Mclean County Mineral Deed with Quitclaim Covenants Form

Mclean County Mineral Deed with Quitclaim Covenants Form

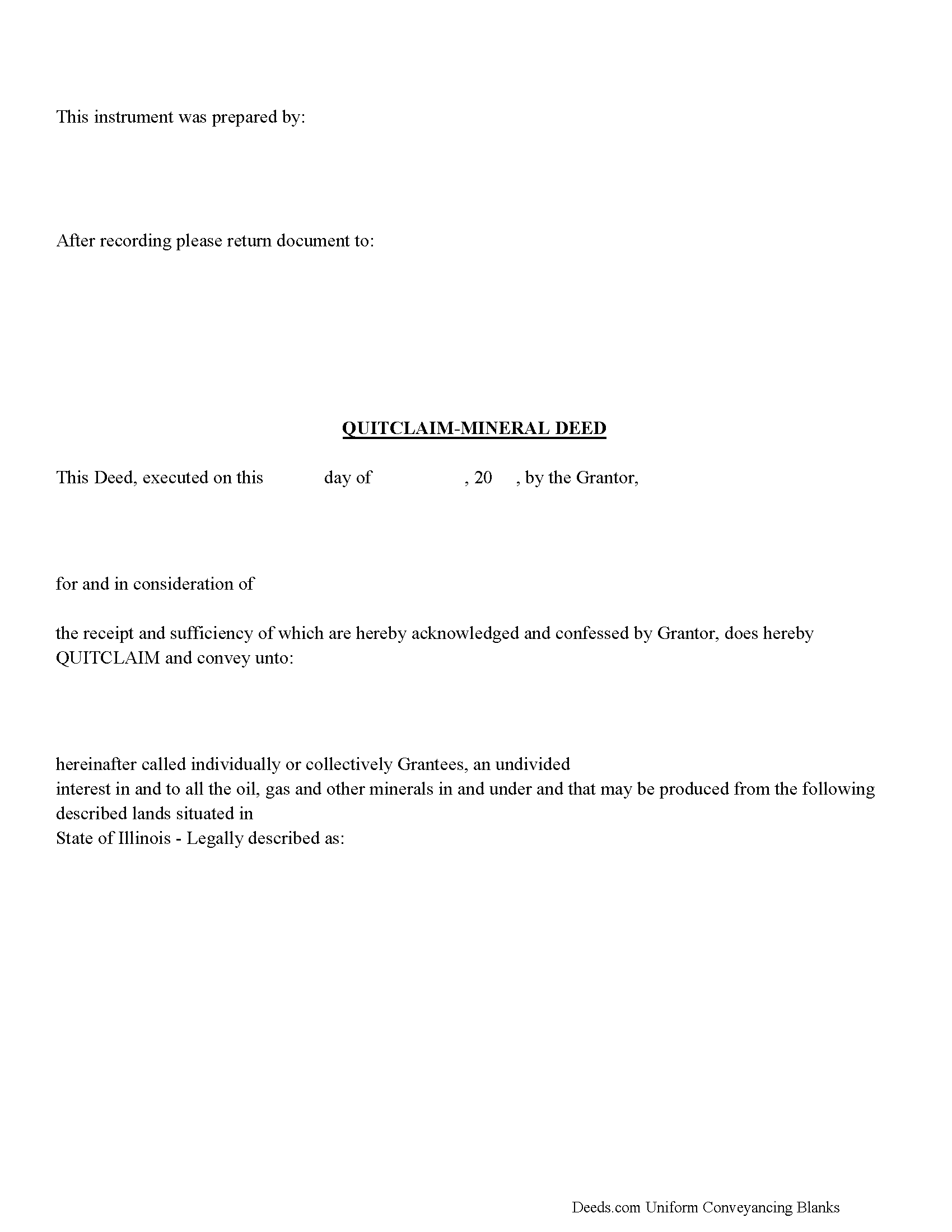

Fill in the blank Mineral Deed with Quitclaim Covenants form formatted to comply with all Illinois recording and content requirements.

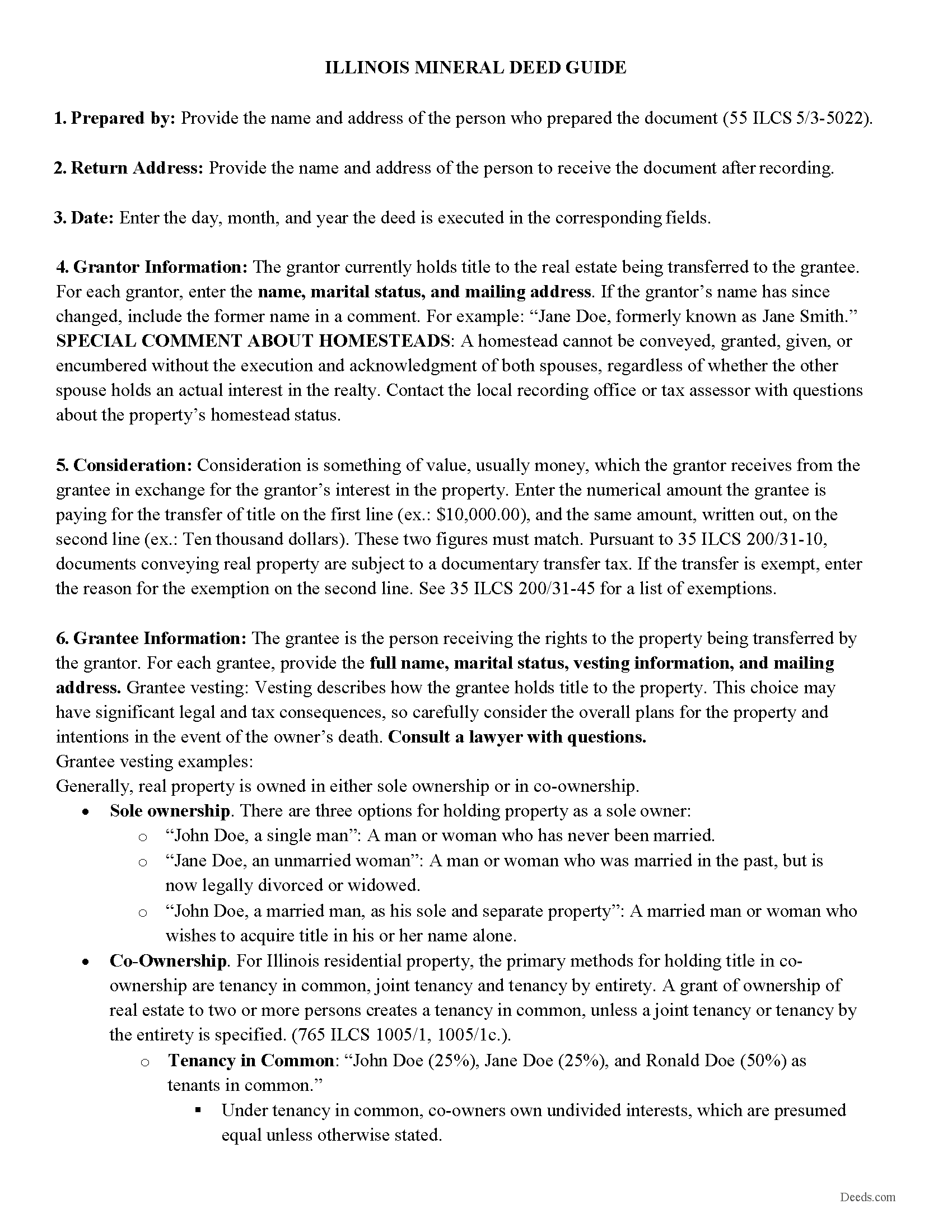

Mclean County Mineral Deed with Quitclaim Covenants Guide

Line by line guide explaining every blank on the Mineral Deed with Quitclaim Covenants form.

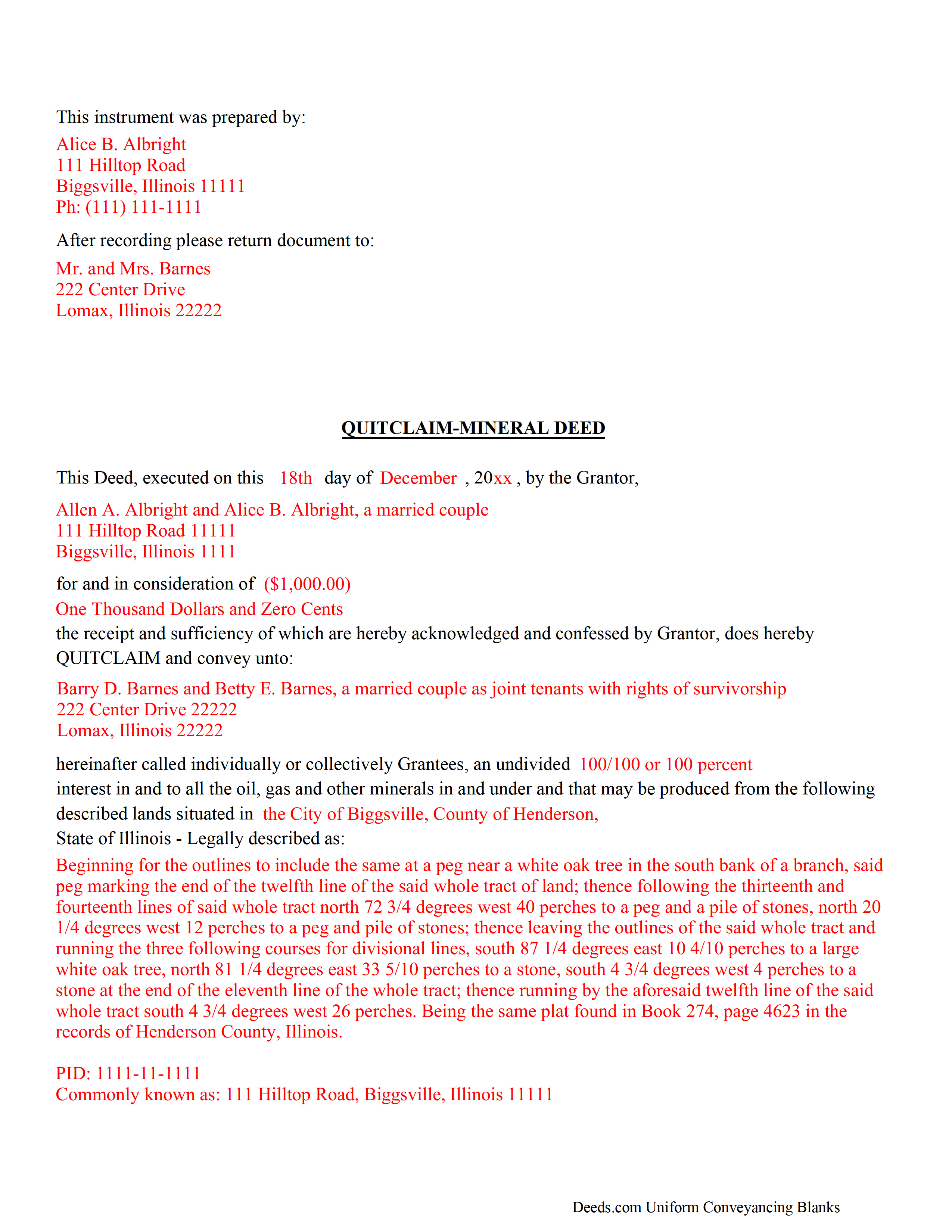

Mclean County Completed Example of the Mineral Deed with Quitclaim Covenants Document

Example of a properly completed Illinois Mineral Deed with Quitclaim Covenants document for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Illinois and Mclean County documents included at no extra charge:

Where to Record Your Documents

McLean County Recorder

Bloomington, Illinois 61702-2400

Hours: 8:00am to 4:30pm M-F

Phone: (309) 888-5170

Recording Tips for Mclean County:

- Bring your driver's license or state-issued photo ID

- Ask if they accept credit cards - many offices are cash/check only

- Both spouses typically need to sign if property is jointly owned

- Bring extra funds - fees can vary by document type and page count

- Leave recording info boxes blank - the office fills these

Cities and Jurisdictions in Mclean County

Properties in any of these areas use Mclean County forms:

- Anchor

- Arrowsmith

- Bellflower

- Bloomington

- Carlock

- Chenoa

- Colfax

- Cooksville

- Cropsey

- Danvers

- Downs

- Ellsworth

- Gridley

- Heyworth

- Hudson

- Le Roy

- Lexington

- Mc Lean

- Merna

- Normal

- Saybrook

- Shirley

- Stanford

- Towanda

Hours, fees, requirements, and more for Mclean County

How do I get my forms?

Forms are available for immediate download after payment. The Mclean County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Mclean County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Mclean County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Mclean County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Mclean County?

Recording fees in Mclean County vary. Contact the recorder's office at (309) 888-5170 for current fees.

Questions answered? Let's get started!

The General Mineral Deed in Illinois Quitclaims oil, gas, and mineral rights from the grantor to the grantee. THIS IS NOT A LEASE. There are no Exceptions or Reservations included.

The transfer includes the oil, gas and other minerals of every kind and nature. The Grantor can stipulate the percentage of Mineral Rights the Grantee will receive.

This general mineral deed gives the grantee the right to access, for the purpose of mining, drilling, exploring, operating and developing said lands for oil, gas, and other minerals, and storing handling, transporting and marketing of such.

The seller, or grantor Quitclaims the mineral rights and does NOT accept responsibility to any discrepancy of title (This assignment is without warranty of title, either express or implied)

Uses: Mineral deeds with quitclaim are often used in situations where the grantor wants to quickly release any interest they might have in mineral rights, such as in settling estates, resolving disputes, clearing up uncertainties about ownership in a title's history or when mineral rights have previously been severed or fragmented from surface rights and cloud a title, making it difficult to transfer property. Resolution often involves the holder(s) of the mineral rights, quit-claiming any rights he/she/they have or might have in the subject property.

Use of this document can have a permanent effect on your rights to the property, if you are not completely sure of what you are executing seek the advice of a legal professional.

(Illinois Mineral Deed with Quitclaim Package includes form, guidelines, and completed example)

Important: Your property must be located in Mclean County to use these forms. Documents should be recorded at the office below.

This Mineral Deed with Quitclaim Covenants meets all recording requirements specific to Mclean County.

Our Promise

The documents you receive here will meet, or exceed, the Mclean County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Mclean County Mineral Deed with Quitclaim Covenants form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Tawnya P.

November 2nd, 2022

I can't believe I haven't found Deeds.com sooner. They made my job so much easier!! They make recording documents effortless. I'm so grateful.

Thank you for your feedback. We really appreciate it. Have a great day!

Reliant Roofers, Inc. N.

September 20th, 2023

Great communication. Quick response. deeds.com is timely and efficient.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Julie K.

September 4th, 2023

The process for obtaining document itself was easy, and the included guide and example are great! I do have an issue with the format itself, though. The form has pre-defined text boxes, which cannot be altered without partially rebuilding the entire document. For the 'property description' field on the Mineral Deed form, the text box is not large enough for the rather lengthy legal description entered on my original plat. Fortunately, I have a copy of Adobe Pro, so I have been able to re-build the doc to accommodate this short-coming.

Thank you for taking the time to provide feedback on our legal form. We're pleased to hear that you found the process for obtaining the document and the included guide beneficial.

We understand and appreciate your concern regarding the formatting and size limitations of certain fields, especially the 'property description' field. Our forms are designed to adhere to specific formatting requirements that are often mandated for legal compliance. Making direct alterations to the document can result in them becoming non-conforming, which is why we advise customers to use an exhibit page when their legal description is extensive or does not fit.

William P.

October 31st, 2019

I was very pleased with the end results regarding Quitclaim deeds.

Thank you!

Gail W.

September 19th, 2019

Deeds.com had the forms I needed, along with completed examples. Fast download. Easy to use site. Thanks!

Thank you!

THOMAS C.

September 16th, 2020

Thank you for the fine, easy to implement service.

Thank you for your feedback. We really appreciate it. Have a great day!

Susie k.

March 3rd, 2020

No complaints

Thank you!

Alexis B.

December 31st, 2018

Highly Pleased- Strongly Recommend Deeds.com Long review... sorry:-) Originally I was very skeptical due to the enormous amount of the scams going on now days and the number of online sources that "claim" to provide you with deed forms for free or for a few. Nothing that you need and want done is free. There is always a cost. So luckily I came across deeds.com. This was the only site that appeared to be simple, to the point, and made no crazy promises. So before selecting this site, I did a little more checking around/price checking to ensure I am getting the best price for the product I needed. I even checked Staples and Amazon to find that they do indeed sell these forms but I do not think the products they provide are specific for my state and county. They claim their forms provided are for all states but my state is specific and I prefer to have forms provided by Deeds.com that is based on Indiana statute that Deed.com clearly identifies on each form. Deeds.com price of $20 seemed a little high at first but when I saw the products provided, the $20 cost is more than reasonable and fair. You not only get the deed form specific for my state and my specific "county" but also the other various/supplemental forms that may be required. Being familiar with my state and knowing how tedious and anal my state is on everything, I was pleasantly please to see the info and extra supplemental forms provided. For example, a person new to the State who recently had property deeded to them, would not necessarily know about the Homestead tax exemption provided if property is your primary residents, over 65 exemption etc. I would highly recommend this site for anyone needing these documents because Deeds.com has you covered on any and all forms/info you could ever need! A bonus is that there is one flat fee and not monthly cost that you have to worry about canceling later unless you superficially select a monthly package. I love the fact that Deeds.com is nothing fancy. There is not a bunch of elaborate graphics etc. They only provide what you need and what they provide is very accurate. Deeds.com has a customer for life.

Thank you so much Alexis. We appreciate you, have a fantastic day.

Timmy S.

December 18th, 2019

The form gave me a perfect place to start. I was looking for something regarding time-shares, so the form was not perfect, but the register of deeds worked with me to get it right. I would not have even been able to start without the form from deeds.com

Thank you for your feedback. We really appreciate it. Have a great day!

Lawrence W.

January 17th, 2019

Great so Far!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Charles F.

January 15th, 2021

I am happy with the document but did not know that it would still have to go before the court. Thought it could be handled by the recorder of deeds.

Thank you for your feedback. We really appreciate it. Have a great day!

David W.

March 21st, 2019

Excellent service! Questions were answered promptly, and the entire process was easy and fast. Thank you!

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Virginia S.

June 28th, 2022

Very easy to use. Had my Transfer of Death Designation Affidavit done in no time and filed with the Recorder's Office the next day.

Thank you for your feedback. We really appreciate it. Have a great day!

Catherine R.

August 7th, 2019

What a great way to put my mind at ease. It was easy to fill out and printed out nicely.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela D.

August 19th, 2020

The only problem I had was that it doesn't let you create a file for all documents to go into as one. Mahalo Angie

Thank you for your feedback. We really appreciate it. Have a great day!