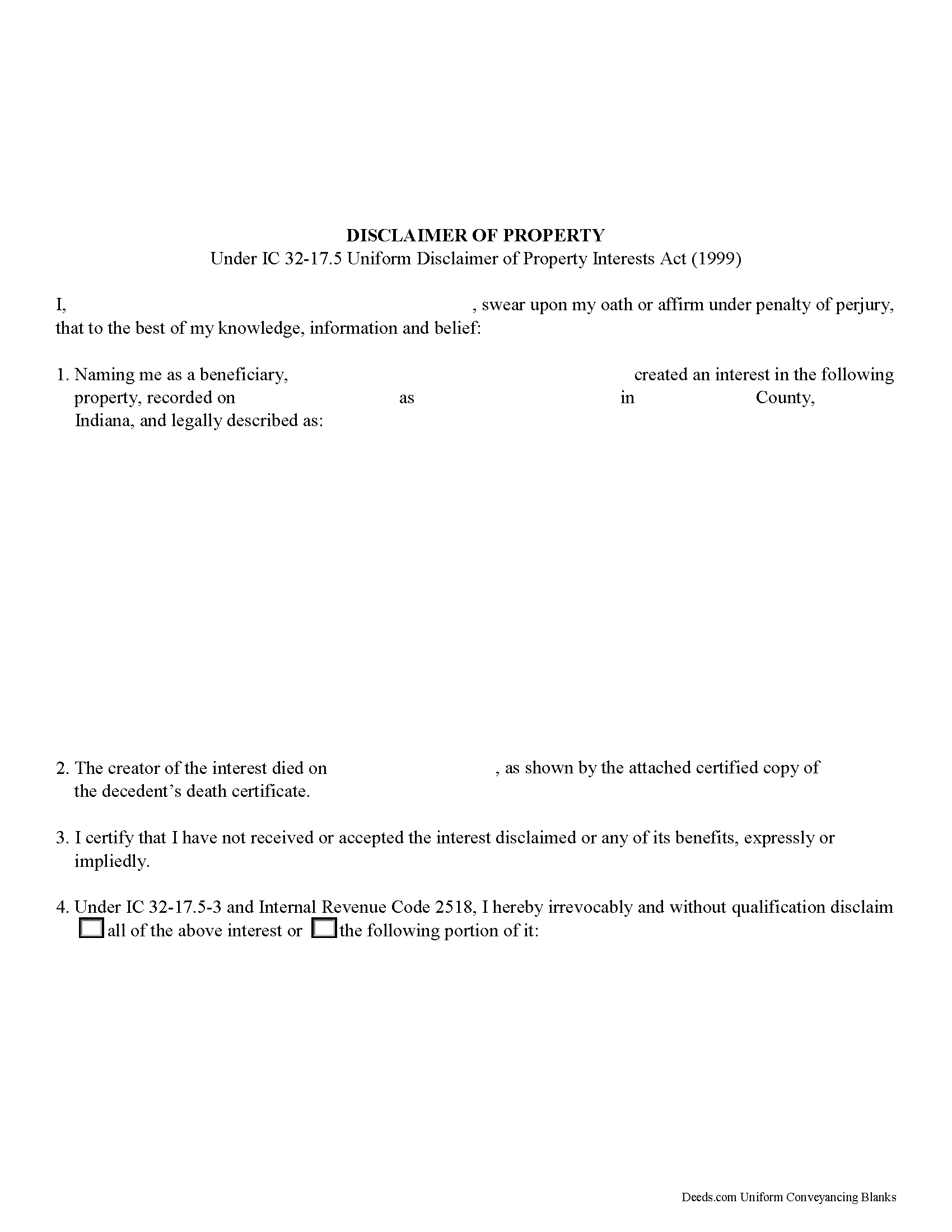

Franklin County Disclaimer of Interest Form

Franklin County Disclaimer of Interest Form

Fill in the blank form formatted to comply with all recording and content requirements.

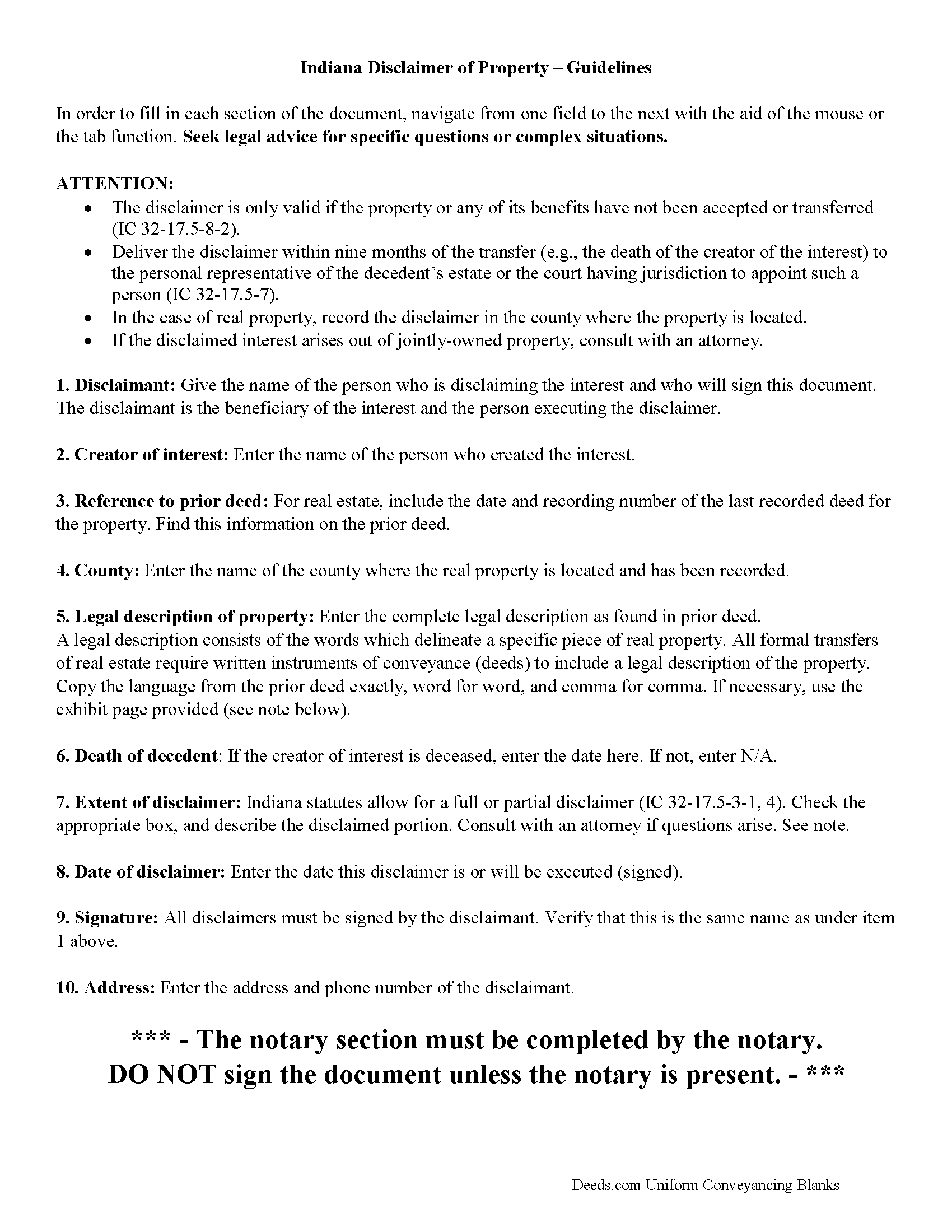

Franklin County Disclaimer of Interest Guide

Line by line guide explaining every blank on the form.

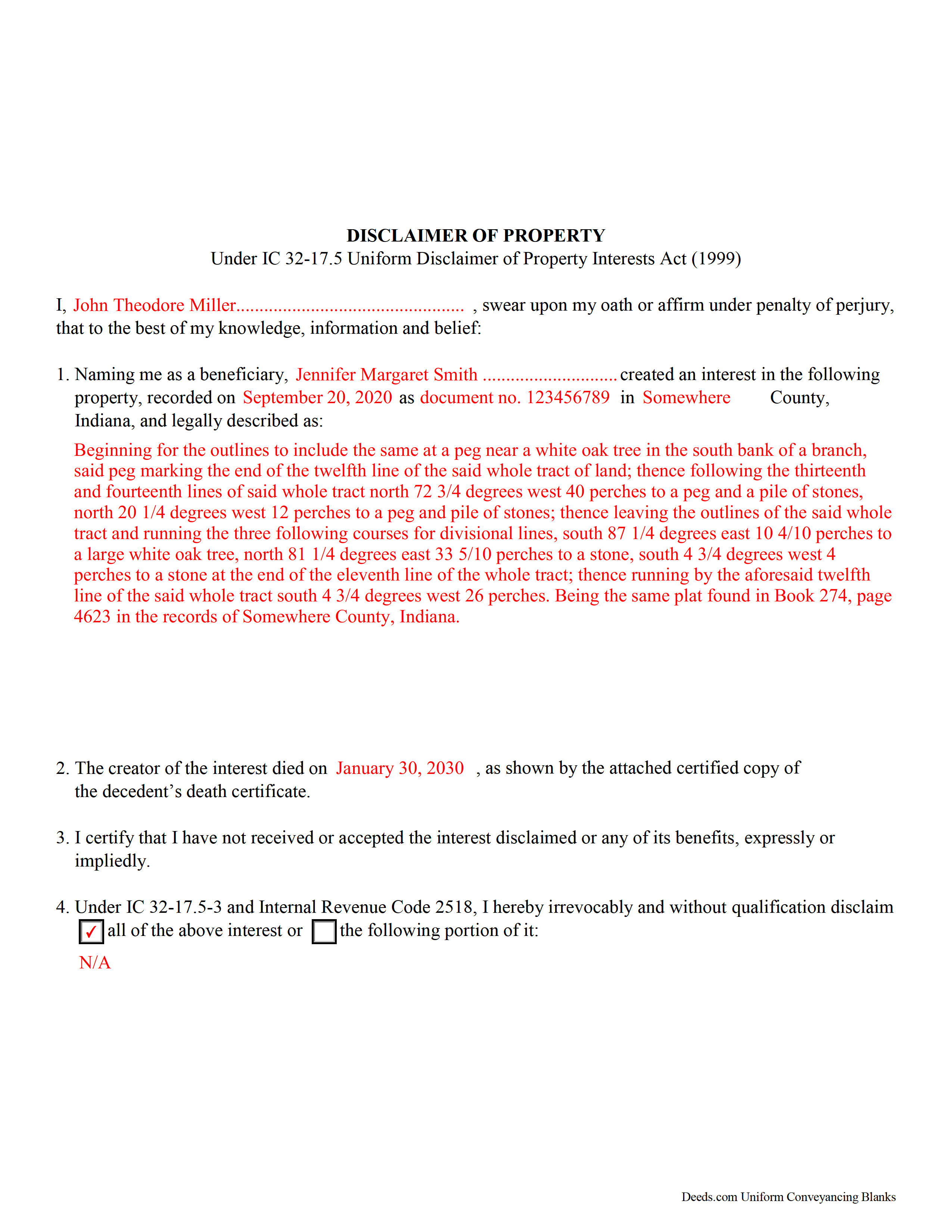

Franklin County Completed Example of the Disclaimer of Interest Document

Example of a properly completed form for reference.

All 3 documents above included • One-time purchase • No recurring fees

Immediate Download • Secure Checkout

Additional Indiana and Franklin County documents included at no extra charge:

Where to Record Your Documents

Franklin County Recorder

Brookville, Indiana 47012

Hours: Monday through Friday 8:30 a.m. – 4:00 p.m.

Phone: (765) 647-5131

Recording Tips for Franklin County:

- Ask if they accept credit cards - many offices are cash/check only

- Double-check legal descriptions match your existing deed

- Bring extra funds - fees can vary by document type and page count

Cities and Jurisdictions in Franklin County

Properties in any of these areas use Franklin County forms:

- Bath

- Brookville

- Cedar Grove

- Laurel

- Metamora

- New Trenton

- Oldenburg

Hours, fees, requirements, and more for Franklin County

How do I get my forms?

Forms are available for immediate download after payment. The Franklin County forms will be in your account ready to download to your computer. An account is created for you during checkout if you don't have one. Forms are NOT emailed.

Are these forms guaranteed to be recordable in Franklin County?

Yes. Our form blanks are guaranteed to meet or exceed all formatting requirements set forth by Franklin County including margin requirements, content requirements, font and font size requirements.

Can I reuse these forms?

Yes. You can reuse the forms for your personal use. For example, if you have multiple properties in Franklin County you only need to order once.

What do I need to use these forms?

The forms are PDFs that you fill out on your computer. You'll need Adobe Reader (free software that most computers already have). You do NOT enter your property information online - you download the blank forms and complete them privately on your own computer.

Are there any recurring fees?

No. This is a one-time purchase. Nothing to cancel, no memberships, no recurring fees.

How much does it cost to record in Franklin County?

Recording fees in Franklin County vary. Contact the recorder's office at (765) 647-5131 for current fees.

Questions answered? Let's get started!

Under the Indiana Uniform Disclaimer of Property Interests Act, found at IC 32-17.5, the beneficiary of an interest in property may renounce the gift, either in part or in full (IC 32-17.5-3-1, 4). Note that the option to disclaim is only available to beneficiaries who have not acted in any way to indicate acceptance or ownership of the interest (IC 32-17.5-8-2).

The disclaimer must be in writing and include a description of the interest, a declaration of intent to disclaim all or a defined portion of the interest, and be signed by the disclaimant in front of a notary (IC 32-17.5-3-3).

Deliver the disclaimer within nine months of the transfer (e.g., the death of the creator of the interest) to the personal representative of the decedent's estate or the court having jurisdiction to appoint such a person (IC 32-17.5-7). In the case of real property, acknowledge the disclaimer as is required for a deed and record it in the county where the property is located. In addition, deliver a copy of the disclaimer to the person or legal entity with current custody or possession of the property.

A disclaimer is irrevocable and binding for the disclaiming party, so be sure to consult an attorney when in doubt about the drawbacks and benefits of disclaiming inherited property. If the disclaimed interest arises out of jointly-owned property, seek legal advice as well.

(Indiana Disclaimer of Interest Package includes form, guidelines, and completed example)

Important: Your property must be located in Franklin County to use these forms. Documents should be recorded at the office below.

This Disclaimer of Interest meets all recording requirements specific to Franklin County.

Our Promise

The documents you receive here will meet, or exceed, the Franklin County recording requirements for formatting. If there's an issue caused by our formatting, we'll make it right and refund your payment.

Save Time and Money

Get your Franklin County Disclaimer of Interest form done right the first time with Deeds.com Uniform Conveyancing Blanks. At Deeds.com, we understand that your time and money are valuable resources, and we don't want you to face a penalty fee or rejection imposed by a county recorder for submitting nonstandard documents. We constantly review and update our forms to meet rapidly changing state and county recording requirements for roughly 3,500 counties and local jurisdictions.

4.8 out of 5 - ( 4585 Reviews )

Bayyinah M.

March 30th, 2022

EasyPeasy!

Thank you!

Danelle S.

November 22nd, 2019

So easy and fast that even I could do it, and I'm technologically challenged! Thank you Deeds.com for taking care of the technical stuff so I can live and play. Definitely speedy delivery!

Thank you!

Arnold R.

March 11th, 2022

this online service worked efficiently and as quickly as the registry allowed it to record new deeds. Thank you for providing services

Thank you for your feedback. We really appreciate it. Have a great day!

Mark E.

March 12th, 2019

Thank you for your Swift response. Have docs I was looking for!

Thank you for your feedback. We really appreciate it. Have a great day!

Thomas S.

April 13th, 2019

Very nice.

Thank you!

kevin d.

April 19th, 2022

the quitclaim form worked well with the Nevada Recorders office. Tried other vendors, theirs were rejected.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

LETICIA N.

August 23rd, 2022

I AM VERY PLEASED WITH YOUR WEBSITE. EASY AND I WAS GIVEN A SAMPLE OF THE FORM AND INSTRUCTIONS. I AM VERY PLEASED.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

John A.

December 21st, 2021

Very easy to use. Would recommend to anyone

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Robert S B.

May 22nd, 2019

I would not have ordered this form had I realised how limited the fields are for details. There is no room for elaboration of terms. The language only allows one grantor and one grantee, and the gender and quantity default construction is a poor choice. Be basic, but leave room for more.

Thank you for your feedback. We really appreciate it. Have a great day!

Michael W.

January 25th, 2022

I needed a quitclaim deed to transfer ownership of a home. An attorney wanted $400.00 to file the deed. I downloaded a blank deed for my area from deeds.com. I received it instantly. (Small fee) it came with instructions and a template. I filled it out and submitted it to the County Clerks office.it was simple and I saved a lot of money. There may be other forms you need, check with whoever you are submitting the deed. You'll have additional fees, but that is up to the municipality in which you reside. It will be helpful if you have the latest deed on file. It was much easier than I thought. This is an easy website to navigate through and it is 100% legitimate. I recommend Deeds.com.

Thank you for your feedback. We really appreciate it. Have a great day!

Nellie V.

October 14th, 2019

You guys make it so easy. Thank you for that! Hugs!

Thank you Nellie!

John K.

September 3rd, 2021

The website was very easy to work. The documents were just what I needed and everything that my state and county required.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Craig W.

August 18th, 2019

This is a great way to get paper work to the land love it

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Mary S.

March 25th, 2022

Really, really great. Instructions are so helpful.

We appreciate your business and value your feedback. Thank you. Have a wonderful day!

Catherine W.

May 7th, 2019

I appreciate your prompt and honest response. You did not find what I was looking for but You also did not charge Me. It was a pleasure working with You.

Thank you for your feedback Catherine, sorry we were unable to find what you needed. Have a wonderful day.