Williamson County Notice of Death Affidavit and Acceptance Form (Illinois)

All Williamson County specific forms and documents listed below are included in your immediate download package:

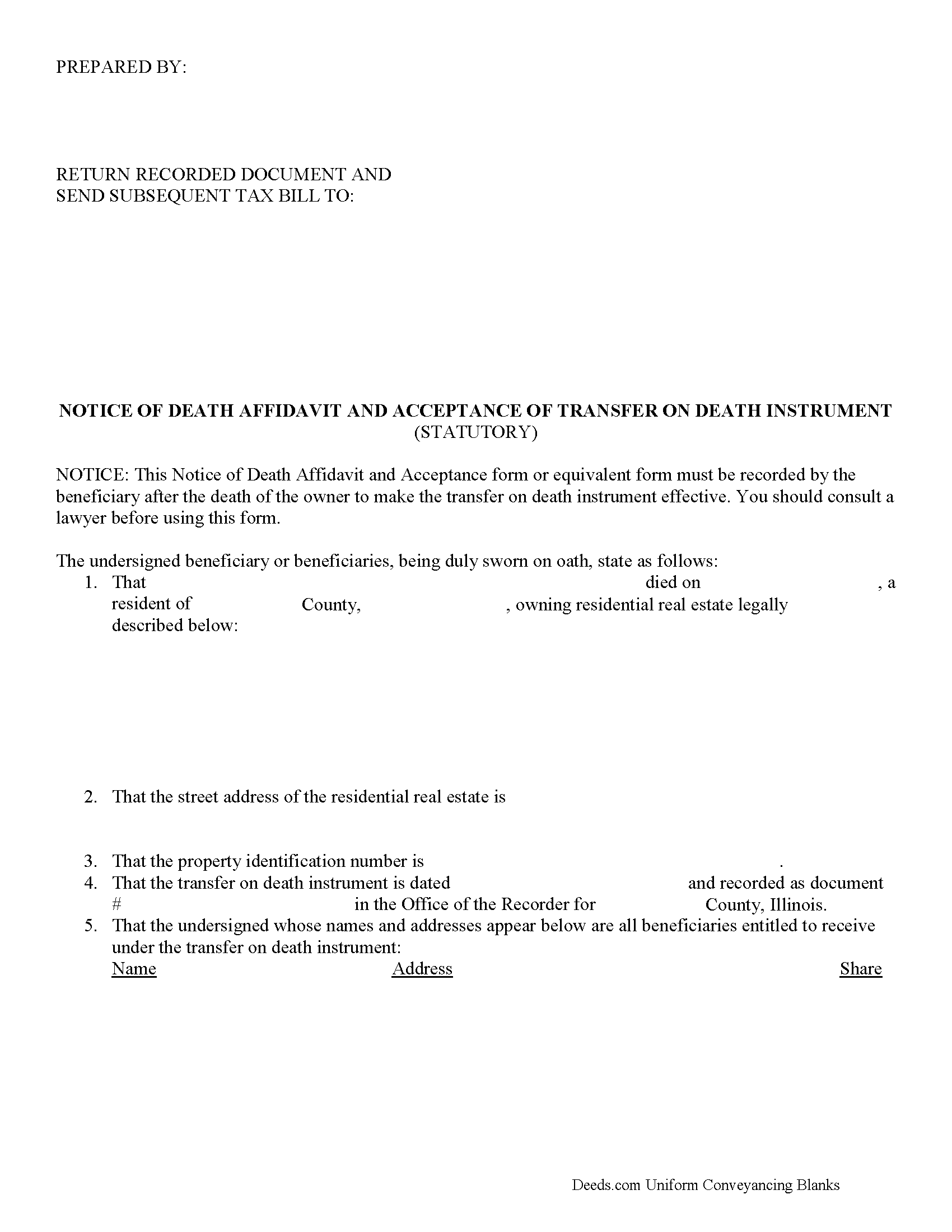

Notice of Death Affidavit Form

Fill in the blank form formatted to comply with all recording and content requirements.

Included Williamson County compliant document last validated/updated 6/2/2025

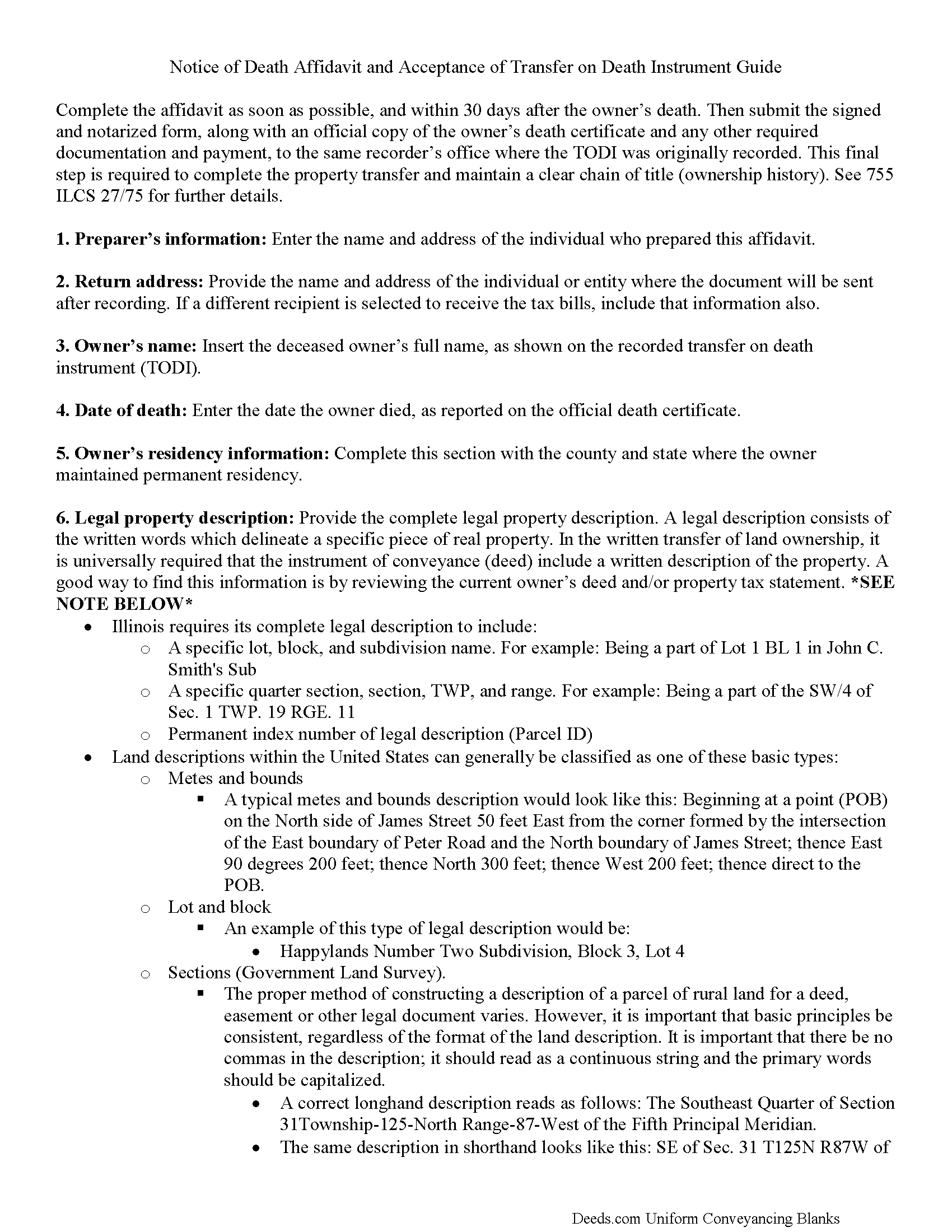

Notice of Death Affidavit Guide

Line by line guide explaining every blank on the form.

Included Williamson County compliant document last validated/updated 7/4/2025

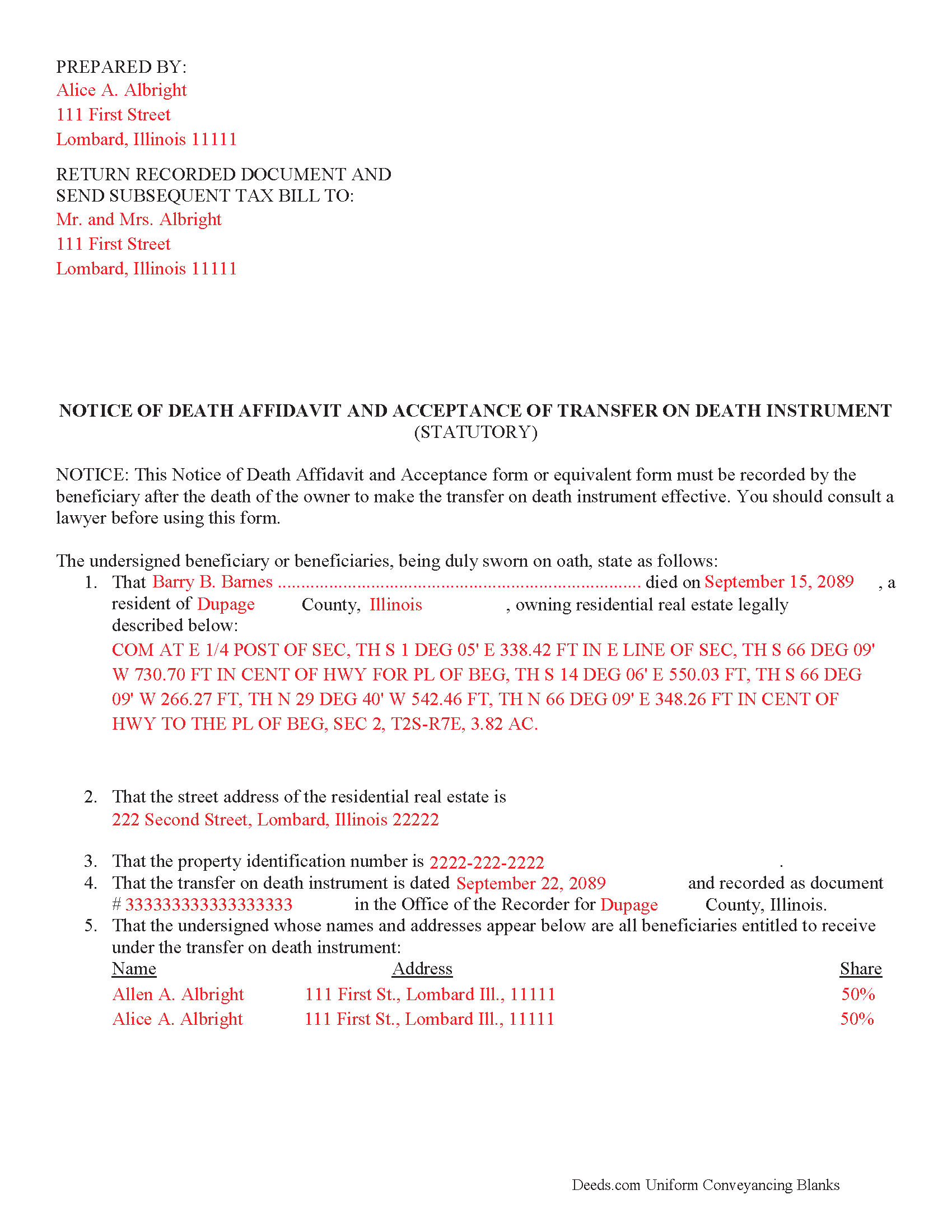

Completed Example of the Notice of Death Affidavit Document

Example of a properly completed form for reference.

Included Williamson County compliant document last validated/updated 4/21/2025

The following Illinois and Williamson County supplemental forms are included as a courtesy with your order:

When using these Notice of Death Affidavit and Acceptance forms, the subject real estate must be physically located in Williamson County. The executed documents should then be recorded in the following office:

Williamson County Clerk & Recorder

407 N Monroe St, Suite 119, Marion, Illinois 62959

Hours: 8:00 to 4:00 Monday through Friday

Phone: (618) 998-2110 and 998-2112

Local jurisdictions located in Williamson County include:

- Cambria

- Carterville

- Colp

- Creal Springs

- Energy

- Freeman Spur

- Herrin

- Hurst

- Johnston City

- Marion

- Pittsburg

How long does it take to get my forms?

Forms are available immediately after submitting payment.

How do I get my forms, are they emailed?

Immediately after you submit payment, the Williamson County forms you order will be available for download directly from your account. You can then download the forms to your computer. If you do not already have an account, one will be created for you as part of the order process, and your login details will be provided to you. If you encounter any issues accessing your forms, please reach out to our support team for assistance. Forms are NOT emailed to you.

What does "validated/updated" mean?

This indicates the most recent date when at least one of the following occurred:

- Updated: The document was updated or changed to remain compliant.

- Validated: The document was examined by an attorney or staff, or it was successfully recorded in Williamson County using our eRecording service.

Are these forms guaranteed to be recordable in Williamson County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Williamson County including margin requirements, content requirements, font and font size requirements.

Can the Notice of Death Affidavit and Acceptance forms be re-used?

Yes. You can re-use the forms for your personal use. For example, if you have more than one property in Williamson County that you need to transfer you would only need to order our forms once for all of your properties in Williamson County.

What are supplemental forms?

Often when a deed is recorded, additional documents are required by Illinois or Williamson County. These could be tax related, informational, or even as simple as a coversheet. Supplemental forms are provided for free with your order where available.

What type of files are the forms?

All of our Williamson County Notice of Death Affidavit and Acceptance forms are PDFs. You will need to have or get Adobe Reader to use our forms. Adobe Reader is free software that most computers already have installed.

Do I need any special software to use these forms?

You will need to have Adobe Reader installed on your computer to use our forms. Adobe Reader is free software that most computers already have installed.

Do I have to enter all of my property information online?

No. The blank forms are downloaded to your computer and you fill them out there, at your convenience.

Can I save the completed form, email it to someone?

Yes, you can save your deed form at any point with your information in it. The forms can also be emailed, blank or complete, as attachments.

Are there any recurring fees involved?

No. Nothing to cancel, no memberships, no recurring fees.

Complete and record this required statutory affidavit to finalize the transfer of residential real property initiated with the Illinois transfer on death instrument as governed by 755 ILSC 27.

A transfer on death instrument is effective as of the owner's death upon the filing of a notice of death affidavit and acceptance by the beneficiary or beneficiaries in the office of the recorder in the county or counties where the residential real estate is located. The notice of death affidavit and acceptance shall contain the name and address of each beneficiary who shall take under the transfer on death instrument, a legal description of the property, the street address, and parcel identification number of the residential real estate, the name of the deceased owner, and the date of death. The notice of death affidavit and acceptance shall be signed by each beneficiary or by the beneficiary's authorized representative.

(Illinois Notice of Death Affidavit Package includes form, guidelines, and completed example)

Our Promise

The documents you receive here will meet, or exceed, the Williamson County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Williamson County Notice of Death Affidavit and Acceptance form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4564 Reviews )

Michael G.

July 14th, 2025

Very helpful and easy to use

Your appreciative words mean the world to us. Thank you.

JAMES D.

July 10th, 2025

Slick as can be and so convenient.rnrnWorked like a charm

Thank you for your feedback. We really appreciate it. Have a great day!

MARY LACEY M.

June 30th, 2025

Great service! Recording was smooth and swiftly performed. Deeds.com is an excellent service.rn

We are delighted to have been of service. Thank you for the positive review!

Gerald G.

September 16th, 2020

I am researching forms required to change deed from joint owners to individual. Subsequently, forms required when/after a trust is established for real property.

Thank you!

Lisa H.

May 27th, 2020

I needed a copy of a deed for a client and wanted to be sure I had the most recent one. I used Deeds.com and had it along with detailed property information within minutes at a very reasonable price. I am very pleased.

Thank you!

Louise P.

April 28th, 2022

Easy to use

Thank you!

Richard B.

May 27th, 2022

Had trouble filling in the forms not very user friendly. The text always had to be manipulated to look in the best place. Could not easily move existing text to look more professional with the text being inserted.

Thank you for your feedback. We really appreciate it. Have a great day!

Marion B.

September 2nd, 2023

As far as I know all is in order as far as my transfer on death instrument for Illinois. Thank you so much!

Thank you for your feedback. We really appreciate it. Have a great day!

Leticia A.

January 20th, 2020

Down to the point,covers every angle with great tips:Don't forget Probate.

Thank you!

Kenneth J.

June 15th, 2021

Great product; Got the Job done.

Thank you!

Gloria J.

July 23rd, 2021

I needed a Missouri Notice of Intent to Sell without a named designated buyer. Mo Statutes require notice be notarized and filed 45 days before any closing to protect buyer from liens. You do not have that document. We are flipping a house so it must be filed. Our lawyer was on vacation. Cannot find one anywhere on net. Finally got a template from our title company.

Thank you for your feedback Gloria.

Carolyn D.

March 18th, 2022

The sight provided exactly what I needed and was easy to use. I was able to download the type of Deed I used and was completely satisfied with the website.

Thank you for your feedback. We really appreciate it. Have a great day!

Angela L.

November 2nd, 2020

AWESOME!

Thank you!

Alan S.

April 28th, 2020

Great job! Fast and easy. Terrific communications.

Thank you!

Tawnya P.

November 2nd, 2022

I can't believe I haven't found Deeds.com sooner. They made my job so much easier!! They make recording documents effortless. I'm so grateful.

Thank you for your feedback. We really appreciate it. Have a great day!