more for Boise County

How do I get my forms?

Forms are available for immediate download after payment. The Boise County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Boise County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Boise County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Boise County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Boise County?

Recording fees in Boise County vary. Contact the recorder's office at (208) 392-4431 for current fees.

Questions answered? Let's get started!

The Idaho Trustee's Deed Upon Sale is codified at I.C. 45-1509.

A trustee uses a trustee's deed upon sale to convey real property sold at a trustee's sale following foreclosure under a deed of trust. A deed of trust is a security instrument that, along with a promissory note, sets out the terms for repaying a loan used to purchase real property. Some states use deeds of trust in the place of mortgages.

The three parties involved in a deed of trust are the lender, the borrower (the grantor under the deed of trust), and the trustee. The trustee is generally a title insurance agent who holds legal title to the real property until the borrower has fulfilled the obligation of the deed of trust. The borrower holds equitable title.

If the borrower defaults on the terms of the deed of trust, the trustee, under the direction of the lender, may act on the power of sale clause in the deed, and initiate non-judicial foreclosure proceedings on the property. Statutory requirements, including the mailing of notices of default and sale, must be met before a trustee's sale is held at public auction. See I.C. Title 45 for more information.

The trustee's deed names the trustee as the grantor and conveys title to the highest bidder at the sale. In addition to describing the real property being conveyed, the deed recites basic information from the deed of trust, including the date of the instrument, the grantor's name, and a reference to where the deed can be found on record. The trustee's deed also includes references to facts about the default and the trustee's sale itself, and is recorded in the county in which the subject property is situated (I.C. 45-1509).

The foreclosure process is complicated, and each situation is unique. Contact an attorney for legal guidance.

Important: Your property must be located in Boise County to use these forms. Documents should be recorded at the office below.

This Trustee Deed Upon Sale meets all recording requirements specific to Boise County.

Our Promise

The documents you receive here will meet, or exceed, the Boise County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Boise County Trustee Deed Upon Sale form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4581 Reviews )

Helen A.

April 11th, 2022

Well not sure yet since I have only downloaded these forms but I read the reviews and this helped me determine if I will use your web site. I will gladly give a good review if this form serves me well!!!

Thank you for your feedback. We really appreciate it. Have a great day!

Sylvia B.

October 21st, 2020

What a wonderful resource! Forms are so easy to use, made the process a breeze. Deeds even helped with the recording. Thank you.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Tim P.

January 22nd, 2020

Super easy and they filed my paperwork the same day

Thank you for your feedback. We really appreciate it. Have a great day!

eric m.

January 28th, 2025

it was a smooth superb timely experience

Your feedback is valuable to us and helps us improve. Thank you for sharing your thoughts!

dill h.

March 5th, 2019

easy-peasy

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Ralph H.

May 8th, 2019

Your documents resolved my problem. Thanks.

Thank you Ralph, we appreciate your feedback.

Vickie W.

October 13th, 2022

Very easy to download and appreciated the other information and affidavits.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mica M.

September 25th, 2020

Best Way EVER to record a warranty deed! It was nice to not have to drive anywhere and find the facility closed or "unable to process due to covid19 and buildings being closed". The correspondence between me and deeds.com was very timely in our back and forth email correspondence, and the processing was all finished in a timely manner. Totally worth the extra $15 that I paid in addition to the recording fee. I would use this again and again. My time and the efficiency of the job completed is worth the money.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Deborah O.

June 3rd, 2019

Response time was fantastic. I had no idea it would be so quick. I would definitely use again. They send you a message if they need additional information, etc. I would rate them a 10+ on a 1-10 scale

Thank you for your feedback. We really appreciate it. Have a great day!

Linda D.

April 27th, 2019

It was quick & easy so thank you!

Thank you Linda.

Kimberly S.

July 21st, 2022

Worked very well. Seamless process with helpful directions.

Thank you for your feedback. We really appreciate it. Have a great day!

Kevin M.

May 14th, 2019

All I can say is WOW. They were so fast and professional. I received my copy of my deed that same day I requested it. There was some confusion on my part but within minutes it was explained.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Anita M.

March 10th, 2019

This was a very easy process to find the correct documents and download them. The price was also reasonable.

Thank you for your feedback. We really appreciate it. Have a great day!

Carol T.

February 26th, 2020

Very east process. Good job!

Thank you for your feedback. We really appreciate it. Have a great day!

virgil r.

January 6th, 2022

Easy access and guide throughout.

Thank you!